Willis Towers Watson Public Limited Company (WTW)

Price:

326.84 USD

( + 1.26 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

eHealth, Inc.

VALUE SCORE:

9

2nd position

Erie Indemnity Company

VALUE SCORE:

9

The best

Zhibao Technology Inc. Class A Ordinary Shares

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Willis Towers Watson Public Limited Company operates as an advisory, broking, and solutions company worldwide. It operates through two segments, Health, Wealth and Career; and Risk and Broking. The company offers actuarial support, plan design, and administrative services for traditional pension and retirement savings plans; plan management consulting, broking, and administration services for health and group benefit programs; and benefits outsourcing services. It also provides advice, data, software, and products to address clients' total rewards and talent issues. In addition, the company offers risk advice, insurance brokerage, and consulting services in the areas of property and casualty, aerospace, construction, and marine. Further, it offers investment consulting and discretionary management services to insurance and reinsurance companies; insurance consulting and technology, risk and capital management, pricing and predictive modeling, financial and regulatory reporting, financial and capital modeling, merger and acquisition, outsourcing, and business management services; wholesale insurance broking services to retail and wholesale brokers; and underwriting and capital management, capital market, and advisory and brokerage services. Additionally, the company provides primary medical and ancillary benefit exchange, and outsourcing services to active employees and retirees in the group and individual markets, as well as delivers healthcare and reimbursement accounts, including health savings accounts, health reimbursement arrangements, flexible spending accounts, and other consumer-directed accounts. The company was formerly known as Willis Group Holdings Public Limited Company and changed its name to Willis Towers Watson Public Limited Company in January 2016. Willis Towers Watson Public Limited Company was founded in 1828 and is based in London, the United Kingdom.

NEWS

Geopolitical alignment becomes essential for internationally exposed firms amid new trade paradigm

globenewswire.com

2025-12-11 05:14:00LONDON, Dec. 11, 2025 (GLOBE NEWSWIRE) -- The international trade landscape was altered beyond recognition in 2025, a year defined by U.S. tariff deals. As geopolitical dynamics shift, countries' national security alignments have become central to risk management and long-term resilience for globally active businesses. The latest Political Risk Index by Willis, a WTW business (NASDAQ: WTW), aims to distinguish risk signals from noise and help globalised firms prepare for the emerging era of tariff geopolitics.

Willis Towers Watson Public Limited Company (WTW) M&A Call Transcript

seekingalpha.com

2025-12-10 14:52:51Willis Towers Watson Public Limited Company (WTW) M&A Call Transcript

WTW Outperforms Industry, Trades at a Discount: Time to Hold?

zacks.com

2025-12-10 11:31:06Willis Towers stock rallies on the back of a strong new business, strategic acquisitions, solid customer retention levels and financial flexibility.

WTW Buys Newfront To Fuse AI With Global Insurance Muscle

feeds.benzinga.com

2025-12-10 09:51:04WTW will acquire Newfront, a technology-driven U.S. insurance broker, in a $1.3 billion deal to boost AI and analytics capabilities.

WTW to acquire cutting-edge UK fintech pensions and savings provider, Cushon

globenewswire.com

2025-12-10 07:44:00LONDON, Dec. 10, 2025 (GLOBE NEWSWIRE) -- WTW (NASDAQ:WTW), a leading global advisory, broking and solutions company, and Cushon, a workplace pensions, savings and financial wellbeing company, are pleased to announce an agreement that sees WTW's UK business acquire Cushon from NatWest Group.

Willis Towers Watson to buy brokerage firm Newfront in $1.3 billion deal

reuters.com

2025-12-10 06:12:38Insurance broker Willis Towers Watson will buy Newfront in a deal valued at $1.3 billion.

WTW to Acquire Newfront, a Specialized Broker Combining Deep Expertise and Cutting-Edge Technology

globenewswire.com

2025-12-10 06:00:00LONDON, Dec. 10, 2025 (GLOBE NEWSWIRE) -- WTW (NASDAQ: WTW) (the “Company”), a leading global advisory, broking and solutions company, announced it has signed a definitive agreement to acquire Newfront, a San Francisco-based, top 40 U.S. broker combining deep specialty expertise and cutting-edge technology. The agreement provides for upfront and contingent consideration payments totaling $1.3 billion. The upfront portion of $1.05 billion is comprised of approximately $900 million in cash and $150 million in equity to be paid to Newfront employee-shareholders; the contingent consideration of up to $250 million is payable primarily in equity, subject to Newfront's achievement of specified performance targets. Additionally, up to an incremental $150 million payable primarily in equity would become payable if Newfront achieves above-target revenue growth. The transaction is expected to close during the first quarter of 2026, subject to receipt of certain regulatory approvals and other customary closing conditions.

Federated Hermes Inc. Has $31.99 Million Holdings in Willis Towers Watson Public Limited Company $WTW

defenseworld.net

2025-12-10 04:32:57Federated Hermes Inc. boosted its position in shares of Willis Towers Watson Public Limited Company (NASDAQ: WTW) by 1.5% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 104,370 shares of the company's stock after buying an additional 1,582 shares during the

California Public Employees Retirement System Sells 68,924 Shares of Willis Towers Watson Public Limited Company $WTW

defenseworld.net

2025-12-08 05:16:51California Public Employees Retirement System lessened its position in shares of Willis Towers Watson Public Limited Company (NASDAQ: WTW) by 15.6% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 373,827 shares of the company's stock after selling 68,924 shares during

WTW launches Radar Fusion to accelerate innovative commercial underwriting for sustainable growth

globenewswire.com

2025-12-04 09:44:00Augmented underwriting technology, Radar Fusion, helps insurers streamline and scale underwriting to improve decision-making in a fast-changing market Augmented underwriting technology, Radar Fusion, helps insurers streamline and scale underwriting to improve decision-making in a fast-changing market

4 Stocks to Watch From the Thriving Insurance Brokerage Industry

zacks.com

2025-12-04 09:11:05Zacks Insurance Brokerage players like BRO, MMC, WTW and AON are likely to benefit from increased demand for insurance products, strategic acquisitions and the adoption of technology.

WTW announces strategic acquisition of FlowStone Partners, enhancing its Wealth offerings

globenewswire.com

2025-12-01 15:06:11NEW YORK, Dec. 01, 2025 (GLOBE NEWSWIRE) -- WTW (NASDAQ: WTW), a leading global advisory and solutions company, today announced the acquisition of FlowStone Partners, LLC, an alternative investment firm with highly specialized expertise in private equity secondaries for individual wealth and institutional clients.

NatWest in exclusive talks to sell Cushon to Willis Towers Watson, sources said

reuters.com

2025-11-28 08:58:32NatWest Group is in exclusive talks to sell its 85% stake in workplace pension provider Cushon to U.S. insurance broker Willis Towers Watson just two years after the British bank acquired the business, two people with knowledge of the matter said.

Coldstream Capital Management Inc. Has $495,000 Stake in Willis Towers Watson Public Limited Company $WTW

defenseworld.net

2025-11-28 04:20:44Coldstream Capital Management Inc. increased its stake in Willis Towers Watson Public Limited Company (NASDAQ: WTW) by 13.3% in the undefined quarter, according to the company in its most recent filing with the SEC. The fund owned 1,615 shares of the company's stock after purchasing an additional 190 shares during the quarter. Coldstream

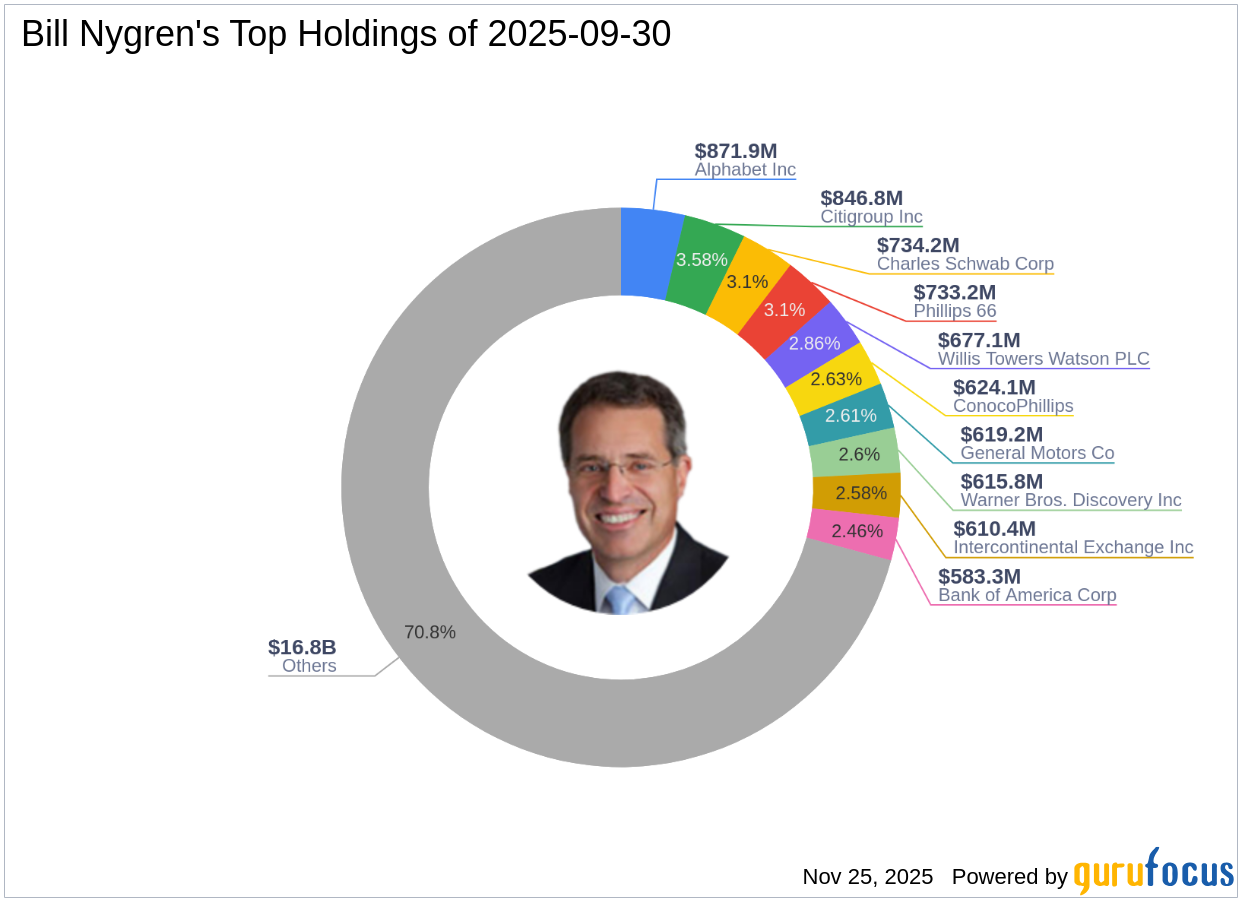

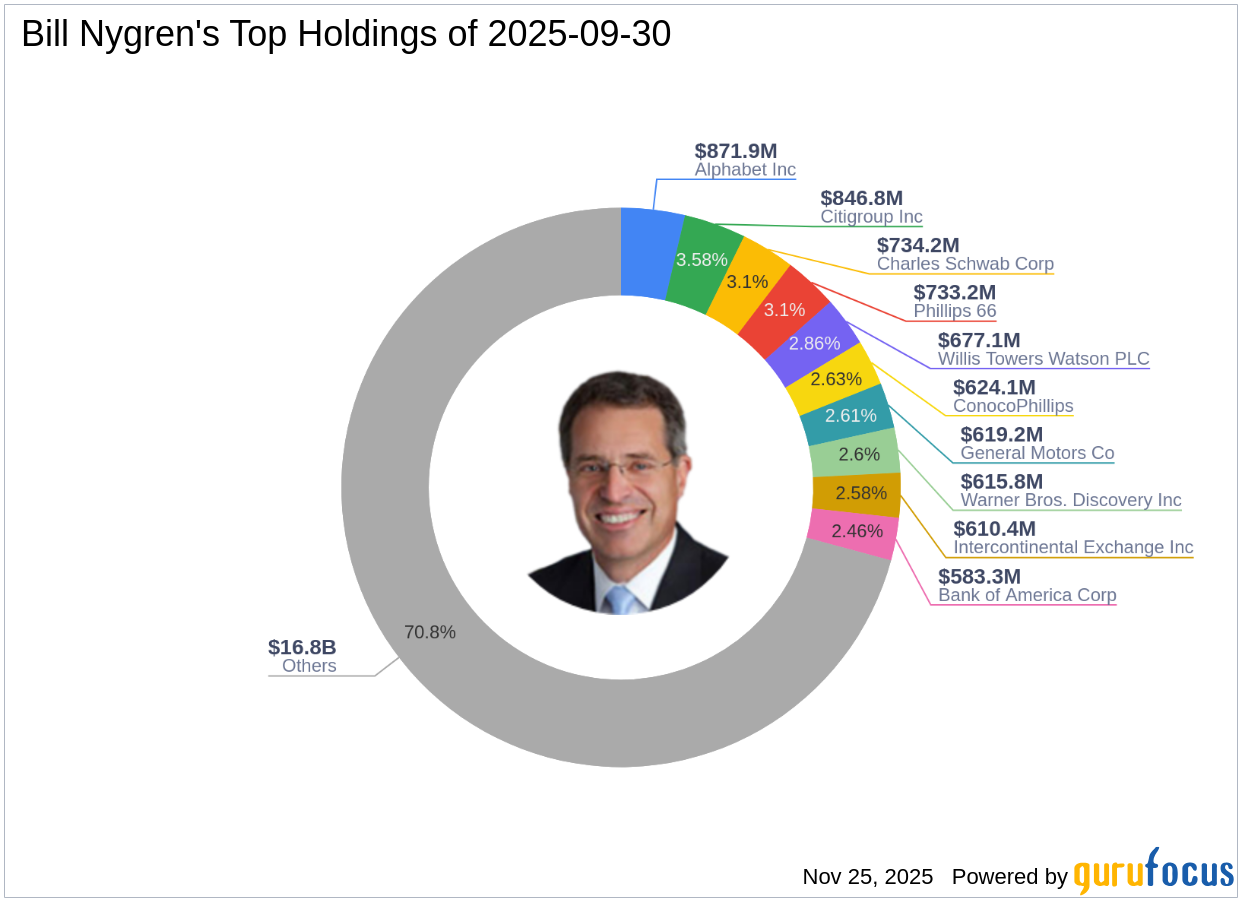

Bill Nygren's Strategic Moves: Centene Corp Exits with a -2.14% Impact

gurufocus.com

2025-11-25 09:01:00Exploring Bill Nygren (Trades, Portfolio)'s Recent Investment Adjustments Bill Nygren (Trades, Portfolio) recently submitted the N-PORT filing for the third qu

Willis Towers Watson Public Limited Company (NASDAQ:WTW) Given Average Recommendation of “Moderate Buy” by Brokerages

defenseworld.net

2025-11-18 02:14:43Willis Towers Watson Public Limited Company (NASDAQ: WTW - Get Free Report) has received a consensus rating of "Moderate Buy" from the fifteen ratings firms that are presently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, nine have given a buy rating

Geopolitical alignment becomes essential for internationally exposed firms amid new trade paradigm

globenewswire.com

2025-12-11 05:14:00LONDON, Dec. 11, 2025 (GLOBE NEWSWIRE) -- The international trade landscape was altered beyond recognition in 2025, a year defined by U.S. tariff deals. As geopolitical dynamics shift, countries' national security alignments have become central to risk management and long-term resilience for globally active businesses. The latest Political Risk Index by Willis, a WTW business (NASDAQ: WTW), aims to distinguish risk signals from noise and help globalised firms prepare for the emerging era of tariff geopolitics.

Willis Towers Watson Public Limited Company (WTW) M&A Call Transcript

seekingalpha.com

2025-12-10 14:52:51Willis Towers Watson Public Limited Company (WTW) M&A Call Transcript

WTW Outperforms Industry, Trades at a Discount: Time to Hold?

zacks.com

2025-12-10 11:31:06Willis Towers stock rallies on the back of a strong new business, strategic acquisitions, solid customer retention levels and financial flexibility.

WTW Buys Newfront To Fuse AI With Global Insurance Muscle

feeds.benzinga.com

2025-12-10 09:51:04WTW will acquire Newfront, a technology-driven U.S. insurance broker, in a $1.3 billion deal to boost AI and analytics capabilities.

WTW to acquire cutting-edge UK fintech pensions and savings provider, Cushon

globenewswire.com

2025-12-10 07:44:00LONDON, Dec. 10, 2025 (GLOBE NEWSWIRE) -- WTW (NASDAQ:WTW), a leading global advisory, broking and solutions company, and Cushon, a workplace pensions, savings and financial wellbeing company, are pleased to announce an agreement that sees WTW's UK business acquire Cushon from NatWest Group.

Willis Towers Watson to buy brokerage firm Newfront in $1.3 billion deal

reuters.com

2025-12-10 06:12:38Insurance broker Willis Towers Watson will buy Newfront in a deal valued at $1.3 billion.

WTW to Acquire Newfront, a Specialized Broker Combining Deep Expertise and Cutting-Edge Technology

globenewswire.com

2025-12-10 06:00:00LONDON, Dec. 10, 2025 (GLOBE NEWSWIRE) -- WTW (NASDAQ: WTW) (the “Company”), a leading global advisory, broking and solutions company, announced it has signed a definitive agreement to acquire Newfront, a San Francisco-based, top 40 U.S. broker combining deep specialty expertise and cutting-edge technology. The agreement provides for upfront and contingent consideration payments totaling $1.3 billion. The upfront portion of $1.05 billion is comprised of approximately $900 million in cash and $150 million in equity to be paid to Newfront employee-shareholders; the contingent consideration of up to $250 million is payable primarily in equity, subject to Newfront's achievement of specified performance targets. Additionally, up to an incremental $150 million payable primarily in equity would become payable if Newfront achieves above-target revenue growth. The transaction is expected to close during the first quarter of 2026, subject to receipt of certain regulatory approvals and other customary closing conditions.

Federated Hermes Inc. Has $31.99 Million Holdings in Willis Towers Watson Public Limited Company $WTW

defenseworld.net

2025-12-10 04:32:57Federated Hermes Inc. boosted its position in shares of Willis Towers Watson Public Limited Company (NASDAQ: WTW) by 1.5% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 104,370 shares of the company's stock after buying an additional 1,582 shares during the

California Public Employees Retirement System Sells 68,924 Shares of Willis Towers Watson Public Limited Company $WTW

defenseworld.net

2025-12-08 05:16:51California Public Employees Retirement System lessened its position in shares of Willis Towers Watson Public Limited Company (NASDAQ: WTW) by 15.6% during the undefined quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 373,827 shares of the company's stock after selling 68,924 shares during

WTW launches Radar Fusion to accelerate innovative commercial underwriting for sustainable growth

globenewswire.com

2025-12-04 09:44:00Augmented underwriting technology, Radar Fusion, helps insurers streamline and scale underwriting to improve decision-making in a fast-changing market Augmented underwriting technology, Radar Fusion, helps insurers streamline and scale underwriting to improve decision-making in a fast-changing market

4 Stocks to Watch From the Thriving Insurance Brokerage Industry

zacks.com

2025-12-04 09:11:05Zacks Insurance Brokerage players like BRO, MMC, WTW and AON are likely to benefit from increased demand for insurance products, strategic acquisitions and the adoption of technology.

WTW announces strategic acquisition of FlowStone Partners, enhancing its Wealth offerings

globenewswire.com

2025-12-01 15:06:11NEW YORK, Dec. 01, 2025 (GLOBE NEWSWIRE) -- WTW (NASDAQ: WTW), a leading global advisory and solutions company, today announced the acquisition of FlowStone Partners, LLC, an alternative investment firm with highly specialized expertise in private equity secondaries for individual wealth and institutional clients.

NatWest in exclusive talks to sell Cushon to Willis Towers Watson, sources said

reuters.com

2025-11-28 08:58:32NatWest Group is in exclusive talks to sell its 85% stake in workplace pension provider Cushon to U.S. insurance broker Willis Towers Watson just two years after the British bank acquired the business, two people with knowledge of the matter said.

Coldstream Capital Management Inc. Has $495,000 Stake in Willis Towers Watson Public Limited Company $WTW

defenseworld.net

2025-11-28 04:20:44Coldstream Capital Management Inc. increased its stake in Willis Towers Watson Public Limited Company (NASDAQ: WTW) by 13.3% in the undefined quarter, according to the company in its most recent filing with the SEC. The fund owned 1,615 shares of the company's stock after purchasing an additional 190 shares during the quarter. Coldstream

Bill Nygren's Strategic Moves: Centene Corp Exits with a -2.14% Impact

gurufocus.com

2025-11-25 09:01:00Exploring Bill Nygren (Trades, Portfolio)'s Recent Investment Adjustments Bill Nygren (Trades, Portfolio) recently submitted the N-PORT filing for the third qu

Willis Towers Watson Public Limited Company (NASDAQ:WTW) Given Average Recommendation of “Moderate Buy” by Brokerages

defenseworld.net

2025-11-18 02:14:43Willis Towers Watson Public Limited Company (NASDAQ: WTW - Get Free Report) has received a consensus rating of "Moderate Buy" from the fifteen ratings firms that are presently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, nine have given a buy rating