Walmart Inc. (WMT)

Price:

116.65 USD

( + 1.13 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

BBB Foods Inc.

VALUE SCORE:

5

2nd position

BJ's Wholesale Club Holdings, Inc.

VALUE SCORE:

7

The best

Target Corporation

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Walmart Inc. engages in the operation of retail, wholesale, other units, and eCommerce worldwide. The company operates through three segments: Walmart U.S., Walmart International, and Sam's Club. It operates supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry stores, and discount stores under Walmart and Walmart Neighborhood Market brands; membership-only warehouse clubs; ecommerce websites, such as walmart.com.mx, walmart.ca, flipkart.com, PhonePe and other sites; and mobile commerce applications. The company offers grocery and consumables, including dairy, meat, bakery, deli, produce, dry, chilled or frozen packaged foods, alcoholic and nonalcoholic beverages, floral, snack foods, candy, other grocery items, health and beauty aids, paper goods, laundry and home care, baby care, pet supplies, and other consumable items; fuel, tobacco and other categories. It is also involved in the provision of health and wellness products covering pharmacy, optical and hearing services, and over-the-counter drugs and other medical products; and home and apparel including home improvement, outdoor living, gardening, furniture, apparel, jewelry, tools and power equipment, housewares, toys, seasonal items, mattresses and tire and battery centers. In addition, the company offers consumer electronics and accessories, software, video games, office supplies, appliances, and third-party gift cards. Further, it operates digital payment platforms; and offers financial services and related products, including money transfers, bill payments, money orders, check cashing, prepaid access, co-branded credit cards, installment lending, and earned wage access. Additionally, the company markets lines of merchandise under private brands, including Allswell, Athletic Works, Equate, and Free Assembly. The company was formerly known as Wal-Mart Stores, Inc. and changed its name to Walmart Inc. in February 2018. Walmart Inc. was founded in 1945 and is based in Bentonville, Arkansas.

NEWS

Here's How Many Shares of Walmart You'd Need for $500 in Yearly Dividends

fool.com

2025-12-14 18:51:00Walmart's annual dividend is $0.94. The company has increased its annual dividend for 52 consecutive years.

Castleark Management LLC Sells 18,540 Shares of Walmart Inc. $WMT

defenseworld.net

2025-12-14 05:36:44Castleark Management LLC cut its holdings in shares of Walmart Inc. (NASDAQ: WMT) by 17.8% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 85,500 shares of the retailer's stock after selling 18,540 shares during the quarter. Castleark Management LLC's holdings in

Walmart was too late for a Nasdaq-100 spot — but these 6 stocks made the cut

marketwatch.com

2025-12-13 11:04:00Six companies will join the Nasdaq-100 later this month — but not Walmart, which switched its listing away from the New York Stock Exchange too late to qualify for a spot in the tech-heavy index.

Walmart's Valuation Makes Zero Mathematical Sense

seekingalpha.com

2025-12-13 09:41:27Walmart is rated a strong sell due to extreme overvaluation versus slow expected growth rates and cheaper peer metrics. WMT trades at historically high multiples—particularly its P/E of 40x—eclipsing peers like Target, Costco, and Amazon. Earnings and free cash flow yields lag well below risk-free money market rates, with rather slight company growth projections around 10% annually.

AQR Capital Management LLC Lowers Stake in Walmart Inc. $WMT

defenseworld.net

2025-12-13 09:20:42AQR Capital Management LLC cut its position in Walmart Inc. (NASDAQ: WMT) by 6.1% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 4,049,000 shares of the retailer's stock after selling 262,382 shares during the period. AQR Capital

Ameriprise Financial Inc. Grows Stake in Walmart Inc. $WMT

defenseworld.net

2025-12-13 03:59:05Ameriprise Financial Inc. grew its stake in shares of Walmart Inc. (NASDAQ: WMT) by 3.6% in the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 31,973,329 shares of the retailer's stock after acquiring an additional 1,098,342 shares during the quarter. Walmart comprises

Why You Can No Longer Find Walmart on the NYSE

fool.com

2025-12-12 10:34:23The retail giant hopes to emphasize its technology innovation by trading on the Nasdaq exchange. Walmart's stock has skyrocketed in value over the past five decades.

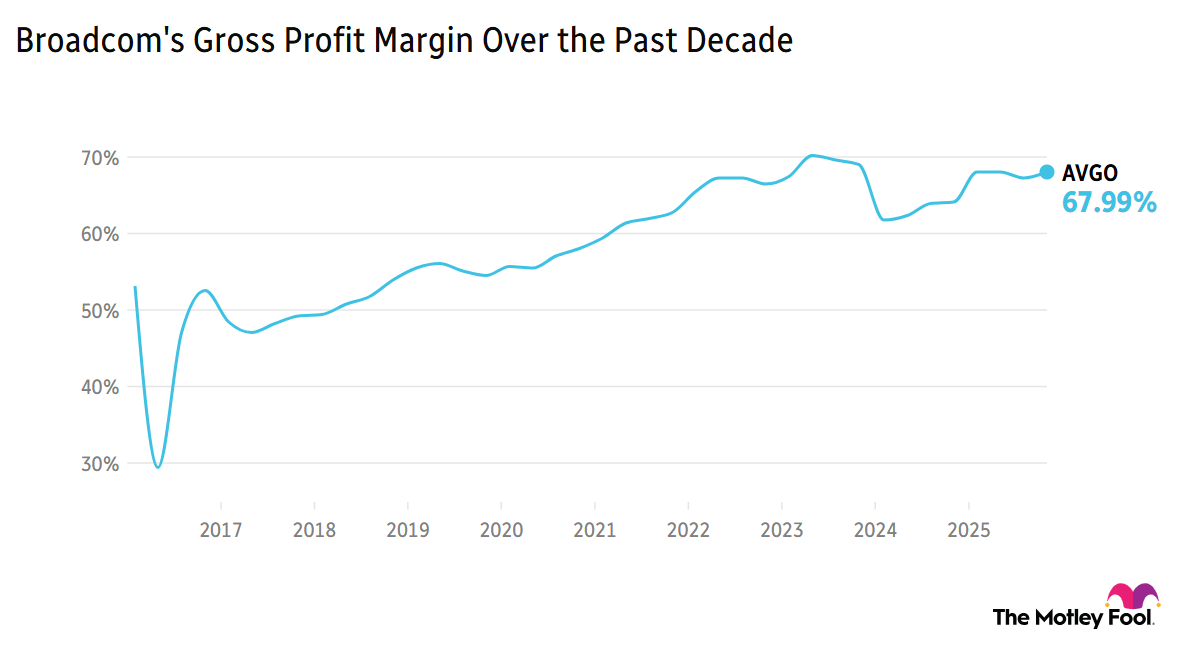

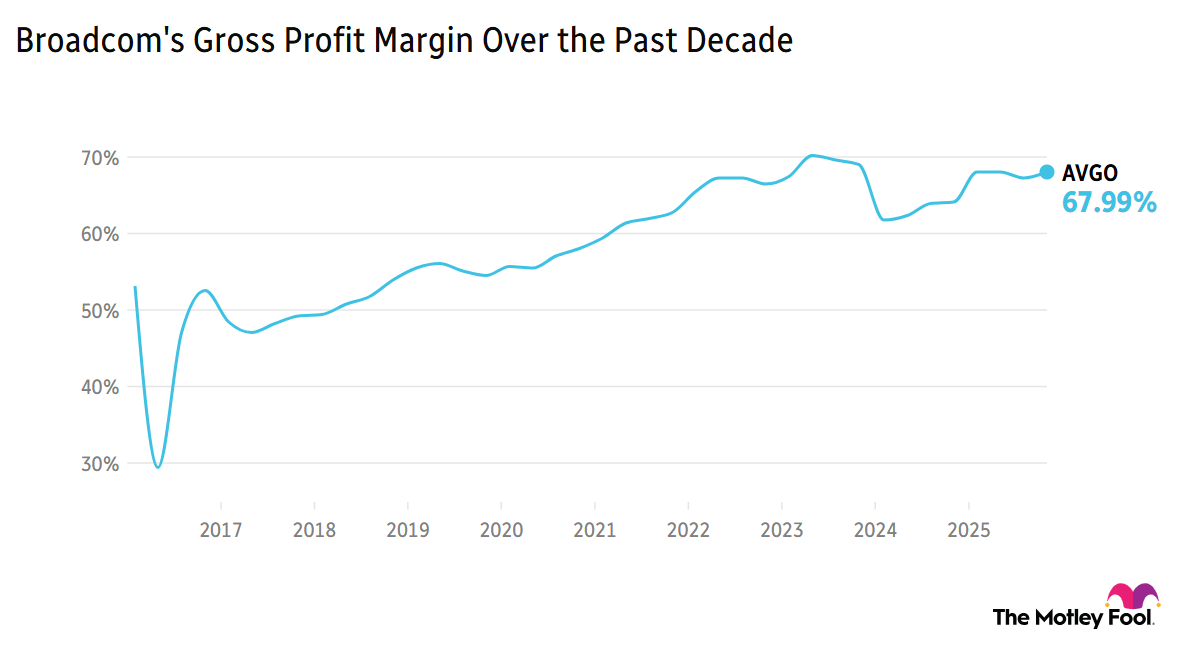

Breakfast News: Broadcom Guides Lower

fool.com

2025-12-12 07:30:00Broadcom feels the heat of AI expectations, LULU soars over 10% on strong results, and more

Dividend Powerhouses: 3 Blue-Chip Stocks Built for the Long Haul

marketbeat.com

2025-12-12 07:07:57The wall of worry continues to grow as investors race into 2026. Concentration risk is one that may not get talked about enough.

AI shopping could drive $263 billion in holiday sales. Walmart and Target are racing to get in

cnbc.com

2025-12-12 07:00:01AI could drive $263 billion in global holiday sales this year, representing 21% of all holiday orders, Salesforce predicts. Companies like Walmart and Target are overhauling their AI strategies to ensure they're meeting consumers where they're shopping.

Amazon vs. Walmart: Which Stock Will Outperform in 2026?

fool.com

2025-12-12 06:45:00Amazon is seeing great operating leverage in its e-commerce business. Walmart is the more defensively positioned retailer given its role as the largest grocer in the U.S. Amazon has the cheaper stock.

Bayesian Capital Management LP Invests $2.55 Million in Walmart Inc. $WMT

defenseworld.net

2025-12-12 04:04:47Bayesian Capital Management LP acquired a new position in shares of Walmart Inc. (NASDAQ: WMT) during the undefined quarter, according to its most recent 13F filing with the SEC. The firm acquired 26,079 shares of the retailer's stock, valued at approximately $2,550,000. Several other hedge funds have also made changes to their positions

Walmart Joins Nasdaq as Amazon Competition Goes High-Tech and Agentic

pymnts.com

2025-12-11 14:55:13When one thinks of retail competition, the battle between eCommerce and brick-and-mortar is typically what leaps to mind. Traditionally, Amazon has been the eCommerce landscape's leading representative, and Walmart the flag bearer for traditional physical shopping.

Top 3 Winter Stocks With Solid Growth Opportunities

marketbeat.com

2025-12-11 12:22:17The winter season often marks a distinct shift in the economic landscape, presenting investors with an opportunity to recalibrate their portfolios. While the colder months can bring market volatility, they also clarify the winners in specific industries that thrive on seasonal demand.

Walmart Stock Up 25% in 2025: What's the Smart Move for 2026?

zacks.com

2025-12-11 09:22:04WMT's 2025 rally, fueled by e-commerce strength and higher-margin growth, sets the stage for a balanced but watchful outlook heading into 2026.

Walmart's NASDAQ Switch Could Change Everything for WMT Stock

marketbeat.com

2025-12-11 08:44:10There's something different about Walmart Inc. NASDAQ: WMT this holiday season, and it has nothing to do with the health of the consumer. On Dec. 9, the company began publicly trading on the NASDAQ exchange.

Here's How Many Shares of Walmart You'd Need for $500 in Yearly Dividends

fool.com

2025-12-14 18:51:00Walmart's annual dividend is $0.94. The company has increased its annual dividend for 52 consecutive years.

Castleark Management LLC Sells 18,540 Shares of Walmart Inc. $WMT

defenseworld.net

2025-12-14 05:36:44Castleark Management LLC cut its holdings in shares of Walmart Inc. (NASDAQ: WMT) by 17.8% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 85,500 shares of the retailer's stock after selling 18,540 shares during the quarter. Castleark Management LLC's holdings in

Walmart was too late for a Nasdaq-100 spot — but these 6 stocks made the cut

marketwatch.com

2025-12-13 11:04:00Six companies will join the Nasdaq-100 later this month — but not Walmart, which switched its listing away from the New York Stock Exchange too late to qualify for a spot in the tech-heavy index.

Walmart's Valuation Makes Zero Mathematical Sense

seekingalpha.com

2025-12-13 09:41:27Walmart is rated a strong sell due to extreme overvaluation versus slow expected growth rates and cheaper peer metrics. WMT trades at historically high multiples—particularly its P/E of 40x—eclipsing peers like Target, Costco, and Amazon. Earnings and free cash flow yields lag well below risk-free money market rates, with rather slight company growth projections around 10% annually.

AQR Capital Management LLC Lowers Stake in Walmart Inc. $WMT

defenseworld.net

2025-12-13 09:20:42AQR Capital Management LLC cut its position in Walmart Inc. (NASDAQ: WMT) by 6.1% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 4,049,000 shares of the retailer's stock after selling 262,382 shares during the period. AQR Capital

Ameriprise Financial Inc. Grows Stake in Walmart Inc. $WMT

defenseworld.net

2025-12-13 03:59:05Ameriprise Financial Inc. grew its stake in shares of Walmart Inc. (NASDAQ: WMT) by 3.6% in the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 31,973,329 shares of the retailer's stock after acquiring an additional 1,098,342 shares during the quarter. Walmart comprises

Why You Can No Longer Find Walmart on the NYSE

fool.com

2025-12-12 10:34:23The retail giant hopes to emphasize its technology innovation by trading on the Nasdaq exchange. Walmart's stock has skyrocketed in value over the past five decades.

Breakfast News: Broadcom Guides Lower

fool.com

2025-12-12 07:30:00Broadcom feels the heat of AI expectations, LULU soars over 10% on strong results, and more

Dividend Powerhouses: 3 Blue-Chip Stocks Built for the Long Haul

marketbeat.com

2025-12-12 07:07:57The wall of worry continues to grow as investors race into 2026. Concentration risk is one that may not get talked about enough.

AI shopping could drive $263 billion in holiday sales. Walmart and Target are racing to get in

cnbc.com

2025-12-12 07:00:01AI could drive $263 billion in global holiday sales this year, representing 21% of all holiday orders, Salesforce predicts. Companies like Walmart and Target are overhauling their AI strategies to ensure they're meeting consumers where they're shopping.

Amazon vs. Walmart: Which Stock Will Outperform in 2026?

fool.com

2025-12-12 06:45:00Amazon is seeing great operating leverage in its e-commerce business. Walmart is the more defensively positioned retailer given its role as the largest grocer in the U.S. Amazon has the cheaper stock.

Bayesian Capital Management LP Invests $2.55 Million in Walmart Inc. $WMT

defenseworld.net

2025-12-12 04:04:47Bayesian Capital Management LP acquired a new position in shares of Walmart Inc. (NASDAQ: WMT) during the undefined quarter, according to its most recent 13F filing with the SEC. The firm acquired 26,079 shares of the retailer's stock, valued at approximately $2,550,000. Several other hedge funds have also made changes to their positions

Walmart Joins Nasdaq as Amazon Competition Goes High-Tech and Agentic

pymnts.com

2025-12-11 14:55:13When one thinks of retail competition, the battle between eCommerce and brick-and-mortar is typically what leaps to mind. Traditionally, Amazon has been the eCommerce landscape's leading representative, and Walmart the flag bearer for traditional physical shopping.

Top 3 Winter Stocks With Solid Growth Opportunities

marketbeat.com

2025-12-11 12:22:17The winter season often marks a distinct shift in the economic landscape, presenting investors with an opportunity to recalibrate their portfolios. While the colder months can bring market volatility, they also clarify the winners in specific industries that thrive on seasonal demand.

Walmart Stock Up 25% in 2025: What's the Smart Move for 2026?

zacks.com

2025-12-11 09:22:04WMT's 2025 rally, fueled by e-commerce strength and higher-margin growth, sets the stage for a balanced but watchful outlook heading into 2026.

Walmart's NASDAQ Switch Could Change Everything for WMT Stock

marketbeat.com

2025-12-11 08:44:10There's something different about Walmart Inc. NASDAQ: WMT this holiday season, and it has nothing to do with the health of the consumer. On Dec. 9, the company began publicly trading on the NASDAQ exchange.