Vipshop Holdings Limited (VIPS)

Price:

20.07 USD

( - -0.03 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Carvana Co.

VALUE SCORE:

6

2nd position

LightInTheBox Holding Co., Ltd.

VALUE SCORE:

10

The best

MINISO Group Holding Limited

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Vipshop Holdings Limited operates online platforms for various brands in the People's Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The company offers women's apparel, such as casual wear, jeans, dresses, outerwear, lingerie, pajamas, and maternity clothes; men's apparel comprising casual and smart-casual T-shirts, polo shirts, jackets, pants, and underwear; and skin care and cosmetic products, including cleansers, lotions, face and body creams, face masks, sunscreen, foundations, lipsticks, eye shadows, and other cosmetics-related items. It also provides shoes and bags, which comprises casual and formal shoes, purses, satchels, luggage, duffel bags, and wallets; handbags; apparel, gears and accessories, furnishings and decor, toys, and games for boys, girls, infants, and toddlers; sportswear, sports gear, and footwear for various sporting activities; home furnishings, such as bed and bath products, home decor, kitchen and tabletop items, and home appliances; and consumer electronic products. In addition, the company offers food and snacks, beverages, fresh produce, and pet goods; beauty products; and internet finance services, including consumer and supplier financing, and microcredit. Vipshop Holdings Limited provides its branded products through its vip.com and vipshop.com online platforms, as well as through its internet website and cellular phone application. Further, it offers warehousing, logistics, product procurement, research and development, technology development, and consulting services; software development and information technology support solutions; and supply chain services. Vipshop Holdings Limited was founded in 2008 and is headquartered in Guangzhou, the People's Republic of China.

NEWS

Vipshop Holdings Limited (NYSE:VIPS) Receives Average Rating of “Hold” from Analysts

defenseworld.net

2025-12-08 01:28:52Shares of Vipshop Holdings Limited (NYSE: VIPS - Get Free Report) have been given an average rating of "Hold" by the seven ratings firms that are currently covering the company, MarketBeat reports. Four investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. The average 1-year

Franklin Resources Inc. Lowers Holdings in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-12-01 05:22:43Franklin Resources Inc. reduced its position in shares of Vipshop Holdings Limited (NYSE: VIPS) by 1.5% during the undefined quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 429,160 shares of the technology company's stock after selling 6,372 shares during the quarter. Franklin Resources Inc.

Ensign Peak Advisors Inc Sells 4,050 Shares of Vipshop Holdings Limited $VIPS

defenseworld.net

2025-12-01 04:13:05Ensign Peak Advisors Inc reduced its position in Vipshop Holdings Limited (NYSE: VIPS) by 13.1% in the undefined quarter, according to its most recent filing with the SEC. The firm owned 26,950 shares of the technology company's stock after selling 4,050 shares during the period. Ensign Peak Advisors Inc's holdings in Vipshop were

American Century Companies Inc. Purchases 387,223 Shares of Vipshop Holdings Limited $VIPS

defenseworld.net

2025-12-01 03:14:59American Century Companies Inc. raised its holdings in shares of Vipshop Holdings Limited (NYSE: VIPS) by 24.1% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,996,122 shares of the technology company's stock after acquiring an additional 387,223 shares during the quarter.

Vipshop (VIPS) Upgraded to Buy: Here's Why

zacks.com

2025-11-27 13:01:14Vipshop (VIPS) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Creative Planning Increases Stock Position in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-11-25 03:57:06Creative Planning increased its stake in shares of Vipshop Holdings Limited (NYSE: VIPS) by 1.7% in the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 162,673 shares of the technology company's stock after purchasing an additional 2,796 shares during the period. Creative Planning's holdings

Should Value Investors Buy Vipshop (VIPS) Stock?

zacks.com

2025-11-21 10:41:21Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Vipshop Is Too Cheap To Sell, But Not Strong Enough To Buy

seekingalpha.com

2025-11-21 09:30:16Vipshop Holdings Limited is a leading Chinese online discount retailer, recently outperforming the S&P 500 with strong share price momentum. VIPS boasts a solid balance sheet, deep valuation discounts, and robust capital returns, but faces modest revenue growth, margin compression, and weakening cash flows. Despite profit per share growth and loyal customer expansion, VIPS's forward growth outlook remains tepid, with management guiding for flat to low single-digit sales growth.

Vipshop Holdings Limited (VIPS) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-20 09:43:25Vipshop Holdings Limited ( VIPS ) Q3 2025 Earnings Call November 20, 2025 7:00 AM EST Company Participants Jessie Fan - Head Of Investor Relations Eric Shen - Co-Founder, Chairman & CEO Mark Wang - Chief Financial Officer Conference Call Participants Thomas Chong - Jefferies LLC, Research Division Alicis a Yap - Citigroup Inc., Research Division Andre Chang - JPMorgan Chase & Co, Research Division Wei Xiong - UBS Investment Bank, Research Division Presentation Operator Ladies and gentlemen, good day, everyone, and welcome to Vipshop Holdings Third Quarter 202 Earnings Conference Call. At this time, I would like to turn the call over to Ms.

Vipshop Reports Unaudited Third Quarter 2025 Financial Results

prnewswire.com

2025-11-20 05:00:00Conference Call to Be Held at 7:00 A.M. U.S. Eastern Time on November 20, 2025 GUANGZHOU, China , Nov. 20, 2025 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced its unaudited financial results for the quarter ended September 30, 2025.

Campbell & CO Investment Adviser LLC Has $430,000 Position in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-11-17 04:37:00Campbell and CO Investment Adviser LLC trimmed its holdings in shares of Vipshop Holdings Limited (NYSE: VIPS) by 24.0% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 28,573 shares of the technology company's stock after selling 9,009 shares

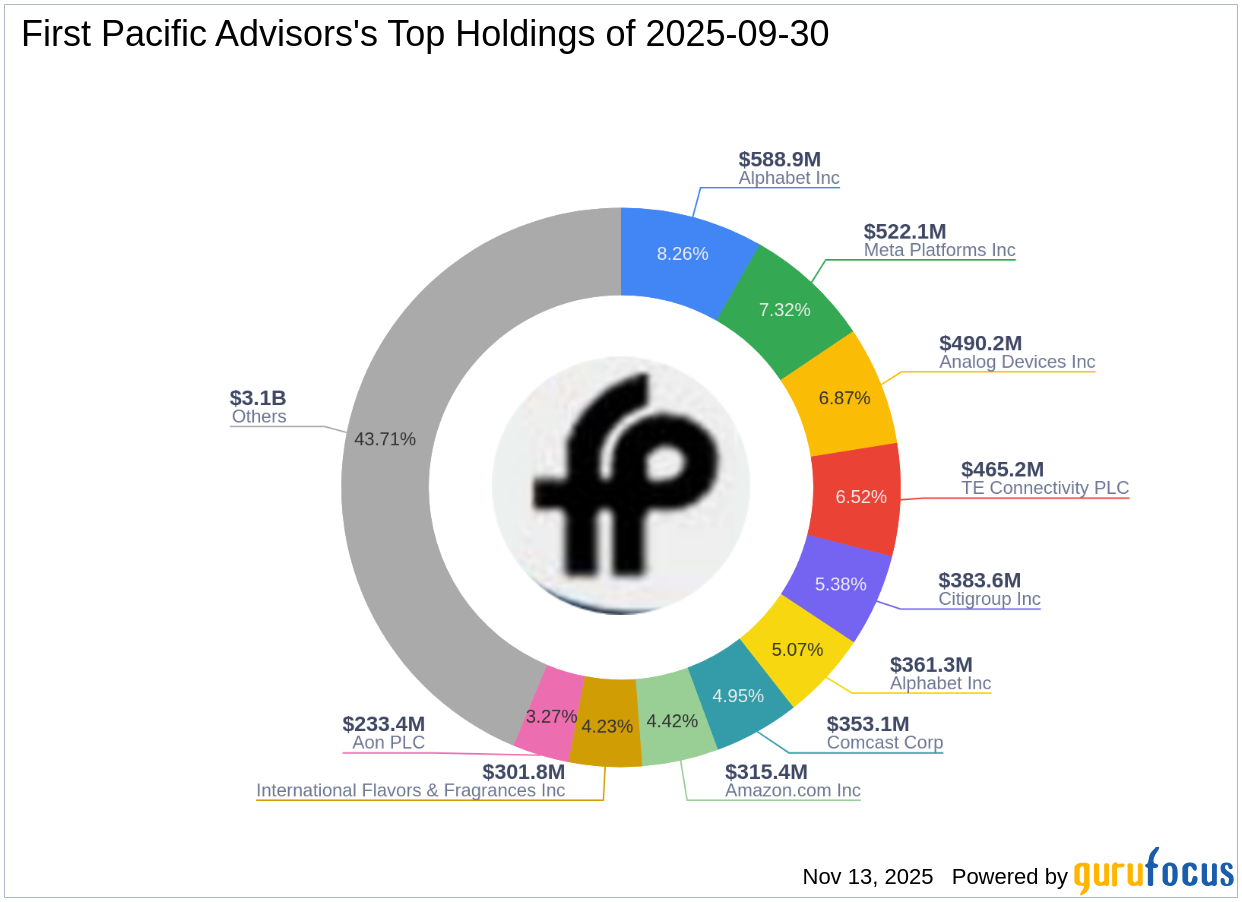

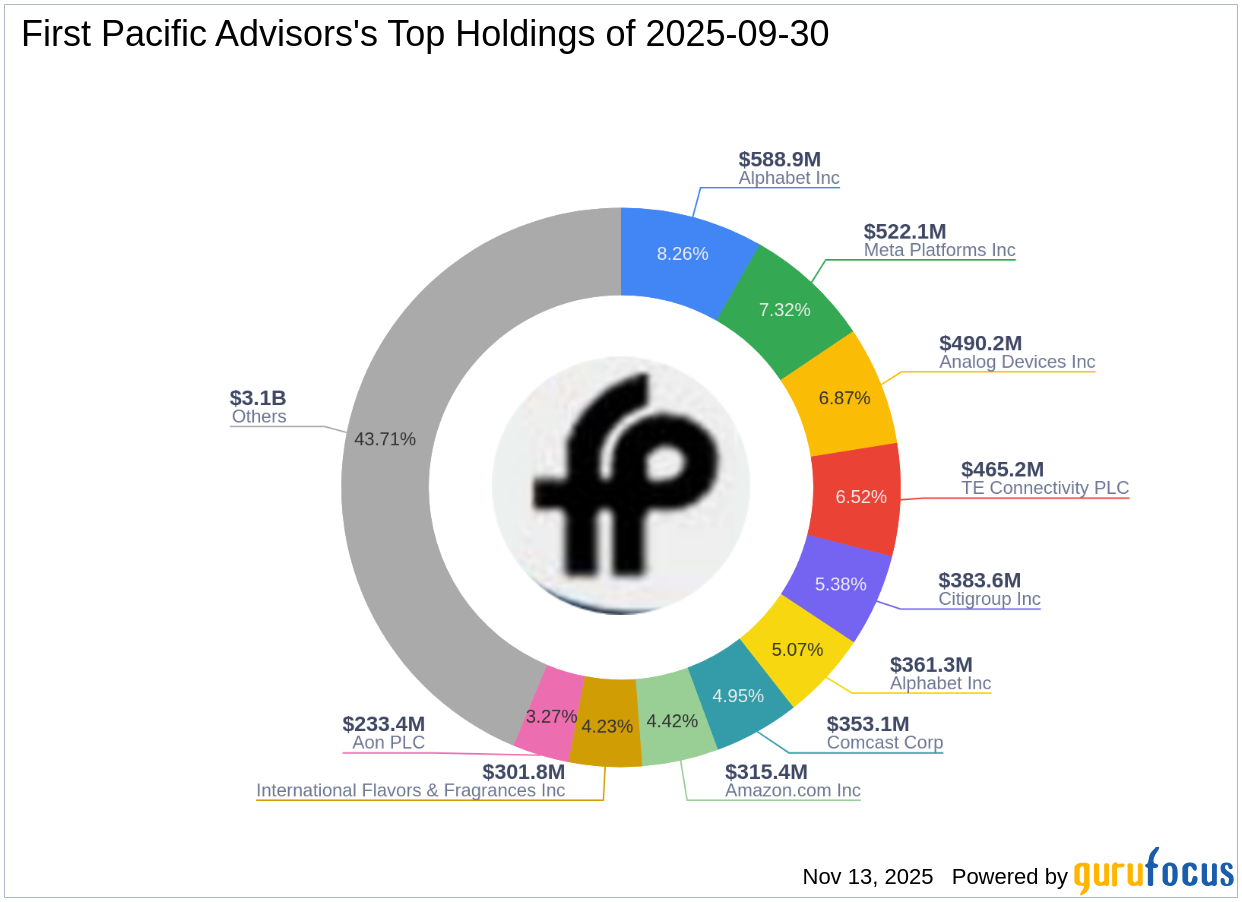

First Pacific Advisors' Strategic Moves: Becton Dickinson & Co Takes Center Stage

gurufocus.com

2025-11-13 18:01:00Exploring the Latest 13F Filing for Q3 2025 First Pacific Advisors (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, providi

Chinese ADR Wins Additional Support From Institutional Heavyweight. Here's What Retail Investors Should Know

fool.com

2025-11-12 10:22:10Added 3,426,079 shares of Vipshop; position value rose by $113.34 million Post-trade stake totals 17,185,535 shares valued at $320.42 million Vipshop now accounts for 9.1% of AUM, making it the fund's 5th-largest holding

Vipshop Holdings Limited to Hold Annual General Meeting on December 5, 2025

prnewswire.com

2025-11-12 05:00:00GUANGZHOU, China , Nov. 12, 2025 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced that it will hold an annual general meeting of shareholders at Vipshop Headquarters, 128 Dingxin Road, Haizhu District, Guangzhou 510220, People's Republic of China on December 5, 2025 at 11:00 a.m., Beijing time.

Vipshop to Announce Third Quarter 2025 Financial Results on November 20, 2025

prnewswire.com

2025-11-10 05:00:00GUANGZHOU, China , Nov. 10, 2025 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced that it plans to release its third quarter 2025 financial results on Thursday, November 20, 2025, before the US market open. The Company will hold a conference call on Thursday, November 20, 2025 at 7:00 am US Eastern Time, 8:00 pm Beijing Time to discuss the financial results.

Hantz Financial Services Inc. Grows Stock Position in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-11-06 03:33:07Hantz Financial Services Inc. boosted its position in Vipshop Holdings Limited (NYSE: VIPS) by 1,187.1% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 3,282 shares of the technology company's stock after purchasing an additional 3,027 shares during the quarter. Hantz Financial Services

Vipshop Holdings Limited (NYSE:VIPS) Receives Average Rating of “Hold” from Analysts

defenseworld.net

2025-12-08 01:28:52Shares of Vipshop Holdings Limited (NYSE: VIPS - Get Free Report) have been given an average rating of "Hold" by the seven ratings firms that are currently covering the company, MarketBeat reports. Four investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. The average 1-year

Franklin Resources Inc. Lowers Holdings in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-12-01 05:22:43Franklin Resources Inc. reduced its position in shares of Vipshop Holdings Limited (NYSE: VIPS) by 1.5% during the undefined quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 429,160 shares of the technology company's stock after selling 6,372 shares during the quarter. Franklin Resources Inc.

Ensign Peak Advisors Inc Sells 4,050 Shares of Vipshop Holdings Limited $VIPS

defenseworld.net

2025-12-01 04:13:05Ensign Peak Advisors Inc reduced its position in Vipshop Holdings Limited (NYSE: VIPS) by 13.1% in the undefined quarter, according to its most recent filing with the SEC. The firm owned 26,950 shares of the technology company's stock after selling 4,050 shares during the period. Ensign Peak Advisors Inc's holdings in Vipshop were

American Century Companies Inc. Purchases 387,223 Shares of Vipshop Holdings Limited $VIPS

defenseworld.net

2025-12-01 03:14:59American Century Companies Inc. raised its holdings in shares of Vipshop Holdings Limited (NYSE: VIPS) by 24.1% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,996,122 shares of the technology company's stock after acquiring an additional 387,223 shares during the quarter.

Vipshop (VIPS) Upgraded to Buy: Here's Why

zacks.com

2025-11-27 13:01:14Vipshop (VIPS) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Creative Planning Increases Stock Position in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-11-25 03:57:06Creative Planning increased its stake in shares of Vipshop Holdings Limited (NYSE: VIPS) by 1.7% in the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 162,673 shares of the technology company's stock after purchasing an additional 2,796 shares during the period. Creative Planning's holdings

Should Value Investors Buy Vipshop (VIPS) Stock?

zacks.com

2025-11-21 10:41:21Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Vipshop Is Too Cheap To Sell, But Not Strong Enough To Buy

seekingalpha.com

2025-11-21 09:30:16Vipshop Holdings Limited is a leading Chinese online discount retailer, recently outperforming the S&P 500 with strong share price momentum. VIPS boasts a solid balance sheet, deep valuation discounts, and robust capital returns, but faces modest revenue growth, margin compression, and weakening cash flows. Despite profit per share growth and loyal customer expansion, VIPS's forward growth outlook remains tepid, with management guiding for flat to low single-digit sales growth.

Vipshop Holdings Limited (VIPS) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-20 09:43:25Vipshop Holdings Limited ( VIPS ) Q3 2025 Earnings Call November 20, 2025 7:00 AM EST Company Participants Jessie Fan - Head Of Investor Relations Eric Shen - Co-Founder, Chairman & CEO Mark Wang - Chief Financial Officer Conference Call Participants Thomas Chong - Jefferies LLC, Research Division Alicis a Yap - Citigroup Inc., Research Division Andre Chang - JPMorgan Chase & Co, Research Division Wei Xiong - UBS Investment Bank, Research Division Presentation Operator Ladies and gentlemen, good day, everyone, and welcome to Vipshop Holdings Third Quarter 202 Earnings Conference Call. At this time, I would like to turn the call over to Ms.

Vipshop Reports Unaudited Third Quarter 2025 Financial Results

prnewswire.com

2025-11-20 05:00:00Conference Call to Be Held at 7:00 A.M. U.S. Eastern Time on November 20, 2025 GUANGZHOU, China , Nov. 20, 2025 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced its unaudited financial results for the quarter ended September 30, 2025.

Campbell & CO Investment Adviser LLC Has $430,000 Position in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-11-17 04:37:00Campbell and CO Investment Adviser LLC trimmed its holdings in shares of Vipshop Holdings Limited (NYSE: VIPS) by 24.0% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 28,573 shares of the technology company's stock after selling 9,009 shares

First Pacific Advisors' Strategic Moves: Becton Dickinson & Co Takes Center Stage

gurufocus.com

2025-11-13 18:01:00Exploring the Latest 13F Filing for Q3 2025 First Pacific Advisors (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, providi

Chinese ADR Wins Additional Support From Institutional Heavyweight. Here's What Retail Investors Should Know

fool.com

2025-11-12 10:22:10Added 3,426,079 shares of Vipshop; position value rose by $113.34 million Post-trade stake totals 17,185,535 shares valued at $320.42 million Vipshop now accounts for 9.1% of AUM, making it the fund's 5th-largest holding

Vipshop Holdings Limited to Hold Annual General Meeting on December 5, 2025

prnewswire.com

2025-11-12 05:00:00GUANGZHOU, China , Nov. 12, 2025 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced that it will hold an annual general meeting of shareholders at Vipshop Headquarters, 128 Dingxin Road, Haizhu District, Guangzhou 510220, People's Republic of China on December 5, 2025 at 11:00 a.m., Beijing time.

Vipshop to Announce Third Quarter 2025 Financial Results on November 20, 2025

prnewswire.com

2025-11-10 05:00:00GUANGZHOU, China , Nov. 10, 2025 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced that it plans to release its third quarter 2025 financial results on Thursday, November 20, 2025, before the US market open. The Company will hold a conference call on Thursday, November 20, 2025 at 7:00 am US Eastern Time, 8:00 pm Beijing Time to discuss the financial results.

Hantz Financial Services Inc. Grows Stock Position in Vipshop Holdings Limited $VIPS

defenseworld.net

2025-11-06 03:33:07Hantz Financial Services Inc. boosted its position in Vipshop Holdings Limited (NYSE: VIPS) by 1,187.1% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 3,282 shares of the technology company's stock after purchasing an additional 3,027 shares during the quarter. Hantz Financial Services