U-Haul Holding Company (UHAL)

Price:

54.48 USD

( + 0.09 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

U-Haul Holding Company

VALUE SCORE:

6

2nd position

GATX Corporation

VALUE SCORE:

8

The best

Ryder System, Inc.

VALUE SCORE:

8

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

U-Haul Holding Company operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada. The company's Moving and Storage segment rents trucks, trailers, portable moving and storage units, specialty rental items, and self-storage spaces primarily to the household movers; and sells moving supplies, towing accessories, and propane. It also provides uhaul.com, an online marketplace that connects consumers to independent Moving Help service providers and independent self-storage affiliates; auto transport and tow dolly options to transport vehicles; and specialty boxes for dishes, computers, flat screen television, and sensitive electronic equipment, as well as tapes, security locks, and packing supplies. This segment rents its products and services through a network of approximately 2,100 company operated retail moving stores and 21,100 independent U-Haul dealers. As of March 31, 2022, it had a rental fleet of approximately 186,000 trucks, 128,000 trailers, and 46,000 towing devices; and 1,844 self-storage locations with approximately 876,000 rentable storage units. The company's Property and Casualty Insurance segment offers loss adjusting and claims handling services. It also provides moving and storage protection packages, such as Safemove and Safetow packages, which offer moving and towing customers with a damage waiver, cargo protection, and medical and life insurance coverage; Safestor that protects storage customers from loss on their goods in storage; Safestor Mobile, which protects customers stored belongings; and Safemove Plus, which provides rental customers with a layer of primary liability protection. The company's Life Insurance segment provides life and health insurance products primarily to the senior market through the direct writing and reinsuring of life insurance, medicare supplement, and annuity policies. The company was formerly known as AMERCO. U-Haul Holding Company was founded in 1945 and is based in Reno, Nevada.

NEWS

Snohomish River Flooding: U-Haul Offers 30 Days of Free Self-Storage in Washington

businesswire.com

2025-12-10 13:48:00SNOHOMISH, Wash.--(BUSINESS WIRE)-- #30daysfree--U-Haul® is offering 30 days of free self-storage and U-Box® container usage at nine Company facilities across western Washington to aid those affected by the Snohomish River flooding. The City of Snohomish has declared a state of emergency following flooding that has already taken place. The river is forecasted to exceed a record-breaking level of 33 feet by Thursday, putting residential properties in jeopardy of sustaining water damage. Access to dry and secu.

Head-To-Head Survey: U-Haul (NYSE:UHAL) and Dynagas LNG Partners (NYSE:DLNG)

defenseworld.net

2025-12-10 02:08:53Dynagas LNG Partners (NYSE: DLNG - Get Free Report) and U-Haul (NYSE: UHAL - Get Free Report) are both transportation companies, but which is the superior stock? We will compare the two companies based on the strength of their analyst recommendations, earnings, profitability, valuation, risk, institutional ownership and dividends. Valuation and Earnings This table compares Dynagas LNG

U-Haul Holding Company Announces Quarterly Cash Dividend

businesswire.com

2025-12-03 16:47:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, on December 3, 2025 declared a quarterly cash dividend of $0.05 per share on its Series N Non-Voting Common Stock (NYSE: UHAL.B). The dividend will be payable December 30, 2025 to holders of record on December 15, 2025. This is the thirteenth dividend issued under the Company's dividend policy ann.

AMG Yacktman Fund Q3 2025 Contributors And Detractors

seekingalpha.com

2025-11-25 12:53:00Samsung (SSNLF) has been a solid contributor to performance after having detracted from results last year. Fox (FOX) benefited from the Murdoch family resolving its disputes and removing the ambiguity of succession. Bolloré (BOIVF) was a detractor for the quarter but the underlying thesis is very much intact.

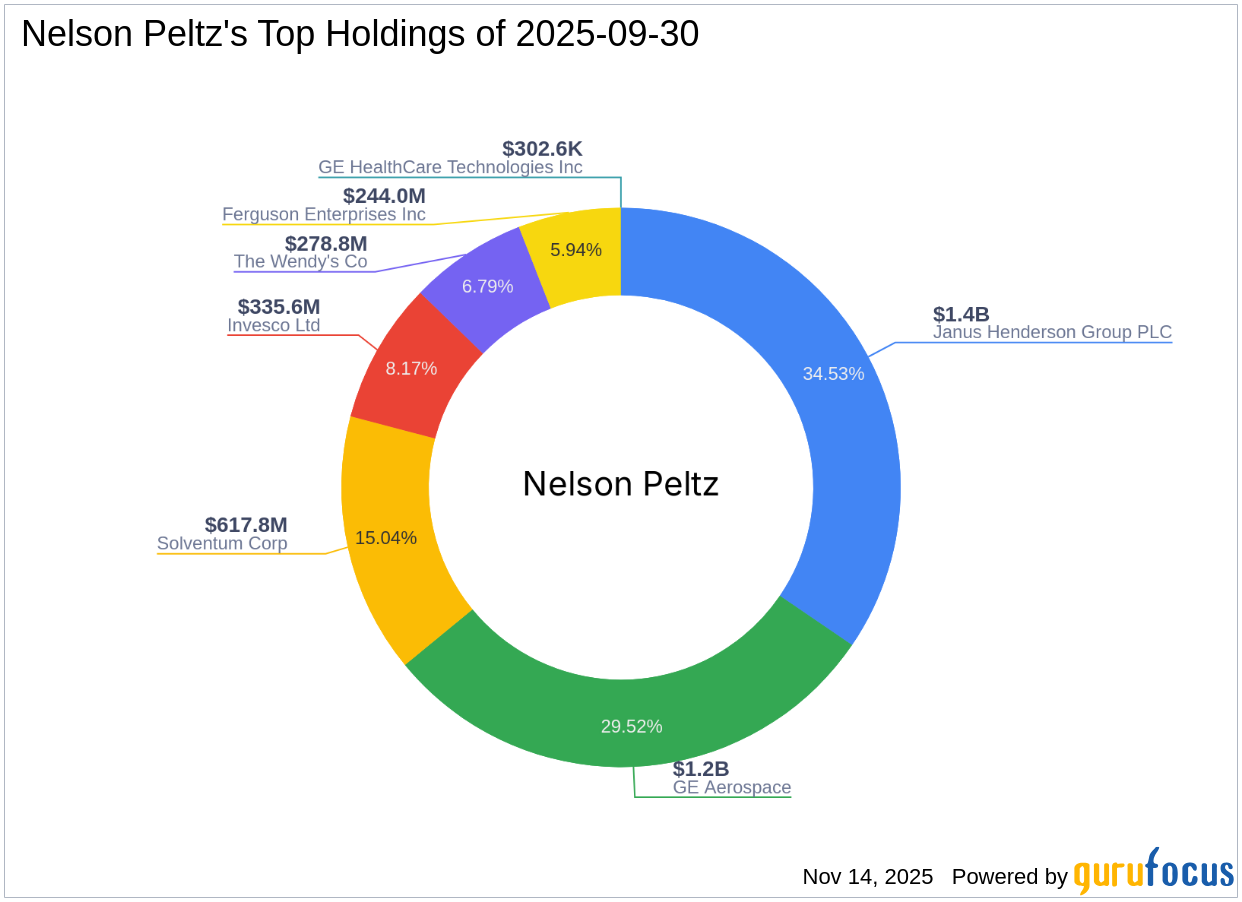

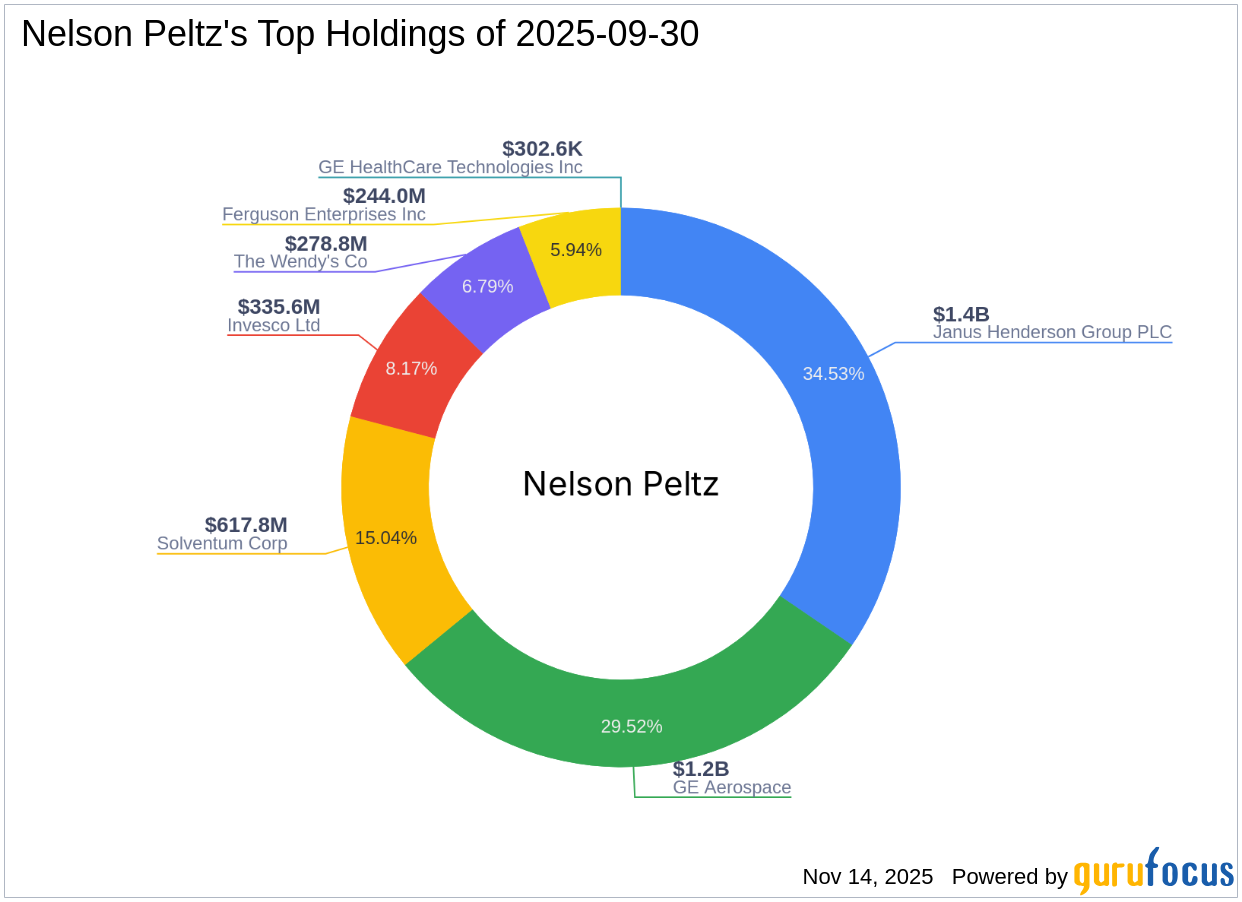

Nelson Peltz's Strategic Moves: U-Haul Holding Co Exit Impacts Portfolio by -0.56%

gurufocus.com

2025-11-14 17:11:00Exploring Nelson Peltz (Trades, Portfolio)'s Recent 13F Filing and Investment Strategy Nelson Peltz (Trades, Portfolio) recently submitted the 13F filing for t

U-Haul Holding Company (UHAL) Q2 2026 Earnings Call Transcript

seekingalpha.com

2025-11-06 15:56:08U-Haul Holding Company ( UHAL ) Q2 2026 Earnings Call November 6, 2025 10:00 AM EST Company Participants Sebastien Reyes - Director of Investor Relations Edward Shoen - Chairman of the Board, President & CEO Jason Berg - Chief Financial Officer Samuel Shoen - Vice Chairman of the Board & U-Box Project Manager Conference Call Participants Steven Ralston - Zacks Investment Research, Inc. Steven Ramsey - Thompson Research Group, LLC Andy Liu - Wolfe Research, LLC Jeffrey Kauffman - Vertical Research Partners, LLC James Wilen - Wilen Investment Management Corp. Stephen Farrell Presentation Operator Good morning, ladies and gentlemen, and welcome to the U-Haul Holding Company Second Quarter Fiscal 2026 Investor Conference Call. [Operator Instructions] This call is being recorded on Thursday, November 6, 2025.

U-Haul Holding Company Reports Second Quarter Fiscal 2026 Financial Results

businesswire.com

2025-11-05 16:43:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, today reported net earnings available to common shareholders for its second quarter ended September 30, 2025, of $105.6 million, compared with net earnings of $186.8 million for the same period last year. Earnings per share for Non-Voting Shares (UHAL.B) were $0.54 for the second quarter of fiscal.

U-Haul Closes Repair Shop in Little Rock after 50 Years

businesswire.com

2025-11-04 07:02:00LITTLE ROCK, Ark.--(BUSINESS WIRE)--U-Haul® ceased operations on Sunday at its regional repair shop at 4809 W. 65th St. The Little Rock Repair Shop had been in operation since 1975. U-Haul will maintain ownership of the 65th Street property, where the U-Haul Company of Arkansas regional offices continue to be housed. The former repair shop will become a storage space for internal purposes. As a result of the Nov. 2 closing, 24 Team Members were let go. U-Haul regional fleet equipment is now bei.

U-Haul Repair Shop Brings Jobs to North Little Rock

businesswire.com

2025-11-03 07:02:00NORTH LITTLE ROCK, Ark.--(BUSINESS WIRE)-- #24NewJobs--U-Haul® is bringing at least 24 jobs to the North Little Rock community with the opening of a new repair shop at 7000 Innerplan Drive. Operations begin today to fulfill routine maintenance and repairs for regional fleet equipment. The shop spans 30,000 square feet and utilizes three acres of a 13-acre parcel that was acquired in 2024. Future plans for the remaining land call for a three-story retail, moving and self-storage center, and a warehouse to ac.

U-Haul Offers Disaster Relief for Flood Victims at 3 Stores in Brevard County

businesswire.com

2025-10-30 16:55:00PALM BAY, Fla.--(BUSINESS WIRE)-- #30daysfree--U-Haul® Company of Eastern Florida has made three of its centers available to provide 30 days of free self-storage and U-Box® container usage to help those affected by the severe flooding that occurred this week in and around Brevard County. Heavy downpours resulted in 14 inches of water covering some areas in a span of just hours early Monday. Many homes and businesses sustained water damage from the flash floods. Access to dry and secure self-storage units and.

U-Haul Holding Company Schedules Second Quarter Fiscal 2026 Financial Results Release and Investor Webcast

businesswire.com

2025-10-22 16:32:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), the parent company of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, plans to report its second quarter fiscal 2026 financial results after the close of market trading on Wednesday, November 5, 2025. The Company is scheduled to conduct its second quarter investor conference call and webcast at 8 a.m. Arizona Time (10 a.m. ET) on Thursday, November 6, 20.

Typhoon Recovery: U-Haul Offers 30 Days Free Storage across Alaska

businesswire.com

2025-10-17 21:13:00ANCHORAGE, Alaska--(BUSINESS WIRE)-- #30daysfree--U-Haul® Company of Alaska has made all of its 11 Company facilities across the state available to provide 30 days of free self-storage and U-Box® container usage to support displaced residents after Typhoon Halong destroyed many Native communities along the western coast. Hurricane-force winds tore through communities last weekend and delivered storm surges that left more than 1,500 residents without homes, according to reports. U-Haul Company of Alaska presi.

Storm Recovery: U-Haul Offers 30 Days Free Storage across Arizona

businesswire.com

2025-10-14 16:24:00PHOENIX--(BUSINESS WIRE)-- #30days--U-Haul® has made all 90 Company stores in Arizona available for 30 days of free self-storage and U-Box® container usage to help residents after a string of powerful storms hit the state on Monday. The City of Tempe experienced a microburst, leaving homes and businesses damaged, downed power lines and trees, and more than 100 people displaced, according to news reports. Many Gila County communities were flooded, and storms also tore through parts of Tucson, causing resi.

U-Haul Holding Company Is Severely Undervalued (Upgrade)

seekingalpha.com

2025-10-02 10:09:24U-Haul Holding Company offers a unique business model combining self-moving and self-storage, with recent revenue growth but mixed profitability. Despite market headwinds and declining profits, UHAL's valuation is highly attractive both absolutely and relative to peers, presenting significant upside potential. The self-storage segment shows long-term growth trends, while the self-moving business faces near-term economic challenges but benefits from U-Box expansion.

U-Haul Holding Company Announces Quarterly Cash Dividend

businesswire.com

2025-08-21 17:00:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, on August 21, 2025 declared a quarterly cash dividend of $0.05 per share on its Series N Non-Voting Common Stock (NYSE: UHAL.B). The dividend will be payable September 26, 2025 to holders of record on September 15, 2025. This is the twelfth dividend issued under the Company's dividend policy annou.

Snohomish River Flooding: U-Haul Offers 30 Days of Free Self-Storage in Washington

businesswire.com

2025-12-10 13:48:00SNOHOMISH, Wash.--(BUSINESS WIRE)-- #30daysfree--U-Haul® is offering 30 days of free self-storage and U-Box® container usage at nine Company facilities across western Washington to aid those affected by the Snohomish River flooding. The City of Snohomish has declared a state of emergency following flooding that has already taken place. The river is forecasted to exceed a record-breaking level of 33 feet by Thursday, putting residential properties in jeopardy of sustaining water damage. Access to dry and secu.

Head-To-Head Survey: U-Haul (NYSE:UHAL) and Dynagas LNG Partners (NYSE:DLNG)

defenseworld.net

2025-12-10 02:08:53Dynagas LNG Partners (NYSE: DLNG - Get Free Report) and U-Haul (NYSE: UHAL - Get Free Report) are both transportation companies, but which is the superior stock? We will compare the two companies based on the strength of their analyst recommendations, earnings, profitability, valuation, risk, institutional ownership and dividends. Valuation and Earnings This table compares Dynagas LNG

U-Haul Holding Company Announces Quarterly Cash Dividend

businesswire.com

2025-12-03 16:47:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, on December 3, 2025 declared a quarterly cash dividend of $0.05 per share on its Series N Non-Voting Common Stock (NYSE: UHAL.B). The dividend will be payable December 30, 2025 to holders of record on December 15, 2025. This is the thirteenth dividend issued under the Company's dividend policy ann.

AMG Yacktman Fund Q3 2025 Contributors And Detractors

seekingalpha.com

2025-11-25 12:53:00Samsung (SSNLF) has been a solid contributor to performance after having detracted from results last year. Fox (FOX) benefited from the Murdoch family resolving its disputes and removing the ambiguity of succession. Bolloré (BOIVF) was a detractor for the quarter but the underlying thesis is very much intact.

Nelson Peltz's Strategic Moves: U-Haul Holding Co Exit Impacts Portfolio by -0.56%

gurufocus.com

2025-11-14 17:11:00Exploring Nelson Peltz (Trades, Portfolio)'s Recent 13F Filing and Investment Strategy Nelson Peltz (Trades, Portfolio) recently submitted the 13F filing for t

U-Haul Holding Company (UHAL) Q2 2026 Earnings Call Transcript

seekingalpha.com

2025-11-06 15:56:08U-Haul Holding Company ( UHAL ) Q2 2026 Earnings Call November 6, 2025 10:00 AM EST Company Participants Sebastien Reyes - Director of Investor Relations Edward Shoen - Chairman of the Board, President & CEO Jason Berg - Chief Financial Officer Samuel Shoen - Vice Chairman of the Board & U-Box Project Manager Conference Call Participants Steven Ralston - Zacks Investment Research, Inc. Steven Ramsey - Thompson Research Group, LLC Andy Liu - Wolfe Research, LLC Jeffrey Kauffman - Vertical Research Partners, LLC James Wilen - Wilen Investment Management Corp. Stephen Farrell Presentation Operator Good morning, ladies and gentlemen, and welcome to the U-Haul Holding Company Second Quarter Fiscal 2026 Investor Conference Call. [Operator Instructions] This call is being recorded on Thursday, November 6, 2025.

U-Haul Holding Company Reports Second Quarter Fiscal 2026 Financial Results

businesswire.com

2025-11-05 16:43:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, today reported net earnings available to common shareholders for its second quarter ended September 30, 2025, of $105.6 million, compared with net earnings of $186.8 million for the same period last year. Earnings per share for Non-Voting Shares (UHAL.B) were $0.54 for the second quarter of fiscal.

U-Haul Closes Repair Shop in Little Rock after 50 Years

businesswire.com

2025-11-04 07:02:00LITTLE ROCK, Ark.--(BUSINESS WIRE)--U-Haul® ceased operations on Sunday at its regional repair shop at 4809 W. 65th St. The Little Rock Repair Shop had been in operation since 1975. U-Haul will maintain ownership of the 65th Street property, where the U-Haul Company of Arkansas regional offices continue to be housed. The former repair shop will become a storage space for internal purposes. As a result of the Nov. 2 closing, 24 Team Members were let go. U-Haul regional fleet equipment is now bei.

U-Haul Repair Shop Brings Jobs to North Little Rock

businesswire.com

2025-11-03 07:02:00NORTH LITTLE ROCK, Ark.--(BUSINESS WIRE)-- #24NewJobs--U-Haul® is bringing at least 24 jobs to the North Little Rock community with the opening of a new repair shop at 7000 Innerplan Drive. Operations begin today to fulfill routine maintenance and repairs for regional fleet equipment. The shop spans 30,000 square feet and utilizes three acres of a 13-acre parcel that was acquired in 2024. Future plans for the remaining land call for a three-story retail, moving and self-storage center, and a warehouse to ac.

U-Haul Offers Disaster Relief for Flood Victims at 3 Stores in Brevard County

businesswire.com

2025-10-30 16:55:00PALM BAY, Fla.--(BUSINESS WIRE)-- #30daysfree--U-Haul® Company of Eastern Florida has made three of its centers available to provide 30 days of free self-storage and U-Box® container usage to help those affected by the severe flooding that occurred this week in and around Brevard County. Heavy downpours resulted in 14 inches of water covering some areas in a span of just hours early Monday. Many homes and businesses sustained water damage from the flash floods. Access to dry and secure self-storage units and.

U-Haul Holding Company Schedules Second Quarter Fiscal 2026 Financial Results Release and Investor Webcast

businesswire.com

2025-10-22 16:32:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), the parent company of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, plans to report its second quarter fiscal 2026 financial results after the close of market trading on Wednesday, November 5, 2025. The Company is scheduled to conduct its second quarter investor conference call and webcast at 8 a.m. Arizona Time (10 a.m. ET) on Thursday, November 6, 20.

Typhoon Recovery: U-Haul Offers 30 Days Free Storage across Alaska

businesswire.com

2025-10-17 21:13:00ANCHORAGE, Alaska--(BUSINESS WIRE)-- #30daysfree--U-Haul® Company of Alaska has made all of its 11 Company facilities across the state available to provide 30 days of free self-storage and U-Box® container usage to support displaced residents after Typhoon Halong destroyed many Native communities along the western coast. Hurricane-force winds tore through communities last weekend and delivered storm surges that left more than 1,500 residents without homes, according to reports. U-Haul Company of Alaska presi.

Storm Recovery: U-Haul Offers 30 Days Free Storage across Arizona

businesswire.com

2025-10-14 16:24:00PHOENIX--(BUSINESS WIRE)-- #30days--U-Haul® has made all 90 Company stores in Arizona available for 30 days of free self-storage and U-Box® container usage to help residents after a string of powerful storms hit the state on Monday. The City of Tempe experienced a microburst, leaving homes and businesses damaged, downed power lines and trees, and more than 100 people displaced, according to news reports. Many Gila County communities were flooded, and storms also tore through parts of Tucson, causing resi.

U-Haul Holding Company Is Severely Undervalued (Upgrade)

seekingalpha.com

2025-10-02 10:09:24U-Haul Holding Company offers a unique business model combining self-moving and self-storage, with recent revenue growth but mixed profitability. Despite market headwinds and declining profits, UHAL's valuation is highly attractive both absolutely and relative to peers, presenting significant upside potential. The self-storage segment shows long-term growth trends, while the self-moving business faces near-term economic challenges but benefits from U-Box expansion.

U-Haul Holding Company Announces Quarterly Cash Dividend

businesswire.com

2025-08-21 17:00:00RENO, Nev.--(BUSINESS WIRE)--U-Haul Holding Company (NYSE: UHAL, UHAL.B), parent of U-Haul International, Inc., Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company, on August 21, 2025 declared a quarterly cash dividend of $0.05 per share on its Series N Non-Voting Common Stock (NYSE: UHAL.B). The dividend will be payable September 26, 2025 to holders of record on September 15, 2025. This is the twelfth dividend issued under the Company's dividend policy annou.