The Toro Company (TTC)

Price:

101.33 USD

( + 0.70 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

RBC Bearings Incorporated

VALUE SCORE:

6

2nd position

The Timken Company

VALUE SCORE:

7

The best

Snap-on Incorporated

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The Toro Company engages in the designing, manufacturing, marketing, and selling professional and residential equipment worldwide. The company's Professional segment offers turf and landscape equipment products, including sports fields and grounds mowing and maintenance equipment, golf course mowing and maintenance equipment, landscape contractor mowing equipment, landscape creation and renovation equipment, and other maintenance equipment; rental, specialty, and underground construction equipment; and snow and ice management equipment, such as snowplows, brush, snow thrower attachment, salt and sand spreaders, and related parts and accessories for light and medium duty trucks, utility task vehicles, skid steers, and front-end loaders. It also provides irrigation and lighting products that consist of sprinkler heads, electric and hydraulic valves, controllers, computer irrigation central control systems, coupling systems, and ag-irrigation drip tape and hose products, as well as professionally installed landscape lighting products offered through distributors and landscape contractors. This segment sells its products primarily through a network of distributors and dealers to professional users engaged in maintaining golf courses, sports fields, municipal properties, agricultural fields, residential and commercial landscapes, and removing snow and ice, as well as directly to government customers, rental companies, and retailers. Its Residential segment provides walk power mowers, zero-turn riding mowers, snow throwers, replacement parts, and home solution products that include grass and hedge trimmers, leaf blowers, blower-vacuums, chainsaws, string trimmers, hoses, and hose-end retail irrigation products. This segment sells its products to homeowners through a network of distributors and dealers; and home centers, hardware retailers, and mass retailers, as well as online. The Toro Company was founded in 1914 and is headquartered in Bloomington, Minnesota.

NEWS

Toro Company (The) (TTC) Soars to 52-Week High, Time to Cash Out?

zacks.com

2026-02-23 10:16:42Toro (TTC) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Investors Buy High Volume of Toro Put Options (NYSE:TTC)

defenseworld.net

2026-02-20 01:31:12Toro Company (The) (NYSE: TTC - Get Free Report) was the recipient of some unusual options trading on Wednesday. Stock traders purchased 1,176 put options on the company. This is an increase of approximately 1,709% compared to the average volume of 65 put options. Hedge Funds Weigh In On Toro Institutional investors have recently added to

Toro Company (The) (NYSE:TTC) Given Consensus Rating of “Hold” by Brokerages

defenseworld.net

2026-02-18 02:08:58Toro Company (The) (NYSE: TTC - Get Free Report) has been given an average rating of "Hold" by the seven research firms that are currently covering the company, Marketbeat Ratings reports. Four investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 1 year

Toro Sees Unusually Large Options Volume (NYSE:TTC)

defenseworld.net

2026-02-05 01:42:46Toro Company (The) (NYSE: TTC - Get Free Report) saw unusually large options trading activity on Wednesday. Traders purchased 1,176 put options on the company. This is an increase of approximately 1,709% compared to the average volume of 65 put options. Institutional Investors Weigh In On Toro A number of hedge funds have recently made changes

Why Toro (TTC) is Poised to Beat Earnings Estimates Again

zacks.com

2026-02-03 13:10:20Toro (TTC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

The Toro Company: A Baby Bull Market Is Gaining Traction

marketbeat.com

2025-12-28 10:42:37The Toro Company's NYSE: TTC weekly stock chart suggests its bear market is over, a baby bull market has formed, and it's gaining traction. Not only is the market showing clear support at long-term lows, aligning with prior price action, but support appears to be strengthening; the indications are strong, and a breakout is imminent.

Traders Purchase Large Volume of Put Options on Toro (NYSE:TTC)

defenseworld.net

2025-12-25 03:32:59Toro Company (The) (NYSE: TTC - Get Free Report) was the recipient of unusually large options trading activity on Wednesday. Investors purchased 1,176 put options on the company. This is an increase of 1,709% compared to the typical volume of 65 put options. Toro Stock Performance Shares of NYSE: TTC opened at $78.88 on Thursday. The firm

One Of The Most Important Rotations Of The Decade - Here's How I'm Preparing

seekingalpha.com

2025-12-19 07:30:00I am rotating from Big Tech to cyclical value, energy, and high-quality dividend growth stocks amid complex market interconnections. AI is the dominant disruptor, impacting macroeconomics, labor, energy demand, and driving market concentration in the Mag-7. Current market valuations are unfavorable and top-heavy, with over 40% in the largest ten holdings.

The Toro Company: The Future Outlook Is Still Murky Despite A Good Earnings Report (Rating Upgrade)

seekingalpha.com

2025-12-18 08:30:00The Toro Company posted a strong Q4 earnings beat, driving a sharp share price rally above $80. TTC's professional segment remains robust, but residential sales and margins have materially declined, highlighting uneven business momentum. Dividend growth continues to slow, with a modest 2.63% increase and a payout ratio now at 45%.

The Toro Company (TTC) Q4 2025 Earnings Call Transcript

seekingalpha.com

2025-12-17 13:29:03The Toro Company (TTC) Q4 2025 Earnings Call Transcript

Toro (TTC) Q4 Earnings and Revenues Beat Estimates

zacks.com

2025-12-17 10:41:33Toro (TTC) came out with quarterly earnings of $0.91 per share, beating the Zacks Consensus Estimate of $0.86 per share. This compares to earnings of $0.95 per share a year ago.

The Toro Company Reports Fourth-Quarter and Full-Year Fiscal 2025 Financial Results

businesswire.com

2025-12-17 08:30:00BLOOMINGTON, Minn.--(BUSINESS WIRE)--The Toro Company (NYSE: TTC), a leading global provider of solutions for the outdoor environment, today reported results for its fiscal fourth-quarter and full-year ended October 31, 2025. Fourth quarter net sales were $1.07 billion, compared to $1.08 billion in the same period of fiscal 2024. Full-year net sales were $4.51 billion, compared to $4.58 billion in fiscal 2024, with most of the difference due to prior year divestitures of non-core assets. Fourth.

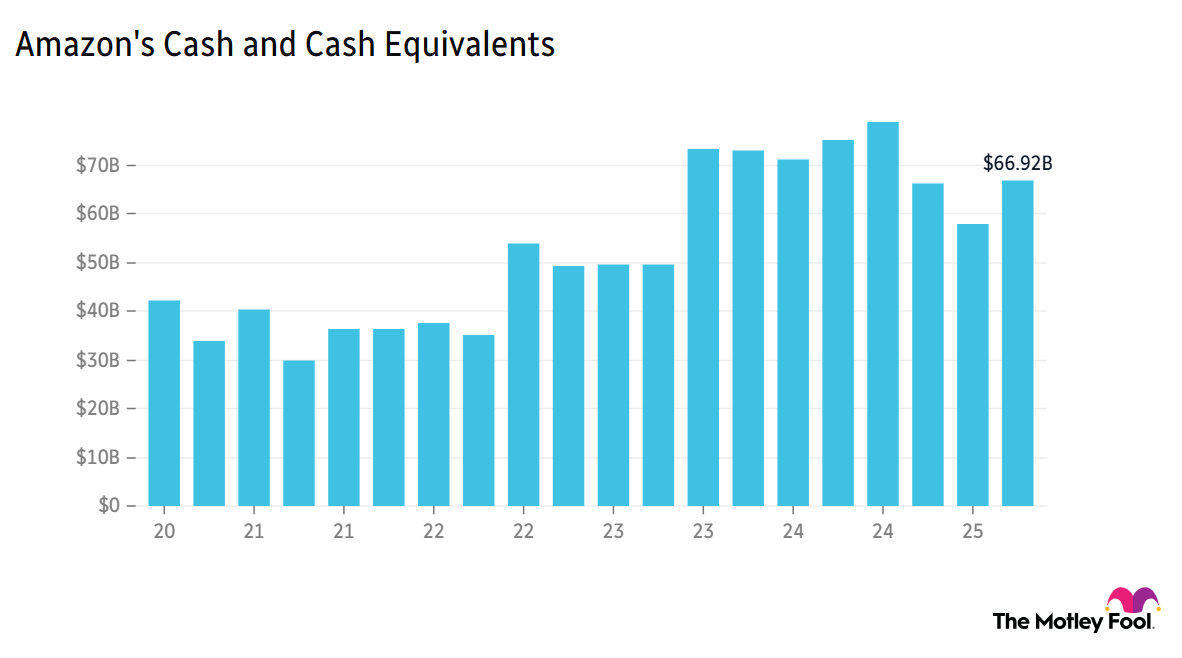

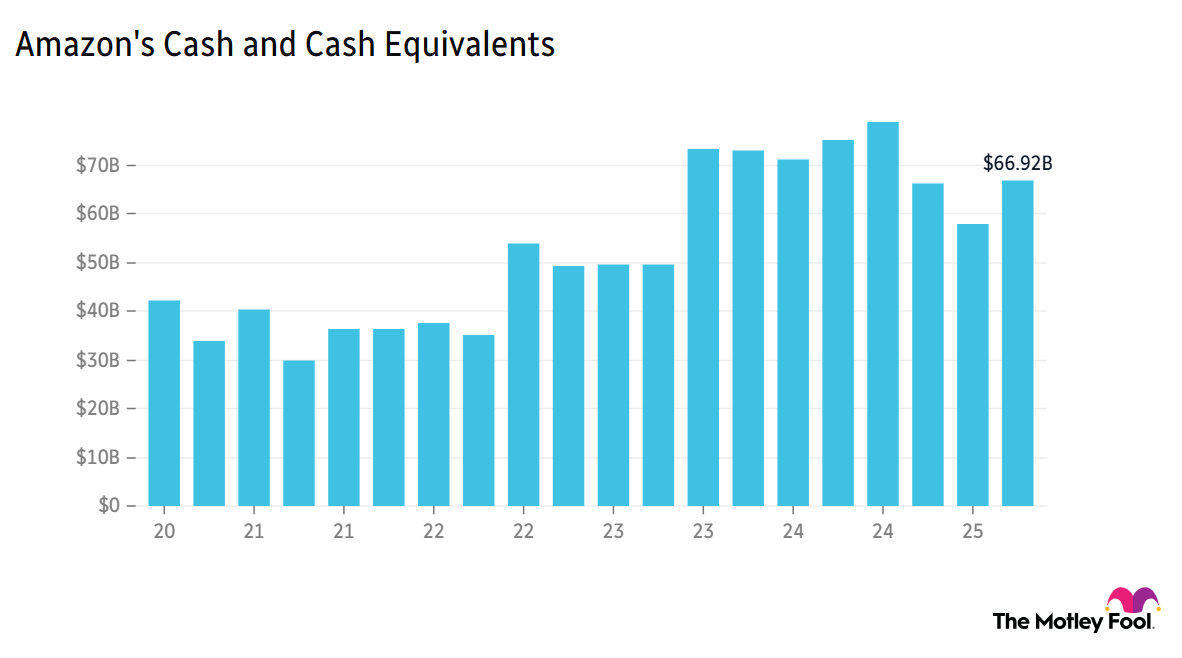

Breakfast News: OpenAI Seeks $10B From AMZN

fool.com

2025-12-17 07:30:00OpenAI in finance talks with Amazon, Waymo plans global expansion, and more

The Toro Company Announces Official Partnership With the 2026 Special Olympics USA Games

businesswire.com

2025-12-15 08:30:00BLOOMINGTON, Minn.--(BUSINESS WIRE)--The Toro Company Announces Official Partnership with the 2026 Special Olympics USA Games.

Toro Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

benzinga.com

2025-12-15 08:28:23The Toro Company (NYSE: TTC) will release earnings results for the fourth quarter before the opening bell on Wednesday, Dec. 17.

The Toro Company Declares Regular Quarterly Cash Dividend

businesswire.com

2025-12-09 16:30:00BLOOMINGTON, Minn.--(BUSINESS WIRE)--The Toro Company's Board of Directors declared a regular quarterly cash dividend and authorized the repurchase of up to an additional 6 million shares.

Toro Company (The) (TTC) Soars to 52-Week High, Time to Cash Out?

zacks.com

2026-02-23 10:16:42Toro (TTC) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Investors Buy High Volume of Toro Put Options (NYSE:TTC)

defenseworld.net

2026-02-20 01:31:12Toro Company (The) (NYSE: TTC - Get Free Report) was the recipient of some unusual options trading on Wednesday. Stock traders purchased 1,176 put options on the company. This is an increase of approximately 1,709% compared to the average volume of 65 put options. Hedge Funds Weigh In On Toro Institutional investors have recently added to

Toro Company (The) (NYSE:TTC) Given Consensus Rating of “Hold” by Brokerages

defenseworld.net

2026-02-18 02:08:58Toro Company (The) (NYSE: TTC - Get Free Report) has been given an average rating of "Hold" by the seven research firms that are currently covering the company, Marketbeat Ratings reports. Four investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 1 year

Toro Sees Unusually Large Options Volume (NYSE:TTC)

defenseworld.net

2026-02-05 01:42:46Toro Company (The) (NYSE: TTC - Get Free Report) saw unusually large options trading activity on Wednesday. Traders purchased 1,176 put options on the company. This is an increase of approximately 1,709% compared to the average volume of 65 put options. Institutional Investors Weigh In On Toro A number of hedge funds have recently made changes

Why Toro (TTC) is Poised to Beat Earnings Estimates Again

zacks.com

2026-02-03 13:10:20Toro (TTC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

The Toro Company: A Baby Bull Market Is Gaining Traction

marketbeat.com

2025-12-28 10:42:37The Toro Company's NYSE: TTC weekly stock chart suggests its bear market is over, a baby bull market has formed, and it's gaining traction. Not only is the market showing clear support at long-term lows, aligning with prior price action, but support appears to be strengthening; the indications are strong, and a breakout is imminent.

Traders Purchase Large Volume of Put Options on Toro (NYSE:TTC)

defenseworld.net

2025-12-25 03:32:59Toro Company (The) (NYSE: TTC - Get Free Report) was the recipient of unusually large options trading activity on Wednesday. Investors purchased 1,176 put options on the company. This is an increase of 1,709% compared to the typical volume of 65 put options. Toro Stock Performance Shares of NYSE: TTC opened at $78.88 on Thursday. The firm

One Of The Most Important Rotations Of The Decade - Here's How I'm Preparing

seekingalpha.com

2025-12-19 07:30:00I am rotating from Big Tech to cyclical value, energy, and high-quality dividend growth stocks amid complex market interconnections. AI is the dominant disruptor, impacting macroeconomics, labor, energy demand, and driving market concentration in the Mag-7. Current market valuations are unfavorable and top-heavy, with over 40% in the largest ten holdings.

The Toro Company: The Future Outlook Is Still Murky Despite A Good Earnings Report (Rating Upgrade)

seekingalpha.com

2025-12-18 08:30:00The Toro Company posted a strong Q4 earnings beat, driving a sharp share price rally above $80. TTC's professional segment remains robust, but residential sales and margins have materially declined, highlighting uneven business momentum. Dividend growth continues to slow, with a modest 2.63% increase and a payout ratio now at 45%.

The Toro Company (TTC) Q4 2025 Earnings Call Transcript

seekingalpha.com

2025-12-17 13:29:03The Toro Company (TTC) Q4 2025 Earnings Call Transcript

Toro (TTC) Q4 Earnings and Revenues Beat Estimates

zacks.com

2025-12-17 10:41:33Toro (TTC) came out with quarterly earnings of $0.91 per share, beating the Zacks Consensus Estimate of $0.86 per share. This compares to earnings of $0.95 per share a year ago.

The Toro Company Reports Fourth-Quarter and Full-Year Fiscal 2025 Financial Results

businesswire.com

2025-12-17 08:30:00BLOOMINGTON, Minn.--(BUSINESS WIRE)--The Toro Company (NYSE: TTC), a leading global provider of solutions for the outdoor environment, today reported results for its fiscal fourth-quarter and full-year ended October 31, 2025. Fourth quarter net sales were $1.07 billion, compared to $1.08 billion in the same period of fiscal 2024. Full-year net sales were $4.51 billion, compared to $4.58 billion in fiscal 2024, with most of the difference due to prior year divestitures of non-core assets. Fourth.

Breakfast News: OpenAI Seeks $10B From AMZN

fool.com

2025-12-17 07:30:00OpenAI in finance talks with Amazon, Waymo plans global expansion, and more

The Toro Company Announces Official Partnership With the 2026 Special Olympics USA Games

businesswire.com

2025-12-15 08:30:00BLOOMINGTON, Minn.--(BUSINESS WIRE)--The Toro Company Announces Official Partnership with the 2026 Special Olympics USA Games.

Toro Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

benzinga.com

2025-12-15 08:28:23The Toro Company (NYSE: TTC) will release earnings results for the fourth quarter before the opening bell on Wednesday, Dec. 17.

The Toro Company Declares Regular Quarterly Cash Dividend

businesswire.com

2025-12-09 16:30:00BLOOMINGTON, Minn.--(BUSINESS WIRE)--The Toro Company's Board of Directors declared a regular quarterly cash dividend and authorized the repurchase of up to an additional 6 million shares.