Townsquare Media, Inc. (TSQ)

Price:

7.20 USD

( + 0.20 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

ACCESS Newswire Inc.

VALUE SCORE:

6

2nd position

Omnicom Group Inc.

VALUE SCORE:

7

The best

Boston Omaha Corporation

VALUE SCORE:

8

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Townsquare Media, Inc. operates as a digital media and marketing solutions company in small and medium-sized businesses. It operates through three segments: Subscription Digital Marketing Solutions, Digital Advertising, and Broadcast Advertising. The Subscription Digital Marketing Solutions segment offers various digital marketing solutions, including hosting, search engine optimization, online directory optimization, e-commerce solutions, online reputation monitoring, social media management, appointment scheduling, payment and invoice, customer management, email marketing, and website retargeting services, as well as traditional and mobile-enabled website design, creation, and development services. The Digital Advertising segment provides digital advertising on its owned and operated digital properties, and digital programmatic advertising platforms, as well as data analytics and management platform. The Broadcast Advertising segment engages in the sale of local radio stations to local, regional, and national spot advertisers, and national network advertisers. As of December 31, 2021, this segment owned and operated 322 radio stations and approximately 330 local websites in 67 local markets. It also owns and operates approximately 200 live events, including concerts, expositions, and other experiential events; and operates local media under the WYRK.com, WJON.com, and NJ101.5.com brands, as well as national music under the XXLmag.com, TasteofCountry.com, UltimateClassicRock.com, and Loudwire.com brands. The company was formerly known as Regent Communications, Inc. and changed its name to Townsquare Media, Inc. in May 2010. Townsquare Media, Inc. was incorporated in 1996 and is headquartered in Purchase, New York.

NEWS

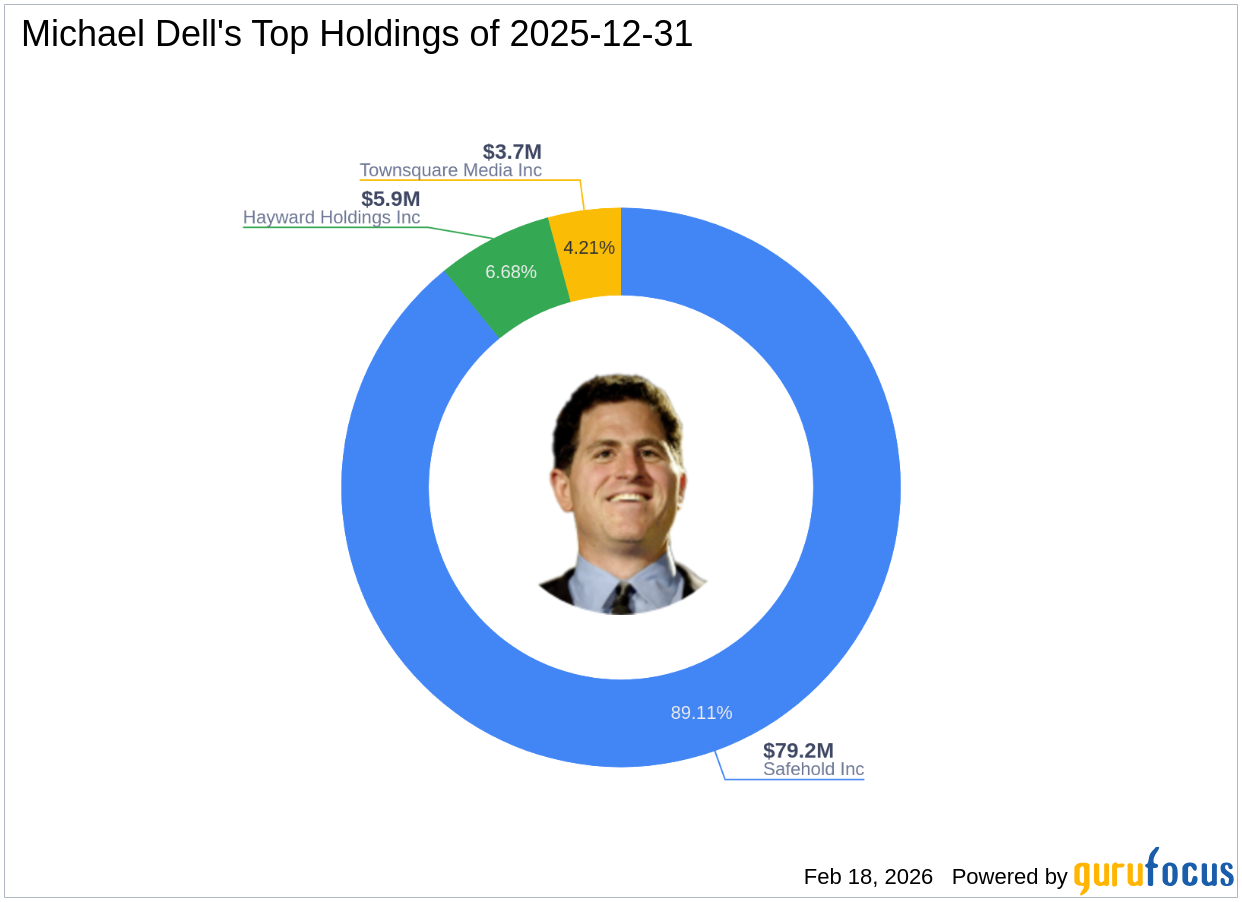

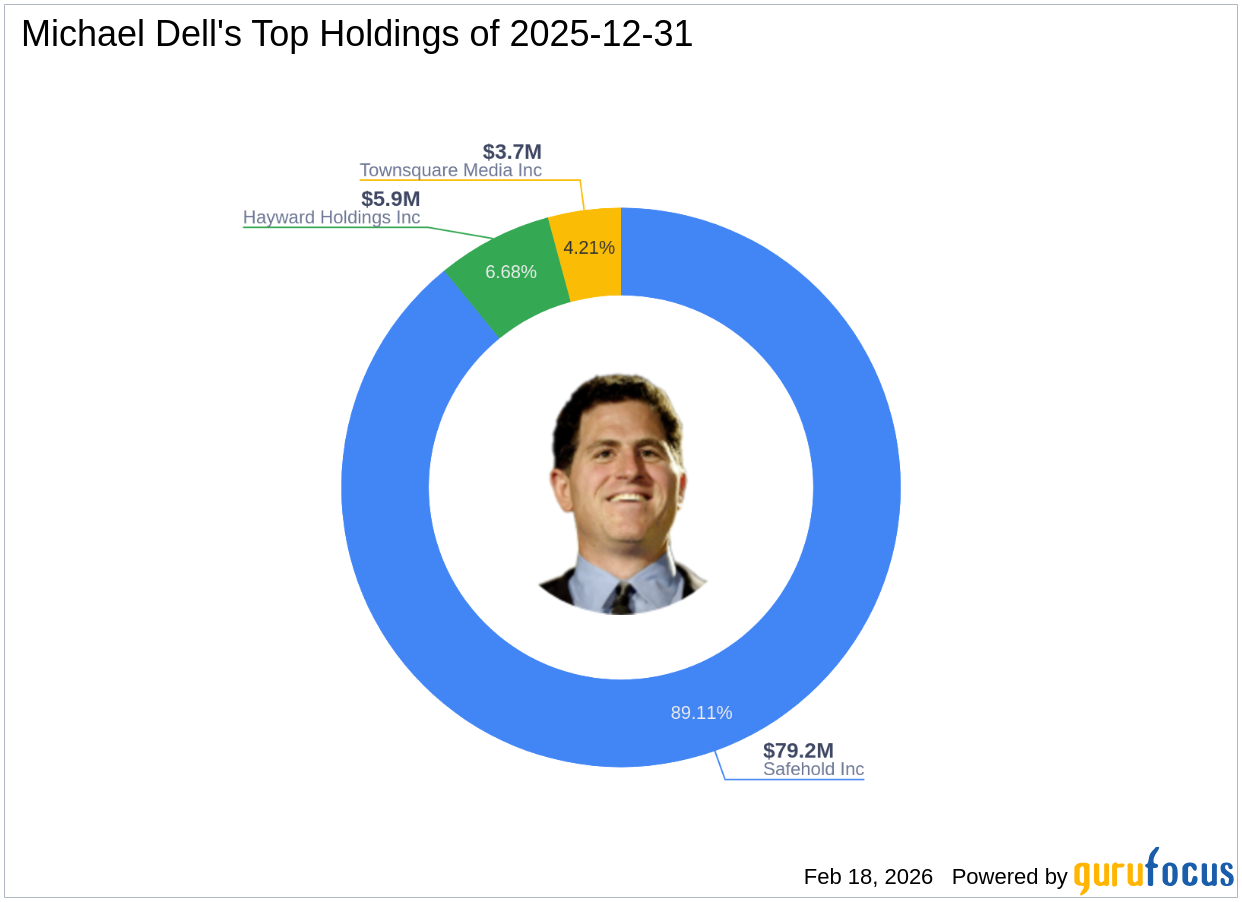

Michael Dell's Strategic Moves: Significant Reduction in Hayward Holdings Inc.

gurufocus.com

2026-02-17 19:04:00Insights from Michael Dell (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing Michael Dell (Trades, Portfolio) recently submitted the 13F filing for the four

These $5 Stocks and ETFs Are Paying Huge Yields to 12%, but There's a Catch

247wallst.com

2026-02-05 07:40:19While most of Wall Street focuses on large- and mega-cap stocks, which offer safety and liquidity, many investors are constrained in the number of shares they can buy.

Should Value Investors Buy Townsquare Media (TSQ) Stock?

zacks.com

2026-01-29 10:41:29Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Townsquare Announces Conference Call to Discuss Fourth Quarter 2025 Results and Participation in Upcoming Emerging Growth Conference

globenewswire.com

2026-01-28 15:00:00PURCHASE, N.Y., Jan. 28, 2026 (GLOBE NEWSWIRE) -- Townsquare Media, Inc. (NYSE: TSQ) (“Townsquare” or the “Company”) announced today details related to its conference call to discuss fourth quarter financial results as well as Townsquare's participation in an upcoming investor conference.

Are Investors Undervaluing Townsquare Media (TSQ) Right Now?

zacks.com

2026-01-13 10:41:43Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Erik Hellum Sells 5,693 Shares of Townsquare Media (NYSE:TSQ) Stock

defenseworld.net

2026-01-02 05:10:49Townsquare Media, Inc. (NYSE: TSQ - Get Free Report) COO Erik Hellum sold 5,693 shares of the stock in a transaction dated Monday, December 29th. The stock was sold at an average price of $5.06, for a total transaction of $28,806.58. Following the transaction, the chief operating officer owned 754,798 shares in the company, valued at

Townsquare Media (NYSE:TSQ) Stock Price Passes Below 50 Day Moving Average – Time to Sell?

defenseworld.net

2025-12-23 05:07:13Townsquare Media, Inc. (NYSE: TSQ - Get Free Report)'s stock price crossed below its 50 day moving average during trading on Monday. The stock has a 50 day moving average of $5.53 and traded as low as $5.13. Townsquare Media shares last traded at $5.2450, with a volume of 127,128 shares trading hands. Analyst Upgrades

Noble Capital Markets 21st Annual Equity Conference - NobleCon21 - Sets Records for Attendance, High-Impact Programming, and Strong Investor-Company Engagement

feeds.newsfilecorp.com

2025-12-17 11:48:00Boca Raton, Florida--(Newsfile Corp. - December 17, 2025) - Noble Capital Markets' 21st NobleCon earlier this month at the Mizner

$5 and $10 Ultra-High-Yield Stock Kings Are Passive Income 2026 Steals

247wallst.com

2025-12-14 09:12:01Investors love dividend stocks, especially those with ultra-high yields, because they offer a significant income stream and have substantial total return potential.

Exclusive Release of Trump Vodka Added to NobleCon21 Experiential Kickoff

feeds.newsfilecorp.com

2025-11-26 17:14:00Boca Raton, Florida--(Newsfile Corp. - November 26, 2025) - After much anticipation and expectation, Trump Vodka will officially make its

Townsquare to Participate in Upcoming Investor Conference

globenewswire.com

2025-11-25 14:30:00PURCHASE, N.Y., Nov. 25, 2025 (GLOBE NEWSWIRE) -- Townsquare Media, Inc. (NYSE: TSQ) (“Townsquare,” or the “Company”) announced today that management will participate in Noble Capital Markets' Twenty First Annual Emerging Growth Equity Conference at Florida Atlantic University, Executive Education Complex, in Boca Raton, FL, on Wednesday, December 3, 2025. The presentation will be held at 1:30 PM Eastern Time. Scheduled 1x1 meetings with management are also available for registered, qualified investor attendees.

Florida Lt. Governor Jay Collins and FAU President Adam Hasner to Open the NobleCon21 Kickoff Event

feeds.newsfilecorp.com

2025-11-18 16:46:00Boca Raton, Florida--(Newsfile Corp. - November 18, 2025) - Noble Capital Markets announced today that Florida Lt. Governor Jay Collins

Michael Dell's Strategic Shift: Significant Reduction in Hayward Holdings Inc.

gurufocus.com

2025-11-14 17:08:00Exploring the Impact of Michael Dell (Trades, Portfolio)'s Recent Investment Moves Michael Dell (Trades, Portfolio) recently submitted the 13F filing for the t

Townsquare Media, Inc. (TSQ) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-10 13:21:48Townsquare Media, Inc. ( TSQ ) Q3 2025 Earnings Call November 10, 2025 8:00 AM EST Company Participants Claire Messner - Executive VP of IR & Corporate Communications Bill Wilson - CEO & Director Stuart Rosenstein - Executive VP & CFO Conference Call Participants Michael Kupinski - NOBLE Capital Markets, Inc., Research Division Patrick Sholl - Barrington Research Associates, Inc., Research Division Presentation Operator Good morning, and welcome to Townsquare Media's Third Quarter 2025 Conference Call. As a reminder, today's call is being recorded, and your participation implies consent to the recording.

Compared to Estimates, Townsquare (TSQ) Q3 Earnings: A Look at Key Metrics

zacks.com

2025-11-10 10:31:04Although the revenue and EPS for Townsquare (TSQ) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Townsquare Media (TSQ) Matches Q3 Earnings Estimates

zacks.com

2025-11-10 08:11:06Townsquare Media (TSQ) came out with quarterly earnings of $0.05 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.35 per share a year ago.

Michael Dell's Strategic Moves: Significant Reduction in Hayward Holdings Inc.

gurufocus.com

2026-02-17 19:04:00Insights from Michael Dell (Trades, Portfolio)'s Fourth Quarter 2025 13F Filing Michael Dell (Trades, Portfolio) recently submitted the 13F filing for the four

These $5 Stocks and ETFs Are Paying Huge Yields to 12%, but There's a Catch

247wallst.com

2026-02-05 07:40:19While most of Wall Street focuses on large- and mega-cap stocks, which offer safety and liquidity, many investors are constrained in the number of shares they can buy.

Should Value Investors Buy Townsquare Media (TSQ) Stock?

zacks.com

2026-01-29 10:41:29Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Townsquare Announces Conference Call to Discuss Fourth Quarter 2025 Results and Participation in Upcoming Emerging Growth Conference

globenewswire.com

2026-01-28 15:00:00PURCHASE, N.Y., Jan. 28, 2026 (GLOBE NEWSWIRE) -- Townsquare Media, Inc. (NYSE: TSQ) (“Townsquare” or the “Company”) announced today details related to its conference call to discuss fourth quarter financial results as well as Townsquare's participation in an upcoming investor conference.

Are Investors Undervaluing Townsquare Media (TSQ) Right Now?

zacks.com

2026-01-13 10:41:43Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Erik Hellum Sells 5,693 Shares of Townsquare Media (NYSE:TSQ) Stock

defenseworld.net

2026-01-02 05:10:49Townsquare Media, Inc. (NYSE: TSQ - Get Free Report) COO Erik Hellum sold 5,693 shares of the stock in a transaction dated Monday, December 29th. The stock was sold at an average price of $5.06, for a total transaction of $28,806.58. Following the transaction, the chief operating officer owned 754,798 shares in the company, valued at

Townsquare Media (NYSE:TSQ) Stock Price Passes Below 50 Day Moving Average – Time to Sell?

defenseworld.net

2025-12-23 05:07:13Townsquare Media, Inc. (NYSE: TSQ - Get Free Report)'s stock price crossed below its 50 day moving average during trading on Monday. The stock has a 50 day moving average of $5.53 and traded as low as $5.13. Townsquare Media shares last traded at $5.2450, with a volume of 127,128 shares trading hands. Analyst Upgrades

Noble Capital Markets 21st Annual Equity Conference - NobleCon21 - Sets Records for Attendance, High-Impact Programming, and Strong Investor-Company Engagement

feeds.newsfilecorp.com

2025-12-17 11:48:00Boca Raton, Florida--(Newsfile Corp. - December 17, 2025) - Noble Capital Markets' 21st NobleCon earlier this month at the Mizner

$5 and $10 Ultra-High-Yield Stock Kings Are Passive Income 2026 Steals

247wallst.com

2025-12-14 09:12:01Investors love dividend stocks, especially those with ultra-high yields, because they offer a significant income stream and have substantial total return potential.

Exclusive Release of Trump Vodka Added to NobleCon21 Experiential Kickoff

feeds.newsfilecorp.com

2025-11-26 17:14:00Boca Raton, Florida--(Newsfile Corp. - November 26, 2025) - After much anticipation and expectation, Trump Vodka will officially make its

Townsquare to Participate in Upcoming Investor Conference

globenewswire.com

2025-11-25 14:30:00PURCHASE, N.Y., Nov. 25, 2025 (GLOBE NEWSWIRE) -- Townsquare Media, Inc. (NYSE: TSQ) (“Townsquare,” or the “Company”) announced today that management will participate in Noble Capital Markets' Twenty First Annual Emerging Growth Equity Conference at Florida Atlantic University, Executive Education Complex, in Boca Raton, FL, on Wednesday, December 3, 2025. The presentation will be held at 1:30 PM Eastern Time. Scheduled 1x1 meetings with management are also available for registered, qualified investor attendees.

Florida Lt. Governor Jay Collins and FAU President Adam Hasner to Open the NobleCon21 Kickoff Event

feeds.newsfilecorp.com

2025-11-18 16:46:00Boca Raton, Florida--(Newsfile Corp. - November 18, 2025) - Noble Capital Markets announced today that Florida Lt. Governor Jay Collins

Michael Dell's Strategic Shift: Significant Reduction in Hayward Holdings Inc.

gurufocus.com

2025-11-14 17:08:00Exploring the Impact of Michael Dell (Trades, Portfolio)'s Recent Investment Moves Michael Dell (Trades, Portfolio) recently submitted the 13F filing for the t

Townsquare Media, Inc. (TSQ) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-10 13:21:48Townsquare Media, Inc. ( TSQ ) Q3 2025 Earnings Call November 10, 2025 8:00 AM EST Company Participants Claire Messner - Executive VP of IR & Corporate Communications Bill Wilson - CEO & Director Stuart Rosenstein - Executive VP & CFO Conference Call Participants Michael Kupinski - NOBLE Capital Markets, Inc., Research Division Patrick Sholl - Barrington Research Associates, Inc., Research Division Presentation Operator Good morning, and welcome to Townsquare Media's Third Quarter 2025 Conference Call. As a reminder, today's call is being recorded, and your participation implies consent to the recording.

Compared to Estimates, Townsquare (TSQ) Q3 Earnings: A Look at Key Metrics

zacks.com

2025-11-10 10:31:04Although the revenue and EPS for Townsquare (TSQ) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Townsquare Media (TSQ) Matches Q3 Earnings Estimates

zacks.com

2025-11-10 08:11:06Townsquare Media (TSQ) came out with quarterly earnings of $0.05 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.35 per share a year ago.