TriMas Corporation (TRS)

Price:

33.89 USD

( - -0.23 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Millennium Group International Holdings Limited

VALUE SCORE:

6

2nd position

Karat Packaging Inc.

VALUE SCORE:

6

The best

Reynolds Consumer Products Inc.

VALUE SCORE:

7

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

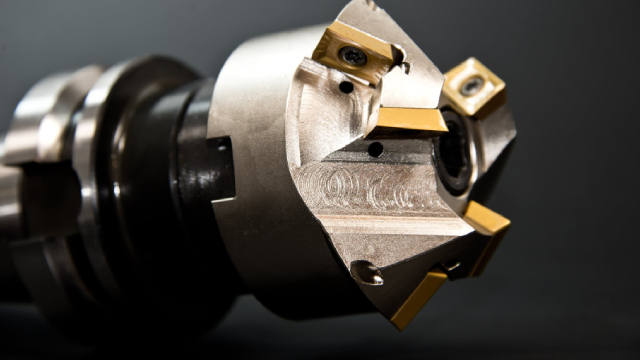

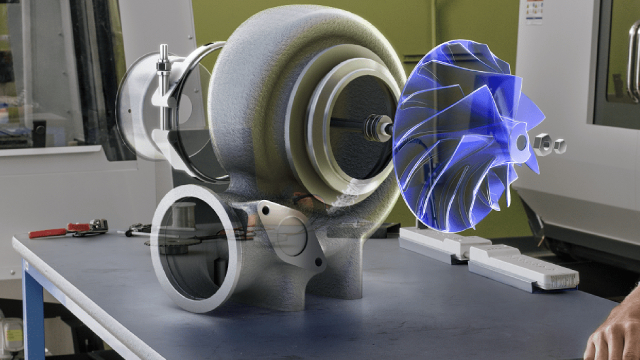

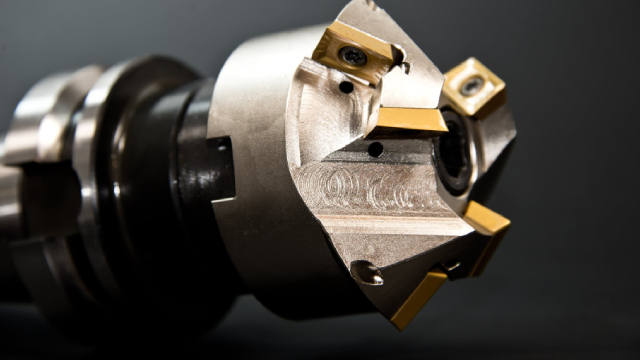

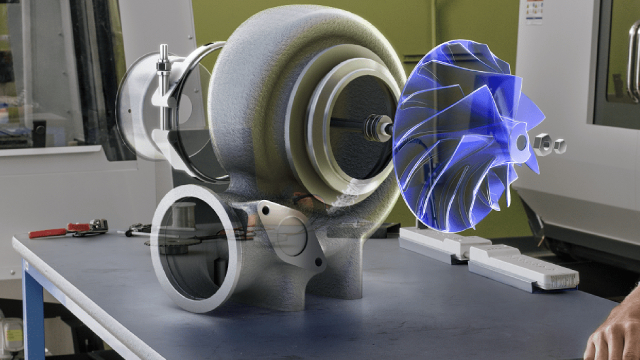

TriMas Corporation designs, develops, manufactures, and sells products for consumer products, aerospace, and industrial markets worldwide. It operates through three segments: Packaging, Aerospace, and Specialty Products. The Packaging segment offers dispensing products, such as foaming and sanitizer pumps, lotion and hand soap pumps, beverage dispensers, perfume sprayers, and nasal and trigger sprayers; polymeric and steel caps and closures comprising food lids, flip-top and beverage closures, child resistance caps, drum and pail closures, flexible spouts, and agricultural closures; polymeric jar products; integrated dispensers; bag-in-box products; aseptic closures; industrial closures and flex spouts; custom injection molded components and devices; various injection molded products; and single-bodied and assembled caps and closures under the Rieke, Taplast, Affaba & Ferrari, Stolz, Omega, and Rapak brands. The Aerospace segment provides fasteners, collars, blind bolts, rivets, ducting, and connectors for air management systems, and machined parts and components to original equipment manufacturers, supply chain distributors, MRO/aftermarket providers, and tier one suppliers; and military and defense aerospace applications and platforms under the Monogram Aerospace Fasteners, Allfast Fastening Systems, Mac Fasteners, TFI Aerospace, RSA Engineered Products, and Martinic Engineering brands. The Specialty Products segment offers steel cylinders for use in the transportation, storage, and dispensing of compressed gases under the Norris Cylinder brand; natural gas powered wellhead engines, compressors, and replacement parts for oil and natural gas production, and other industrial and commercial markets under the Arrow brand; and spare parts for various industrial engines. The company sells its products through a direct sales force, third-party agents, and distributors. TriMas Corporation was incorporated in 1986 and is headquartered in Bloomfield Hills, Michigan.

NEWS

TriMas Announces New Chief Financial Officer

businesswire.com

2025-12-04 13:00:00BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) today announced the appointment of Paul Swart as Chief Financial Officer, effective December 15, 2025. Paul will report to Thomas Snyder, TriMas President and Chief Executive Officer, and will succeed Teresa Finley, Interim Chief Financial Officer and TriMas Board Member. Paul brings more than 25 years of strategic leadership and financial oversight experience, including two decades in key operational and corporate finance and accou.

Why TriMas (TRS) is a Top Growth Stock for the Long-Term

zacks.com

2025-12-04 10:46:10Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Geode Capital Management LLC Sells 58,362 Shares of TriMas Corporation $TRS

defenseworld.net

2025-11-29 03:59:02Geode Capital Management LLC cut its holdings in TriMas Corporation (NASDAQ: TRS) by 6.1% during the undefined quarter, according to the company in its most recent disclosure with the SEC. The firm owned 892,817 shares of the industrial products company's stock after selling 58,362 shares during the quarter. Geode Capital Management LLC owned

TriMas (TRS) Upgraded to Strong Buy: What Does It Mean for the Stock?

zacks.com

2025-11-18 13:01:18TriMas (TRS) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Here's Why TriMas (TRS) is a Strong Growth Stock

zacks.com

2025-11-14 10:46:13The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

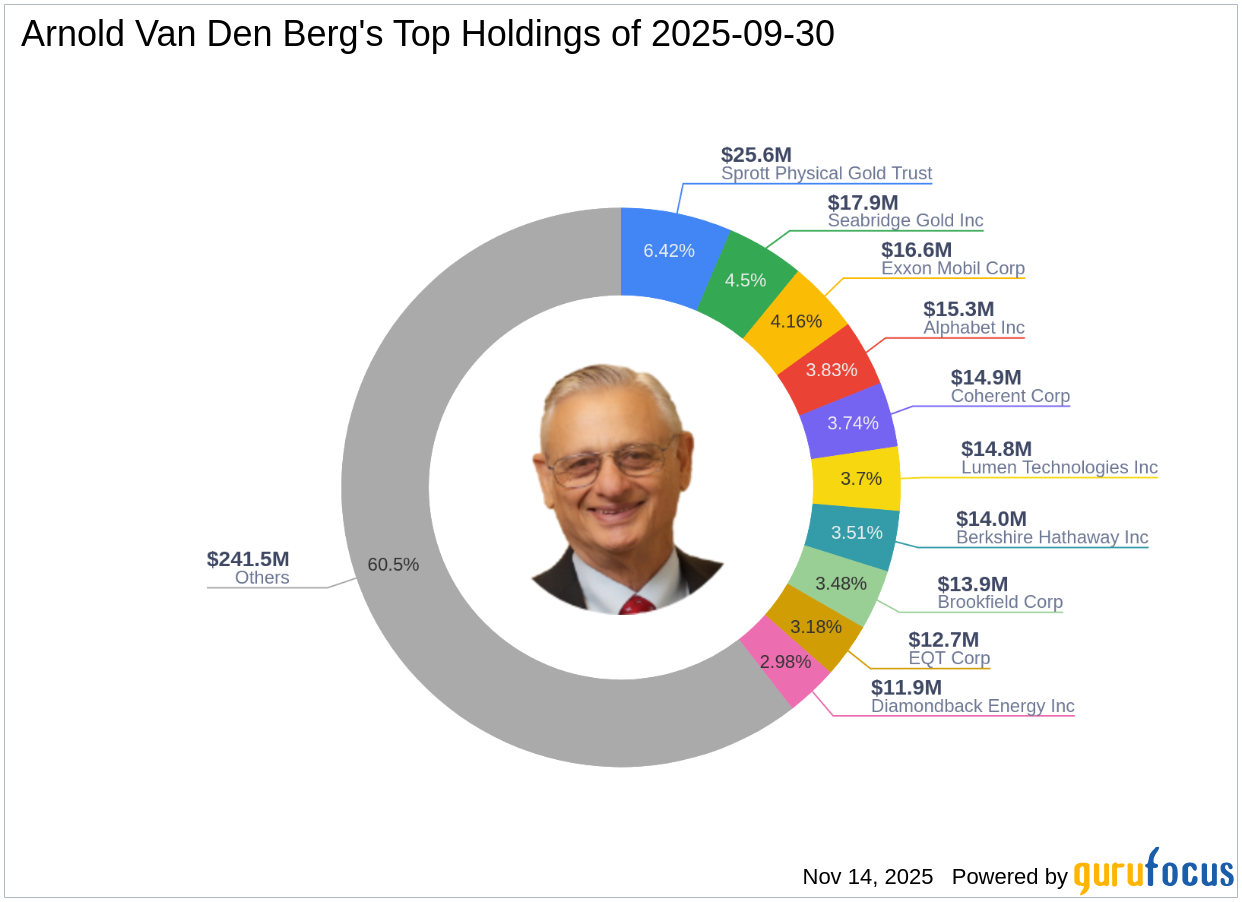

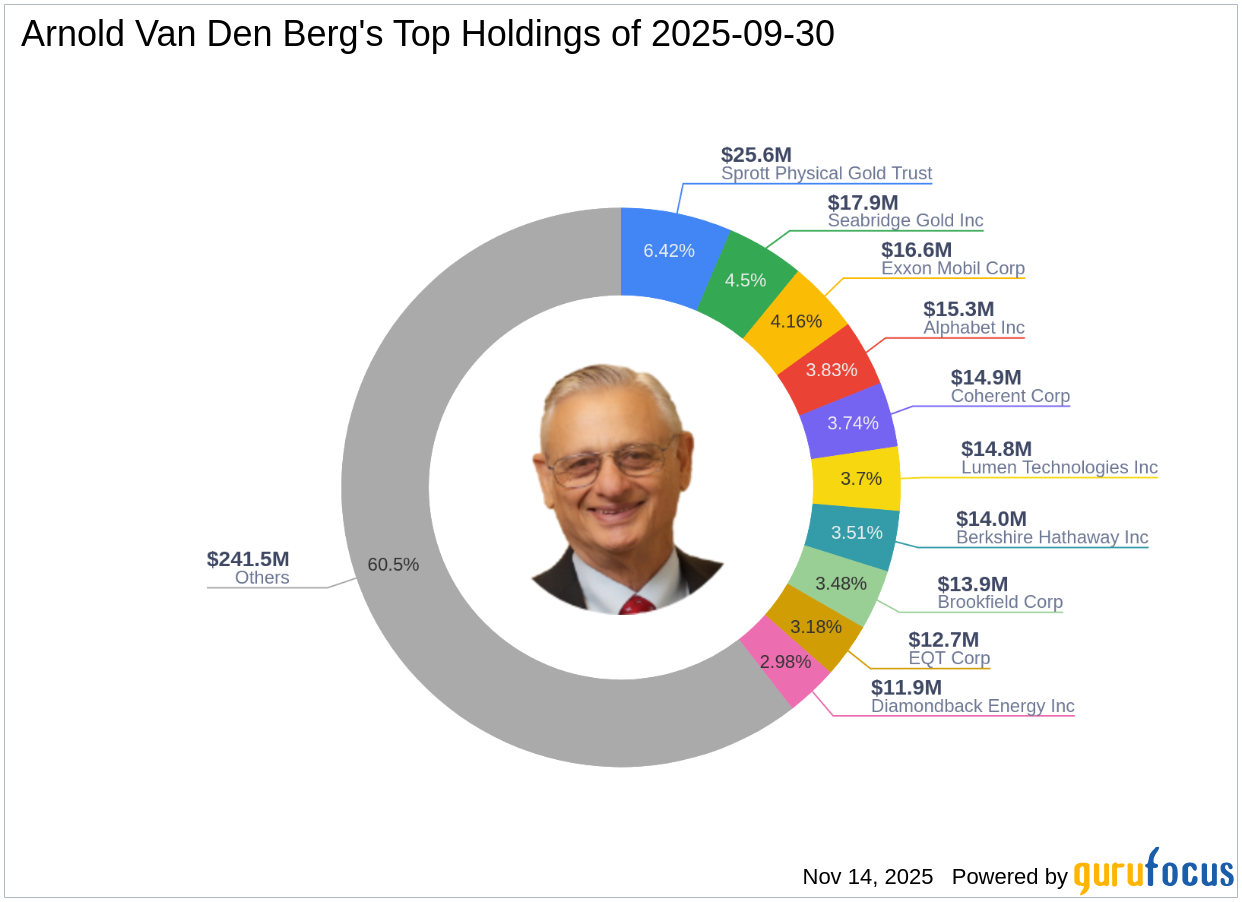

Arnold Van Den Berg Exits Atkore Inc, Impacting Portfolio by -0.85%

gurufocus.com

2025-11-14 10:00:00Insight into Arnold Van Den Berg (Trades, Portfolio)'s Strategic Moves in Q3 2025 Arnold Van Den Berg (Trades, Portfolio) recently submitted the 13F filing for

TriMas Announces Increased Share Repurchase Authorization to $150 Million

businesswire.com

2025-11-14 08:30:00BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) today announced that its Board of Directors has increased the Company's common stock share repurchase authorization to a total of up to $150 million, adding to the $65.4 million remaining under the previous authorization. “Increasing our share repurchase authorization reinforces our long-term commitment to returning capital to shareholders and the Board's confidence in TriMas' future,” said Thomas Snyder, TriMas President and Chief.

After Plunging 12.7% in 4 Weeks, Here's Why the Trend Might Reverse for TriMas (TRS)

zacks.com

2025-11-06 10:35:51The heavy selling pressure might have exhausted for TriMas (TRS) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

PennAero and Tinicum Announce Acquisition of TriMas Aerospace

businesswire.com

2025-11-04 14:17:00NEW YORK--(BUSINESS WIRE)--Tinicum, L.P. (“Tinicum”) today announced that one of its affiliates has signed an agreement to acquire the aerospace assets of TriMas Corporation (“TriMas Aerospace”), through which TriMas Aerospace will be merged with PennAero, a Tinicum portfolio company (“the Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. This investment reinforces PennAero's strategy of partnering with its customers to provide best-in-class engineering,.

TriMas to Sell Aerospace Segment for $1.45 Billion

wsj.com

2025-11-04 09:28:00TriMas agreed to sell its aerospace business for $1.45 billion to an affiliate of private investment firm Tinicum. Funds managed by Blackstone will be a minority investor in the transaction.

TriMas Enters Into Agreement to Sell TriMas Aerospace for $1.45 Billion

businesswire.com

2025-11-04 08:45:00BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) announced today that it has entered into a definitive agreement to sell its Aerospace segment for an all-cash purchase price of approximately $1.45 billion to an affiliate of Tinicum L.P. (the “Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. The purchase price represents an enterprise value multiple of approximately 18x last twelve months (LTM) third quarter 2025 adjusted EBITDA(1). “As pre.

Ethic Inc. Grows Holdings in TriMas Corporation $TRS

defenseworld.net

2025-10-30 04:03:02Ethic Inc. grew its holdings in shares of TriMas Corporation (NASDAQ: TRS) by 28.5% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 13,598 shares of the industrial products company's stock after buying an additional 3,015 shares during the

4 Metal Fabrication Stocks to Buy as Industry Trends Improve

zacks.com

2025-10-29 11:21:19The outlook of the Zacks Metal Products - Procurement and Fabrication industry looks upbeat and stocks like CENX, AMBP, TRS and EAF are well-positioned to gain on industry trends.

Why TriMas (TRS) is a Top Growth Stock for the Long-Term

zacks.com

2025-10-29 10:45:15The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

TriMas Corporation (TRS) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-10-28 12:11:52TriMas Corporation (NASDAQ:TRS ) Q3 2025 Earnings Call October 28, 2025 10:00 AM EDT Company Participants Sherry Lauderback - Vice President of Investor Relations, Communications & Sustainability Thomas Snyder - President, CEO & Director Teresa Finley - CFO, Treasurer & Director Conference Call Participants Katie Fleischer - KeyBanc Capital Markets Inc., Research Division Hamed Khorsand - BWS Financial Inc. Presentation Operator Greetings, and welcome to the TriMas Third Quarter 2025 Earnings Conference Call. [Operator Instructions] As a reminder, this conference is being recorded.

TriMas (TRS) Q3 Earnings and Revenues Top Estimates

zacks.com

2025-10-28 10:16:51TriMas (TRS) came out with quarterly earnings of $0.61 per share, beating the Zacks Consensus Estimate of $0.57 per share. This compares to earnings of $0.43 per share a year ago.

TriMas Announces New Chief Financial Officer

businesswire.com

2025-12-04 13:00:00BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) today announced the appointment of Paul Swart as Chief Financial Officer, effective December 15, 2025. Paul will report to Thomas Snyder, TriMas President and Chief Executive Officer, and will succeed Teresa Finley, Interim Chief Financial Officer and TriMas Board Member. Paul brings more than 25 years of strategic leadership and financial oversight experience, including two decades in key operational and corporate finance and accou.

Why TriMas (TRS) is a Top Growth Stock for the Long-Term

zacks.com

2025-12-04 10:46:10Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Geode Capital Management LLC Sells 58,362 Shares of TriMas Corporation $TRS

defenseworld.net

2025-11-29 03:59:02Geode Capital Management LLC cut its holdings in TriMas Corporation (NASDAQ: TRS) by 6.1% during the undefined quarter, according to the company in its most recent disclosure with the SEC. The firm owned 892,817 shares of the industrial products company's stock after selling 58,362 shares during the quarter. Geode Capital Management LLC owned

TriMas (TRS) Upgraded to Strong Buy: What Does It Mean for the Stock?

zacks.com

2025-11-18 13:01:18TriMas (TRS) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Here's Why TriMas (TRS) is a Strong Growth Stock

zacks.com

2025-11-14 10:46:13The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Arnold Van Den Berg Exits Atkore Inc, Impacting Portfolio by -0.85%

gurufocus.com

2025-11-14 10:00:00Insight into Arnold Van Den Berg (Trades, Portfolio)'s Strategic Moves in Q3 2025 Arnold Van Den Berg (Trades, Portfolio) recently submitted the 13F filing for

TriMas Announces Increased Share Repurchase Authorization to $150 Million

businesswire.com

2025-11-14 08:30:00BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) today announced that its Board of Directors has increased the Company's common stock share repurchase authorization to a total of up to $150 million, adding to the $65.4 million remaining under the previous authorization. “Increasing our share repurchase authorization reinforces our long-term commitment to returning capital to shareholders and the Board's confidence in TriMas' future,” said Thomas Snyder, TriMas President and Chief.

After Plunging 12.7% in 4 Weeks, Here's Why the Trend Might Reverse for TriMas (TRS)

zacks.com

2025-11-06 10:35:51The heavy selling pressure might have exhausted for TriMas (TRS) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

PennAero and Tinicum Announce Acquisition of TriMas Aerospace

businesswire.com

2025-11-04 14:17:00NEW YORK--(BUSINESS WIRE)--Tinicum, L.P. (“Tinicum”) today announced that one of its affiliates has signed an agreement to acquire the aerospace assets of TriMas Corporation (“TriMas Aerospace”), through which TriMas Aerospace will be merged with PennAero, a Tinicum portfolio company (“the Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. This investment reinforces PennAero's strategy of partnering with its customers to provide best-in-class engineering,.

TriMas to Sell Aerospace Segment for $1.45 Billion

wsj.com

2025-11-04 09:28:00TriMas agreed to sell its aerospace business for $1.45 billion to an affiliate of private investment firm Tinicum. Funds managed by Blackstone will be a minority investor in the transaction.

TriMas Enters Into Agreement to Sell TriMas Aerospace for $1.45 Billion

businesswire.com

2025-11-04 08:45:00BLOOMFIELD HILLS, Mich.--(BUSINESS WIRE)--TriMas (NASDAQ: TRS) announced today that it has entered into a definitive agreement to sell its Aerospace segment for an all-cash purchase price of approximately $1.45 billion to an affiliate of Tinicum L.P. (the “Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. The purchase price represents an enterprise value multiple of approximately 18x last twelve months (LTM) third quarter 2025 adjusted EBITDA(1). “As pre.

Ethic Inc. Grows Holdings in TriMas Corporation $TRS

defenseworld.net

2025-10-30 04:03:02Ethic Inc. grew its holdings in shares of TriMas Corporation (NASDAQ: TRS) by 28.5% in the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 13,598 shares of the industrial products company's stock after buying an additional 3,015 shares during the

4 Metal Fabrication Stocks to Buy as Industry Trends Improve

zacks.com

2025-10-29 11:21:19The outlook of the Zacks Metal Products - Procurement and Fabrication industry looks upbeat and stocks like CENX, AMBP, TRS and EAF are well-positioned to gain on industry trends.

Why TriMas (TRS) is a Top Growth Stock for the Long-Term

zacks.com

2025-10-29 10:45:15The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

TriMas Corporation (TRS) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-10-28 12:11:52TriMas Corporation (NASDAQ:TRS ) Q3 2025 Earnings Call October 28, 2025 10:00 AM EDT Company Participants Sherry Lauderback - Vice President of Investor Relations, Communications & Sustainability Thomas Snyder - President, CEO & Director Teresa Finley - CFO, Treasurer & Director Conference Call Participants Katie Fleischer - KeyBanc Capital Markets Inc., Research Division Hamed Khorsand - BWS Financial Inc. Presentation Operator Greetings, and welcome to the TriMas Third Quarter 2025 Earnings Conference Call. [Operator Instructions] As a reminder, this conference is being recorded.

TriMas (TRS) Q3 Earnings and Revenues Top Estimates

zacks.com

2025-10-28 10:16:51TriMas (TRS) came out with quarterly earnings of $0.61 per share, beating the Zacks Consensus Estimate of $0.57 per share. This compares to earnings of $0.43 per share a year ago.