Transcat, Inc. (TRNS)

Price:

72.23 USD

( + 1.69 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Pool Corporation

VALUE SCORE:

6

2nd position

Distribution Solutions Group, Inc.

VALUE SCORE:

7

The best

DXP Enterprises, Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

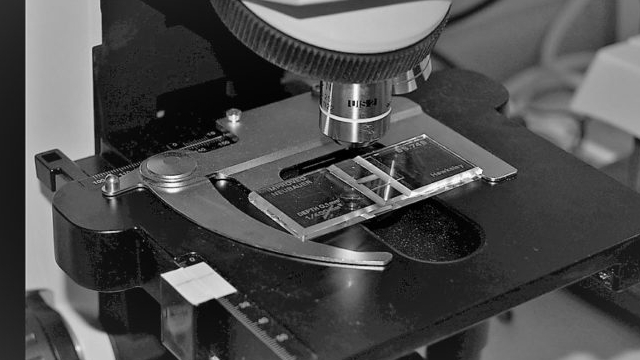

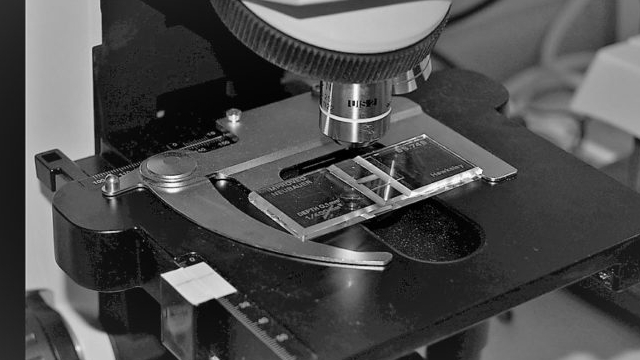

Transcat, Inc. provides calibration and laboratory instrument services in the United States, Canada, and internationally. It operates through two segments, Service and Distribution. The Service segment offers calibration, repair, inspection, analytical qualification, preventative maintenance, consulting, and other related services. This segment also provides CalTrak, a proprietary document and asset management software that is used to integrate and manage the workflow of its calibration service centers and customers' assets; and Compliance, Control and Cost, an online customer portal that provides its customers with web-based asset management capability, as well as a safe and secure off-site archive of calibration and other service records. The Distribution segment sells and rents test, measurement, and control instruments for customers' test and measurement instrumentation needs, as well as value added services, such as calibration/certification of equipment purchase, equipment rental, used equipment for sale, and equipment kitting. This segment markets and sells its products through website, digital and print advertising, proactive outbound sales, and an inbound call center. The company provides services and products to highly regulated industries, principally life science, which includes companies in the pharmaceutical, biotechnology, medical device, and other FDA-regulated industries; and additional industries, including aerospace and defense industrial manufacturing, energy and utilities, and other industries that require accuracy in processes and confirmation of the capabilities of their equipment. Transcat, Inc. was incorporated in 1964 and is headquartered in Rochester, New York.

NEWS

Transcat Announces CEO Succession Plan

businesswire.com

2025-08-25 16:05:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Announces CEO Succession Plan.

Transcat, Inc. (TRNS) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-08-08 21:14:41Transcat, Inc. (NASDAQ:TRNS ) Q1 2026 Earnings Conference Call August 7, 2025 11:00 AM ET Company Participants John Howe - Corporate Participant Lee D. Rudow - President, CEO & Director Thomas L.

Transcat (TRNS) Q1 Revenue Rises 15%

fool.com

2025-08-07 12:23:11Transcat (TRNS) Q1 Revenue Rises 15%

New Strong Buy Stocks for August 7th

zacks.com

2025-08-07 06:45:14GRPN, BHB, TRNS, RDDT and GHM have been added to the Zacks Rank #1 (Strong Buy) List on August 7, 2025.

Transcat (TRNS) Reports Q1 Earnings: What Key Metrics Have to Say

zacks.com

2025-08-06 19:01:38Although the revenue and EPS for Transcat (TRNS) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Transcat, Inc. (TRNS) Tops Q1 Earnings and Revenue Estimates

zacks.com

2025-08-06 18:25:19Transcat, Inc. (TRNS) came out with quarterly earnings of $0.59 per share, beating the Zacks Consensus Estimate of $0.4 per share. This compares to earnings of $0.48 per share a year ago.

Transcat Reports Strong Fiscal First Quarter 2026 Financial Results with Double-Digit Revenue & Gross Profit Growth

businesswire.com

2025-08-06 16:01:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Reports Strong Fiscal First Quarter 2026 Financial Results with Double-Digit Revenue & Gross Profit Growth.

Transcat Acquires Premier Calibration Services Provider Essco Calibration Laboratory

businesswire.com

2025-08-05 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Acquires Premier Calibration Services Provider Essco Calibration Laboratory.

Transcat Closes New 5-Year $150 Million Syndicated Secured Credit Facility With M&T Bank

businesswire.com

2025-07-29 16:05:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Closes New 5-Year $150 Million Syndicated Secured Credit Facility With M&T Bank.

Transcat to Host First Quarter Fiscal Year 2026 Conference Call and Webcast on Thursday, August 7, 2025 at 11:00 a.m. Eastern Time

businesswire.com

2025-07-23 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat to Host First Quarter Fiscal Year 2026 Conference Call and Webcast on Thursday, August 7, 2025 at 11:00 a.m. Eastern Time.

Battery Testing Equipment Rental Market Forecast 2025-2034, with Profiles of Avalon Test Equipment, Electro Rent, Transcat, Brandis Hire, Alpine, DNJ Energy, RCC Electronics, LOTTE Rental, & Powerent

globenewswire.com

2025-07-15 11:16:00The Battery Testing Equipment Rental Market is essential for sectors involved in battery innovation, especially for electric vehicles (EVs) and renewable energy solutions. With battery technology advancing, there's a growing need for testing tools like cyclers and battery analyzers, driving demand in this market. This sector, currently in its growth phase, offers cost-efficient options over buying equipment outright and is expected to expand due to the rise of EVs and tech advancements. Key players include Advanced Test Equipment Corp. and Avalon Test Equipment. However, the high cost of advanced equipment poses challenges. The market sees strong potential in Asia-Pacific due to increasing EV adoption. The Battery Testing Equipment Rental Market is essential for sectors involved in battery innovation, especially for electric vehicles (EVs) and renewable energy solutions. With battery technology advancing, there's a growing need for testing tools like cyclers and battery analyzers, driving demand in this market. This sector, currently in its growth phase, offers cost-efficient options over buying equipment outright and is expected to expand due to the rise of EVs and tech advancements. Key players include Advanced Test Equipment Corp. and Avalon Test Equipment. However, the high cost of advanced equipment poses challenges. The market sees strong potential in Asia-Pacific due to increasing EV adoption.

Transcat to Participate in the Northland Growth Conference 2025

businesswire.com

2025-06-12 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat to Participate in the Northland Growth Conference 2025.

Transcat to Participate in the 22nd Annual Craig-Hallum Institutional Investor Conference

businesswire.com

2025-05-21 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat to Participate in the 22nd Annual Craig-Hallum Institutional Investor Conference.

Transcat, Inc. (TRNS) Q4 2025 Earnings Call Transcript

seekingalpha.com

2025-05-20 14:56:29Transcat, Inc. (NASDAQ:TRNS ) Q4 2025 Earnings Conference Call May 20, 2025 11:00 AM ET Company Participants Tom Barbato - CFO Lee Rudow - President & CEO Mike West - Chief Operating Officer Conference Call Participants Greg Palm - Craig-Hallum Ted Jackson - Northland Securities Scott Buck - H.C. Wainwright Operator Greetings.

CORRECTING and REPLACING: Transcat Reports Fiscal Fourth Quarter and Full Year 2025 Financial Results

businesswire.com

2025-05-20 11:41:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Reports Fiscal Fourth Quarter and Full Year 2025 Financial Results.

No data to display

Transcat Announces CEO Succession Plan

businesswire.com

2025-08-25 16:05:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Announces CEO Succession Plan.

Transcat, Inc. (TRNS) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-08-08 21:14:41Transcat, Inc. (NASDAQ:TRNS ) Q1 2026 Earnings Conference Call August 7, 2025 11:00 AM ET Company Participants John Howe - Corporate Participant Lee D. Rudow - President, CEO & Director Thomas L.

Transcat (TRNS) Q1 Revenue Rises 15%

fool.com

2025-08-07 12:23:11Transcat (TRNS) Q1 Revenue Rises 15%

New Strong Buy Stocks for August 7th

zacks.com

2025-08-07 06:45:14GRPN, BHB, TRNS, RDDT and GHM have been added to the Zacks Rank #1 (Strong Buy) List on August 7, 2025.

Transcat (TRNS) Reports Q1 Earnings: What Key Metrics Have to Say

zacks.com

2025-08-06 19:01:38Although the revenue and EPS for Transcat (TRNS) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Transcat, Inc. (TRNS) Tops Q1 Earnings and Revenue Estimates

zacks.com

2025-08-06 18:25:19Transcat, Inc. (TRNS) came out with quarterly earnings of $0.59 per share, beating the Zacks Consensus Estimate of $0.4 per share. This compares to earnings of $0.48 per share a year ago.

Transcat Reports Strong Fiscal First Quarter 2026 Financial Results with Double-Digit Revenue & Gross Profit Growth

businesswire.com

2025-08-06 16:01:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Reports Strong Fiscal First Quarter 2026 Financial Results with Double-Digit Revenue & Gross Profit Growth.

Transcat Acquires Premier Calibration Services Provider Essco Calibration Laboratory

businesswire.com

2025-08-05 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Acquires Premier Calibration Services Provider Essco Calibration Laboratory.

Transcat Closes New 5-Year $150 Million Syndicated Secured Credit Facility With M&T Bank

businesswire.com

2025-07-29 16:05:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Closes New 5-Year $150 Million Syndicated Secured Credit Facility With M&T Bank.

Transcat to Host First Quarter Fiscal Year 2026 Conference Call and Webcast on Thursday, August 7, 2025 at 11:00 a.m. Eastern Time

businesswire.com

2025-07-23 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat to Host First Quarter Fiscal Year 2026 Conference Call and Webcast on Thursday, August 7, 2025 at 11:00 a.m. Eastern Time.

Battery Testing Equipment Rental Market Forecast 2025-2034, with Profiles of Avalon Test Equipment, Electro Rent, Transcat, Brandis Hire, Alpine, DNJ Energy, RCC Electronics, LOTTE Rental, & Powerent

globenewswire.com

2025-07-15 11:16:00The Battery Testing Equipment Rental Market is essential for sectors involved in battery innovation, especially for electric vehicles (EVs) and renewable energy solutions. With battery technology advancing, there's a growing need for testing tools like cyclers and battery analyzers, driving demand in this market. This sector, currently in its growth phase, offers cost-efficient options over buying equipment outright and is expected to expand due to the rise of EVs and tech advancements. Key players include Advanced Test Equipment Corp. and Avalon Test Equipment. However, the high cost of advanced equipment poses challenges. The market sees strong potential in Asia-Pacific due to increasing EV adoption. The Battery Testing Equipment Rental Market is essential for sectors involved in battery innovation, especially for electric vehicles (EVs) and renewable energy solutions. With battery technology advancing, there's a growing need for testing tools like cyclers and battery analyzers, driving demand in this market. This sector, currently in its growth phase, offers cost-efficient options over buying equipment outright and is expected to expand due to the rise of EVs and tech advancements. Key players include Advanced Test Equipment Corp. and Avalon Test Equipment. However, the high cost of advanced equipment poses challenges. The market sees strong potential in Asia-Pacific due to increasing EV adoption.

Transcat to Participate in the Northland Growth Conference 2025

businesswire.com

2025-06-12 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat to Participate in the Northland Growth Conference 2025.

Transcat to Participate in the 22nd Annual Craig-Hallum Institutional Investor Conference

businesswire.com

2025-05-21 08:31:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat to Participate in the 22nd Annual Craig-Hallum Institutional Investor Conference.

Transcat, Inc. (TRNS) Q4 2025 Earnings Call Transcript

seekingalpha.com

2025-05-20 14:56:29Transcat, Inc. (NASDAQ:TRNS ) Q4 2025 Earnings Conference Call May 20, 2025 11:00 AM ET Company Participants Tom Barbato - CFO Lee Rudow - President & CEO Mike West - Chief Operating Officer Conference Call Participants Greg Palm - Craig-Hallum Ted Jackson - Northland Securities Scott Buck - H.C. Wainwright Operator Greetings.

CORRECTING and REPLACING: Transcat Reports Fiscal Fourth Quarter and Full Year 2025 Financial Results

businesswire.com

2025-05-20 11:41:00ROCHESTER, N.Y.--(BUSINESS WIRE)--Transcat Reports Fiscal Fourth Quarter and Full Year 2025 Financial Results.