The TJX Companies, Inc. (TJX)

Price:

138.56 USD

( - -2.15 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

American Eagle Outfitters, Inc.

VALUE SCORE:

7

2nd position

On Holding AG

VALUE SCORE:

9

The best

Abercrombie & Fitch Co.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

The TJX Companies, Inc., together with its subsidiaries, operates as an off-price apparel and home fashions retailer. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, kids, and gourmet food departments; jewelry and accessories; and other merchandise. As of February 23, 2022, it operated 1,284 T.J. Maxx, 1,148 Marshalls, 850 HomeGoods, 59 Sierra, and 39 Homesense stores, as well as tjmaxx.com, marshalls.com, and sierra.com in the United States; 293 Winners, 147 HomeSense, and 106 Marshalls stores in Canada; 618 T.K. Maxx and 77 Homesense stores, as well as tkmaxx.com in Europe; and 68 T.K. Maxx stores in Australia. The company was incorporated in 1962 and is headquartered in Framingham, Massachusetts.

NEWS

TJX (TJX) Stock Declines While Market Improves: Some Information for Investors

zacks.com

2025-10-08 18:51:20TJX (TJX) concluded the recent trading session at $140.71, signifying a -1.37% move from its prior day's close.

Osprey Private Wealth Buys $2.9 Million in TJX Stock — Here's What to Know About This Retail Play

fool.com

2025-10-08 16:29:03On Wednesday, Osprey Private Wealth disclosed a buy of TJX Companies (TJX -1.41%) in the third quarter, adding 22,005 shares in an estimated $2.9 million transaction.

3 Reasons Why Growth Investors Shouldn't Overlook TJX (TJX)

zacks.com

2025-10-08 13:46:07TJX (TJX) possesses solid growth attributes, which could help it handily outperform the market.

Here's Why TJX (TJX) is a Strong Growth Stock

zacks.com

2025-10-03 10:46:07The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

TJX (TJX) Stock Declines While Market Improves: Some Information for Investors

zacks.com

2025-10-02 18:45:35In the most recent trading session, TJX (TJX) closed at $142.49, indicating a -1.27% shift from the previous trading day.

Weighing Winners & Losers in Holiday Shopping Season

youtube.com

2025-10-01 14:00:08Chris Versace says the government shutdown will impact the retail space heading into the holiday shopping season. He points to cost-conscious stores like Walmart (WMT) and TJX Companies (TJX) as fortress-like companies that withstand consumer weakness.

The TJX Companies, Inc. (TJX) is Attracting Investor Attention: Here is What You Should Know

zacks.com

2025-10-01 10:01:18TJX (TJX) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Is It Worth Investing in TJX (TJX) Based on Wall Street's Bullish Views?

zacks.com

2025-09-30 10:31:11The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Will TJX's Off-Price Model & Expansion Efforts Fuel Growth?

zacks.com

2025-09-29 15:41:06The TJX Companies' off-price model with fresh, branded merchandise at unbeatable prices and multi-channel marketing looks to drive growth.

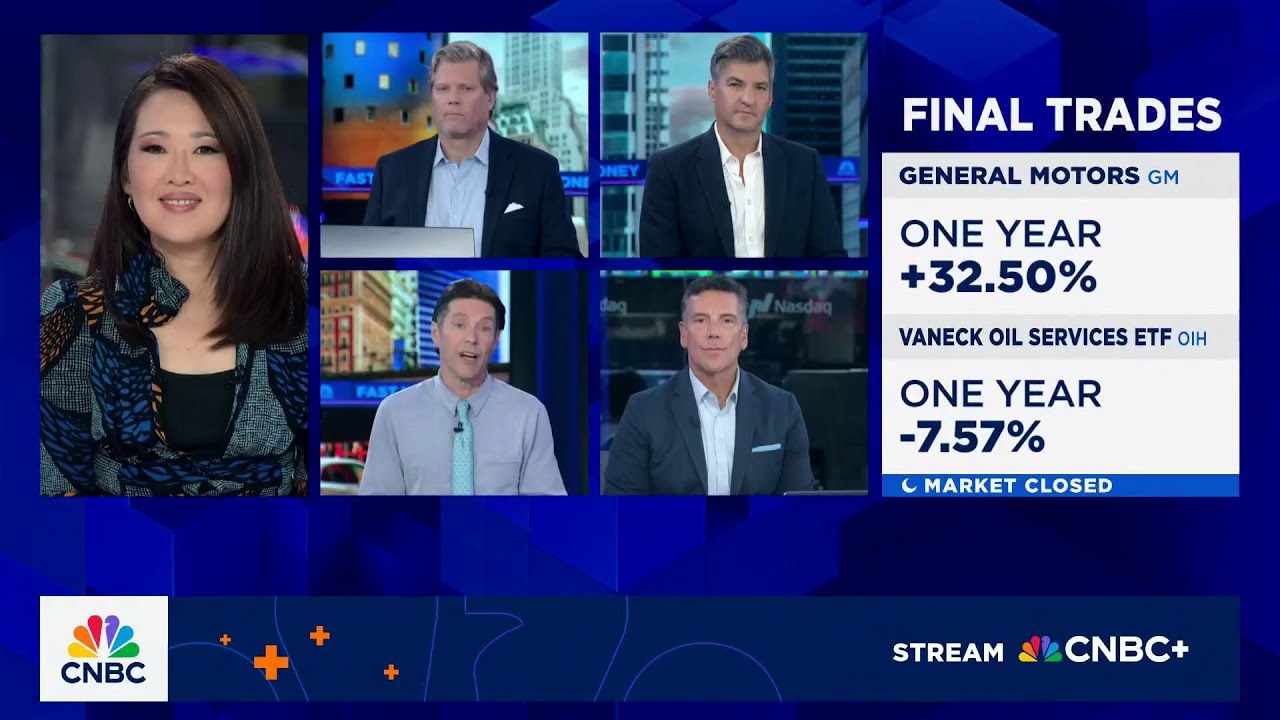

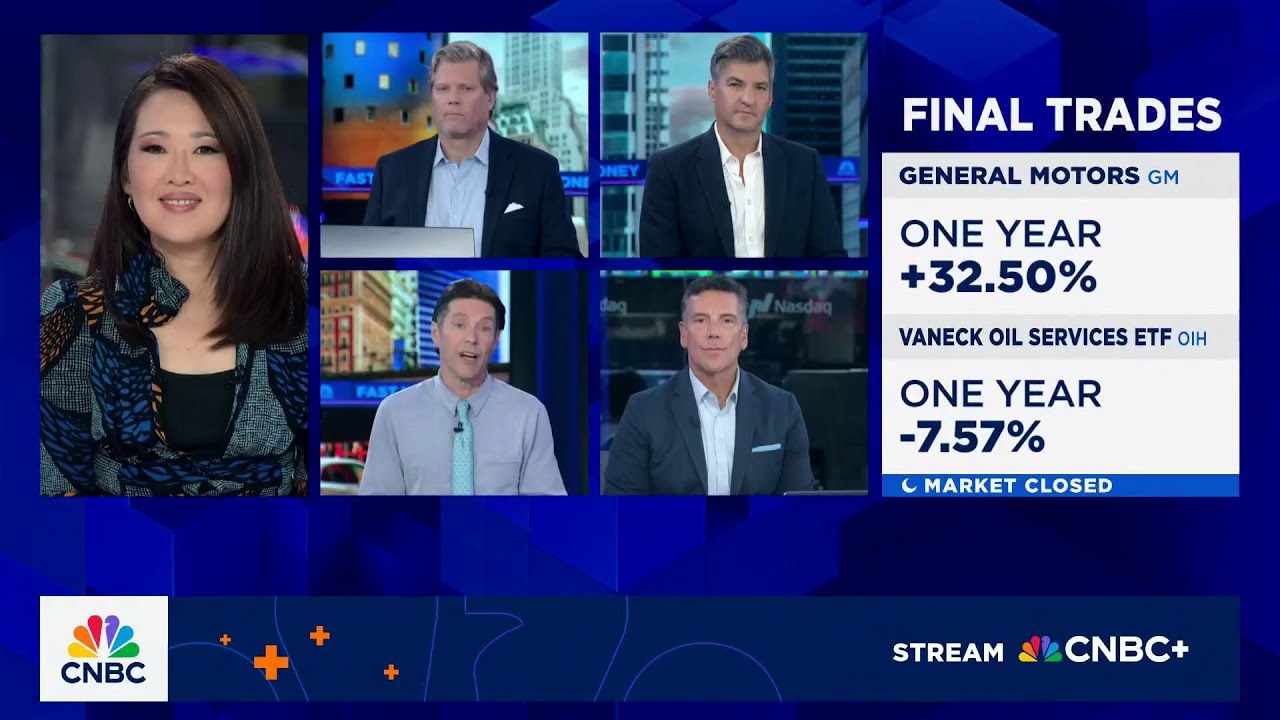

Final Trade: GM, OIH, IWM, TJX

youtube.com

2025-09-25 18:26:55CNBC's "Fast Money" team shares their final trades of the day.

TJX Companies: Business Fundamentally Sound, With Good Drivers Backing (Rating Upgrade)

seekingalpha.com

2025-09-25 01:43:59Upgrade TJX Companies to buy, targeting a 10% 1-year return as fundamentals and growth drivers strengthen. TJX's consistent traffic-led comparable sales growth, especially among younger consumers, de-risks the brand and supports long-term relevance. HomeGoods' transformation into a year-round destination drives recurring traffic and smooths seasonal volatility, enhancing TJX's growth outlook.

Will TJX's Marketing Campaigns Boost Holiday Shopping Strength?

zacks.com

2025-09-22 13:56:14The TJX Companies is set to make the holidays exciting with fresh, branded merchandise at unbeatable prices, multi-channel marketing and a focus on younger shoppers.

Costco vs. TJX Companies: Which Discount Retail Stock Is a Buy?

zacks.com

2025-09-22 11:40:19Strong earnings, expansion plans and resilient consumer demand position TJX ahead of COST in the retail discount race.

Is The TJX Companies (TJX) Outperforming Other Retail-Wholesale Stocks This Year?

zacks.com

2025-09-19 10:40:50Here is how TJX (TJX) and Dutch Bros (BROS) have performed compared to their sector so far this year.

TJX Trading Cheaper Than Industry: What's the Next Best Move?

zacks.com

2025-09-18 12:11:15TJX shows resilient comparable sales and upgraded guidance, while long-term momentum hinges on expansion gains offsetting currency and margin pressures.

The TJX Companies, Inc. Announces Quarterly Common Stock Dividend

businesswire.com

2025-09-17 13:29:00FRAMINGHAM, Mass.--(BUSINESS WIRE)--The TJX Companies, Inc. (NYSE: TJX) today announced the declaration of a quarterly dividend on its common stock of $.425 per share payable December 4, 2025, to shareholders of record on November 13, 2025. About The TJX Companies, Inc. The TJX Companies, Inc., a Fortune 100 company, is the leading off-price retailer of apparel and home fashions in the U.S. and worldwide. Our mission is to deliver great value to customers every day. We do this by offering a rap.

TJX (TJX) Stock Declines While Market Improves: Some Information for Investors

zacks.com

2025-10-08 18:51:20TJX (TJX) concluded the recent trading session at $140.71, signifying a -1.37% move from its prior day's close.

Osprey Private Wealth Buys $2.9 Million in TJX Stock — Here's What to Know About This Retail Play

fool.com

2025-10-08 16:29:03On Wednesday, Osprey Private Wealth disclosed a buy of TJX Companies (TJX -1.41%) in the third quarter, adding 22,005 shares in an estimated $2.9 million transaction.

3 Reasons Why Growth Investors Shouldn't Overlook TJX (TJX)

zacks.com

2025-10-08 13:46:07TJX (TJX) possesses solid growth attributes, which could help it handily outperform the market.

Here's Why TJX (TJX) is a Strong Growth Stock

zacks.com

2025-10-03 10:46:07The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

TJX (TJX) Stock Declines While Market Improves: Some Information for Investors

zacks.com

2025-10-02 18:45:35In the most recent trading session, TJX (TJX) closed at $142.49, indicating a -1.27% shift from the previous trading day.

Weighing Winners & Losers in Holiday Shopping Season

youtube.com

2025-10-01 14:00:08Chris Versace says the government shutdown will impact the retail space heading into the holiday shopping season. He points to cost-conscious stores like Walmart (WMT) and TJX Companies (TJX) as fortress-like companies that withstand consumer weakness.

The TJX Companies, Inc. (TJX) is Attracting Investor Attention: Here is What You Should Know

zacks.com

2025-10-01 10:01:18TJX (TJX) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Is It Worth Investing in TJX (TJX) Based on Wall Street's Bullish Views?

zacks.com

2025-09-30 10:31:11The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Will TJX's Off-Price Model & Expansion Efforts Fuel Growth?

zacks.com

2025-09-29 15:41:06The TJX Companies' off-price model with fresh, branded merchandise at unbeatable prices and multi-channel marketing looks to drive growth.

Final Trade: GM, OIH, IWM, TJX

youtube.com

2025-09-25 18:26:55CNBC's "Fast Money" team shares their final trades of the day.

TJX Companies: Business Fundamentally Sound, With Good Drivers Backing (Rating Upgrade)

seekingalpha.com

2025-09-25 01:43:59Upgrade TJX Companies to buy, targeting a 10% 1-year return as fundamentals and growth drivers strengthen. TJX's consistent traffic-led comparable sales growth, especially among younger consumers, de-risks the brand and supports long-term relevance. HomeGoods' transformation into a year-round destination drives recurring traffic and smooths seasonal volatility, enhancing TJX's growth outlook.

Will TJX's Marketing Campaigns Boost Holiday Shopping Strength?

zacks.com

2025-09-22 13:56:14The TJX Companies is set to make the holidays exciting with fresh, branded merchandise at unbeatable prices, multi-channel marketing and a focus on younger shoppers.

Costco vs. TJX Companies: Which Discount Retail Stock Is a Buy?

zacks.com

2025-09-22 11:40:19Strong earnings, expansion plans and resilient consumer demand position TJX ahead of COST in the retail discount race.

Is The TJX Companies (TJX) Outperforming Other Retail-Wholesale Stocks This Year?

zacks.com

2025-09-19 10:40:50Here is how TJX (TJX) and Dutch Bros (BROS) have performed compared to their sector so far this year.

TJX Trading Cheaper Than Industry: What's the Next Best Move?

zacks.com

2025-09-18 12:11:15TJX shows resilient comparable sales and upgraded guidance, while long-term momentum hinges on expansion gains offsetting currency and margin pressures.

The TJX Companies, Inc. Announces Quarterly Common Stock Dividend

businesswire.com

2025-09-17 13:29:00FRAMINGHAM, Mass.--(BUSINESS WIRE)--The TJX Companies, Inc. (NYSE: TJX) today announced the declaration of a quarterly dividend on its common stock of $.425 per share payable December 4, 2025, to shareholders of record on November 13, 2025. About The TJX Companies, Inc. The TJX Companies, Inc., a Fortune 100 company, is the leading off-price retailer of apparel and home fashions in the U.S. and worldwide. Our mission is to deliver great value to customers every day. We do this by offering a rap.