Taylor Devices, Inc. (TAYD)

Price:

43.49 USD

( + 0.52 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Serve Robotics Inc.

VALUE SCORE:

9

2nd position

Franklin Electric Co., Inc.

VALUE SCORE:

9

The best

Roper Technologies, Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

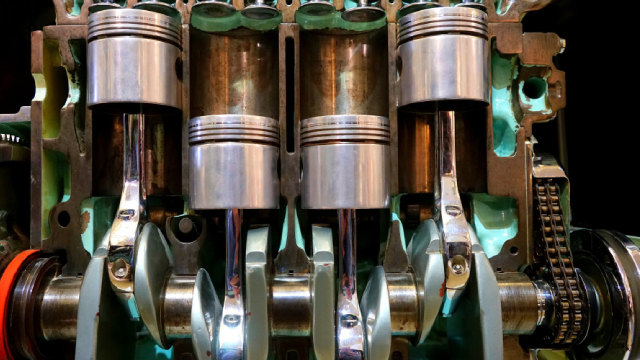

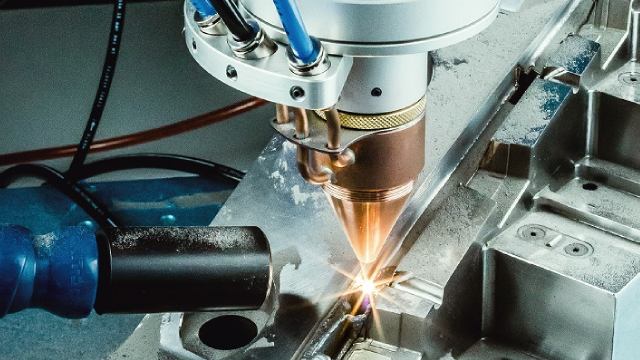

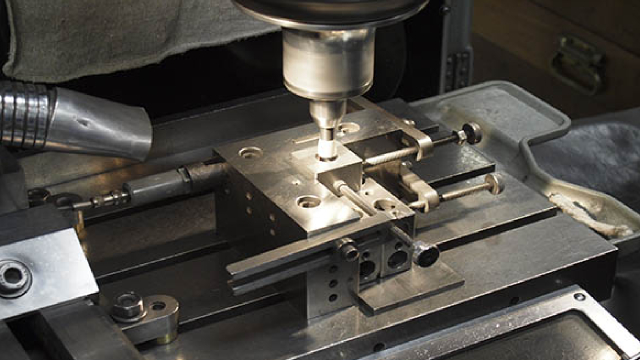

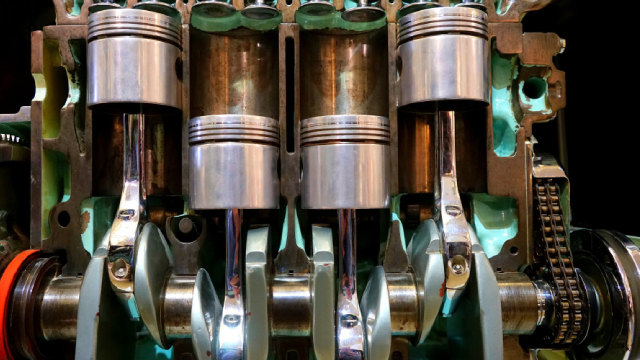

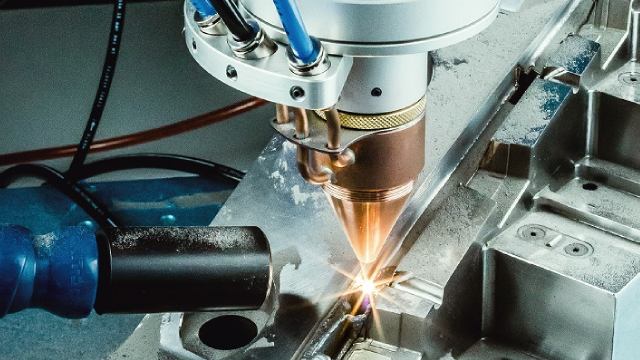

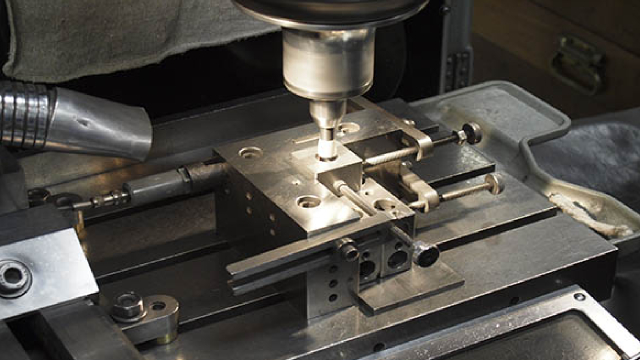

Taylor Devices, Inc. engages in design, development, manufacture, and marketing of shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in North America, Asia, and internationally. Its products include seismic dampers that are designed to mitigate the effects of earthquakes on structures; Fluidicshoks, which are compact shock absorbers primarily used in defense, aerospace, and commercial industries; and crane and industrial buffers, which are larger versions of the Fluidicshoks for industrial application on cranes and crane trolleys, truck docks, ladle and ingot cars, ore trolleys, and car stops. The company's products also comprise self-adjusting shock absorbers that include versions of Fluidicshoks, and crane and industrial buffers, which automatically adjust to various impact conditions and are designed for high cycle application primarily in the heavy industry; liquid die springs that are used as component parts of machinery and equipment used in the manufacture of tools and dies; vibration dampers, which are primarily used by aerospace and defense industries to control the response of electronics and optical systems subjected to air, ship, or spacecraft vibration; machined springs used in the aerospace applications; and custom actuators for special aerospace and defense applications. It markets its products through a network of sales representatives and distributors. The company was incorporated in 1955 and is headquartered in North Tonawanda, New York.

NEWS

Taylor Devices' Q4 Earnings Surge Y/Y on Defense Demand

zacks.com

2025-08-22 14:46:09TAYD delivers record fiscal fourth-quarter results, as strong Aerospace/Defense demand led to a year-over-year increase in earnings despite challenges in Structural markets.

TAYLOR DEVICES ANNOUNCES RECORD HIGH FOURTH QUARTER AND FULL YEAR SALES AND PROFIT FOR FISCAL YEAR 2025

prnewswire.com

2025-08-15 07:01:00NORTH TONAWANDA, N.Y. , Aug. 15, 2025 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 4th quarter sales of $15,561,154, significantly up from last year's 4th quarter sales of $12,065,211.

TAYD Stock Gains 2% Despite Q3 Earnings Decline Y/Y, Backlog Grows

zacks.com

2025-04-02 14:45:31Taylor Devices reports a year-over-year fall in fiscal Q3 earnings amid high interest rates but sees strong backlog growth, highlighting operational resilience and market diversification.

TAYLOR DEVICES ANNOUNCES THIRD QUARTER AND NINE-MONTH RESULTS

prnewswire.com

2025-03-28 09:19:00NORTH TONAWANDA, N.Y. , March 28, 2025 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 3rd quarter sales of $10,564,834, down from last year's 3rd quarter sales of $12,254,093 while sales for the 1st nine months were $30,731,571, also down from last year's 1st nine-month sales of $32,517,596.

GOODYEAR ASSOCIATES HONORED AS LEADERS IN MANUFACTURING

prnewswire.com

2025-03-06 09:30:00Taylor Davis and Jingwei Yu recognized by the Manufacturing Institute as 2025 Women MAKE Awards Winners. AKRON, Ohio , March 6, 2025 /PRNewswire/ -- The Goodyear Tire & Rubber Company's Taylor Davis, staff electrical engineer, and Jingwei Yu, finance director, Asia Pacific Operations, have been recognized as 2025 Women MAKE Awards Winners.

Taylor Devices: Big Profitability And Sector Outperformance

seekingalpha.com

2025-01-14 12:04:58Taylor Devices, Inc. is a debt-free, highly profitable micro-cap stock with strong historical growth and market-leading margins in the vibration control product industry. TAYD outperforms near-peers with an attractive 12.42 P/E ratio, solid balance sheet, and robust financial health, making it a valuable investment. Key risks include revenue concentration among a few customers, exposure to cyclical markets, and potential new competitors or industry consolidation.

Taylor Devices Q2 Earnings Fall 39% Y/Y, Shares Drop 2%

zacks.com

2025-01-07 13:16:26TAYD reports a drop in EPS during the fiscal second quarter as lower sales weigh, but strong backlog growth hints at recovery opportunities in key markets.

Aerospace Demand Drives Taylor Devices' Y/Y Earnings Growth in Q1

zacks.com

2024-09-30 14:46:08TAYD's fiscal Q1 2025 EPS jumps to 85 cents, fueled by robust Aerospace/Defense sales. Revenues increase 17% year over year as the company leveraged strong order flow and strategic investments.

TAYLOR DEVICES ANNOUNCES FIRST QUARTER RESULTS

prnewswire.com

2024-09-27 08:00:00NORTH TONAWANDA, N.Y. , Sept. 27, 2024 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had first quarter sales of $11,617,856, up from last year's first quarter sales of $9,923,628.

Taylor Devices: Record Fundamentals, Reduced Cyclicality, Undervalued Shares

seekingalpha.com

2024-09-11 06:24:15Taylor Devices has surged 70% since February, driven by strong growth in A&D revenues, record earnings and backlog. TAYD's competitive edge is bolstered by proprietary products, customer relationships, and niche market positioning and enables ample opportunity for continued growth. Despite cyclicality risks TAYD has demonstrated operational excellence and expanding margins using zero debt.

Taylor Devices (TAYD) Q4 EPS Up 36% Y/Y on Defense Segment Growth

zacks.com

2024-08-16 11:45:49Taylor Devices (TAYD) delivered a strong fourth quarter of fiscal 2024, with EPS up 35.6% year over year to 80 cents per share and revenues rising to $12.1 million, driven by growth in the Aerospace/Defense segment despite challenges in the Structural market.

TAYLOR DEVICES ANNOUNCES RECORD HIGH FULL YEAR SALES, PROFIT AND FIRM ORDER BACKLOG FOR FISCAL YEAR 2024 CONCURRENT WITH STRONG FOURTH QUARTER RESULTS

prnewswire.com

2024-08-15 08:30:00NORTH TONAWANDA, N.Y. , Aug. 15, 2024 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 4th quarter sales of $12,065,211, up from last year's 4th quarter sales of $10,720,017.

Zacks Initiates Coverage of Taylor Devices With Outperform Recommendation

zacks.com

2024-06-12 05:35:15Discover why Zacks rates Taylor Devices as "Outperform", being the first on Wall Street to initiate coverage on the stock. Learn about the company's impressive net income growth, strong aerospace/defense sales, enhanced profit margins and robust order backlog, positioning it for future success.

TAYLOR DEVICES ANNOUNCES THIRD QUARTER AND NINE-MONTH RESULTS INCLUDING RECORD HIGH SALES AND EARNINGS

prnewswire.com

2024-03-28 08:27:00NORTH TONAWANDA, N.Y. , March 28, 2024 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 3rd quarter sales of $12,254,093, up 24% from last year's 3rd quarter sales of $9,891,272 while sales for the 1st nine months were $32,517,596, up 10% from last year's 1st nine-month sales of $29,479,337.

Taylor Devices Is A Well Run Small Cap At A Reasonable Valuation

seekingalpha.com

2024-01-22 15:39:06Taylor Devices is a company that specializes in seismic dampers, which reduce the effects of earthquakes and strong winds on buildings. The company has seen strong financial results in 2023, with a 27% increase in sales and a significant boost in revenues from aerospace and industrial applications. The company's backlog of orders has been growing, indicating potential future sales growth, and its valuation suggests it may be undervalued. However, the company is subject to cyclical risks and fluctuations in the construction and defense industries.

Taylor Devices Is A Great Company, But Trades At An Expensive Price

seekingalpha.com

2023-02-01 10:57:39TAYD specializes in shock-absorbing devices for construction and aerospace uses, among others. The company seems to have a technological moat in these segments. Unfortunately, construction is cyclical and aerospace stagnant.

Taylor Devices' Q4 Earnings Surge Y/Y on Defense Demand

zacks.com

2025-08-22 14:46:09TAYD delivers record fiscal fourth-quarter results, as strong Aerospace/Defense demand led to a year-over-year increase in earnings despite challenges in Structural markets.

TAYLOR DEVICES ANNOUNCES RECORD HIGH FOURTH QUARTER AND FULL YEAR SALES AND PROFIT FOR FISCAL YEAR 2025

prnewswire.com

2025-08-15 07:01:00NORTH TONAWANDA, N.Y. , Aug. 15, 2025 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 4th quarter sales of $15,561,154, significantly up from last year's 4th quarter sales of $12,065,211.

TAYD Stock Gains 2% Despite Q3 Earnings Decline Y/Y, Backlog Grows

zacks.com

2025-04-02 14:45:31Taylor Devices reports a year-over-year fall in fiscal Q3 earnings amid high interest rates but sees strong backlog growth, highlighting operational resilience and market diversification.

TAYLOR DEVICES ANNOUNCES THIRD QUARTER AND NINE-MONTH RESULTS

prnewswire.com

2025-03-28 09:19:00NORTH TONAWANDA, N.Y. , March 28, 2025 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 3rd quarter sales of $10,564,834, down from last year's 3rd quarter sales of $12,254,093 while sales for the 1st nine months were $30,731,571, also down from last year's 1st nine-month sales of $32,517,596.

GOODYEAR ASSOCIATES HONORED AS LEADERS IN MANUFACTURING

prnewswire.com

2025-03-06 09:30:00Taylor Davis and Jingwei Yu recognized by the Manufacturing Institute as 2025 Women MAKE Awards Winners. AKRON, Ohio , March 6, 2025 /PRNewswire/ -- The Goodyear Tire & Rubber Company's Taylor Davis, staff electrical engineer, and Jingwei Yu, finance director, Asia Pacific Operations, have been recognized as 2025 Women MAKE Awards Winners.

Taylor Devices: Big Profitability And Sector Outperformance

seekingalpha.com

2025-01-14 12:04:58Taylor Devices, Inc. is a debt-free, highly profitable micro-cap stock with strong historical growth and market-leading margins in the vibration control product industry. TAYD outperforms near-peers with an attractive 12.42 P/E ratio, solid balance sheet, and robust financial health, making it a valuable investment. Key risks include revenue concentration among a few customers, exposure to cyclical markets, and potential new competitors or industry consolidation.

Taylor Devices Q2 Earnings Fall 39% Y/Y, Shares Drop 2%

zacks.com

2025-01-07 13:16:26TAYD reports a drop in EPS during the fiscal second quarter as lower sales weigh, but strong backlog growth hints at recovery opportunities in key markets.

Aerospace Demand Drives Taylor Devices' Y/Y Earnings Growth in Q1

zacks.com

2024-09-30 14:46:08TAYD's fiscal Q1 2025 EPS jumps to 85 cents, fueled by robust Aerospace/Defense sales. Revenues increase 17% year over year as the company leveraged strong order flow and strategic investments.

TAYLOR DEVICES ANNOUNCES FIRST QUARTER RESULTS

prnewswire.com

2024-09-27 08:00:00NORTH TONAWANDA, N.Y. , Sept. 27, 2024 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had first quarter sales of $11,617,856, up from last year's first quarter sales of $9,923,628.

Taylor Devices: Record Fundamentals, Reduced Cyclicality, Undervalued Shares

seekingalpha.com

2024-09-11 06:24:15Taylor Devices has surged 70% since February, driven by strong growth in A&D revenues, record earnings and backlog. TAYD's competitive edge is bolstered by proprietary products, customer relationships, and niche market positioning and enables ample opportunity for continued growth. Despite cyclicality risks TAYD has demonstrated operational excellence and expanding margins using zero debt.

Taylor Devices (TAYD) Q4 EPS Up 36% Y/Y on Defense Segment Growth

zacks.com

2024-08-16 11:45:49Taylor Devices (TAYD) delivered a strong fourth quarter of fiscal 2024, with EPS up 35.6% year over year to 80 cents per share and revenues rising to $12.1 million, driven by growth in the Aerospace/Defense segment despite challenges in the Structural market.

TAYLOR DEVICES ANNOUNCES RECORD HIGH FULL YEAR SALES, PROFIT AND FIRM ORDER BACKLOG FOR FISCAL YEAR 2024 CONCURRENT WITH STRONG FOURTH QUARTER RESULTS

prnewswire.com

2024-08-15 08:30:00NORTH TONAWANDA, N.Y. , Aug. 15, 2024 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 4th quarter sales of $12,065,211, up from last year's 4th quarter sales of $10,720,017.

Zacks Initiates Coverage of Taylor Devices With Outperform Recommendation

zacks.com

2024-06-12 05:35:15Discover why Zacks rates Taylor Devices as "Outperform", being the first on Wall Street to initiate coverage on the stock. Learn about the company's impressive net income growth, strong aerospace/defense sales, enhanced profit margins and robust order backlog, positioning it for future success.

TAYLOR DEVICES ANNOUNCES THIRD QUARTER AND NINE-MONTH RESULTS INCLUDING RECORD HIGH SALES AND EARNINGS

prnewswire.com

2024-03-28 08:27:00NORTH TONAWANDA, N.Y. , March 28, 2024 /PRNewswire/ -- Taylor Devices, Inc. (NASDAQ SmallCap: "TAYD") announced today that it had 3rd quarter sales of $12,254,093, up 24% from last year's 3rd quarter sales of $9,891,272 while sales for the 1st nine months were $32,517,596, up 10% from last year's 1st nine-month sales of $29,479,337.

Taylor Devices Is A Well Run Small Cap At A Reasonable Valuation

seekingalpha.com

2024-01-22 15:39:06Taylor Devices is a company that specializes in seismic dampers, which reduce the effects of earthquakes and strong winds on buildings. The company has seen strong financial results in 2023, with a 27% increase in sales and a significant boost in revenues from aerospace and industrial applications. The company's backlog of orders has been growing, indicating potential future sales growth, and its valuation suggests it may be undervalued. However, the company is subject to cyclical risks and fluctuations in the construction and defense industries.

Taylor Devices Is A Great Company, But Trades At An Expensive Price

seekingalpha.com

2023-02-01 10:57:39TAYD specializes in shock-absorbing devices for construction and aerospace uses, among others. The company seems to have a technological moat in these segments. Unfortunately, construction is cyclical and aerospace stagnant.