Stanley Black & Decker, Inc. (SWK)

Price:

75.67 USD

( - -0.87 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

RBC Bearings Incorporated

VALUE SCORE:

6

2nd position

The Timken Company

VALUE SCORE:

9

The best

Snap-on Incorporated

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

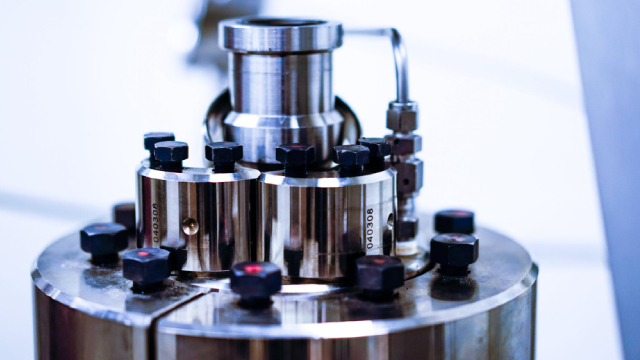

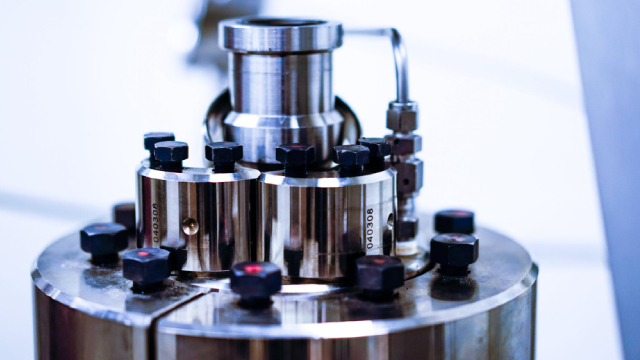

Stanley Black & Decker, Inc. engages in the tools and storage and industrial businesses in the United States, Canada, rest of Americas, France, rest of Europe, and Asia. Its Tools & Storage segment offers professional products, including professional grade corded and cordless electric power tools and equipment, and pneumatic tools and fasteners; and consumer products, such as corded and cordless electric power tools primarily under the BLACK+DECKER brand, as well as corded and cordless lawn and garden products and related accessories; home products; and hand tools, power tool accessories, and storage products. This segment sells its products through retailers, distributors, dealers, and a direct sales force to professional end users, distributors, dealers, retail consumers, and industrial customers in various industries. The company's Industrial segment provides engineered fastening systems and products to customers in the automotive, manufacturing, electronics, construction, aerospace, and other industries; sells and rents custom pipe handling, joint welding, and coating equipment for use in the construction of large and small diameter pipelines, as well as provides pipeline inspection services; and sells hydraulic tools and performance-driven heavy equipment attachment tools. This segment serves oil and natural gas pipeline industry and other industrial customers. It also sells automatic doors to commercial customers. The company was formerly known as The Stanley Works and changed its name to Stanley Black & Decker, Inc. in March 2010. Stanley Black & Decker, Inc. was founded in 1843 and is headquartered in New Britain, Connecticut.

NEWS

Dividend Kings: 3 Ideal Buys In 56 For December

seekingalpha.com

2025-12-11 17:50:12Dividend Kings remain largely overvalued, but six—including MO, UVV, HRL, KVUE, CDUAF, and UBSI—are now fairly priced with yields (from $1k invested) exceeding share prices. Analyst forecasts project net gains of 19.89% to 93.08% for select high-yield Dividend Kings by December 2026, with an average net gain of 34.89%. Only three Dividend Kings—MO, KVUE, UBSI—currently meet both the 'safer' dividend and fair price criteria, supported by positive free cash flow yields.

Baird Financial Group Inc. Purchases 47,176 Shares of Stanley Black & Decker, Inc. $SWK

defenseworld.net

2025-12-11 05:14:42Baird Financial Group Inc. grew its holdings in shares of Stanley Black and Decker, Inc. (NYSE: SWK) by 773.1% during the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 53,278 shares of the industrial products company's stock after buying an

Stanley Black & Decker, Inc. (SWK) Presents at Goldman Sachs Industrials and Materials Conference 2025 Transcript

seekingalpha.com

2025-12-04 13:38:51Stanley Black & Decker, Inc. (SWK) Presents at Goldman Sachs Industrials and Materials Conference 2025 Transcript

Why Is Stanley Black & Decker (SWK) Up 4.2% Since Last Earnings Report?

zacks.com

2025-12-04 12:36:26Stanley Black & Decker (SWK) reported earnings 30 days ago. What's next for the stock?

Stanley Black Exhibits Strong Prospects Despite Persisting Headwinds

zacks.com

2025-12-04 11:16:07SWK pushes toward $2B in cost savings as supply-chain actions, portfolio moves and shareholder returns reshape its long-term outlook.

Stanley Black & Decker, Inc. (NYSE:SWK) Receives Consensus Recommendation of “Hold” from Brokerages

defenseworld.net

2025-12-04 01:40:56Shares of Stanley Black and Decker, Inc. (NYSE: SWK - Get Free Report) have received a consensus recommendation of "Hold" from the twelve brokerages that are currently covering the company, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, five have given a hold recommendation and six have given a buy recommendation

Stanley Black & Decker Appoints Agustin Lopez Diaz as Chief Global Supply Chain Officer

prnewswire.com

2025-12-03 09:03:00NEW BRITAIN, Conn. , Dec. 3, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) today announced the appointment of Agustin Lopez Diaz as Chief Global Supply Chain Officer of the Company, effective December 15, 2025.

Stanley Black & Decker To Present At The 2025 Goldman Sachs Industrials And Materials Conference

prnewswire.com

2025-11-20 09:00:00NEW BRITAIN, Conn. , Nov. 20, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) invites investors and the general public to listen to a webcast of a presentation by Pat Hallinan, Executive Vice President and CFO, at the 2025 Goldman Sachs Industrials and Materials Conference on Thursday, December 4, 2025 at 11:30 AM ET.

Campbell & CO Investment Adviser LLC Takes $355,000 Position in Stanley Black & Decker, Inc. $SWK

defenseworld.net

2025-11-17 04:32:51Campbell and CO Investment Adviser LLC bought a new position in shares of Stanley Black and Decker, Inc. (NYSE: SWK) during the undefined quarter, according to its most recent disclosure with the SEC. The institutional investor bought 5,244 shares of the industrial products company's stock, valued at approximately $355,000. Other institutional investors and

4 Ideal November Buys In Barron's 100 Sustainable Dividend Dogs Of 47 'Safer'

seekingalpha.com

2025-11-13 10:38:16Barron's 2025 list of 100 most sustainable companies highlights top ESG performers, with 82 paying dividends and 47 deemed "safer" by free cash flow metrics. Yield-based "dogcatcher" analysis identifies 10 high-yield ESG stocks, including RHI, IPG, GIS, HRL, CPB, RF, LKQ, AVNT, KDP, and GPK, with notable upside potential. Analyst forecasts project average net gains of 37.1% for the top ten ESG "dogs" by November 2026, with several stocks already at or near "fair price" levels.

Stanley Black & Decker, Inc. (SWK) Presents at Baird 55th Annual Global Industrial Conference Transcript

seekingalpha.com

2025-11-12 15:01:37Stanley Black & Decker, Inc. ( SWK ) Baird 55th Annual Global Industrial Conference November 12, 2025 1:35 PM EST Company Participants Christopher Nelson - President, CEO & Director Conference Call Participants Timothy Wojs - Robert W. Baird & Co. Incorporated, Research Division Presentation Timothy Wojs Robert W.

Buy 3 Ideal Dividend Kings Of 24 'Safer' In November's 56

seekingalpha.com

2025-11-10 13:53:17The article reviews the November 2025 Dividend Kings, highlighting 56 stocks with long dividend growth records and recent changes to the list. Six Dividend Kings - MO, UVV, HRL, KVUE, CDUAF, UBSI - are currently fairly priced, with annual dividends from $1,000 invested meeting or exceeding share prices. Analyst forecasts suggest top-yielding Kings could deliver net gains of 18.55% to 101.43% by November 2026, with Stepan, H2O America, and National Fuel Gas among the top projections.

Stanley Black & Decker To Present At Baird's 2025 Global Industrial Conference

prnewswire.com

2025-11-05 09:00:00NEW BRITAIN, Conn. , Nov. 5, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) invites investors and the general public to listen to a webcast of a presentation by Chris Nelson, President and CEO, at Baird's 2025 Global Industrial Conference on Wednesday, November 12, 2025 at 12:35 PM CT (1:35 PM ET).

Stanley Black's Q3 Earnings Beat Estimates, Revenues Miss

zacks.com

2025-11-04 14:01:04SWK tops Q3 earnings estimates with margin gains, despite flat sales and a trimmed full-year outlook.

Stanley Black & Decker, Inc. (SWK) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-04 12:26:30Stanley Black & Decker, Inc. ( SWK ) Q3 2025 Earnings Call November 4, 2025 8:00 AM EST Company Participants Michael Wherley - Vice President of Investor Relations Christopher Nelson - President, CEO & Director Patrick Hallinan - Executive VP & CFO Conference Call Participants Timothy Wojs - Robert W. Baird & Co. Incorporated, Research Division Julian Mitchell - Barclays Bank PLC, Research Division Nigel Coe - Wolfe Research, LLC Christopher Snyder - Morgan Stanley, Research Division Michael Rehaut - JPMorgan Chase & Co, Research Division Adam Baumgarten - Vertical Research Partners, LLC Jonathan Matuszewski - Jefferies LLC, Research Division Joseph O'Dea - Wells Fargo Securities, LLC, Research Division Joseph Ritchie - Goldman Sachs Group, Inc., Research Division Presentation Operator Welcome to the Third Quarter 2025 Stanley Black & Decker Earnings Conference Call.

Stanley Black & Decker (SWK) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

zacks.com

2025-11-04 10:30:19While the top- and bottom-line numbers for Stanley Black & Decker (SWK) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Dividend Kings: 3 Ideal Buys In 56 For December

seekingalpha.com

2025-12-11 17:50:12Dividend Kings remain largely overvalued, but six—including MO, UVV, HRL, KVUE, CDUAF, and UBSI—are now fairly priced with yields (from $1k invested) exceeding share prices. Analyst forecasts project net gains of 19.89% to 93.08% for select high-yield Dividend Kings by December 2026, with an average net gain of 34.89%. Only three Dividend Kings—MO, KVUE, UBSI—currently meet both the 'safer' dividend and fair price criteria, supported by positive free cash flow yields.

Baird Financial Group Inc. Purchases 47,176 Shares of Stanley Black & Decker, Inc. $SWK

defenseworld.net

2025-12-11 05:14:42Baird Financial Group Inc. grew its holdings in shares of Stanley Black and Decker, Inc. (NYSE: SWK) by 773.1% during the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 53,278 shares of the industrial products company's stock after buying an

Stanley Black & Decker, Inc. (SWK) Presents at Goldman Sachs Industrials and Materials Conference 2025 Transcript

seekingalpha.com

2025-12-04 13:38:51Stanley Black & Decker, Inc. (SWK) Presents at Goldman Sachs Industrials and Materials Conference 2025 Transcript

Why Is Stanley Black & Decker (SWK) Up 4.2% Since Last Earnings Report?

zacks.com

2025-12-04 12:36:26Stanley Black & Decker (SWK) reported earnings 30 days ago. What's next for the stock?

Stanley Black Exhibits Strong Prospects Despite Persisting Headwinds

zacks.com

2025-12-04 11:16:07SWK pushes toward $2B in cost savings as supply-chain actions, portfolio moves and shareholder returns reshape its long-term outlook.

Stanley Black & Decker, Inc. (NYSE:SWK) Receives Consensus Recommendation of “Hold” from Brokerages

defenseworld.net

2025-12-04 01:40:56Shares of Stanley Black and Decker, Inc. (NYSE: SWK - Get Free Report) have received a consensus recommendation of "Hold" from the twelve brokerages that are currently covering the company, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, five have given a hold recommendation and six have given a buy recommendation

Stanley Black & Decker Appoints Agustin Lopez Diaz as Chief Global Supply Chain Officer

prnewswire.com

2025-12-03 09:03:00NEW BRITAIN, Conn. , Dec. 3, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) today announced the appointment of Agustin Lopez Diaz as Chief Global Supply Chain Officer of the Company, effective December 15, 2025.

Stanley Black & Decker To Present At The 2025 Goldman Sachs Industrials And Materials Conference

prnewswire.com

2025-11-20 09:00:00NEW BRITAIN, Conn. , Nov. 20, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) invites investors and the general public to listen to a webcast of a presentation by Pat Hallinan, Executive Vice President and CFO, at the 2025 Goldman Sachs Industrials and Materials Conference on Thursday, December 4, 2025 at 11:30 AM ET.

Campbell & CO Investment Adviser LLC Takes $355,000 Position in Stanley Black & Decker, Inc. $SWK

defenseworld.net

2025-11-17 04:32:51Campbell and CO Investment Adviser LLC bought a new position in shares of Stanley Black and Decker, Inc. (NYSE: SWK) during the undefined quarter, according to its most recent disclosure with the SEC. The institutional investor bought 5,244 shares of the industrial products company's stock, valued at approximately $355,000. Other institutional investors and

4 Ideal November Buys In Barron's 100 Sustainable Dividend Dogs Of 47 'Safer'

seekingalpha.com

2025-11-13 10:38:16Barron's 2025 list of 100 most sustainable companies highlights top ESG performers, with 82 paying dividends and 47 deemed "safer" by free cash flow metrics. Yield-based "dogcatcher" analysis identifies 10 high-yield ESG stocks, including RHI, IPG, GIS, HRL, CPB, RF, LKQ, AVNT, KDP, and GPK, with notable upside potential. Analyst forecasts project average net gains of 37.1% for the top ten ESG "dogs" by November 2026, with several stocks already at or near "fair price" levels.

Stanley Black & Decker, Inc. (SWK) Presents at Baird 55th Annual Global Industrial Conference Transcript

seekingalpha.com

2025-11-12 15:01:37Stanley Black & Decker, Inc. ( SWK ) Baird 55th Annual Global Industrial Conference November 12, 2025 1:35 PM EST Company Participants Christopher Nelson - President, CEO & Director Conference Call Participants Timothy Wojs - Robert W. Baird & Co. Incorporated, Research Division Presentation Timothy Wojs Robert W.

Buy 3 Ideal Dividend Kings Of 24 'Safer' In November's 56

seekingalpha.com

2025-11-10 13:53:17The article reviews the November 2025 Dividend Kings, highlighting 56 stocks with long dividend growth records and recent changes to the list. Six Dividend Kings - MO, UVV, HRL, KVUE, CDUAF, UBSI - are currently fairly priced, with annual dividends from $1,000 invested meeting or exceeding share prices. Analyst forecasts suggest top-yielding Kings could deliver net gains of 18.55% to 101.43% by November 2026, with Stepan, H2O America, and National Fuel Gas among the top projections.

Stanley Black & Decker To Present At Baird's 2025 Global Industrial Conference

prnewswire.com

2025-11-05 09:00:00NEW BRITAIN, Conn. , Nov. 5, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) invites investors and the general public to listen to a webcast of a presentation by Chris Nelson, President and CEO, at Baird's 2025 Global Industrial Conference on Wednesday, November 12, 2025 at 12:35 PM CT (1:35 PM ET).

Stanley Black's Q3 Earnings Beat Estimates, Revenues Miss

zacks.com

2025-11-04 14:01:04SWK tops Q3 earnings estimates with margin gains, despite flat sales and a trimmed full-year outlook.

Stanley Black & Decker, Inc. (SWK) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-04 12:26:30Stanley Black & Decker, Inc. ( SWK ) Q3 2025 Earnings Call November 4, 2025 8:00 AM EST Company Participants Michael Wherley - Vice President of Investor Relations Christopher Nelson - President, CEO & Director Patrick Hallinan - Executive VP & CFO Conference Call Participants Timothy Wojs - Robert W. Baird & Co. Incorporated, Research Division Julian Mitchell - Barclays Bank PLC, Research Division Nigel Coe - Wolfe Research, LLC Christopher Snyder - Morgan Stanley, Research Division Michael Rehaut - JPMorgan Chase & Co, Research Division Adam Baumgarten - Vertical Research Partners, LLC Jonathan Matuszewski - Jefferies LLC, Research Division Joseph O'Dea - Wells Fargo Securities, LLC, Research Division Joseph Ritchie - Goldman Sachs Group, Inc., Research Division Presentation Operator Welcome to the Third Quarter 2025 Stanley Black & Decker Earnings Conference Call.

Stanley Black & Decker (SWK) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

zacks.com

2025-11-04 10:30:19While the top- and bottom-line numbers for Stanley Black & Decker (SWK) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.