S&P Global Inc. (SPGI)

Price:

501.06 USD

( + 3.50 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Intercontinental Exchange, Inc.

VALUE SCORE:

7

2nd position

MSCI Inc.

VALUE SCORE:

8

The best

FactSet Research Systems Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

S&P Global Inc., together with its subsidiaries, provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets. It operates in six divisions: S&P Global Ratings, S&P Dow Jones Indices, S&P Global Commodity Insights, S&P Global Market Intelligence, S&P Global Mobility, and S&P Global Engineering Solutions. The S&P Global Ratings division operates as an independent provider of credit ratings, research, and analytics, offering investors and other market participants information, ratings, and benchmarks. The S&P Dow Jones Indices division is an index provider that maintains various valuation and index benchmarks for investment advisors, wealth managers, and institutional investors. The S&P Global Commodity Insights division offers data and insights for global energy and commodity markets and enable its customers to make decisions. The S&P Global Market Intelligence division delivers data and technology solutions for customers to provide insights for making decisions. It offers data and services that bring end-to-end workflow solutions, including capital formation, data and distribution, ESG and sustainability, leveraged loans, private markets, sector coverage, supply chain, and issuer solutions, as well as credit, risk, and regulatory solutions. The S&P Global Mobility division provides insights derived from unmatched automotive data, enabling its customers to anticipate change and make decisions. The S&P Global Engineering Solutions division offers engineering expertise and solutions in industries, such as aerospace and defense, energy, architecture, construction, and transportation. Its solutions empower business and technical leaders to transform workflows and make decisions. S&P Global Inc. was founded in 1860 and is headquartered in New York, New York.

NEWS

Energy Companies from Around the World Win Honors at S&P Global Energy's 27th Annual Platts Global Energy Awards

prnewswire.com

2025-12-11 22:37:00CNBC's Brian Sullivan Emceed as Winners from Australia, Brazil, China, Denmark, India, Singapore, Spain, UAE, UK, and US Were Announced NEW YORK , Dec. 11, 2025 /PRNewswire/ -- S&P Global Energy (formerly S&P Global Commodity Insights), the leading global independent provider of data, insights, analysis, and benchmark prices for the commodities and energy expansion markets, tonight honored industry excellence in 21 performance categories and winners from across the globe at the Platts Global Energy Awards gala held at the Casa Cipriani South Street in downtown New York City. The Awards program, now in its 27th year and often described as the "Oscars" of the energy industry, recognizes corporate and individual innovation, leadership, and performance in the energy and chemicals industries and bestowed honors on energy companies from Australia, Brazil, China, Denmark, India, Singapore, Spain, UAE, UK, and the US.

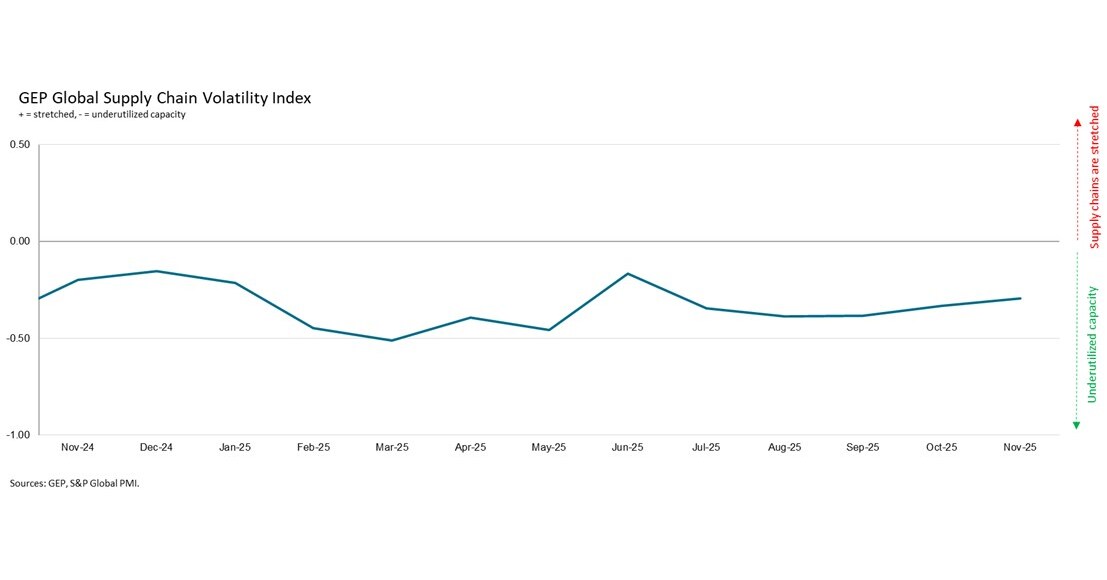

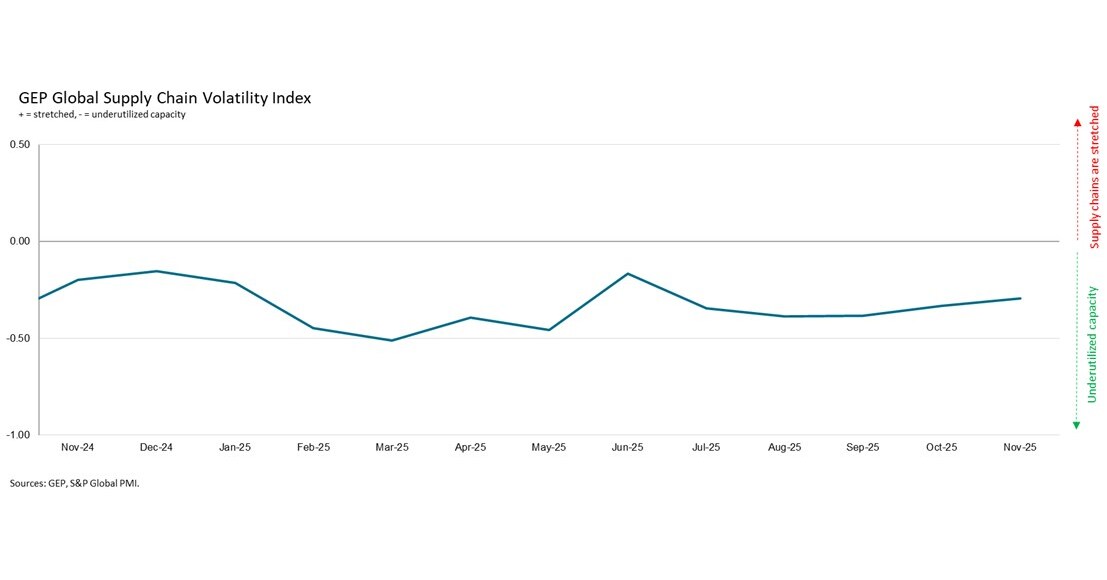

SPARE CAPACITY PERSISTS GLOBALLY, WHILE NORTH AMERICA REPORTS A STEEPER PULLBACK IN MANUFACTURING DEMAND, SIGNALLING WEAK CONDITIONS HEADING INTO 2026: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

prnewswire.com

2025-12-10 08:17:00/PRNewswire/ -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply

SPARE CAPACITY PERSISTS GLOBALLY, WHILE NORTH AMERICA REPORTS A STEEPER PULLBACK IN MANUFACTURING DEMAND, SIGNALLING WEAK CONDITIONS HEADING INTO 2026: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

prnewswire.com

2025-12-10 08:17:00North America posts the steepest decline in input demand by region, signaling softening activity heading into 2026 Europe and the UK remain subdued amid weak manufacturing pipelines Asia sees another month of low demand as Chinese factory purchasing continues to slow With ample spare capacity worldwide, companies face little price pressure outside of tariffs CLARK, N.J. , Dec. 10, 2025 /PRNewswire/ -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply chains remained underutilized in November, with manufacturers continuing to limit purchasing, signaling a weakening outlook for the start of 2026.

S&P Global Advances AI-Powered Enterprise Transformation Through Strategic Partnership with Google Cloud

prnewswire.com

2025-12-10 08:00:00Multi-year strategic partnership accelerates the unification of S&P Global's data distribution for A I and expands agentic capabilities NEW YORK , Dec. 10, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) today announced a multi-year strategic partnership with Google Cloud to accelerate its enterprise-wide transformation across agentic innovation, data distribution and workflow automation. This expansion marks yet another milestone in S&P Global's strategic AI and cloud journey.

S&P Global Inc. (SPGI) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

seekingalpha.com

2025-12-09 15:27:06S&P Global Inc. (SPGI) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

S&P Global Energy Releases Key Clean Energy+ Trends for 2026 as AI Growth and Geopolitical Shifts Reshape Global Energy Markets

prnewswire.com

2025-12-09 08:00:00AI-driven power demand surge tests grid, sustainability limits while China consolidates cleantech leadership in transformative year for energy transition - Solar Installations Peak (for Now) – LONDON and NEW YORK and SINGAPORE , Dec. 9, 2025 /PRNewswire/ -- S&P Global Energy today released its Top Trends report identifying the pivotal developments shaping clean energy technology, sustainability and growth in global energy markets in 2026. The report was produced by analysts of its Horizons team, which provides comprehensive energy expansion and sustainability intelligence, from big picture trends to asset level insights.

Cerity Partners LLC Raises Position in S&P Global Inc. $SPGI

defenseworld.net

2025-12-08 05:03:18Cerity Partners LLC grew its stake in S&P Global Inc. (NYSE: SPGI) by 11.4% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 194,357 shares of the business services provider's stock after purchasing an additional 19,915 shares during the period. Cerity Partners

CRH, Carvana and Comfort Systems USA Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600

prnewswire.com

2025-12-05 17:49:00NEW YORK , Dec. 5, 2025 /PRNewswire/ -- S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 22, to coincide with the quarterly rebalance. The changes ensure that each index is more representative of its market capitalization range.

S&P Global (SPGI) Upgraded to Buy: Here's What You Should Know

zacks.com

2025-12-05 13:01:19S&P Global (SPGI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

BNY and Nasdaq Invest in Blockchain Tech Company Digital Asset

pymnts.com

2025-12-04 12:52:57Blockchain technology company Digital Asset received an investment from BNY, iCapital, Nasdaq and S&P Global. The company did not disclose the amount of funding in the Thursday (Dec. 4) press release announcing the investment.

S&P Global Announces Additional Leadership Appointments in Mobility Division

prnewswire.com

2025-12-04 08:00:00Key appointments include Chief People, Legal, and Information Officers who will lead Mobility through its planned separation from S&P Global and remain in leadership roles of the standalone company NEW YORK , Dec. 4, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) today announced the appointments of key roles on the S&P Global Mobility ("Mobility") executive leadership team as the business continues working towards its planned separation from S&P Global into a standalone public company. The appointments are as follows: Larissa Cerqueira, former Chief Human Resources Officer of Fluence Energy, has been appointed Chief People Officer of Mobility, effective January 1, 2026; Tasha Matharu , current Deputy General Counsel and Corporate Secretary of S&P Global, has been appointed Chief Legal Officer of Mobility, effective January 1, 2026; and Joseph "Joedy" Lenz, former Chief Technology Officer of CARFAX, has been appointed Chief Information Officer of Mobility, effective immediately.

S&P Global Announces Pricing of Offering of $600,000,000 Senior Notes due 2031 and $400,000,000 Senior Notes due 2035

prnewswire.com

2025-12-01 17:07:00NEW YORK , Dec. 1, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) (the "Company" or "S&P Global") today announced that it has priced an offering (the "Offering") of $600,000,000 aggregate principal amount of 4.250% senior notes due 2031 (the "2031 Notes") and $400,000,000 aggregate principal amount of 4.800% senior notes due 2035 (the "2035 Notes" and, together with the 2031 Notes, the "Notes") in a private placement transaction pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the "Securities Act"). The 2031 Notes will bear interest at a rate of 4.250% per annum and will mature on January 15, 2031.

S&P Global Energy Celebrates Ten-year Anniversary of Platts Benchmark Steel Rebar and Scrap Assessments as Settlement Basis for London Metals Exchange

prnewswire.com

2025-12-01 13:15:00LONDON and NEW YORK and HOUSTON , Dec. 1, 2025 /PRNewswire/ -- S&P Global Energy (formerly S&P Global Commodity Insights) commemorates the 10-year anniversary of its Platts steel scrap and rebar price benchmarks becoming the settlement reference for two of the London Metals Exchange (LME) futures contracts whose popularity demonstrate growing demand for risk management solutions in the growing recycled steel market. S&P Global Energy is the leading independent provider of information, data, analysis and benchmark prices for the energy, petrochemicals, metals, shipping, and commodities markets, On November 23, 2015, the London Metals Exchange launched steel scrap and steel rebar futures contracts with settlement against the Platts benchmark for spot physical premium steel scrap delivered to Turkey on a cost and freight (CFR) basis, known as Platts HMS 1/2 80:20 CFR Turkey* benchmark, and the Platts spot physical steel rebar benchmark, known as Platts Steel Rebar free-on-board (FOB) Turkey, respectively.

S&P Global Collaborates with AWS to Bring Trusted Data Directly to Customer AI Workflows

prnewswire.com

2025-12-01 12:06:00New Model Context Protocol (MCP) Server integrations with Amazon Quick Suite enable seamless access to S&P Global data Partnership expands the reach of S&P Global's trusted market, financial and energy intelligence across the AI ecosystem NEW YORK , Dec. 1, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) today announced new integrations with Amazon Web Services (AWS) to enable customers to use AI agents to ask complex market, financial, and energy-related questions and receive reliable answers from S&P Global directly within their AWS environments. S&P Global's trusted data is now available through two new Model Context Protocol (MCP) server integrations with Amazon Quick Suite.

S&P Global Announces Proposed Offering of Senior Notes

prnewswire.com

2025-12-01 09:01:00NEW YORK , Dec. 1, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) (the "Company" or "S&P Global") today announced that it is commencing an offering, subject to market conditions, of a tranche of senior notes due 2031 (the "2031 Notes") and a tranche of senior notes due 2035 (the "2035 Notes" and, together with the 2031 Notes, the "Notes") in a private placement transaction (the "Offering"). The Notes will be unsecured obligations of the Company and will be guaranteed by its subsidiary, Standard & Poor's Financial Services LLC.

Boston Family Office LLC Has $28.03 Million Stock Position in S&P Global Inc. $SPGI

defenseworld.net

2025-12-01 03:30:51Boston Family Office LLC increased its holdings in shares of S&P Global Inc. (NYSE: SPGI) by 0.9% in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 53,181 shares of the business services provider's stock after buying an additional 467 shares

Energy Companies from Around the World Win Honors at S&P Global Energy's 27th Annual Platts Global Energy Awards

prnewswire.com

2025-12-11 22:37:00CNBC's Brian Sullivan Emceed as Winners from Australia, Brazil, China, Denmark, India, Singapore, Spain, UAE, UK, and US Were Announced NEW YORK , Dec. 11, 2025 /PRNewswire/ -- S&P Global Energy (formerly S&P Global Commodity Insights), the leading global independent provider of data, insights, analysis, and benchmark prices for the commodities and energy expansion markets, tonight honored industry excellence in 21 performance categories and winners from across the globe at the Platts Global Energy Awards gala held at the Casa Cipriani South Street in downtown New York City. The Awards program, now in its 27th year and often described as the "Oscars" of the energy industry, recognizes corporate and individual innovation, leadership, and performance in the energy and chemicals industries and bestowed honors on energy companies from Australia, Brazil, China, Denmark, India, Singapore, Spain, UAE, UK, and the US.

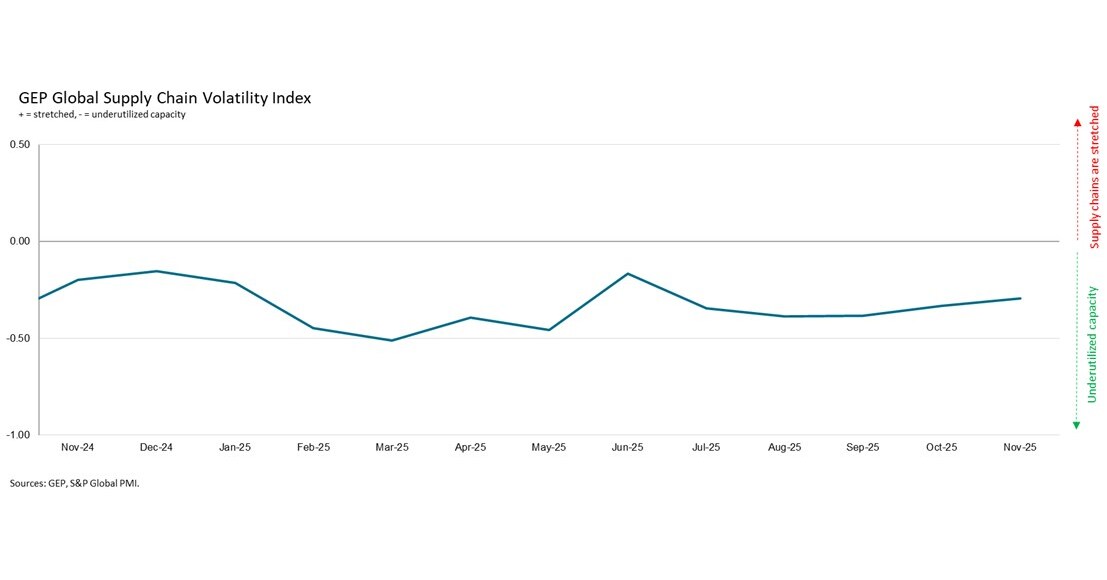

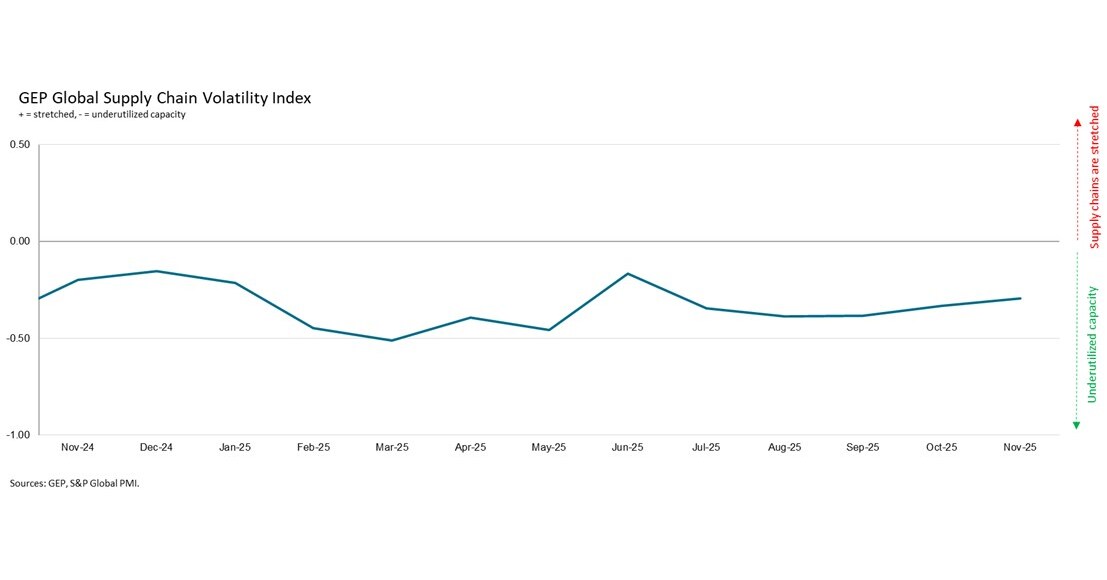

SPARE CAPACITY PERSISTS GLOBALLY, WHILE NORTH AMERICA REPORTS A STEEPER PULLBACK IN MANUFACTURING DEMAND, SIGNALLING WEAK CONDITIONS HEADING INTO 2026: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

prnewswire.com

2025-12-10 08:17:00/PRNewswire/ -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply

SPARE CAPACITY PERSISTS GLOBALLY, WHILE NORTH AMERICA REPORTS A STEEPER PULLBACK IN MANUFACTURING DEMAND, SIGNALLING WEAK CONDITIONS HEADING INTO 2026: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

prnewswire.com

2025-12-10 08:17:00North America posts the steepest decline in input demand by region, signaling softening activity heading into 2026 Europe and the UK remain subdued amid weak manufacturing pipelines Asia sees another month of low demand as Chinese factory purchasing continues to slow With ample spare capacity worldwide, companies face little price pressure outside of tariffs CLARK, N.J. , Dec. 10, 2025 /PRNewswire/ -- GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, shows that global supply chains remained underutilized in November, with manufacturers continuing to limit purchasing, signaling a weakening outlook for the start of 2026.

S&P Global Advances AI-Powered Enterprise Transformation Through Strategic Partnership with Google Cloud

prnewswire.com

2025-12-10 08:00:00Multi-year strategic partnership accelerates the unification of S&P Global's data distribution for A I and expands agentic capabilities NEW YORK , Dec. 10, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) today announced a multi-year strategic partnership with Google Cloud to accelerate its enterprise-wide transformation across agentic innovation, data distribution and workflow automation. This expansion marks yet another milestone in S&P Global's strategic AI and cloud journey.

S&P Global Inc. (SPGI) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

seekingalpha.com

2025-12-09 15:27:06S&P Global Inc. (SPGI) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

S&P Global Energy Releases Key Clean Energy+ Trends for 2026 as AI Growth and Geopolitical Shifts Reshape Global Energy Markets

prnewswire.com

2025-12-09 08:00:00AI-driven power demand surge tests grid, sustainability limits while China consolidates cleantech leadership in transformative year for energy transition - Solar Installations Peak (for Now) – LONDON and NEW YORK and SINGAPORE , Dec. 9, 2025 /PRNewswire/ -- S&P Global Energy today released its Top Trends report identifying the pivotal developments shaping clean energy technology, sustainability and growth in global energy markets in 2026. The report was produced by analysts of its Horizons team, which provides comprehensive energy expansion and sustainability intelligence, from big picture trends to asset level insights.

Cerity Partners LLC Raises Position in S&P Global Inc. $SPGI

defenseworld.net

2025-12-08 05:03:18Cerity Partners LLC grew its stake in S&P Global Inc. (NYSE: SPGI) by 11.4% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 194,357 shares of the business services provider's stock after purchasing an additional 19,915 shares during the period. Cerity Partners

CRH, Carvana and Comfort Systems USA Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600

prnewswire.com

2025-12-05 17:49:00NEW YORK , Dec. 5, 2025 /PRNewswire/ -- S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 22, to coincide with the quarterly rebalance. The changes ensure that each index is more representative of its market capitalization range.

S&P Global (SPGI) Upgraded to Buy: Here's What You Should Know

zacks.com

2025-12-05 13:01:19S&P Global (SPGI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

BNY and Nasdaq Invest in Blockchain Tech Company Digital Asset

pymnts.com

2025-12-04 12:52:57Blockchain technology company Digital Asset received an investment from BNY, iCapital, Nasdaq and S&P Global. The company did not disclose the amount of funding in the Thursday (Dec. 4) press release announcing the investment.

S&P Global Announces Additional Leadership Appointments in Mobility Division

prnewswire.com

2025-12-04 08:00:00Key appointments include Chief People, Legal, and Information Officers who will lead Mobility through its planned separation from S&P Global and remain in leadership roles of the standalone company NEW YORK , Dec. 4, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) today announced the appointments of key roles on the S&P Global Mobility ("Mobility") executive leadership team as the business continues working towards its planned separation from S&P Global into a standalone public company. The appointments are as follows: Larissa Cerqueira, former Chief Human Resources Officer of Fluence Energy, has been appointed Chief People Officer of Mobility, effective January 1, 2026; Tasha Matharu , current Deputy General Counsel and Corporate Secretary of S&P Global, has been appointed Chief Legal Officer of Mobility, effective January 1, 2026; and Joseph "Joedy" Lenz, former Chief Technology Officer of CARFAX, has been appointed Chief Information Officer of Mobility, effective immediately.

S&P Global Announces Pricing of Offering of $600,000,000 Senior Notes due 2031 and $400,000,000 Senior Notes due 2035

prnewswire.com

2025-12-01 17:07:00NEW YORK , Dec. 1, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) (the "Company" or "S&P Global") today announced that it has priced an offering (the "Offering") of $600,000,000 aggregate principal amount of 4.250% senior notes due 2031 (the "2031 Notes") and $400,000,000 aggregate principal amount of 4.800% senior notes due 2035 (the "2035 Notes" and, together with the 2031 Notes, the "Notes") in a private placement transaction pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the "Securities Act"). The 2031 Notes will bear interest at a rate of 4.250% per annum and will mature on January 15, 2031.

S&P Global Energy Celebrates Ten-year Anniversary of Platts Benchmark Steel Rebar and Scrap Assessments as Settlement Basis for London Metals Exchange

prnewswire.com

2025-12-01 13:15:00LONDON and NEW YORK and HOUSTON , Dec. 1, 2025 /PRNewswire/ -- S&P Global Energy (formerly S&P Global Commodity Insights) commemorates the 10-year anniversary of its Platts steel scrap and rebar price benchmarks becoming the settlement reference for two of the London Metals Exchange (LME) futures contracts whose popularity demonstrate growing demand for risk management solutions in the growing recycled steel market. S&P Global Energy is the leading independent provider of information, data, analysis and benchmark prices for the energy, petrochemicals, metals, shipping, and commodities markets, On November 23, 2015, the London Metals Exchange launched steel scrap and steel rebar futures contracts with settlement against the Platts benchmark for spot physical premium steel scrap delivered to Turkey on a cost and freight (CFR) basis, known as Platts HMS 1/2 80:20 CFR Turkey* benchmark, and the Platts spot physical steel rebar benchmark, known as Platts Steel Rebar free-on-board (FOB) Turkey, respectively.

S&P Global Collaborates with AWS to Bring Trusted Data Directly to Customer AI Workflows

prnewswire.com

2025-12-01 12:06:00New Model Context Protocol (MCP) Server integrations with Amazon Quick Suite enable seamless access to S&P Global data Partnership expands the reach of S&P Global's trusted market, financial and energy intelligence across the AI ecosystem NEW YORK , Dec. 1, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) today announced new integrations with Amazon Web Services (AWS) to enable customers to use AI agents to ask complex market, financial, and energy-related questions and receive reliable answers from S&P Global directly within their AWS environments. S&P Global's trusted data is now available through two new Model Context Protocol (MCP) server integrations with Amazon Quick Suite.

S&P Global Announces Proposed Offering of Senior Notes

prnewswire.com

2025-12-01 09:01:00NEW YORK , Dec. 1, 2025 /PRNewswire/ -- S&P Global (NYSE: SPGI) (the "Company" or "S&P Global") today announced that it is commencing an offering, subject to market conditions, of a tranche of senior notes due 2031 (the "2031 Notes") and a tranche of senior notes due 2035 (the "2035 Notes" and, together with the 2031 Notes, the "Notes") in a private placement transaction (the "Offering"). The Notes will be unsecured obligations of the Company and will be guaranteed by its subsidiary, Standard & Poor's Financial Services LLC.

Boston Family Office LLC Has $28.03 Million Stock Position in S&P Global Inc. $SPGI

defenseworld.net

2025-12-01 03:30:51Boston Family Office LLC increased its holdings in shares of S&P Global Inc. (NYSE: SPGI) by 0.9% in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 53,181 shares of the business services provider's stock after buying an additional 467 shares