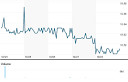

Highland/iBoxx Senior Loan ETF (SNLN)

Price:

14.62 USD

( + 0.10 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

AXS 2X PFE Bull Daily ETF

VALUE SCORE:

0

2nd position

Vanguard Short-Term Treasury Index Fund

VALUE SCORE:

11

The best

Direxion Daily AMZN Bull 2X Shares

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

The fund will, under normal circumstances, invest at least 80% of its assets (the "80% basket") in component securities of the underlying index. The underlying index is a subset of the Markit iBoxx USD Leveraged Loan Index. "Leveraged Loans" are loans to companies that typically already have a high amount of debt and are often characterized by lower credit ratings or higher interest rates. It is non-diversified.

NEWS

This Week in ETFs: Launches Ramp Up

etftrends.com

2023-09-22 17:15:57The week ending Sept. 22 marks a strong post-summer resurgence for the industry, with 25 new ETF launches in all.

Bond Yields Likely to Remain High in 2024: ETF Strategies in Focus

zacks.com

2023-09-13 14:17:20Bond yields are likely to be high going into 2024. Here are the best ETF strategies to play the scenario.

Time to Buy Senior Loan ETFs as Rates Hit a 16-Year High?

zacks.com

2023-08-22 14:17:16With their unique characteristics, such as floating interest rates and seniority in the capital structure, senior loan ETFs can provide stability amid rising rate environment.

ETF Strategies to Fight Rising Rates

zacks.com

2023-08-18 09:34:18The U.S. Treasury yields have been on a surge lately, driven by expectations that the Fed will keep interest rates higher for longer to fight inflation.

Stagflation in 2023? ETF Strategies to Follow

zacks.com

2023-01-06 14:18:04Market participants are fearing a recession in 2023. Is the fear exaggerated?

Will 2023 Be the "Best Year" for Bond ETFs in 14 Years?

zacks.com

2023-01-04 14:18:07Per Goldman Sachs, 2023 bond yields will surpass stock dividends. Should you tap bond ETFs for 2023?

"Bonds Are Back": ETF Strategies to Follow

zacks.com

2022-11-23 14:18:06Investors are finding value in bonds for the first time in a decade as higher interest rates make fixed-income lucrative, according to JPMorgan Chase.

Time for a 40/60 ETF Portfolio Instead of 60/40?

zacks.com

2022-10-20 09:02:07The year 2022 has produced the worst returns in 100 years for the classic 60/40 strategy. Should you tap 40/60 ETF strategy now?

Bond ETF Investing Strategies for Rising Rate Environment

zacks.com

2022-10-18 14:18:17Rising rate worries have crippled the investing world this year.

Is 60/40 Rule Useless in 2022? 4 High-Yielding ETFs to Play

zacks.com

2022-09-15 16:12:31The 60/40 portfolio fails to impress investors this year. Hence, investors might like these high-yielding options.

4 Bond ETFs to Play If Rates Continue to Rise

zacks.com

2022-03-25 09:02:03There are fixed-income ways that would help investors mitigate faster Fed rate hike threats yet emerge profitable.

ETF Strategies to Play Rising U.S. Treasury Yields

zacks.com

2021-09-30 10:23:13Inside the rising U.S. treasury yields and ways to play the trend with ETFs.

4 Bond ETFs to Play If Rates Rise

zacks.com

2021-08-12 10:06:39Two Federal Reserve officials recently gave cues of a sooner-than-expected QE taper. Play these bond ETFs if rates rise.

Yellen Triggers Rate Rise Talks: 6 ETFs to Play

zacks.com

2021-05-05 13:54:07On May 4, Treasury Secretary Janet Yellen commented that interest rates may need to rise modestly over time to keep the U.S. economy from overheating, though she clarified later on that she is not "predicting or recommending" such policies.

Play 4 Rate-Proof Bond ETFs in a Rising Rate Environment

zacks.com

2021-03-05 15:12:03Rising rate worries started bothering both equity and bond markets from February-end. Bonds have registered steep selloffs.

No data to display

This Week in ETFs: Launches Ramp Up

etftrends.com

2023-09-22 17:15:57The week ending Sept. 22 marks a strong post-summer resurgence for the industry, with 25 new ETF launches in all.

Bond Yields Likely to Remain High in 2024: ETF Strategies in Focus

zacks.com

2023-09-13 14:17:20Bond yields are likely to be high going into 2024. Here are the best ETF strategies to play the scenario.

Time to Buy Senior Loan ETFs as Rates Hit a 16-Year High?

zacks.com

2023-08-22 14:17:16With their unique characteristics, such as floating interest rates and seniority in the capital structure, senior loan ETFs can provide stability amid rising rate environment.

ETF Strategies to Fight Rising Rates

zacks.com

2023-08-18 09:34:18The U.S. Treasury yields have been on a surge lately, driven by expectations that the Fed will keep interest rates higher for longer to fight inflation.

Stagflation in 2023? ETF Strategies to Follow

zacks.com

2023-01-06 14:18:04Market participants are fearing a recession in 2023. Is the fear exaggerated?

Will 2023 Be the "Best Year" for Bond ETFs in 14 Years?

zacks.com

2023-01-04 14:18:07Per Goldman Sachs, 2023 bond yields will surpass stock dividends. Should you tap bond ETFs for 2023?

"Bonds Are Back": ETF Strategies to Follow

zacks.com

2022-11-23 14:18:06Investors are finding value in bonds for the first time in a decade as higher interest rates make fixed-income lucrative, according to JPMorgan Chase.

Time for a 40/60 ETF Portfolio Instead of 60/40?

zacks.com

2022-10-20 09:02:07The year 2022 has produced the worst returns in 100 years for the classic 60/40 strategy. Should you tap 40/60 ETF strategy now?

Bond ETF Investing Strategies for Rising Rate Environment

zacks.com

2022-10-18 14:18:17Rising rate worries have crippled the investing world this year.

Is 60/40 Rule Useless in 2022? 4 High-Yielding ETFs to Play

zacks.com

2022-09-15 16:12:31The 60/40 portfolio fails to impress investors this year. Hence, investors might like these high-yielding options.

4 Bond ETFs to Play If Rates Continue to Rise

zacks.com

2022-03-25 09:02:03There are fixed-income ways that would help investors mitigate faster Fed rate hike threats yet emerge profitable.

ETF Strategies to Play Rising U.S. Treasury Yields

zacks.com

2021-09-30 10:23:13Inside the rising U.S. treasury yields and ways to play the trend with ETFs.

4 Bond ETFs to Play If Rates Rise

zacks.com

2021-08-12 10:06:39Two Federal Reserve officials recently gave cues of a sooner-than-expected QE taper. Play these bond ETFs if rates rise.

Yellen Triggers Rate Rise Talks: 6 ETFs to Play

zacks.com

2021-05-05 13:54:07On May 4, Treasury Secretary Janet Yellen commented that interest rates may need to rise modestly over time to keep the U.S. economy from overheating, though she clarified later on that she is not "predicting or recommending" such policies.

Play 4 Rate-Proof Bond ETFs in a Rising Rate Environment

zacks.com

2021-03-05 15:12:03Rising rate worries started bothering both equity and bond markets from February-end. Bonds have registered steep selloffs.