SLM Corporation (SLM)

Price:

26.89 USD

( - -0.48 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

SoFi Technologies, Inc.

VALUE SCORE:

6

2nd position

Qfin Holdings, Inc.

VALUE SCORE:

10

The best

Medallion Financial Corp.

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

SLM Corporation, through its subsidiaries, originates and services private education loans to students and their families to finance the cost of their education in the United States. It also offers retail deposit accounts, including certificates of deposit, money market deposit accounts, and high-yield savings accounts; and omnibus accounts, as well as credit card loans. It serves students and families through financial aid, federal loans, and student and family resources. The company was formerly known as New BLC Corporation and changed its name to SLM Corporation in December 2013. SLM Corporation was founded in 1972 and is headquartered in Newark, Delaware.

NEWS

Sallie Mae Outlines Strategic Shift, Projects Higher Revenues & EPS

zacks.com

2025-12-09 13:36:09SLM pivots to fee-based partnerships and private credit, aiming for steadier growth and higher EPS in a transforming student-lending market.

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Agilent, Alibaba, Delta Air Lines, Intel, JD.com, Micron Technology, Reddit and More

247wallst.com

2025-12-09 08:15:02Pre-Market Stock Futures: The futures are trading flat on Tuesday after we opened the week on the downside, with all major indices finishing the day lower. With the Federal Reserve meeting this week, investors are playing a wait-and-see game before bidding stocks higher to ensure there will indeed be a 25-basis-point cut. Wall Street will... Here Are Tuesday's Top Wall Street Analyst Research Calls: Agilent, Alibaba, Delta Air Lines, Intel, JD.com, Micron Technology, Reddit and More.

SLM Corporation (SLM) Discusses Evolving Strategy and Private Credit Strategic Partnerships at Investor Forum Transcript

seekingalpha.com

2025-12-08 22:17:18SLM Corporation (SLM) Discusses Evolving Strategy and Private Credit Strategic Partnerships at Investor Forum Transcript

Fidelity Stock Selector Mid Cap Fund Q3 2025 Performance Review

seekingalpha.com

2025-11-26 14:29:00For the three months ending September 30, 2025, the fund's Retail Class shares gained 3.70%, trailing the 5.55% advance of the benchmark S&P MidCap 400® Index. In the third quarter, U.S. stocks extended the rally that began in April following the 90-day pause for most tariffs. Lower interest rates are viewed as particularly beneficial for smaller businesses, which have access to fewer ways of raising working capital.

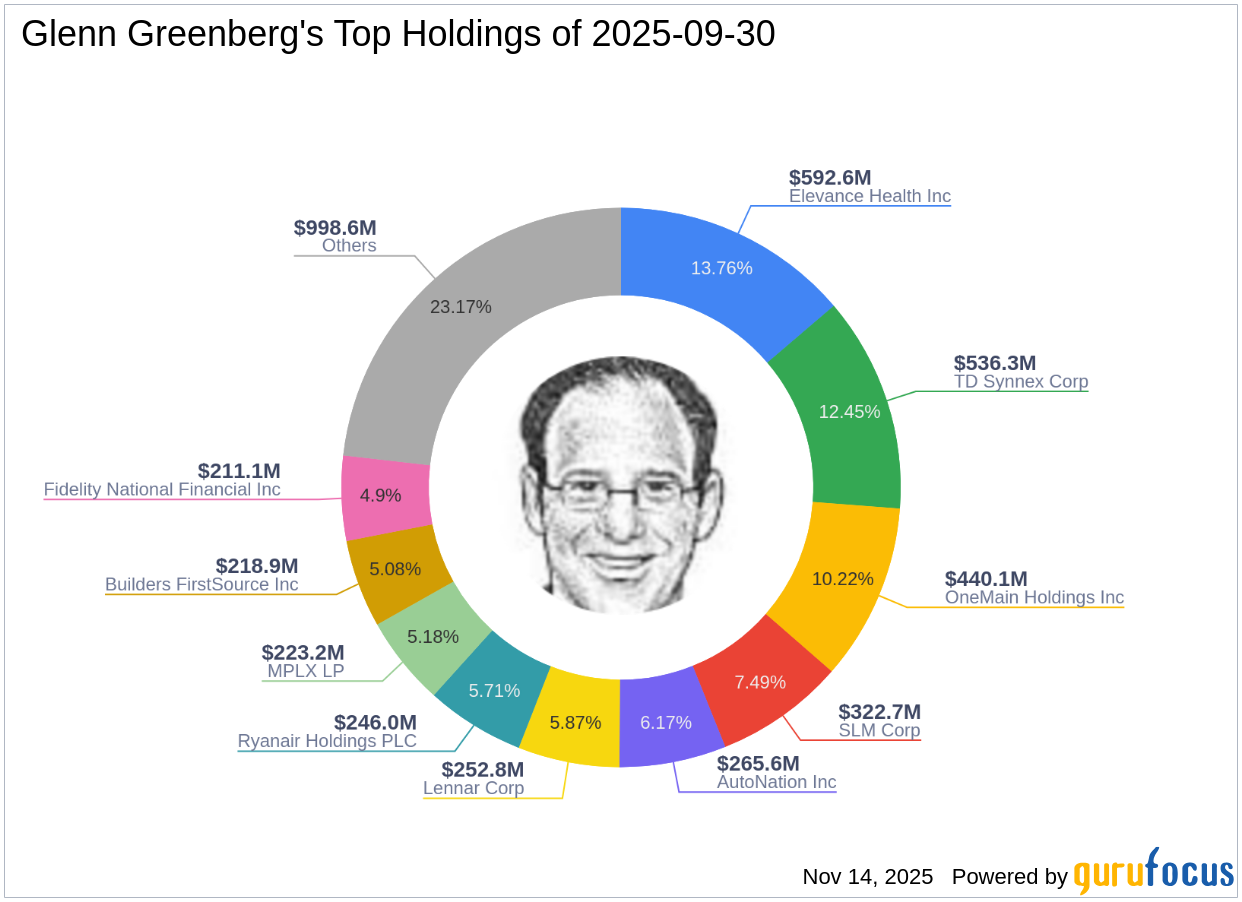

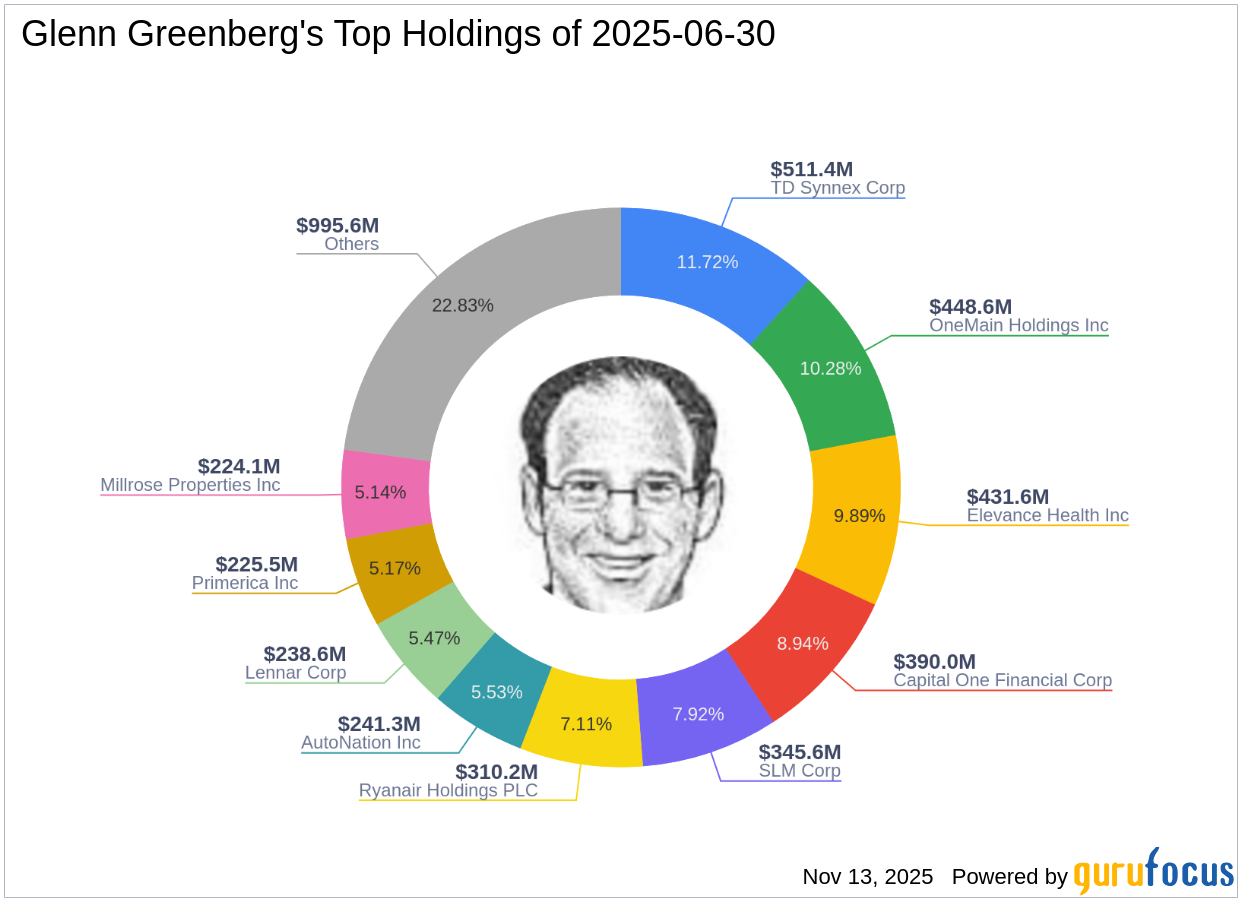

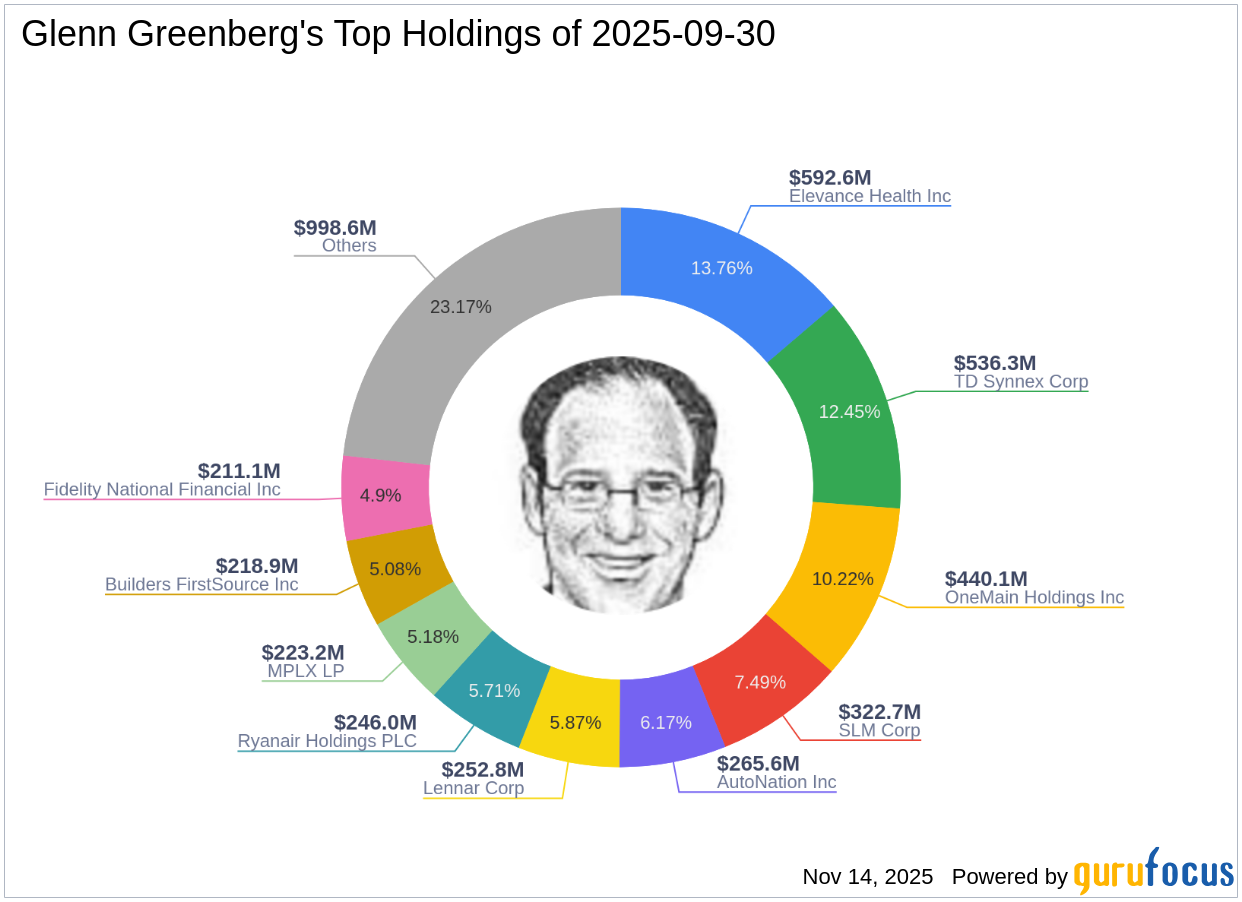

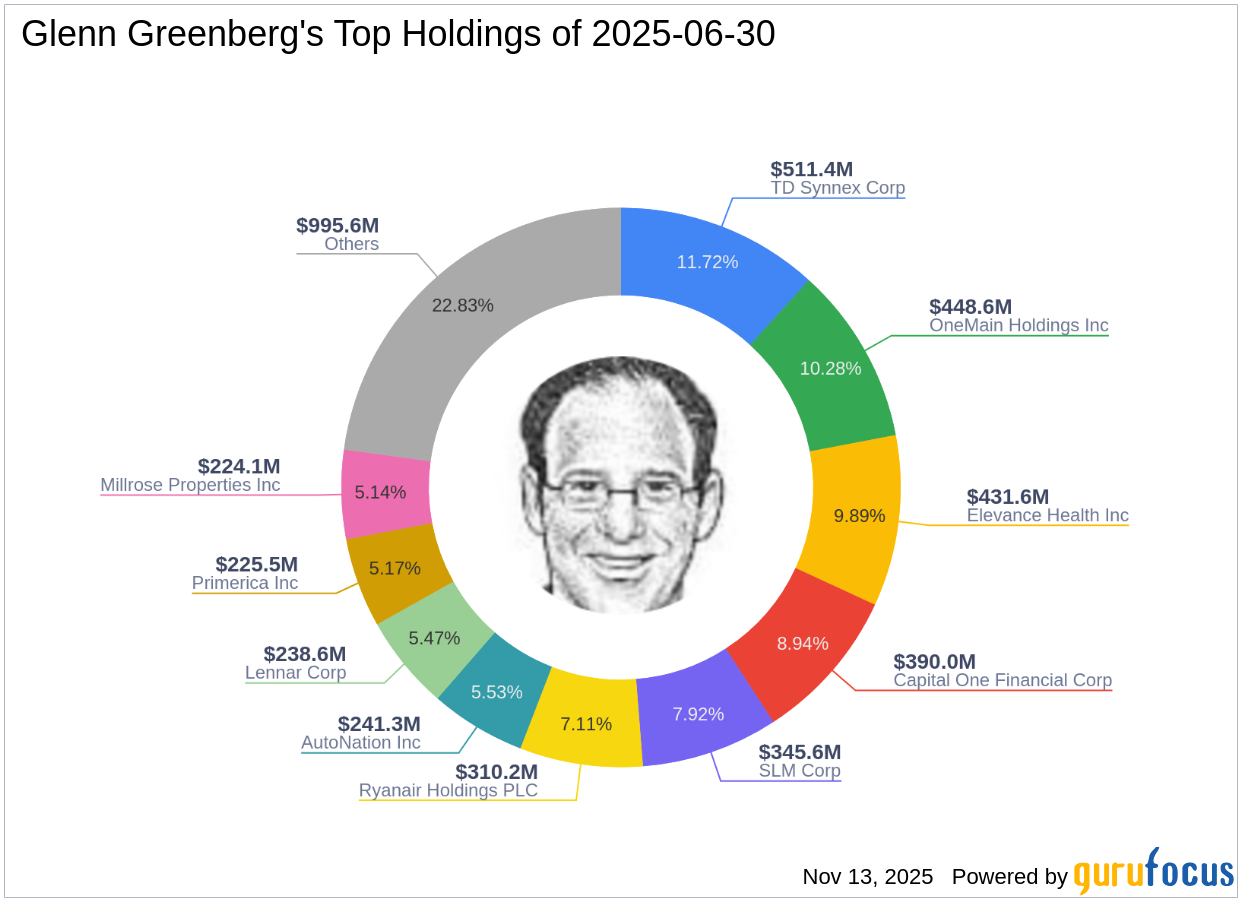

Glenn Greenberg's Strategic Moves: Elevance Health Inc. Takes Center Stage with a 5.43% Portfolio Impact

gurufocus.com

2025-11-14 17:02:00Insights from Glenn Greenberg (Trades, Portfolio)'s Third Quarter 2025 13F Filing Glenn Greenberg (Trades, Portfolio) recently submitted the 13F filing for the

Salie Mae Enters Multi-Year Private Credit Partnership With KKR

zacks.com

2025-11-13 14:45:33SLM partners with KKR in a multi-year deal to enter private credit, expanding funding and boosting capital efficiency.

Glenn Greenberg's Strategic Acquisition of SLM Corp Shares

gurufocus.com

2025-11-12 19:31:00On September 30, 2025, Glenn Greenberg (Trades, Portfolio) executed a significant transaction involving SLM Corp, a prominent player in the education solutions

Sallie Mae to Host Investor Forum on Dec. 8

businesswire.com

2025-11-12 16:30:00NEWARK, Del.--(BUSINESS WIRE)--Sallie Mae® (Nasdaq: SLM), formally SLM Corporation, will host an investor forum on Monday, Dec. 8, 2025 at 5 p.m. ET. A live audio webcast and presentation slides will be available at SallieMae.com/investors and the hosting website. Investors should log in at least 15 minutes prior to the broadcast. For those dialing in or participating in the question-and-answer portion of the investor forum, please pre-register beginning today. Once registered, participants wil.

Sallie Mae Launches Private Credit Strategic Partnership with KKR

businesswire.com

2025-11-12 09:30:00NEWARK, Del.--(BUSINESS WIRE)--Sallie Mae, the leader in private student lending, has announced a multi-year strategic partnership with KKR, a leading global investment firm. Through this multi-year engagement, KKR expects to purchase an initial seed portfolio of private education loans followed by a minimum of $2 billion in newly originated private education loans annually, for an initial three-year term. KKR's investment comes from KKR-managed credit funds and accounts via the firm's Asset-Ba.

Sallie Mae Awards $500,000 in Scholarships to Help Students Access and Complete College

businesswire.com

2025-11-06 13:11:00NEWARK, Del.--(BUSINESS WIRE)--In celebration of National Scholarship Month, Sallie Mae today announced the newest recipients of its Bridging the Dream Scholarship Program. This year, 40 high school students from across the country, who excelled both inside and outside the classroom—and demonstrated financial need—were awarded a $10,000 Bridging the Dream Scholarship from The Sallie Mae Fund, in partnership with Thurgood Marshall College Fund. In addition, 10 graduate students who are making a.

Scholarship Myths May Be Costing Families Free Money for Higher Education

businesswire.com

2025-10-28 12:33:00NEWARK, Del.--(BUSINESS WIRE)--November is National Scholarship Month, a timely reminder for students and families to explore scholarship opportunities, yet nearly 40% of families miss out, leaving millions of dollars unclaimed each year. Common misconceptions about scholarships persist, discouraging students from applying. Many believe scholarships are only for students with exceptional grades or abilities (46%), applications are only for incoming freshmen (36%), or that their family earns too.

Sallie Mae Q3 Earnings Lag on Higher Expenses, Provisions Decline Y/Y

zacks.com

2025-10-24 15:01:07SLM's Q3 profit slips below estimates as higher expenses weighed, though stronger income and lower provisions offered support.

SLM Corporation (SLM) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-10-23 19:57:37SLM Corporation (NASDAQ:SLM ) Q3 2025 Earnings Call October 23, 2025 5:30 PM EDT Company Participants Kate deLacy - Senior Director & Head of Investor Relations Jonathan Witter - CEO & Director Peter Graham - Executive VP, CFO & Treasurer Conference Call Participants Moshe Orenbuch - TD Cowen, Research Division Jeffrey Adelson - Morgan Stanley, Research Division Mark DeVries - Deutsche Bank AG, Research Division Terry Ma - Barclays Bank PLC, Research Division Donald Fandetti - Wells Fargo Securities, LLC, Research Division Sanjay Sakhrani - Keefe, Bruyette, & Woods, Inc., Research Division Richard Shane - JPMorgan Chase & Co, Research Division Giuliano Anderes-Bologna - Compass Point Research & Trading, LLC, Research Division Jon Arfstrom - RBC Capital Markets, Research Division Caroline Latta - BofA Securities, Research Division Presentation Operator Welcome to the Sallie Mae Third Quarter 2025 Earnings Conference Call. [Operator Instructions] I would now like to turn the call over to Kate deLacy, Senior Director and Head of Investor Relations.

Sallie Mae (SLM) Reports Q3 Earnings: What Key Metrics Have to Say

zacks.com

2025-10-23 19:31:08Although the revenue and EPS for Sallie Mae (SLM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Sallie Mae (SLM) Q3 Earnings and Revenues Miss Estimates

zacks.com

2025-10-23 18:46:28Sallie Mae (SLM) came out with quarterly earnings of $0.63 per share, missing the Zacks Consensus Estimate of $0.84 per share. This compares to a loss of $0.23 per share a year ago.

Sallie Mae Reports Third Quarter 2025 Financial Results

businesswire.com

2025-10-23 16:30:00NEWARK, Del.--(BUSINESS WIRE)--Sallie Mae (Nasdaq: SLM), formally SLM Corporation, today released third quarter 2025 financial results. Complete financial results and related materials are available at www.SallieMae.com/investors. The materials will also be available on the Securities and Exchange Commission's website at www.sec.gov. Sallie Mae will host an earnings conference call today, Oct. 23, 2025, at 5:30 p.m. ET. Executives will be on hand to discuss various highlights of the quarter and.

Sallie Mae Outlines Strategic Shift, Projects Higher Revenues & EPS

zacks.com

2025-12-09 13:36:09SLM pivots to fee-based partnerships and private credit, aiming for steadier growth and higher EPS in a transforming student-lending market.

Here Are Tuesday’s Top Wall Street Analyst Research Calls: Agilent, Alibaba, Delta Air Lines, Intel, JD.com, Micron Technology, Reddit and More

247wallst.com

2025-12-09 08:15:02Pre-Market Stock Futures: The futures are trading flat on Tuesday after we opened the week on the downside, with all major indices finishing the day lower. With the Federal Reserve meeting this week, investors are playing a wait-and-see game before bidding stocks higher to ensure there will indeed be a 25-basis-point cut. Wall Street will... Here Are Tuesday's Top Wall Street Analyst Research Calls: Agilent, Alibaba, Delta Air Lines, Intel, JD.com, Micron Technology, Reddit and More.

SLM Corporation (SLM) Discusses Evolving Strategy and Private Credit Strategic Partnerships at Investor Forum Transcript

seekingalpha.com

2025-12-08 22:17:18SLM Corporation (SLM) Discusses Evolving Strategy and Private Credit Strategic Partnerships at Investor Forum Transcript

Fidelity Stock Selector Mid Cap Fund Q3 2025 Performance Review

seekingalpha.com

2025-11-26 14:29:00For the three months ending September 30, 2025, the fund's Retail Class shares gained 3.70%, trailing the 5.55% advance of the benchmark S&P MidCap 400® Index. In the third quarter, U.S. stocks extended the rally that began in April following the 90-day pause for most tariffs. Lower interest rates are viewed as particularly beneficial for smaller businesses, which have access to fewer ways of raising working capital.

Glenn Greenberg's Strategic Moves: Elevance Health Inc. Takes Center Stage with a 5.43% Portfolio Impact

gurufocus.com

2025-11-14 17:02:00Insights from Glenn Greenberg (Trades, Portfolio)'s Third Quarter 2025 13F Filing Glenn Greenberg (Trades, Portfolio) recently submitted the 13F filing for the

Salie Mae Enters Multi-Year Private Credit Partnership With KKR

zacks.com

2025-11-13 14:45:33SLM partners with KKR in a multi-year deal to enter private credit, expanding funding and boosting capital efficiency.

Glenn Greenberg's Strategic Acquisition of SLM Corp Shares

gurufocus.com

2025-11-12 19:31:00On September 30, 2025, Glenn Greenberg (Trades, Portfolio) executed a significant transaction involving SLM Corp, a prominent player in the education solutions

Sallie Mae to Host Investor Forum on Dec. 8

businesswire.com

2025-11-12 16:30:00NEWARK, Del.--(BUSINESS WIRE)--Sallie Mae® (Nasdaq: SLM), formally SLM Corporation, will host an investor forum on Monday, Dec. 8, 2025 at 5 p.m. ET. A live audio webcast and presentation slides will be available at SallieMae.com/investors and the hosting website. Investors should log in at least 15 minutes prior to the broadcast. For those dialing in or participating in the question-and-answer portion of the investor forum, please pre-register beginning today. Once registered, participants wil.

Sallie Mae Launches Private Credit Strategic Partnership with KKR

businesswire.com

2025-11-12 09:30:00NEWARK, Del.--(BUSINESS WIRE)--Sallie Mae, the leader in private student lending, has announced a multi-year strategic partnership with KKR, a leading global investment firm. Through this multi-year engagement, KKR expects to purchase an initial seed portfolio of private education loans followed by a minimum of $2 billion in newly originated private education loans annually, for an initial three-year term. KKR's investment comes from KKR-managed credit funds and accounts via the firm's Asset-Ba.

Sallie Mae Awards $500,000 in Scholarships to Help Students Access and Complete College

businesswire.com

2025-11-06 13:11:00NEWARK, Del.--(BUSINESS WIRE)--In celebration of National Scholarship Month, Sallie Mae today announced the newest recipients of its Bridging the Dream Scholarship Program. This year, 40 high school students from across the country, who excelled both inside and outside the classroom—and demonstrated financial need—were awarded a $10,000 Bridging the Dream Scholarship from The Sallie Mae Fund, in partnership with Thurgood Marshall College Fund. In addition, 10 graduate students who are making a.

Scholarship Myths May Be Costing Families Free Money for Higher Education

businesswire.com

2025-10-28 12:33:00NEWARK, Del.--(BUSINESS WIRE)--November is National Scholarship Month, a timely reminder for students and families to explore scholarship opportunities, yet nearly 40% of families miss out, leaving millions of dollars unclaimed each year. Common misconceptions about scholarships persist, discouraging students from applying. Many believe scholarships are only for students with exceptional grades or abilities (46%), applications are only for incoming freshmen (36%), or that their family earns too.

Sallie Mae Q3 Earnings Lag on Higher Expenses, Provisions Decline Y/Y

zacks.com

2025-10-24 15:01:07SLM's Q3 profit slips below estimates as higher expenses weighed, though stronger income and lower provisions offered support.

SLM Corporation (SLM) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-10-23 19:57:37SLM Corporation (NASDAQ:SLM ) Q3 2025 Earnings Call October 23, 2025 5:30 PM EDT Company Participants Kate deLacy - Senior Director & Head of Investor Relations Jonathan Witter - CEO & Director Peter Graham - Executive VP, CFO & Treasurer Conference Call Participants Moshe Orenbuch - TD Cowen, Research Division Jeffrey Adelson - Morgan Stanley, Research Division Mark DeVries - Deutsche Bank AG, Research Division Terry Ma - Barclays Bank PLC, Research Division Donald Fandetti - Wells Fargo Securities, LLC, Research Division Sanjay Sakhrani - Keefe, Bruyette, & Woods, Inc., Research Division Richard Shane - JPMorgan Chase & Co, Research Division Giuliano Anderes-Bologna - Compass Point Research & Trading, LLC, Research Division Jon Arfstrom - RBC Capital Markets, Research Division Caroline Latta - BofA Securities, Research Division Presentation Operator Welcome to the Sallie Mae Third Quarter 2025 Earnings Conference Call. [Operator Instructions] I would now like to turn the call over to Kate deLacy, Senior Director and Head of Investor Relations.

Sallie Mae (SLM) Reports Q3 Earnings: What Key Metrics Have to Say

zacks.com

2025-10-23 19:31:08Although the revenue and EPS for Sallie Mae (SLM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Sallie Mae (SLM) Q3 Earnings and Revenues Miss Estimates

zacks.com

2025-10-23 18:46:28Sallie Mae (SLM) came out with quarterly earnings of $0.63 per share, missing the Zacks Consensus Estimate of $0.84 per share. This compares to a loss of $0.23 per share a year ago.

Sallie Mae Reports Third Quarter 2025 Financial Results

businesswire.com

2025-10-23 16:30:00NEWARK, Del.--(BUSINESS WIRE)--Sallie Mae (Nasdaq: SLM), formally SLM Corporation, today released third quarter 2025 financial results. Complete financial results and related materials are available at www.SallieMae.com/investors. The materials will also be available on the Securities and Exchange Commission's website at www.sec.gov. Sallie Mae will host an earnings conference call today, Oct. 23, 2025, at 5:30 p.m. ET. Executives will be on hand to discuss various highlights of the quarter and.