RLI Corp. (RLI)

Price:

61.82 USD

( + 0.17 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

HCI Group, Inc.

VALUE SCORE:

7

2nd position

The Progressive Corporation

VALUE SCORE:

12

The best

Horace Mann Educators Corporation

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

RLI Corp., an insurance holding company, underwrites property and casualty insurance in the United States and internationally. Its Casualty segment provides commercial and personal coverage products; and general liability products, such as coverage for third-party liability of commercial insureds, including manufacturers, contractors, apartments, and mercantile. It also offers coverages for security guards and in the areas of onshore energy-related businesses and environmental liability for underground storage tanks, contractors and asbestos, and environmental remediation specialists; and professional liability coverages focuses on providing errors and omission coverage to small to medium-sized design, technical, computer, and miscellaneous professionals. This segment provides commercial automobile liability and physical damage insurance to local, intermediate and long haul truckers, public transportation entities, and other types of specialty commercial automobile risks; incidental and related insurance coverages; inland marine coverages; management liability coverages, such as directors and officers liability insurance, fiduciary liability and coverages, employment practice liability, and for various classes of risks, including public and private businesses; and healthcare liability and home business insurance products. The company's Property segment offers commercial property, cargo, hull, protection and indemnity, marine liability, inland marine, homeowners' and dwelling fire, and other property insurance products. Its Surety segment offers commercial surety bonds for medium to large-sized businesses; small bonds for businesses and individuals; and bonds for small to medium-sized contractors. The company also underwrites various reinsurance coverages. It markets its products through branch offices, brokers, carrier partners, and underwriting and independent agents. RLI Corp. was founded in 1965 and is headquartered in Peoria, Illinois.

NEWS

AM Best Upgrades Financial Strength Rating to A++ (Superior) and Revises Outlook to Stable for RLI Corp., RLI Insurance Co., Mt. Hawley Insurance Co. and Contractors Bonding and Insurance Co.

businesswire.com

2026-02-20 16:10:00PEORIA, Ill.--(BUSINESS WIRE)-- #AMBest--RLI Corp. announces AM Best has upgraded its financial strength rating to A++ Superior.

AM Best Upgrades Credit Ratings for RLI Corp. and Its Subsidiaries

businesswire.com

2026-02-20 14:01:00OLDWICK, N.J.--(BUSINESS WIRE)-- #insurance--AM Best has upgraded the Financial Strength Rating (FSR) to A++ (Superior) from A+ (Superior) and the Long-Term Issuer Credit Ratings (Long-Term ICR) to “aa+” (Superior) from “aa” (Superior) for the members of RLI Group (RLI). In addition, AM Best has upgraded the Long-Term ICR to “a+” (Excellent) from “a” (Excellent) of RLI's publicly traded parent holding company, RLI Corp. [NYSE: RLI]. The outlook of these Credit Ratings (ratings) has been revised to stable fr.

RLI Corp. (RLI) Up 6.2% Since Last Earnings Report: Can It Continue?

zacks.com

2026-02-20 12:30:18RLI Corp. (RLI) reported earnings 30 days ago. What's next for the stock?

FPA Queens Road Small Cap Value Fund Q4 2025 Performance Review

seekingalpha.com

2026-02-20 09:05:00We believe Fabrinet will be a compounder for many years, and we continue to hold a position. We like InterDigital 's long-term prospects but began trimming the Fund's position this year on valuation. We are pleased with UGI Corp's improved financial position, green shoots at Amerigas and the upgrade to UGI's long-term EPS growth rate announced during fiscal Q4 earnings.

RLI Declares Regular Dividend

businesswire.com

2026-02-18 16:10:00PEORIA, Ill.--(BUSINESS WIRE)-- #casualtyinsurance--RLI declares a first quarter dividend of $0.16 per share marking 50 consecutive years of dividend increases.

RLI Corp. (NYSE:RLI) Sees Large Increase in Short Interest

defenseworld.net

2026-02-18 02:20:46RLI Corp. (NYSE: RLI - Get Free Report) saw a large growth in short interest in the month of January. As of January 30th, there was short interest totaling 3,599,984 shares, a growth of 29.2% from the January 15th total of 2,785,912 shares. Currently, 4.0% of the shares of the company are short sold. Based on

Dividend Kings: No Ideal Buys In February's 57

seekingalpha.com

2026-02-10 09:45:12Dividend Kings remain broadly overvalued, with only a handful approaching fair price despite elevated yields. Three Dividend Kings—Canadian Utilities, Fortis, and Hormel—currently meet the dogcatcher 'ideal' but face dividend safety concerns due to negative free cash flow margins. Analyst projections estimate 14.16% to 27.77% net gains for top-yielding Dividend Kings by February 2027, with ABBV and NWN ranking in the top 20 across yield, target, and returns.

Alps Advisors Inc. Sells 43,496 Shares of RLI Corp. $RLI

defenseworld.net

2026-02-09 06:36:45Alps Advisors Inc. decreased its holdings in RLI Corp. (NYSE: RLI) by 25.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 129,972 shares of the insurance provider's stock after selling 43,496 shares during the period. Alps Advisors Inc.

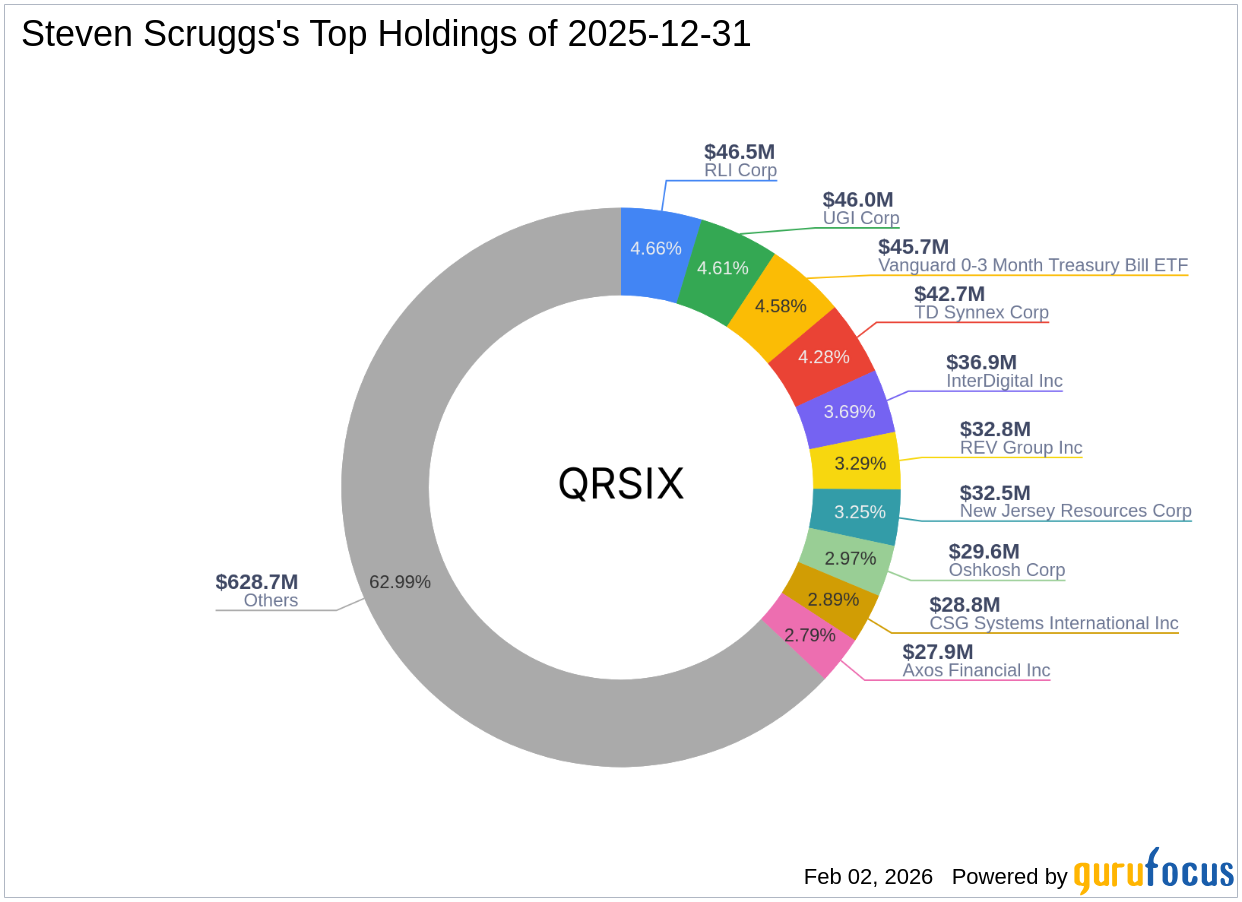

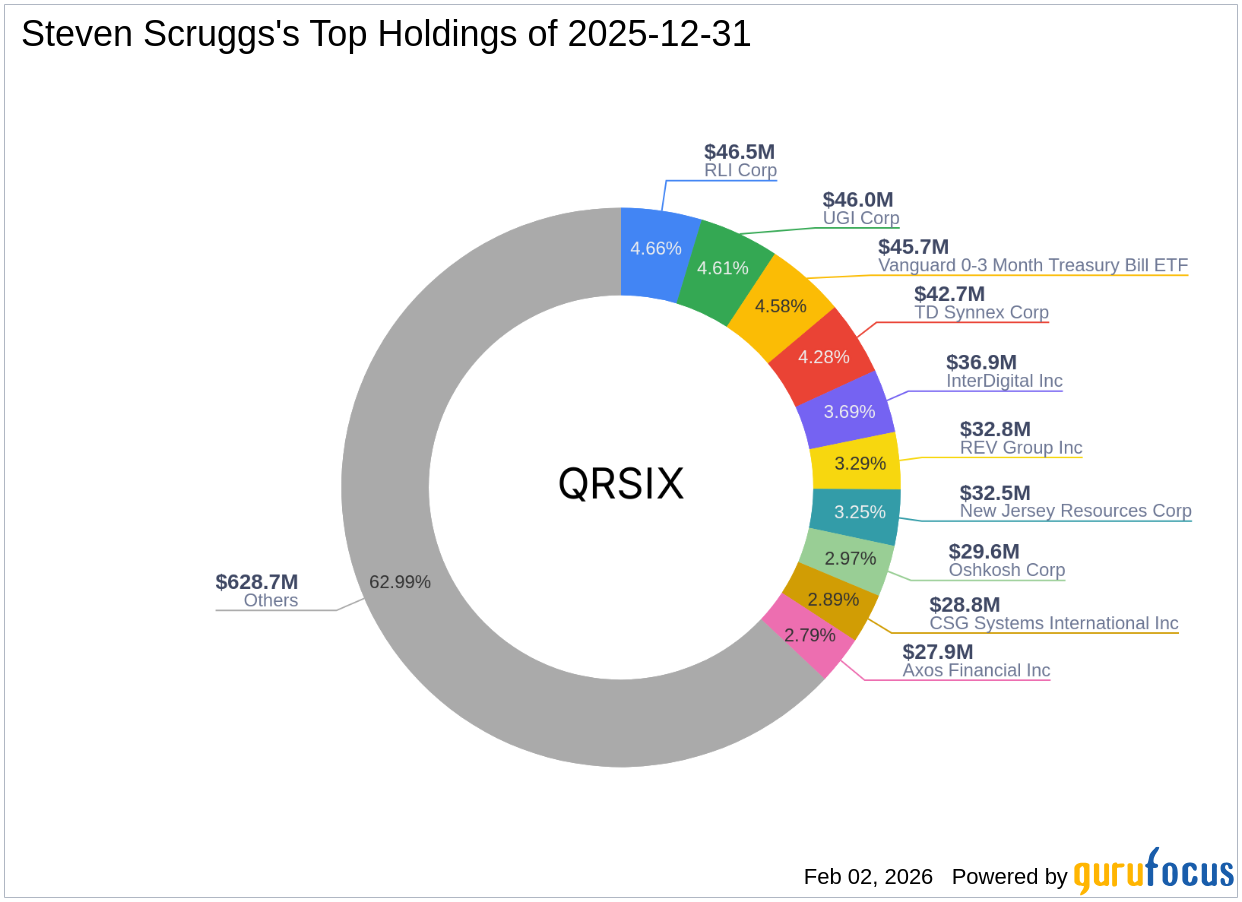

Vanguard 0-3 Month Treasury Bill ETF: A Key Addition in Steven Scruggs' Portfolio

gurufocus.com

2026-02-02 17:03:00Insights from the Fourth Quarter 2025 N-PORT Filing Steven Scruggs (Trades, Portfolio) recently submitted the N-PORT filing for the fourth quarter of 2025, pro

Underwriting First, Dividends Second: Why RLI's Discipline Finally Earned A Buy Rating

seekingalpha.com

2026-01-27 13:20:47RLI Corp. delivered an outstanding FY2025, with a combined ratio of 83.6% and $403 million in net income, confirming its best-in-class underwriting model. Underwriting discipline remains the core of the thesis, with RLI prioritizing margin over growth across niche property and surety lines. Dividend growth remains well supported with a 10% increase in 2025, a $2 special dividend, and a payout ratio below 20%.

RLI (NYSE:RLI) COO Acquires $115,980.00 in Stock

defenseworld.net

2026-01-26 05:22:48RLI Corp. (NYSE: RLI - Get Free Report) COO Jennifer Klobnak acquired 2,000 shares of the stock in a transaction that occurred on Friday, January 23rd. The shares were bought at an average price of $57.99 per share, with a total value of $115,980.00. Following the completion of the transaction, the chief operating officer owned 100,318

RLI Corp. (RLI) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-01-22 16:24:49RLI Corp. (RLI) Q4 2025 Earnings Call Transcript

RLI's Q4 Earnings Beat Estimates on Strong Net Investment Income

zacks.com

2026-01-22 11:26:06RLI's Q4 earnings reflect higher premiums, improved investment income, reduced expenses, and solid underwriting income.

Here's What Key Metrics Tell Us About RLI Corp. (RLI) Q4 Earnings

zacks.com

2026-01-21 20:00:28While the top- and bottom-line numbers for RLI Corp. (RLI) give a sense of how the business performed in the quarter ended December 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

RLI Corp. (RLI) Q4 Earnings Surpass Estimates

zacks.com

2026-01-21 18:26:06RLI Corp. (RLI) came out with quarterly earnings of $0.94 per share, beating the Zacks Consensus Estimate of $0.76 per share. This compares to earnings of $0.41 per share a year ago.

RLI Reports Fourth Quarter and Year-End 2025 Results

businesswire.com

2026-01-21 16:10:00PEORIA, Ill.--(BUSINESS WIRE)-- #casualtyinsurance--RLI Corp. reported Q4 2025 net earnings of $91.2 million, or $0.99 per share, up from $40.9 million, or $0.44, a year earlier.

AM Best Upgrades Financial Strength Rating to A++ (Superior) and Revises Outlook to Stable for RLI Corp., RLI Insurance Co., Mt. Hawley Insurance Co. and Contractors Bonding and Insurance Co.

businesswire.com

2026-02-20 16:10:00PEORIA, Ill.--(BUSINESS WIRE)-- #AMBest--RLI Corp. announces AM Best has upgraded its financial strength rating to A++ Superior.

AM Best Upgrades Credit Ratings for RLI Corp. and Its Subsidiaries

businesswire.com

2026-02-20 14:01:00OLDWICK, N.J.--(BUSINESS WIRE)-- #insurance--AM Best has upgraded the Financial Strength Rating (FSR) to A++ (Superior) from A+ (Superior) and the Long-Term Issuer Credit Ratings (Long-Term ICR) to “aa+” (Superior) from “aa” (Superior) for the members of RLI Group (RLI). In addition, AM Best has upgraded the Long-Term ICR to “a+” (Excellent) from “a” (Excellent) of RLI's publicly traded parent holding company, RLI Corp. [NYSE: RLI]. The outlook of these Credit Ratings (ratings) has been revised to stable fr.

RLI Corp. (RLI) Up 6.2% Since Last Earnings Report: Can It Continue?

zacks.com

2026-02-20 12:30:18RLI Corp. (RLI) reported earnings 30 days ago. What's next for the stock?

FPA Queens Road Small Cap Value Fund Q4 2025 Performance Review

seekingalpha.com

2026-02-20 09:05:00We believe Fabrinet will be a compounder for many years, and we continue to hold a position. We like InterDigital 's long-term prospects but began trimming the Fund's position this year on valuation. We are pleased with UGI Corp's improved financial position, green shoots at Amerigas and the upgrade to UGI's long-term EPS growth rate announced during fiscal Q4 earnings.

RLI Declares Regular Dividend

businesswire.com

2026-02-18 16:10:00PEORIA, Ill.--(BUSINESS WIRE)-- #casualtyinsurance--RLI declares a first quarter dividend of $0.16 per share marking 50 consecutive years of dividend increases.

RLI Corp. (NYSE:RLI) Sees Large Increase in Short Interest

defenseworld.net

2026-02-18 02:20:46RLI Corp. (NYSE: RLI - Get Free Report) saw a large growth in short interest in the month of January. As of January 30th, there was short interest totaling 3,599,984 shares, a growth of 29.2% from the January 15th total of 2,785,912 shares. Currently, 4.0% of the shares of the company are short sold. Based on

Dividend Kings: No Ideal Buys In February's 57

seekingalpha.com

2026-02-10 09:45:12Dividend Kings remain broadly overvalued, with only a handful approaching fair price despite elevated yields. Three Dividend Kings—Canadian Utilities, Fortis, and Hormel—currently meet the dogcatcher 'ideal' but face dividend safety concerns due to negative free cash flow margins. Analyst projections estimate 14.16% to 27.77% net gains for top-yielding Dividend Kings by February 2027, with ABBV and NWN ranking in the top 20 across yield, target, and returns.

Alps Advisors Inc. Sells 43,496 Shares of RLI Corp. $RLI

defenseworld.net

2026-02-09 06:36:45Alps Advisors Inc. decreased its holdings in RLI Corp. (NYSE: RLI) by 25.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 129,972 shares of the insurance provider's stock after selling 43,496 shares during the period. Alps Advisors Inc.

Vanguard 0-3 Month Treasury Bill ETF: A Key Addition in Steven Scruggs' Portfolio

gurufocus.com

2026-02-02 17:03:00Insights from the Fourth Quarter 2025 N-PORT Filing Steven Scruggs (Trades, Portfolio) recently submitted the N-PORT filing for the fourth quarter of 2025, pro

Underwriting First, Dividends Second: Why RLI's Discipline Finally Earned A Buy Rating

seekingalpha.com

2026-01-27 13:20:47RLI Corp. delivered an outstanding FY2025, with a combined ratio of 83.6% and $403 million in net income, confirming its best-in-class underwriting model. Underwriting discipline remains the core of the thesis, with RLI prioritizing margin over growth across niche property and surety lines. Dividend growth remains well supported with a 10% increase in 2025, a $2 special dividend, and a payout ratio below 20%.

RLI (NYSE:RLI) COO Acquires $115,980.00 in Stock

defenseworld.net

2026-01-26 05:22:48RLI Corp. (NYSE: RLI - Get Free Report) COO Jennifer Klobnak acquired 2,000 shares of the stock in a transaction that occurred on Friday, January 23rd. The shares were bought at an average price of $57.99 per share, with a total value of $115,980.00. Following the completion of the transaction, the chief operating officer owned 100,318

RLI Corp. (RLI) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-01-22 16:24:49RLI Corp. (RLI) Q4 2025 Earnings Call Transcript

RLI's Q4 Earnings Beat Estimates on Strong Net Investment Income

zacks.com

2026-01-22 11:26:06RLI's Q4 earnings reflect higher premiums, improved investment income, reduced expenses, and solid underwriting income.

Here's What Key Metrics Tell Us About RLI Corp. (RLI) Q4 Earnings

zacks.com

2026-01-21 20:00:28While the top- and bottom-line numbers for RLI Corp. (RLI) give a sense of how the business performed in the quarter ended December 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

RLI Corp. (RLI) Q4 Earnings Surpass Estimates

zacks.com

2026-01-21 18:26:06RLI Corp. (RLI) came out with quarterly earnings of $0.94 per share, beating the Zacks Consensus Estimate of $0.76 per share. This compares to earnings of $0.41 per share a year ago.

RLI Reports Fourth Quarter and Year-End 2025 Results

businesswire.com

2026-01-21 16:10:00PEORIA, Ill.--(BUSINESS WIRE)-- #casualtyinsurance--RLI Corp. reported Q4 2025 net earnings of $91.2 million, or $0.99 per share, up from $40.9 million, or $0.44, a year earlier.