QuinStreet, Inc. (QNST)

Price:

14.52 USD

( - -0.04 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

QMMM Holdings Limited Ordinary Shares

VALUE SCORE:

6

2nd position

Criteo S.A.

VALUE SCORE:

9

The best

Xunlei Limited

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

QuinStreet, Inc., an online performance marketing company, provides customer acquisition services for its clients in the United States and internationally. The company offers online marketing services, such as qualified clicks, leads, calls, applications, and customers through its websites or third-party publishers. It serves financial and home services industries. The company was incorporated in 1999 and is headquartered in Foster City, California.

NEWS

Arrowstreet Capital Limited Partnership Buys 261,802 Shares of QuinStreet, Inc. $QNST

defenseworld.net

2025-12-10 03:27:10Arrowstreet Capital Limited Partnership increased its stake in QuinStreet, Inc. (NASDAQ: QNST) by 58.6% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 708,367 shares of the technology company's stock after purchasing an additional 261,802 shares during the period. Arrowstreet

QuinStreet Announces Agreement to Acquire HomeBuddy

businesswire.com

2025-12-03 08:00:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (NASDAQ: QNST), a leader in performance marketplaces and technologies for the financial and home services industries, announced today that on November 30, 2025, it entered into a definitive agreement to acquire SIREN GROUP AG d/b/a as HomeBuddy (“HomeBuddy”), a digital marketplace platform that matches homeowners with the most appropriate home services professional. QuinStreet will integrate HomeBuddy into its Modernize Home Services busine.

QuinStreet, Inc. $QNST Shares Sold by Campbell & CO Investment Adviser LLC

defenseworld.net

2025-11-17 04:37:01Campbell and CO Investment Adviser LLC lessened its stake in QuinStreet, Inc. (NASDAQ: QNST) by 48.4% in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 26,256 shares of the technology company's stock after selling 24,666 shares during the quarter. Campbell

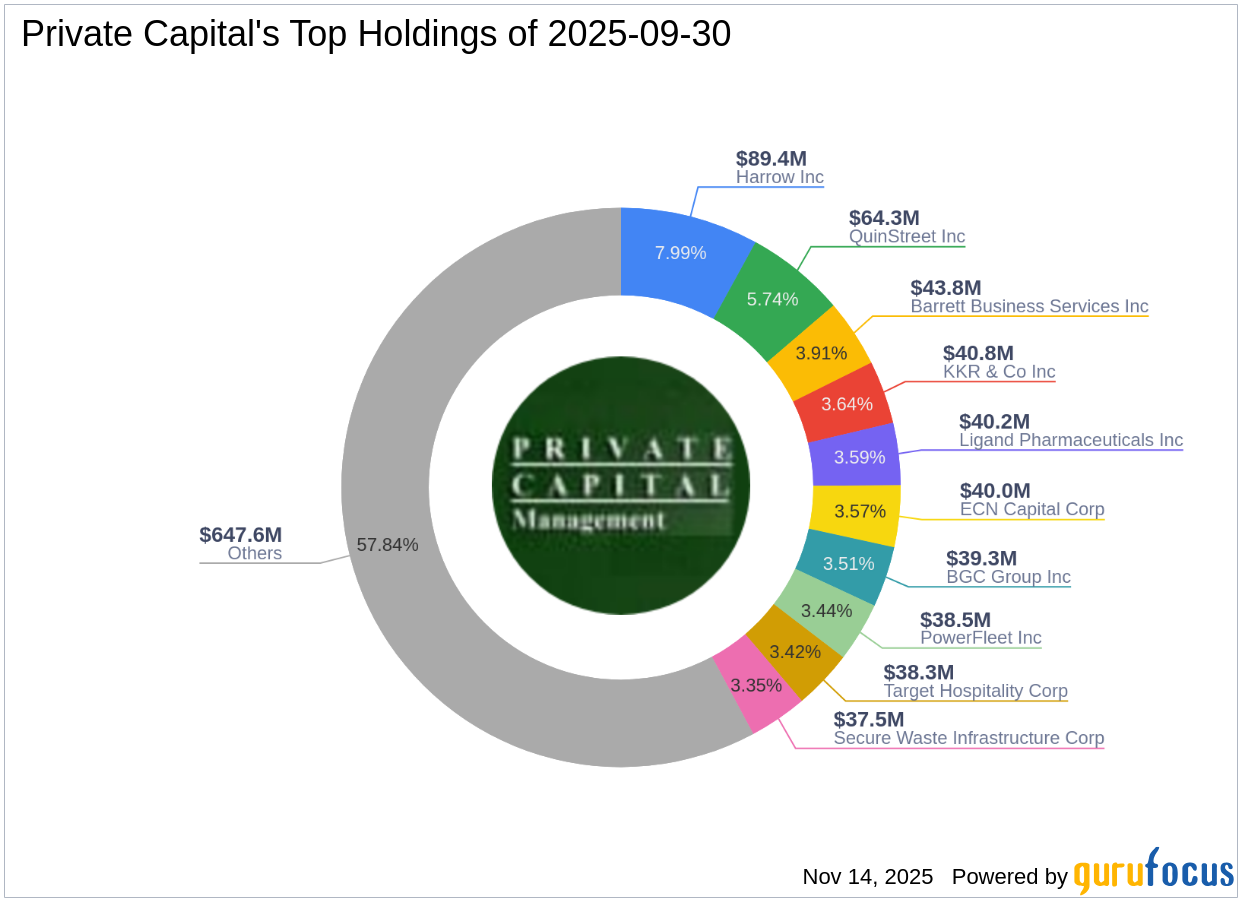

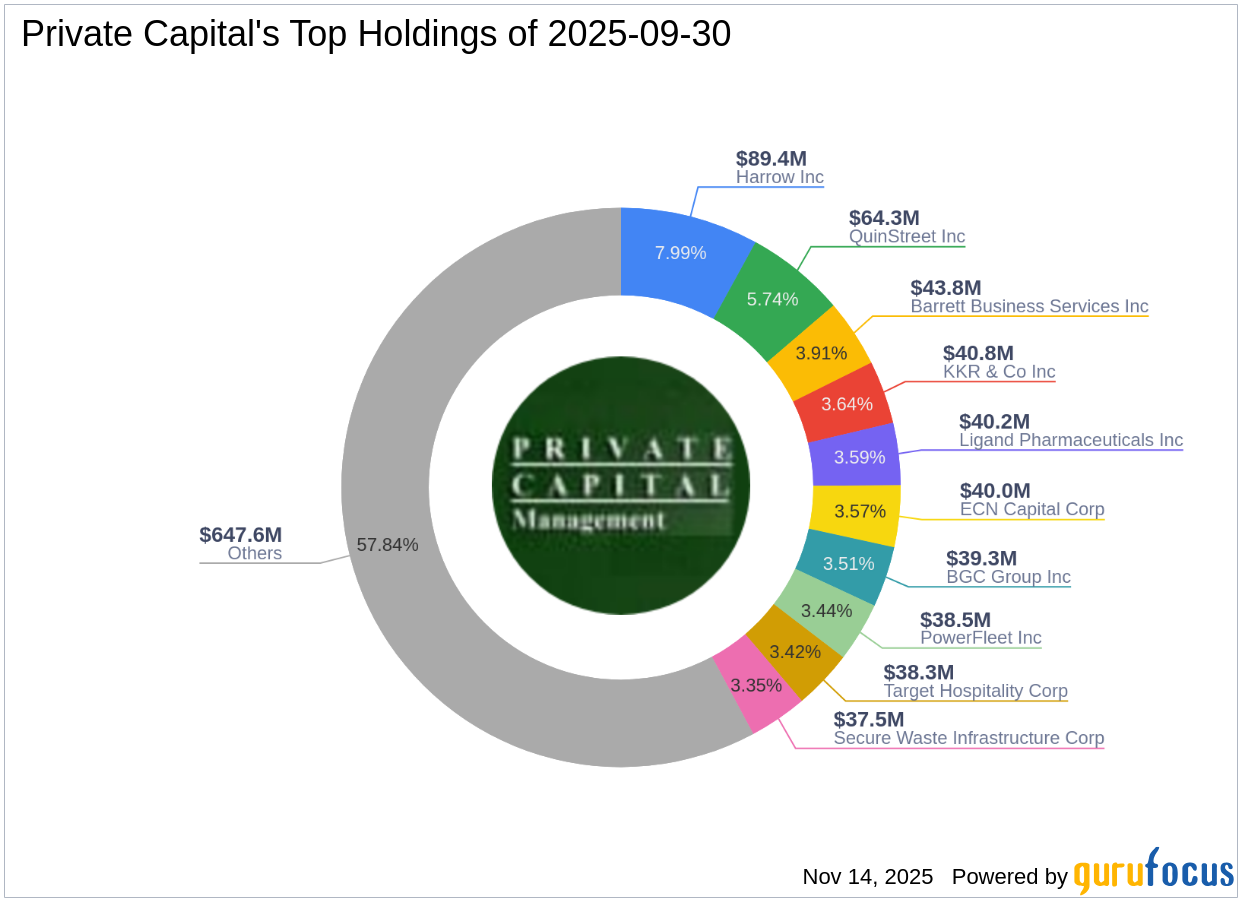

Private Capital's Strategic Moves: Spotlight on Matthews International Corp

gurufocus.com

2025-11-14 17:03:00Insights from Private Capital (Trades, Portfolio)'s Third Quarter 2025 13F Filing Private Capital (Trades, Portfolio) recently submitted its 13F filing for the

QuinStreet to Participate at Stephens Investment Conference

businesswire.com

2025-11-13 16:02:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced that management will participate at the Stephens Investment Conference from November 19-20 in Nashville, TN. The Company looks forward to discussing the details of its performance momentum, market opportunity, and business model with investors. About QuinStreet QuinStreet, Inc. (Nasdaq: QNST) is a le.

QuinStreet to Participate at Evercore Investment Conference

businesswire.com

2025-11-12 16:02:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced that management will participate at the 3rd Annual Evercore ISI Insurance Conference on November 18 in New York, NY. The Company looks forward to discussing the details of its performance momentum, market opportunity, and business model with investors. About QuinStreet QuinStreet, Inc. (Nasdaq: QNST).

QuinStreet, Inc. (QNST) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-11-07 09:36:10QuinStreet, Inc. ( QNST ) Q1 2026 Earnings Call November 6, 2025 5:00 PM EST Company Participants Robert Amparo - Senior Director of Investor Relations & Finance Douglas Valenti - Chairman, President & CEO Gregory Wong - Chief Financial Officer Conference Call Participants Jason Kreyer - Craig-Hallum Capital Group LLC, Research Division Zach Cummins - B. Riley Securities, Inc., Research Division Patrick Sholl - Barrington Research Associates, Inc., Research Division Presentation Operator Good day, and welcome to QuinStreet's Fiscal First Quarter 2026 Financial Results Conference Call.

QuinStreet (QNST) Q1 Earnings Meet Estimates

zacks.com

2025-11-06 19:06:03QuinStreet (QNST) came out with quarterly earnings of $0.22 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.22 per share a year ago.

QuinStreet Reports Results for First Quarter Fiscal 2026

businesswire.com

2025-11-06 16:07:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced financial results for the fiscal first quarter ended September 30, 2025. For the fiscal first quarter, the Company reported revenue of $285.9 million, up 2% year-over-year. GAAP net income for the fiscal first quarter was $4.5 million, or $0.08 per diluted share. Adjusted net income for the fiscal fi.

QuinStreet Sets Date to Announce Fiscal First Quarter 2026 Financial Results

businesswire.com

2025-10-27 16:10:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced it will report financial results for its fiscal first quarter ended September 30, 2025 after the market closes on Thursday, November 6, 2025. On that day, management will hold a conference call and webcast at 2:00 PM PT to review and discuss the company's results. What: QuinStreet First Quarter 2026.

QuinStreet (QNST) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

zacks.com

2025-10-27 11:06:13QuinStreet (QNST) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Are Investors Undervaluing QuinStreet (QNST) Right Now?

zacks.com

2025-10-24 10:40:22Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Here's Why QuinStreet (QNST) is Poised for a Turnaround After Losing 14.8% in 4 Weeks

zacks.com

2025-10-14 10:36:21QuinStreet (QNST) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

Is QuinStreet (QNST) Stock Undervalued Right Now?

zacks.com

2025-10-08 10:41:17Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

CarInsurance.com Report Reveals Stark Car Insurance Rate Gaps Between U.S. Cities

businesswire.com

2025-10-03 14:20:00FOSTER CITY, Calif.--(BUSINESS WIRE)-- #insurance--CarInsurance.com, a leading online resource for auto insurance education and comparisons, today released its analysis of car insurance premiums across U.S. cities, revealing dramatic cost differences between neighboring municipalities and states. The report, "The Most Expensive Cities for Car Insurance in 2025 (and the Cheapest)," highlights how factors such as population density, traffic risk, crime, weather, and local laws contribute to premiums that can.

No data to display

Arrowstreet Capital Limited Partnership Buys 261,802 Shares of QuinStreet, Inc. $QNST

defenseworld.net

2025-12-10 03:27:10Arrowstreet Capital Limited Partnership increased its stake in QuinStreet, Inc. (NASDAQ: QNST) by 58.6% in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 708,367 shares of the technology company's stock after purchasing an additional 261,802 shares during the period. Arrowstreet

QuinStreet Announces Agreement to Acquire HomeBuddy

businesswire.com

2025-12-03 08:00:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (NASDAQ: QNST), a leader in performance marketplaces and technologies for the financial and home services industries, announced today that on November 30, 2025, it entered into a definitive agreement to acquire SIREN GROUP AG d/b/a as HomeBuddy (“HomeBuddy”), a digital marketplace platform that matches homeowners with the most appropriate home services professional. QuinStreet will integrate HomeBuddy into its Modernize Home Services busine.

QuinStreet, Inc. $QNST Shares Sold by Campbell & CO Investment Adviser LLC

defenseworld.net

2025-11-17 04:37:01Campbell and CO Investment Adviser LLC lessened its stake in QuinStreet, Inc. (NASDAQ: QNST) by 48.4% in the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 26,256 shares of the technology company's stock after selling 24,666 shares during the quarter. Campbell

Private Capital's Strategic Moves: Spotlight on Matthews International Corp

gurufocus.com

2025-11-14 17:03:00Insights from Private Capital (Trades, Portfolio)'s Third Quarter 2025 13F Filing Private Capital (Trades, Portfolio) recently submitted its 13F filing for the

QuinStreet to Participate at Stephens Investment Conference

businesswire.com

2025-11-13 16:02:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced that management will participate at the Stephens Investment Conference from November 19-20 in Nashville, TN. The Company looks forward to discussing the details of its performance momentum, market opportunity, and business model with investors. About QuinStreet QuinStreet, Inc. (Nasdaq: QNST) is a le.

QuinStreet to Participate at Evercore Investment Conference

businesswire.com

2025-11-12 16:02:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced that management will participate at the 3rd Annual Evercore ISI Insurance Conference on November 18 in New York, NY. The Company looks forward to discussing the details of its performance momentum, market opportunity, and business model with investors. About QuinStreet QuinStreet, Inc. (Nasdaq: QNST).

QuinStreet, Inc. (QNST) Q1 2026 Earnings Call Transcript

seekingalpha.com

2025-11-07 09:36:10QuinStreet, Inc. ( QNST ) Q1 2026 Earnings Call November 6, 2025 5:00 PM EST Company Participants Robert Amparo - Senior Director of Investor Relations & Finance Douglas Valenti - Chairman, President & CEO Gregory Wong - Chief Financial Officer Conference Call Participants Jason Kreyer - Craig-Hallum Capital Group LLC, Research Division Zach Cummins - B. Riley Securities, Inc., Research Division Patrick Sholl - Barrington Research Associates, Inc., Research Division Presentation Operator Good day, and welcome to QuinStreet's Fiscal First Quarter 2026 Financial Results Conference Call.

QuinStreet (QNST) Q1 Earnings Meet Estimates

zacks.com

2025-11-06 19:06:03QuinStreet (QNST) came out with quarterly earnings of $0.22 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.22 per share a year ago.

QuinStreet Reports Results for First Quarter Fiscal 2026

businesswire.com

2025-11-06 16:07:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced financial results for the fiscal first quarter ended September 30, 2025. For the fiscal first quarter, the Company reported revenue of $285.9 million, up 2% year-over-year. GAAP net income for the fiscal first quarter was $4.5 million, or $0.08 per diluted share. Adjusted net income for the fiscal fi.

QuinStreet Sets Date to Announce Fiscal First Quarter 2026 Financial Results

businesswire.com

2025-10-27 16:10:00FOSTER CITY, Calif.--(BUSINESS WIRE)--QuinStreet, Inc. (Nasdaq: QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, today announced it will report financial results for its fiscal first quarter ended September 30, 2025 after the market closes on Thursday, November 6, 2025. On that day, management will hold a conference call and webcast at 2:00 PM PT to review and discuss the company's results. What: QuinStreet First Quarter 2026.

QuinStreet (QNST) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

zacks.com

2025-10-27 11:06:13QuinStreet (QNST) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Are Investors Undervaluing QuinStreet (QNST) Right Now?

zacks.com

2025-10-24 10:40:22Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Here's Why QuinStreet (QNST) is Poised for a Turnaround After Losing 14.8% in 4 Weeks

zacks.com

2025-10-14 10:36:21QuinStreet (QNST) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

Is QuinStreet (QNST) Stock Undervalued Right Now?

zacks.com

2025-10-08 10:41:17Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

CarInsurance.com Report Reveals Stark Car Insurance Rate Gaps Between U.S. Cities

businesswire.com

2025-10-03 14:20:00FOSTER CITY, Calif.--(BUSINESS WIRE)-- #insurance--CarInsurance.com, a leading online resource for auto insurance education and comparisons, today released its analysis of car insurance premiums across U.S. cities, revealing dramatic cost differences between neighboring municipalities and states. The report, "The Most Expensive Cities for Car Insurance in 2025 (and the Cheapest)," highlights how factors such as population density, traffic risk, crime, weather, and local laws contribute to premiums that can.