Qifu Technology, Inc. (QFIN)

Price:

31.45 USD

( + 0.78 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Jefferson Capital, Inc. Common Stock

VALUE SCORE:

9

2nd position

EZCORP, Inc.

VALUE SCORE:

11

The best

Medallion Financial Corp.

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Qifu Technology, Inc., together with its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. The company provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service. It offers e-commerce loans, enterprise loans, and invoice loans to SME owners. It serves financial institutions, consumers, and small- and micro-enterprises. The company was formerly known as 360 DigiTech, Inc. and changed its name to Qifu Technology, Inc. in March 2023. Qifu Technology, Inc. was founded in 2016 and is headquartered in Shanghai, the People's Republic of China.

NEWS

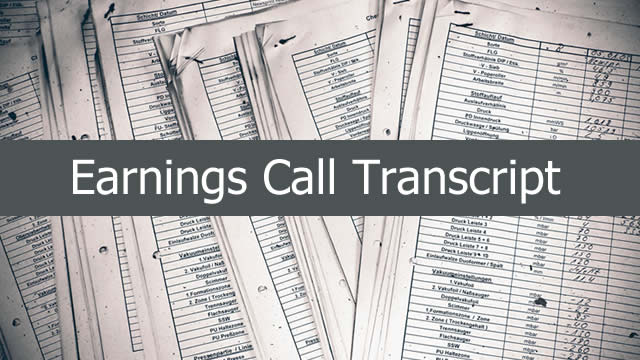

Qfin Holdings, Inc. (QFIN) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-15 01:06:48Qfin Holdings, Inc. (NASDAQ:QFIN ) Q2 2025 Earnings Conference Call August 14, 2025 8:30 PM ET Company Participants Haisheng Wu - CEO & Director Karen Ji - Senior Director of Capital Markets Yan Zheng - Chief Risk Officer Zuoli Xu - CFO & Director Conference Call Participants Emma Xu - BofA Securities, Research Division Lihan Yu - JPMorgan Chase & Co, Research Division Ran Xu - Morgan Stanley, Research Division Xiaoxiong Ye - UBS Investment Bank, Research Division Yun-Yin Wang - China Renaissance, Research Division Operator Ladies and gentlemen, thank you for standing by, and welcome to the Qfin Holdings Second Quarter 2025 Earnings Conference Call. [Operator Instructions] Please also note today's event is being recorded.

Qfin Holdings Inc. - Sponsored ADR (QFIN) Q2 Earnings Lag Estimates

zacks.com

2025-08-14 20:21:06Qfin Holdings Inc. - Sponsored ADR (QFIN) came out with quarterly earnings of $1.78 per share, missing the Zacks Consensus Estimate of $1.79 per share. This compares to earnings of $1.22 per share a year ago.

Qfin Holdings Announces Second Quarter and Interim 2025 Unaudited Financial Results and Raises Semi-Annual Dividend

globenewswire.com

2025-08-14 18:00:00SHANGHAI, China, Aug. 14, 2025 (GLOBE NEWSWIRE) -- Qfin Holdings, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qfin Holdings” or the “Company”), a leading AI-empowered Credit-Tech platform in China, today announced its unaudited financial results for the second quarter and six months ended June 30, 2025 and raised semi-annual dividend.

QFIN Gears Up to Report Q2 Earnings: What's in the Offing?

zacks.com

2025-08-12 12:31:14Qifu Technology eyes second-quarter 2025 revenue growth and a strong earnings boost, driven by AI-led user gains and expanding embedded finance channels.

4 Stocks That May Get a Big Earnings Bump This Week

marketbeat.com

2025-08-11 14:16:16As Amazon.com Inc. NASDAQ: AMZN reminds us, sometimes it can be difficult to predict how the market will respond to a company's earnings report, even if the firm comes out ahead of analyst expectations for earnings and revenue. Amazon's dip following its latest report, despite top- and bottom-line beats, shows that sometimes details like forward guidance or the suggestion of short-term difficulties can be enough to undo any investor goodwill that may have built.

Qfin Holdings to Announce Second Quarter 2025 Unaudited Financial Results on August 14, 2025

globenewswire.com

2025-08-04 05:00:00SHANGHAI, China, Aug. 04, 2025 (GLOBE NEWSWIRE) -- Qfin Holdings, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qfin Holdings” or the “Company”), a leading AI-empowered Credit-Tech platform in China, today announced that it will report its unaudited financial results for the second quarter ended June 30, 2025, after U.S. markets close on Thursday, August 14, 2025.

Buy the Dip on 3 Overlooked Names With Major Potential

marketbeat.com

2025-08-03 08:26:06The S&P 500 has risen steadily since a tumble in early April alongside the Trump administration's major tariff announcement. But returns of more than 8% year-to-date (YTD) after a sharp decline at the start of the second quarter may obscure broad uncertainty in the market.

3 Reasons Growth Investors Will Love Qifu Technology, Inc. (QFIN)

zacks.com

2025-07-21 13:46:04Qifu Technology, Inc. (QFIN) possesses solid growth attributes, which could help it handily outperform the market.

Best Growth Stocks to Buy for July 21st

zacks.com

2025-07-21 08:00:18GOOS, QFIN and QFIN made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 21, 2025.

Best Growth Stocks to Buy for July 17th

zacks.com

2025-07-17 06:06:05QFIN, AFYA and PAHC made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 17, 2025.

5 Dividend Growth Stocks for a Safe & Income-Driven Portfolio

zacks.com

2025-07-16 12:11:06AEM, UGI, QFIN, TSM and GPI stand out as top dividend growth picks for building a safer, income-focused portfolio in 2025.

Best Growth Stocks to Buy for July 15th

zacks.com

2025-07-15 06:20:12QFIN, AFYA and PAHC made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 15, 2025.

Best Growth Stocks to Buy for July 11th

zacks.com

2025-07-11 10:11:06STRT, AFYA and QFIN made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 11, 2025.

Qifu Technology, Inc. (QFIN) is on the Move, Here's Why the Trend Could be Sustainable

zacks.com

2025-07-11 09:50:28Qifu Technology, Inc. (QFIN) made it through our "Recent Price Strength" screen and could be a great choice for investors looking to make a profit from stocks that are currently on the move.

Qifu Technology, Inc. (QFIN) Upgraded to Strong Buy: Here's What You Should Know

zacks.com

2025-07-09 13:00:58Qifu Technology, Inc. (QFIN) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Best Momentum Stock to Buy for July 9th

zacks.com

2025-07-09 11:01:26QFIN, ATEYY and OPBK made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on July 9, 2025.

Qfin Holdings, Inc. (QFIN) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-15 01:06:48Qfin Holdings, Inc. (NASDAQ:QFIN ) Q2 2025 Earnings Conference Call August 14, 2025 8:30 PM ET Company Participants Haisheng Wu - CEO & Director Karen Ji - Senior Director of Capital Markets Yan Zheng - Chief Risk Officer Zuoli Xu - CFO & Director Conference Call Participants Emma Xu - BofA Securities, Research Division Lihan Yu - JPMorgan Chase & Co, Research Division Ran Xu - Morgan Stanley, Research Division Xiaoxiong Ye - UBS Investment Bank, Research Division Yun-Yin Wang - China Renaissance, Research Division Operator Ladies and gentlemen, thank you for standing by, and welcome to the Qfin Holdings Second Quarter 2025 Earnings Conference Call. [Operator Instructions] Please also note today's event is being recorded.

Qfin Holdings Inc. - Sponsored ADR (QFIN) Q2 Earnings Lag Estimates

zacks.com

2025-08-14 20:21:06Qfin Holdings Inc. - Sponsored ADR (QFIN) came out with quarterly earnings of $1.78 per share, missing the Zacks Consensus Estimate of $1.79 per share. This compares to earnings of $1.22 per share a year ago.

Qfin Holdings Announces Second Quarter and Interim 2025 Unaudited Financial Results and Raises Semi-Annual Dividend

globenewswire.com

2025-08-14 18:00:00SHANGHAI, China, Aug. 14, 2025 (GLOBE NEWSWIRE) -- Qfin Holdings, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qfin Holdings” or the “Company”), a leading AI-empowered Credit-Tech platform in China, today announced its unaudited financial results for the second quarter and six months ended June 30, 2025 and raised semi-annual dividend.

QFIN Gears Up to Report Q2 Earnings: What's in the Offing?

zacks.com

2025-08-12 12:31:14Qifu Technology eyes second-quarter 2025 revenue growth and a strong earnings boost, driven by AI-led user gains and expanding embedded finance channels.

4 Stocks That May Get a Big Earnings Bump This Week

marketbeat.com

2025-08-11 14:16:16As Amazon.com Inc. NASDAQ: AMZN reminds us, sometimes it can be difficult to predict how the market will respond to a company's earnings report, even if the firm comes out ahead of analyst expectations for earnings and revenue. Amazon's dip following its latest report, despite top- and bottom-line beats, shows that sometimes details like forward guidance or the suggestion of short-term difficulties can be enough to undo any investor goodwill that may have built.

Qfin Holdings to Announce Second Quarter 2025 Unaudited Financial Results on August 14, 2025

globenewswire.com

2025-08-04 05:00:00SHANGHAI, China, Aug. 04, 2025 (GLOBE NEWSWIRE) -- Qfin Holdings, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qfin Holdings” or the “Company”), a leading AI-empowered Credit-Tech platform in China, today announced that it will report its unaudited financial results for the second quarter ended June 30, 2025, after U.S. markets close on Thursday, August 14, 2025.

Buy the Dip on 3 Overlooked Names With Major Potential

marketbeat.com

2025-08-03 08:26:06The S&P 500 has risen steadily since a tumble in early April alongside the Trump administration's major tariff announcement. But returns of more than 8% year-to-date (YTD) after a sharp decline at the start of the second quarter may obscure broad uncertainty in the market.

3 Reasons Growth Investors Will Love Qifu Technology, Inc. (QFIN)

zacks.com

2025-07-21 13:46:04Qifu Technology, Inc. (QFIN) possesses solid growth attributes, which could help it handily outperform the market.

Best Growth Stocks to Buy for July 21st

zacks.com

2025-07-21 08:00:18GOOS, QFIN and QFIN made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 21, 2025.

Best Growth Stocks to Buy for July 17th

zacks.com

2025-07-17 06:06:05QFIN, AFYA and PAHC made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 17, 2025.

5 Dividend Growth Stocks for a Safe & Income-Driven Portfolio

zacks.com

2025-07-16 12:11:06AEM, UGI, QFIN, TSM and GPI stand out as top dividend growth picks for building a safer, income-focused portfolio in 2025.

Best Growth Stocks to Buy for July 15th

zacks.com

2025-07-15 06:20:12QFIN, AFYA and PAHC made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 15, 2025.

Best Growth Stocks to Buy for July 11th

zacks.com

2025-07-11 10:11:06STRT, AFYA and QFIN made it to the Zacks Rank #1 (Strong Buy) growth stocks list on July 11, 2025.

Qifu Technology, Inc. (QFIN) is on the Move, Here's Why the Trend Could be Sustainable

zacks.com

2025-07-11 09:50:28Qifu Technology, Inc. (QFIN) made it through our "Recent Price Strength" screen and could be a great choice for investors looking to make a profit from stocks that are currently on the move.

Qifu Technology, Inc. (QFIN) Upgraded to Strong Buy: Here's What You Should Know

zacks.com

2025-07-09 13:00:58Qifu Technology, Inc. (QFIN) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Best Momentum Stock to Buy for July 9th

zacks.com

2025-07-09 11:01:26QFIN, ATEYY and OPBK made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on July 9, 2025.