Perimeter Solutions, S.A. (PRM)

Price:

26.37 USD

( - -0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Sasol Limited

VALUE SCORE:

6

2nd position

Eastman Chemical Company

VALUE SCORE:

10

The best

Oil-Dri Corporation of America

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Perimeter Solutions, SA manufactures and supplies firefighting products and lubricant additives in the United States, Germany, and internationally. It operates in two segments, Fire Safety and Oil Additives. The Fire Safety segment provides fire retardants and firefighting foams, as well as specialized equipment and services for federal, state, provincial, local/municipal, and commercial customers. The Oil Additives segment produces Phosphorus Pentasulfide which is primarily used in the preparation of lubricant additives, including a family of compounds called Zinc Dialkyldithiophosphates. The company offers its products under the brands PHOS-CHEK, FIRE-TROL, AUXQUIMIA, SOLBERG. and BIOGEMA. Perimeter Solutions, SA was founded in 1963 and is headquartered in Clayton, Missouri.

NEWS

Perimeter Solutions (PRM) Projected to Post Earnings on Thursday

defenseworld.net

2026-02-24 01:24:42Perimeter Solutions (NYSE: PRM - Get Free Report) is expected to be issuing its Q4 2025 results before the market opens on Thursday, February 26th. Analysts expect Perimeter Solutions to post earnings of $0.09 per share and revenue of $94.0480 million for the quarter. Investors may review the information on the company's upcoming Q4 2025 earning

CenterBook Partners LP Sells 369,543 Shares of Perimeter Solutions, SA $PRM

defenseworld.net

2026-02-21 04:18:51CenterBook Partners LP lessened its stake in shares of Perimeter Solutions, SA (NYSE: PRM) by 88.3% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 49,100 shares of the company's stock after selling 369,543 shares during the period. CenterBook

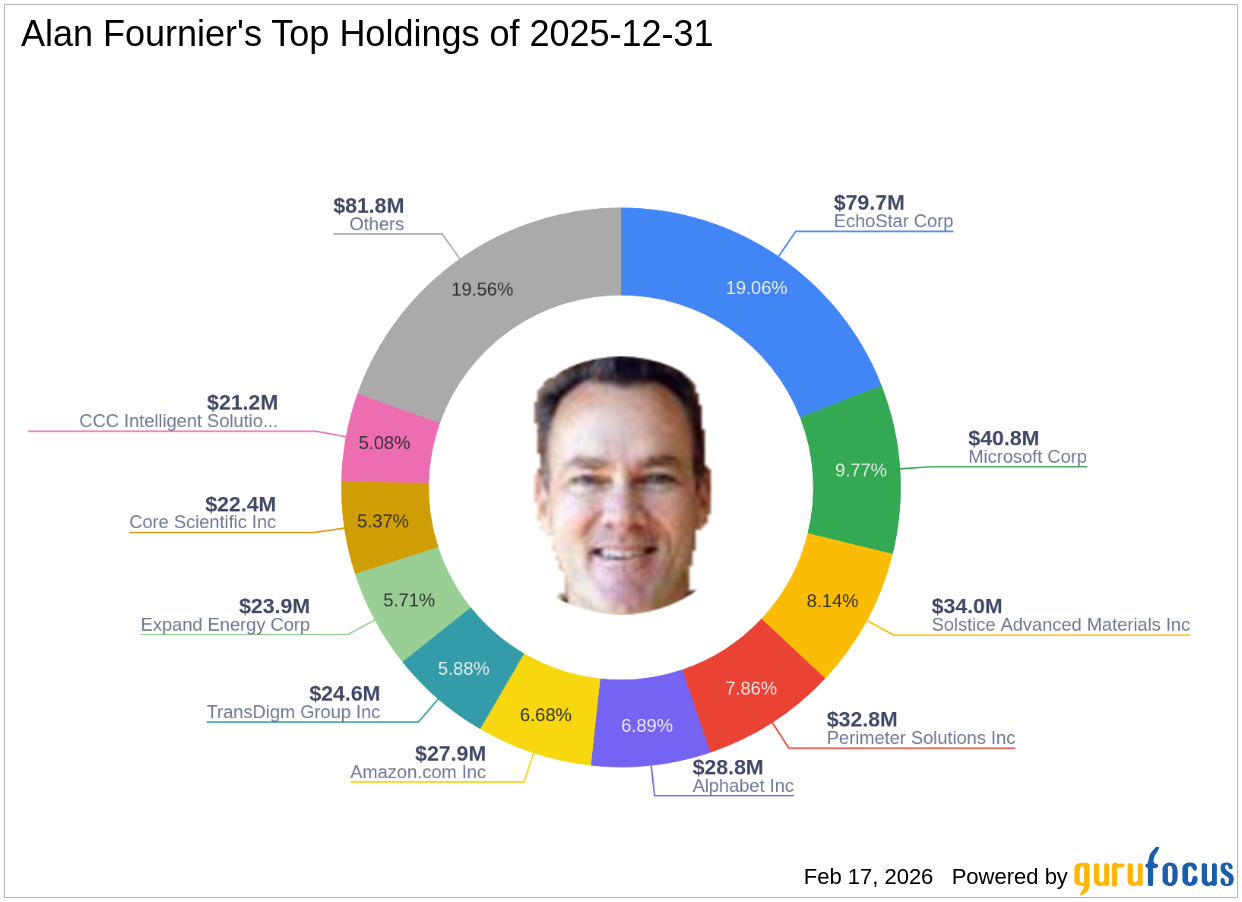

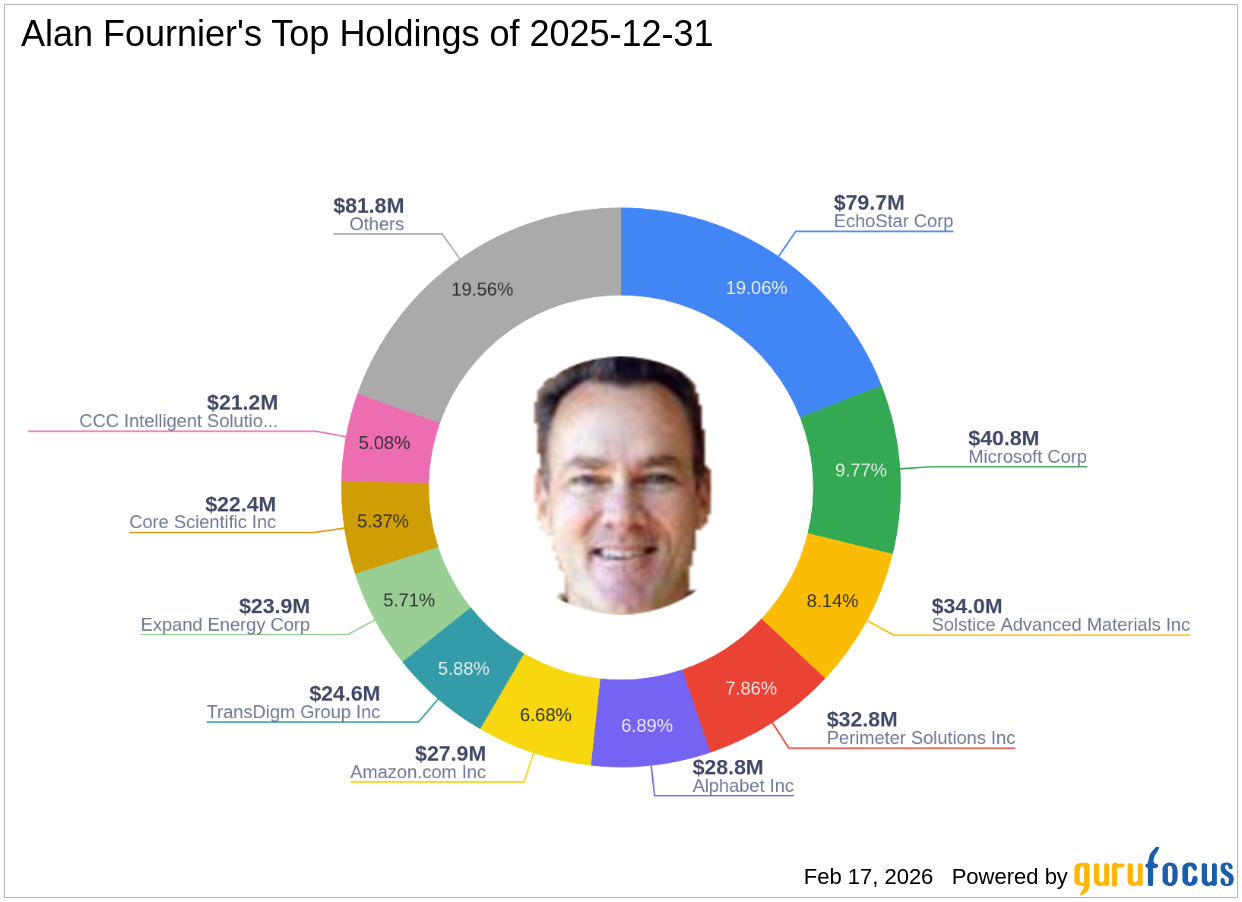

Alan Fournier's Strategic Move: Solstice Advanced Materials Inc Takes Center Stage

gurufocus.com

2026-02-17 18:15:00Exploring Alan Fournier (Trades, Portfolio)'s Latest Investment Decisions Alan Fournier (Trades, Portfolio) recently submitted the 13F filing for the fourth qu

Perimeter Announces Date for Fourth Quarter and Year End 2025 Earnings Call

globenewswire.com

2026-02-12 16:05:00CLAYTON, Mo., Feb. 12, 2026 (GLOBE NEWSWIRE) -- Perimeter Solutions (NYSE: PRM) (“Perimeter” or the “Company”), a leading provider of industrial products and services that support critical and complex customer missions across a range of niche applications, announced today it will release its financial results for the fourth quarter and year end 2025 on Thursday, February 26, 2026, before the market opens.

Head-To-Head Review: 5E Advanced Materials (NASDAQ:FEAM) & Perimeter Solutions (NYSE:PRM)

defenseworld.net

2026-02-06 02:01:145E Advanced Materials (NASDAQ: FEAM - Get Free Report) and Perimeter Solutions (NYSE: PRM - Get Free Report) are both basic materials companies, but which is the superior stock? We will compare the two businesses based on the strength of their institutional ownership, dividends, profitability, analyst recommendations, valuation, earnings and risk. Analyst Recommendations This is a breakdown

Perimeter Solutions (NYSE:PRM) vs. Orbia Advance (OTCMKTS:MXCHY) Critical Analysis

defenseworld.net

2026-01-29 01:12:46Orbia Advance (OTCMKTS:MXCHY - Get Free Report) and Perimeter Solutions (NYSE: PRM - Get Free Report) are both mid-cap basic materials companies, but which is the better investment? We will contrast the two businesses based on the strength of their dividends, profitability, earnings, institutional ownership, risk, analyst recommendations and valuation. Analyst Recommendations This is a breakdown

Perimeter Solutions Completes Acquisition of MMT

globenewswire.com

2026-01-22 16:05:00CLAYTON, Mo., Jan. 22, 2026 (GLOBE NEWSWIRE) -- Perimeter Solutions, Inc. (NYSE: PRM) (“Perimeter,” “Perimeter Solutions,” or the “Company”), today announced that it has completed the acquisition of Medical Manufacturing Technologies LLC (“MMT”) from Arcline Investment Management (“Arcline”) for approximately $685 million in cash, including certain tax benefits. The signing of the definitive agreement was previously announced on December 10, 2025. The Company financed the transaction with cash on hand and the proceeds of the senior secured notes offering that closed on January 2, 2026.

Cott (TSE:PRM) Trading Up 1.4% – Here’s Why

defenseworld.net

2026-01-13 01:58:58Cott Corp. (TSE: PRM - Get Free Report)'s share price shot up 1.4% during trading on Monday. The stock traded as high as C$14.48 and last traded at C$14.25. 3,009 shares were traded during mid-day trading, an increase of 75% from the average session volume of 1,717 shares. The stock had previously closed at C$14.05.

Perimeter Solutions Stock Up 111% but One Fund Trimmed Its $35 Million Stake

fool.com

2025-12-26 18:01:13Massachusetts-based East Coast Asset Management sold 497,847 shares of Perimeter Solutions in the third quarter. The position value fell by $6.40 million from the previous period.

Cott Corp. (TSE:PRM) Given Consensus Recommendation of “Buy” by Analysts

defenseworld.net

2025-12-22 01:12:46Cott Corp. (TSE: PRM - Get Free Report) has received an average recommendation of "Buy" from the six ratings firms that are currently covering the firm, MarketBeat Ratings reports. Two equities research analysts have rated the stock with a hold recommendation and four have given a strong buy recommendation to the company. PRM has been the

Cott (TSE:PRM) Trading Down 3.5% – What’s Next?

defenseworld.net

2025-12-19 03:20:59Cott Corp. (TSE: PRM - Get Free Report) traded down 3.5% on Thursday. The stock traded as low as C$13.25 and last traded at C$13.25. 1,211 shares were traded during trading, a decline of 47% from the average session volume of 2,271 shares. The stock had previously closed at C$13.73. Wall Street Analysts Forecast Growth

PRM Prices $550 Million Senior Secured Notes to Fund Acquisition

zacks.com

2025-12-18 10:07:08PRM prices $550M of 6.250% senior secured notes due 2034, with proceeds and cash on hand set to fund the planned MMT acquisition.

Kyle Sable Sells 100,000 Shares of Perimeter Solutions (NYSE:PRM) Stock

defenseworld.net

2025-12-18 04:42:48Perimeter Solutions, SA (NYSE: PRM - Get Free Report) CFO Kyle Sable sold 100,000 shares of the company's stock in a transaction that occurred on Friday, December 12th. The stock was sold at an average price of $28.47, for a total value of $2,847,000.00. The sale was disclosed in a filing with the SEC, which is

Corient Private Wealth LLC Sells 112,105 Shares of Perimeter Solutions, SA $PRM

defenseworld.net

2025-12-17 03:52:50Corient Private Wealth LLC trimmed its position in shares of Perimeter Solutions, SA (NYSE: PRM) by 3.3% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 3,312,008 shares of the company's stock after selling 112,105 shares during the period. Corient Private Wealth

3 Chemicals Stocks Set to Continue Their Winning Streaks in 2026

zacks.com

2025-12-16 11:01:22While 2025 brought challenges for the chemical industry, PRM, ALB and SQM showed resilience and delivered solid returns on the bourses.

Perimeter Solutions Prices Offering of $550 Million of Senior Secured Notes Due 2034

globenewswire.com

2025-12-15 16:59:00CLAYTON, Miss., Dec. 15, 2025 (GLOBE NEWSWIRE) -- Perimeter Solutions, Inc. (NYSE: PRM) (“Perimeter,” “Perimeter Solutions,” or the “Company”), today announced that its indirect subsidiary, Perimeter Holdings, LLC (“Perimeter Holdings”) priced an offering of $550 million aggregate principal amount of 6.250% senior secured notes due 2034 (the “Notes”). The Notes will bear interest at 6.250% per year, payable semi-annually, will mature on January 15, 2034. The Notes will be fully and unconditionally guaranteed on a senior secured basis, jointly and severally, by Perimeter Intermediate, LLC (“Perimeter Intermediate”), the direct parent of Perimeter Holdings, and, subject to certain exclusions, all of Perimeter Holdings' existing or future restricted subsidiaries that guarantee Perimeter Holdings' revolving credit facility. The Notes will be secured, subject to permitted liens, by a first-priority security interest in substantially all present and hereafter acquired property and assets of Perimeter Holdings and the guarantors, which also constitutes collateral securing indebtedness under Perimeter Holdings' revolving credit facility. The offering of the Notes is expected to close on January 2, 2026, subject to customary closing conditions.

Perimeter Solutions (PRM) Projected to Post Earnings on Thursday

defenseworld.net

2026-02-24 01:24:42Perimeter Solutions (NYSE: PRM - Get Free Report) is expected to be issuing its Q4 2025 results before the market opens on Thursday, February 26th. Analysts expect Perimeter Solutions to post earnings of $0.09 per share and revenue of $94.0480 million for the quarter. Investors may review the information on the company's upcoming Q4 2025 earning

CenterBook Partners LP Sells 369,543 Shares of Perimeter Solutions, SA $PRM

defenseworld.net

2026-02-21 04:18:51CenterBook Partners LP lessened its stake in shares of Perimeter Solutions, SA (NYSE: PRM) by 88.3% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 49,100 shares of the company's stock after selling 369,543 shares during the period. CenterBook

Alan Fournier's Strategic Move: Solstice Advanced Materials Inc Takes Center Stage

gurufocus.com

2026-02-17 18:15:00Exploring Alan Fournier (Trades, Portfolio)'s Latest Investment Decisions Alan Fournier (Trades, Portfolio) recently submitted the 13F filing for the fourth qu

Perimeter Announces Date for Fourth Quarter and Year End 2025 Earnings Call

globenewswire.com

2026-02-12 16:05:00CLAYTON, Mo., Feb. 12, 2026 (GLOBE NEWSWIRE) -- Perimeter Solutions (NYSE: PRM) (“Perimeter” or the “Company”), a leading provider of industrial products and services that support critical and complex customer missions across a range of niche applications, announced today it will release its financial results for the fourth quarter and year end 2025 on Thursday, February 26, 2026, before the market opens.

Head-To-Head Review: 5E Advanced Materials (NASDAQ:FEAM) & Perimeter Solutions (NYSE:PRM)

defenseworld.net

2026-02-06 02:01:145E Advanced Materials (NASDAQ: FEAM - Get Free Report) and Perimeter Solutions (NYSE: PRM - Get Free Report) are both basic materials companies, but which is the superior stock? We will compare the two businesses based on the strength of their institutional ownership, dividends, profitability, analyst recommendations, valuation, earnings and risk. Analyst Recommendations This is a breakdown

Perimeter Solutions (NYSE:PRM) vs. Orbia Advance (OTCMKTS:MXCHY) Critical Analysis

defenseworld.net

2026-01-29 01:12:46Orbia Advance (OTCMKTS:MXCHY - Get Free Report) and Perimeter Solutions (NYSE: PRM - Get Free Report) are both mid-cap basic materials companies, but which is the better investment? We will contrast the two businesses based on the strength of their dividends, profitability, earnings, institutional ownership, risk, analyst recommendations and valuation. Analyst Recommendations This is a breakdown

Perimeter Solutions Completes Acquisition of MMT

globenewswire.com

2026-01-22 16:05:00CLAYTON, Mo., Jan. 22, 2026 (GLOBE NEWSWIRE) -- Perimeter Solutions, Inc. (NYSE: PRM) (“Perimeter,” “Perimeter Solutions,” or the “Company”), today announced that it has completed the acquisition of Medical Manufacturing Technologies LLC (“MMT”) from Arcline Investment Management (“Arcline”) for approximately $685 million in cash, including certain tax benefits. The signing of the definitive agreement was previously announced on December 10, 2025. The Company financed the transaction with cash on hand and the proceeds of the senior secured notes offering that closed on January 2, 2026.

Cott (TSE:PRM) Trading Up 1.4% – Here’s Why

defenseworld.net

2026-01-13 01:58:58Cott Corp. (TSE: PRM - Get Free Report)'s share price shot up 1.4% during trading on Monday. The stock traded as high as C$14.48 and last traded at C$14.25. 3,009 shares were traded during mid-day trading, an increase of 75% from the average session volume of 1,717 shares. The stock had previously closed at C$14.05.

Perimeter Solutions Stock Up 111% but One Fund Trimmed Its $35 Million Stake

fool.com

2025-12-26 18:01:13Massachusetts-based East Coast Asset Management sold 497,847 shares of Perimeter Solutions in the third quarter. The position value fell by $6.40 million from the previous period.

Cott Corp. (TSE:PRM) Given Consensus Recommendation of “Buy” by Analysts

defenseworld.net

2025-12-22 01:12:46Cott Corp. (TSE: PRM - Get Free Report) has received an average recommendation of "Buy" from the six ratings firms that are currently covering the firm, MarketBeat Ratings reports. Two equities research analysts have rated the stock with a hold recommendation and four have given a strong buy recommendation to the company. PRM has been the

Cott (TSE:PRM) Trading Down 3.5% – What’s Next?

defenseworld.net

2025-12-19 03:20:59Cott Corp. (TSE: PRM - Get Free Report) traded down 3.5% on Thursday. The stock traded as low as C$13.25 and last traded at C$13.25. 1,211 shares were traded during trading, a decline of 47% from the average session volume of 2,271 shares. The stock had previously closed at C$13.73. Wall Street Analysts Forecast Growth

PRM Prices $550 Million Senior Secured Notes to Fund Acquisition

zacks.com

2025-12-18 10:07:08PRM prices $550M of 6.250% senior secured notes due 2034, with proceeds and cash on hand set to fund the planned MMT acquisition.

Kyle Sable Sells 100,000 Shares of Perimeter Solutions (NYSE:PRM) Stock

defenseworld.net

2025-12-18 04:42:48Perimeter Solutions, SA (NYSE: PRM - Get Free Report) CFO Kyle Sable sold 100,000 shares of the company's stock in a transaction that occurred on Friday, December 12th. The stock was sold at an average price of $28.47, for a total value of $2,847,000.00. The sale was disclosed in a filing with the SEC, which is

Corient Private Wealth LLC Sells 112,105 Shares of Perimeter Solutions, SA $PRM

defenseworld.net

2025-12-17 03:52:50Corient Private Wealth LLC trimmed its position in shares of Perimeter Solutions, SA (NYSE: PRM) by 3.3% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 3,312,008 shares of the company's stock after selling 112,105 shares during the period. Corient Private Wealth

3 Chemicals Stocks Set to Continue Their Winning Streaks in 2026

zacks.com

2025-12-16 11:01:22While 2025 brought challenges for the chemical industry, PRM, ALB and SQM showed resilience and delivered solid returns on the bourses.

Perimeter Solutions Prices Offering of $550 Million of Senior Secured Notes Due 2034

globenewswire.com

2025-12-15 16:59:00CLAYTON, Miss., Dec. 15, 2025 (GLOBE NEWSWIRE) -- Perimeter Solutions, Inc. (NYSE: PRM) (“Perimeter,” “Perimeter Solutions,” or the “Company”), today announced that its indirect subsidiary, Perimeter Holdings, LLC (“Perimeter Holdings”) priced an offering of $550 million aggregate principal amount of 6.250% senior secured notes due 2034 (the “Notes”). The Notes will bear interest at 6.250% per year, payable semi-annually, will mature on January 15, 2034. The Notes will be fully and unconditionally guaranteed on a senior secured basis, jointly and severally, by Perimeter Intermediate, LLC (“Perimeter Intermediate”), the direct parent of Perimeter Holdings, and, subject to certain exclusions, all of Perimeter Holdings' existing or future restricted subsidiaries that guarantee Perimeter Holdings' revolving credit facility. The Notes will be secured, subject to permitted liens, by a first-priority security interest in substantially all present and hereafter acquired property and assets of Perimeter Holdings and the guarantors, which also constitutes collateral securing indebtedness under Perimeter Holdings' revolving credit facility. The offering of the Notes is expected to close on January 2, 2026, subject to customary closing conditions.