Invesco Golden Dragon China ETF (PGJ)

Price:

29.86 USD

( - -0.08 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

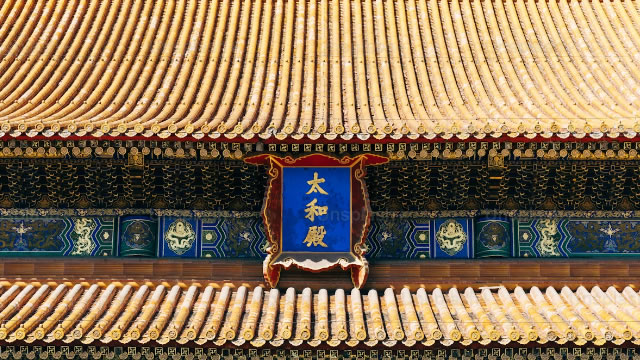

The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. The underlying index is composed of securities of U.S. exchange-listed companies that are headquartered or incorporated in the People's Republic of China. The fund is non-diversified.

NEWS

PGJ: 3 Factors To Consider Before Investing

seekingalpha.com

2025-10-14 13:06:47The Invesco Golden Dragon China ETF stands out right with its over 20% returns YTD, ahead of the Shanghai Composite and the S&P 500. Despite this, it's hard to fully get behind the PGJ story right now, as tariff flip-flops between the U.S. and China create uncertainty. Additionally, the Chinese economy continues to struggle, which can cast a shadow on the impressive growth in the technology sector.

The Hunt for AI Gains Is Lifting Chinese Stocks. Here's What You Need to Know.

investopedia.com

2025-09-25 11:35:40As the U.S. wrestles China for AI dominance, investors are playing both sides.

Some of the Top China Stocks Reside in This ETF

etftrends.com

2025-09-03 08:42:46Count stocks from China among this year's international standouts. Widely observed gauges of equities in the world's second-largest economy are outpacing both the S&P 500 and the MSCI Emerging Markets Index by comfortable margins since the start of this year.

Chinese Stocks Take Off On The Upside: The PGJ ETF Is Another Option For Exposure

seekingalpha.com

2025-08-18 15:21:54A looming trade deal between the U.S. and China is bullish for the Chinese stock market. When Invesco Golden Dragon China ETF is compared to iShares China Large-Cap ETF, FXI appears to be a better choice. Seeking Alpha ETF Grades highlight the differences between PGJ and FXI.

Worst-Performing ETFs of April

zacks.com

2025-05-02 04:40:28April saw a sharp stock market drop due to Trump's aggressive new tariffs, especially on China.

PGJ: China Wasn't Doing So Well Even Before The Trade War

seekingalpha.com

2025-04-13 08:30:00I am bearish on China's long-term prospects, despite a recent 4.5% rise in the index since June 2024, due to government stimulus measures. The People's Bank of China's September stimulus included lower bank reserve requirements, mortgage rate reductions, and subsidized business loans, temporarily boosting markets. Recent market gains from the stimulus have retracted, highlighting persistent underlying issues in China's economy despite short-term boosts.

Disruptive Theme of the Week: China ETFs Rallying YTD

etftrends.com

2025-03-04 09:14:08One of the top themes year-to-date has been China-focused technology ETFs. China technology stocks have surged on AI enthusiasm related to China startup DeepSeek's AI model launch.

PGJ: High Volatility And Structural Challenges Ahead

seekingalpha.com

2025-01-27 04:37:48Invesco Golden Dragon China ETF has underperformed with a volatile history and an annualized total return of only 4.7% since inception. PGJ is heavily concentrated in consumer discretionary stocks, making it highly sensitive to economic cycles and vulnerable during downturns. China's long-term structural challenges, including population decline, high household debt, and a housing market bubble burst, will likely hinder PGJ's future performance.

Bullish On China, But Not On PGJ

seekingalpha.com

2024-11-08 05:40:11Chinese stocks appear undervalued and could offer diversification from US markets, which are currently priced for perfection. Valuations in China are much lower compared to the US, making it a contrarian buy, especially during periods of negative sentiment. Invesco Golden Dragon China ETF is holding mostly ADRs from technology companies, which comes with additional risks, which I am not comfortable with.

China stock ETFs rip higher even as mainland markets close for holiday

cnbc.com

2024-10-02 10:32:24Exchange-traded funds overseas that track Chinese stocks continued their rally Wednesday even as mainland markets were shut for a week-long holiday.

Hang Seng Index: Start Of A Potential New Medium-Term Bullish Trend

seekingalpha.com

2024-09-30 13:38:00Aggressive interest rate cuts by PBoC coupled with potential expansionary fiscal policies that target consumer spending have stoked positive animal spirits. Market breadth has improved on China CSI 300 and Hong Kong Hang Seng Index.

China ETFs set for best week on record after Beijing fires policy ‘bazooka' to boost economy. Is it time to jump in?

marketwatch.com

2024-09-26 19:04:00China ETFs have surged on the back of a blitz of stimulus measures by the country's government to revive the world's second-largest economy.

Time to Buy China ETFs Following Billionaire Investors?

zacks.com

2024-09-18 16:01:16Although concerns over China's economic challenges remain rife, some billionaire investors are betting big on China ETFs.

China's Stalling Credit Market Signals an Era Of Stagnation

seekingalpha.com

2024-08-19 10:18:45The latest figures published by the People's Bank of China show that credit and liquidity are stalling as demand for new loans declines. Deteriorating confidence in China's prospects explains why households prefer paying down debts while companies borrow less.

China's Key Growth Indicators Continue To Present A Case For Further Policy Easing

seekingalpha.com

2024-08-15 11:45:00Data came in generally in line or slightly weaker than forecasts, as weak confidence continued to depress investment and consumption. New home prices fell by -0.65% MoM in July, compared to a -0.67% MoM drop in June.

China's Sluggish May Economic Data To Increase Calls For Rate Cuts

seekingalpha.com

2024-06-17 12:10:00The People's Bank of China kept the one-year medium-term lending facility rate unchanged at 2.5% today, in line with market expectations. We believe that in conjunction with today's data releases and the start of rate cuts in other central banks such as the European Central Bank and Bank of Canada, the odds of a PBoC rate cut in the coming months have risen.

No data to display

PGJ: 3 Factors To Consider Before Investing

seekingalpha.com

2025-10-14 13:06:47The Invesco Golden Dragon China ETF stands out right with its over 20% returns YTD, ahead of the Shanghai Composite and the S&P 500. Despite this, it's hard to fully get behind the PGJ story right now, as tariff flip-flops between the U.S. and China create uncertainty. Additionally, the Chinese economy continues to struggle, which can cast a shadow on the impressive growth in the technology sector.

The Hunt for AI Gains Is Lifting Chinese Stocks. Here's What You Need to Know.

investopedia.com

2025-09-25 11:35:40As the U.S. wrestles China for AI dominance, investors are playing both sides.

Some of the Top China Stocks Reside in This ETF

etftrends.com

2025-09-03 08:42:46Count stocks from China among this year's international standouts. Widely observed gauges of equities in the world's second-largest economy are outpacing both the S&P 500 and the MSCI Emerging Markets Index by comfortable margins since the start of this year.

Chinese Stocks Take Off On The Upside: The PGJ ETF Is Another Option For Exposure

seekingalpha.com

2025-08-18 15:21:54A looming trade deal between the U.S. and China is bullish for the Chinese stock market. When Invesco Golden Dragon China ETF is compared to iShares China Large-Cap ETF, FXI appears to be a better choice. Seeking Alpha ETF Grades highlight the differences between PGJ and FXI.

Worst-Performing ETFs of April

zacks.com

2025-05-02 04:40:28April saw a sharp stock market drop due to Trump's aggressive new tariffs, especially on China.

PGJ: China Wasn't Doing So Well Even Before The Trade War

seekingalpha.com

2025-04-13 08:30:00I am bearish on China's long-term prospects, despite a recent 4.5% rise in the index since June 2024, due to government stimulus measures. The People's Bank of China's September stimulus included lower bank reserve requirements, mortgage rate reductions, and subsidized business loans, temporarily boosting markets. Recent market gains from the stimulus have retracted, highlighting persistent underlying issues in China's economy despite short-term boosts.

Disruptive Theme of the Week: China ETFs Rallying YTD

etftrends.com

2025-03-04 09:14:08One of the top themes year-to-date has been China-focused technology ETFs. China technology stocks have surged on AI enthusiasm related to China startup DeepSeek's AI model launch.

PGJ: High Volatility And Structural Challenges Ahead

seekingalpha.com

2025-01-27 04:37:48Invesco Golden Dragon China ETF has underperformed with a volatile history and an annualized total return of only 4.7% since inception. PGJ is heavily concentrated in consumer discretionary stocks, making it highly sensitive to economic cycles and vulnerable during downturns. China's long-term structural challenges, including population decline, high household debt, and a housing market bubble burst, will likely hinder PGJ's future performance.

Bullish On China, But Not On PGJ

seekingalpha.com

2024-11-08 05:40:11Chinese stocks appear undervalued and could offer diversification from US markets, which are currently priced for perfection. Valuations in China are much lower compared to the US, making it a contrarian buy, especially during periods of negative sentiment. Invesco Golden Dragon China ETF is holding mostly ADRs from technology companies, which comes with additional risks, which I am not comfortable with.

China stock ETFs rip higher even as mainland markets close for holiday

cnbc.com

2024-10-02 10:32:24Exchange-traded funds overseas that track Chinese stocks continued their rally Wednesday even as mainland markets were shut for a week-long holiday.

Hang Seng Index: Start Of A Potential New Medium-Term Bullish Trend

seekingalpha.com

2024-09-30 13:38:00Aggressive interest rate cuts by PBoC coupled with potential expansionary fiscal policies that target consumer spending have stoked positive animal spirits. Market breadth has improved on China CSI 300 and Hong Kong Hang Seng Index.

China ETFs set for best week on record after Beijing fires policy ‘bazooka' to boost economy. Is it time to jump in?

marketwatch.com

2024-09-26 19:04:00China ETFs have surged on the back of a blitz of stimulus measures by the country's government to revive the world's second-largest economy.

Time to Buy China ETFs Following Billionaire Investors?

zacks.com

2024-09-18 16:01:16Although concerns over China's economic challenges remain rife, some billionaire investors are betting big on China ETFs.

China's Stalling Credit Market Signals an Era Of Stagnation

seekingalpha.com

2024-08-19 10:18:45The latest figures published by the People's Bank of China show that credit and liquidity are stalling as demand for new loans declines. Deteriorating confidence in China's prospects explains why households prefer paying down debts while companies borrow less.

China's Key Growth Indicators Continue To Present A Case For Further Policy Easing

seekingalpha.com

2024-08-15 11:45:00Data came in generally in line or slightly weaker than forecasts, as weak confidence continued to depress investment and consumption. New home prices fell by -0.65% MoM in July, compared to a -0.67% MoM drop in June.

China's Sluggish May Economic Data To Increase Calls For Rate Cuts

seekingalpha.com

2024-06-17 12:10:00The People's Bank of China kept the one-year medium-term lending facility rate unchanged at 2.5% today, in line with market expectations. We believe that in conjunction with today's data releases and the start of rate cuts in other central banks such as the European Central Bank and Bank of Canada, the odds of a PBoC rate cut in the coming months have risen.