Prospect Capital Corporation (PBY)

Price:

25.00 USD

( - -0.04 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Citigroup Capital XIII TR PFD SECS

VALUE SCORE:

6

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

ClearBridge Energy Midstream Opportunity Fund Inc

VALUE SCORE:

15

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Prospect Capital Corporation is a business development company. It specializes in middle market, mature, mezzanine finance, later stage, emerging growth, leveraged buyouts, refinancing, acquisitions, recapitalizations, turnaround, growth capital, development, capital expenditures and subordinated debt tranches of collateralized loan obligations, cash flow term loans, market place lending and bridge transactions. It also makes real estate investments particularly in multi-family residential real estate asset class. The fund makes secured debt, senior debt, senior and secured term loans, unitranche debt, first-lien and second lien, private debt, private equity, mezzanine debt, and equity investments in private and microcap public businesses. It focuses on both primary origination and secondary loans/portfolios and invests in situations like debt financings for private equity sponsors, acquisitions, dividend recapitalizations, growth financings, bridge loans, cash flow term loans, real estate financings/investments. It also focuses on investing in small-sized and medium-sized private companies rather than large public companies. The fund typically invests across all industry sectors, with a particular expertise in the energy and industrial sectors. It invests in aerospace and defense, chemicals, conglomerate services, consumer services, ecological, electronics, financial services, machinery, manufacturing, media, pharmaceuticals, retail, software, specialty minerals, textiles and leather, transportation, oil and gas production, coal production, materials, industrials, consumer discretionary, information technology, utilities, pipeline, storage, power generation and distribution, renewable and clean energy, oilfield services, healthcare, food and beverage, education, business services, and other select sectors. It prefers to invest in the United States and Canada. The fund seeks to invest between $10 million to $500 million per transaction in companies with EBITDA between $5 million and $150 million, sales value between $25 million and $500 million, and enterprise value between $5 million and $1000 million. It fund also co-invests for larger deals. The fund seeks control acquisitions by providing multiple levels of the capital structure. The fund focuses on sole, agented, club, or syndicated deals.

NEWS

ReconAfrica advances toward spud of largest exploration well in Namibia

proactiveinvestors.com

2025-05-30 08:41:56Reconnaissance Energy Africa Ltd (TSX-V:RECO, OTCQX:RECAF) (ReconAfrica) said Thursday it is advancing preparations to drill its largest exploration target to date, Prospect I, in Namibia, while expanding its footprint in the Etosha-Okavango basin with a new joint venture in Angola. CEO Brian Reinsborough said the company remains “excited” about the potential of Prospect I, located on Petroleum Exploration License 073 (PEL 73), and expects the rig to move on site by late June, with spud to follow shortly after.

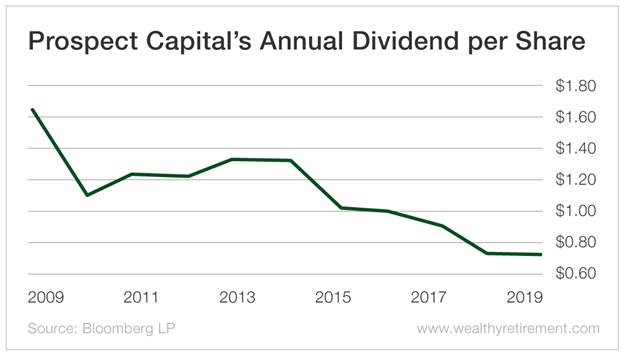

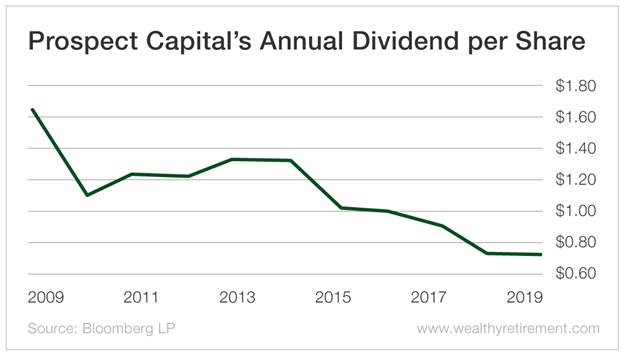

Prospect Capital: Why I Am Buying The 25% Dividend Cut

seekingalpha.com

2024-11-12 18:09:25Prospect Capital's 25% dividend cut, the first since 2017, shocked the market, causing a 15% stock plunge, but still offers a 12% yield. The dividend cut stems from a strategic shift to focus on higher-quality, secured loans, enhancing long-term return potential and portfolio quality. Despite the cut, Prospect Capital's low non-accrual ratio and excessive NAV discount present a compelling risk/reward opportunity for high-risk-tolerant investors.

Prospect Capital: Bad Reputation But Enticing Value

seekingalpha.com

2024-09-15 09:27:37Prospect Capital offers a remarkable 13% yield, supported by strong balance sheet quality and a well-performing investment portfolio. The BDC's favorable non-accrual trend and healthy dividend coverage profile make it an attractive buy for dividend investors. Despite a near-40% discount to NAV, Prospect Capital's dividend is well-supported,.

Prospect Capital: Surprisingly Well-Covered 14% Yield

seekingalpha.com

2024-09-01 13:31:43Prospect Capital's 14% dividend yield is sustainable, supported by a 70% LTM dividend pay-out ratio and a low non-accrual ratio of 0.3%. The stock's 40% discount to net asset value is exaggerated given its robust financial condition and strong credit quality. Prospect Capital's portfolio performance is solid, with impressive loan quality and substantial excess coverage for passive income investors.

Prospect Capital: The 12.7% Dividend Yield Could Be At Risk

seekingalpha.com

2024-05-23 11:16:35Prospect Capital's monthly cash dividend remains unchanged at $0.06 per share, resulting in a 12.7% dividend yield. The BDC's net investment income for the third quarter beat consensus but was down sequentially and from the year-ago quarter. Prospect Capital is not fully covering its current dividend distributions. This could be ominous as the Fed looks set to cut interest rates.

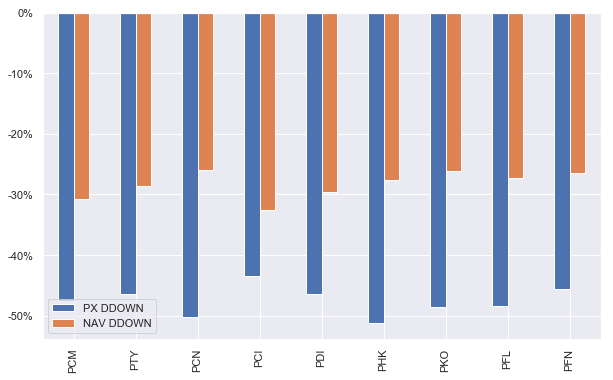

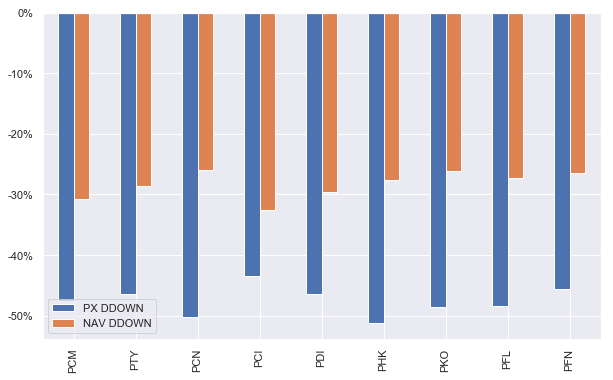

How To Get CEF Yields Without CEF Problems

seekingalpha.com

2020-08-21 00:35:07With the market entering its sixth month of recovery and valuations becoming ever more expensive, investors may be looking how to bulletproof their portfolios.

BT Wealth Management LLC Reduces Stock Position in Prospect Capital Co. (NASDAQ:PSEC)

thelincolnianonline.com

2020-05-01 10:10:48BT Wealth Management LLC reduced its stake in Prospect Capital Co. (NASDAQ:PSEC) by 21.0% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 18,840 shares of the financial services provider’s stock after selling 5,000 shares during the period. BT Wealth Management LLC’s […]

Biltmore Capital Advisors LLC Sells 27,000 Shares of Prospect Capital Co. (NASDAQ:PSEC)

thelincolnianonline.com

2020-05-01 09:00:43Biltmore Capital Advisors LLC lessened its holdings in Prospect Capital Co. (NASDAQ:PSEC) by 56.3% in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 21,000 shares of the financial services provider’s stock after selling 27,000 shares during the quarter. Biltmore Capital Advisors LLC’s holdings […]

Prospect Capital (NASDAQ:PSEC) Upgraded to "Sell" by BidaskClub

thelincolnianonline.com

2020-04-30 09:24:08Prospect Capital (NASDAQ:PSEC) was upgraded by investment analysts at BidaskClub from a “strong sell” rating to a “sell” rating in a note issued to investors on Thursday, BidAskClub reports. Several other research firms have also issued reports on PSEC. ValuEngine lowered Prospect Capital from a “hold” rating to a “sell” rating in a research note […]

This Stock Has A 16.74% Yield And Sells For Less Than Book

forbes.com

2020-04-29 13:10:28Prospect Capital has been named as a Top 25 dividend stock, according the most recent Dividend Channel ''DividendRank'' report.

Prospect Capital (NASDAQ:PSEC) Trading Up 5%

thelincolnianonline.com

2020-04-26 08:24:43Shares of Prospect Capital Co. (NASDAQ:PSEC) were up 5% on Friday . The company traded as high as $4.20 and last traded at $4.20, approximately 2,620,570 shares changed hands during mid-day trading. A decline of 27% from the average daily volume of 3,599,266 shares. The stock had previously closed at $4.00. A number of research […]

Raymond James Lowers Prospect Capital (NASDAQ:PSEC) to Underperform

thelincolnianonline.com

2020-04-24 10:06:44Raymond James downgraded shares of Prospect Capital (NASDAQ:PSEC) from a market perform rating to an underperform rating in a research report sent to investors on Monday morning, Benzinga reports. Other research analysts have also issued research reports about the company. ValuEngine lowered Prospect Capital from a hold rating to a sell rating in a report […]

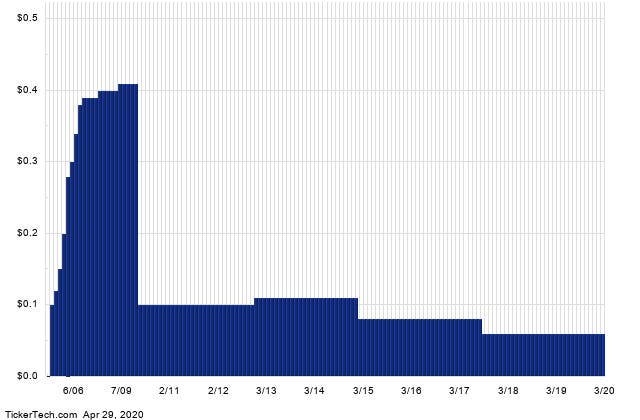

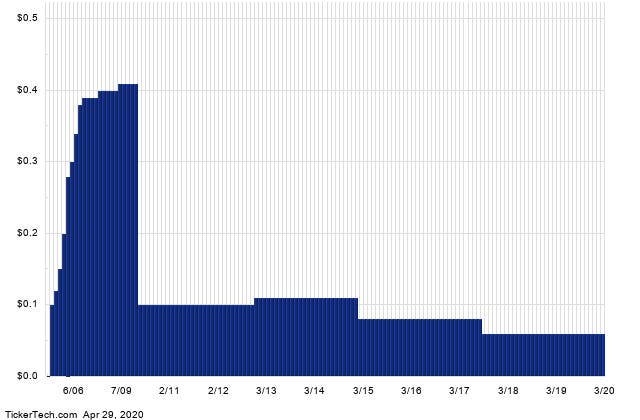

PSEC: A Likely Dividend Cut For This 18% Yielder?

talkmarkets.com

2020-04-22 23:56:23Considering its high debt load, its likelihood of reduced net investment income, and its tendency to lower the dividend when times get tough, Prospect Capital’s dividend cannot be considered safe. Expect a dividend cut in the next 12 months.

BidaskClub Downgrades Prospect Capital (NASDAQ:PSEC) to Strong Sell

thelincolnianonline.com

2020-04-22 07:38:47Prospect Capital (NASDAQ:PSEC) was downgraded by stock analysts at BidaskClub from a “sell” rating to a “strong sell” rating in a report released on Wednesday, BidAskClub reports. PSEC has been the subject of several other research reports. Zacks Investment Research downgraded shares of Prospect Capital from a “buy” rating to a “hold” rating in a […]

10 High-Yield Monthly Dividend Stocks to Buy

investorplace.com

2020-04-17 15:26:23Not all dividend stocks pay investors on a quarterly basis. These names will help you pay your monthly bills.

These 37 Companies Teeter On The Verge Of 'Junk'

investors.com

2020-04-17 12:00:46The coronavirus stock market crash is doing the unimaginable: Turning once rock-solid S&P 500 companies into junk. And it's happening fast.

ReconAfrica advances toward spud of largest exploration well in Namibia

proactiveinvestors.com

2025-05-30 08:41:56Reconnaissance Energy Africa Ltd (TSX-V:RECO, OTCQX:RECAF) (ReconAfrica) said Thursday it is advancing preparations to drill its largest exploration target to date, Prospect I, in Namibia, while expanding its footprint in the Etosha-Okavango basin with a new joint venture in Angola. CEO Brian Reinsborough said the company remains “excited” about the potential of Prospect I, located on Petroleum Exploration License 073 (PEL 73), and expects the rig to move on site by late June, with spud to follow shortly after.

Prospect Capital: Why I Am Buying The 25% Dividend Cut

seekingalpha.com

2024-11-12 18:09:25Prospect Capital's 25% dividend cut, the first since 2017, shocked the market, causing a 15% stock plunge, but still offers a 12% yield. The dividend cut stems from a strategic shift to focus on higher-quality, secured loans, enhancing long-term return potential and portfolio quality. Despite the cut, Prospect Capital's low non-accrual ratio and excessive NAV discount present a compelling risk/reward opportunity for high-risk-tolerant investors.

Prospect Capital: Bad Reputation But Enticing Value

seekingalpha.com

2024-09-15 09:27:37Prospect Capital offers a remarkable 13% yield, supported by strong balance sheet quality and a well-performing investment portfolio. The BDC's favorable non-accrual trend and healthy dividend coverage profile make it an attractive buy for dividend investors. Despite a near-40% discount to NAV, Prospect Capital's dividend is well-supported,.

Prospect Capital: Surprisingly Well-Covered 14% Yield

seekingalpha.com

2024-09-01 13:31:43Prospect Capital's 14% dividend yield is sustainable, supported by a 70% LTM dividend pay-out ratio and a low non-accrual ratio of 0.3%. The stock's 40% discount to net asset value is exaggerated given its robust financial condition and strong credit quality. Prospect Capital's portfolio performance is solid, with impressive loan quality and substantial excess coverage for passive income investors.

Prospect Capital: The 12.7% Dividend Yield Could Be At Risk

seekingalpha.com

2024-05-23 11:16:35Prospect Capital's monthly cash dividend remains unchanged at $0.06 per share, resulting in a 12.7% dividend yield. The BDC's net investment income for the third quarter beat consensus but was down sequentially and from the year-ago quarter. Prospect Capital is not fully covering its current dividend distributions. This could be ominous as the Fed looks set to cut interest rates.

How To Get CEF Yields Without CEF Problems

seekingalpha.com

2020-08-21 00:35:07With the market entering its sixth month of recovery and valuations becoming ever more expensive, investors may be looking how to bulletproof their portfolios.

BT Wealth Management LLC Reduces Stock Position in Prospect Capital Co. (NASDAQ:PSEC)

thelincolnianonline.com

2020-05-01 10:10:48BT Wealth Management LLC reduced its stake in Prospect Capital Co. (NASDAQ:PSEC) by 21.0% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 18,840 shares of the financial services provider’s stock after selling 5,000 shares during the period. BT Wealth Management LLC’s […]

Biltmore Capital Advisors LLC Sells 27,000 Shares of Prospect Capital Co. (NASDAQ:PSEC)

thelincolnianonline.com

2020-05-01 09:00:43Biltmore Capital Advisors LLC lessened its holdings in Prospect Capital Co. (NASDAQ:PSEC) by 56.3% in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 21,000 shares of the financial services provider’s stock after selling 27,000 shares during the quarter. Biltmore Capital Advisors LLC’s holdings […]

Prospect Capital (NASDAQ:PSEC) Upgraded to "Sell" by BidaskClub

thelincolnianonline.com

2020-04-30 09:24:08Prospect Capital (NASDAQ:PSEC) was upgraded by investment analysts at BidaskClub from a “strong sell” rating to a “sell” rating in a note issued to investors on Thursday, BidAskClub reports. Several other research firms have also issued reports on PSEC. ValuEngine lowered Prospect Capital from a “hold” rating to a “sell” rating in a research note […]

This Stock Has A 16.74% Yield And Sells For Less Than Book

forbes.com

2020-04-29 13:10:28Prospect Capital has been named as a Top 25 dividend stock, according the most recent Dividend Channel ''DividendRank'' report.

Prospect Capital (NASDAQ:PSEC) Trading Up 5%

thelincolnianonline.com

2020-04-26 08:24:43Shares of Prospect Capital Co. (NASDAQ:PSEC) were up 5% on Friday . The company traded as high as $4.20 and last traded at $4.20, approximately 2,620,570 shares changed hands during mid-day trading. A decline of 27% from the average daily volume of 3,599,266 shares. The stock had previously closed at $4.00. A number of research […]

Raymond James Lowers Prospect Capital (NASDAQ:PSEC) to Underperform

thelincolnianonline.com

2020-04-24 10:06:44Raymond James downgraded shares of Prospect Capital (NASDAQ:PSEC) from a market perform rating to an underperform rating in a research report sent to investors on Monday morning, Benzinga reports. Other research analysts have also issued research reports about the company. ValuEngine lowered Prospect Capital from a hold rating to a sell rating in a report […]

PSEC: A Likely Dividend Cut For This 18% Yielder?

talkmarkets.com

2020-04-22 23:56:23Considering its high debt load, its likelihood of reduced net investment income, and its tendency to lower the dividend when times get tough, Prospect Capital’s dividend cannot be considered safe. Expect a dividend cut in the next 12 months.

BidaskClub Downgrades Prospect Capital (NASDAQ:PSEC) to Strong Sell

thelincolnianonline.com

2020-04-22 07:38:47Prospect Capital (NASDAQ:PSEC) was downgraded by stock analysts at BidaskClub from a “sell” rating to a “strong sell” rating in a report released on Wednesday, BidAskClub reports. PSEC has been the subject of several other research reports. Zacks Investment Research downgraded shares of Prospect Capital from a “buy” rating to a “hold” rating in a […]

10 High-Yield Monthly Dividend Stocks to Buy

investorplace.com

2020-04-17 15:26:23Not all dividend stocks pay investors on a quarterly basis. These names will help you pay your monthly bills.

These 37 Companies Teeter On The Verge Of 'Junk'

investors.com

2020-04-17 12:00:46The coronavirus stock market crash is doing the unimaginable: Turning once rock-solid S&P 500 companies into junk. And it's happening fast.