PagSeguro Digital Ltd. (PAGS)

Price:

10.61 USD

( - -0.02 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

UiPath Inc.

VALUE SCORE:

8

2nd position

Toast, Inc.

VALUE SCORE:

9

The best

Samsara Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

PagSeguro Digital Ltd., together with its subsidiaries, provides financial technology solutions and services for consumers, individual entrepreneurs, micro-merchants, and small and medium-sized companies in Brazil and internationally. The company's products and services include PagSeguro Ecosystem, a digital ecosystem that operates as a closed loop where its clients are able to address their primary day to day financial needs, including receiving and spending funds, and managing and growing their businesses; PagBank digital account, which offers banking services through the PagBank mobile app, as well as centralizes various cash-in options, functionalities, services, and cash-out options in a single ecosystem; and PlugPag, a tool for medium-sized and larger merchants that enables them to connect their point of sale (POS) device directly to their enterprise resource planning software or sales automation system through Bluetooth. It also offers cash-in solutions; online and in-person payment tools; and online gaming and cross-border digital services, as well as issues prepaid, credit, and cash cards. In addition, the company provides functionalities, and value-added services and features, such as purchase protection mechanisms, antifraud platform, account and business management tools, and POS app; and operates an online platform that facilitates peer-to-peer lending. Further, it is involved in processing of back-office solutions, including sales reconciliation, and gateway solutions and services, as well as the capture of credit cards with acquirers and sub acquirers. The company was founded in 2006 and is headquartered in São Paulo, Brazil.

NEWS

PagSeguro Digital Ltd. (PAGS) Registers a Bigger Fall Than the Market: Important Facts to Note

zacks.com

2026-02-23 19:16:21PagSeguro Digital Ltd. (PAGS) reached $10.57 at the closing of the latest trading day, reflecting a -6.38% change compared to its last close.

CenterBook Partners LP Acquires Shares of 100,843 PagSeguro Digital Ltd. $PAGS

defenseworld.net

2026-02-21 04:08:49CenterBook Partners LP bought a new position in PagSeguro Digital Ltd. (NYSE: PAGS) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 100,843 shares of the company's stock, valued at approximately $1,008,000. A number of other large investors have also

PagSeguro Digital Ltd. (PAGS) Stock Slides as Market Rises: Facts to Know Before You Trade

zacks.com

2026-02-17 19:16:15PagSeguro Digital Ltd. (PAGS) closed the most recent trading day at $10.29, moving 2.46% from the previous trading session.

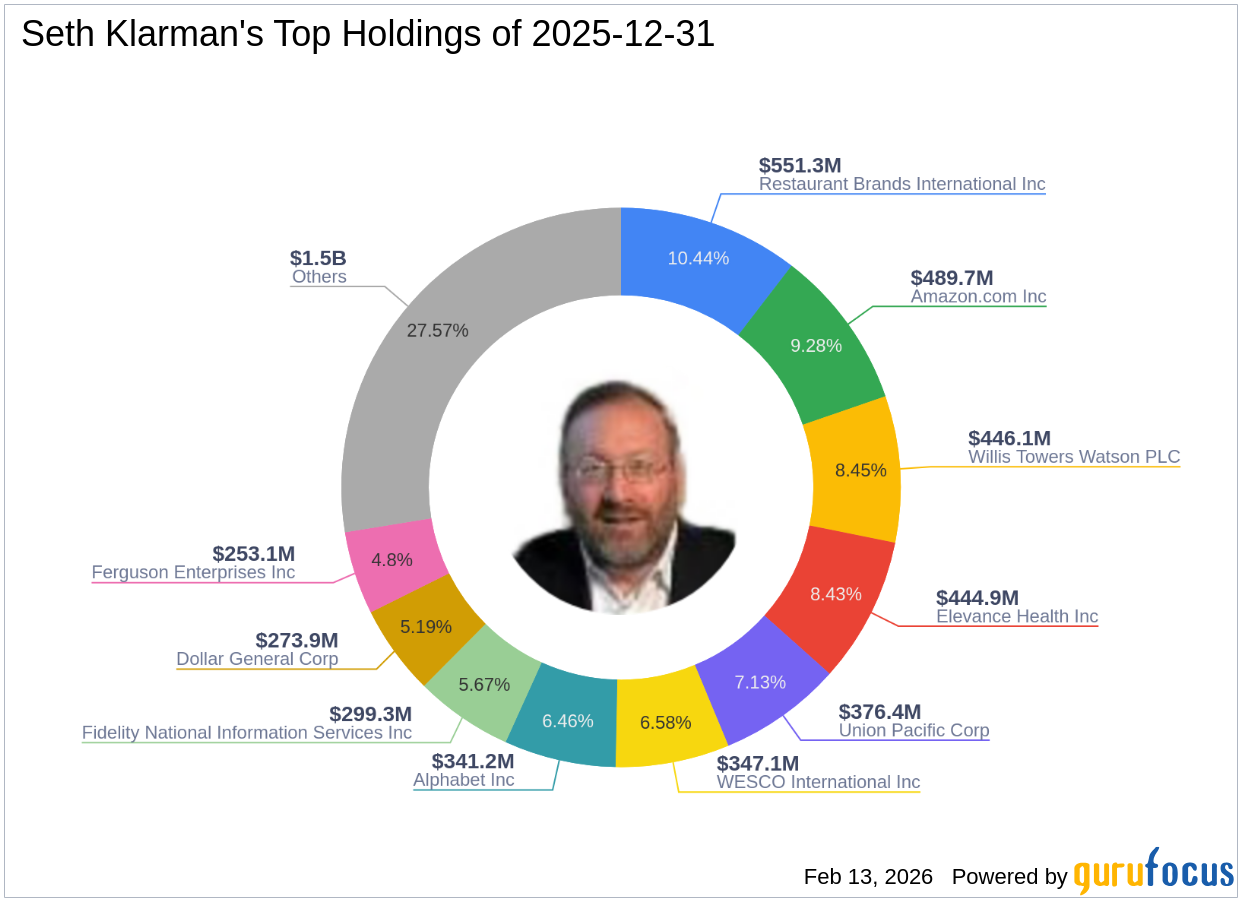

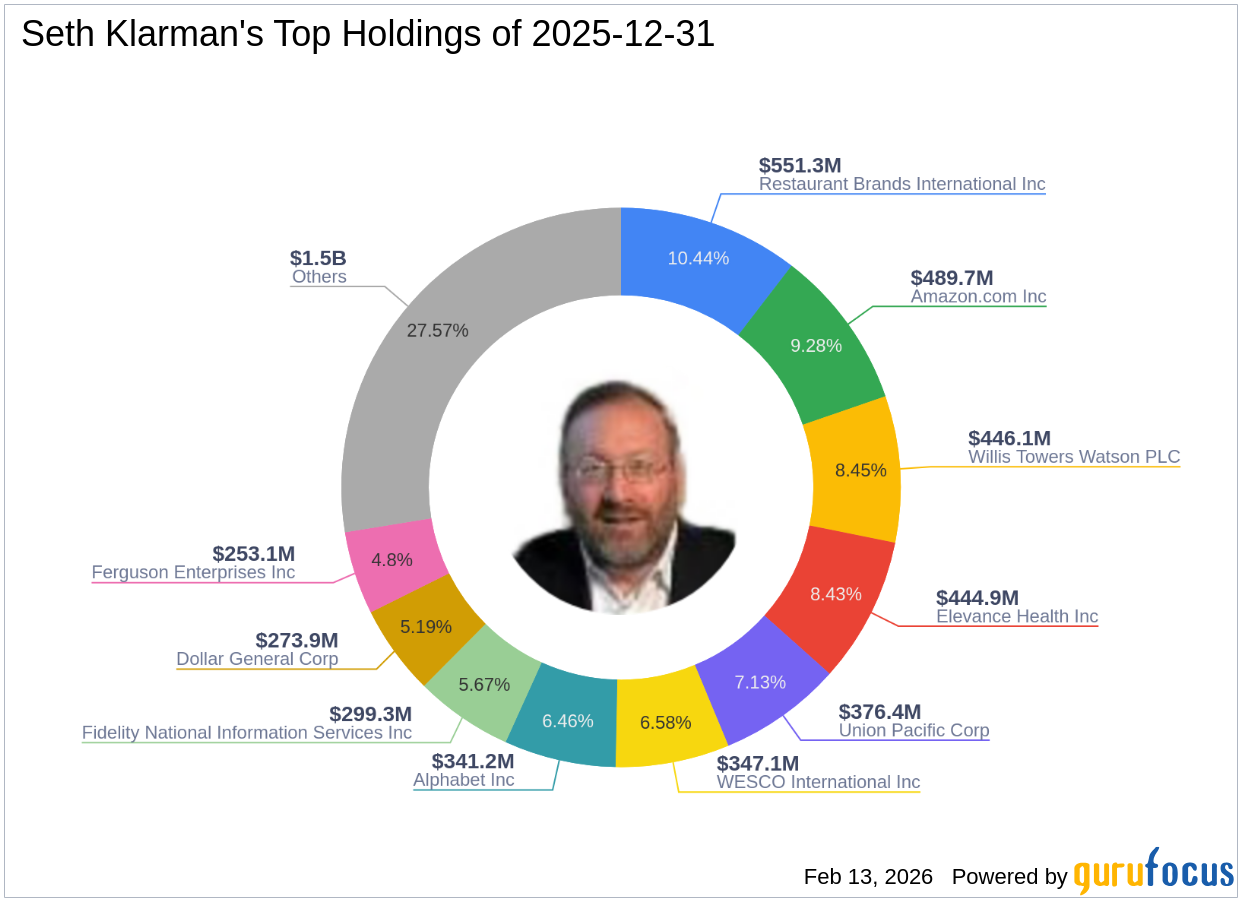

Seth Klarman's Strategic Moves: Amazon.com Inc. Takes Center Stage with 9.28% Portfolio Share

gurufocus.com

2026-02-13 18:01:00Insight into Seth Klarman (Trades, Portfolio)'s Fourth Quarter 2025 Investment Decisions Seth Klarman (Trades, Portfolio) recently submitted the 13F filing for

PagSeguro Digital Ltd. (PAGS) Earnings Expected to Grow: What to Know Ahead of Q4 Release

zacks.com

2026-02-13 11:01:21PagSeguro Digital (PAGS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why PagSeguro Digital Ltd. (PAGS) Dipped More Than Broader Market Today

zacks.com

2026-02-11 19:15:30In the latest trading session, PagSeguro Digital Ltd. (PAGS) closed at $11.17, marking a -1.24% move from the previous day.

SaaSmageddon Is Here – and Not All Software Stocks Will Survive

investorplace.com

2026-02-09 00:00:00An explanation of why software stocks - especially SaaS - are being structurally disrupted by AI, and how investors can identify survivors.

PagSeguro Digital Ltd. (PAGS) Suffers a Larger Drop Than the General Market: Key Insights

zacks.com

2026-02-04 19:15:27PagSeguro Digital Ltd. (PAGS) closed at $10.86 in the latest trading session, marking a -4.23% move from the prior day.

Here Are Friday’s Top Wall Street Analyst Research Calls: Broadcom, Circle Internet, Kenvue, Medtronic, Sandisk, Southwest Airlines, Spotify, and More

247wallst.com

2026-01-30 07:59:10Pre-Market Stock Futures: Futures are trading lower as we prepare to close out the trading week. What a difference a day can make. After a blockbuster rally on Wednesday, the stock market reversed course and sold off on Thursday, and that could carry over into today. While the major indices ended off their midday lows,... Here Are Friday's Top Wall Street Analyst Research Calls: Broadcom, Circle Internet, Kenvue, Medtronic, Sandisk, Southwest Airlines, Spotify, and More.

PagSeguro Digital Ltd. (PAGS) Increases Despite Market Slip: Here's What You Need to Know

zacks.com

2026-01-28 19:16:04The latest trading day saw PagSeguro Digital Ltd. (PAGS) settling at $11.97, representing a +1.18% change from its previous close.

Contrasting Joint Stock Company Kaspi.kz (NASDAQ:KSPI) & PagSeguro Digital (NYSE:PAGS)

defenseworld.net

2026-01-20 06:13:08PagSeguro Digital (NYSE: PAGS - Get Free Report) and Joint Stock Company Kaspi.kz (NASDAQ: KSPI - Get Free Report) are both business services companies, but which is the better stock? We will compare the two businesses based on the strength of their dividends, analyst recommendations, valuation, earnings, risk, institutional ownership and profitability. Insider and Institutional Ownership 45.9%

Critical Analysis: Shift4 Payments (NYSE:FOUR) vs. PagSeguro Digital (NYSE:PAGS)

defenseworld.net

2026-01-16 01:22:53Shift4 Payments (NYSE: FOUR - Get Free Report) and PagSeguro Digital (NYSE: PAGS - Get Free Report) are both mid-cap business services companies, but which is the superior business? We will compare the two businesses based on the strength of their earnings, dividends, risk, institutional ownership, profitability, analyst recommendations and valuation. Analyst Ratings This is a summary

PagSeguro Digital Ltd. (PAGS) Declines More Than Market: Some Information for Investors

zacks.com

2026-01-13 19:15:37PagSeguro Digital Ltd. (PAGS) concluded the recent trading session at $10.13, signifying a -2.88% move from its prior day's close.

Contrasting PagSeguro Digital (NYSE:PAGS) & Expensify (NASDAQ:EXFY)

defenseworld.net

2026-01-11 03:20:55Expensify (NASDAQ: EXFY - Get Free Report) and PagSeguro Digital (NYSE: PAGS - Get Free Report) are both business services companies, but which is the better stock? We will compare the two companies based on the strength of their dividends, institutional ownership, analyst recommendations, profitability, valuation, earnings and risk. Valuation and Earnings This table compares Expensify and

Here's Why PagSeguro Digital Ltd. (PAGS) Fell More Than Broader Market

zacks.com

2026-01-07 19:15:58In the closing of the recent trading day, PagSeguro Digital Ltd. (PAGS) stood at $9.62, denoting a -2.83% move from the preceding trading day.

PagSeguro: Undervalued Double-Digit Growth And Yield Amid Rising Global Uncertainty

seekingalpha.com

2026-01-01 05:29:14PagSeguro Digital is rated a Strong Buy, supported by robust financials, double-digit EPS growth, and significant shareholder returns that were ramped up. PAGS recently delivered 14% EPS growth, 14% revenue growth, and 50% higher banking income, demonstrating resilience amid macroeconomic pressures. Updated guidance forecasts 13% to 15% EPS growth and R$2.2 to R$2.3 billion in CAPEX, with at least R$1.4 billion in dividends and major buybacks planned for 2026.

PagSeguro Digital Ltd. (PAGS) Registers a Bigger Fall Than the Market: Important Facts to Note

zacks.com

2026-02-23 19:16:21PagSeguro Digital Ltd. (PAGS) reached $10.57 at the closing of the latest trading day, reflecting a -6.38% change compared to its last close.

CenterBook Partners LP Acquires Shares of 100,843 PagSeguro Digital Ltd. $PAGS

defenseworld.net

2026-02-21 04:08:49CenterBook Partners LP bought a new position in PagSeguro Digital Ltd. (NYSE: PAGS) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 100,843 shares of the company's stock, valued at approximately $1,008,000. A number of other large investors have also

PagSeguro Digital Ltd. (PAGS) Stock Slides as Market Rises: Facts to Know Before You Trade

zacks.com

2026-02-17 19:16:15PagSeguro Digital Ltd. (PAGS) closed the most recent trading day at $10.29, moving 2.46% from the previous trading session.

Seth Klarman's Strategic Moves: Amazon.com Inc. Takes Center Stage with 9.28% Portfolio Share

gurufocus.com

2026-02-13 18:01:00Insight into Seth Klarman (Trades, Portfolio)'s Fourth Quarter 2025 Investment Decisions Seth Klarman (Trades, Portfolio) recently submitted the 13F filing for

PagSeguro Digital Ltd. (PAGS) Earnings Expected to Grow: What to Know Ahead of Q4 Release

zacks.com

2026-02-13 11:01:21PagSeguro Digital (PAGS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why PagSeguro Digital Ltd. (PAGS) Dipped More Than Broader Market Today

zacks.com

2026-02-11 19:15:30In the latest trading session, PagSeguro Digital Ltd. (PAGS) closed at $11.17, marking a -1.24% move from the previous day.

SaaSmageddon Is Here – and Not All Software Stocks Will Survive

investorplace.com

2026-02-09 00:00:00An explanation of why software stocks - especially SaaS - are being structurally disrupted by AI, and how investors can identify survivors.

PagSeguro Digital Ltd. (PAGS) Suffers a Larger Drop Than the General Market: Key Insights

zacks.com

2026-02-04 19:15:27PagSeguro Digital Ltd. (PAGS) closed at $10.86 in the latest trading session, marking a -4.23% move from the prior day.

Here Are Friday’s Top Wall Street Analyst Research Calls: Broadcom, Circle Internet, Kenvue, Medtronic, Sandisk, Southwest Airlines, Spotify, and More

247wallst.com

2026-01-30 07:59:10Pre-Market Stock Futures: Futures are trading lower as we prepare to close out the trading week. What a difference a day can make. After a blockbuster rally on Wednesday, the stock market reversed course and sold off on Thursday, and that could carry over into today. While the major indices ended off their midday lows,... Here Are Friday's Top Wall Street Analyst Research Calls: Broadcom, Circle Internet, Kenvue, Medtronic, Sandisk, Southwest Airlines, Spotify, and More.

PagSeguro Digital Ltd. (PAGS) Increases Despite Market Slip: Here's What You Need to Know

zacks.com

2026-01-28 19:16:04The latest trading day saw PagSeguro Digital Ltd. (PAGS) settling at $11.97, representing a +1.18% change from its previous close.

Contrasting Joint Stock Company Kaspi.kz (NASDAQ:KSPI) & PagSeguro Digital (NYSE:PAGS)

defenseworld.net

2026-01-20 06:13:08PagSeguro Digital (NYSE: PAGS - Get Free Report) and Joint Stock Company Kaspi.kz (NASDAQ: KSPI - Get Free Report) are both business services companies, but which is the better stock? We will compare the two businesses based on the strength of their dividends, analyst recommendations, valuation, earnings, risk, institutional ownership and profitability. Insider and Institutional Ownership 45.9%

Critical Analysis: Shift4 Payments (NYSE:FOUR) vs. PagSeguro Digital (NYSE:PAGS)

defenseworld.net

2026-01-16 01:22:53Shift4 Payments (NYSE: FOUR - Get Free Report) and PagSeguro Digital (NYSE: PAGS - Get Free Report) are both mid-cap business services companies, but which is the superior business? We will compare the two businesses based on the strength of their earnings, dividends, risk, institutional ownership, profitability, analyst recommendations and valuation. Analyst Ratings This is a summary

PagSeguro Digital Ltd. (PAGS) Declines More Than Market: Some Information for Investors

zacks.com

2026-01-13 19:15:37PagSeguro Digital Ltd. (PAGS) concluded the recent trading session at $10.13, signifying a -2.88% move from its prior day's close.

Contrasting PagSeguro Digital (NYSE:PAGS) & Expensify (NASDAQ:EXFY)

defenseworld.net

2026-01-11 03:20:55Expensify (NASDAQ: EXFY - Get Free Report) and PagSeguro Digital (NYSE: PAGS - Get Free Report) are both business services companies, but which is the better stock? We will compare the two companies based on the strength of their dividends, institutional ownership, analyst recommendations, profitability, valuation, earnings and risk. Valuation and Earnings This table compares Expensify and

Here's Why PagSeguro Digital Ltd. (PAGS) Fell More Than Broader Market

zacks.com

2026-01-07 19:15:58In the closing of the recent trading day, PagSeguro Digital Ltd. (PAGS) stood at $9.62, denoting a -2.83% move from the preceding trading day.

PagSeguro: Undervalued Double-Digit Growth And Yield Amid Rising Global Uncertainty

seekingalpha.com

2026-01-01 05:29:14PagSeguro Digital is rated a Strong Buy, supported by robust financials, double-digit EPS growth, and significant shareholder returns that were ramped up. PAGS recently delivered 14% EPS growth, 14% revenue growth, and 50% higher banking income, demonstrating resilience amid macroeconomic pressures. Updated guidance forecasts 13% to 15% EPS growth and R$2.2 to R$2.3 billion in CAPEX, with at least R$1.4 billion in dividends and major buybacks planned for 2026.