Opendoor Technologies Inc. (OPEN)

Price:

8.14 USD

( - -0.35 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Brookfield Property Partners L.P.

VALUE SCORE:

6

2nd position

CoStar Group, Inc.

VALUE SCORE:

8

The best

Wetouch Technology Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

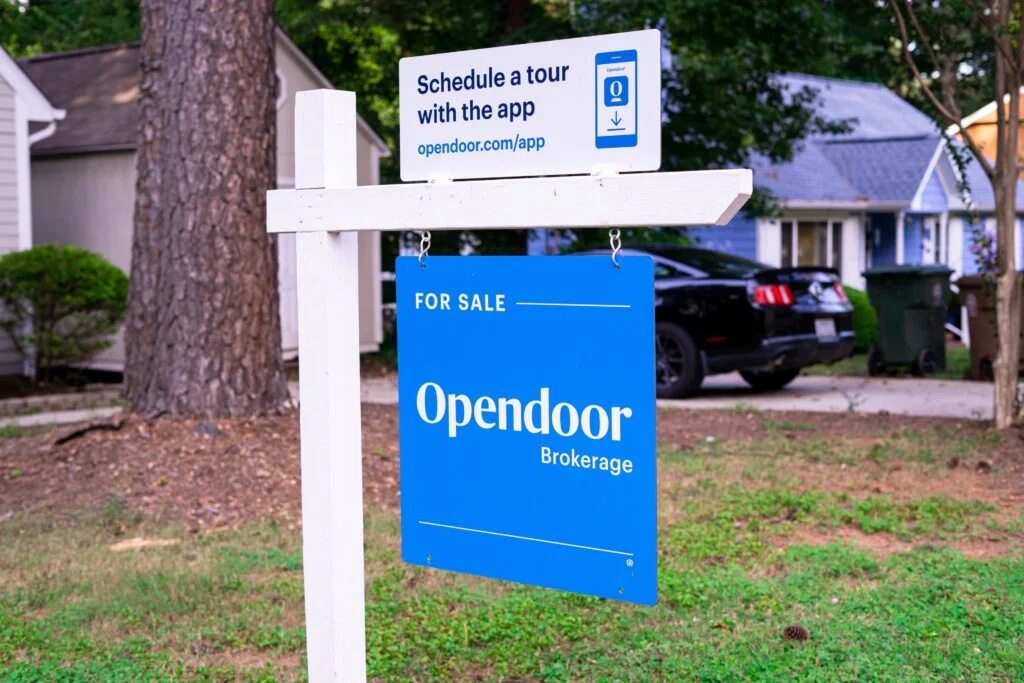

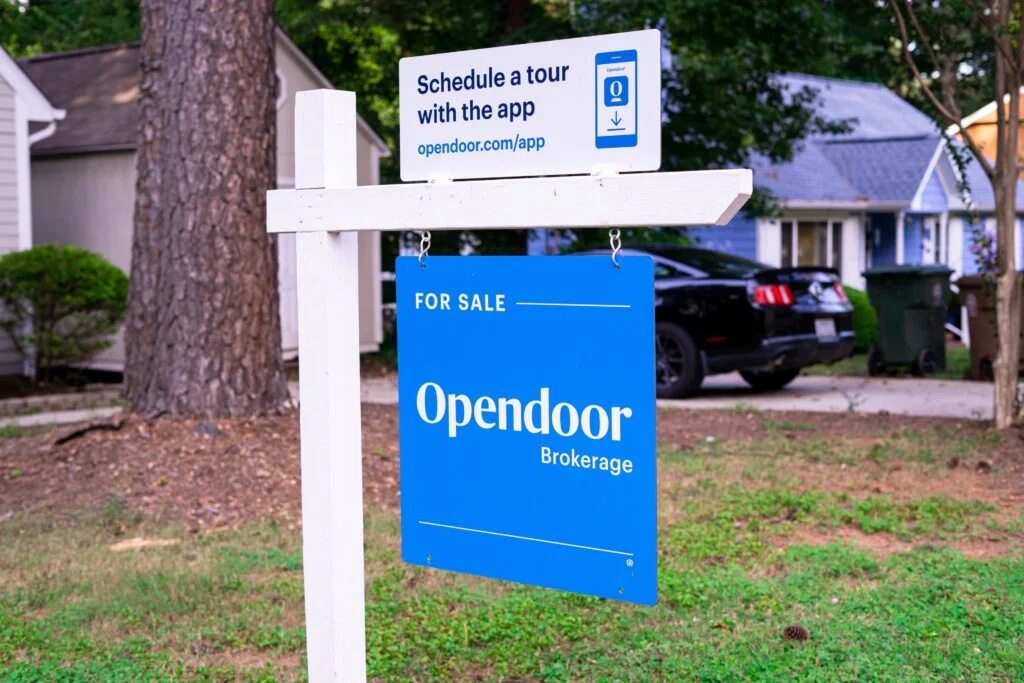

Opendoor Technologies Inc. operates a digital platform for residential real estate in the United States. The company's platform enables consumers to buy and sell a home online. It also provides title insurance and escrow services. Opendoor Technologies Inc. was incorporated in 2013 and is based in Tempe, Arizona.

NEWS

Opendoor to Report Third Quarter 2025 Financial Results on November 6th, 2025

globenewswire.com

2025-10-09 09:00:00SAN FRANCISCO, Oct. 09, 2025 (GLOBE NEWSWIRE) -- Opendoor Technologies Inc. (“Opendoor”) (Nasdaq: OPEN), a leading e-commerce platform for residential real estate transactions, today announced that it will report third quarter 2025 financial results for the period ended September 30, 2025 following the close of the market on Thursday, November 6, 2025. On that day, management will host a conference call and webcast at 2:00 p.m.

Is Opendoor Stock Worth Buying Now?

fool.com

2025-10-09 06:22:00To call Opendoor's (OPEN -8.45%) recent stock performance strong would be an understatement. However, the real estate disruptor's stock is starting to remind me of the 2021 meme stock craze, and not in a good way.

These 5 Beaten-Down Tech Stocks Could Catch Fire Next

marketbeat.com

2025-10-08 17:48:01Short interest is a powerful market force that can not only cap gains but drive share prices lower, but not always. Sometimes, even the short sellers get things wrong.

Roundhill Brings Back a Meme Stock ETF. Opendoor, Rigetti, Bloom Energy Make the Cut.

barrons.com

2025-10-08 11:38:00The relaunched fund shows how the idea of meme stocks has evolved.

Can Opendoor Be Like Tesla? Eric Jackson Thinks So

benzinga.com

2025-10-07 19:07:19Eric Jackson, outspoken supporter of Opendoor Technologies, Inc. (NASDAQ:OPEN), believes the U.S. housing market is ready to enter a new phase of growth.

This Stock Is Up 400% in 2025, and With a Brand New CEO, It Could Keep Climbing

fool.com

2025-10-07 03:55:00Share prices of Opendoor Technologies (OPEN 14.43%) have risen a shocking 400% so far in 2025. Most of that gain has come in just the last couple of months, which has been a time of massive change for the company.

How Strong Is Opendoor's Seller Funnel After Platform Shift?

zacks.com

2025-10-06 11:06:06OPEN's agent-led platform shift is doubling seller conversions and reshaping its capital-light growth strategy.

Why Opendoor Technologies Stock Is Gaining Today

fool.com

2025-10-03 16:03:51Opendoor Technologies (OPEN 1.25%) stock is in the green in Friday's trading. The company's share price was up 3.3% as of 2:30 p.m.

Should Investors Buy Opendoor Stock Right Now?

fool.com

2025-10-03 06:15:00Opendoor (OPEN -0.50%) is one of the most popular stocks in the market right now.

Opendoor Hype Won't Make Its Business Any More Viable

wsj.com

2025-10-03 05:30:00The loss-making house flipper has become a meme stock.

Can New Opendoor CEO Kaz Nejatian Help the Stock Sustain Recent Highs?

fool.com

2025-10-03 05:15:00Just a short while ago, Opendoor (OPEN -0.50%) was on the verge of being delisted by the Nasdaq stock exchange. It was planning on conducting a reverse stock split to avoid that fate.

Opendoor Stock Just Soared 450% -- Is It Too Late to Buy?

fool.com

2025-10-03 05:00:00Opendoor (OPEN -0.50%) has staged a massive comeback, soaring 450% year to date. With a new CEO, bold national expansion plans, and a dominant position in the iBuyer space, the company could disrupt real estate at scale.

Opendoor's Buyer Perks Are A 'Nothing Burger' — Business Model Still A Mystery, Says Hedge Funder

benzinga.com

2025-10-02 12:37:23Hedge fund manager George Noble posted a bold criticism of Opendoor Technologies, Inc.'s (NASDAQ:OPEN) latest product rollouts in a social media post on Wednesday night.

This Is Opendoor's Biggest Risk (Hint: It's Not the Housing Market)

fool.com

2025-10-02 06:00:00Opendoor Technologies (OPEN 1.13%) is in the business of iBuying, which involves buying and selling houses. If the housing market is in good shape, then that can result in a lot of business for the company.

Opendoor Stock Is Dropping. Should You Buy It on the Dip?

fool.com

2025-09-30 13:43:00If you hadn't heard of Opendoor Technologies (OPEN -2.07%) before June, chances are you've heard of it since. Opendoor stock has had an unparalleled rally over the past few months, fueled by retail investor power and the strength of social media.

How Strong Is OPEN's Liquidity Position Amid a Housing Market Slowdown?

zacks.com

2025-09-30 10:31:37Opendoor's $1.1B capital base, boosted by new debt financing, gives it liquidity to face housing market headwinds.

No data to display

Opendoor to Report Third Quarter 2025 Financial Results on November 6th, 2025

globenewswire.com

2025-10-09 09:00:00SAN FRANCISCO, Oct. 09, 2025 (GLOBE NEWSWIRE) -- Opendoor Technologies Inc. (“Opendoor”) (Nasdaq: OPEN), a leading e-commerce platform for residential real estate transactions, today announced that it will report third quarter 2025 financial results for the period ended September 30, 2025 following the close of the market on Thursday, November 6, 2025. On that day, management will host a conference call and webcast at 2:00 p.m.

Is Opendoor Stock Worth Buying Now?

fool.com

2025-10-09 06:22:00To call Opendoor's (OPEN -8.45%) recent stock performance strong would be an understatement. However, the real estate disruptor's stock is starting to remind me of the 2021 meme stock craze, and not in a good way.

These 5 Beaten-Down Tech Stocks Could Catch Fire Next

marketbeat.com

2025-10-08 17:48:01Short interest is a powerful market force that can not only cap gains but drive share prices lower, but not always. Sometimes, even the short sellers get things wrong.

Roundhill Brings Back a Meme Stock ETF. Opendoor, Rigetti, Bloom Energy Make the Cut.

barrons.com

2025-10-08 11:38:00The relaunched fund shows how the idea of meme stocks has evolved.

Can Opendoor Be Like Tesla? Eric Jackson Thinks So

benzinga.com

2025-10-07 19:07:19Eric Jackson, outspoken supporter of Opendoor Technologies, Inc. (NASDAQ:OPEN), believes the U.S. housing market is ready to enter a new phase of growth.

This Stock Is Up 400% in 2025, and With a Brand New CEO, It Could Keep Climbing

fool.com

2025-10-07 03:55:00Share prices of Opendoor Technologies (OPEN 14.43%) have risen a shocking 400% so far in 2025. Most of that gain has come in just the last couple of months, which has been a time of massive change for the company.

How Strong Is Opendoor's Seller Funnel After Platform Shift?

zacks.com

2025-10-06 11:06:06OPEN's agent-led platform shift is doubling seller conversions and reshaping its capital-light growth strategy.

Why Opendoor Technologies Stock Is Gaining Today

fool.com

2025-10-03 16:03:51Opendoor Technologies (OPEN 1.25%) stock is in the green in Friday's trading. The company's share price was up 3.3% as of 2:30 p.m.

Should Investors Buy Opendoor Stock Right Now?

fool.com

2025-10-03 06:15:00Opendoor (OPEN -0.50%) is one of the most popular stocks in the market right now.

Opendoor Hype Won't Make Its Business Any More Viable

wsj.com

2025-10-03 05:30:00The loss-making house flipper has become a meme stock.

Can New Opendoor CEO Kaz Nejatian Help the Stock Sustain Recent Highs?

fool.com

2025-10-03 05:15:00Just a short while ago, Opendoor (OPEN -0.50%) was on the verge of being delisted by the Nasdaq stock exchange. It was planning on conducting a reverse stock split to avoid that fate.

Opendoor Stock Just Soared 450% -- Is It Too Late to Buy?

fool.com

2025-10-03 05:00:00Opendoor (OPEN -0.50%) has staged a massive comeback, soaring 450% year to date. With a new CEO, bold national expansion plans, and a dominant position in the iBuyer space, the company could disrupt real estate at scale.

Opendoor's Buyer Perks Are A 'Nothing Burger' — Business Model Still A Mystery, Says Hedge Funder

benzinga.com

2025-10-02 12:37:23Hedge fund manager George Noble posted a bold criticism of Opendoor Technologies, Inc.'s (NASDAQ:OPEN) latest product rollouts in a social media post on Wednesday night.

This Is Opendoor's Biggest Risk (Hint: It's Not the Housing Market)

fool.com

2025-10-02 06:00:00Opendoor Technologies (OPEN 1.13%) is in the business of iBuying, which involves buying and selling houses. If the housing market is in good shape, then that can result in a lot of business for the company.

Opendoor Stock Is Dropping. Should You Buy It on the Dip?

fool.com

2025-09-30 13:43:00If you hadn't heard of Opendoor Technologies (OPEN -2.07%) before June, chances are you've heard of it since. Opendoor stock has had an unparalleled rally over the past few months, fueled by retail investor power and the strength of social media.

How Strong Is OPEN's Liquidity Position Amid a Housing Market Slowdown?

zacks.com

2025-09-30 10:31:37Opendoor's $1.1B capital base, boosted by new debt financing, gives it liquidity to face housing market headwinds.