Omega Flex, Inc. (OFLX)

Price:

36.27 USD

( - -0.29 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Nordson Corporation

VALUE SCORE:

7

2nd position

American Superconductor Corporation

VALUE SCORE:

10

The best

Roper Technologies, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

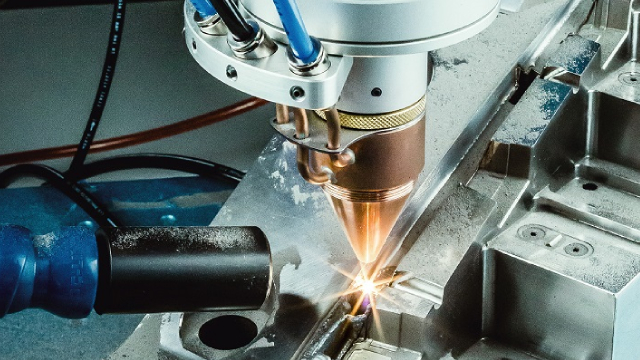

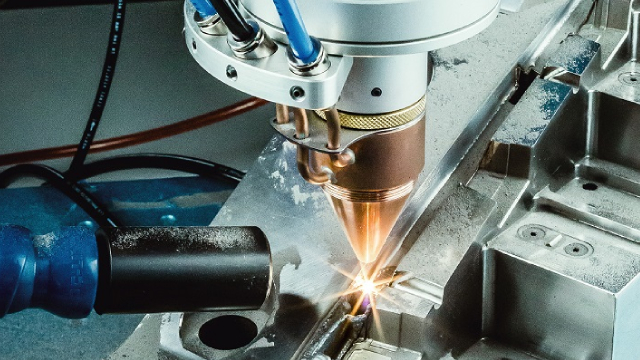

Omega Flex, Inc., together with its subsidiaries, manufactures and sells flexible metal hoses and accessories in North America and internationally. It offers flexible gas piping for use in residential and commercial buildings, as well as its fittings; and corrugated medical tubing for use in hospitals, ambulatory care centers, dental, physician and veterinary clinics, laboratories, and other facilities. The company sells its products under the TracPipe, CounterStrike, AutoSnap, AutoFlare, DoubleTrac, DEF-Trac, and MediTrac brand names. It serves various markets, including construction, manufacturing, transportation, petrochemical, pharmaceutical, and other industries. The company sells its products through independent sales representatives, distributors, original equipment manufacturers, and direct sales, as well as through its website. The company was formerly known as Tofle America, Inc. and changed its name to Omega Flex, Inc. in 1996. Omega Flex, Inc. was incorporated in 1975 and is based in Exton, Pennsylvania.

NEWS

The Zacks Analyst Blog Johnson & Johnson, Netflix, Arista Networks, Omega and AXIL

zacks.com

2026-01-29 04:56:05Johnson & Johnson leads Zacks' latest Analyst Blog as new research highlights earnings beats, growth drivers, and risks across major and micro-cap stocks.

Omega Flex (NASDAQ:OFLX) Share Price Passes Below 200 Day Moving Average – Here’s What Happened

defenseworld.net

2025-12-25 03:13:02Shares of Omega Flex, Inc. (NASDAQ: OFLX - Get Free Report) passed below its 200-day moving average during trading on Wednesday. The stock has a 200-day moving average of $31.49 and traded as low as $28.51. Omega Flex shares last traded at $29.35, with a volume of 70,522 shares changing hands. Analyst Ratings Changes Separately,

Omega Flex, Inc. Announces Regular Quarterly Dividend for the Fourth Quarter 2025

globenewswire.com

2025-12-05 16:15:00EXTON, Pa., Dec. 05, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on January 7, 2026, to shareholders of record on December 19, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex's Q3 Earnings Slip Y/Y Due to Elevated Costs

zacks.com

2025-11-04 13:36:08OFLX's Q3 earnings and revenues decline year over year as higher staffing costs and tariffs pressure margins, while weak housing demand keep sales under pressure despite a solid cash position.

Omega Flex, Inc. Announces Regular Quarterly Dividend for the Third Quarter 2025

globenewswire.com

2025-09-12 16:20:00EXTON, Pa., Sept. 12, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on October 8, 2025, to shareholders of record on September 25, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex: A Robust Business, But Fairly Valued

seekingalpha.com

2025-08-07 10:30:00Omega Flex delivered solid H1 results, with stable revenues and strong free cash flow, fully covering its dividend payouts. The company boasts a fortress-like balance sheet, holding over $50 million in cash and zero debt, supporting financial stability. Despite a reasonable valuation and niche market strength, shares trade at about 20x earnings and a double-digit EV/EBITDA, limiting upside.

OFLX's Q2 Earnings Slip Y/Y Amid Housing Market Slowdown

zacks.com

2025-08-05 14:45:16Despite higher sales, Omega Flex sees a year-over-year drop in Q2 earnings as rising costs and a weak housing market pressured margins.

Omega Flex (OFLX) Q2 Revenue Rises 4%

fool.com

2025-07-31 23:06:37Omega Flex (OFLX -0.96%), a supplier of flexible metal hoses and piping systems for construction, medical, and industrial end markets, released its second quarter 2025 financial results on July 30, 2025. The earnings announcement showed revenue (GAAP) of $25.5 million, up 3.7% from the prior year.

Omega Flex, Inc. Announces Second Quarter 2025 Earnings

globenewswire.com

2025-07-30 16:15:00EXTON, Pa., July 30, 2025 (GLOBE NEWSWIRE) -- Dean W. Rivest, CEO, announced that net sales of Omega Flex, Inc. (the “Company”) for the first six months of 2025 and 2024 were $48,855,000 and $49,836,000, respectively, decreasing $981,000 or 2.0%. Net Sales for the three months ended June 30, 2025 were 3.7% higher than the second quarter of 2024.

Omega Flex, Inc. Announces Regular Quarterly Dividend for the Second Quarter 2025

globenewswire.com

2025-06-18 10:00:00EXTON, Pa., June 18, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on July 10, 2025, to shareholders of record on June 30, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex Q1 Earnings Drop Y/Y on Weak Housing Demand, Stock Down 2%

zacks.com

2025-05-06 15:20:32OFLX sees Q1 EPS and revenue decline year over year on weak housing demand, lower sales volumes, and market softness.

Omega Flex, Inc. Announces First Quarter 2025 Earnings

globenewswire.com

2025-04-30 16:15:00EXTON, Pa., April 30, 2025 (GLOBE NEWSWIRE) -- Dean W. Rivest, CEO, announced that net sales of Omega Flex, Inc. (the “Company”) for the first quarters of 2025 and 2024 were $23,330,000 and $25,216,000, respectively, decreasing $1,886,000 or 7.5%. Net income for the first quarters of 2025 and 2024 were $3,568,000 and $4,219,000, respectively, decreasing $651,000 or 15.4%. The decrease in net sales and net income was mainly due to lower sales unit volumes as the overall market continued to be suppressed because of, among other factors, a decline in housing starts.

Omega Flex, Inc. Announces Regular Quarterly Dividend for the First Quarter 2025

globenewswire.com

2025-03-27 16:15:00EXTON, Pa., March 27, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on April 22, 2025, to shareholders of record on April 10, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex Stock: Buy, Sell, or Hold?

fool.com

2025-03-22 06:15:00Omega Flex (OFLX 2.80%), a leading producer of flexible metal hose and piping products, is often considered a reliable long-term investment. Its pipes are used to deliver gas fuels in residential and commercial buildings, as well as liquid fuels for automotive customers, marinas, and back-up generators.

Omega Flex Stock Rises 8% Despite Q4 Earnings Falling Y/Y

zacks.com

2025-03-10 14:26:03OFLX sees lower Q4 earnings and sales but remains supported by a stable dividend and strong market position amid housing market challenges.

Omega Flex, Inc. Announces Fourth Quarter 2024 Earnings

globenewswire.com

2025-03-05 16:28:00EXTON, Pa., March 05, 2025 (GLOBE NEWSWIRE) -- Dean W. Rivest, CEO, announced that net sales of Omega Flex, Inc. (the “Company” or “Omega Flex”) (Nasdaq: OFLX) for 2024 and 2023 were $101,681,000 and $111,465,000, respectively, decreasing $9,784,000 or 8.8%. Net Sales for the fourth quarter of 2024 were 4.2% lower than during the same period in 2023. The decrease in net sales was mainly due to lower sales unit volumes as the overall market continued to be suppressed because of, among other factors, a decline in housing starts.

The Zacks Analyst Blog Johnson & Johnson, Netflix, Arista Networks, Omega and AXIL

zacks.com

2026-01-29 04:56:05Johnson & Johnson leads Zacks' latest Analyst Blog as new research highlights earnings beats, growth drivers, and risks across major and micro-cap stocks.

Omega Flex (NASDAQ:OFLX) Share Price Passes Below 200 Day Moving Average – Here’s What Happened

defenseworld.net

2025-12-25 03:13:02Shares of Omega Flex, Inc. (NASDAQ: OFLX - Get Free Report) passed below its 200-day moving average during trading on Wednesday. The stock has a 200-day moving average of $31.49 and traded as low as $28.51. Omega Flex shares last traded at $29.35, with a volume of 70,522 shares changing hands. Analyst Ratings Changes Separately,

Omega Flex, Inc. Announces Regular Quarterly Dividend for the Fourth Quarter 2025

globenewswire.com

2025-12-05 16:15:00EXTON, Pa., Dec. 05, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on January 7, 2026, to shareholders of record on December 19, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex's Q3 Earnings Slip Y/Y Due to Elevated Costs

zacks.com

2025-11-04 13:36:08OFLX's Q3 earnings and revenues decline year over year as higher staffing costs and tariffs pressure margins, while weak housing demand keep sales under pressure despite a solid cash position.

Omega Flex, Inc. Announces Regular Quarterly Dividend for the Third Quarter 2025

globenewswire.com

2025-09-12 16:20:00EXTON, Pa., Sept. 12, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on October 8, 2025, to shareholders of record on September 25, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex: A Robust Business, But Fairly Valued

seekingalpha.com

2025-08-07 10:30:00Omega Flex delivered solid H1 results, with stable revenues and strong free cash flow, fully covering its dividend payouts. The company boasts a fortress-like balance sheet, holding over $50 million in cash and zero debt, supporting financial stability. Despite a reasonable valuation and niche market strength, shares trade at about 20x earnings and a double-digit EV/EBITDA, limiting upside.

OFLX's Q2 Earnings Slip Y/Y Amid Housing Market Slowdown

zacks.com

2025-08-05 14:45:16Despite higher sales, Omega Flex sees a year-over-year drop in Q2 earnings as rising costs and a weak housing market pressured margins.

Omega Flex (OFLX) Q2 Revenue Rises 4%

fool.com

2025-07-31 23:06:37Omega Flex (OFLX -0.96%), a supplier of flexible metal hoses and piping systems for construction, medical, and industrial end markets, released its second quarter 2025 financial results on July 30, 2025. The earnings announcement showed revenue (GAAP) of $25.5 million, up 3.7% from the prior year.

Omega Flex, Inc. Announces Second Quarter 2025 Earnings

globenewswire.com

2025-07-30 16:15:00EXTON, Pa., July 30, 2025 (GLOBE NEWSWIRE) -- Dean W. Rivest, CEO, announced that net sales of Omega Flex, Inc. (the “Company”) for the first six months of 2025 and 2024 were $48,855,000 and $49,836,000, respectively, decreasing $981,000 or 2.0%. Net Sales for the three months ended June 30, 2025 were 3.7% higher than the second quarter of 2024.

Omega Flex, Inc. Announces Regular Quarterly Dividend for the Second Quarter 2025

globenewswire.com

2025-06-18 10:00:00EXTON, Pa., June 18, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on July 10, 2025, to shareholders of record on June 30, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex Q1 Earnings Drop Y/Y on Weak Housing Demand, Stock Down 2%

zacks.com

2025-05-06 15:20:32OFLX sees Q1 EPS and revenue decline year over year on weak housing demand, lower sales volumes, and market softness.

Omega Flex, Inc. Announces First Quarter 2025 Earnings

globenewswire.com

2025-04-30 16:15:00EXTON, Pa., April 30, 2025 (GLOBE NEWSWIRE) -- Dean W. Rivest, CEO, announced that net sales of Omega Flex, Inc. (the “Company”) for the first quarters of 2025 and 2024 were $23,330,000 and $25,216,000, respectively, decreasing $1,886,000 or 7.5%. Net income for the first quarters of 2025 and 2024 were $3,568,000 and $4,219,000, respectively, decreasing $651,000 or 15.4%. The decrease in net sales and net income was mainly due to lower sales unit volumes as the overall market continued to be suppressed because of, among other factors, a decline in housing starts.

Omega Flex, Inc. Announces Regular Quarterly Dividend for the First Quarter 2025

globenewswire.com

2025-03-27 16:15:00EXTON, Pa., March 27, 2025 (GLOBE NEWSWIRE) -- Omega Flex, Inc. (the “Company”) (NASDAQ: OFLX) today announced that the Board of Directors declared a regular quarterly dividend of $0.34 per share payable on April 22, 2025, to shareholders of record on April 10, 2025. In determining the amount of future regular quarterly dividends, the Board will review the cash needs of the Company, and based on results of operations, financial condition, capital expenditure plans, and consideration of possible acquisitions, as well as such other factors as the Board of Directors may consider relevant, determine on a quarterly basis the amount of a regular quarterly dividend.

Omega Flex Stock: Buy, Sell, or Hold?

fool.com

2025-03-22 06:15:00Omega Flex (OFLX 2.80%), a leading producer of flexible metal hose and piping products, is often considered a reliable long-term investment. Its pipes are used to deliver gas fuels in residential and commercial buildings, as well as liquid fuels for automotive customers, marinas, and back-up generators.

Omega Flex Stock Rises 8% Despite Q4 Earnings Falling Y/Y

zacks.com

2025-03-10 14:26:03OFLX sees lower Q4 earnings and sales but remains supported by a stable dividend and strong market position amid housing market challenges.

Omega Flex, Inc. Announces Fourth Quarter 2024 Earnings

globenewswire.com

2025-03-05 16:28:00EXTON, Pa., March 05, 2025 (GLOBE NEWSWIRE) -- Dean W. Rivest, CEO, announced that net sales of Omega Flex, Inc. (the “Company” or “Omega Flex”) (Nasdaq: OFLX) for 2024 and 2023 were $101,681,000 and $111,465,000, respectively, decreasing $9,784,000 or 8.8%. Net Sales for the fourth quarter of 2024 were 4.2% lower than during the same period in 2023. The decrease in net sales was mainly due to lower sales unit volumes as the overall market continued to be suppressed because of, among other factors, a decline in housing starts.