OFS Credit Company, Inc. (OCCIP)

Price:

25.03 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

ProShares UltraShort Nasdaq Biotechnology

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

OFS Credit Company, Inc. is a fund of OFS Advisor.

NEWS

New Preferred Stock IPOs, December 2021

seekingalpha.com

2021-12-30 07:00:00As December 2021 comes to a close, we look back at the new preferred stocks and ETDs introduced during the month, offering annual yields ranging from 4.375% to 10%.

Preferreds Market Weekly Review: Managing Libor Termination Risk

seekingalpha.com

2021-12-12 08:56:08We take a look at the action in preferreds and baby bonds through the first week of December and highlight some of the key themes we are watching. November wrapped up as the worst month for preferreds since March of 2020 with the first days of December seeing some stabilization.

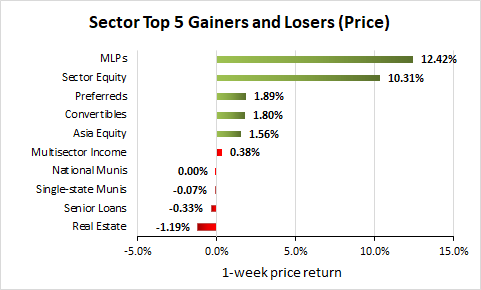

CEF Weekly Market Review: Funds Take A Breather

seekingalpha.com

2021-07-25 05:25:14We review CEF market valuation and performance over the past week and highlight recent events. CEF prices stalled in July on the back of lower risk sentiment driving discounts wider.

How To Retire With A Millionaire's Income

seekingalpha.com

2021-05-13 08:35:00How To Retire With A Millionaire's Income

5 Closed-End Funds Bought In February

seekingalpha.com

2021-03-16 15:04:36I put capital to work in 5 funds for the month - 2 were new purchases and 3 were the result of swapping funds.

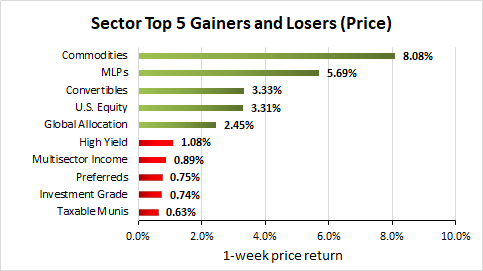

Weekly Closed-End Fund Roundup: August 30, 2020

seekingalpha.com

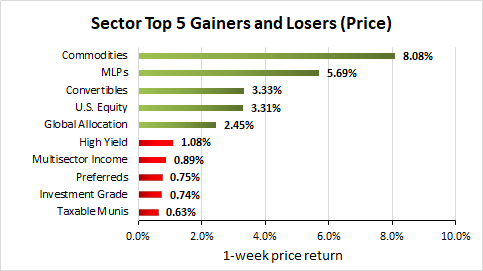

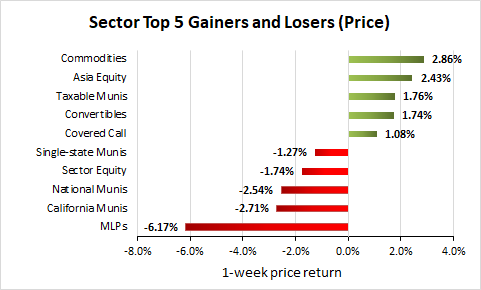

2020-09-09 08:15:0713 out of 23 CEF sectors positive on price and 16 out of 23 sectors positive on NAV last week. Commodities lead while MLPs lag.

Weekly Closed-End Fund Roundup: August 23, 2020

seekingalpha.com

2020-08-31 12:35:248 out of 23 CEF sectors positive on price and 7 out of 23 sectors positive on NAV last week. Taxable munis gain while MLPs lag.

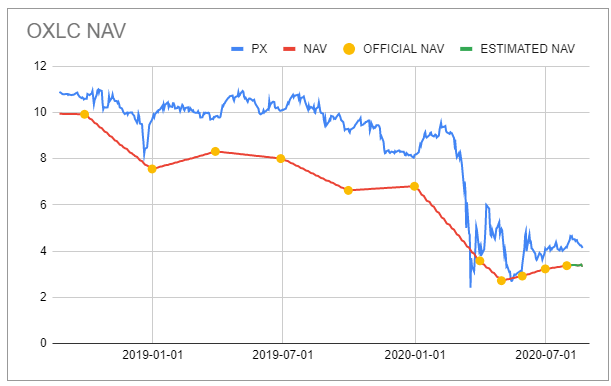

What We Hold Across The CLO Equity Capital Structures

seekingalpha.com

2020-08-24 14:00:19CLO equity funds offer the highest yields across the income investment space. However, this comes at the expense of NAV transparency.

Weekly Closed-End Fund Roundup: August 9, 2020

seekingalpha.com

2020-08-18 04:16:0523 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Commodities continue to rally, energy also puts in a strong performance.

The Chemist's Closed-End Fund Report: July 2020

seekingalpha.com

2020-07-31 12:28:00CEF discounts remain significantly wider than their historical average, indicating attractive valuations.

Income Lab Ideas: H1 2020 Closed-End Fund Sector Performance

seekingalpha.com

2020-07-24 01:46:08The first half of 2020 certainly saw a volatile market as we hit all-time highs on February 19th, then quickly entered into a bear market.

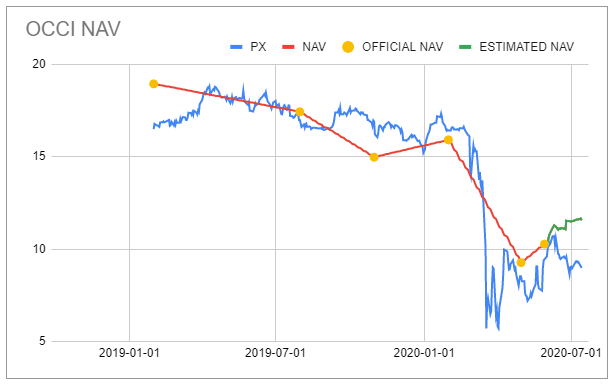

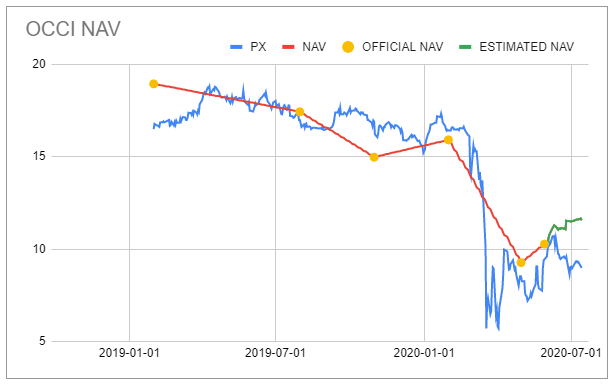

OFS Credit Company Preferreds: A Dozen Tailwinds

seekingalpha.com

2020-07-15 12:15:05OCCIP are preferred shares of the small OFS Credit Company CLO equity CEF. The preferreds have a number of structural mitigants and tailwinds such as good asset coverage, decent fund-level cash hold, and PIK distribution profile.

JRI: Digging In To See Why This Fund Went Off A Cliff

seekingalpha.com

2020-07-13 10:44:23I had originally thought of JRI as a 'defensive' type fund, this turned out to be incorrect. The fund has an extremely deep discount, likely due to investors losing confidence in the fund.

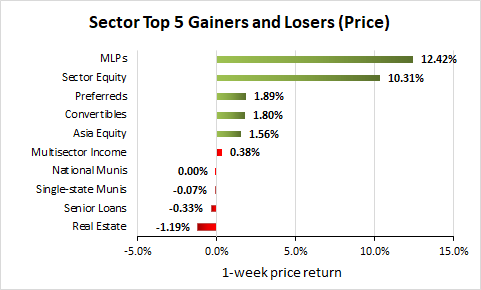

Weekly Closed-End Fund Roundup: June 21, 2020

seekingalpha.com

2020-06-30 09:40:334 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. MLPs lead while commodities lag. Preferreds have the highest sector

Income Lab Ideas: Dividend Changes Review And Discussion Through The Pandemic

seekingalpha.com

2020-06-30 07:00:00There were many funds that cut distributions throughout the COVID-19 pandemic. Several funds belonged to the very hard hit sector of the energy space, which isn

The Chemist's Closed-End Fund Report, June 2020: Valuations And Sentiment Improving

seekingalpha.com

2020-06-25 00:02:13Sentiment and valuations improving, with average discounts over 1% narrower than last month. However, CEF discounts are still wider than average, which is a buy

New Preferred Stock IPOs, December 2021

seekingalpha.com

2021-12-30 07:00:00As December 2021 comes to a close, we look back at the new preferred stocks and ETDs introduced during the month, offering annual yields ranging from 4.375% to 10%.

Preferreds Market Weekly Review: Managing Libor Termination Risk

seekingalpha.com

2021-12-12 08:56:08We take a look at the action in preferreds and baby bonds through the first week of December and highlight some of the key themes we are watching. November wrapped up as the worst month for preferreds since March of 2020 with the first days of December seeing some stabilization.

CEF Weekly Market Review: Funds Take A Breather

seekingalpha.com

2021-07-25 05:25:14We review CEF market valuation and performance over the past week and highlight recent events. CEF prices stalled in July on the back of lower risk sentiment driving discounts wider.

How To Retire With A Millionaire's Income

seekingalpha.com

2021-05-13 08:35:00How To Retire With A Millionaire's Income

5 Closed-End Funds Bought In February

seekingalpha.com

2021-03-16 15:04:36I put capital to work in 5 funds for the month - 2 were new purchases and 3 were the result of swapping funds.

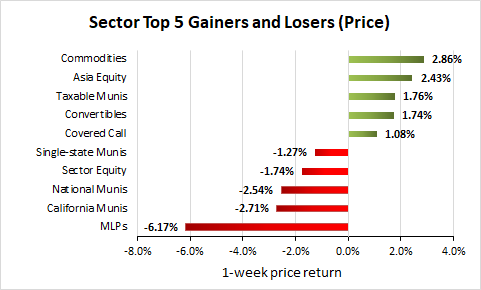

Weekly Closed-End Fund Roundup: August 30, 2020

seekingalpha.com

2020-09-09 08:15:0713 out of 23 CEF sectors positive on price and 16 out of 23 sectors positive on NAV last week. Commodities lead while MLPs lag.

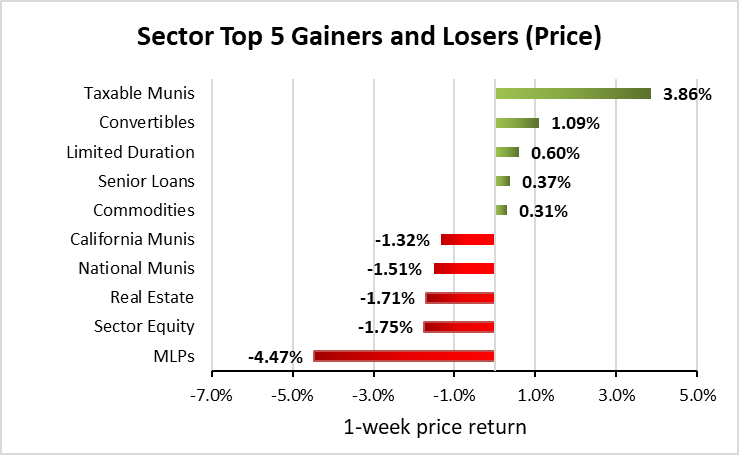

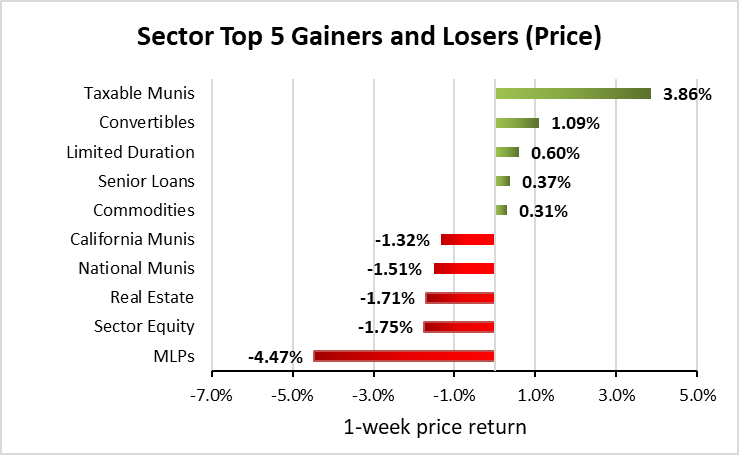

Weekly Closed-End Fund Roundup: August 23, 2020

seekingalpha.com

2020-08-31 12:35:248 out of 23 CEF sectors positive on price and 7 out of 23 sectors positive on NAV last week. Taxable munis gain while MLPs lag.

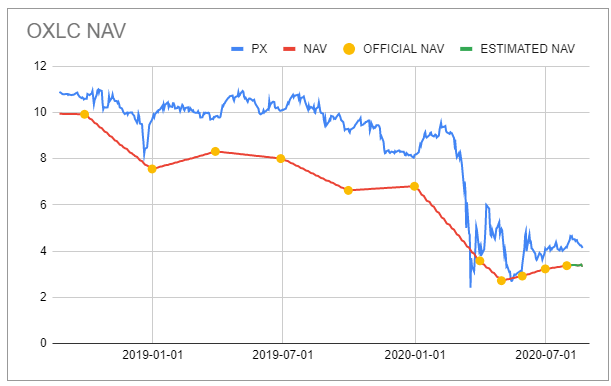

What We Hold Across The CLO Equity Capital Structures

seekingalpha.com

2020-08-24 14:00:19CLO equity funds offer the highest yields across the income investment space. However, this comes at the expense of NAV transparency.

Weekly Closed-End Fund Roundup: August 9, 2020

seekingalpha.com

2020-08-18 04:16:0523 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Commodities continue to rally, energy also puts in a strong performance.

The Chemist's Closed-End Fund Report: July 2020

seekingalpha.com

2020-07-31 12:28:00CEF discounts remain significantly wider than their historical average, indicating attractive valuations.

Income Lab Ideas: H1 2020 Closed-End Fund Sector Performance

seekingalpha.com

2020-07-24 01:46:08The first half of 2020 certainly saw a volatile market as we hit all-time highs on February 19th, then quickly entered into a bear market.

OFS Credit Company Preferreds: A Dozen Tailwinds

seekingalpha.com

2020-07-15 12:15:05OCCIP are preferred shares of the small OFS Credit Company CLO equity CEF. The preferreds have a number of structural mitigants and tailwinds such as good asset coverage, decent fund-level cash hold, and PIK distribution profile.

JRI: Digging In To See Why This Fund Went Off A Cliff

seekingalpha.com

2020-07-13 10:44:23I had originally thought of JRI as a 'defensive' type fund, this turned out to be incorrect. The fund has an extremely deep discount, likely due to investors losing confidence in the fund.

Weekly Closed-End Fund Roundup: June 21, 2020

seekingalpha.com

2020-06-30 09:40:334 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. MLPs lead while commodities lag. Preferreds have the highest sector

Income Lab Ideas: Dividend Changes Review And Discussion Through The Pandemic

seekingalpha.com

2020-06-30 07:00:00There were many funds that cut distributions throughout the COVID-19 pandemic. Several funds belonged to the very hard hit sector of the energy space, which isn

The Chemist's Closed-End Fund Report, June 2020: Valuations And Sentiment Improving

seekingalpha.com

2020-06-25 00:02:13Sentiment and valuations improving, with average discounts over 1% narrower than last month. However, CEF discounts are still wider than average, which is a buy