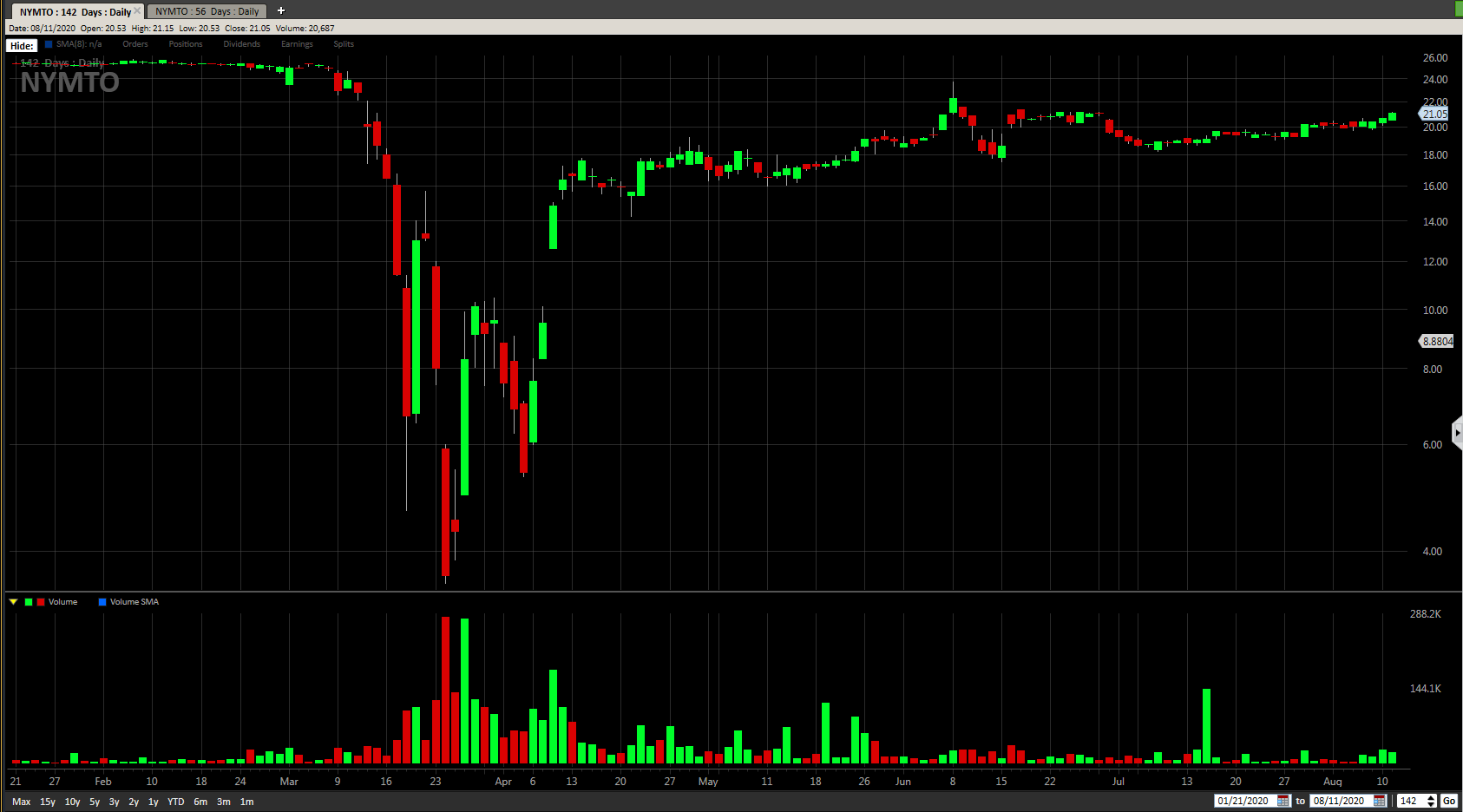

New York Mortgage Trust, Inc. (NYMTP)

Price:

25.32 USD

( + 0.00 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

New York Mortgage Trust, Inc.

VALUE SCORE:

0

2nd position

Adamas Trust, Inc.

VALUE SCORE:

8

The best

Manhattan Bridge Capital, Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

New York Mortgage Trust, Inc. acquires, invests in, finances, and manages mortgage-related single-family and multi-family residential assets in the United States. Its targeted investments include residential loans, second mortgages, and business purpose loans; structured multi-family property investments, such as preferred equity in, and mezzanine loans to owners of multi-family properties, as well as joint venture equity investments in multi-family properties; non-agency residential mortgage-backed securities (RMBS); agency RMBS; commercial mortgage-backed securities (CMBS); and other mortgage, residential housing, and credit-related assets. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was incorporated in 2003 and is headquartered in New York, New York.

NEWS

Preferreds Market Weekly Review

seekingalpha.com

2021-07-11 10:59:14We take a look at the action in preferreds and baby bonds through the first short week of July and highlight some of the key themes we are watching. We highlight the steep fall-off yield dynamic of callable securities moving past their "par" price level.

Inflation Running Hot: 3 Big Dividends To Beat It

seekingalpha.com

2021-05-26 08:35:00We have been warning about the risks of inflation and rising interest rates for many months now. Warren Buffett raised a red flag recently. Yellen admits inflation is rising fast.

Buy Rated Preferreds (And Market Update)

seekingalpha.com

2021-01-18 07:00:00Preferreds have continued powering higher on the back of lower volatility and spread compression. Few opportunities exist among IG preferreds but there are still some beaten-down high yield preferreds with catch-up potential.

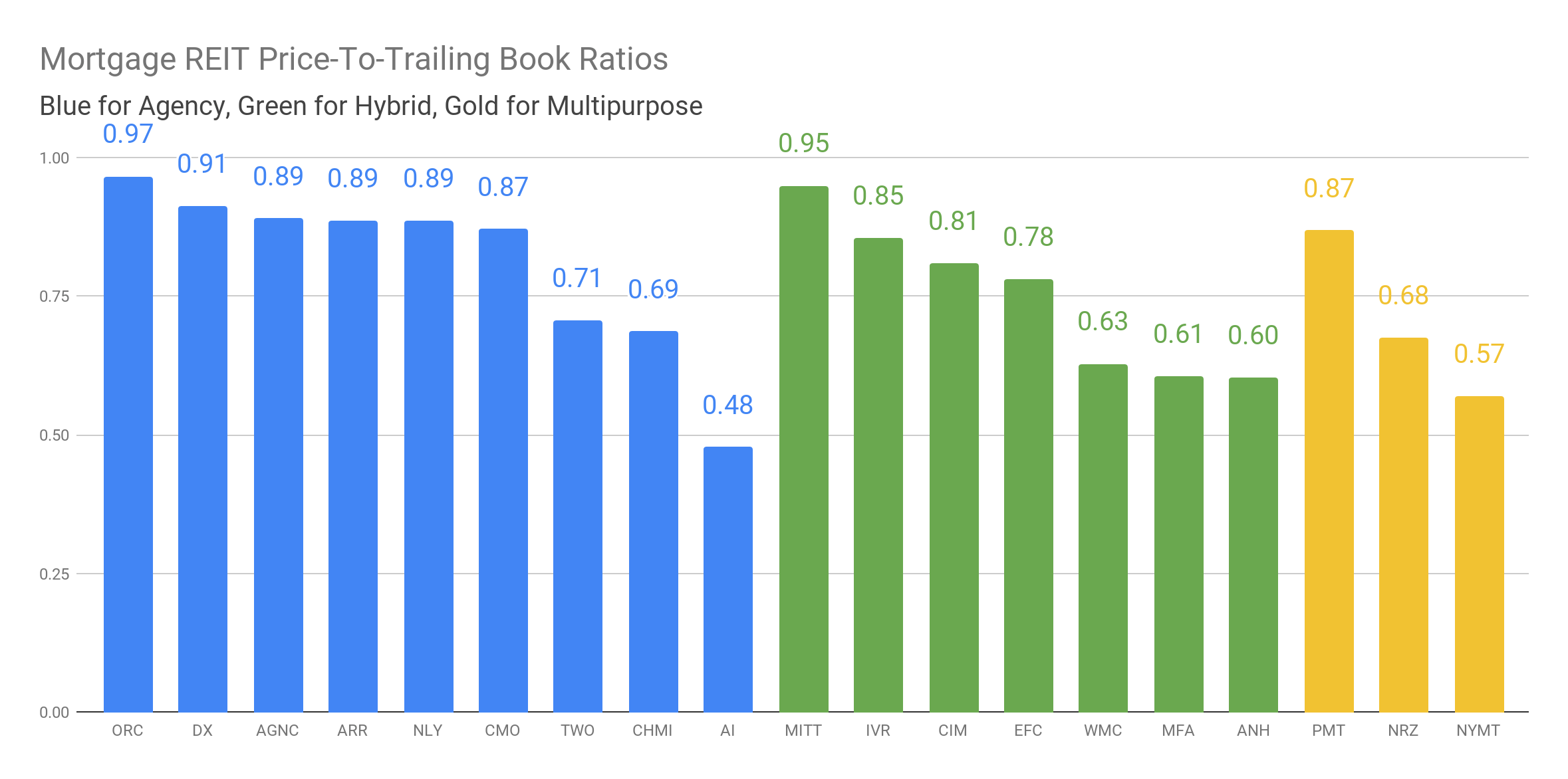

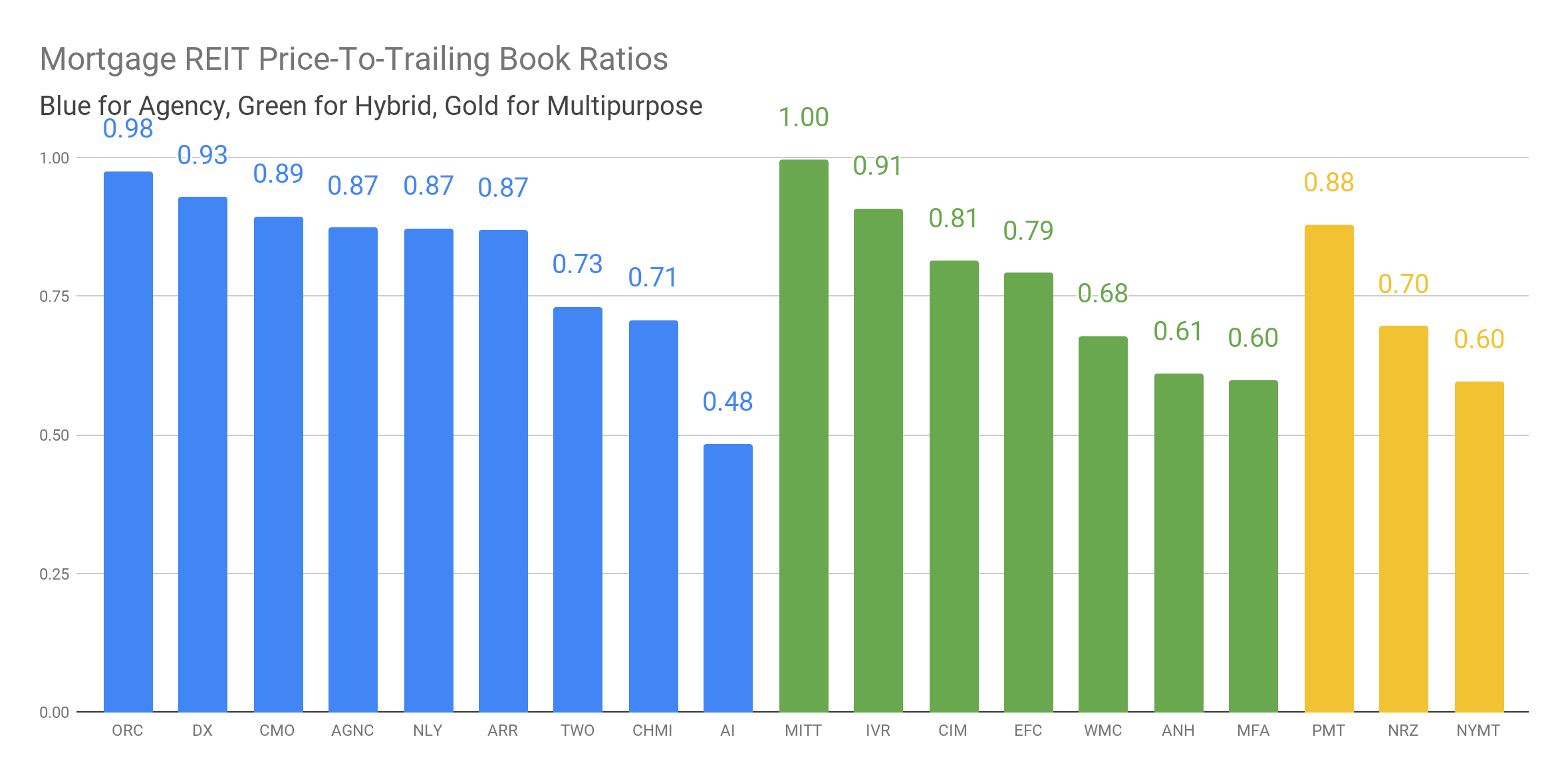

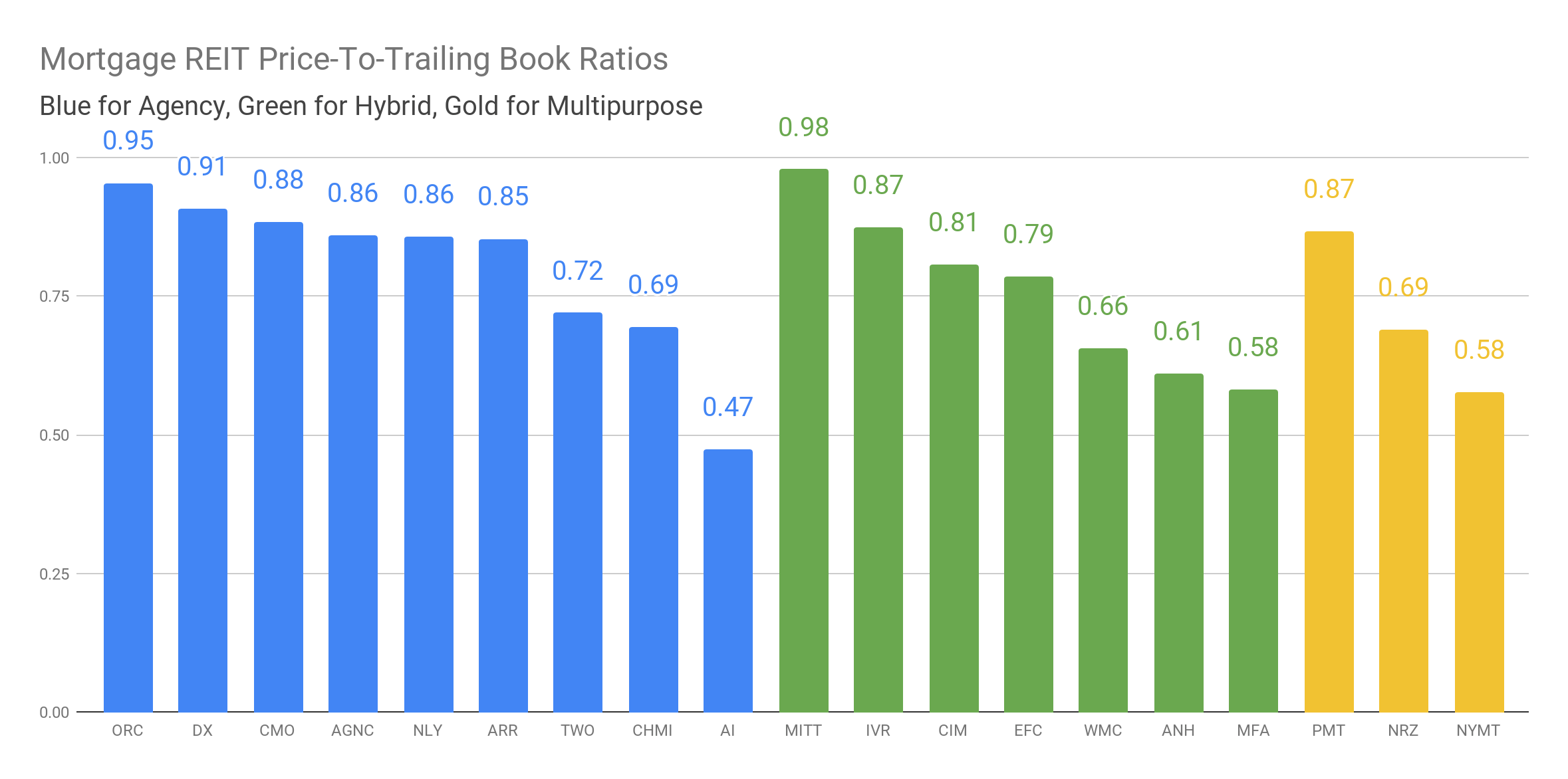

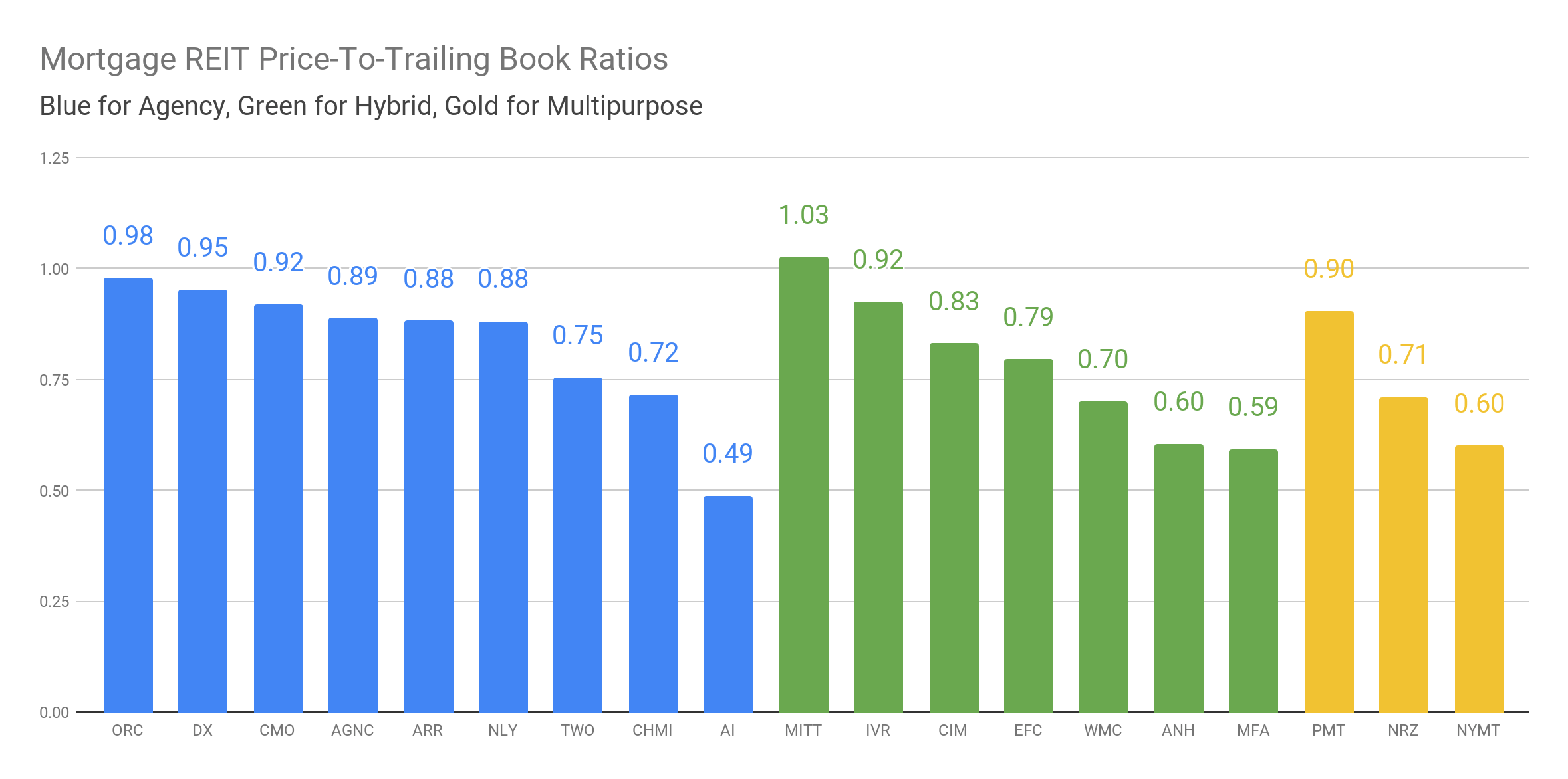

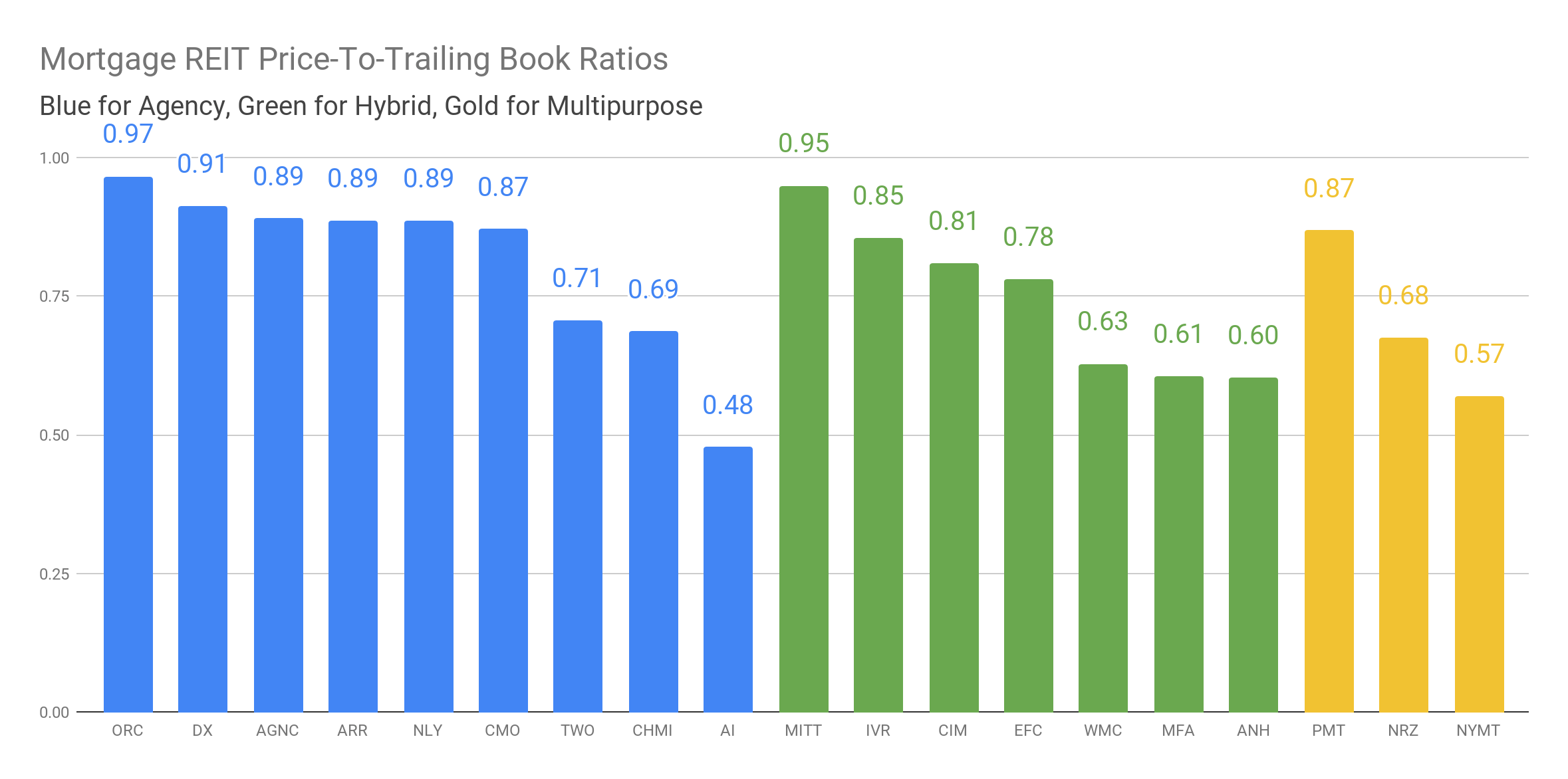

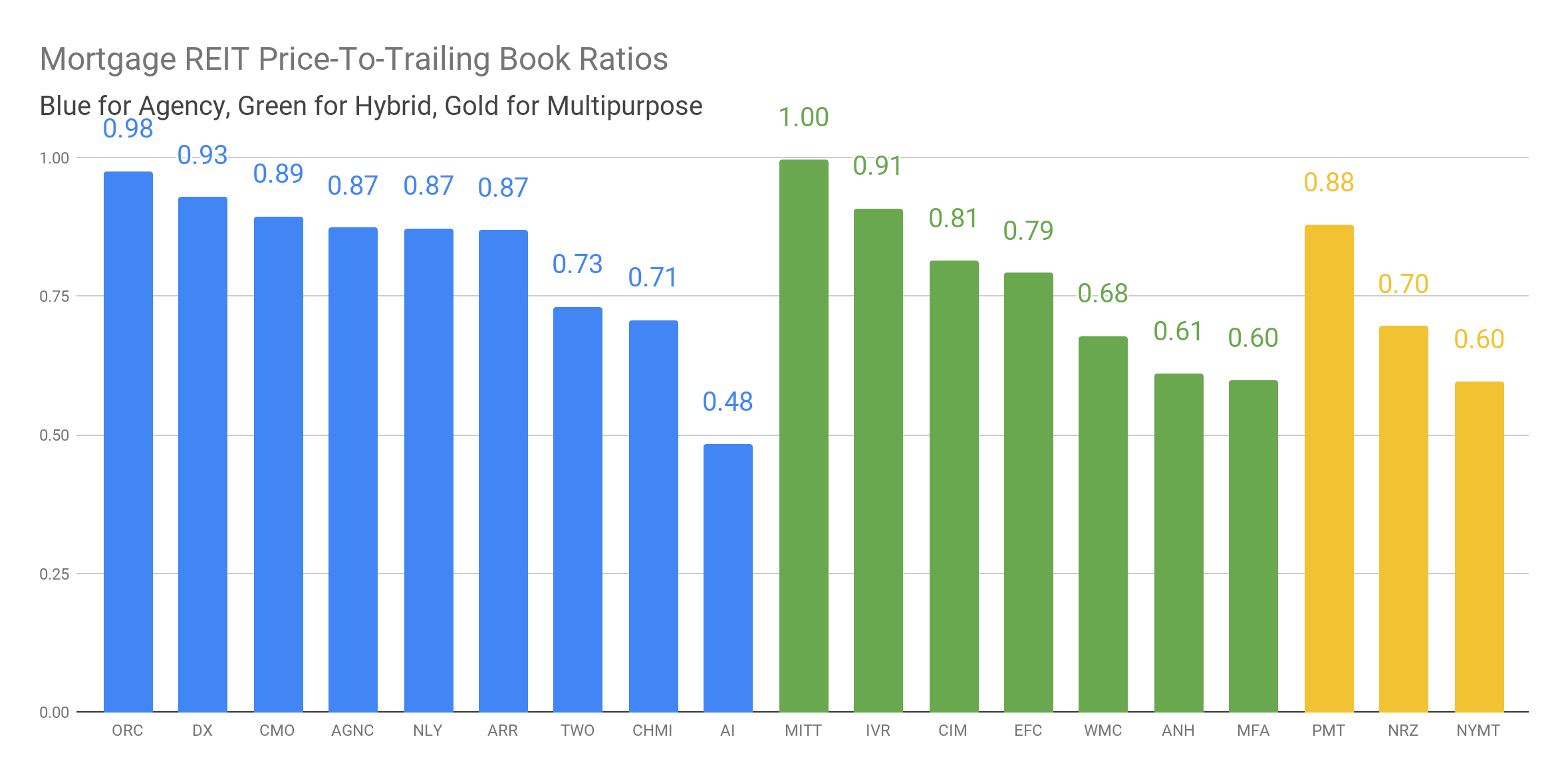

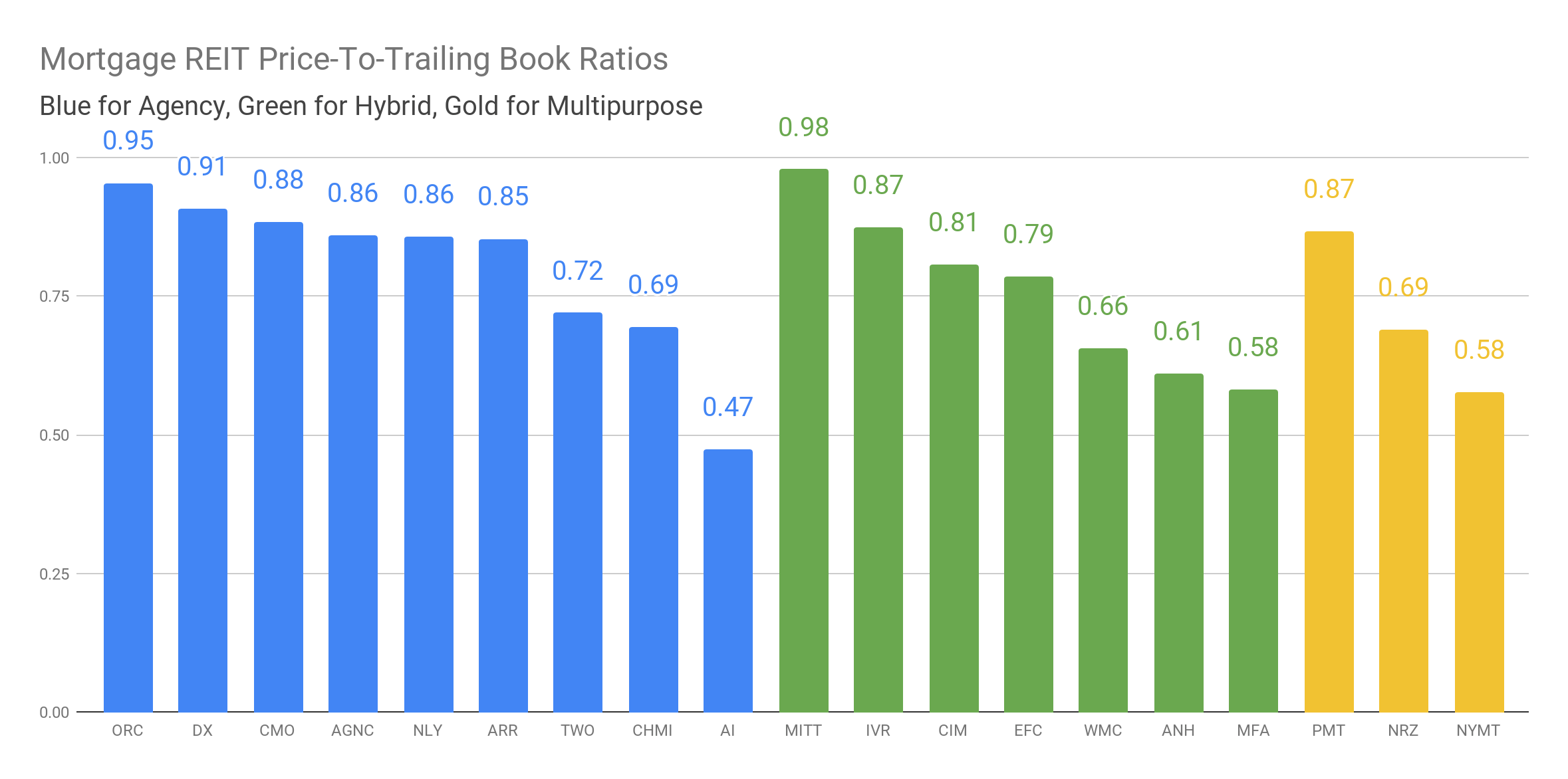

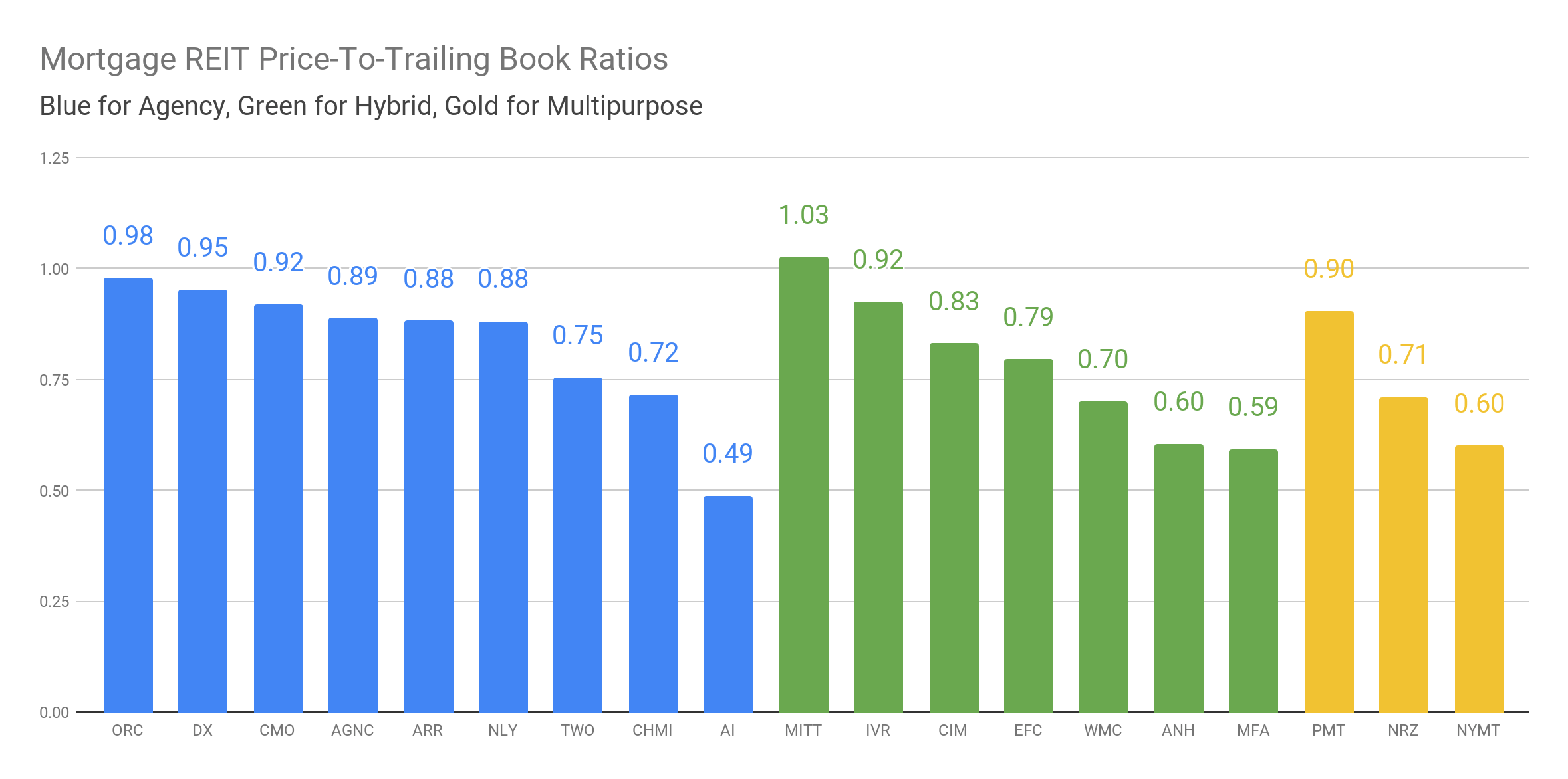

Plenty Of Upside From Discounts To NAV

seekingalpha.com

2020-09-13 17:17:34Discounts to book value (or NAV) are the start of your mortgage REIT analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Upgrading One Of Our Least Favorite Mortgage REITs

seekingalpha.com

2020-09-08 13:34:14Discounts to book value are the start of your analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Sales Return For Mortgage REITs

seekingalpha.com

2020-09-04 13:48:13Price-to-book ratios dropped materially, creating new opportunities. Buying with a discount to book value doesn’t guarantee success, yet it does improve the odds dramatically.

Quick And Dirty Discounts To Book Value For September 1st, 2020

seekingalpha.com

2020-09-02 07:33:16Discounts to book value are the start of your analysis, but not the end. In this series, we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

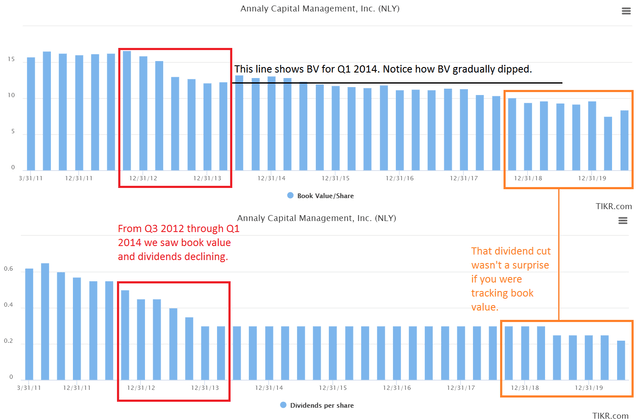

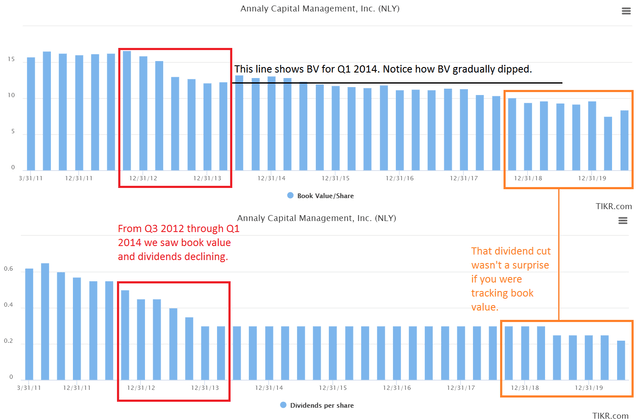

An Introduction To Annaly

seekingalpha.com

2020-08-28 07:00:00We're breaking down Annaly Capital Management for new readers to demonstrate how to analyze the stock.

How To Pick Mortgage REITs

seekingalpha.com

2020-08-25 10:49:57Analysis starts with discount to book, but it doesn't end there. Using current estimates for book value is far superior to using trailing book values, but the trailing values will still give investors a rough idea.

Mortgage REIT Common Shares Are For Trading

seekingalpha.com

2020-08-17 20:42:37One topic that seems to come up regularly is investors wondering about using a buy-and-hold strategy for years on common shares.

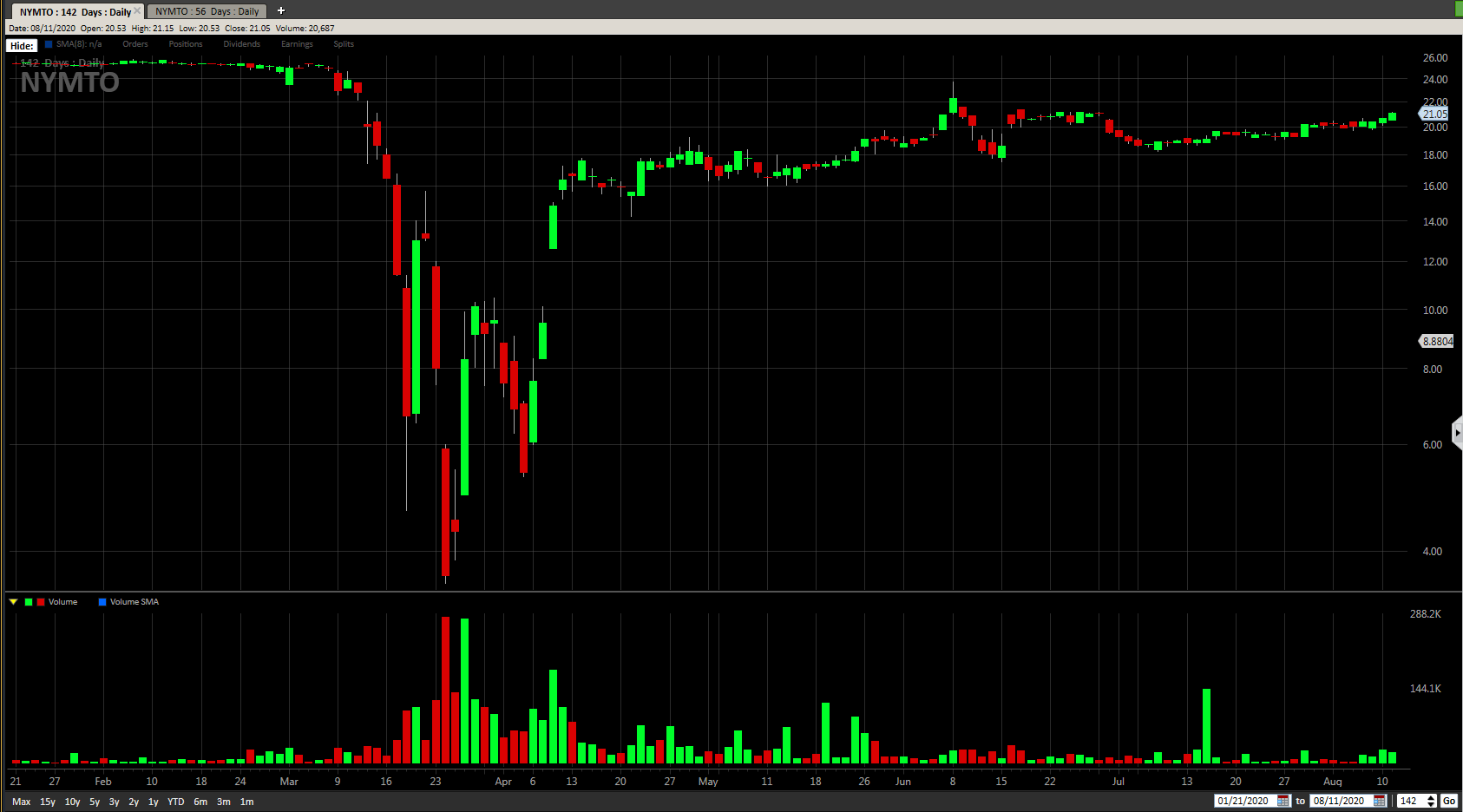

New York Mortgage Trust: What Happened With The Preferred Shares?

seekingalpha.com

2020-08-16 07:00:00Volatility in the NYMT preferred shares can get pretty intense when the market expects a recession. When a recession actually occurs, the volatility roars higher.

Mortgage REITs: Earnings Recap

seekingalpha.com

2020-08-13 10:20:31Mortgage REIT earnings season wrapped up this week. As with their Equity REIT peers, earnings reports were generally better-than-expected.

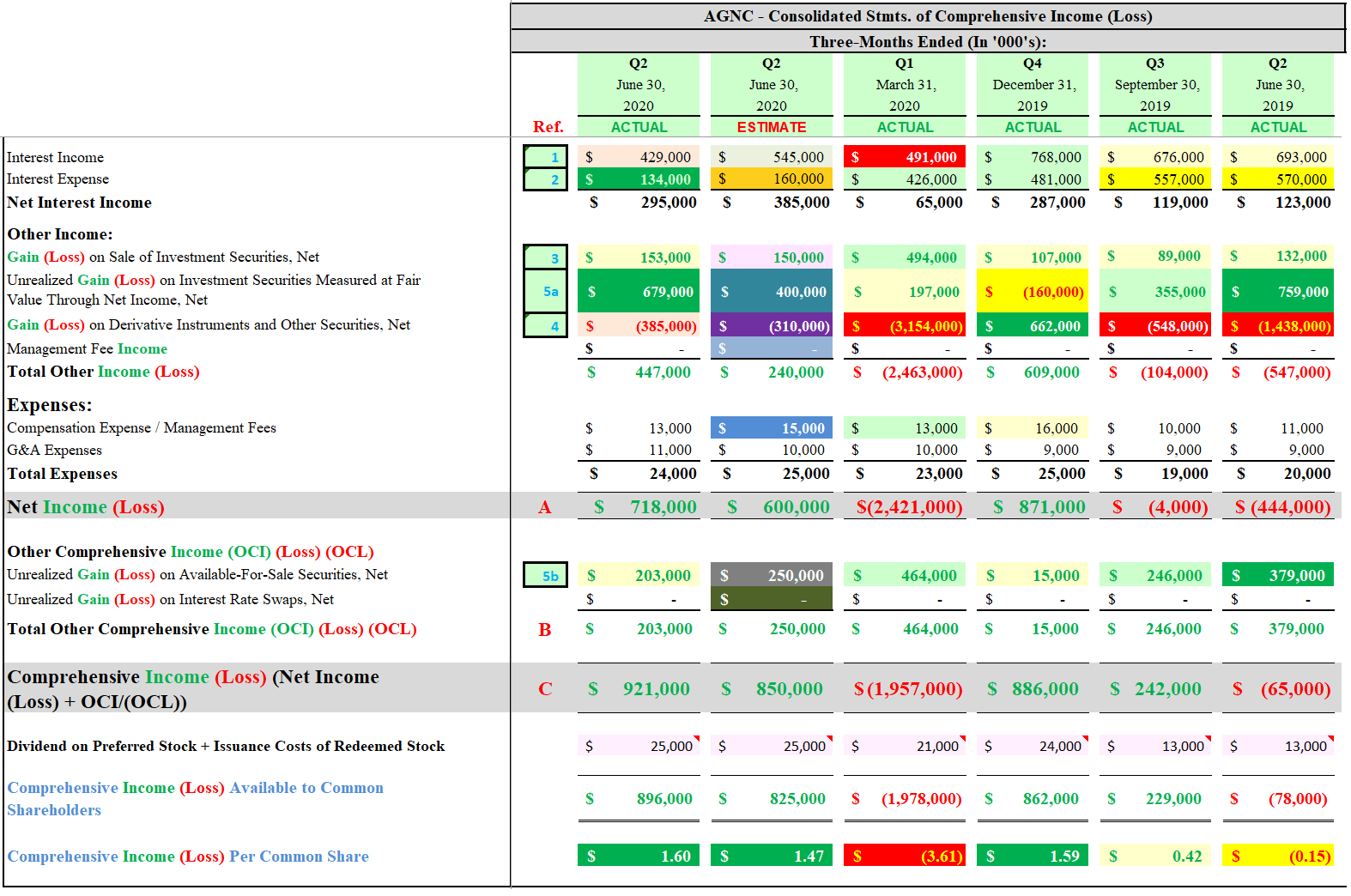

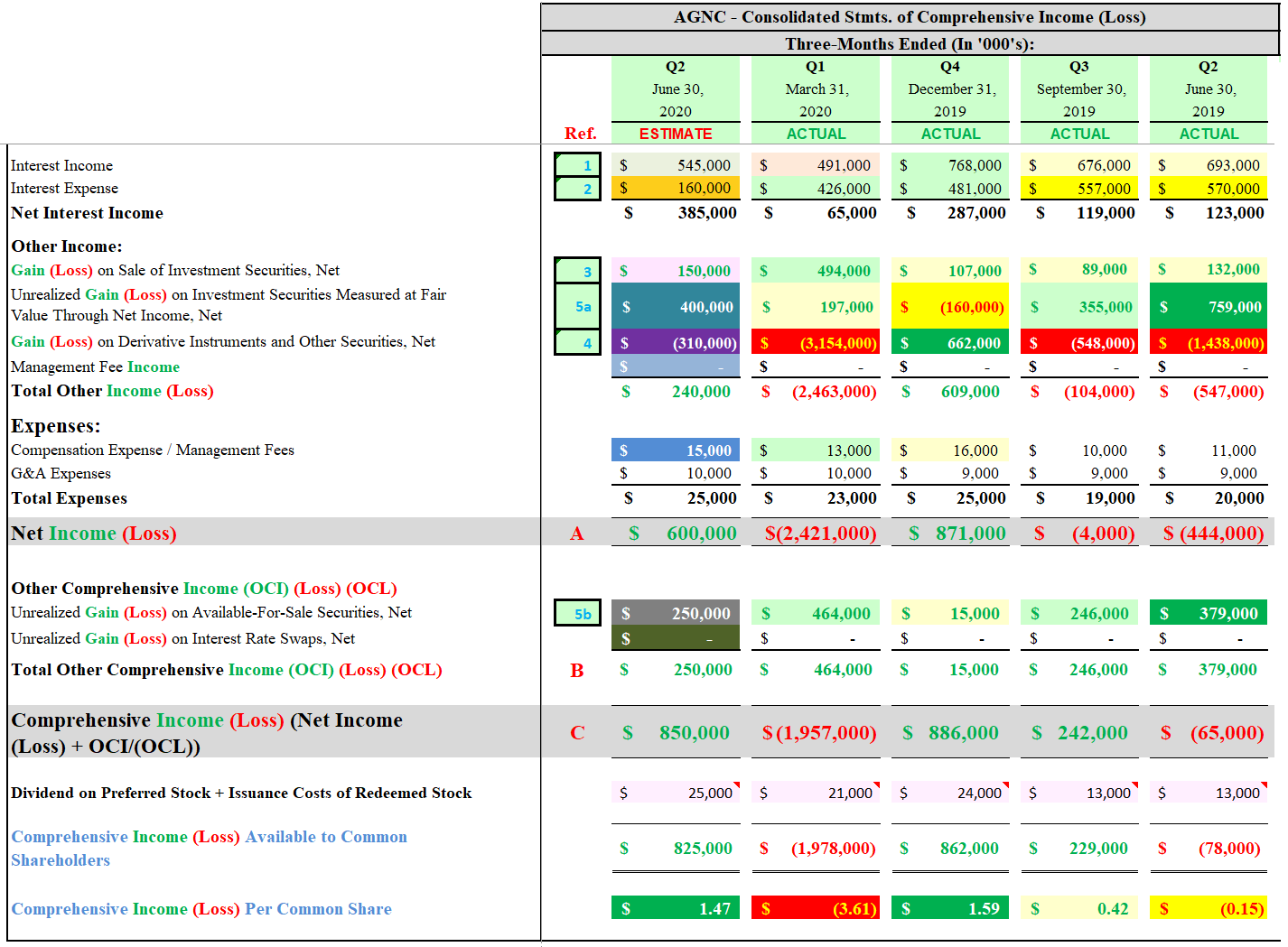

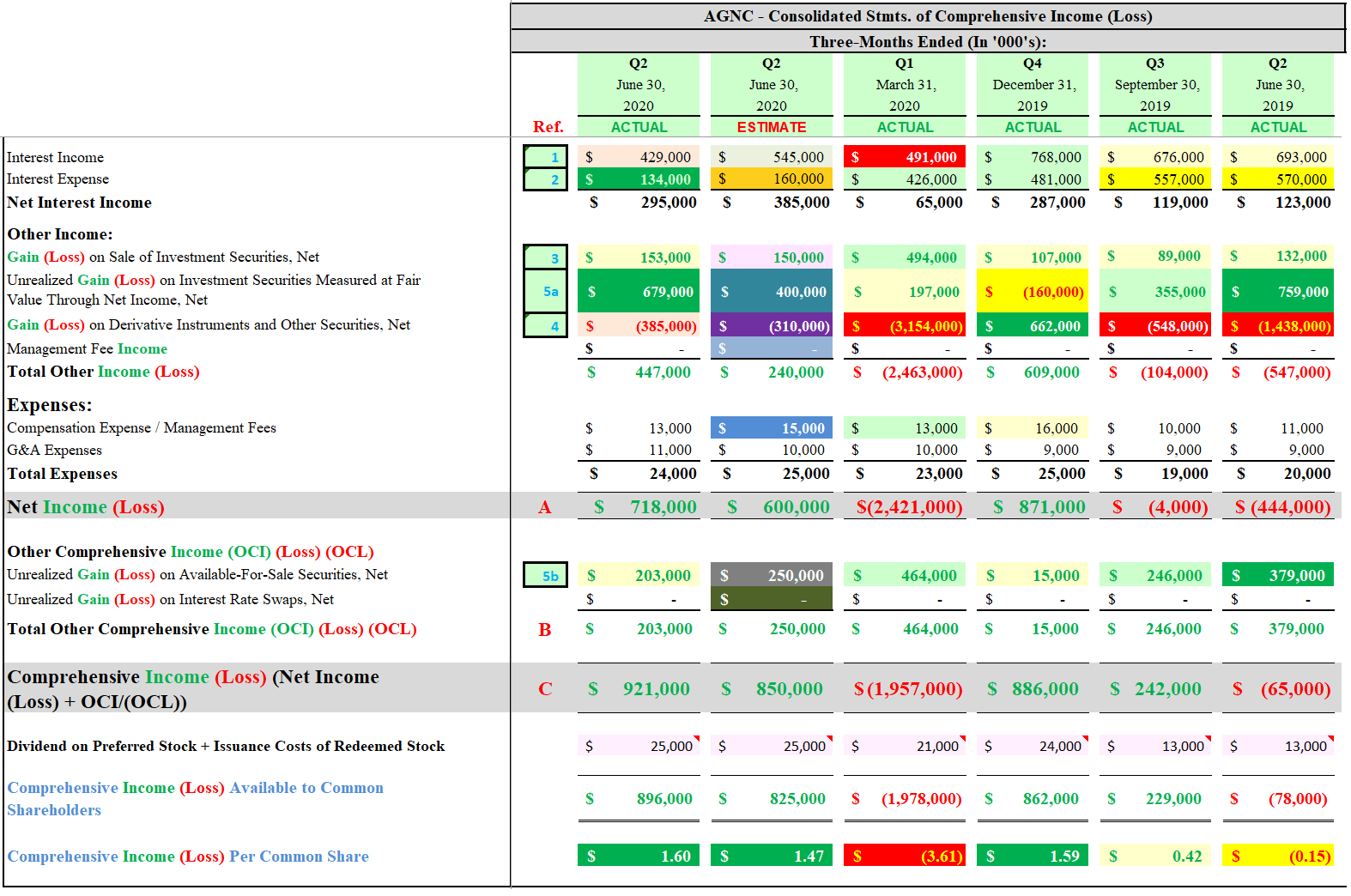

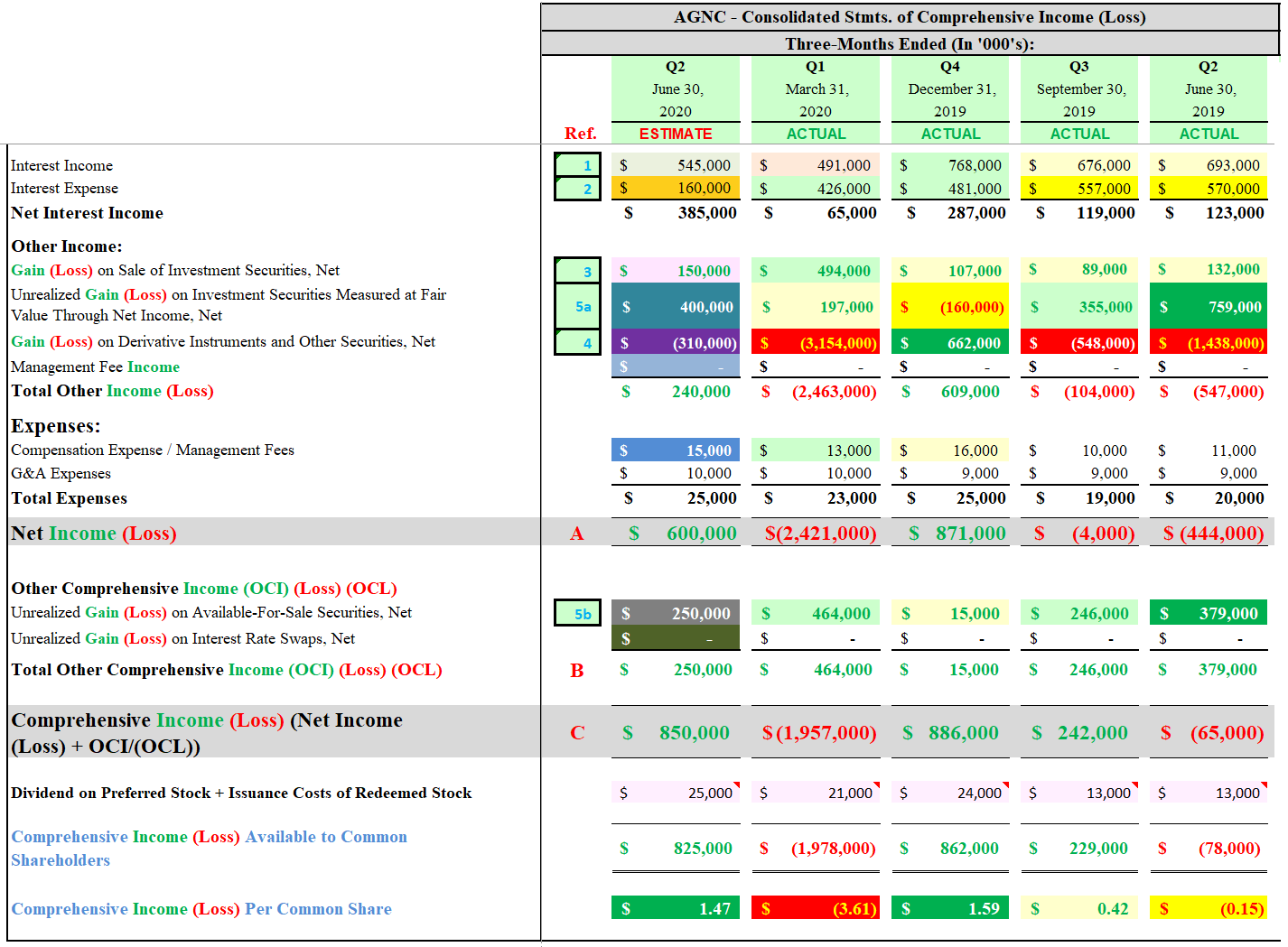

Assessing AGNC Investment's Results For Q2 2020 (Running On All Cylinders)

seekingalpha.com

2020-08-13 04:55:14On 7/27/2020, AGNC reported results for the second quarter of 2020. AGNC reported comprehensive income of $921 million and a non-tangible BV as of 6/30/2020 of $15.86 per common share.

Mortgage REITs: Back From The Brink

seekingalpha.com

2020-07-28 15:00:00Few asset classes have been slammed harder by the pandemic than Mortgage REITs, which have seen a dividend cut bloodbath with 33 of 42 mREITs suspending or reducing their dividends.

AGNC Investment's Q2 2020 And 7/24/2020 BV Projection (Indication Of An Undervalued Stock; NLY BV Projection Included)

seekingalpha.com

2020-07-27 07:16:58I am projecting AGNC will report a modest (at or greater than 5% but less than 10%) BV increase for the second quarter of 2020.

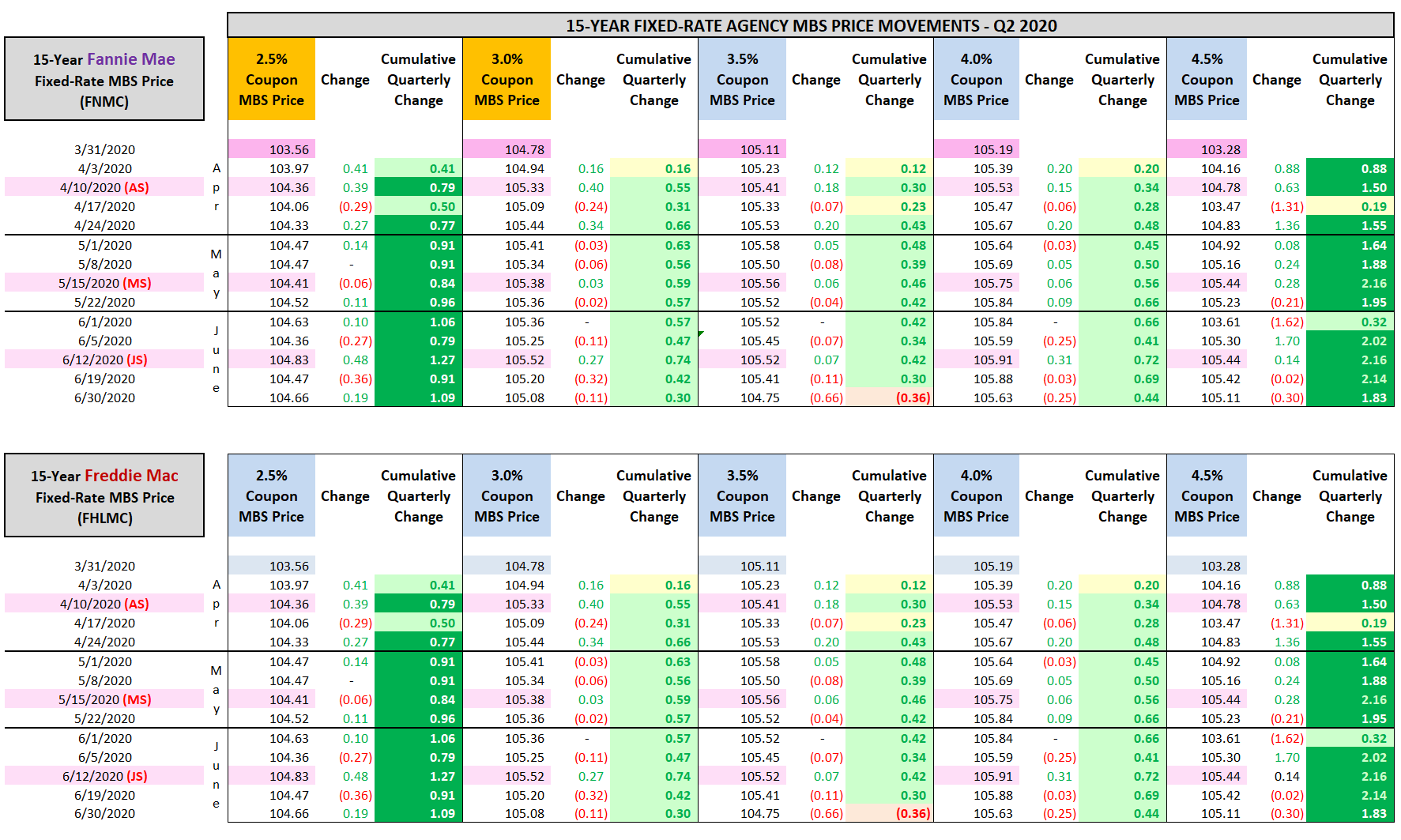

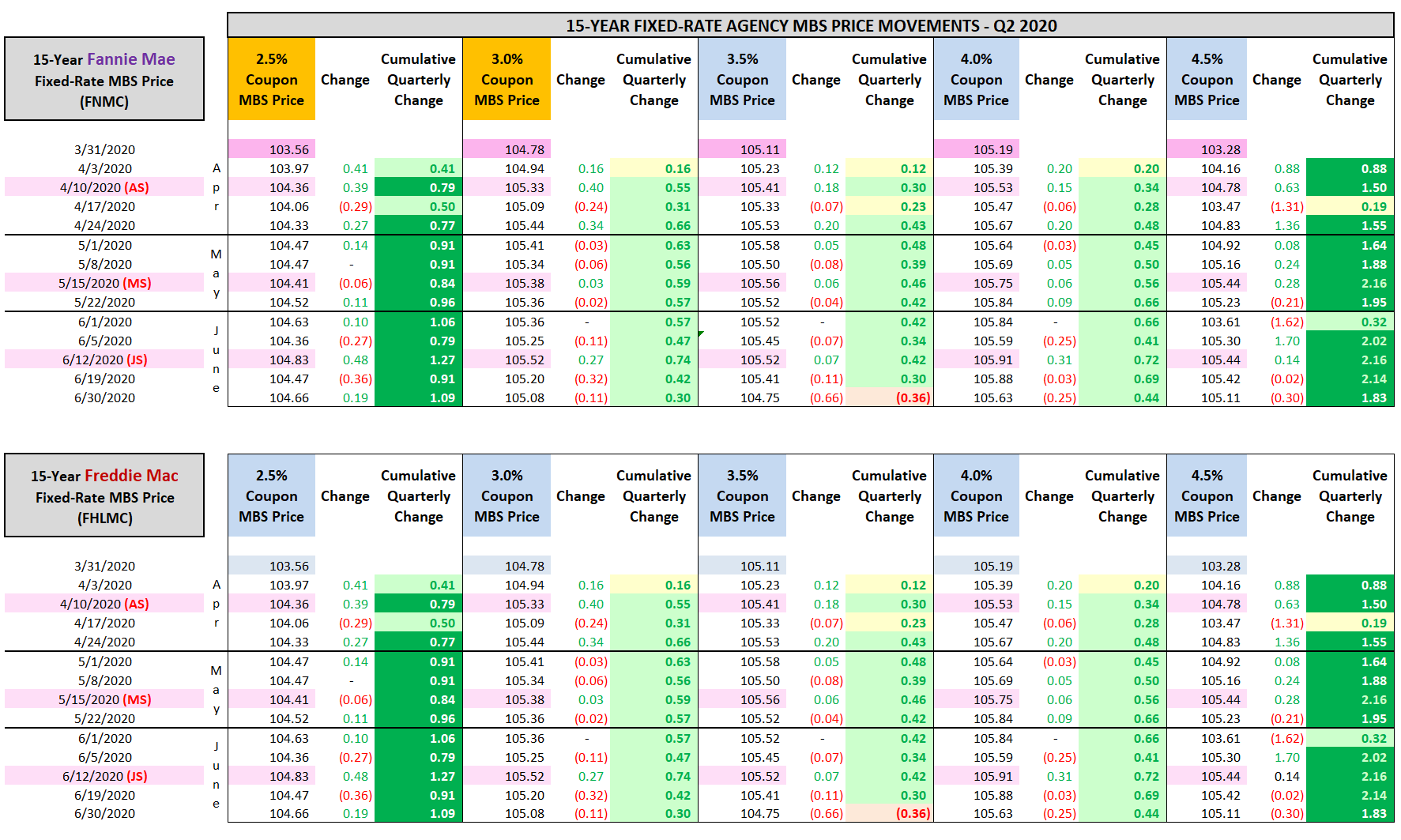

AGNC Investment's Q2 2020 Income Statement And Earnings Preview - Part 3 (Includes Price Target And Recommendation)

seekingalpha.com

2020-07-23 20:43:04I am projecting AGNC will report a combined notable net unrealized gain on available-for-sale securities and investment securities measured at FMV for the second quarter of 2020.

Preferreds Market Weekly Review

seekingalpha.com

2021-07-11 10:59:14We take a look at the action in preferreds and baby bonds through the first short week of July and highlight some of the key themes we are watching. We highlight the steep fall-off yield dynamic of callable securities moving past their "par" price level.

Inflation Running Hot: 3 Big Dividends To Beat It

seekingalpha.com

2021-05-26 08:35:00We have been warning about the risks of inflation and rising interest rates for many months now. Warren Buffett raised a red flag recently. Yellen admits inflation is rising fast.

Buy Rated Preferreds (And Market Update)

seekingalpha.com

2021-01-18 07:00:00Preferreds have continued powering higher on the back of lower volatility and spread compression. Few opportunities exist among IG preferreds but there are still some beaten-down high yield preferreds with catch-up potential.

Plenty Of Upside From Discounts To NAV

seekingalpha.com

2020-09-13 17:17:34Discounts to book value (or NAV) are the start of your mortgage REIT analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Upgrading One Of Our Least Favorite Mortgage REITs

seekingalpha.com

2020-09-08 13:34:14Discounts to book value are the start of your analysis, but not the end. In this series we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

Sales Return For Mortgage REITs

seekingalpha.com

2020-09-04 13:48:13Price-to-book ratios dropped materially, creating new opportunities. Buying with a discount to book value doesn’t guarantee success, yet it does improve the odds dramatically.

Quick And Dirty Discounts To Book Value For September 1st, 2020

seekingalpha.com

2020-09-02 07:33:16Discounts to book value are the start of your analysis, but not the end. In this series, we’re providing readers with the discounts to trailing book values throughout the sector and a few notes on the current environment.

An Introduction To Annaly

seekingalpha.com

2020-08-28 07:00:00We're breaking down Annaly Capital Management for new readers to demonstrate how to analyze the stock.

How To Pick Mortgage REITs

seekingalpha.com

2020-08-25 10:49:57Analysis starts with discount to book, but it doesn't end there. Using current estimates for book value is far superior to using trailing book values, but the trailing values will still give investors a rough idea.

Mortgage REIT Common Shares Are For Trading

seekingalpha.com

2020-08-17 20:42:37One topic that seems to come up regularly is investors wondering about using a buy-and-hold strategy for years on common shares.

New York Mortgage Trust: What Happened With The Preferred Shares?

seekingalpha.com

2020-08-16 07:00:00Volatility in the NYMT preferred shares can get pretty intense when the market expects a recession. When a recession actually occurs, the volatility roars higher.

Mortgage REITs: Earnings Recap

seekingalpha.com

2020-08-13 10:20:31Mortgage REIT earnings season wrapped up this week. As with their Equity REIT peers, earnings reports were generally better-than-expected.

Assessing AGNC Investment's Results For Q2 2020 (Running On All Cylinders)

seekingalpha.com

2020-08-13 04:55:14On 7/27/2020, AGNC reported results for the second quarter of 2020. AGNC reported comprehensive income of $921 million and a non-tangible BV as of 6/30/2020 of $15.86 per common share.

Mortgage REITs: Back From The Brink

seekingalpha.com

2020-07-28 15:00:00Few asset classes have been slammed harder by the pandemic than Mortgage REITs, which have seen a dividend cut bloodbath with 33 of 42 mREITs suspending or reducing their dividends.

AGNC Investment's Q2 2020 And 7/24/2020 BV Projection (Indication Of An Undervalued Stock; NLY BV Projection Included)

seekingalpha.com

2020-07-27 07:16:58I am projecting AGNC will report a modest (at or greater than 5% but less than 10%) BV increase for the second quarter of 2020.

AGNC Investment's Q2 2020 Income Statement And Earnings Preview - Part 3 (Includes Price Target And Recommendation)

seekingalpha.com

2020-07-23 20:43:04I am projecting AGNC will report a combined notable net unrealized gain on available-for-sale securities and investment securities measured at FMV for the second quarter of 2020.