Nuveen California Select Tax-Free Income Portfolio (NXC)

Price:

12.96 USD

( - -0.07 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

PIMCO Corporate & Income Opportunity Fund

VALUE SCORE:

6

2nd position

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

The best

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Nuveen California Select Tax-Free Income Portfolio is a closed-ended fixed income mutual fund launched by Nuveen Investments Inc. The fund is co-managed by Nuveen Fund Advisors LLC and Nuveen Asset Management, LLC. It invests in the fixed income markets of California. The fund invests in the securities of companies that operate across diversified sectors. It primarily invests in municipal bonds. The fund employs fundamental analysis to create its portfolio. It benchmarks the performance of its portfolio against Barclays Capital California Municipal Bond Index and S&P California Municipal Bond Index. Nuveen California Select Tax-Free Income Portfolio was formed on June 19, 1992 and is domiciled in the United States.

NEWS

Nuveen Wants To Merge NXC And NXN Into NXP: What Now?

seekingalpha.com

2025-09-08 13:38:01I voted against the NXC and NXN merger into Nuveen Select Tax-Free Income Portfolio, as it would overweight NXP with bonds from states facing population decline and high taxes. NXP offers lower fees, higher yields, better credit quality, and stronger historical returns compared to the single-state funds NXC and NXN. State fund holders would benefit from the merger, but must consider that distributions will become subject to steep state income taxes.

Immix Biopharma Announces Primary Endpoint Met in positive NXC-201 Interim Results Presented at ASCO, Enabling Path to Best-in-Class Therapy for relapsed/refractory AL Amyloidosis

globenewswire.com

2025-06-03 14:55:00Immix Biopharma today presented results at ASCO from its U.S. multi-center NEXICART-2 Phase 1/2 clinical trial of NXC-201, meeting its primary endpoint.

Immix Biopharma Announces Positive Results for NXC-201 at ASCO Oral Presentation, Enabling Pathway to Best-in-Class Therapy for relapsed/refractory AL Amyloidosis

globenewswire.com

2025-05-22 16:02:00Immix Biopharma today reported ASCO abstract results from its U.S. multi-center NEXICART-2 Phase 1/2 clinical trial of NXC-201 demonstrating strong efficacy and favorable safety.

Immix Biopharma's NXC-201 NEXICART-2 Clinical Trial Data Selected for Oral Presentation at ASCO 2025

globenewswire.com

2025-04-23 10:04:00— Oral presentation Tuesday, June 3, 2025 in Chicago — LOS ANGELES, April 23, 2025 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (“ImmixBio”, “Company”, “We” or “Us” or ”IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL Amyloidosis and other serious diseases, today announced that Phase 1/2 interim readout data from its U.S. NXC-201 NEXICART-2 trial in relapsed/refractory AL Amyloidosis has been selected for oral presentation at the upcoming 2025 American Society of Clinical Oncology Annual Meeting (ASCO 2025) being held in Chicago, Illinois, May 30 – June 3, 2025, presented by lead investigator Heather Landau, M.D., Director of Amyloidosis Program and a Bone Marrow Transplant Specialist & Cellular Therapist at Memorial Sloan-Kettering Cancer Center in New York.

Sell Equities, Buy Municipal Debt At A 7.21% Discount With Nuveen California Select Tax-Free Income Portfolio

seekingalpha.com

2025-02-13 03:15:00Municipal CEFs like Nuveen California Select Tax-Free Income Portfolio offer tax-free returns, low leverage, and are currently trading at a discount. NXC invests in high-quality municipal securities, with an average coupon of 3.68% and a distribution rate on NAV of 3.97%. The fund's market price is $13.17, NAV is $13.69, and it's trading at a 3.80% discount, presenting a potential profit opportunity.

Immix Biopharma Receives FDA Regenerative Medicine Advanced Therapy (RMAT) Designation for NXC-201, sterically-optimized CAR-T for relapsed/refractory AL Amyloidosis

globenewswire.com

2025-02-10 09:35:00FDA RMAT designation follows positive proof-of-concept U.S. clinical data from the NXC-201 NEXICART-2 clinical trial in relapsed/refractory AL Amyloidosis RMAT designation potentially streamlines the path to market approval by allowing frequent interactions with FDA and routes to FDA Accelerated Approval and Priority Review Enrollment in NEXICART-2 study accelerating; next update planned for H1 2025 LOS ANGELES,CA, Feb. 10, 2025 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (Nasdaq: IMMX) (“ImmixBio”, “Company”, “We” or “Us”, “IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL amyloidosis and select immune-mediated diseases, today announced that the U.S. Food and Drug Administration (FDA) has granted RMAT designation to sterically-optimized CAR-T NXC-201 for the treatment of relapsed/refractory AL amyloidosis. As of June 2024 public information, FDA approved less than half of RMAT applications submitted to the agency during the last eight years.

Immix Biopharma Accelerates Enrollment in U.S. AL Amyloidosis Trial of NXC-201 CAR-T

globenewswire.com

2025-01-07 09:34:00LOS ANGELES, Jan. 07, 2025 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (Nasdaq: IMMX) (“ImmixBio”, “Company”, “We” or “Us”, “IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL Amyloidosis and select immune-mediated diseases, today announced successful completion of the six-patient Phase 1b safety run-in segment in the U.S. NEXICART-2 study of NXC-201, an investigational CAR-T therapy, in patients relapsed/refractory (R/R) AL Amyloidosis. Achievement of this milestone is expected to accelerate enrollment across U.S. study sites beginning in January 2025.

Journal of Clinical Oncology Publishes NXC-201 Positive Clinical Results in relapsed/refractory AL Amyloidosis

globenewswire.com

2024-12-16 09:48:00Chimeric antigen receptor T-cell (CAR-T) cell therapy NXC-201 is a novel approach to treat relapsed/refractory AL Amyloidosis NXC-201 demonstrated compelling clinical activity, rapid and deep complete responses in frail and resistant relapsed/refractory AL Amyloidosis patients LOS ANGELES, Dec. 16, 2024 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (“ImmixBio”, “Company”, “We” or “Us” or “IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL Amyloidosis and select immune-mediated diseases, announced today the Journal of Clinical Oncology (JCO) published NXC-201 clinical results in relapsed/refractory AL Amyloidosis. The data reported on 16 enrolled patients in NEXICART-1 who had received a median 4 prior lines of therapy prior to treatment with NXC-201.

Nuveen Closed-End Funds Declare Distributions and Updates to Distribution Policies

businesswire.com

2023-12-01 16:15:00NEW YORK--(BUSINESS WIRE)--Nuveen Closed-End Funds today announced that the Board of Trustees of the Funds has approved the regular monthly and quarterly distributions. In addition, the Board of Trustees has approved updated distribution polices described below under “Monthly & Quarterly Distributions” for The Nuveen Preferred & Income Opportunities Fund (NYSE: JPC), Nuveen Preferred and Income Term Fund (NYSE: JPI), Nuveen Variable Rate Preferred & Income Fund (NYSE: NPFD), Nuveen.

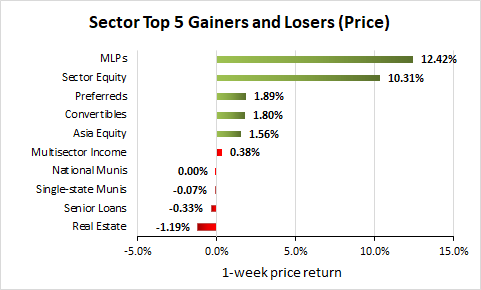

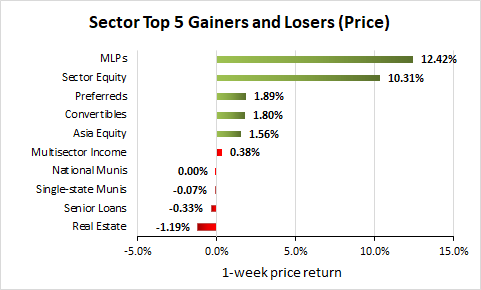

Weekly Closed-End Fund Roundup: January 8, 2023

seekingalpha.com

2023-01-17 08:02:3221 out of 22 CEF sectors were positive on price and 20 out of 22 sectors were positive on NAV last week. MLPs are the most discounted CEF sector.

Weekly Closed-End Fund Roundup: VFL Tender Results (December 18, 2022)

seekingalpha.com

2022-12-27 23:19:432 out of 23 CEF sectors were positive on price and 2 out of 23 sectors were positive on NAV last week. VFL offers tender results.

Weekly Closed-End Fund Roundup: June 21, 2020

seekingalpha.com

2020-06-30 09:40:334 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. MLPs lead while commodities lag. Preferreds have the highest sector

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Nuveen Wants To Merge NXC And NXN Into NXP: What Now?

seekingalpha.com

2025-09-08 13:38:01I voted against the NXC and NXN merger into Nuveen Select Tax-Free Income Portfolio, as it would overweight NXP with bonds from states facing population decline and high taxes. NXP offers lower fees, higher yields, better credit quality, and stronger historical returns compared to the single-state funds NXC and NXN. State fund holders would benefit from the merger, but must consider that distributions will become subject to steep state income taxes.

Immix Biopharma Announces Primary Endpoint Met in positive NXC-201 Interim Results Presented at ASCO, Enabling Path to Best-in-Class Therapy for relapsed/refractory AL Amyloidosis

globenewswire.com

2025-06-03 14:55:00Immix Biopharma today presented results at ASCO from its U.S. multi-center NEXICART-2 Phase 1/2 clinical trial of NXC-201, meeting its primary endpoint.

Immix Biopharma Announces Positive Results for NXC-201 at ASCO Oral Presentation, Enabling Pathway to Best-in-Class Therapy for relapsed/refractory AL Amyloidosis

globenewswire.com

2025-05-22 16:02:00Immix Biopharma today reported ASCO abstract results from its U.S. multi-center NEXICART-2 Phase 1/2 clinical trial of NXC-201 demonstrating strong efficacy and favorable safety.

Immix Biopharma's NXC-201 NEXICART-2 Clinical Trial Data Selected for Oral Presentation at ASCO 2025

globenewswire.com

2025-04-23 10:04:00— Oral presentation Tuesday, June 3, 2025 in Chicago — LOS ANGELES, April 23, 2025 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (“ImmixBio”, “Company”, “We” or “Us” or ”IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL Amyloidosis and other serious diseases, today announced that Phase 1/2 interim readout data from its U.S. NXC-201 NEXICART-2 trial in relapsed/refractory AL Amyloidosis has been selected for oral presentation at the upcoming 2025 American Society of Clinical Oncology Annual Meeting (ASCO 2025) being held in Chicago, Illinois, May 30 – June 3, 2025, presented by lead investigator Heather Landau, M.D., Director of Amyloidosis Program and a Bone Marrow Transplant Specialist & Cellular Therapist at Memorial Sloan-Kettering Cancer Center in New York.

Sell Equities, Buy Municipal Debt At A 7.21% Discount With Nuveen California Select Tax-Free Income Portfolio

seekingalpha.com

2025-02-13 03:15:00Municipal CEFs like Nuveen California Select Tax-Free Income Portfolio offer tax-free returns, low leverage, and are currently trading at a discount. NXC invests in high-quality municipal securities, with an average coupon of 3.68% and a distribution rate on NAV of 3.97%. The fund's market price is $13.17, NAV is $13.69, and it's trading at a 3.80% discount, presenting a potential profit opportunity.

Immix Biopharma Receives FDA Regenerative Medicine Advanced Therapy (RMAT) Designation for NXC-201, sterically-optimized CAR-T for relapsed/refractory AL Amyloidosis

globenewswire.com

2025-02-10 09:35:00FDA RMAT designation follows positive proof-of-concept U.S. clinical data from the NXC-201 NEXICART-2 clinical trial in relapsed/refractory AL Amyloidosis RMAT designation potentially streamlines the path to market approval by allowing frequent interactions with FDA and routes to FDA Accelerated Approval and Priority Review Enrollment in NEXICART-2 study accelerating; next update planned for H1 2025 LOS ANGELES,CA, Feb. 10, 2025 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (Nasdaq: IMMX) (“ImmixBio”, “Company”, “We” or “Us”, “IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL amyloidosis and select immune-mediated diseases, today announced that the U.S. Food and Drug Administration (FDA) has granted RMAT designation to sterically-optimized CAR-T NXC-201 for the treatment of relapsed/refractory AL amyloidosis. As of June 2024 public information, FDA approved less than half of RMAT applications submitted to the agency during the last eight years.

Immix Biopharma Accelerates Enrollment in U.S. AL Amyloidosis Trial of NXC-201 CAR-T

globenewswire.com

2025-01-07 09:34:00LOS ANGELES, Jan. 07, 2025 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (Nasdaq: IMMX) (“ImmixBio”, “Company”, “We” or “Us”, “IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL Amyloidosis and select immune-mediated diseases, today announced successful completion of the six-patient Phase 1b safety run-in segment in the U.S. NEXICART-2 study of NXC-201, an investigational CAR-T therapy, in patients relapsed/refractory (R/R) AL Amyloidosis. Achievement of this milestone is expected to accelerate enrollment across U.S. study sites beginning in January 2025.

Journal of Clinical Oncology Publishes NXC-201 Positive Clinical Results in relapsed/refractory AL Amyloidosis

globenewswire.com

2024-12-16 09:48:00Chimeric antigen receptor T-cell (CAR-T) cell therapy NXC-201 is a novel approach to treat relapsed/refractory AL Amyloidosis NXC-201 demonstrated compelling clinical activity, rapid and deep complete responses in frail and resistant relapsed/refractory AL Amyloidosis patients LOS ANGELES, Dec. 16, 2024 (GLOBE NEWSWIRE) -- Immix Biopharma, Inc. (“ImmixBio”, “Company”, “We” or “Us” or “IMMX”), a clinical-stage biopharmaceutical company developing cell therapies for AL Amyloidosis and select immune-mediated diseases, announced today the Journal of Clinical Oncology (JCO) published NXC-201 clinical results in relapsed/refractory AL Amyloidosis. The data reported on 16 enrolled patients in NEXICART-1 who had received a median 4 prior lines of therapy prior to treatment with NXC-201.

Nuveen Closed-End Funds Declare Distributions and Updates to Distribution Policies

businesswire.com

2023-12-01 16:15:00NEW YORK--(BUSINESS WIRE)--Nuveen Closed-End Funds today announced that the Board of Trustees of the Funds has approved the regular monthly and quarterly distributions. In addition, the Board of Trustees has approved updated distribution polices described below under “Monthly & Quarterly Distributions” for The Nuveen Preferred & Income Opportunities Fund (NYSE: JPC), Nuveen Preferred and Income Term Fund (NYSE: JPI), Nuveen Variable Rate Preferred & Income Fund (NYSE: NPFD), Nuveen.

Weekly Closed-End Fund Roundup: January 8, 2023

seekingalpha.com

2023-01-17 08:02:3221 out of 22 CEF sectors were positive on price and 20 out of 22 sectors were positive on NAV last week. MLPs are the most discounted CEF sector.

Weekly Closed-End Fund Roundup: VFL Tender Results (December 18, 2022)

seekingalpha.com

2022-12-27 23:19:432 out of 23 CEF sectors were positive on price and 2 out of 23 sectors were positive on NAV last week. VFL offers tender results.

Weekly Closed-End Fund Roundup: June 21, 2020

seekingalpha.com

2020-06-30 09:40:334 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. MLPs lead while commodities lag. Preferreds have the highest sector

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ