Mudrick Capital Acquisition Corporation II (MUDS)

Price:

10.17 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Centurion Acquisition Corp.

VALUE SCORE:

5

2nd position

Melar Acquisition Corp. I

VALUE SCORE:

11

The best

M3-Brigade Acquisition V Corp. Units

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Mudrick Capital Acquisition Corp II does not have significant operations. It focuses on effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. The company was incorporated in 2020 and is based in New York, New York.

NEWS

Its IPO Planned, Blue Nile's Online-Showroom Model Meets Diamond Jewelry Customers Anywhere

forbes.com

2022-06-17 14:05:37Blue Nile, a market leader in online diamond jewelry, has combined with Mudrick Capital Acquisition to take the company public by early 4Q2022. CEO Sean Kell explains the company's fully integrated showroom-digital business model that is a cornerstone for its future.

Seattle jewelry company Blue Nile is going public again through a SPAC deal

geekwire.com

2022-06-13 11:33:53Blue Nile, the online jewelry retailer founded 23 years ago in Seattle, is going public — again.

Blue Nile plans to go public through merger with SPAC Mudrick Capital

marketwatch.com

2022-06-10 18:30:00Blue Nile Inc. plans to become a publicly traded company following an agreement to combine with special purpose acquisition company Mudrick Capital Acquisition Corp. II.

Mudrick Capital Acquisition Corp. II: Attractive Warrants After Failed Deal

seekingalpha.com

2021-10-15 16:16:15Mudrick Capital Acquisition Corp. II: Attractive Warrants After Failed Deal

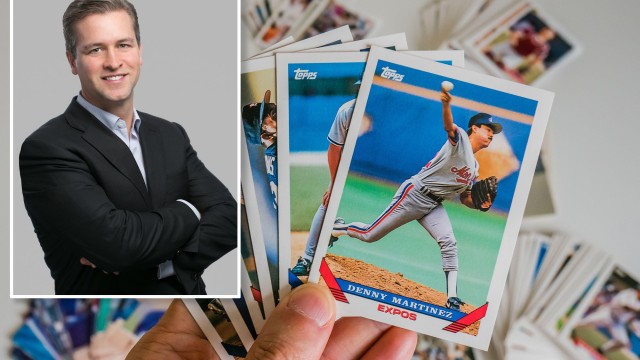

Topps deal to go public scrapped after MLB ends 70-year-old trading card deal

nypost.com

2021-08-20 14:24:28A deal to take the Topps Co. public has been scrapped after Major League Baseball said it won't renew its exclusive, 70-year-old relationship with the trading-card company. On Friday — a day after MLB announced its surprise decision to jilt Topps in favor of sports merchandising giant Fanatics — hedge fund Mudrick Capital said in.

Topps SPAC merger with Mudrick Capital is dead because MLB killed 70-year-old trading card deal

cnbc.com

2021-08-20 08:37:31Topps had been the trading card partner of Major League Baseball since 1952. Its SPAC merger with Mudrick Capital just blew up.

Topps, SPAC Mudrick Capital terminate merger deal that would have taken Topps public

marketwatch.com

2021-08-20 07:45:26Shares of Mudrick Capital Acquisition Corp. II MUDS, -2.13% fell 2.1% toward a 4 1/2-month low in premarket trading Friday, after the special purpose acquisition company (SPAC) said the merger agreement that would've have taken The Topps Company public has been terminated "by mutual agreement." The termination announcement comes a day after the companies learned Major League Baseball and the Major League Baseball Players Association would not be renewing their baseball card agreements with Topps, when they come up for renewal.

Mudrick Capital Acquisition Corporation II Announces Termination of Merger Agreement for Business Combination with The Topps Company

prnewswire.com

2021-08-20 07:30:00NEW YORK, Aug. 20, 2021 /PRNewswire/ -- Mudrick Capital Acquisition Corporation II (Nasdaq: MUDS) announced today that the Agreement and Plan of Merger with Topps Intermediate Holdco, Inc. and Tornante-MDP Joe Holding LLC has been terminated by mutual agreement, after notification on August 19, 2021 from Major League Baseball and the Major League Baseball Players Association that they would not be renewing their respective agreements with The Topps Company when they come up for renewal at the end of 2025 and 2022, respectively. About Mudrick Capital Acquisition Corporation II MUDS is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

The Topps Company Raises 2021 Outlook and Announces Second Quarter 2021 Results

globenewswire.com

2021-08-18 07:30:00Raises Full Year 2021 Outlook Net Sales Increased 77.7% to $212.2 Million Net Income Increased 176.4% to $36.3 Million Adjusted EBITDA* Increased 144.0% to $55.1 Million

Mudrick Capital Acquisition Corporation II Reminds Stockholders to Vote in Favor of Business Combination With Topps

globenewswire.com

2021-08-17 16:55:00NEW YORK, Aug. 17, 2021 (GLOBE NEWSWIRE) -- Mudrick Capital Acquisition Corporation II (“MUDS” or the “Company”) (Nasdaq: MUDS) today reminded stockholders to vote in favor of the previously announced business combination (the “Business Combination Proposal”) with The Topps Company, Inc. ("Topps").

SHAREHOLDER ALERT: Levi & Korsinsky, LLP Notifies Investors of an Investigation into the Fairness of the Merger of Mudrick Capital Acquisition Corporation with Hycroft Mining Holding Corporation

newsfilecorp.com

2021-08-12 16:59:00New York, New York--(Newsfile Corp. - August 12, 2021) - The following statement is being issued by Levi & Korsinsky, LLP:To: All Persons or Entities who purchased Mudrick Capital Acquisition Corporation ("Mudrick Capital" or the "Company"). Entities who purchased Mudrick Capital (NASDAQ: MUDS) stock prior to January 13, 2020.You are hereby notified that Levi & Korsinsky, LLP has commenced an investigation into the fairness of the merger of Mudrick Capital with Hycroft Mining Holding Corporation...

Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corporation’s Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

businesswire.com

2021-08-03 14:45:00NEW YORK--(BUSINESS WIRE)--Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international securities and consumer rights litigation firm, is investigating whether certain directors and officers of Mudrick Capital Acquisition Corporation (“Mudrick Capital”) (NASDAQ: MUDS), now known as Hycroft Mining Holding Corporation (“Hycroft”) (NASDAQ: HYMC), breached their fiduciary duties to Mudrick Capital and its shareholders. If you were a Mudrick Capital shareholder, you may contact attorney Joe Pettigrew for additional information toll-free at 844-818-6982 or jpettigrew@scott-scott.com. Scott+Scott is investigating whether Mudrick Capital’s board of directors or senior management failed to manage Mudrick Capital in an acceptable manner, in breach of their fiduciary duties to Mudrick Capital shareholders, and whether Mudrick Capital’s shareholders suffered damages as a result. On January 13, 2020, Mudrick Capital executed a merger agreement with the predecessor to Hycroft, with an April 17, 2020 record date for the shareholder vote. On May 29, 2020, the merger transaction closed, with Hycroft continuing as the successor entity. On October 1, 2020, Hycroft announced a secondary offering, ultimately consisting of 9.5 million shares of common stock and the same number of immediately exercisable warrants, bringing net proceeds of $83.1 million. On this news, shares dropped 16% to $7.58/share. On March 24, 2021, Hycroft announced financial results for 2020 and the financial outlook for 2021. On this news, shares dropped over 28% to $4.96. What You Can Do If you were a Mudrick Capital shareholder, you may have legal claims against Mudrick Capital’s directors and officers. If you wish to discuss this investigation, or have questions about this notice or your legal rights, please contact attorney Joe Pettigrew toll-free at 844-818-6982 or jpettigrew@scott-scott.com. About Scott+Scott Scott+Scott has significant experience in prosecuting major securities, antitrust, and consumer rights actions throughout the United States. The firm represents pension funds, foundations, individuals, and other entities worldwide with offices in New York, London, Amsterdam, Connecticut, California, Virginia, and Ohio. Attorney Advertising

Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corporation’s Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

businesswire.com

2021-07-08 17:37:00NEW YORK--(BUSINESS WIRE)--Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international securities and consumer rights litigation firm, is investigating whether certain directors and officers of Mudrick Capital Acquisition Corporation (“Mudrick Capital”) (NASDAQ: MUDS), now known as Hycroft Mining Holding Corporation (“Hycroft”) (NASDAQ: HYMC), breached their fiduciary duties to Mudrick Capital and its shareholders. If you were a Mudrick Capital shareholder, you may contact attorney Joe Pettigrew for additional information toll-free at 844-818-6982 or jpettigrew@scott-scott.com. Scott+Scott is investigating whether Mudrick Capital’s board of directors or senior management failed to manage Mudrick Capital in an acceptable manner, in breach of their fiduciary duties to Mudrick Capital shareholders, and whether Mudrick Capital’s shareholders suffered damages as a result. On January 13, 2020, Mudrick Capital executed a merger agreement with the predecessor to Hycroft, with an April 17, 2020 record date for the shareholder vote. On May 29, 2020, the merger transaction closed, with Hycroft continuing as the successor entity. On October 1, 2020, Hycroft announced a secondary offering, ultimately consisting of 9.5 million shares of common stock and the same number of immediately exercisable warrants, bringing net proceeds of $83.1 million. On this news, shares dropped 16% to $7.58/share. On March 24, 2021, Hycroft announced financial results for 2020 and the financial outlook for 2021. On this news, shares dropped over 28% to $4.96. What You Can Do If you were a Mudrick Capital shareholder, you may have legal claims against Mudrick Capital’s directors and officers. If you wish to discuss this investigation, or have questions about this notice or your legal rights, please contact attorney Joe Pettigrew toll-free at 844-818-6982 or jpettigrew@scott-scott.com. About Scott+Scott Scott+Scott has significant experience in prosecuting major securities, antitrust, and consumer rights actions throughout the United States. The firm represents pension funds, foundations, individuals, and other entities worldwide with offices in New York, London, Amsterdam, Connecticut, California, Virginia, and Ohio. Attorney Advertising

Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corporation's Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

businesswire.com

2021-07-08 17:37:00NEW YORK--(BUSINESS WIRE)-- #HYMC--Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corp.'s Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

Topps: Q1 Earnings Analysis And FY2021 Forecasts

seekingalpha.com

2021-07-07 11:12:58Topps reported blowout earnings for Q1 2021 with topline revenue growth and margin improvement. The company also increased EBITDA guidance for FY2021 by 40%.

Topps: Be Careful Here

seekingalpha.com

2021-06-16 04:31:40Topps reported Q1 sales that surged 55% to $166.6 million. The sports card market has seen a huge correction since the SPAC deal was announced in April.

No data to display

Its IPO Planned, Blue Nile's Online-Showroom Model Meets Diamond Jewelry Customers Anywhere

forbes.com

2022-06-17 14:05:37Blue Nile, a market leader in online diamond jewelry, has combined with Mudrick Capital Acquisition to take the company public by early 4Q2022. CEO Sean Kell explains the company's fully integrated showroom-digital business model that is a cornerstone for its future.

Seattle jewelry company Blue Nile is going public again through a SPAC deal

geekwire.com

2022-06-13 11:33:53Blue Nile, the online jewelry retailer founded 23 years ago in Seattle, is going public — again.

Blue Nile plans to go public through merger with SPAC Mudrick Capital

marketwatch.com

2022-06-10 18:30:00Blue Nile Inc. plans to become a publicly traded company following an agreement to combine with special purpose acquisition company Mudrick Capital Acquisition Corp. II.

Mudrick Capital Acquisition Corp. II: Attractive Warrants After Failed Deal

seekingalpha.com

2021-10-15 16:16:15Mudrick Capital Acquisition Corp. II: Attractive Warrants After Failed Deal

Topps deal to go public scrapped after MLB ends 70-year-old trading card deal

nypost.com

2021-08-20 14:24:28A deal to take the Topps Co. public has been scrapped after Major League Baseball said it won't renew its exclusive, 70-year-old relationship with the trading-card company. On Friday — a day after MLB announced its surprise decision to jilt Topps in favor of sports merchandising giant Fanatics — hedge fund Mudrick Capital said in.

Topps SPAC merger with Mudrick Capital is dead because MLB killed 70-year-old trading card deal

cnbc.com

2021-08-20 08:37:31Topps had been the trading card partner of Major League Baseball since 1952. Its SPAC merger with Mudrick Capital just blew up.

Topps, SPAC Mudrick Capital terminate merger deal that would have taken Topps public

marketwatch.com

2021-08-20 07:45:26Shares of Mudrick Capital Acquisition Corp. II MUDS, -2.13% fell 2.1% toward a 4 1/2-month low in premarket trading Friday, after the special purpose acquisition company (SPAC) said the merger agreement that would've have taken The Topps Company public has been terminated "by mutual agreement." The termination announcement comes a day after the companies learned Major League Baseball and the Major League Baseball Players Association would not be renewing their baseball card agreements with Topps, when they come up for renewal.

Mudrick Capital Acquisition Corporation II Announces Termination of Merger Agreement for Business Combination with The Topps Company

prnewswire.com

2021-08-20 07:30:00NEW YORK, Aug. 20, 2021 /PRNewswire/ -- Mudrick Capital Acquisition Corporation II (Nasdaq: MUDS) announced today that the Agreement and Plan of Merger with Topps Intermediate Holdco, Inc. and Tornante-MDP Joe Holding LLC has been terminated by mutual agreement, after notification on August 19, 2021 from Major League Baseball and the Major League Baseball Players Association that they would not be renewing their respective agreements with The Topps Company when they come up for renewal at the end of 2025 and 2022, respectively. About Mudrick Capital Acquisition Corporation II MUDS is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

The Topps Company Raises 2021 Outlook and Announces Second Quarter 2021 Results

globenewswire.com

2021-08-18 07:30:00Raises Full Year 2021 Outlook Net Sales Increased 77.7% to $212.2 Million Net Income Increased 176.4% to $36.3 Million Adjusted EBITDA* Increased 144.0% to $55.1 Million

Mudrick Capital Acquisition Corporation II Reminds Stockholders to Vote in Favor of Business Combination With Topps

globenewswire.com

2021-08-17 16:55:00NEW YORK, Aug. 17, 2021 (GLOBE NEWSWIRE) -- Mudrick Capital Acquisition Corporation II (“MUDS” or the “Company”) (Nasdaq: MUDS) today reminded stockholders to vote in favor of the previously announced business combination (the “Business Combination Proposal”) with The Topps Company, Inc. ("Topps").

SHAREHOLDER ALERT: Levi & Korsinsky, LLP Notifies Investors of an Investigation into the Fairness of the Merger of Mudrick Capital Acquisition Corporation with Hycroft Mining Holding Corporation

newsfilecorp.com

2021-08-12 16:59:00New York, New York--(Newsfile Corp. - August 12, 2021) - The following statement is being issued by Levi & Korsinsky, LLP:To: All Persons or Entities who purchased Mudrick Capital Acquisition Corporation ("Mudrick Capital" or the "Company"). Entities who purchased Mudrick Capital (NASDAQ: MUDS) stock prior to January 13, 2020.You are hereby notified that Levi & Korsinsky, LLP has commenced an investigation into the fairness of the merger of Mudrick Capital with Hycroft Mining Holding Corporation...

Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corporation’s Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

businesswire.com

2021-08-03 14:45:00NEW YORK--(BUSINESS WIRE)--Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international securities and consumer rights litigation firm, is investigating whether certain directors and officers of Mudrick Capital Acquisition Corporation (“Mudrick Capital”) (NASDAQ: MUDS), now known as Hycroft Mining Holding Corporation (“Hycroft”) (NASDAQ: HYMC), breached their fiduciary duties to Mudrick Capital and its shareholders. If you were a Mudrick Capital shareholder, you may contact attorney Joe Pettigrew for additional information toll-free at 844-818-6982 or jpettigrew@scott-scott.com. Scott+Scott is investigating whether Mudrick Capital’s board of directors or senior management failed to manage Mudrick Capital in an acceptable manner, in breach of their fiduciary duties to Mudrick Capital shareholders, and whether Mudrick Capital’s shareholders suffered damages as a result. On January 13, 2020, Mudrick Capital executed a merger agreement with the predecessor to Hycroft, with an April 17, 2020 record date for the shareholder vote. On May 29, 2020, the merger transaction closed, with Hycroft continuing as the successor entity. On October 1, 2020, Hycroft announced a secondary offering, ultimately consisting of 9.5 million shares of common stock and the same number of immediately exercisable warrants, bringing net proceeds of $83.1 million. On this news, shares dropped 16% to $7.58/share. On March 24, 2021, Hycroft announced financial results for 2020 and the financial outlook for 2021. On this news, shares dropped over 28% to $4.96. What You Can Do If you were a Mudrick Capital shareholder, you may have legal claims against Mudrick Capital’s directors and officers. If you wish to discuss this investigation, or have questions about this notice or your legal rights, please contact attorney Joe Pettigrew toll-free at 844-818-6982 or jpettigrew@scott-scott.com. About Scott+Scott Scott+Scott has significant experience in prosecuting major securities, antitrust, and consumer rights actions throughout the United States. The firm represents pension funds, foundations, individuals, and other entities worldwide with offices in New York, London, Amsterdam, Connecticut, California, Virginia, and Ohio. Attorney Advertising

Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corporation’s Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

businesswire.com

2021-07-08 17:37:00NEW YORK--(BUSINESS WIRE)--Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international securities and consumer rights litigation firm, is investigating whether certain directors and officers of Mudrick Capital Acquisition Corporation (“Mudrick Capital”) (NASDAQ: MUDS), now known as Hycroft Mining Holding Corporation (“Hycroft”) (NASDAQ: HYMC), breached their fiduciary duties to Mudrick Capital and its shareholders. If you were a Mudrick Capital shareholder, you may contact attorney Joe Pettigrew for additional information toll-free at 844-818-6982 or jpettigrew@scott-scott.com. Scott+Scott is investigating whether Mudrick Capital’s board of directors or senior management failed to manage Mudrick Capital in an acceptable manner, in breach of their fiduciary duties to Mudrick Capital shareholders, and whether Mudrick Capital’s shareholders suffered damages as a result. On January 13, 2020, Mudrick Capital executed a merger agreement with the predecessor to Hycroft, with an April 17, 2020 record date for the shareholder vote. On May 29, 2020, the merger transaction closed, with Hycroft continuing as the successor entity. On October 1, 2020, Hycroft announced a secondary offering, ultimately consisting of 9.5 million shares of common stock and the same number of immediately exercisable warrants, bringing net proceeds of $83.1 million. On this news, shares dropped 16% to $7.58/share. On March 24, 2021, Hycroft announced financial results for 2020 and the financial outlook for 2021. On this news, shares dropped over 28% to $4.96. What You Can Do If you were a Mudrick Capital shareholder, you may have legal claims against Mudrick Capital’s directors and officers. If you wish to discuss this investigation, or have questions about this notice or your legal rights, please contact attorney Joe Pettigrew toll-free at 844-818-6982 or jpettigrew@scott-scott.com. About Scott+Scott Scott+Scott has significant experience in prosecuting major securities, antitrust, and consumer rights actions throughout the United States. The firm represents pension funds, foundations, individuals, and other entities worldwide with offices in New York, London, Amsterdam, Connecticut, California, Virginia, and Ohio. Attorney Advertising

Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corporation's Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

businesswire.com

2021-07-08 17:37:00NEW YORK--(BUSINESS WIRE)-- #HYMC--Scott+Scott Attorneys at Law LLP Investigates Mudrick Capital Acquisition Corp.'s Directors and Officers for Breach of Fiduciary Duties – MUDS, HYMC

Topps: Q1 Earnings Analysis And FY2021 Forecasts

seekingalpha.com

2021-07-07 11:12:58Topps reported blowout earnings for Q1 2021 with topline revenue growth and margin improvement. The company also increased EBITDA guidance for FY2021 by 40%.

Topps: Be Careful Here

seekingalpha.com

2021-06-16 04:31:40Topps reported Q1 sales that surged 55% to $166.6 million. The sports card market has seen a huge correction since the SPAC deal was announced in April.