MSC Industrial Direct Co., Inc. (MSM)

Price:

88.59 USD

( - -0.94 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

WESCO International, Inc.

VALUE SCORE:

5

2nd position

Applied Industrial Technologies, Inc.

VALUE SCORE:

9

The best

W.W. Grainger, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

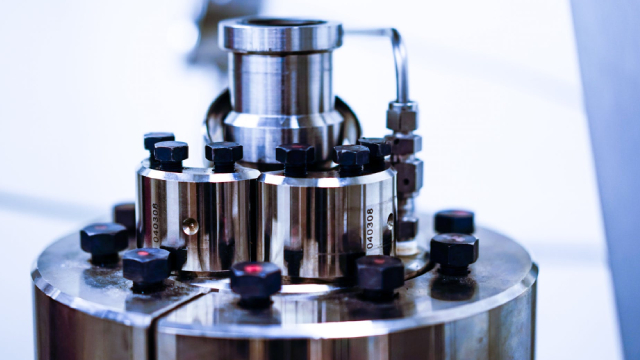

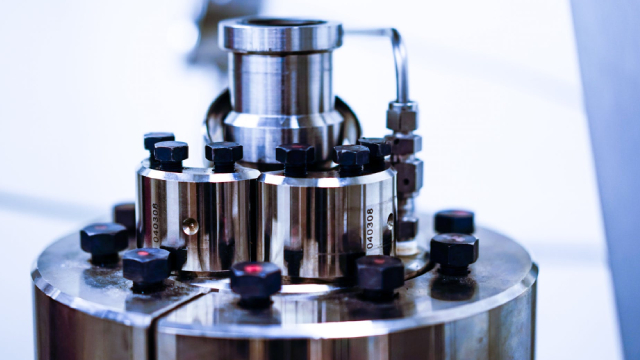

MSC Industrial Direct Co., Inc., together with its subsidiaries, distributes metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, and the United Kingdom. Its MRO products include cutting tools, measuring instruments, tooling components, metalworking products, fasteners, flat stock products, raw materials, abrasives, machinery hand and power tools, safety and janitorial supplies, plumbing supplies, materials handling products, power transmission components, and electrical supplies. The company offers approximately 1.9 million stock-keeping units through its catalogs and brochures; e-commerce channels, including its Website, mscdirect.com; inventory management solutions; and call-centers and branches. It operates through a distribution network of 28 branch offices, 11 customer fulfilment centers, and seven regional inventory centers. The company serves individual machine shops, Fortune 1000 manufacturing companies, and government agencies, as well as manufacturers of various sizes. MSC Industrial Direct Co., Inc. was founded in 1941 and is headquartered in Melville, New York.

NEWS

Are Industrial Products Stocks Lagging MSC (MSM) This Year?

zacks.com

2025-10-09 10:40:13Here is how MSC Industrial (MSM) and Mueller Water Products (MWA) have performed compared to their sector so far this year.

MSC Industrial Supply Co. Declares Increase in Regular Quarterly Dividend

accessnewswire.com

2025-10-07 17:00:00MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / October 7, 2025 / MSC Industrial Supply Co. (NYSE:MSM), a premier distributor of Metalworking and Maintenance, Repair and Operations (MRO) products and services to industrial customers throughout North America, today announced that its Board of Directors has declared a cash dividend of $0.87 per share. This represents an increase of approximately 2.4% from the previously paid regular quarterly dividend of $0.85 per share.

3 Industrial Services Stocks to Buy as Industry Prospects Improve

zacks.com

2025-10-03 09:26:12The Zacks Industrial Services industry has a promising near-term outlook, with stocks such as FAST, MSM and SCSC standing out as compelling portfolio additions.

Will MSC Industrial (MSM) Beat Estimates Again in Its Next Earnings Report?

zacks.com

2025-09-23 13:11:06MSC Industrial (MSM) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

MSC Industrial Supply Co. to Webcast Review of Fiscal 2025 Fourth Quarter and Full Year Results

accessnewswire.com

2025-09-22 17:30:00MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / September 22, 2025 / MSC INDUSTRIAL SUPPLY CO. (NYSE:MSM), a premier distributor of Metalworking and Maintenance, Repair and Operations (MRO) products and services to industrial customers throughout North America, today announced that the Company's conference call to review its fiscal year 2025 fourth quarter and full year results, as well as its current operations, will be broadcast online live on Thursday, October 23, 2025 at 8:30 a.m.

MSC Industrial Direct Co., Inc. (MSM) Presents At Jefferies Industrials Conference (Transcript)

seekingalpha.com

2025-09-03 17:16:06MSC Industrial Direct Co., Inc. (NYSE:MSM ) Jefferies Industrials Conference September 3, 2025 2:50 PM EDT Company Participants Erik Gershwind - CEO & Director Ryan Mills - Head of Investor Relations Conference Call Participants Chirag Patel - Jefferies LLC, Research Division Presentation Chirag Patel Equity Associate Session here with MSC Industrial. I'm Chirag Patel, I cover the machinery, multis and distribution space here at Jefferies, along with Steve Volkmann.

MSC Industrial Supply Co. To Attend Jefferies Industrial Conference

accessnewswire.com

2025-08-27 17:00:00MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / August 27, 2025 / MSC INDUSTRIAL SUPPLY CO. (NYSE:MSM), a leading North American distributor of a broad range of metalworking and maintenance, repair and operations ("MRO") products and services, today announced the following upcoming investor event: Jefferies Industrials Conference When: September 3, 2025 Attendees: Erik Gershwind, CEO Ryan Mills, Head of Investor Relations Fireside Chat: Wednesday, September 3, 2025, at 2:50 p.m.

MSC Industrial (MSM) Upgraded to Strong Buy: Here's What You Should Know

zacks.com

2025-08-27 13:01:28MSC Industrial (MSM) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Is MSC (MSM) Stock Undervalued Right Now?

zacks.com

2025-08-22 10:40:17Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sealed Air Names Kristen Actis-Grande Chief Financial Officer

prnewswire.com

2025-08-04 16:36:00CHARLOTTE, N.C. , Aug. 4, 2025 /PRNewswire/ -- Sealed Air Corporation (NYSE: SEE) today announced Kristen Actis-Grande will join the company as Chief Financial Officer, effective August 25, 2025.

MSC INDUSTRIAL SUPPLY CO. ANNOUNCES RESIGNATION OF CHIEF FINANCIAL OFFICER AND SEES FISCAL FOURTH QUARTER PERFORMANCE TRENDING TOWARDS THE UPPER HALF OF GUIDANCE RANGE

prnewswire.com

2025-07-28 16:30:00MELVILLE, N.Y. and DAVIDSON, N.C.

Is MSC (MSM) Stock Outpacing Its Industrial Products Peers This Year?

zacks.com

2025-07-24 10:41:11Here is how MSC Industrial (MSM) and Siemens AG (SIEGY) have performed compared to their sector so far this year.

MSC Industrial: Turnaround Story With Attractive Risk-Reward

seekingalpha.com

2025-07-23 16:33:00Revenue recovery from digital growth, high-touch solutions (In-Plant + vending), and improving SMB segment. Margin upside from price hikes, cost savings, and better operating leverage. Attractive valuation vs. peers with solid 3.89% dividend yield.

Best Income Stocks to Buy for July 14th

zacks.com

2025-07-14 05:55:11WIT, AB and MSM made it to the Zacks Rank #1 (Strong Buy) income stocks list on July 14, 2025.

MSC Industrial (MSM) is a Great Momentum Stock: Should You Buy?

zacks.com

2025-07-10 13:06:19Does MSC Industrial (MSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

3 Industrial Services Stocks to Buy in a Promising Industry

zacks.com

2025-07-09 13:20:12The Zacks Industrial Services industry has a promising near-term outlook, with stocks such as SIEGY, MSM and EOSE standing out as compelling portfolio additions.

Are Industrial Products Stocks Lagging MSC (MSM) This Year?

zacks.com

2025-10-09 10:40:13Here is how MSC Industrial (MSM) and Mueller Water Products (MWA) have performed compared to their sector so far this year.

MSC Industrial Supply Co. Declares Increase in Regular Quarterly Dividend

accessnewswire.com

2025-10-07 17:00:00MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / October 7, 2025 / MSC Industrial Supply Co. (NYSE:MSM), a premier distributor of Metalworking and Maintenance, Repair and Operations (MRO) products and services to industrial customers throughout North America, today announced that its Board of Directors has declared a cash dividend of $0.87 per share. This represents an increase of approximately 2.4% from the previously paid regular quarterly dividend of $0.85 per share.

3 Industrial Services Stocks to Buy as Industry Prospects Improve

zacks.com

2025-10-03 09:26:12The Zacks Industrial Services industry has a promising near-term outlook, with stocks such as FAST, MSM and SCSC standing out as compelling portfolio additions.

Will MSC Industrial (MSM) Beat Estimates Again in Its Next Earnings Report?

zacks.com

2025-09-23 13:11:06MSC Industrial (MSM) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

MSC Industrial Supply Co. to Webcast Review of Fiscal 2025 Fourth Quarter and Full Year Results

accessnewswire.com

2025-09-22 17:30:00MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / September 22, 2025 / MSC INDUSTRIAL SUPPLY CO. (NYSE:MSM), a premier distributor of Metalworking and Maintenance, Repair and Operations (MRO) products and services to industrial customers throughout North America, today announced that the Company's conference call to review its fiscal year 2025 fourth quarter and full year results, as well as its current operations, will be broadcast online live on Thursday, October 23, 2025 at 8:30 a.m.

MSC Industrial Direct Co., Inc. (MSM) Presents At Jefferies Industrials Conference (Transcript)

seekingalpha.com

2025-09-03 17:16:06MSC Industrial Direct Co., Inc. (NYSE:MSM ) Jefferies Industrials Conference September 3, 2025 2:50 PM EDT Company Participants Erik Gershwind - CEO & Director Ryan Mills - Head of Investor Relations Conference Call Participants Chirag Patel - Jefferies LLC, Research Division Presentation Chirag Patel Equity Associate Session here with MSC Industrial. I'm Chirag Patel, I cover the machinery, multis and distribution space here at Jefferies, along with Steve Volkmann.

MSC Industrial Supply Co. To Attend Jefferies Industrial Conference

accessnewswire.com

2025-08-27 17:00:00MELVILLE, NY AND DAVIDSON, NC / ACCESS Newswire / August 27, 2025 / MSC INDUSTRIAL SUPPLY CO. (NYSE:MSM), a leading North American distributor of a broad range of metalworking and maintenance, repair and operations ("MRO") products and services, today announced the following upcoming investor event: Jefferies Industrials Conference When: September 3, 2025 Attendees: Erik Gershwind, CEO Ryan Mills, Head of Investor Relations Fireside Chat: Wednesday, September 3, 2025, at 2:50 p.m.

MSC Industrial (MSM) Upgraded to Strong Buy: Here's What You Should Know

zacks.com

2025-08-27 13:01:28MSC Industrial (MSM) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Is MSC (MSM) Stock Undervalued Right Now?

zacks.com

2025-08-22 10:40:17Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sealed Air Names Kristen Actis-Grande Chief Financial Officer

prnewswire.com

2025-08-04 16:36:00CHARLOTTE, N.C. , Aug. 4, 2025 /PRNewswire/ -- Sealed Air Corporation (NYSE: SEE) today announced Kristen Actis-Grande will join the company as Chief Financial Officer, effective August 25, 2025.

MSC INDUSTRIAL SUPPLY CO. ANNOUNCES RESIGNATION OF CHIEF FINANCIAL OFFICER AND SEES FISCAL FOURTH QUARTER PERFORMANCE TRENDING TOWARDS THE UPPER HALF OF GUIDANCE RANGE

prnewswire.com

2025-07-28 16:30:00MELVILLE, N.Y. and DAVIDSON, N.C.

Is MSC (MSM) Stock Outpacing Its Industrial Products Peers This Year?

zacks.com

2025-07-24 10:41:11Here is how MSC Industrial (MSM) and Siemens AG (SIEGY) have performed compared to their sector so far this year.

MSC Industrial: Turnaround Story With Attractive Risk-Reward

seekingalpha.com

2025-07-23 16:33:00Revenue recovery from digital growth, high-touch solutions (In-Plant + vending), and improving SMB segment. Margin upside from price hikes, cost savings, and better operating leverage. Attractive valuation vs. peers with solid 3.89% dividend yield.

Best Income Stocks to Buy for July 14th

zacks.com

2025-07-14 05:55:11WIT, AB and MSM made it to the Zacks Rank #1 (Strong Buy) income stocks list on July 14, 2025.

MSC Industrial (MSM) is a Great Momentum Stock: Should You Buy?

zacks.com

2025-07-10 13:06:19Does MSC Industrial (MSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

3 Industrial Services Stocks to Buy in a Promising Industry

zacks.com

2025-07-09 13:20:12The Zacks Industrial Services industry has a promising near-term outlook, with stocks such as SIEGY, MSM and EOSE standing out as compelling portfolio additions.