Modine Manufacturing Company (MOD)

Price:

139.84 USD

( - -25.35 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Aptiv PLC

VALUE SCORE:

8

2nd position

AutoZone, Inc.

VALUE SCORE:

9

The best

Autoliv, Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Modine Manufacturing Company provides engineered heat transfer systems and heat transfer components for use in on- and off-highway original equipment manufacturer (OEM) vehicular applications. It operates through Climate Solutions and Performance Technologies segments. The company offers gas-fired, hydronic, electric, and oil-fired unit heaters; indoor and outdoor duct furnaces; infrared units; perimeter heating products, such as commercial fin-tube radiation, cabinet unit heaters, and convectors; roof-mounted direct- and indirect-fired makeup air units; unit ventilators; single packaged vertical units; precision air conditioning units for data center applications; air handler units; fan walls; chillers; ceiling cassettes; hybrid fan coils; and condensers and condensing units. It also provides microchannel, heat recovery, round tube plate fin, and motor and generator cooling coils; evaporator unit, fluid, transformer oil, gas, air blast, and dry and brine coolers, as well as remote condensers; and coatings to protect against corrosion. In addition, the company offers powertrain cooling products, including engine cooling modules, radiators, charge air coolers, condensers, oil coolers, fan shrouds, and surge tanks; on-engine cooling products comprising exhaust gas recirculation, engine oil, fuel, charge air, and intake air coolers; auxiliary cooling products, such as transmission and retarder oil coolers, and power steering coolers; and complete battery thermal management systems and electronics cooling packages. It serves heating, ventilation, and cooling OEMs; construction architects and contractors; wholesalers of heating equipment; automobile, truck, bus, and specialty vehicle OEMs; agricultural, industrial, and construction equipment OEMs; and commercial and industrial equipment OEMs. The company has operations in North America, South America, Europe, and Asia. Modine Manufacturing Company was incorporated in 1916 and is headquartered in Racine, Wisconsin.

NEWS

Modine Manufacturing Company $MOD Position Lowered by Frontier Capital Management Co. LLC

defenseworld.net

2025-12-12 04:14:52Frontier Capital Management Co. LLC reduced its position in Modine Manufacturing Company (NYSE: MOD) by 2.7% in the undefined quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 418,172 shares of the auto parts company's stock after selling 11,559 shares during

Modine (MOD) Exceeds Market Returns: Some Facts to Consider

zacks.com

2025-12-11 18:46:23Modine (MOD) closed at $165.19 in the latest trading session, marking a +1.56% move from the prior day.

Modine Manufacturing's President and CEO Sells Nearly 32,000 Shares

fool.com

2025-12-05 15:21:38Modine Manufacturing, a global supplier of heat transfer solutions, reported a notable insider sale amid ongoing sector diversification.

Investors Heavily Search Modine Manufacturing Company (MOD): Here is What You Need to Know

zacks.com

2025-12-04 10:01:39Modine (MOD) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Is It Worth Investing in Modine (MOD) Based on Wall Street's Bullish Views?

zacks.com

2025-12-02 10:31:13When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Modine Manufacturing Company $MOD Stock Holdings Increased by Cetera Investment Advisers

defenseworld.net

2025-12-02 04:10:51Cetera Investment Advisers grew its position in shares of Modine Manufacturing Company (NYSE: MOD) by 17.1% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 15,837 shares of the auto parts company's stock after buying an additional 2,317 shares

APTV vs. MOD: Which Stock Is the Better Value Option?

zacks.com

2025-12-01 12:48:19Investors interested in stocks from the Automotive - Original Equipment sector have probably already heard of Aptiv PLC (APTV) and Modine (MOD). But which of these two stocks is more attractive to value investors?

Boston Partners Acquires Shares of 200,833 Modine Manufacturing Company $MOD

defenseworld.net

2025-11-29 03:28:45Boston Partners bought a new stake in Modine Manufacturing Company (NYSE: MOD) during the second quarter, according to the company in its most recent disclosure with the SEC. The firm bought 200,833 shares of the auto parts company's stock, valued at approximately $20,547,000. Boston Partners owned approximately 0.38% of Modine Manufacturing as of

Wasatch Global Opportunities Fund Q3 2025 Contributors And Detractors

seekingalpha.com

2025-11-27 09:11:00A longtime holding in many of our small-cap funds, Shift4 is a U.S. company that provides payment processing solutions for hospitality, retail and e‑commerce businesses. Five-Star is an Indian company that provides small-business and mortgage loans to eligible borrowers to meet their business and personal needs. Modine has experienced substantial growth from its data-center business, which likely played a role in driving the stock higher.

Why Modine Manufacturing Stock Was Motoring Higher This Week

fool.com

2025-11-21 15:01:50Two analysts waxed bullish on the cooling systems specialist in new takes on its stock. The pair both consider it to be a buy at current levels.

Here is What to Know Beyond Why Modine Manufacturing Company (MOD) is a Trending Stock

zacks.com

2025-11-20 10:06:46Recently, Zacks.com users have been paying close attention to Modine (MOD). This makes it worthwhile to examine what the stock has in store.

Artisan Global Discovery Fund: Q3 Delivers Strong Results Amid Trimming And Exits

seekingalpha.com

2025-11-20 08:40:00The portfolio generated a modestly positive absolute return in Q3, but it trailed the MSCI All Country World Small Mid Index. The Q3 underperformance was driven by stock selection in the IT, financials and consumer discretionary sectors. On the positive side, stock selection in the health care and industrials sectors was the strongest contributor to performance.

Airedale by Modine Announces Stainless Steel Extension of TurboChill™ DCS Chiller for Liquid Cooling Data Centers

prnewswire.com

2025-11-18 07:00:00New design enhances water loop cleanliness and enables removal of in-row CDUs in high density applications, optimizing PUE and freeing space for additional IT racks. RACINE, Wis.

Modine Expands Data Center Cooling Capacity with Opening of New Facility in Franklin, Wisconsin

prnewswire.com

2025-11-17 07:00:00RACINE, Wis. , Nov. 17, 2025 /PRNewswire/ -- Modine (NYSE: MOD), a diversified global leader in thermal management technology and solutions, is proud to announce the official opening of its new manufacturing facility in Franklin, Wisconsin.

Panoramic Capital Adds 26,547 Modine Manufacturing (MOD) Shares to Portfolio

fool.com

2025-11-15 13:56:08Increased MOD stake by 26,547 shares, representing a net position change of $5.46 million Transaction accounts for approximately 1.52% of Panoramic Capital's 13F reportable assets under management (AUM) Panoramic Capital now holds 65,116 shares valued at $9.26 million as of September 30, 2025 The MOD position is approximately 4.16% of AUM, making it the fund's 5th-largest stock holding

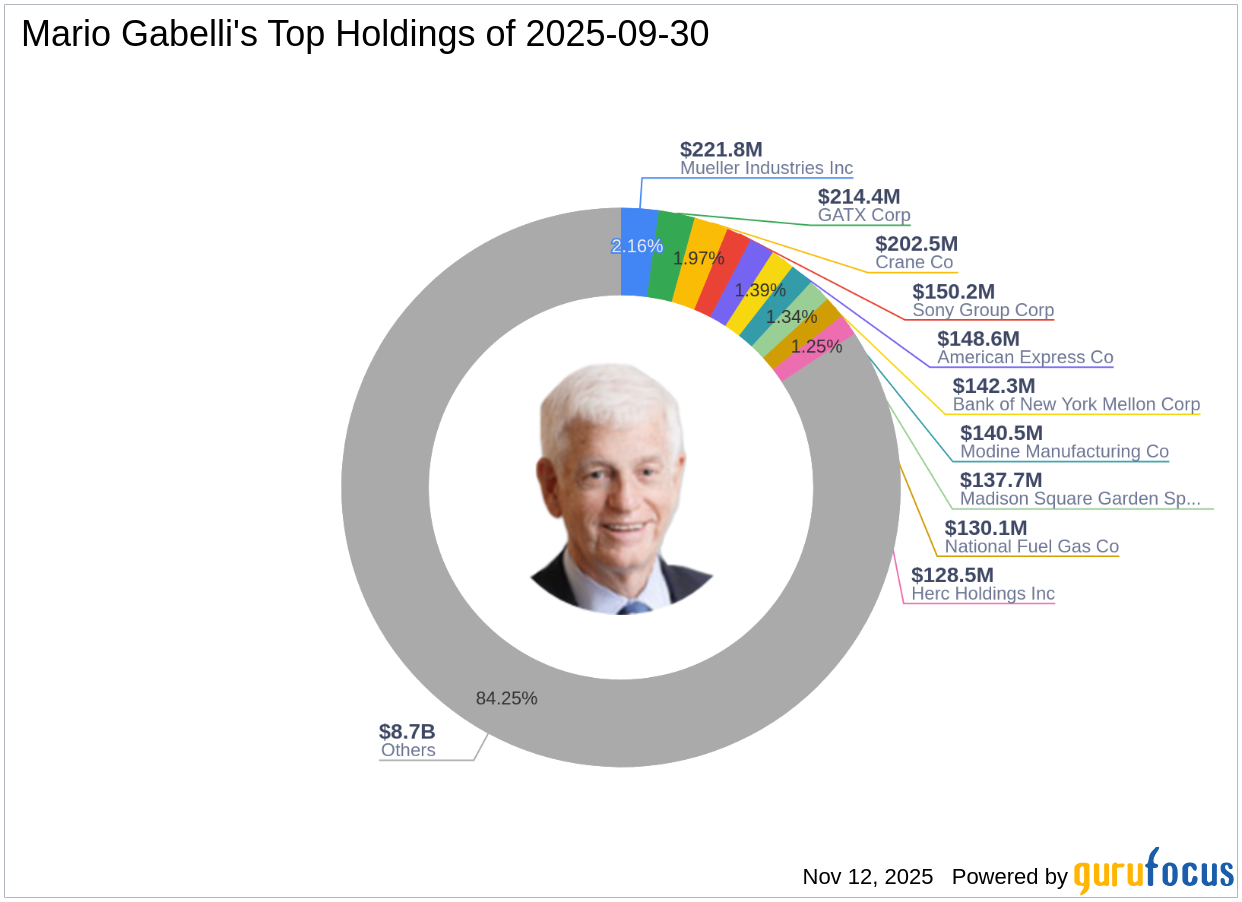

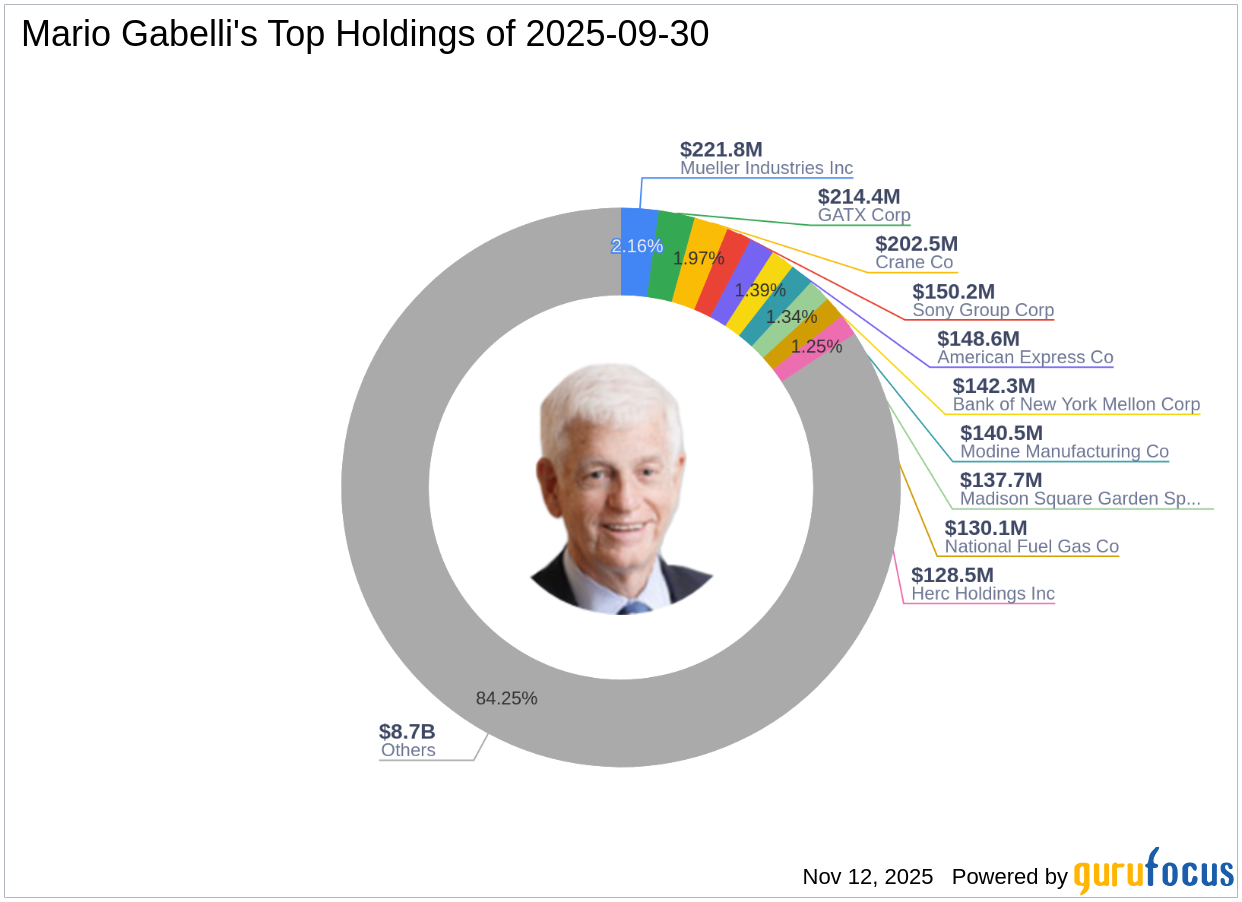

Paramount Global: Mario Gabelli's Strategic Exit with a -0.62% Portfolio Impact

gurufocus.com

2025-11-12 18:01:00Insights into Mario Gabelli (Trades, Portfolio)'s Third Quarter 2025 Investment Moves Mario Gabelli (Trades, Portfolio) recently submitted the 13F filing for t

Modine Manufacturing Company $MOD Position Lowered by Frontier Capital Management Co. LLC

defenseworld.net

2025-12-12 04:14:52Frontier Capital Management Co. LLC reduced its position in Modine Manufacturing Company (NYSE: MOD) by 2.7% in the undefined quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 418,172 shares of the auto parts company's stock after selling 11,559 shares during

Modine (MOD) Exceeds Market Returns: Some Facts to Consider

zacks.com

2025-12-11 18:46:23Modine (MOD) closed at $165.19 in the latest trading session, marking a +1.56% move from the prior day.

Modine Manufacturing's President and CEO Sells Nearly 32,000 Shares

fool.com

2025-12-05 15:21:38Modine Manufacturing, a global supplier of heat transfer solutions, reported a notable insider sale amid ongoing sector diversification.

Investors Heavily Search Modine Manufacturing Company (MOD): Here is What You Need to Know

zacks.com

2025-12-04 10:01:39Modine (MOD) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Is It Worth Investing in Modine (MOD) Based on Wall Street's Bullish Views?

zacks.com

2025-12-02 10:31:13When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Modine Manufacturing Company $MOD Stock Holdings Increased by Cetera Investment Advisers

defenseworld.net

2025-12-02 04:10:51Cetera Investment Advisers grew its position in shares of Modine Manufacturing Company (NYSE: MOD) by 17.1% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 15,837 shares of the auto parts company's stock after buying an additional 2,317 shares

APTV vs. MOD: Which Stock Is the Better Value Option?

zacks.com

2025-12-01 12:48:19Investors interested in stocks from the Automotive - Original Equipment sector have probably already heard of Aptiv PLC (APTV) and Modine (MOD). But which of these two stocks is more attractive to value investors?

Boston Partners Acquires Shares of 200,833 Modine Manufacturing Company $MOD

defenseworld.net

2025-11-29 03:28:45Boston Partners bought a new stake in Modine Manufacturing Company (NYSE: MOD) during the second quarter, according to the company in its most recent disclosure with the SEC. The firm bought 200,833 shares of the auto parts company's stock, valued at approximately $20,547,000. Boston Partners owned approximately 0.38% of Modine Manufacturing as of

Wasatch Global Opportunities Fund Q3 2025 Contributors And Detractors

seekingalpha.com

2025-11-27 09:11:00A longtime holding in many of our small-cap funds, Shift4 is a U.S. company that provides payment processing solutions for hospitality, retail and e‑commerce businesses. Five-Star is an Indian company that provides small-business and mortgage loans to eligible borrowers to meet their business and personal needs. Modine has experienced substantial growth from its data-center business, which likely played a role in driving the stock higher.

Why Modine Manufacturing Stock Was Motoring Higher This Week

fool.com

2025-11-21 15:01:50Two analysts waxed bullish on the cooling systems specialist in new takes on its stock. The pair both consider it to be a buy at current levels.

Here is What to Know Beyond Why Modine Manufacturing Company (MOD) is a Trending Stock

zacks.com

2025-11-20 10:06:46Recently, Zacks.com users have been paying close attention to Modine (MOD). This makes it worthwhile to examine what the stock has in store.

Artisan Global Discovery Fund: Q3 Delivers Strong Results Amid Trimming And Exits

seekingalpha.com

2025-11-20 08:40:00The portfolio generated a modestly positive absolute return in Q3, but it trailed the MSCI All Country World Small Mid Index. The Q3 underperformance was driven by stock selection in the IT, financials and consumer discretionary sectors. On the positive side, stock selection in the health care and industrials sectors was the strongest contributor to performance.

Airedale by Modine Announces Stainless Steel Extension of TurboChill™ DCS Chiller for Liquid Cooling Data Centers

prnewswire.com

2025-11-18 07:00:00New design enhances water loop cleanliness and enables removal of in-row CDUs in high density applications, optimizing PUE and freeing space for additional IT racks. RACINE, Wis.

Modine Expands Data Center Cooling Capacity with Opening of New Facility in Franklin, Wisconsin

prnewswire.com

2025-11-17 07:00:00RACINE, Wis. , Nov. 17, 2025 /PRNewswire/ -- Modine (NYSE: MOD), a diversified global leader in thermal management technology and solutions, is proud to announce the official opening of its new manufacturing facility in Franklin, Wisconsin.

Panoramic Capital Adds 26,547 Modine Manufacturing (MOD) Shares to Portfolio

fool.com

2025-11-15 13:56:08Increased MOD stake by 26,547 shares, representing a net position change of $5.46 million Transaction accounts for approximately 1.52% of Panoramic Capital's 13F reportable assets under management (AUM) Panoramic Capital now holds 65,116 shares valued at $9.26 million as of September 30, 2025 The MOD position is approximately 4.16% of AUM, making it the fund's 5th-largest stock holding

Paramount Global: Mario Gabelli's Strategic Exit with a -0.62% Portfolio Impact

gurufocus.com

2025-11-12 18:01:00Insights into Mario Gabelli (Trades, Portfolio)'s Third Quarter 2025 Investment Moves Mario Gabelli (Trades, Portfolio) recently submitted the 13F filing for t