Western Asset Municipal Partners Fund Inc. (MNP)

Price:

10.58 USD

( + 0.02 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Citigroup Capital XIII TR PFD SECS

VALUE SCORE:

6

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

ClearBridge Energy Midstream Opportunity Fund Inc

VALUE SCORE:

15

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

DESCRIPTION

Western Asset Municipal Partners Fund Inc. is a closed ended fixed income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. The fund is co-managed by Western Asset Management Company. It invests in fixed income markets of the United States. The fund primarily invests in investment grade tax exempt securities issued by municipalities. It benchmarks the performance of its portfolio against the Barclays Municipal Bond Index. The fund was formerly known as the Salomon Brothers Municipal Partners Fund. Western Asset Municipal Partners Fund Inc. was formed on January 29, 1993 and is domiciled in the United States.

NEWS

FRX Innovations Inc. Announces a Change in Auditor

newsfilecorp.com

2025-06-19 12:18:44Toronto, Ontario--(Newsfile Corp. - June 19, 2025) - FRX Innovations Inc. (TSXV: FRXI.H) (the "Company") announces that the Company has changed its auditor from MNP LLP ("MNP") to Manning Elliott LLP ("Manning Elliott") effective as of June 16, 2025. At the request of the Company, MNP resigned as auditor of the Company effective as of June 16, 2025 (the "Date of Resignation").

AISIX Solutions Inc. Selected by MNP to Support Wildfire Risk Modeling Services for Canadian Businesses

newsfilecorp.com

2025-04-09 09:03:00Vancouver, British Columbia--(Newsfile Corp. - April 9, 2025) - AISIX Solutions Inc. , (TSXV: AISX) (OTCQB: AISXF) (FSE: QT7) ("AISIX" or "the Company"), a frontrunner in climate risk assessment and modeling, today announced that it has been selected by MNP to support wildfire risk modeling services to MNP clients, contributing to the firm's broader climate risk and adaptation advisory offerings, commencing March 27, 2025. MNP is one of Canada's largest professional services firms, with 152 offices across the country.

Spectral Medical Inc. Announces Change to Auditor

globenewswire.com

2024-07-11 16:00:00TORONTO, July 11, 2024 (GLOBE NEWSWIRE) -- Spectral Medical Inc. ("Spectral" or the "Company") (TSX: EDT), a late-stage theranostic company advancing therapeutic options for sepsis and septic shock, today announced that MNP LLP (“MNP”) have today been appointed as the auditors of the Company following the decision by PricewaterhouseCoopers LLP (“PwC”) to resign as the auditor of Spectral (the “Effective Date”). The resignation of PwC as the auditor of Spectral and the appointment of MNP as auditor of Spectral were considered and approved by the Finance & Audit Committee and the board of directors.

Weekly Closed-End Fund Roundup: MNP And MMU To Merge (August 13, 2023)

seekingalpha.com

2023-08-24 08:44:3213 out of 22 CEF sectors positive on price and 13 out of 22 sectors positive on NAV. MNP and MMU to merge. Current arbitrage potential is slim.

Certain Closed End Funds Advised by Legg Mason Partners Fund Advisor, LLC Announce Appointment of New Lead Independent Director

businesswire.com

2022-11-10 08:00:00The Board of each Fund announced today the appointment of Eileen Kamerick as Lead Independent Director, effective November 8, 2022. Ms. Kamerick replaces William Hutchinson, the former Lead Independent Director of the Funds, who recently passed away. The Boards also announced that Nisha Kumar will succeed Ms. Kamerick as Chair of each Fund's Audit Committee.

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of September, October, and November 2022

businesswire.com

2022-08-02 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of March, April and May 2022

businesswire.com

2022-02-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

MNP: Attractively Valued For Tax-Free Income

seekingalpha.com

2020-11-16 13:00:00Muni bonds provide tax-free income to investors, MNP provides a way to gain diversified exposure to many positions. The fund has paid monthly distributions since its inception back to 1993.

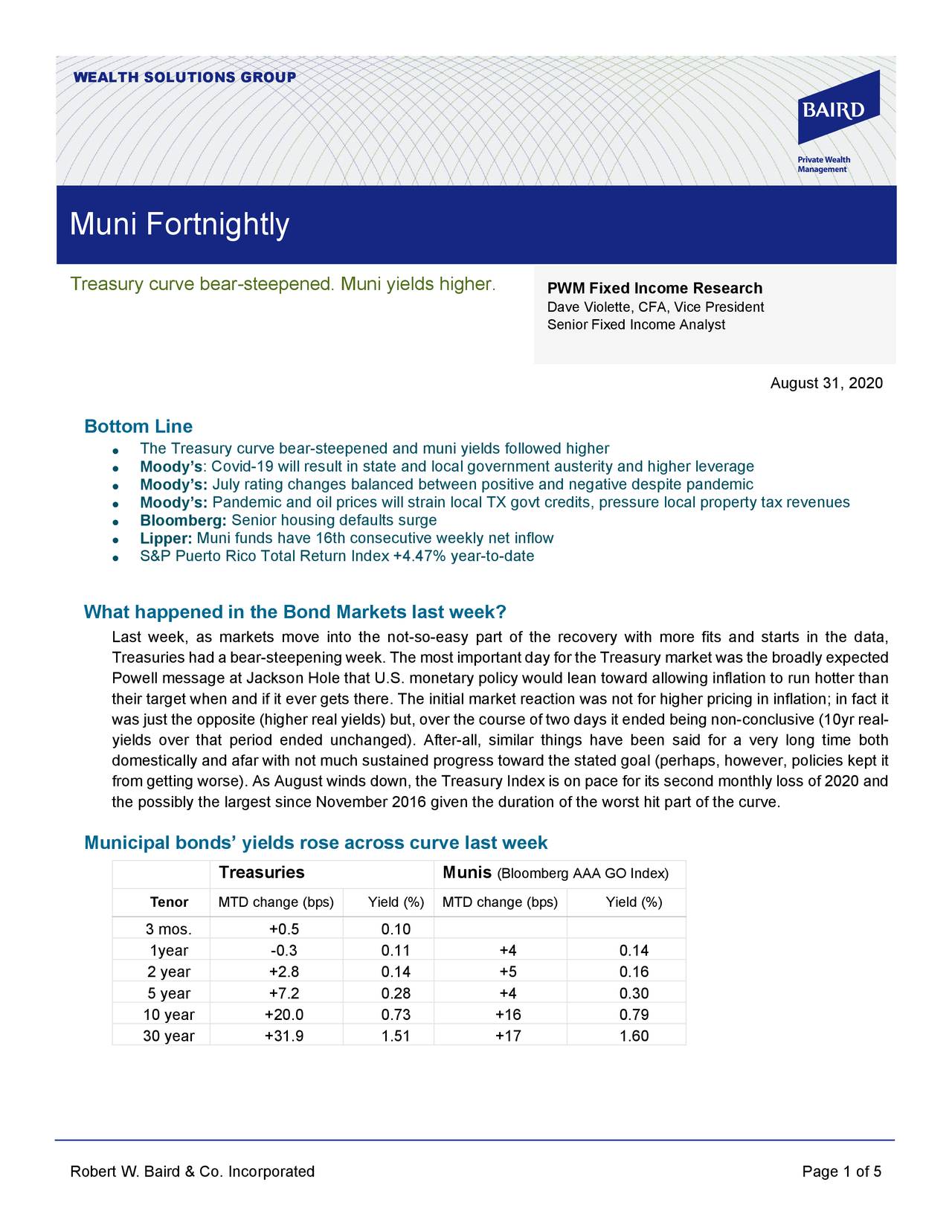

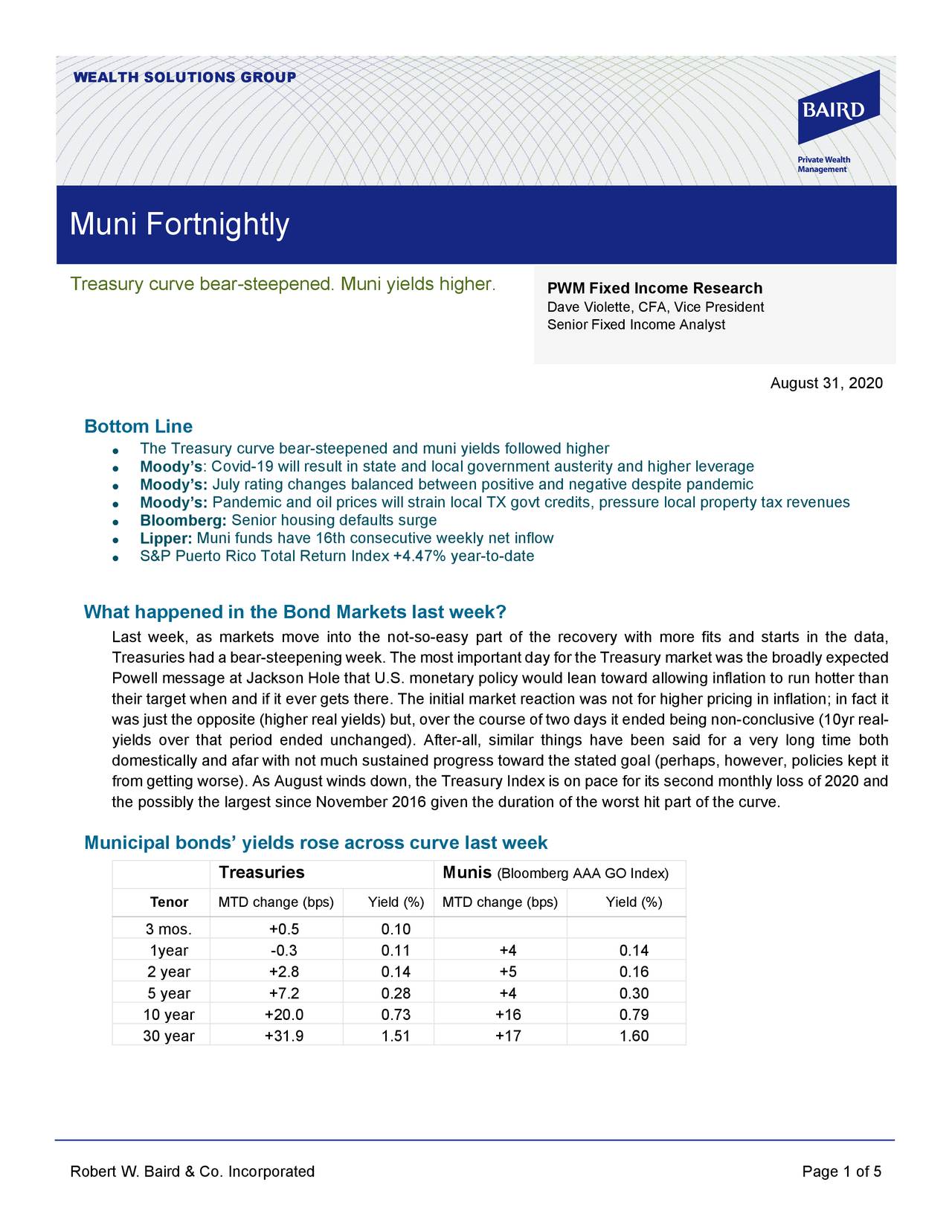

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

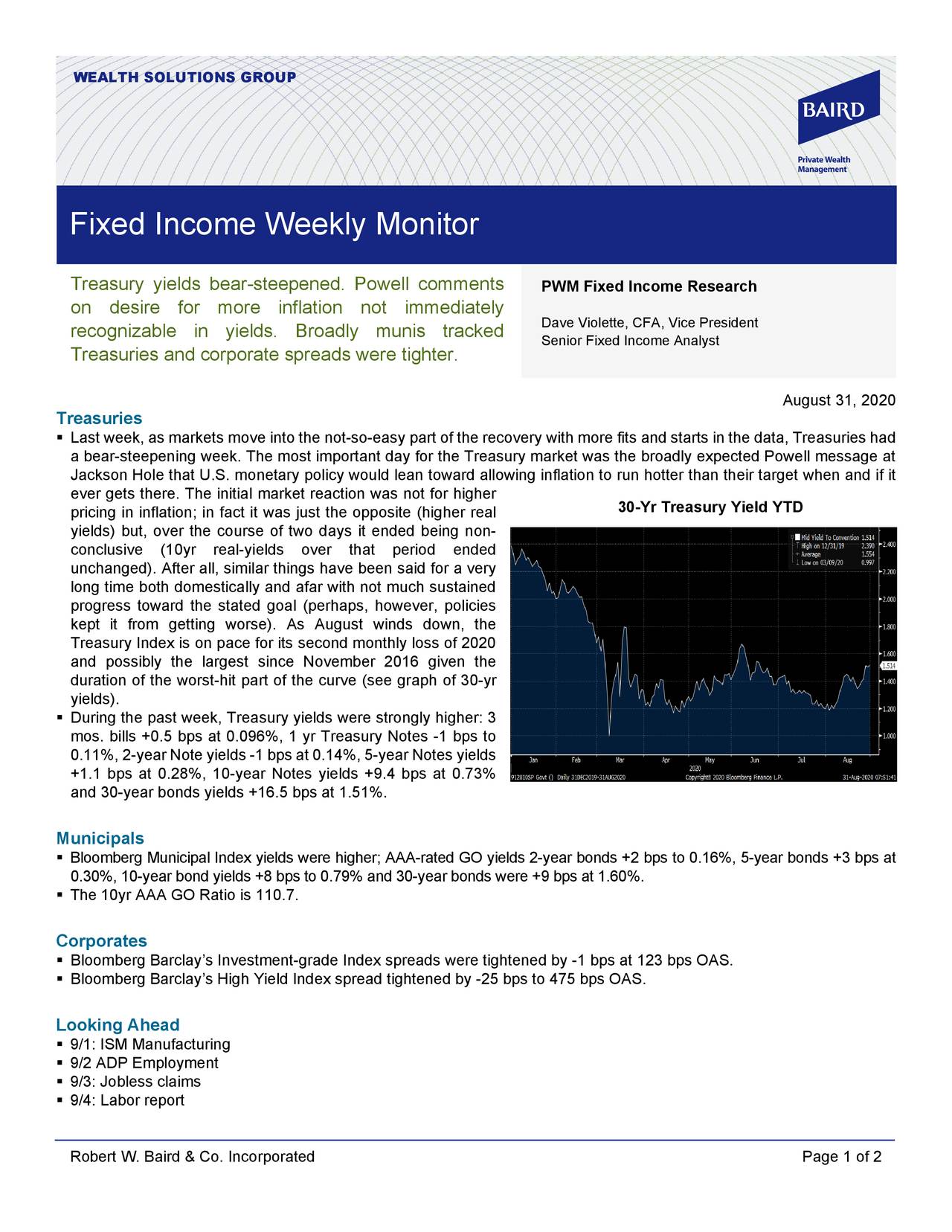

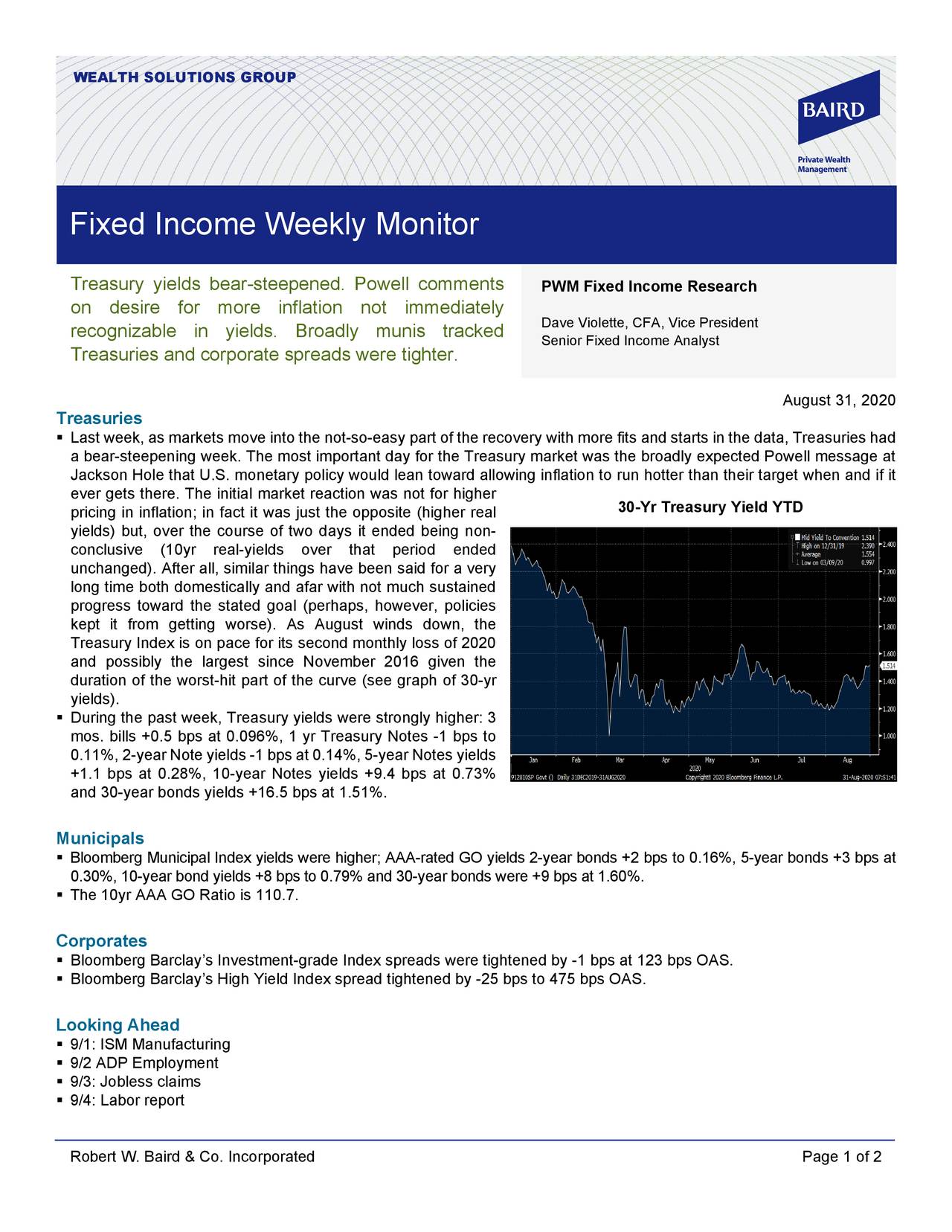

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

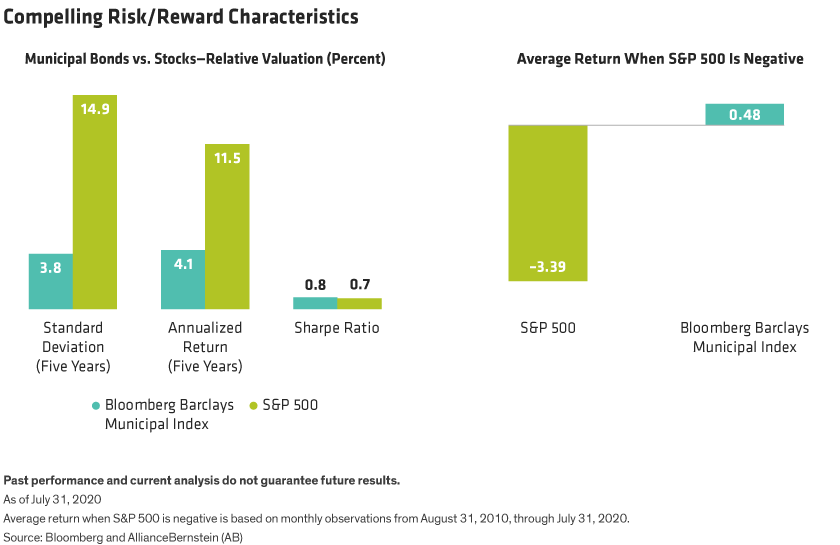

Rule #1 For Bonds: Don't Lose Money

seekingalpha.com

2020-08-30 05:47:09At the beginning of this year, we created the Baskin Fixed Income Fund as a more efficient way to manage your fixed income investments.

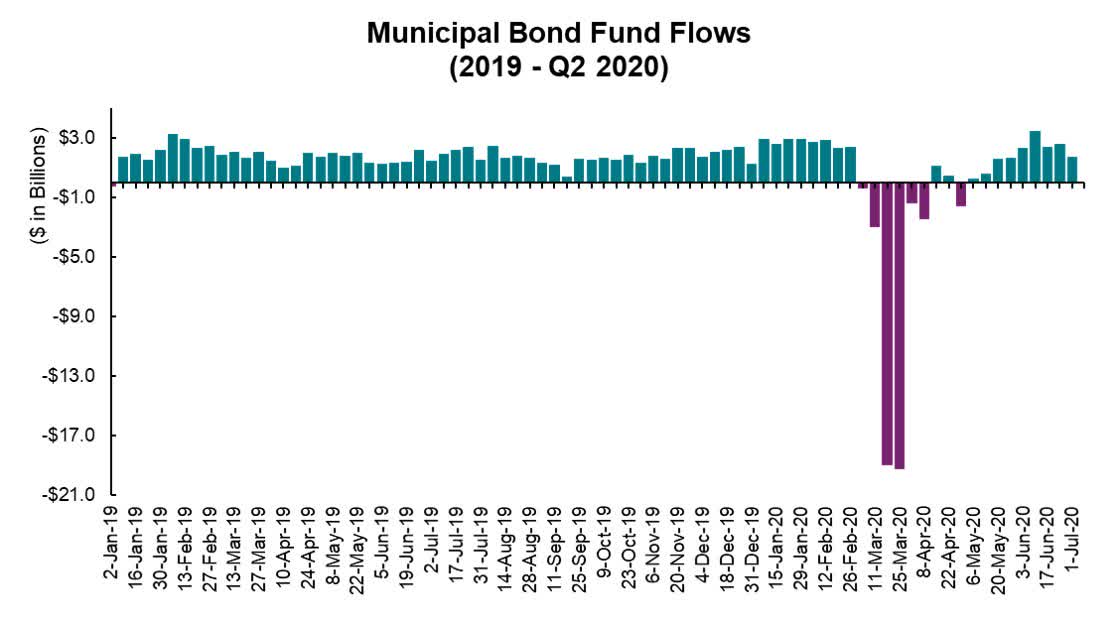

For Muni Investors, COVID-19 Provides Lessons In Liquidity

seekingalpha.com

2020-08-27 10:19:48Over the years, individual investors have flocked to municipal bonds to meet safety, income and after-tax return goals.

Small Ways Muni Investors Can Make A Big Difference

seekingalpha.com

2020-07-28 08:58:55Municipal bonds issued by state and local entities fund projects across various sectors that create the foundation upon which local economies thrive.

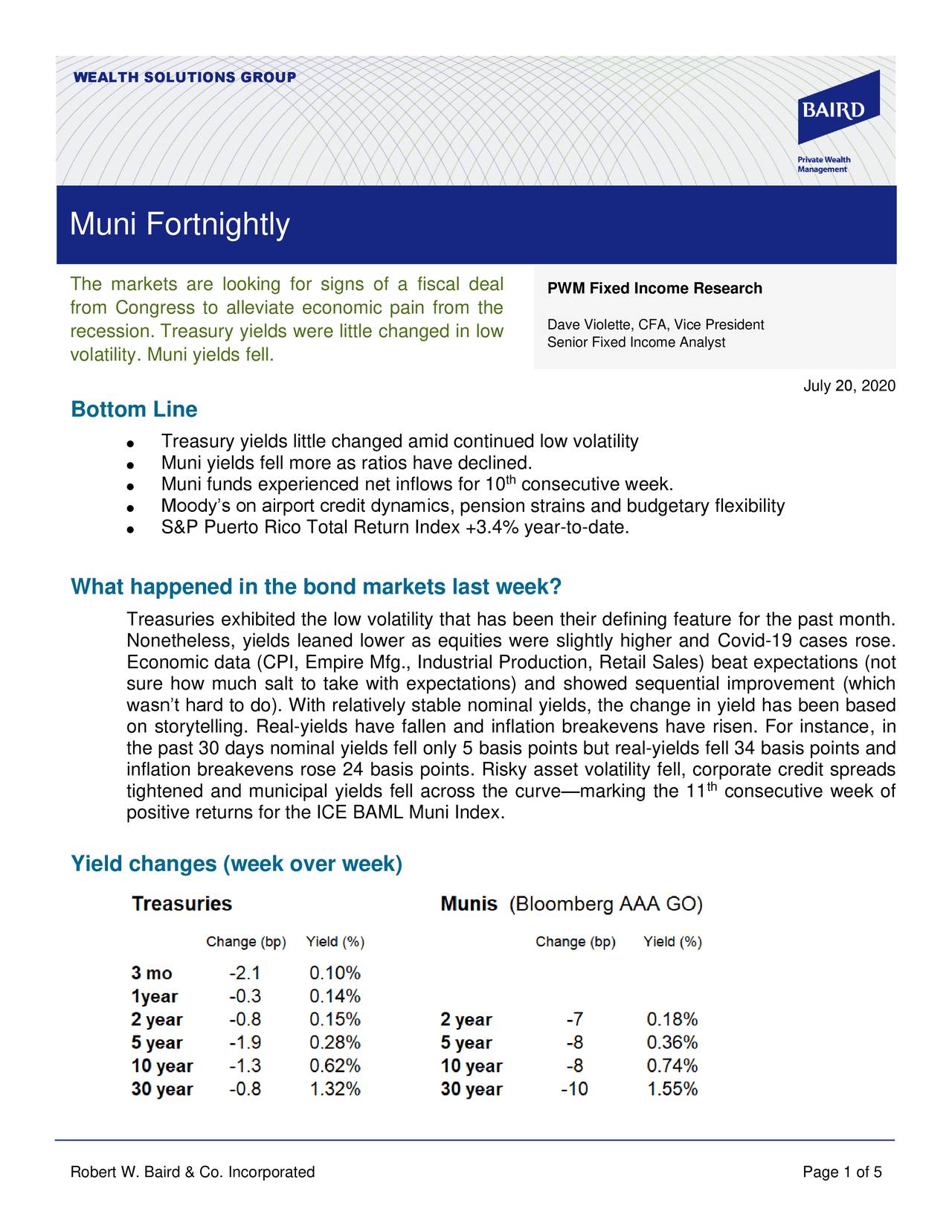

What Happened In The Bond Markets Last Week? Muni Fortnightly, July 20, 2020

seekingalpha.com

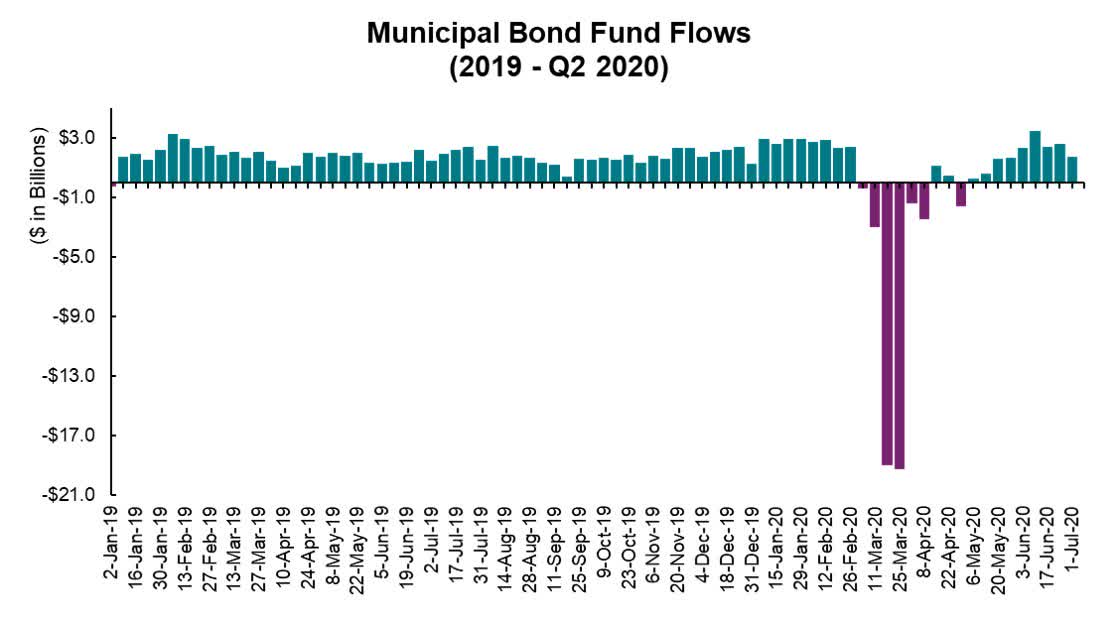

2020-07-27 03:15:00Muni yields fell more as ratios have declined. Muni funds experienced net inflows for 10th consecutive week.

2020 Muni Market Midyear Update

seekingalpha.com

2020-07-15 10:29:54States and towns are reluctant to make any issuance until they have an understanding of just how bad their revenue losses are going to be.

Heroes And Villains

seekingalpha.com

2020-07-05 01:35:08My attention is fully focused on the markets and what is driving them. The Superman for the markets is Chairman Jerome Powell, the Presidents and Governors of t

FRX Innovations Inc. Announces a Change in Auditor

newsfilecorp.com

2025-06-19 12:18:44Toronto, Ontario--(Newsfile Corp. - June 19, 2025) - FRX Innovations Inc. (TSXV: FRXI.H) (the "Company") announces that the Company has changed its auditor from MNP LLP ("MNP") to Manning Elliott LLP ("Manning Elliott") effective as of June 16, 2025. At the request of the Company, MNP resigned as auditor of the Company effective as of June 16, 2025 (the "Date of Resignation").

AISIX Solutions Inc. Selected by MNP to Support Wildfire Risk Modeling Services for Canadian Businesses

newsfilecorp.com

2025-04-09 09:03:00Vancouver, British Columbia--(Newsfile Corp. - April 9, 2025) - AISIX Solutions Inc. , (TSXV: AISX) (OTCQB: AISXF) (FSE: QT7) ("AISIX" or "the Company"), a frontrunner in climate risk assessment and modeling, today announced that it has been selected by MNP to support wildfire risk modeling services to MNP clients, contributing to the firm's broader climate risk and adaptation advisory offerings, commencing March 27, 2025. MNP is one of Canada's largest professional services firms, with 152 offices across the country.

Spectral Medical Inc. Announces Change to Auditor

globenewswire.com

2024-07-11 16:00:00TORONTO, July 11, 2024 (GLOBE NEWSWIRE) -- Spectral Medical Inc. ("Spectral" or the "Company") (TSX: EDT), a late-stage theranostic company advancing therapeutic options for sepsis and septic shock, today announced that MNP LLP (“MNP”) have today been appointed as the auditors of the Company following the decision by PricewaterhouseCoopers LLP (“PwC”) to resign as the auditor of Spectral (the “Effective Date”). The resignation of PwC as the auditor of Spectral and the appointment of MNP as auditor of Spectral were considered and approved by the Finance & Audit Committee and the board of directors.

Weekly Closed-End Fund Roundup: MNP And MMU To Merge (August 13, 2023)

seekingalpha.com

2023-08-24 08:44:3213 out of 22 CEF sectors positive on price and 13 out of 22 sectors positive on NAV. MNP and MMU to merge. Current arbitrage potential is slim.

Certain Closed End Funds Advised by Legg Mason Partners Fund Advisor, LLC Announce Appointment of New Lead Independent Director

businesswire.com

2022-11-10 08:00:00The Board of each Fund announced today the appointment of Eileen Kamerick as Lead Independent Director, effective November 8, 2022. Ms. Kamerick replaces William Hutchinson, the former Lead Independent Director of the Funds, who recently passed away. The Boards also announced that Nisha Kumar will succeed Ms. Kamerick as Chair of each Fund's Audit Committee.

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of September, October, and November 2022

businesswire.com

2022-08-02 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of March, April and May 2022

businesswire.com

2022-02-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

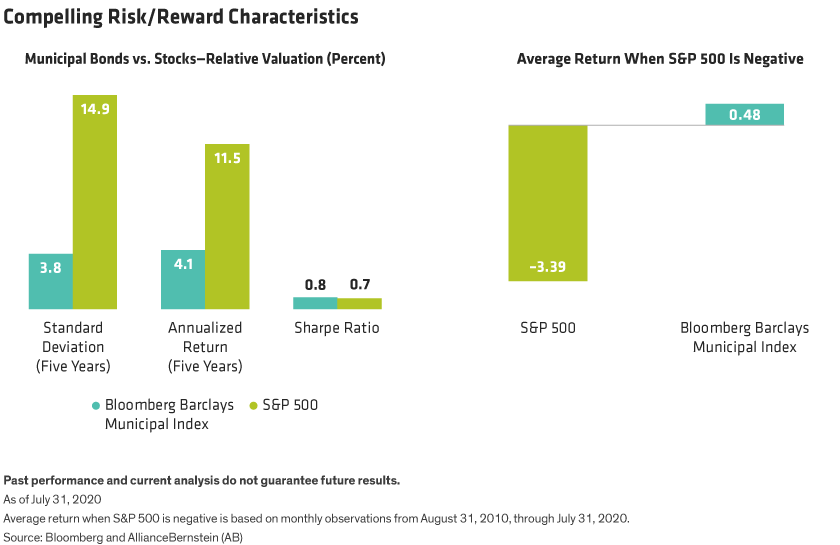

MNP: Attractively Valued For Tax-Free Income

seekingalpha.com

2020-11-16 13:00:00Muni bonds provide tax-free income to investors, MNP provides a way to gain diversified exposure to many positions. The fund has paid monthly distributions since its inception back to 1993.

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

Rule #1 For Bonds: Don't Lose Money

seekingalpha.com

2020-08-30 05:47:09At the beginning of this year, we created the Baskin Fixed Income Fund as a more efficient way to manage your fixed income investments.

For Muni Investors, COVID-19 Provides Lessons In Liquidity

seekingalpha.com

2020-08-27 10:19:48Over the years, individual investors have flocked to municipal bonds to meet safety, income and after-tax return goals.

Small Ways Muni Investors Can Make A Big Difference

seekingalpha.com

2020-07-28 08:58:55Municipal bonds issued by state and local entities fund projects across various sectors that create the foundation upon which local economies thrive.

What Happened In The Bond Markets Last Week? Muni Fortnightly, July 20, 2020

seekingalpha.com

2020-07-27 03:15:00Muni yields fell more as ratios have declined. Muni funds experienced net inflows for 10th consecutive week.

2020 Muni Market Midyear Update

seekingalpha.com

2020-07-15 10:29:54States and towns are reluctant to make any issuance until they have an understanding of just how bad their revenue losses are going to be.

Heroes And Villains

seekingalpha.com

2020-07-05 01:35:08My attention is fully focused on the markets and what is driving them. The Superman for the markets is Chairman Jerome Powell, the Presidents and Governors of t