Western Asset Managed Municipals Fund Inc. (MMU)

Price:

10.44 USD

( - -0.06 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

State Street Corporation

VALUE SCORE:

7

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

ClearBridge Energy Midstream Opportunity Fund Inc

VALUE SCORE:

15

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Western Asset Managed Municipals Fund Inc. is a closed ended fixed income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. The fund is co-managed by Western Asset Management Company. It invests in the fixed income markets of the United States. The fund invests in securities that provide income exempt from federal income tax. It invests primarily in investment grade municipal securities. The fund employs intensive proprietary research to create its portfolio. It benchmarks the performance of its portfolio against the Barclays Capital Municipal Bond Index. The fund was formerly known as Managed Municipals Portfolio Inc. Western Asset Managed Municipals Fund Inc. was formed on June 26, 1992 and is domiciled in the United States.

NEWS

Western Asset Managed Municipals Fund Inc. Announces Financial Position as of February 28, 2025

businesswire.com

2025-04-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Municipal CEF Update: High Yields And Wide Discounts

seekingalpha.com

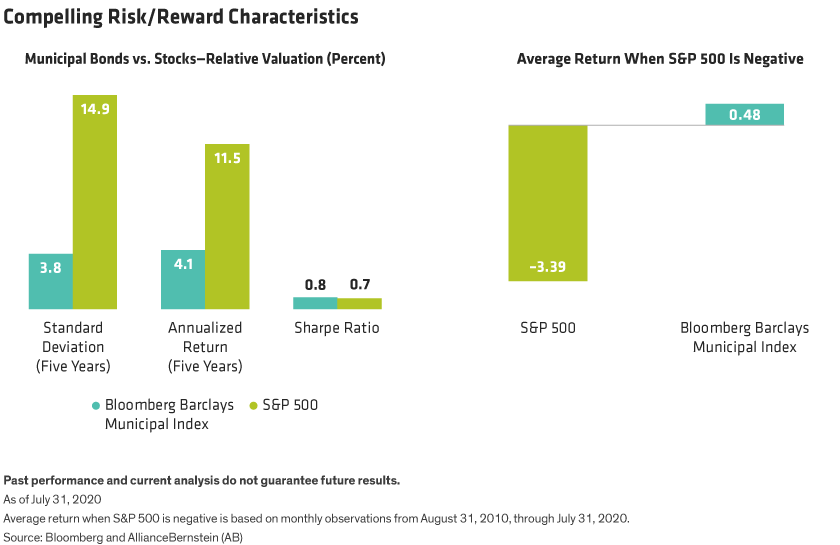

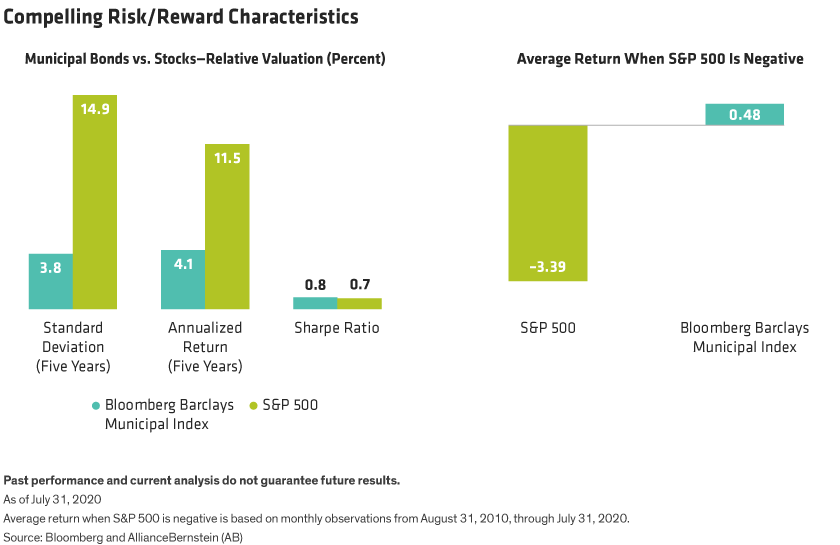

2024-06-14 08:23:38Municipal CEFs have seen distribution hikes in response to activist attacks, aiming to tighten discounts and attract additional demand. Municipal bonds offer attractive valuations, high tax exemption value, and resilience during credit drawdowns, making them an appealing investment. We recently added to our muni CEF holdings on the back of these supporting tactical and strategic factors.

Western Asset Managed Municipals Fund Inc. Announces Financial Position as of February 29, 2024

businesswire.com

2024-04-29 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Western Asset Managed Municipals Fund Inc. (NYSE: MMU) Announces Portfolio Management Team Update

businesswire.com

2024-03-04 08:00:00NEW YORK--(BUSINESS WIRE)--Effective March 1, 2024, the named portfolio management team responsible for the day-to-day oversight of the Fund is as follows:

Municipal Bond CEF Update Aug 2023: Valuations Are Incredible

seekingalpha.com

2023-09-06 07:00:00Municipal bonds experienced a drop in 2022 due to rising interest rates, presenting a buying opportunity. Muni closed-end funds have higher portfolio yields, but net investment income has been affected by increased leverage costs. Muni CEFs have upside potential once interest rates normalize, but individual munis offer lower risk and higher yields.

Weekly Closed-End Fund Roundup: MNP And MMU To Merge (August 13, 2023)

seekingalpha.com

2023-08-24 08:44:3213 out of 22 CEF sectors positive on price and 13 out of 22 sectors positive on NAV. MNP and MMU to merge. Current arbitrage potential is slim.

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of September, October, and November 2022

businesswire.com

2022-08-02 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of March, April and May 2022

businesswire.com

2022-02-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

CEF Weekly Market Review: Treasuries Remain In The Driver's Seat

seekingalpha.com

2021-10-02 08:03:33CEF Weekly Market Review: Treasuries Remain In The Driver's Seat

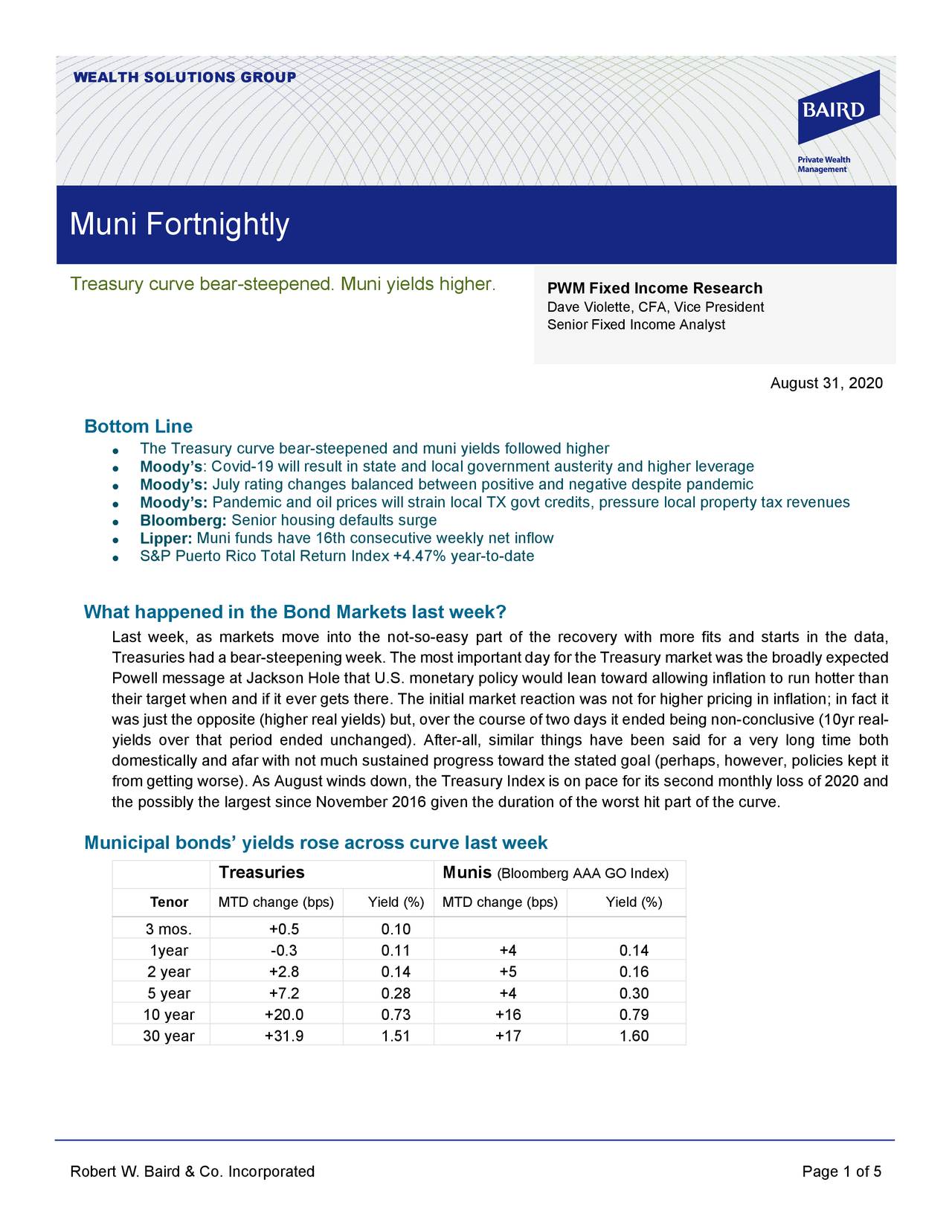

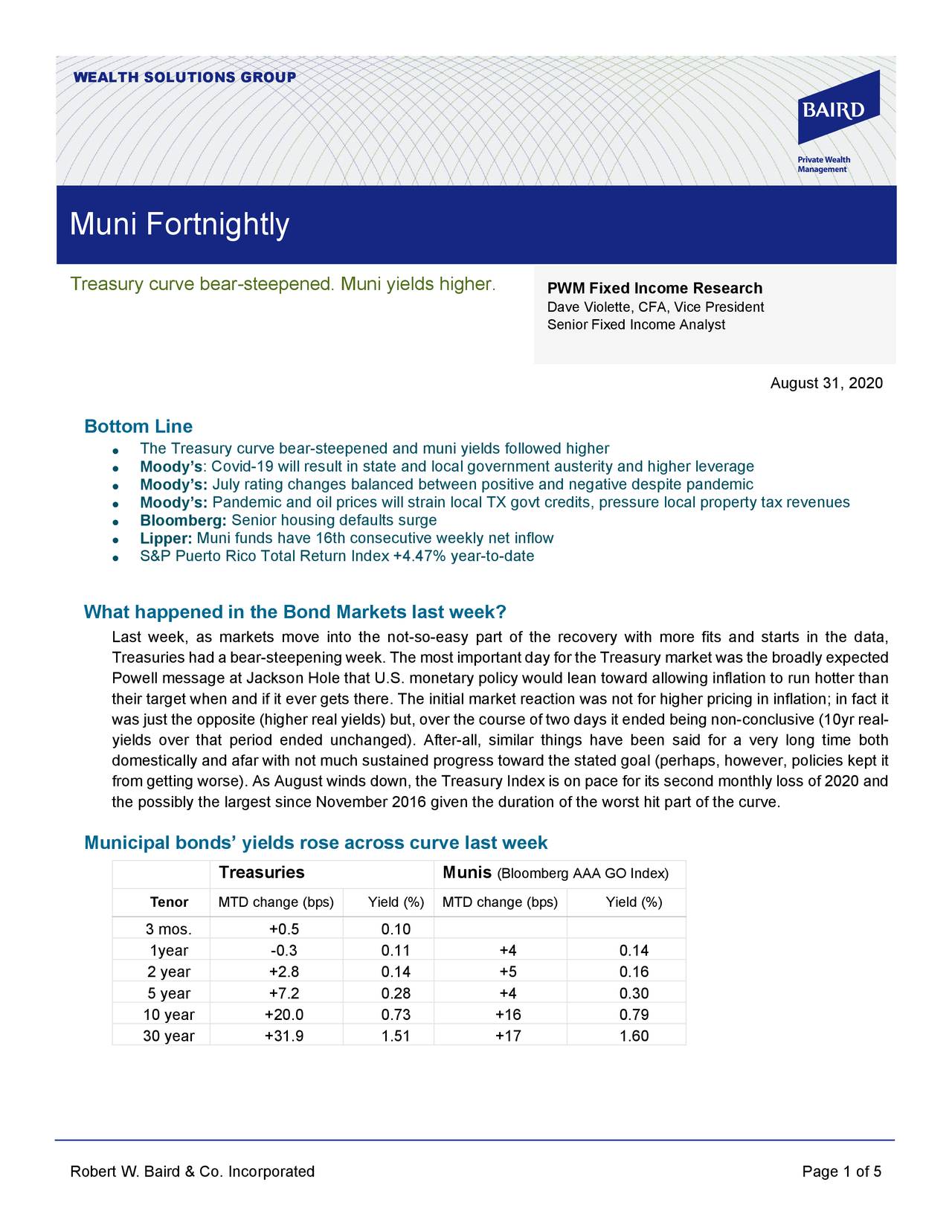

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

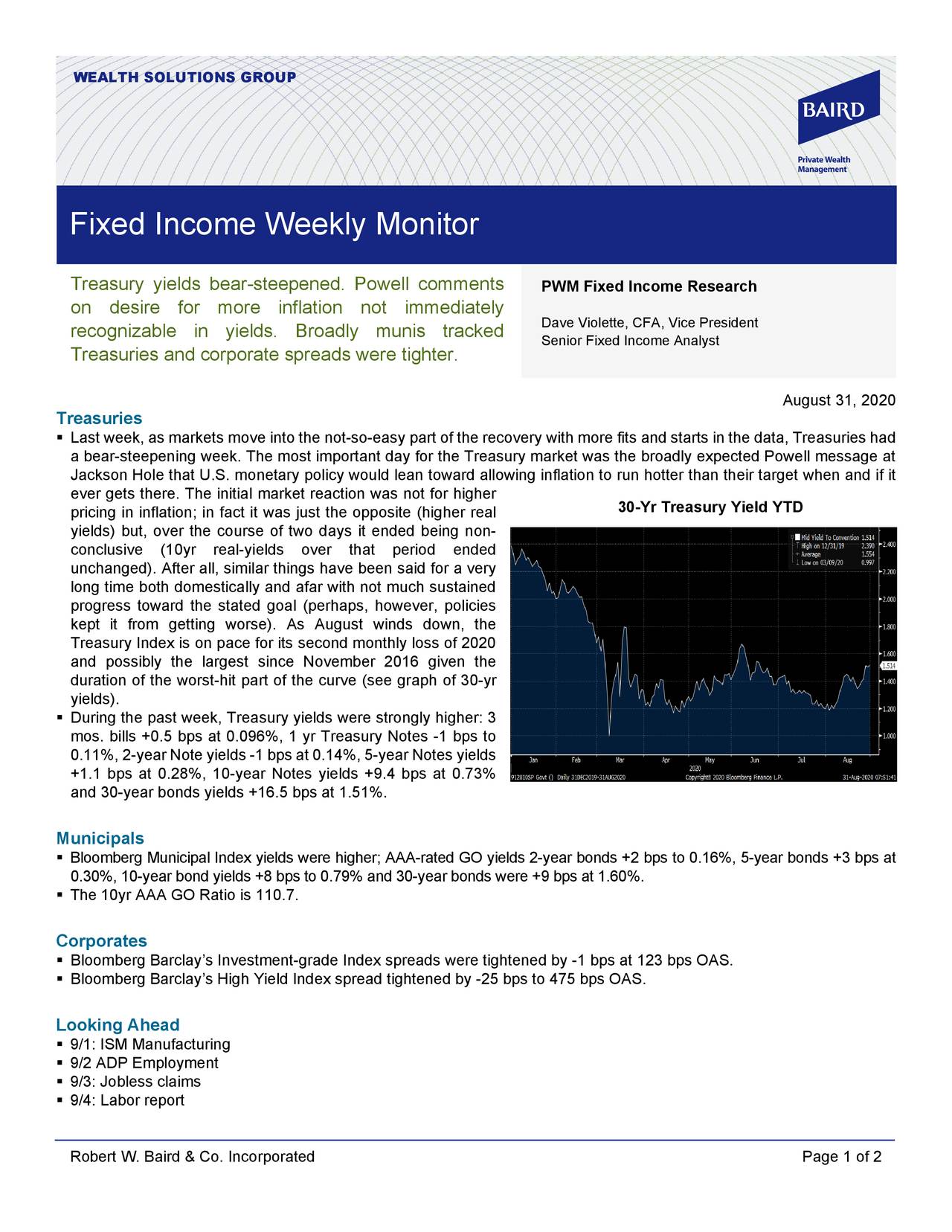

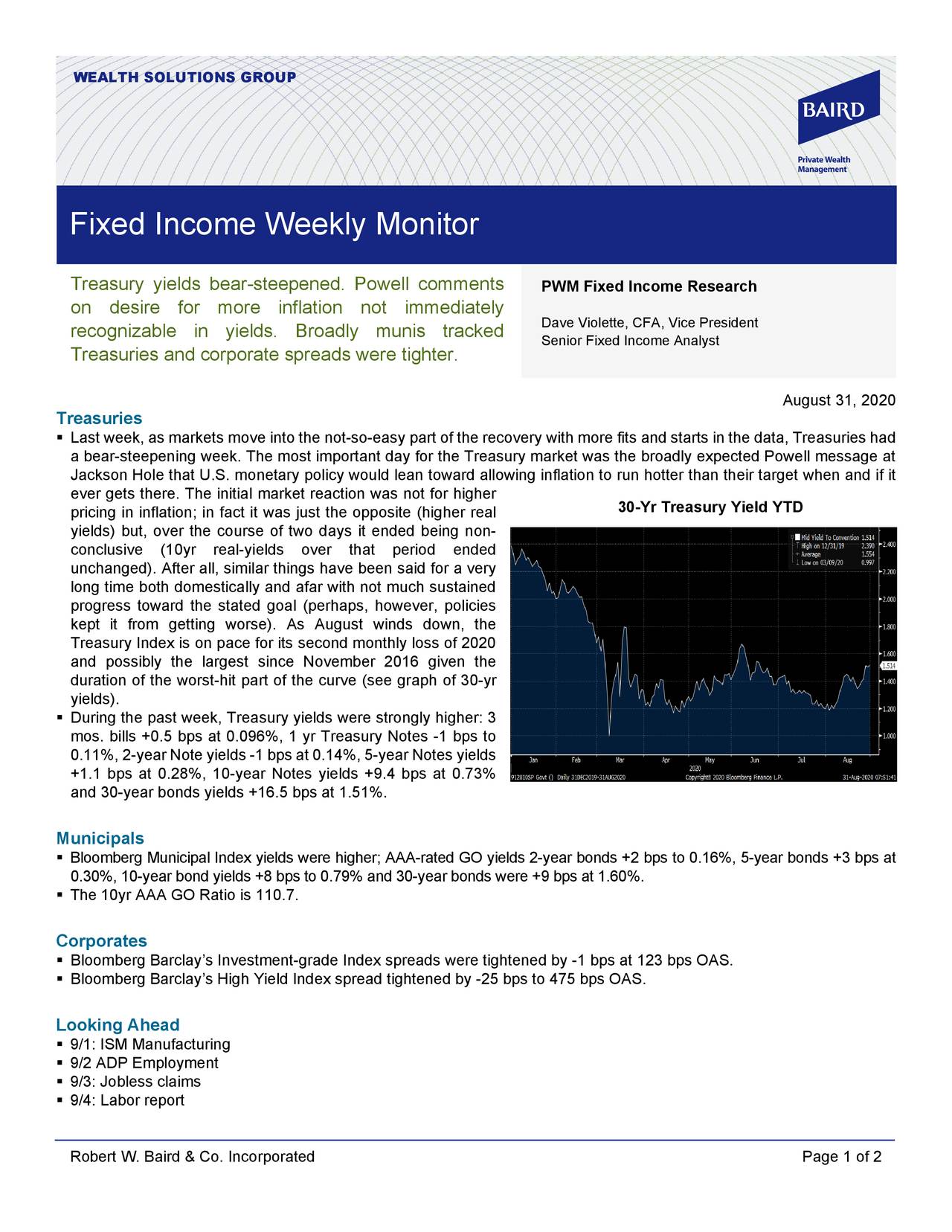

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

Rule #1 For Bonds: Don't Lose Money

seekingalpha.com

2020-08-30 05:47:09At the beginning of this year, we created the Baskin Fixed Income Fund as a more efficient way to manage your fixed income investments.

For Muni Investors, COVID-19 Provides Lessons In Liquidity

seekingalpha.com

2020-08-27 10:19:48Over the years, individual investors have flocked to municipal bonds to meet safety, income and after-tax return goals.

Activists Continue To Hold Out In WIA (NYSE:WIA)

seekingalpha.com

2020-08-11 15:48:11Certain activists in Legg Mason funds continue to hold out. Owners of WIA should take note.

Cathy Carilli, CFA® Joins Fiduciary Trust International’s New York Office as Senior Portfolio Manager

businesswire.com

2020-08-11 00:00:00Cathy Carilli, CFA® Joins Fiduciary Trust International’s New York Office as Senior Portfolio Manager

ClearBridge MLP and Midstream Total Return Fund Inc. Announces Unaudited Balance Sheet Information as of July 31, 2020

businesswire.com

2020-08-07 00:00:00ClearBridge MLP and Midstream Total Return Fund Inc. (NYSE: CTR) announced today the unaudited statement of assets and liabilities, the net asset valu

Western Asset Managed Municipals Fund Inc. Announces Financial Position as of February 28, 2025

businesswire.com

2025-04-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Municipal CEF Update: High Yields And Wide Discounts

seekingalpha.com

2024-06-14 08:23:38Municipal CEFs have seen distribution hikes in response to activist attacks, aiming to tighten discounts and attract additional demand. Municipal bonds offer attractive valuations, high tax exemption value, and resilience during credit drawdowns, making them an appealing investment. We recently added to our muni CEF holdings on the back of these supporting tactical and strategic factors.

Western Asset Managed Municipals Fund Inc. Announces Financial Position as of February 29, 2024

businesswire.com

2024-04-29 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Western Asset Managed Municipals Fund Inc. (NYSE: MMU) Announces Portfolio Management Team Update

businesswire.com

2024-03-04 08:00:00NEW YORK--(BUSINESS WIRE)--Effective March 1, 2024, the named portfolio management team responsible for the day-to-day oversight of the Fund is as follows:

Municipal Bond CEF Update Aug 2023: Valuations Are Incredible

seekingalpha.com

2023-09-06 07:00:00Municipal bonds experienced a drop in 2022 due to rising interest rates, presenting a buying opportunity. Muni closed-end funds have higher portfolio yields, but net investment income has been affected by increased leverage costs. Muni CEFs have upside potential once interest rates normalize, but individual munis offer lower risk and higher yields.

Weekly Closed-End Fund Roundup: MNP And MMU To Merge (August 13, 2023)

seekingalpha.com

2023-08-24 08:44:3213 out of 22 CEF sectors positive on price and 13 out of 22 sectors positive on NAV. MNP and MMU to merge. Current arbitrage potential is slim.

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of September, October, and November 2022

businesswire.com

2022-08-02 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of March, April and May 2022

businesswire.com

2022-02-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

CEF Weekly Market Review: Treasuries Remain In The Driver's Seat

seekingalpha.com

2021-10-02 08:03:33CEF Weekly Market Review: Treasuries Remain In The Driver's Seat

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

seekingalpha.com

2020-09-02 03:00:00Treasury yields bear-steepened. Powell comments on desire for more inflation not immediately recognizable in yields.

Rule #1 For Bonds: Don't Lose Money

seekingalpha.com

2020-08-30 05:47:09At the beginning of this year, we created the Baskin Fixed Income Fund as a more efficient way to manage your fixed income investments.

For Muni Investors, COVID-19 Provides Lessons In Liquidity

seekingalpha.com

2020-08-27 10:19:48Over the years, individual investors have flocked to municipal bonds to meet safety, income and after-tax return goals.

Activists Continue To Hold Out In WIA (NYSE:WIA)

seekingalpha.com

2020-08-11 15:48:11Certain activists in Legg Mason funds continue to hold out. Owners of WIA should take note.

Cathy Carilli, CFA® Joins Fiduciary Trust International’s New York Office as Senior Portfolio Manager

businesswire.com

2020-08-11 00:00:00Cathy Carilli, CFA® Joins Fiduciary Trust International’s New York Office as Senior Portfolio Manager

ClearBridge MLP and Midstream Total Return Fund Inc. Announces Unaudited Balance Sheet Information as of July 31, 2020

businesswire.com

2020-08-07 00:00:00ClearBridge MLP and Midstream Total Return Fund Inc. (NYSE: CTR) announced today the unaudited statement of assets and liabilities, the net asset valu