MarketAxess Holdings Inc. (MKTX)

Price:

179.01 USD

( + 1.16 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Riot Platforms, Inc.

VALUE SCORE:

6

2nd position

BitFuFu Inc.

VALUE SCORE:

12

The best

BitFuFu Inc.

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

MarketAxess Holdings Inc., together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. It offers the access to liquidity in the U.S. investment-grade bonds, U.S. high-yield bonds, and U.S. Treasuries, as well as municipal bonds, emerging market debts, Eurobonds, and other fixed income securities. The company, through its Open Trading protocols, executes bond trades between and among institutional investor and broker-dealer clients in an all-to-all anonymous trading environment for corporate bonds. It also offers trading-related products and services, including composite+ pricing and other market data products to assist clients with trading decisions; auto-execution and other execution services for clients requiring specialized workflow solutions; connectivity solutions that facilitate straight-through processing; and technology services to optimize trading environments. In addition, the company provides various pre-and post-trade services, such as trade matching, trade publication, regulatory transaction reporting, and market and reference data across a range of fixed-income and other products. MarketAxess Holdings Inc. was incorporated in 2000 and is headquartered in New York, New York.

NEWS

California Public Employees Retirement System Boosts Position in MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-12-12 03:57:00California Public Employees Retirement System increased its holdings in MarketAxess Holdings Inc. (NASDAQ: MKTX) by 90.1% during the undefined quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 120,647 shares of the financial services provider's stock after buying an additional 57,183 shares during the

MKTX Sets 2026-2028 Growth Targets, Boosts Share Buybacks

zacks.com

2025-12-10 14:51:04MarketAxess targets 8-9% annual revenue growth from 2026-2028 and authorizes $505 million in share buybacks, including a $300 million ASR.

Bank of Nova Scotia Has $24.23 Million Stock Position in MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-12-10 04:31:08Bank of Nova Scotia boosted its holdings in MarketAxess Holdings Inc. (NASDAQ: MKTX) by 535.8% during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 108,481 shares of the financial services provider's stock after buying an additional 91,419 shares during the quarter. Bank

MarketAxess Holdings Inc. (MKTX) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

seekingalpha.com

2025-12-09 14:17:02MarketAxess Holdings Inc. (MKTX) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

MarketAxess Announces Medium-Term Financial Targets1 Increases Stock Repurchase Authorization to $505 million Intends to Effect an Accelerated Stock Repurchase

businesswire.com

2025-12-09 07:30:00NEW YORK--(BUSINESS WIRE)--MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, today announced medium-term financial targets for the Company. In conjunction with the new medium-term financial targets, the Company also announced that its Board of Directors has authorized the repurchase of up to $400 million of additional shares of MarketAxess common stock. The new authorization, combined with the $105 million remaining capa.

Top 50 High-Quality Dividend Growth Stocks For December 2025

seekingalpha.com

2025-12-08 21:03:44I track a custom universe of 50 high-quality dividend growth stocks to identify timely, attractive investment opportunities based on valuation and forward return potential. 28 of these stocks currently offer estimated future returns of at least 10%, with 18 appearing potentially undervalued per my Free Cash Flow model. Top-ranked names like ResMed, Mastercard, and MSCI combine strong projected EPS growth with reasonable valuations.

MarketAxess Announces Trading Volume Statistics for November 2025

businesswire.com

2025-12-04 06:30:00NEW YORK--(BUSINESS WIRE)--MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, today announced trading volume and preliminary variable transaction fees per million (“FPM”) for November 2025.1 Select November 2025 Highlights* (See tables 1-1C and table 2) Our new initiatives continued to show solid year-over-year progress across the client-initiated, portfolio trading and dealer-initiated channels. We also unveiled our new.

SCHW or MKTX: Which Is the Better Value Stock Right Now?

zacks.com

2025-12-02 12:41:16Investors looking for stocks in the Financial - Investment Bank sector might want to consider either The Charles Schwab Corporation (SCHW) or MarketAxess (MKTX). But which of these two companies is the best option for those looking for undervalued stocks?

MarketAxess to Participate in the Goldman Sachs Financial Services Conference

businesswire.com

2025-12-01 16:30:00NEW YORK--(BUSINESS WIRE)--MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, today announced that Chris Concannon, Chief Executive Officer, and Ilene Fiszel Bieler, Chief Financial Officer, will participate in the Goldman Sachs Financial Services Conference on December 9, 2025. Mr. Concannon and Ms. Fiszel Bieler will participate in a fireside chat at 10:00 a.m. ET. The live webcast and replay for the fireside chat will.

Here Are Thursday's Top Wall Street Analyst Research Calls: AON, Apollo Global Managment, Bullish, Jack Henry, Marsh & McClennan, Nasdaq, NVIDIA,

247wallst.com

2025-11-20 08:21:10The futures are trading higher after NVIDIA Inc. (NASDAQ: NVDA) blew out its fiscal third-quarter results and offered strong forward guidance, though perhaps not as robust as Wall Street had hoped.

Alberta Investment Management Corp Has $4.09 Million Holdings in MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-11-17 03:38:48Alberta Investment Management Corp raised its holdings in shares of MarketAxess Holdings Inc. (NASDAQ: MKTX) by 12.3% during the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 18,300 shares of the financial services provider's stock after acquiring an

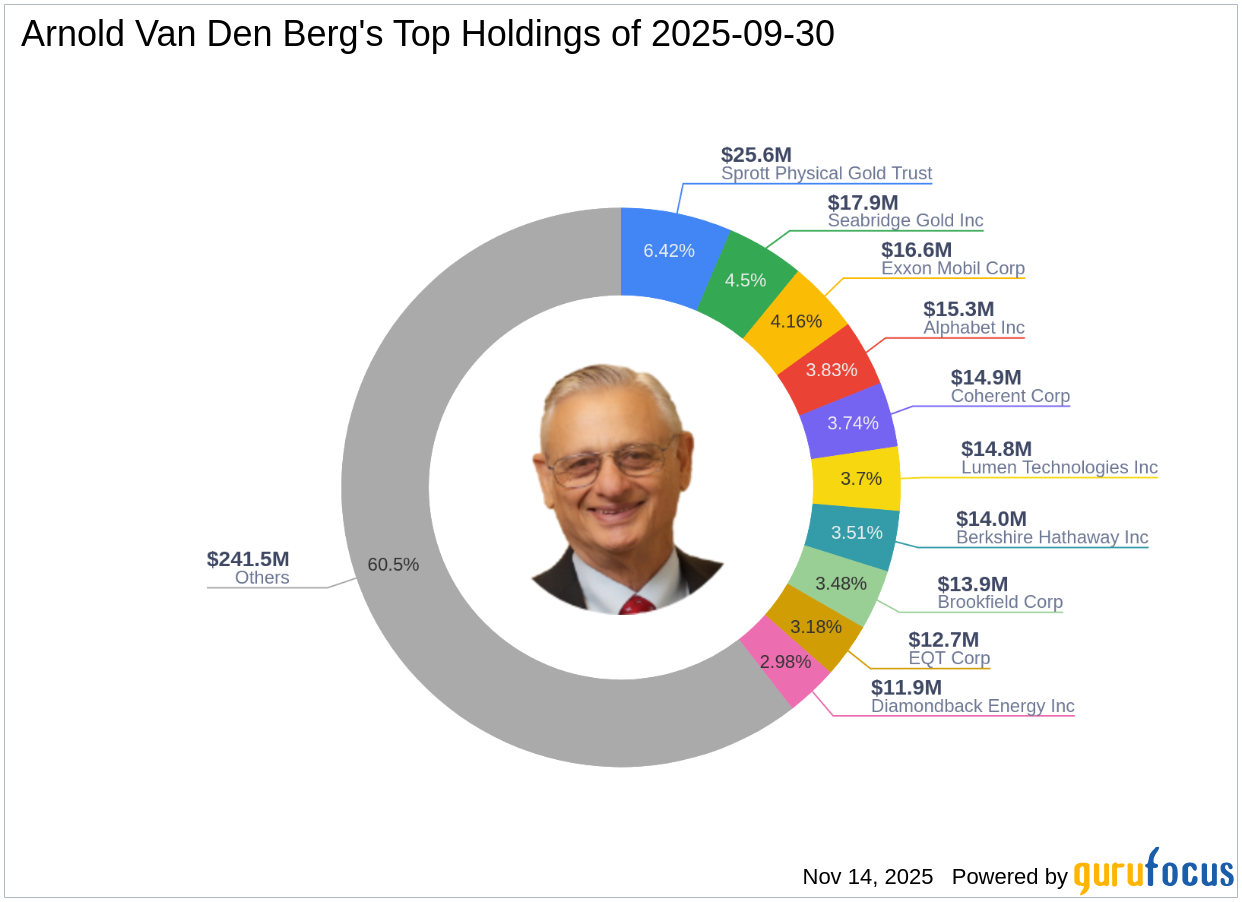

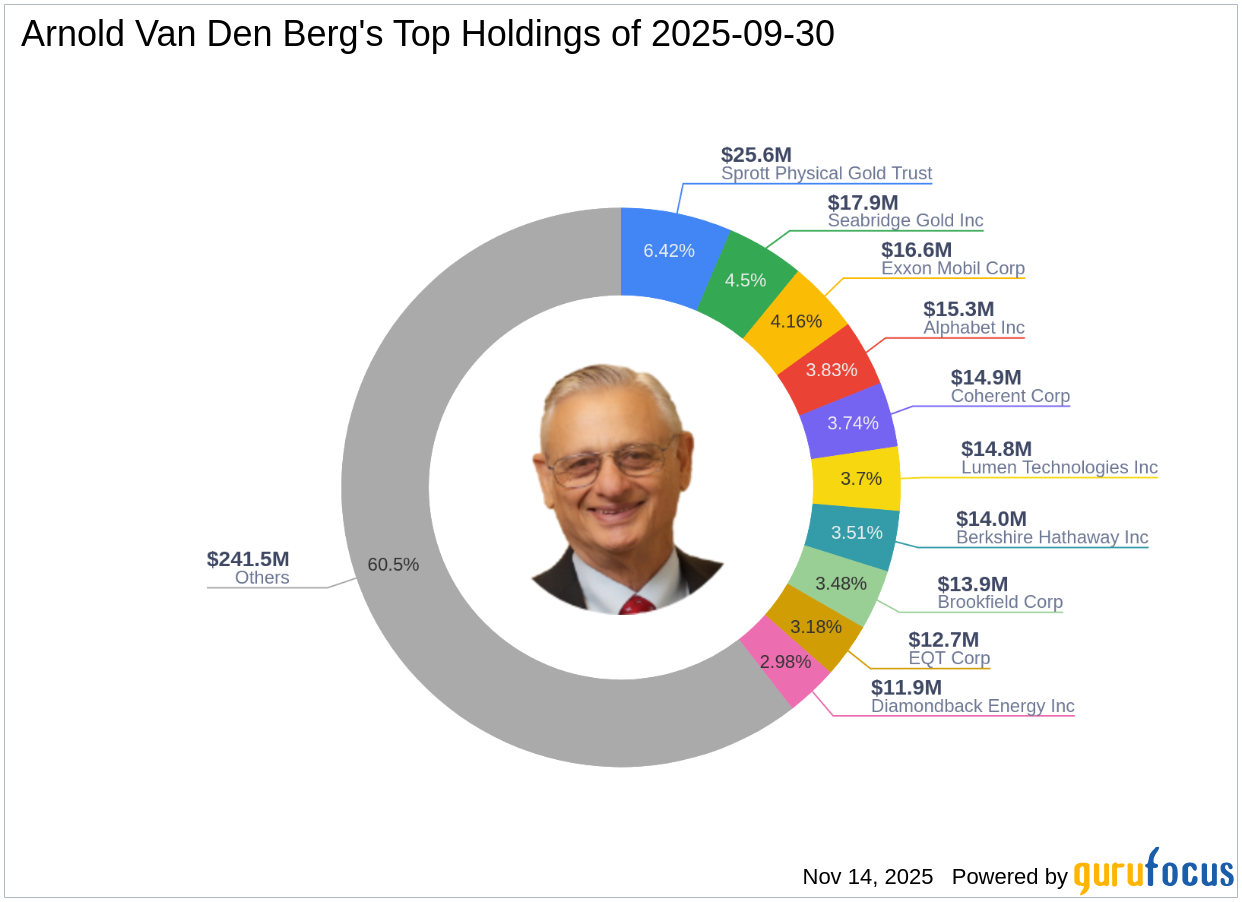

Arnold Van Den Berg Exits Atkore Inc, Impacting Portfolio by -0.85%

gurufocus.com

2025-11-14 10:00:00Insight into Arnold Van Den Berg (Trades, Portfolio)'s Strategic Moves in Q3 2025 Arnold Van Den Berg (Trades, Portfolio) recently submitted the 13F filing for

Aviva PLC Sells 818 Shares of MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-11-14 04:42:58Aviva PLC reduced its position in shares of MarketAxess Holdings Inc. (NASDAQ: MKTX) by 27.5% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 2,158 shares of the financial services provider's stock after selling 818 shares during the period. Aviva PLC's holdings in

MarketAxess Q3: Steady Beat Amid U.S. Credit Headwinds, Fairly Valued For Now

seekingalpha.com

2025-11-14 04:03:23MarketAxess delivered a solid quarter, beating revenue and EPS estimates despite ongoing weakness in U.S. credit market demand. MKTX is making progress with market share gains, expanding service revenues, and early traction in auctions and automation, positioning for a stronger 2026. The company maintains a fortress balance sheet, robust free cash flow, and consistent dividend growth, but faces risks from low volatility and rising competition.

MarketAxess Holdings Inc. (MKTX) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-07 14:26:06MarketAxess Holdings Inc. ( MKTX ) Q3 2025 Earnings Call November 7, 2025 11:00 AM EST Company Participants Stephen Davidson - Head of Investor Relations Christopher Concannon - CEO & Director Ilene Bieler - Chief Financial Officer Conference Call Participants Christopher Allen - Citigroup Inc., Research Division Patrick Moley - Piper Sandler & Co., Research Division Alex Kramm - UBS Investment Bank, Research Division Christopher O'Brien - Barclays Bank PLC, Research Division Michael Cyprys - Morgan Stanley, Research Division Simon Alistair Clinch - Rothschild & Co Redburn, Research Division Jeffrey Schmitt - William Blair & Company L.L.C., Research Division Ritwik Roy - Jefferies LLC, Research Division Elias Abboud - BofA Securities, Research Division Patrick O'Shaughnessy - Raymond James & Associates, Inc., Research Division Presentation Operator Ladies and gentlemen, thank you for standing by.

MarketAxess Q3 Earnings Beat on Strong Emerging Markets Volumes

zacks.com

2025-11-07 13:55:22MKTX posts Q3 EPS of $1.84, beating estimates as emerging markets and Eurobonds volumes lift revenues despite higher expenses.

California Public Employees Retirement System Boosts Position in MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-12-12 03:57:00California Public Employees Retirement System increased its holdings in MarketAxess Holdings Inc. (NASDAQ: MKTX) by 90.1% during the undefined quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 120,647 shares of the financial services provider's stock after buying an additional 57,183 shares during the

MKTX Sets 2026-2028 Growth Targets, Boosts Share Buybacks

zacks.com

2025-12-10 14:51:04MarketAxess targets 8-9% annual revenue growth from 2026-2028 and authorizes $505 million in share buybacks, including a $300 million ASR.

Bank of Nova Scotia Has $24.23 Million Stock Position in MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-12-10 04:31:08Bank of Nova Scotia boosted its holdings in MarketAxess Holdings Inc. (NASDAQ: MKTX) by 535.8% during the undefined quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 108,481 shares of the financial services provider's stock after buying an additional 91,419 shares during the quarter. Bank

MarketAxess Holdings Inc. (MKTX) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

seekingalpha.com

2025-12-09 14:17:02MarketAxess Holdings Inc. (MKTX) Presents at Goldman Sachs 2025 U.S. Financial Services Conference Transcript

MarketAxess Announces Medium-Term Financial Targets1 Increases Stock Repurchase Authorization to $505 million Intends to Effect an Accelerated Stock Repurchase

businesswire.com

2025-12-09 07:30:00NEW YORK--(BUSINESS WIRE)--MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, today announced medium-term financial targets for the Company. In conjunction with the new medium-term financial targets, the Company also announced that its Board of Directors has authorized the repurchase of up to $400 million of additional shares of MarketAxess common stock. The new authorization, combined with the $105 million remaining capa.

Top 50 High-Quality Dividend Growth Stocks For December 2025

seekingalpha.com

2025-12-08 21:03:44I track a custom universe of 50 high-quality dividend growth stocks to identify timely, attractive investment opportunities based on valuation and forward return potential. 28 of these stocks currently offer estimated future returns of at least 10%, with 18 appearing potentially undervalued per my Free Cash Flow model. Top-ranked names like ResMed, Mastercard, and MSCI combine strong projected EPS growth with reasonable valuations.

MarketAxess Announces Trading Volume Statistics for November 2025

businesswire.com

2025-12-04 06:30:00NEW YORK--(BUSINESS WIRE)--MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, today announced trading volume and preliminary variable transaction fees per million (“FPM”) for November 2025.1 Select November 2025 Highlights* (See tables 1-1C and table 2) Our new initiatives continued to show solid year-over-year progress across the client-initiated, portfolio trading and dealer-initiated channels. We also unveiled our new.

SCHW or MKTX: Which Is the Better Value Stock Right Now?

zacks.com

2025-12-02 12:41:16Investors looking for stocks in the Financial - Investment Bank sector might want to consider either The Charles Schwab Corporation (SCHW) or MarketAxess (MKTX). But which of these two companies is the best option for those looking for undervalued stocks?

MarketAxess to Participate in the Goldman Sachs Financial Services Conference

businesswire.com

2025-12-01 16:30:00NEW YORK--(BUSINESS WIRE)--MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading electronic trading platform for fixed-income securities, today announced that Chris Concannon, Chief Executive Officer, and Ilene Fiszel Bieler, Chief Financial Officer, will participate in the Goldman Sachs Financial Services Conference on December 9, 2025. Mr. Concannon and Ms. Fiszel Bieler will participate in a fireside chat at 10:00 a.m. ET. The live webcast and replay for the fireside chat will.

Here Are Thursday's Top Wall Street Analyst Research Calls: AON, Apollo Global Managment, Bullish, Jack Henry, Marsh & McClennan, Nasdaq, NVIDIA,

247wallst.com

2025-11-20 08:21:10The futures are trading higher after NVIDIA Inc. (NASDAQ: NVDA) blew out its fiscal third-quarter results and offered strong forward guidance, though perhaps not as robust as Wall Street had hoped.

Alberta Investment Management Corp Has $4.09 Million Holdings in MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-11-17 03:38:48Alberta Investment Management Corp raised its holdings in shares of MarketAxess Holdings Inc. (NASDAQ: MKTX) by 12.3% during the undefined quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 18,300 shares of the financial services provider's stock after acquiring an

Arnold Van Den Berg Exits Atkore Inc, Impacting Portfolio by -0.85%

gurufocus.com

2025-11-14 10:00:00Insight into Arnold Van Den Berg (Trades, Portfolio)'s Strategic Moves in Q3 2025 Arnold Van Den Berg (Trades, Portfolio) recently submitted the 13F filing for

Aviva PLC Sells 818 Shares of MarketAxess Holdings Inc. $MKTX

defenseworld.net

2025-11-14 04:42:58Aviva PLC reduced its position in shares of MarketAxess Holdings Inc. (NASDAQ: MKTX) by 27.5% in the undefined quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 2,158 shares of the financial services provider's stock after selling 818 shares during the period. Aviva PLC's holdings in

MarketAxess Q3: Steady Beat Amid U.S. Credit Headwinds, Fairly Valued For Now

seekingalpha.com

2025-11-14 04:03:23MarketAxess delivered a solid quarter, beating revenue and EPS estimates despite ongoing weakness in U.S. credit market demand. MKTX is making progress with market share gains, expanding service revenues, and early traction in auctions and automation, positioning for a stronger 2026. The company maintains a fortress balance sheet, robust free cash flow, and consistent dividend growth, but faces risks from low volatility and rising competition.

MarketAxess Holdings Inc. (MKTX) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-07 14:26:06MarketAxess Holdings Inc. ( MKTX ) Q3 2025 Earnings Call November 7, 2025 11:00 AM EST Company Participants Stephen Davidson - Head of Investor Relations Christopher Concannon - CEO & Director Ilene Bieler - Chief Financial Officer Conference Call Participants Christopher Allen - Citigroup Inc., Research Division Patrick Moley - Piper Sandler & Co., Research Division Alex Kramm - UBS Investment Bank, Research Division Christopher O'Brien - Barclays Bank PLC, Research Division Michael Cyprys - Morgan Stanley, Research Division Simon Alistair Clinch - Rothschild & Co Redburn, Research Division Jeffrey Schmitt - William Blair & Company L.L.C., Research Division Ritwik Roy - Jefferies LLC, Research Division Elias Abboud - BofA Securities, Research Division Patrick O'Shaughnessy - Raymond James & Associates, Inc., Research Division Presentation Operator Ladies and gentlemen, thank you for standing by.

MarketAxess Q3 Earnings Beat on Strong Emerging Markets Volumes

zacks.com

2025-11-07 13:55:22MKTX posts Q3 EPS of $1.84, beating estimates as emerging markets and Eurobonds volumes lift revenues despite higher expenses.