MIND Technology, Inc. (MINDP)

Price:

13.30 USD

( - -0.19 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

II-VI Incorporated

VALUE SCORE:

0

2nd position

MicroCloud Hologram Inc.

VALUE SCORE:

9

The best

MicroCloud Hologram Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

MIND Technology, Inc., together with its subsidiaries, provides technology to the oceanographic, hydrographic, defense, seismic, and maritime security industries. The company's products include the GunLink seismic source acquisition and control systems that provide operators of marine seismic surveys with precise monitoring and control of energy sources; the BuoyLink RGPS tracking system, which is used to offer precise positioning of marine seismic energy sources and streamers; Digishot energy source controllers; Sleeve Gun energy sources; and SeaLink product line of marine sensors and solid streamer systems. It also provides streamer weight collars, depth and pressure transducers, air control valves, and source array systems; spare and replacement parts; and repair and engineering services, training and field service operations, and umbilical terminations, as well as side scan sonar equipment and systems. The company markets its products to governmental and commercial customers through internal sales organization and a network of distributors and representatives. It operates in the United States, Europe, Canada, Latin America, the Asia/South Pacific, Eurasia, and internationally. The company was formerly known as Mitcham Industries, Inc. MIND Technology, Inc. was incorporated in 1987 and is headquartered in The Woodlands, Texas.

NEWS

MIND Technology, Inc. (MIND) Q1 2025 Earnings Call Transcript

seekingalpha.com

2024-06-11 11:19:07MIND Technology, Inc. (NASDAQ:MIND ) Q1 2025 Earnings Conference Call June 11, 2024 9:00 AM ET Company Participants Ken Dennard - IR Rob Capps - President and CEO Mark Cox - VP and CFO Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings, and welcome to the MIND Technology First Quarter Fiscal 2025 Earnings Call. At this time all participants are in a listen only mode.

MIND Technology Announces New Date For Virtual Special Meeting of Preferred Stockholders and Revised Proposal

prnewswire.com

2024-05-08 08:00:00THE WOODLANDS, Texas , May 8, 2024 /PRNewswire/ -- MIND Technology, Inc. ("MIND" or the "Company") (Nasdaq: MIND) (Nasdaq: MINDP) announced today that the previously announced virtual special meeting of holders of its 9% Series A Cumulative Preferred Stock (the "preferred stock") to approve an amendment to the Certificate of Designations, Preferences and Rights of the Preferred Stock has been rescheduled for June 13, 2024. Additionally, the proposed amendment has been revised such that each share of preferred stock would be converted into 3.9 shares of common stock, $0.01 par value per share (the "common stock"), rather than the 2.7 shares initially proposed, at the sole discretion of the Company's Board of Directors at any time prior to July 31, 2024 (the "revised proposal").

MIND Technology, Inc. (MIND) Q4 2024 Earnings Call Transcript

seekingalpha.com

2024-04-30 15:31:10MIND Technology, Inc. (NASDAQ:MIND ) Q4 2024 Earnings Conference Call April 30, 2024 9:00 AM ET Company Participants Zach Vaughan - IR Rob Capps - President and CEO Mark Cox - VP and CFO Conference Call Participants Tyson Bauer - KC Capital Sam Schwartz - Kaliber Management Operator Ladies and gentlemen, good morning, and welcome to the MIND Technology Fiscal 2024 Fourth Quarter Earnings Conference Call. At this time, all participants are in a listen-only mode.

MIND Technology, Inc. (MIND) Q3 2024 Earnings Call Transcript

seekingalpha.com

2023-12-14 11:13:04MIND Technology, Inc. (NASDAQ:MIND ) Q3 2024 Earnings Conference Call December 14, 2023 9:00 AM ET Company Participants Ken Dennard - Investor Relations Rob Capps - President and Chief Executive Officer Mark Cox - Vice President and Chief Financial Officer Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings, and welcome to the MIND Technology Third Quarter Fiscal 2024 Conference Call. At this time, all participants are in a listen-only mode.

MIND Technology, Inc. (MIND) Q4 2023 Earnings Call Transcript

seekingalpha.com

2023-04-20 14:26:06MIND Technology, Inc. (MIND) Q4 2023 Earnings Call Transcript.

MIND Technology, Inc. (MIND) CEO Rob Capps on Q1 2023 Results - Earnings Call Transcript

seekingalpha.com

2022-06-09 11:04:05MIND Technology, Inc. (NASDAQ:MIND ) Q1 2023 Earnings Conference Call June 9, 2022 9:00 AM ET Company Participants Ken Dennard - IR Rob Capps - President & CEO Mark Cox - Vice President & CFO Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings. Welcome to the MIND Technology Fiscal 2023 First Quarter Conference Call.

MIND Technology, Inc.'s (MIND) CEO Rob Capps on Q4 2022 Results - Earnings Call Transcript

seekingalpha.com

2022-04-21 11:47:03MIND Technology, Inc. (NASDAQ:MIND ) Q4 2022 Earnings Conference Call April 21, 2022 9:00 AM ET Company Participants Zach Vaughan - Dennard Lascar Investor Relations Rob Capps - President and CEO Mark Cox - Vice President and CFO Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings. And welcome to the MIND Technologies' Fourth Quarter 2022 Conference Call.

MIND Technology: Poised To Outperform As Transformation Is Taking Shape

seekingalpha.com

2021-02-17 09:57:59Strategic transformation is gaining some initial traction as evidenced by sequentially improved quarterly results and a large customer order last week.

The Retirees' Dividend Portfolio: John And Jane's August Taxable Account Update

seekingalpha.com

2020-09-10 13:52:49The Taxable account generated $1,674.90 of dividends in August of 2020 compared with $1,591.52 of dividends in August of 2019.

The Retirees' Dividend Portfolio: John And Jane's July Taxable Account Update

seekingalpha.com

2020-08-13 15:44:08The Taxable account generated $1,337.01 of dividends in July of 2020 compared with $1,030.43 of dividends in July of 2019.

The Retirees' Dividend Portfolio: John And Jane's May Taxable Account Update

seekingalpha.com

2020-07-20 11:37:58The Taxable account generated $1,407.88 of dividends in June of 2020 compared with $936.06 of dividends in June of 2019.

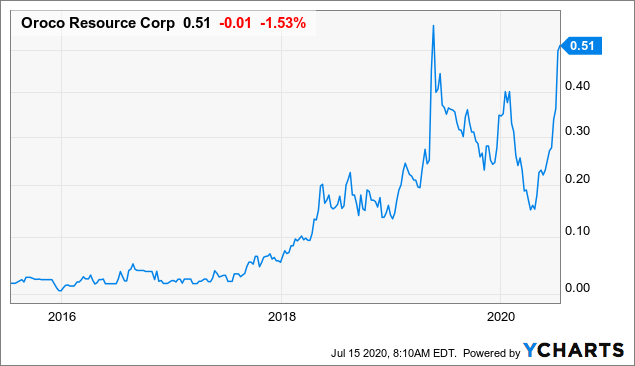

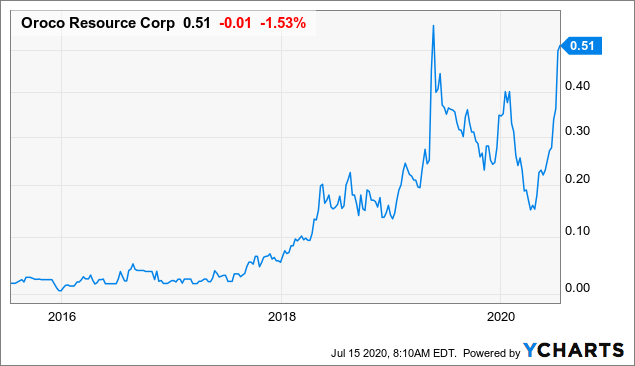

Interview With Mariusz Skonieczny On Tankers, Oroco Resources And Mitcham Industries

seekingalpha.com

2020-07-15 13:59:00Video interview with Mariusz Skonieczny, founder of Classic Value Investors. Mariusz also recently published a book called How To Profit From The Coronavirus Recession.

MIND Technology, Inc. (MIND) Q1 2025 Earnings Call Transcript

seekingalpha.com

2024-06-11 11:19:07MIND Technology, Inc. (NASDAQ:MIND ) Q1 2025 Earnings Conference Call June 11, 2024 9:00 AM ET Company Participants Ken Dennard - IR Rob Capps - President and CEO Mark Cox - VP and CFO Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings, and welcome to the MIND Technology First Quarter Fiscal 2025 Earnings Call. At this time all participants are in a listen only mode.

MIND Technology Announces New Date For Virtual Special Meeting of Preferred Stockholders and Revised Proposal

prnewswire.com

2024-05-08 08:00:00THE WOODLANDS, Texas , May 8, 2024 /PRNewswire/ -- MIND Technology, Inc. ("MIND" or the "Company") (Nasdaq: MIND) (Nasdaq: MINDP) announced today that the previously announced virtual special meeting of holders of its 9% Series A Cumulative Preferred Stock (the "preferred stock") to approve an amendment to the Certificate of Designations, Preferences and Rights of the Preferred Stock has been rescheduled for June 13, 2024. Additionally, the proposed amendment has been revised such that each share of preferred stock would be converted into 3.9 shares of common stock, $0.01 par value per share (the "common stock"), rather than the 2.7 shares initially proposed, at the sole discretion of the Company's Board of Directors at any time prior to July 31, 2024 (the "revised proposal").

MIND Technology, Inc. (MIND) Q4 2024 Earnings Call Transcript

seekingalpha.com

2024-04-30 15:31:10MIND Technology, Inc. (NASDAQ:MIND ) Q4 2024 Earnings Conference Call April 30, 2024 9:00 AM ET Company Participants Zach Vaughan - IR Rob Capps - President and CEO Mark Cox - VP and CFO Conference Call Participants Tyson Bauer - KC Capital Sam Schwartz - Kaliber Management Operator Ladies and gentlemen, good morning, and welcome to the MIND Technology Fiscal 2024 Fourth Quarter Earnings Conference Call. At this time, all participants are in a listen-only mode.

MIND Technology, Inc. (MIND) Q3 2024 Earnings Call Transcript

seekingalpha.com

2023-12-14 11:13:04MIND Technology, Inc. (NASDAQ:MIND ) Q3 2024 Earnings Conference Call December 14, 2023 9:00 AM ET Company Participants Ken Dennard - Investor Relations Rob Capps - President and Chief Executive Officer Mark Cox - Vice President and Chief Financial Officer Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings, and welcome to the MIND Technology Third Quarter Fiscal 2024 Conference Call. At this time, all participants are in a listen-only mode.

MIND Technology, Inc. (MIND) Q4 2023 Earnings Call Transcript

seekingalpha.com

2023-04-20 14:26:06MIND Technology, Inc. (MIND) Q4 2023 Earnings Call Transcript.

MIND Technology, Inc. (MIND) CEO Rob Capps on Q1 2023 Results - Earnings Call Transcript

seekingalpha.com

2022-06-09 11:04:05MIND Technology, Inc. (NASDAQ:MIND ) Q1 2023 Earnings Conference Call June 9, 2022 9:00 AM ET Company Participants Ken Dennard - IR Rob Capps - President & CEO Mark Cox - Vice President & CFO Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings. Welcome to the MIND Technology Fiscal 2023 First Quarter Conference Call.

MIND Technology, Inc.'s (MIND) CEO Rob Capps on Q4 2022 Results - Earnings Call Transcript

seekingalpha.com

2022-04-21 11:47:03MIND Technology, Inc. (NASDAQ:MIND ) Q4 2022 Earnings Conference Call April 21, 2022 9:00 AM ET Company Participants Zach Vaughan - Dennard Lascar Investor Relations Rob Capps - President and CEO Mark Cox - Vice President and CFO Conference Call Participants Tyson Bauer - KC Capital Ross Taylor - ARS Investment Partners Operator Greetings. And welcome to the MIND Technologies' Fourth Quarter 2022 Conference Call.

MIND Technology: Poised To Outperform As Transformation Is Taking Shape

seekingalpha.com

2021-02-17 09:57:59Strategic transformation is gaining some initial traction as evidenced by sequentially improved quarterly results and a large customer order last week.

The Retirees' Dividend Portfolio: John And Jane's August Taxable Account Update

seekingalpha.com

2020-09-10 13:52:49The Taxable account generated $1,674.90 of dividends in August of 2020 compared with $1,591.52 of dividends in August of 2019.

The Retirees' Dividend Portfolio: John And Jane's July Taxable Account Update

seekingalpha.com

2020-08-13 15:44:08The Taxable account generated $1,337.01 of dividends in July of 2020 compared with $1,030.43 of dividends in July of 2019.

The Retirees' Dividend Portfolio: John And Jane's May Taxable Account Update

seekingalpha.com

2020-07-20 11:37:58The Taxable account generated $1,407.88 of dividends in June of 2020 compared with $936.06 of dividends in June of 2019.

Interview With Mariusz Skonieczny On Tankers, Oroco Resources And Mitcham Industries

seekingalpha.com

2020-07-15 13:59:00Video interview with Mariusz Skonieczny, founder of Classic Value Investors. Mariusz also recently published a book called How To Profit From The Coronavirus Recession.