Western Asset Municipal High Income Fund Inc. (MHF)

Price:

6.98 USD

( - -0.07 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

LMP Capital and Income Fund Inc.

VALUE SCORE:

9

2nd position

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

The best

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Western Asset Municipal High Income Fund Inc. is a closed ended fixed income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. It is co-managed by Western Asset Management Company. The fund invests in the fixed income markets of the United States. It invests primarily in intermediate and long-term municipal debt securities issued by state and local governments including U.S. territories and possessions, political subdivisions, agencies and public authorities. The fund seeks to invest in investment grade debt securities rated in one of the four highest rating categories by a nationally recognized statistical rating organization to create its portfolio. It benchmarks the performance of its portfolio against the Lehman Brothers Municipal Bond Index. The fund was formerly known as Municipal High Income Fund Inc. Western Asset Municipal High Income Fund Inc. was formed on November 28, 1988 and is domiciled in the United States.

NEWS

Western Asset Municipal High Income Fund Inc. Announces Financial Position as of July 31, 2025

businesswire.com

2025-09-22 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Western Asset Municipal High Income Fund Inc. Announces Results of Annual Meeting of Stockholders

businesswire.com

2025-04-17 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Fund Announcement.

Western Asset Municipal High Income Fund Inc. Announces Financial Position as of January 31, 2025

businesswire.com

2025-03-24 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Western Asset Municipal High Income Fund Inc. (MHF) To Go Ex-Dividend on May 22nd

https://www.defenseworld.net

2024-05-20 07:18:52Western Asset Municipal High Income Fund Inc. (NYSE:MHF – Get Free Report) announced a monthly dividend on Thursday, February 22nd, Wall Street Journal reports. Stockholders of record on Thursday, May 23rd will be paid a dividend of 0.034 per share by the financial services provider on Monday, June 3rd. This represents a $0.41 dividend on an annualized basis and a dividend yield of 5.99%. The ex-dividend date is Wednesday, May 22nd. Western Asset Municipal High Income Fund has decreased its dividend payment by an average of 4.8% per year over the last three years and has raised its dividend every year for the last 2 years. Western Asset Municipal High Income Fund Price Performance Shares of Western Asset Municipal High Income Fund stock opened at $6.81 on Monday. The business has a fifty day simple moving average of $6.77 and a two-hundred day simple moving average of $6.55. Western Asset Municipal High Income Fund has a 1 year low of $5.92 and a 1 year high of $6.92. Western Asset Municipal High Income Fund Company Profile (Get Free Report) Western Asset Municipal High Income Fund Inc is a closed ended fixed income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. It is co-managed by Western Asset Management Company. The fund invests in the fixed income markets of the United States. It invests primarily in intermediate and long-term municipal debt securities issued by state and local governments including U.S.

Western Asset Municipal High Income Fund Inc. Announces Results of Annual Meeting of Stockholders

businesswire.com

2024-04-17 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Fund Announcement.

MHF: A Look At The 6% Tax Advantaged Yield

seekingalpha.com

2024-03-31 09:29:12Muni bonds are popular ways to avoid taxes and get your income fix. We look at MHF today which provides a 6.00%, tax advantaged, yield. The fund has some solid advantages and we weigh that versus the difficulty of sustaining the 6% yield.

Certain Closed End Funds Advised by Legg Mason Partners Fund Advisor, LLC Announce Appointment of New Lead Independent Director

businesswire.com

2022-11-10 08:00:00The Board of each Fund announced today the appointment of Eileen Kamerick as Lead Independent Director, effective November 8, 2022. Ms. Kamerick replaces William Hutchinson, the former Lead Independent Director of the Funds, who recently passed away. The Boards also announced that Nisha Kumar will succeed Ms. Kamerick as Chair of each Fund's Audit Committee.

These Funds Are Solid Bargains When Markets Go South. 9 That Offer High Yields.

barrons.com

2022-09-30 11:42:00Closed-end funds offer hefty yields and trade at discounts from the value of their underlying assets. But leverage poses a danger.

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of September, October, and November 2022

businesswire.com

2022-08-02 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of March, April and May 2022

businesswire.com

2022-02-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Western Asset Municipal High Income Fund Inc. Announces Financial Position as of January 31, 2021

businesswire.com

2021-03-23 08:00:00NEW YORK--(BUSINESS WIRE)--Western Asset Municipal High Income Fund Inc. (NYSE: MHF) today announced the financial position of the Fund as of January 31, 2021. Current Q Previous Q Prior Yr Q January 31, 2021 October 31, 2020 January 31, 2020 Total Net Assets (a) $ 176,028,815 $ 169,947,451 $ 176,345,741 NAV Per Share of Common Stock (a) $ 8.14 $ 7.86 $ 8.15 Market Price Per Share $ 7.84 $ 7.19 $ 7.78 Premium / (Discount) (3.69 )% (8.52 )% (4.54 )% Outstanding Shares 2

Western Asset Cuts: DMO Most Affected, Sell Alert For MHF

seekingalpha.com

2020-09-08 07:00:00DMO cut their distribution as we expected on the 19th of August. We expect one more cut Nov.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

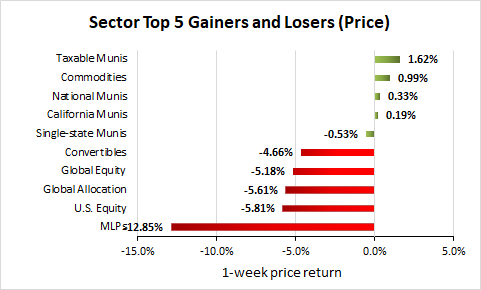

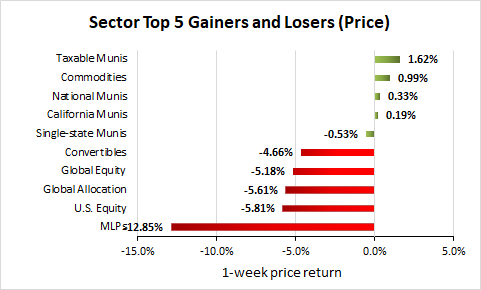

Weekly Closed-End Fund Roundup: June 14, 2020

seekingalpha.com

2020-06-23 07:49:09Risk-off week as 4 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. Munis lead while MLPs lag. Big cuts to KYN/KMF.

Commonwealth Equity Services LLC Has $131,000 Stock Position in Western Asset Municipal Hgh Incm Fnd Inc (NYSE:MHF)

thelincolnianonline.com

2020-06-22 04:38:48Commonwealth Equity Services LLC decreased its position in shares of Western Asset Municipal Hgh Incm Fnd Inc (NYSE:MHF) by 52.7% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 18,549 shares of the financial services provider’s stock after selling 20,646 shares during […]

Weekly Closed-End Fund Roundup: VAM To Merge Into FINS, EGIF To Liquidate (May 31, 2020)

seekingalpha.com

2020-06-08 10:02:03The rebound continues, with 23 out of 23 CEF sectors positive on price and 22 out of 23 sectors positive on NAV last week. VAM will be merged into FINS this wee

Western Asset Municipal High Income Fund Inc. Announces Financial Position as of July 31, 2025

businesswire.com

2025-09-22 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Western Asset Municipal High Income Fund Inc. Announces Results of Annual Meeting of Stockholders

businesswire.com

2025-04-17 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Fund Announcement.

Western Asset Municipal High Income Fund Inc. Announces Financial Position as of January 31, 2025

businesswire.com

2025-03-24 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Financials.

Western Asset Municipal High Income Fund Inc. (MHF) To Go Ex-Dividend on May 22nd

https://www.defenseworld.net

2024-05-20 07:18:52Western Asset Municipal High Income Fund Inc. (NYSE:MHF – Get Free Report) announced a monthly dividend on Thursday, February 22nd, Wall Street Journal reports. Stockholders of record on Thursday, May 23rd will be paid a dividend of 0.034 per share by the financial services provider on Monday, June 3rd. This represents a $0.41 dividend on an annualized basis and a dividend yield of 5.99%. The ex-dividend date is Wednesday, May 22nd. Western Asset Municipal High Income Fund has decreased its dividend payment by an average of 4.8% per year over the last three years and has raised its dividend every year for the last 2 years. Western Asset Municipal High Income Fund Price Performance Shares of Western Asset Municipal High Income Fund stock opened at $6.81 on Monday. The business has a fifty day simple moving average of $6.77 and a two-hundred day simple moving average of $6.55. Western Asset Municipal High Income Fund has a 1 year low of $5.92 and a 1 year high of $6.92. Western Asset Municipal High Income Fund Company Profile (Get Free Report) Western Asset Municipal High Income Fund Inc is a closed ended fixed income mutual fund launched and managed by Legg Mason Partners Fund Advisor, LLC. It is co-managed by Western Asset Management Company. The fund invests in the fixed income markets of the United States. It invests primarily in intermediate and long-term municipal debt securities issued by state and local governments including U.S.

Western Asset Municipal High Income Fund Inc. Announces Results of Annual Meeting of Stockholders

businesswire.com

2024-04-17 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Fund Announcement.

MHF: A Look At The 6% Tax Advantaged Yield

seekingalpha.com

2024-03-31 09:29:12Muni bonds are popular ways to avoid taxes and get your income fix. We look at MHF today which provides a 6.00%, tax advantaged, yield. The fund has some solid advantages and we weigh that versus the difficulty of sustaining the 6% yield.

Certain Closed End Funds Advised by Legg Mason Partners Fund Advisor, LLC Announce Appointment of New Lead Independent Director

businesswire.com

2022-11-10 08:00:00The Board of each Fund announced today the appointment of Eileen Kamerick as Lead Independent Director, effective November 8, 2022. Ms. Kamerick replaces William Hutchinson, the former Lead Independent Director of the Funds, who recently passed away. The Boards also announced that Nisha Kumar will succeed Ms. Kamerick as Chair of each Fund's Audit Committee.

These Funds Are Solid Bargains When Markets Go South. 9 That Offer High Yields.

barrons.com

2022-09-30 11:42:00Closed-end funds offer hefty yields and trade at discounts from the value of their underlying assets. But leverage poses a danger.

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of September, October, and November 2022

businesswire.com

2022-08-02 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Months of March, April and May 2022

businesswire.com

2022-02-16 08:00:00NEW YORK--(BUSINESS WIRE)--Category: Distribution Related

Western Asset Municipal High Income Fund Inc. Announces Financial Position as of January 31, 2021

businesswire.com

2021-03-23 08:00:00NEW YORK--(BUSINESS WIRE)--Western Asset Municipal High Income Fund Inc. (NYSE: MHF) today announced the financial position of the Fund as of January 31, 2021. Current Q Previous Q Prior Yr Q January 31, 2021 October 31, 2020 January 31, 2020 Total Net Assets (a) $ 176,028,815 $ 169,947,451 $ 176,345,741 NAV Per Share of Common Stock (a) $ 8.14 $ 7.86 $ 8.15 Market Price Per Share $ 7.84 $ 7.19 $ 7.78 Premium / (Discount) (3.69 )% (8.52 )% (4.54 )% Outstanding Shares 2

Western Asset Cuts: DMO Most Affected, Sell Alert For MHF

seekingalpha.com

2020-09-08 07:00:00DMO cut their distribution as we expected on the 19th of August. We expect one more cut Nov.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Weekly Closed-End Fund Roundup: June 14, 2020

seekingalpha.com

2020-06-23 07:49:09Risk-off week as 4 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. Munis lead while MLPs lag. Big cuts to KYN/KMF.

Commonwealth Equity Services LLC Has $131,000 Stock Position in Western Asset Municipal Hgh Incm Fnd Inc (NYSE:MHF)

thelincolnianonline.com

2020-06-22 04:38:48Commonwealth Equity Services LLC decreased its position in shares of Western Asset Municipal Hgh Incm Fnd Inc (NYSE:MHF) by 52.7% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 18,549 shares of the financial services provider’s stock after selling 20,646 shares during […]

Weekly Closed-End Fund Roundup: VAM To Merge Into FINS, EGIF To Liquidate (May 31, 2020)

seekingalpha.com

2020-06-08 10:02:03The rebound continues, with 23 out of 23 CEF sectors positive on price and 22 out of 23 sectors positive on NAV last week. VAM will be merged into FINS this wee