BlackRock MuniHoldings Fund, Inc. (MHD)

Price:

11.08 USD

( - -0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Citigroup Capital XIII TR PFD SECS

VALUE SCORE:

6

2nd position

Kayne Anderson Energy Infrastructure Fund, Inc.

VALUE SCORE:

12

The best

FS Credit Opportunities Corp.

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

BlackRock MuniHoldings Fund, Inc. is a closed-ended fixed income mutual fund launched by BlackRock, Inc. It is managed by BlackRock Advisors, LLC. The fund invests in the fixed income markets of the United States. It primarily invests in investment grade municipal bonds that are exempt from federal income taxes. The fund seeks to invest in securities with a maturity of more than ten years. BlackRock MuniHoldings Fund, Inc. was formed on May 2, 1997 and is domiciled in the United States.

NEWS

Lundbeck to Present a Breadth of Migraine and Cluster Headache Data at the 66th Annual Scientific Meeting of the American Headache Society

businesswire.com

2024-06-13 08:00:00DEERFIELD, Ill.--(BUSINESS WIRE)--Lundbeck to Present a Breadth of Migraine and Cluster Headache Data at the 66th Annual Scientific Meeting of the American Headache Society.

BlackRock Announces Management Fee Waiver for Certain Closed-End Funds

https://www.businesswire.com

2024-05-20 06:00:00NEW YORK--(BUSINESS WIRE)--The BlackRock closed-end funds (each a “Fund,” and collectively the “Funds”) listed below announced today the implementation of voluntary management fee waivers, effective May 1, 2024. Under the terms of this initiative, BlackRock Advisors, LLC (“BlackRock”) intends to waive management fees if certain conditions, detailed below, are met. In addition, BlackRock will be waiving an additional one-time $2 million in management/advisory fees pro-rata across the Funds. “We believe this fee waiver is a meaningful enhancement to these Funds and will increase tax-exempt income to shareholders, consistent with their investment objective. We will continue to evaluate options for improving our closed-end funds for the benefit of all shareholders, as we work to protect and advance their best interests,” said R. Glenn Hubbard, Chair of the Board of BlackRock Closed-End Funds. BlackRock Closed-End Funds Implementing a Voluntary Management Fee Waiver Fund Name Ticker BlackRock MuniHoldings California Quality Fund, Inc. MUC BlackRock MuniHoldings New Jersey Quality Fund, Inc. MUJ BlackRock MuniHoldings New York Quality Fund, Inc. MHN BlackRock MuniHoldings Fund, Inc. MHD BlackRock MuniHoldings Quality Fund II, Inc. MUE BlackRock MuniAssets Fund, Inc. MUA BlackRock Investment Quality Municipal Trust, Inc. BKN BlackRock MuniYield Fund, Inc. MYD BlackRock MuniYield Quality Fund III, Inc. MYI BlackRock MuniYield New York Quality Fund, Inc. MYN BlackRock MuniYield Quality Fund, Inc. MQY BlackRock MuniYield Quality Fund II, Inc. MQT BlackRock MuniYield Michigan Quality Fund, Inc. MIY BlackRock MuniYield Pennsylvania Quality Fund MPA BlackRock MuniVest Fund II, Inc. MVT BlackRock MuniVest Fund, Inc. MVF BlackRock Municipal Income Fund, Inc. MUI BlackRock Municipal Income Trust BFK BlackRock Municipal Income Trust II BLE BlackRock Municipal Income Quality Trust BYM BlackRock California Municipal Income Trust BFZ BlackRock New York Municipal Income Trust BNY BlackRock Virginia Municipal Bond Trust BHV BlackRock Long-Term Municipal Advantage Trust BTA With respect to each Fund, if the monthly dividend on preferred shares (VRDP or VMTP) exceeds the calculated value1 of the Fund’s gross monthly income attributable to investments from the proceeds of the preferred shares, then BlackRock will waive the management fee payable to BlackRock charged on preferred share assets.2 About BlackRock BlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. For additional information on BlackRock, please visit www.blackrock.com/corporate Availability of Fund Updates BlackRock will update performance and certain other data for the Funds on a monthly basis on its website in the “Closed-end Funds” section of www.blackrock.com as well as certain other material information as necessary from time to time. Investors and others are advised to check the website for updated performance information and the release of other material information about the Funds. This reference to BlackRock’s website is intended to allow investors public access to information regarding the Funds and does not, and is not intended to, incorporate BlackRock’s website in this release. Forward-Looking Statements This press release, and other statements that BlackRock or a Fund may make, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to a Fund’s or BlackRock’s future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” or similar expressions. BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to and does not undertake to update forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance. With respect to the Funds, the following factors, among others, could cause actual events to differ materially from forward-looking statements or historical performance: (1) changes and volatility in political, economic or industry conditions, the interest rate environment, foreign exchange rates or financial and capital markets, which could result in changes in demand for the Funds or in a Fund’s net asset value; (2) the relative and absolute investment performance of a Fund and its investments; (3) the impact of increased competition; (4) the unfavorable resolution of any legal proceedings; (5) the extent and timing of any distributions or share repurchases; (6) the impact, extent and timing of technological changes; (7) the impact of legislative and regulatory actions and reforms, and regulatory, supervisory or enforcement actions of government agencies relating to a Fund or BlackRock, as applicable; (8) terrorist activities, international hostilities, health epidemics and/or pandemics and natural disasters, which may adversely affect the general economy, domestic and local financial and capital markets, specific industries or BlackRock; (9) BlackRock’s ability to attract and retain highly talented professionals; (10) the impact of BlackRock electing to provide support to its products from time to time; and (11) the impact of problems at other financial institutions or the failure or negative performance of products at other financial institutions. Annual and Semi-Annual Reports and other regulatory filings of the Funds with the Securities and Exchange Commission (“SEC”) are accessible on the SEC's website at www.sec.gov and on BlackRock’s website at www.blackrock.com, and may discuss these or other factors that affect the Funds. The information contained on BlackRock’s website is not a part of this press release. 1 Determined by multiplying the Fund’s gross monthly income by the ratio of (i) the liquidation preference of any outstanding preferred shares to (ii) total assets of the Fund minus the sum of its accrued liabilities (which does not include liabilities represented by TOB Trusts and the liquidation preference of any outstanding preferred shares. 2 The voluntary waivers may be reduced or discontinued at any time without notice.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2024-03-01 16:30:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. Municipal Funds: Declaration- 3/1/2024 Ex-Date- 3/14/2024 Record- 3/15/2024 Payable- 4/1/2024 National Funds Ticker Distribution Change From Prior Distribution BlackRock Municipal Income Quality Trust* BYM $0.052500 - BlackRock Long-Term Municipal Advantage Trust* BTA $0.043500 - BlackRock MuniAssets Fund, Inc.* MUA $0.055500 - BlackRock Municipal Income Fund, Inc.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2023-12-05 17:00:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. BlackRock Floating Rate Income Trust (NYSE: BGT), BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA) and BlackRock Debt Strategies Fund, Inc. (NYSE: DSU) announced increases to their monthly distributions. Certain BlackRock municipal Funds previously declared their December, January and February distributions and declared special distributions today in order.

Certain BlackRock Municipal Closed-End Funds Announce Variable Rate Muni Term Preferred Shares Actions

businesswire.com

2023-11-02 17:15:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced BlackRock Municipal Income Trust (NYSE: BFK), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN), BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM), BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), BlackRock MuniYield Quality Fund II, Inc. (NYSE: MQT), BlackRock MuniHoldings Quality Fund II, Inc. (NYSE: MUE), BlackRock MuniVest Fund, Inc. (NYSE: MVF), and BlackRock MuniVest Fund II, Inc. (NYSE: MVT) (collectively, the “Funds”) intend to redeem a portion of their outstanding Series W-7 Variable Rate Muni Term Preferred Shares (“VMTP Shares”) on or about November 24, 2023, at a redemption price equal to the liquidation preference of $100,000 per share, together with accumulated and unpaid dividends through the day prior to the redemption date. Shareholders are expected to benefit from lower expenses as a result of the redemptions.

CORRECTING and REPLACING BlackRock Closed-End Fund Share Repurchase Program Update

businesswire.com

2023-04-14 16:30:00NEW YORK--(BUSINESS WIRE)--Please replace the release dated April 11, 2023, with the following corrected version due to changes in the table, "Summary of share repurchase activity since Repurchase Program inception as of March 31, 2023".

Weekly Closed-End Fund Roundup: PIMCO Muni CEF Distribution Cuts (January 1, 2023)

seekingalpha.com

2023-01-10 12:58:493 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. PIMCO muni CEFs cut.

BlackRock Announces Fiscal Year End Changes for Certain Municipal Closed-End Funds

businesswire.com

2022-06-03 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC (“BlackRock”) announced today a change to the fiscal year end (“FYE”) for each Fund listed below. These changes were made to reduce operating costs for the Funds and will be effective as of July 31, 2022. Ticker (NYSE) Fund Current FYE New FYE BKN BlackRock Investment Quality Municipal Trust, Inc. 4/30 7/31 BTA BlackRock Long-Term Municipal Advantage Trust 4/30 7/31 MUA BlackRock MuniAssets Fund, Inc. 4/30 7/31 MUI BlackRock Municipal Income Fu

CEF Weekly Market Review: The Attraction Of Shadow High Yielders

seekingalpha.com

2022-02-11 11:25:33CEF Weekly Market Review: The Attraction Of Shadow High Yielders

CEF Weekly Market Review: Key Hazards To Watch Out For

seekingalpha.com

2021-08-28 11:18:19We review CEF market valuation and performance over the third week of August and highlight recent market events. August has delivered fairly flat returns so far with CEF sectors following the moves in major asset classes.

YH Weekly Commentary Peak

seekingalpha.com

2021-08-20 07:00:00Stocks finished the week up nicely with the S&P 500 up nearly 1% and the Nasdaq up just over 1%, for all new record highs.

CEF Report April 2021: A Complete Round Trip

seekingalpha.com

2021-04-21 07:00:00CEF Report April 2021: A Complete Round Trip

BlackRock Announces Special Distributions Related to the Reorganization of Five Municipal Closed-End Funds

businesswire.com

2021-02-19 17:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced the declaration of a special distribution for BlackRock Municipal Income Investment Quality Trust (NYSE: BAF), BlackRock Municipal Bond Trust (NYSE: BBK), BlackRock MuniHoldings Fund II, Inc. (NYSE: MUH), BlackRock MuniHoldings Quality Fund, Inc. (NYSE: MUS), and BlackRock MuniHoldings Fund, Inc. (NYSE: MHD) (collectively, the “Funds”) in connection with the reorganizations of BAF, BBK, MUH, and MUS into MHD, with MHD continuing

BlackRock Announces Results of Shareholder Vote at Adjourned Joint Special Shareholder Meeting Relating to the Reorganizations of Five Municipal Closed-End Funds

businesswire.com

2021-01-21 18:00:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC announced today that, at a joint special meeting of shareholders (the “Meeting”) of BlackRock Municipal Income Investment Quality Trust (NYSE: BAF), BlackRock MuniHoldings Fund II, Inc. (NYSE: MUH) and BlackRock MuniHoldings Quality Fund, Inc. (NYSE: MUS), the requisite votes of shareholders of BAF, MUH and MUS have approved the reorganization of each of BAF, MUH and MUS with and into BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), with MHD cont

BlackRock Announces Results of Joint Special Shareholder Meeting Relating to the Reorganizations of Five Municipal Closed-End Funds

businesswire.com

2020-12-15 17:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC announced today that, at a joint special meeting of shareholders (the “Meeting”) of BlackRock Municipal Income Investment Quality Trust (“BAF”), BlackRock Municipal Bond Trust (NYSE: BBK), BlackRock MuniHoldings Fund II, Inc. (NYSE: MUH), BlackRock MuniHoldings Quality Fund, Inc. (NYSE: MUS) and BlackRock MuniHoldings Fund, Inc. (NYSE: MHD and collectively with BAF, BBK, MUH and MUS, the “Funds,” and each, a “Fund”), the requisite votes of shar

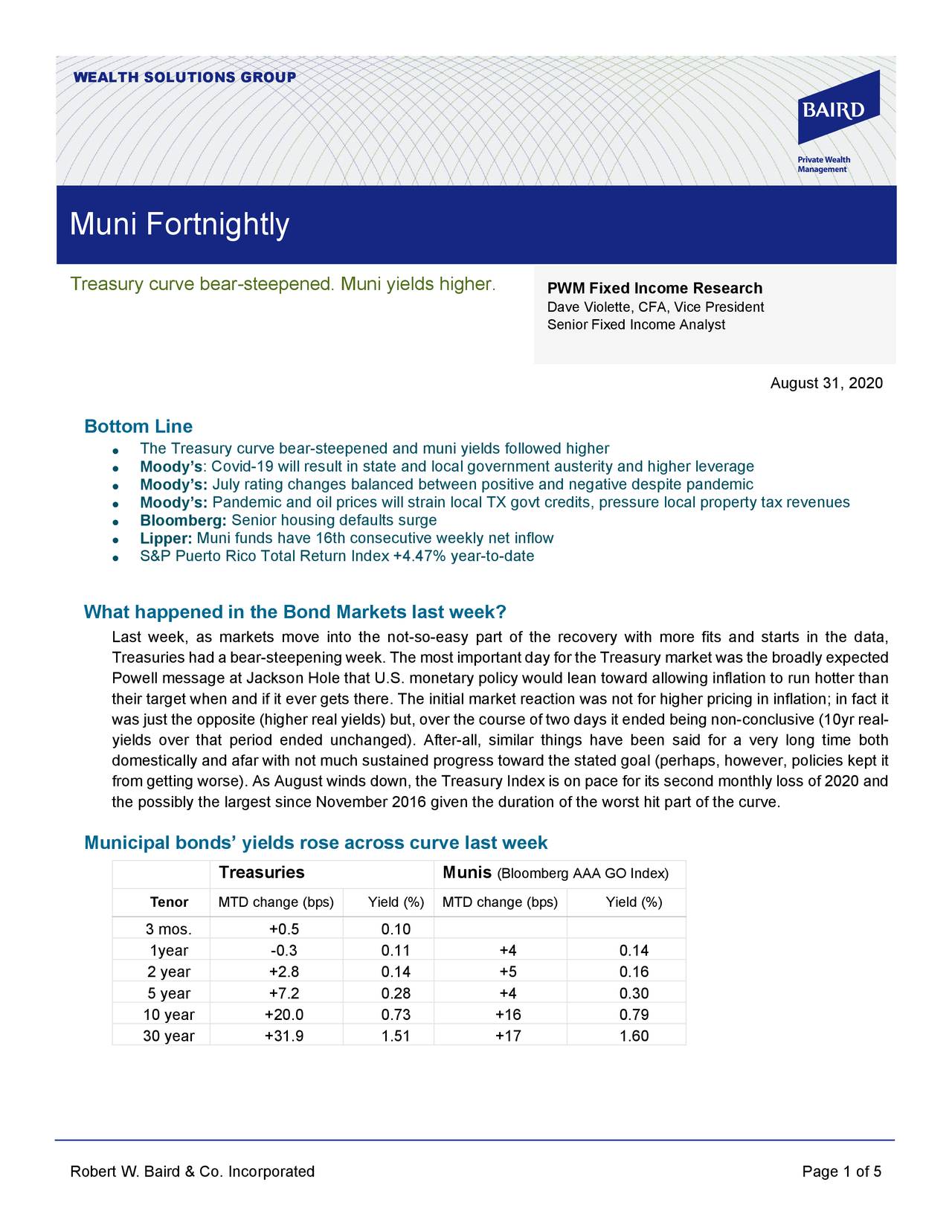

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.

Lundbeck to Present a Breadth of Migraine and Cluster Headache Data at the 66th Annual Scientific Meeting of the American Headache Society

businesswire.com

2024-06-13 08:00:00DEERFIELD, Ill.--(BUSINESS WIRE)--Lundbeck to Present a Breadth of Migraine and Cluster Headache Data at the 66th Annual Scientific Meeting of the American Headache Society.

BlackRock Announces Management Fee Waiver for Certain Closed-End Funds

https://www.businesswire.com

2024-05-20 06:00:00NEW YORK--(BUSINESS WIRE)--The BlackRock closed-end funds (each a “Fund,” and collectively the “Funds”) listed below announced today the implementation of voluntary management fee waivers, effective May 1, 2024. Under the terms of this initiative, BlackRock Advisors, LLC (“BlackRock”) intends to waive management fees if certain conditions, detailed below, are met. In addition, BlackRock will be waiving an additional one-time $2 million in management/advisory fees pro-rata across the Funds. “We believe this fee waiver is a meaningful enhancement to these Funds and will increase tax-exempt income to shareholders, consistent with their investment objective. We will continue to evaluate options for improving our closed-end funds for the benefit of all shareholders, as we work to protect and advance their best interests,” said R. Glenn Hubbard, Chair of the Board of BlackRock Closed-End Funds. BlackRock Closed-End Funds Implementing a Voluntary Management Fee Waiver Fund Name Ticker BlackRock MuniHoldings California Quality Fund, Inc. MUC BlackRock MuniHoldings New Jersey Quality Fund, Inc. MUJ BlackRock MuniHoldings New York Quality Fund, Inc. MHN BlackRock MuniHoldings Fund, Inc. MHD BlackRock MuniHoldings Quality Fund II, Inc. MUE BlackRock MuniAssets Fund, Inc. MUA BlackRock Investment Quality Municipal Trust, Inc. BKN BlackRock MuniYield Fund, Inc. MYD BlackRock MuniYield Quality Fund III, Inc. MYI BlackRock MuniYield New York Quality Fund, Inc. MYN BlackRock MuniYield Quality Fund, Inc. MQY BlackRock MuniYield Quality Fund II, Inc. MQT BlackRock MuniYield Michigan Quality Fund, Inc. MIY BlackRock MuniYield Pennsylvania Quality Fund MPA BlackRock MuniVest Fund II, Inc. MVT BlackRock MuniVest Fund, Inc. MVF BlackRock Municipal Income Fund, Inc. MUI BlackRock Municipal Income Trust BFK BlackRock Municipal Income Trust II BLE BlackRock Municipal Income Quality Trust BYM BlackRock California Municipal Income Trust BFZ BlackRock New York Municipal Income Trust BNY BlackRock Virginia Municipal Bond Trust BHV BlackRock Long-Term Municipal Advantage Trust BTA With respect to each Fund, if the monthly dividend on preferred shares (VRDP or VMTP) exceeds the calculated value1 of the Fund’s gross monthly income attributable to investments from the proceeds of the preferred shares, then BlackRock will waive the management fee payable to BlackRock charged on preferred share assets.2 About BlackRock BlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. For additional information on BlackRock, please visit www.blackrock.com/corporate Availability of Fund Updates BlackRock will update performance and certain other data for the Funds on a monthly basis on its website in the “Closed-end Funds” section of www.blackrock.com as well as certain other material information as necessary from time to time. Investors and others are advised to check the website for updated performance information and the release of other material information about the Funds. This reference to BlackRock’s website is intended to allow investors public access to information regarding the Funds and does not, and is not intended to, incorporate BlackRock’s website in this release. Forward-Looking Statements This press release, and other statements that BlackRock or a Fund may make, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to a Fund’s or BlackRock’s future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” or similar expressions. BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to and does not undertake to update forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance. With respect to the Funds, the following factors, among others, could cause actual events to differ materially from forward-looking statements or historical performance: (1) changes and volatility in political, economic or industry conditions, the interest rate environment, foreign exchange rates or financial and capital markets, which could result in changes in demand for the Funds or in a Fund’s net asset value; (2) the relative and absolute investment performance of a Fund and its investments; (3) the impact of increased competition; (4) the unfavorable resolution of any legal proceedings; (5) the extent and timing of any distributions or share repurchases; (6) the impact, extent and timing of technological changes; (7) the impact of legislative and regulatory actions and reforms, and regulatory, supervisory or enforcement actions of government agencies relating to a Fund or BlackRock, as applicable; (8) terrorist activities, international hostilities, health epidemics and/or pandemics and natural disasters, which may adversely affect the general economy, domestic and local financial and capital markets, specific industries or BlackRock; (9) BlackRock’s ability to attract and retain highly talented professionals; (10) the impact of BlackRock electing to provide support to its products from time to time; and (11) the impact of problems at other financial institutions or the failure or negative performance of products at other financial institutions. Annual and Semi-Annual Reports and other regulatory filings of the Funds with the Securities and Exchange Commission (“SEC”) are accessible on the SEC's website at www.sec.gov and on BlackRock’s website at www.blackrock.com, and may discuss these or other factors that affect the Funds. The information contained on BlackRock’s website is not a part of this press release. 1 Determined by multiplying the Fund’s gross monthly income by the ratio of (i) the liquidation preference of any outstanding preferred shares to (ii) total assets of the Fund minus the sum of its accrued liabilities (which does not include liabilities represented by TOB Trusts and the liquidation preference of any outstanding preferred shares. 2 The voluntary waivers may be reduced or discontinued at any time without notice.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2024-03-01 16:30:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. Municipal Funds: Declaration- 3/1/2024 Ex-Date- 3/14/2024 Record- 3/15/2024 Payable- 4/1/2024 National Funds Ticker Distribution Change From Prior Distribution BlackRock Municipal Income Quality Trust* BYM $0.052500 - BlackRock Long-Term Municipal Advantage Trust* BTA $0.043500 - BlackRock MuniAssets Fund, Inc.* MUA $0.055500 - BlackRock Municipal Income Fund, Inc.

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

businesswire.com

2023-12-05 17:00:00NEW YORK--(BUSINESS WIRE)--Certain BlackRock closed-end funds (the “Funds”) announced distributions today as detailed below. BlackRock Floating Rate Income Trust (NYSE: BGT), BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA) and BlackRock Debt Strategies Fund, Inc. (NYSE: DSU) announced increases to their monthly distributions. Certain BlackRock municipal Funds previously declared their December, January and February distributions and declared special distributions today in order.

Certain BlackRock Municipal Closed-End Funds Announce Variable Rate Muni Term Preferred Shares Actions

businesswire.com

2023-11-02 17:15:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced BlackRock Municipal Income Trust (NYSE: BFK), BlackRock Investment Quality Municipal Trust, Inc. (NYSE: BKN), BlackRock Municipal Income Trust II (NYSE: BLE), BlackRock Municipal Income Quality Trust (NYSE: BYM), BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), BlackRock MuniYield Quality Fund II, Inc. (NYSE: MQT), BlackRock MuniHoldings Quality Fund II, Inc. (NYSE: MUE), BlackRock MuniVest Fund, Inc. (NYSE: MVF), and BlackRock MuniVest Fund II, Inc. (NYSE: MVT) (collectively, the “Funds”) intend to redeem a portion of their outstanding Series W-7 Variable Rate Muni Term Preferred Shares (“VMTP Shares”) on or about November 24, 2023, at a redemption price equal to the liquidation preference of $100,000 per share, together with accumulated and unpaid dividends through the day prior to the redemption date. Shareholders are expected to benefit from lower expenses as a result of the redemptions.

CORRECTING and REPLACING BlackRock Closed-End Fund Share Repurchase Program Update

businesswire.com

2023-04-14 16:30:00NEW YORK--(BUSINESS WIRE)--Please replace the release dated April 11, 2023, with the following corrected version due to changes in the table, "Summary of share repurchase activity since Repurchase Program inception as of March 31, 2023".

Weekly Closed-End Fund Roundup: PIMCO Muni CEF Distribution Cuts (January 1, 2023)

seekingalpha.com

2023-01-10 12:58:493 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. PIMCO muni CEFs cut.

BlackRock Announces Fiscal Year End Changes for Certain Municipal Closed-End Funds

businesswire.com

2022-06-03 16:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC (“BlackRock”) announced today a change to the fiscal year end (“FYE”) for each Fund listed below. These changes were made to reduce operating costs for the Funds and will be effective as of July 31, 2022. Ticker (NYSE) Fund Current FYE New FYE BKN BlackRock Investment Quality Municipal Trust, Inc. 4/30 7/31 BTA BlackRock Long-Term Municipal Advantage Trust 4/30 7/31 MUA BlackRock MuniAssets Fund, Inc. 4/30 7/31 MUI BlackRock Municipal Income Fu

CEF Weekly Market Review: The Attraction Of Shadow High Yielders

seekingalpha.com

2022-02-11 11:25:33CEF Weekly Market Review: The Attraction Of Shadow High Yielders

CEF Weekly Market Review: Key Hazards To Watch Out For

seekingalpha.com

2021-08-28 11:18:19We review CEF market valuation and performance over the third week of August and highlight recent market events. August has delivered fairly flat returns so far with CEF sectors following the moves in major asset classes.

YH Weekly Commentary Peak

seekingalpha.com

2021-08-20 07:00:00Stocks finished the week up nicely with the S&P 500 up nearly 1% and the Nasdaq up just over 1%, for all new record highs.

CEF Report April 2021: A Complete Round Trip

seekingalpha.com

2021-04-21 07:00:00CEF Report April 2021: A Complete Round Trip

BlackRock Announces Special Distributions Related to the Reorganization of Five Municipal Closed-End Funds

businesswire.com

2021-02-19 17:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC today announced the declaration of a special distribution for BlackRock Municipal Income Investment Quality Trust (NYSE: BAF), BlackRock Municipal Bond Trust (NYSE: BBK), BlackRock MuniHoldings Fund II, Inc. (NYSE: MUH), BlackRock MuniHoldings Quality Fund, Inc. (NYSE: MUS), and BlackRock MuniHoldings Fund, Inc. (NYSE: MHD) (collectively, the “Funds”) in connection with the reorganizations of BAF, BBK, MUH, and MUS into MHD, with MHD continuing

BlackRock Announces Results of Shareholder Vote at Adjourned Joint Special Shareholder Meeting Relating to the Reorganizations of Five Municipal Closed-End Funds

businesswire.com

2021-01-21 18:00:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC announced today that, at a joint special meeting of shareholders (the “Meeting”) of BlackRock Municipal Income Investment Quality Trust (NYSE: BAF), BlackRock MuniHoldings Fund II, Inc. (NYSE: MUH) and BlackRock MuniHoldings Quality Fund, Inc. (NYSE: MUS), the requisite votes of shareholders of BAF, MUH and MUS have approved the reorganization of each of BAF, MUH and MUS with and into BlackRock MuniHoldings Fund, Inc. (NYSE: MHD), with MHD cont

BlackRock Announces Results of Joint Special Shareholder Meeting Relating to the Reorganizations of Five Municipal Closed-End Funds

businesswire.com

2020-12-15 17:30:00NEW YORK--(BUSINESS WIRE)--BlackRock Advisors, LLC announced today that, at a joint special meeting of shareholders (the “Meeting”) of BlackRock Municipal Income Investment Quality Trust (“BAF”), BlackRock Municipal Bond Trust (NYSE: BBK), BlackRock MuniHoldings Fund II, Inc. (NYSE: MUH), BlackRock MuniHoldings Quality Fund, Inc. (NYSE: MUS) and BlackRock MuniHoldings Fund, Inc. (NYSE: MHD and collectively with BAF, BBK, MUH and MUS, the “Funds,” and each, a “Fund”), the requisite votes of shar

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

seekingalpha.com

2020-09-06 01:50:00The Treasury curve bear-steepened and muni yields followed higher. Moody’s: Covid-19 will result in state and local government austerity and higher leverage.