Mayville Engineering Company, Inc. (MEC)

Price:

18.63 USD

( - -0.19 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Ryerson Holding Corporation

VALUE SCORE:

5

2nd position

Insteel Industries, Inc.

VALUE SCORE:

7

The best

ATI Inc.

VALUE SCORE:

7

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

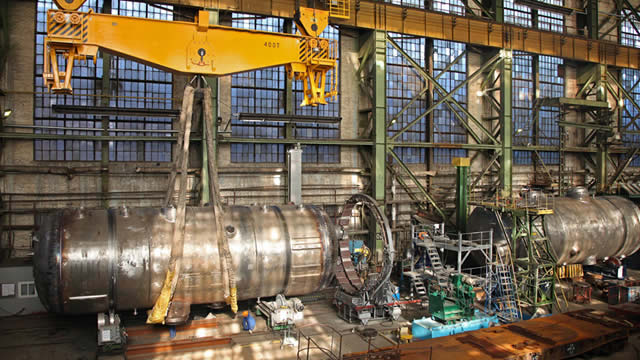

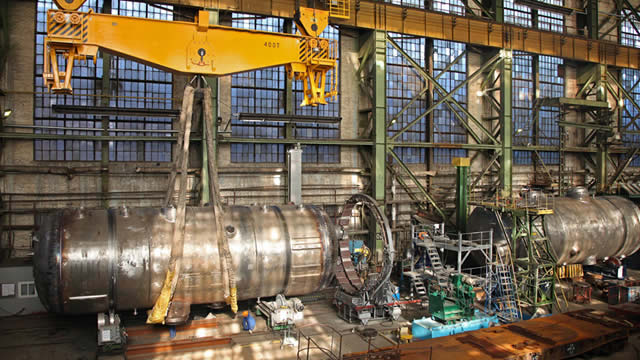

Mayville Engineering Company, Inc., together with its subsidiaries, operates as a contract manufacturer that serves the heavy and medium duty commercial vehicle, construction and access equipment, powersports, agriculture, military, and other end markets in the United States. The company provides a range of prototyping and tooling, production fabrication, coating, assembly, and aftermarket components. It also supplies engineered components to original equipment manufacturers. The company was founded in 1945 and is headquartered in Mayville, Wisconsin.

NEWS

Mayville Engineering (NYSE:MEC) & Skyline Builders Group (NASDAQ:SKBL) Head-To-Head Survey

defenseworld.net

2025-12-08 01:28:47Skyline Builders Group (NASDAQ: SKBL - Get Free Report) and Mayville Engineering (NYSE: MEC - Get Free Report) are both small-cap construction companies, but which is the superior stock? We will contrast the two companies based on the strength of their risk, dividends, profitability, valuation, analyst recommendations, institutional ownership and earnings. Profitability This table compares Skyline Builders

Mustang Energy Corp. Stakes Two New Mineral Properties in Newfoundland: Onyx Uranium Project and Bridal Veil Copper–Silver Project

globenewswire.com

2025-12-03 18:49:00VANCOUVER, British Columbia, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Mustang Energy Corp. (CSE: MEC, OTC: MECPF, FRA: 92T) (the “Company” or “Mustang”) is pleased to announce that it has staked two new mineral exploration properties in Newfoundland and Labrador — the Onyx Uranium Project (the “Onyx Project”) in southern Newfoundland and the Bridal Veil Copper–Silver Project (the “Bridal Veil Project”) in central Newfoundland — consisting of a combined 446 claims totaling approximately 3,875 hectares. Together, these acquisitions mark Mustang's first move into eastern Canada and represent a strategic expansion of its exploration portfolio beyond Saskatchewan's Athabasca Basin.

Mayville Engineering's Surge Has Been Well Justified

seekingalpha.com

2025-11-23 05:50:39Mayville Engineering Company remains a strong buy, with shares up 14.3% since August, outperforming the S&P 500. Despite near-term challenges and a weaker 2025 outlook, MEC's revenue growth is driven by the Accu-Fab acquisition and expanding data center operations. MEC trades at single-digit multiples, significantly undervalued compared to peers, offering substantial upside potential even with stagnant growth.

Mayville Engineering Company, Inc. (MEC) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-05 15:31:13Mayville Engineering Company, Inc. ( MEC ) Q3 2025 Earnings Call November 5, 2025 10:00 AM EST Company Participants Jagadeesh Reddy - President, CEO & Director Rachele Lehr - Chief Financial Officer Conference Call Participants Stefan Neely Ross Sparenblek - William Blair & Company L.L.C., Research Division Greg Palm - Craig-Hallum Capital Group LLC, Research Division Michael Shlisky - D.A.

Mayville Engineering (MEC) Tops Q3 Earnings and Revenue Estimates

zacks.com

2025-11-04 20:06:04Mayville Engineering (MEC) came out with quarterly earnings of $0.1 per share, beating the Zacks Consensus Estimate of $0.05 per share. This compares to earnings of $0.14 per share a year ago.

Mayville Engineering Company Announces Third Quarter 2025 Results

businesswire.com

2025-11-04 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (the “Company” or “MEC”), a leading value-added provider of design, prototyping and manufacturing solutions serving diverse end markets, today announced results for the three-months ended September 30, 2025. THIRD QUARTER 2025 RESULTS (All comparisons versus the prior year period) Net sales of $144.3 million, or +6.6%; organic net sales decreased 9.1% GAAP Net loss of $2.7 million, or ($0.13) per diluted share Non-GAAP Adjuste.

Mayville Engineering (MEC) to Release Earnings on Tuesday

defenseworld.net

2025-11-02 03:30:18Mayville Engineering (NYSE: MEC - Get Free Report) is expected to release its Q3 2025 results after the market closes on Tuesday, November 4th. Analysts expect the company to announce earnings of $0.05 per share and revenue of $141.3620 million for the quarter. Parties are encouraged to explore the company's upcoming Q3 2025 earningoverview page for

Mayville Engineering Company Announces Third Quarter 2025 Results Conference Call and Webcast Date

businesswire.com

2025-10-22 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (the “Company” or “MEC”), a leading value-added provider of design, prototyping and manufacturing solutions serving diverse end-markets, today announced that it will issue third quarter 2025 results after the market closes on Tuesday, November 4, 2025. A conference call will be held the following day, Wednesday, November 5, 2025, at 10:00 a.m. ET to review the Company's financial results, discuss recent events and conduct a qu.

Aptera Motors Transitions to Public Benefit Corporation, Adds Industry Veterans to Board

globenewswire.com

2025-10-22 08:00:00CARLSBAD, Calif., Oct. 22, 2025 (GLOBE NEWSWIRE) -- Aptera Motors Corp. (NASDAQ: SEV), a solar mobility company pioneering ultra-efficient transportation, today announced its formal transition to a Public Benefit Corporation (PBC) under Delaware law.

Mayville Engineering Company: A Strong Prospect Even In Light Of Recent Pain

seekingalpha.com

2025-08-12 10:35:44Despite recent revenue and profit declines, Mayville Engineering remains deeply undervalued compared to peers, supporting my continued "Strong Buy" rating. Management's major acquisition of Accu-Fab brings high-margin EBITDA, offsetting some of the legacy business's current weakness and boosting long-term prospects. Short-term headwinds include soft end-market demand, high interest rates, and geopolitical factors, but these are likely to reverse by mid-next year.

Mayville Engineering Company, Inc. (MEC) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-07 01:10:36Mayville Engineering Company, Inc. (NYSE:MEC ) Q2 2025 Earnings Conference Call August 6, 2025 10:00 AM ET Company Participants Jagadeesh A. Reddy - President, CEO & Director Rachele Marie Lehr - Chief Financial Officer Conference Call Participants Edward Randolph Jackson - Northland Capital Markets, Research Division Michael Shlisky - D.A.

Mayville Engineering (MEC) Earnings Transcript

fool.com

2025-08-06 11:09:11Image source: The Motley Fool.

Mayville Engineering (MEC) Q2 Earnings Meet Estimates

zacks.com

2025-08-05 20:16:00Mayville Engineering (MEC) came out with quarterly earnings of $0.1 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.18 per share a year ago.

Mayville Engineering Company Announces Second Quarter 2025 Results

businesswire.com

2025-08-05 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (the “Company” or “MEC”), a leading value-added provider of design, prototyping and manufacturing solutions serving diverse end markets, today announced results for the three-months ended June 30, 2025. SECOND QUARTER 2025 RESULTS Net sales of $132.3 million GAAP Net loss of $1.1 million, or ($0.05) per diluted share Non-GAAP Adjusted Net Income of $2.1 million, or Adjusted Diluted EPS of $0.10 Adjusted EBITDA of $13.7 million.

Mayville Engineering Company Elects Tania Wingfield to Board of Directors

businesswire.com

2025-07-24 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (“MEC” or the “Company”), a leading U.S.-based provider of design, prototyping, and manufacturing solutions across diverse end markets, today announced the election of Tania Wingfield to its Board of Directors, effective immediately. Ms. Wingfield will serve on the Compensation Committee. The election brings the total number directors on MEC's board to seven. Ms. Wingfield currently serves as Executive Vice President and Chief.

No data to display

Mayville Engineering (NYSE:MEC) & Skyline Builders Group (NASDAQ:SKBL) Head-To-Head Survey

defenseworld.net

2025-12-08 01:28:47Skyline Builders Group (NASDAQ: SKBL - Get Free Report) and Mayville Engineering (NYSE: MEC - Get Free Report) are both small-cap construction companies, but which is the superior stock? We will contrast the two companies based on the strength of their risk, dividends, profitability, valuation, analyst recommendations, institutional ownership and earnings. Profitability This table compares Skyline Builders

Mustang Energy Corp. Stakes Two New Mineral Properties in Newfoundland: Onyx Uranium Project and Bridal Veil Copper–Silver Project

globenewswire.com

2025-12-03 18:49:00VANCOUVER, British Columbia, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Mustang Energy Corp. (CSE: MEC, OTC: MECPF, FRA: 92T) (the “Company” or “Mustang”) is pleased to announce that it has staked two new mineral exploration properties in Newfoundland and Labrador — the Onyx Uranium Project (the “Onyx Project”) in southern Newfoundland and the Bridal Veil Copper–Silver Project (the “Bridal Veil Project”) in central Newfoundland — consisting of a combined 446 claims totaling approximately 3,875 hectares. Together, these acquisitions mark Mustang's first move into eastern Canada and represent a strategic expansion of its exploration portfolio beyond Saskatchewan's Athabasca Basin.

Mayville Engineering's Surge Has Been Well Justified

seekingalpha.com

2025-11-23 05:50:39Mayville Engineering Company remains a strong buy, with shares up 14.3% since August, outperforming the S&P 500. Despite near-term challenges and a weaker 2025 outlook, MEC's revenue growth is driven by the Accu-Fab acquisition and expanding data center operations. MEC trades at single-digit multiples, significantly undervalued compared to peers, offering substantial upside potential even with stagnant growth.

Mayville Engineering Company, Inc. (MEC) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-05 15:31:13Mayville Engineering Company, Inc. ( MEC ) Q3 2025 Earnings Call November 5, 2025 10:00 AM EST Company Participants Jagadeesh Reddy - President, CEO & Director Rachele Lehr - Chief Financial Officer Conference Call Participants Stefan Neely Ross Sparenblek - William Blair & Company L.L.C., Research Division Greg Palm - Craig-Hallum Capital Group LLC, Research Division Michael Shlisky - D.A.

Mayville Engineering (MEC) Tops Q3 Earnings and Revenue Estimates

zacks.com

2025-11-04 20:06:04Mayville Engineering (MEC) came out with quarterly earnings of $0.1 per share, beating the Zacks Consensus Estimate of $0.05 per share. This compares to earnings of $0.14 per share a year ago.

Mayville Engineering Company Announces Third Quarter 2025 Results

businesswire.com

2025-11-04 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (the “Company” or “MEC”), a leading value-added provider of design, prototyping and manufacturing solutions serving diverse end markets, today announced results for the three-months ended September 30, 2025. THIRD QUARTER 2025 RESULTS (All comparisons versus the prior year period) Net sales of $144.3 million, or +6.6%; organic net sales decreased 9.1% GAAP Net loss of $2.7 million, or ($0.13) per diluted share Non-GAAP Adjuste.

Mayville Engineering (MEC) to Release Earnings on Tuesday

defenseworld.net

2025-11-02 03:30:18Mayville Engineering (NYSE: MEC - Get Free Report) is expected to release its Q3 2025 results after the market closes on Tuesday, November 4th. Analysts expect the company to announce earnings of $0.05 per share and revenue of $141.3620 million for the quarter. Parties are encouraged to explore the company's upcoming Q3 2025 earningoverview page for

Mayville Engineering Company Announces Third Quarter 2025 Results Conference Call and Webcast Date

businesswire.com

2025-10-22 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (the “Company” or “MEC”), a leading value-added provider of design, prototyping and manufacturing solutions serving diverse end-markets, today announced that it will issue third quarter 2025 results after the market closes on Tuesday, November 4, 2025. A conference call will be held the following day, Wednesday, November 5, 2025, at 10:00 a.m. ET to review the Company's financial results, discuss recent events and conduct a qu.

Aptera Motors Transitions to Public Benefit Corporation, Adds Industry Veterans to Board

globenewswire.com

2025-10-22 08:00:00CARLSBAD, Calif., Oct. 22, 2025 (GLOBE NEWSWIRE) -- Aptera Motors Corp. (NASDAQ: SEV), a solar mobility company pioneering ultra-efficient transportation, today announced its formal transition to a Public Benefit Corporation (PBC) under Delaware law.

Mayville Engineering Company: A Strong Prospect Even In Light Of Recent Pain

seekingalpha.com

2025-08-12 10:35:44Despite recent revenue and profit declines, Mayville Engineering remains deeply undervalued compared to peers, supporting my continued "Strong Buy" rating. Management's major acquisition of Accu-Fab brings high-margin EBITDA, offsetting some of the legacy business's current weakness and boosting long-term prospects. Short-term headwinds include soft end-market demand, high interest rates, and geopolitical factors, but these are likely to reverse by mid-next year.

Mayville Engineering Company, Inc. (MEC) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-07 01:10:36Mayville Engineering Company, Inc. (NYSE:MEC ) Q2 2025 Earnings Conference Call August 6, 2025 10:00 AM ET Company Participants Jagadeesh A. Reddy - President, CEO & Director Rachele Marie Lehr - Chief Financial Officer Conference Call Participants Edward Randolph Jackson - Northland Capital Markets, Research Division Michael Shlisky - D.A.

Mayville Engineering (MEC) Earnings Transcript

fool.com

2025-08-06 11:09:11Image source: The Motley Fool.

Mayville Engineering (MEC) Q2 Earnings Meet Estimates

zacks.com

2025-08-05 20:16:00Mayville Engineering (MEC) came out with quarterly earnings of $0.1 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.18 per share a year ago.

Mayville Engineering Company Announces Second Quarter 2025 Results

businesswire.com

2025-08-05 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (the “Company” or “MEC”), a leading value-added provider of design, prototyping and manufacturing solutions serving diverse end markets, today announced results for the three-months ended June 30, 2025. SECOND QUARTER 2025 RESULTS Net sales of $132.3 million GAAP Net loss of $1.1 million, or ($0.05) per diluted share Non-GAAP Adjusted Net Income of $2.1 million, or Adjusted Diluted EPS of $0.10 Adjusted EBITDA of $13.7 million.

Mayville Engineering Company Elects Tania Wingfield to Board of Directors

businesswire.com

2025-07-24 16:15:00MILWAUKEE--(BUSINESS WIRE)--Mayville Engineering Company (NYSE: MEC) (“MEC” or the “Company”), a leading U.S.-based provider of design, prototyping, and manufacturing solutions across diverse end markets, today announced the election of Tania Wingfield to its Board of Directors, effective immediately. Ms. Wingfield will serve on the Compensation Committee. The election brings the total number directors on MEC's board to seven. Ms. Wingfield currently serves as Executive Vice President and Chief.