MBIA Inc. (MBI)

Price:

7.55 USD

( - -0.12 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Ambac Financial Group, Inc.

VALUE SCORE:

5

2nd position

Fidelity National Financial, Inc.

VALUE SCORE:

11

The best

Hippo Holdings Inc.

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

MBIA Inc. provides financial guarantee insurance services to public finance markets. It operates through United States (U.S.) Public Finance Insurance, and International and Structured Finance Insurance segments. The company issues financial guarantees for municipal bonds, including tax-exempt and taxable indebtedness of the U.S. political subdivisions and territories, as well as utilities, airports, health care institutions, higher educational facilities, student loan issuers, housing authorities, and other similar agencies and obligations issued by private entities. It also insures the non-U.S. public finance and global structured finance, including asset-backed obligations; and sovereign-related and sub-sovereign bonds, utilities, and privately issued bonds used for the financing of projects that include toll roads, bridges, airports, public transportation facilities, and other types of infrastructure projects, as well as offers third-party reinsurance services. MBIA Inc. was founded in 1973 and is headquartered in Purchase, New York.

NEWS

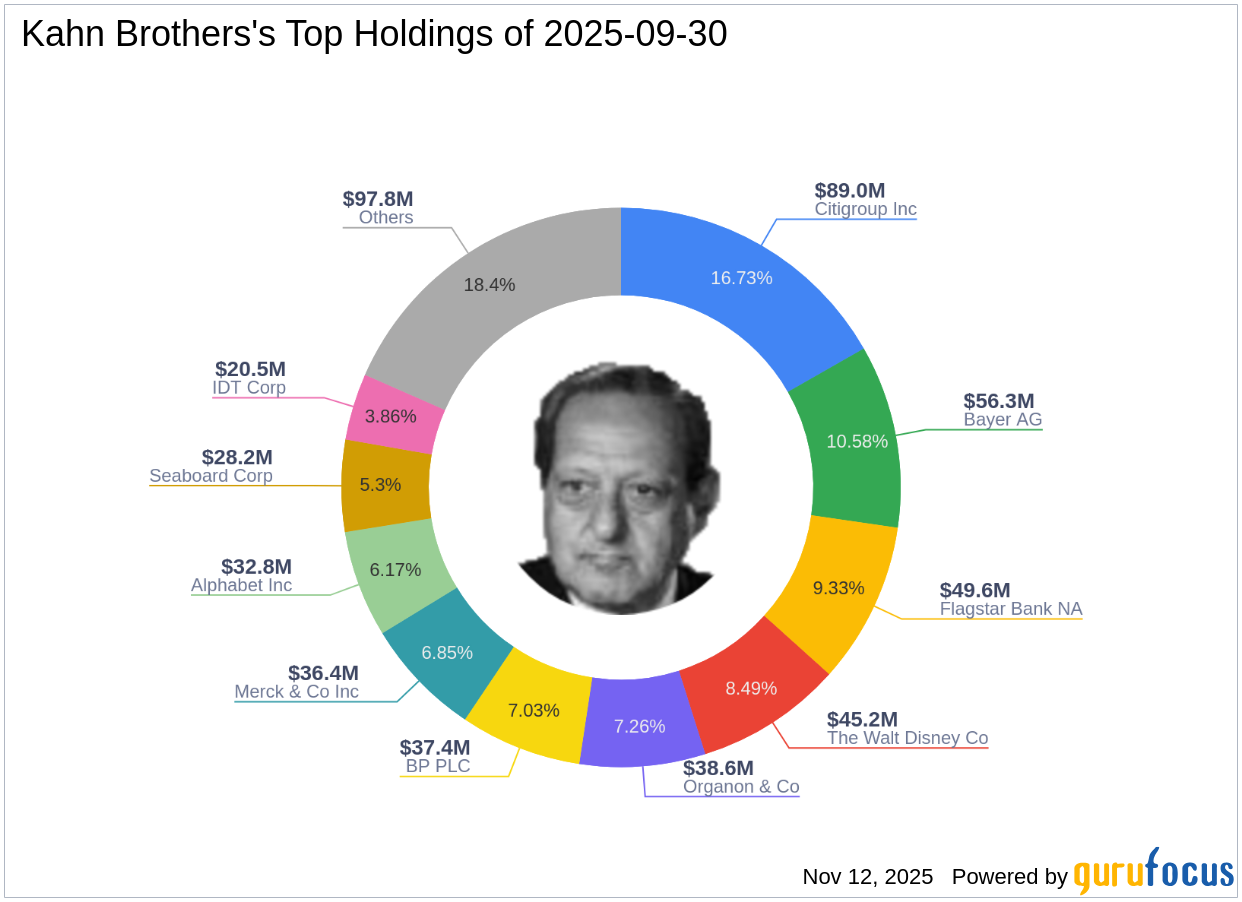

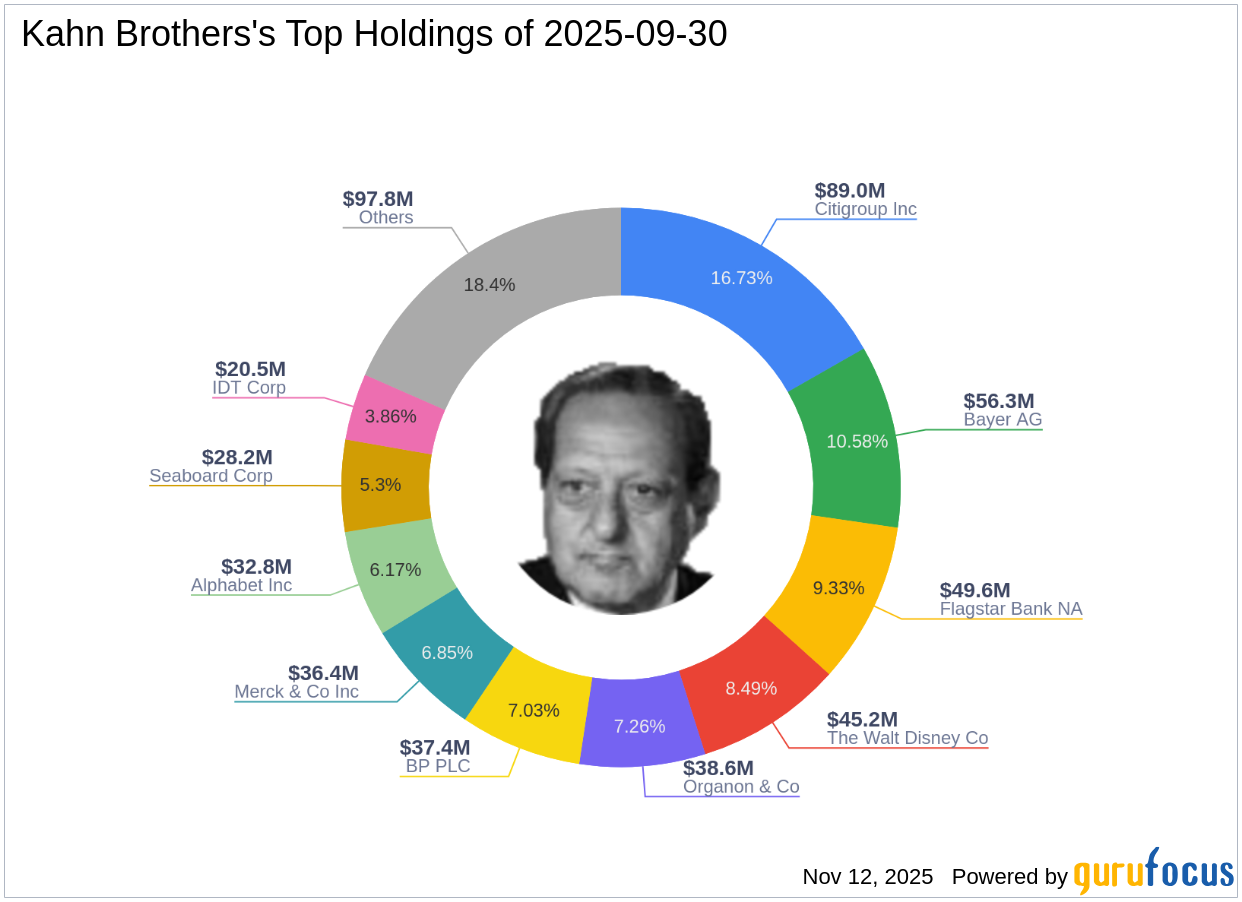

Kahn Brothers' Strategic Moves: GSK PLC Sees a -3.08% Impact

gurufocus.com

2025-11-12 12:00:00Exploring Kahn Brothers (Trades, Portfolio)' Recent 13F Filing and Investment Strategies Kahn Brothers (Trades, Portfolio) recently submitted their 13F filing

MBIA Inc. (MBI) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-05 11:01:10MBIA Inc. ( MBI ) Q3 2025 Earnings Call November 5, 2025 8:00 AM EST Company Participants Greg Diamond - MD and Head of Investor & Media Relations William Fallon - CEO & Director Joseph Schachinger - Executive VP, CFO & Treasurer Conference Call Participants Carlos Pardo Patrick Stadelhofer John Staley - Staley Capital Advisers, Inc. Presentation Operator Welcome to the MBIA Inc. Third Quarter 2025 Financial Results Conference Call. I would now like to turn the call over to Greg Diamond, Managing Director of Investor and Media Relations at MBIA.

MBIA (MBI) Reports Q3 Loss, Lags Revenue Estimates

zacks.com

2025-11-04 19:56:06MBIA (MBI) came out with a quarterly loss of $0.15 per share versus the Zacks Consensus Estimate of a loss of $0.03. This compares to break-even earnings per share a year ago.

MBIA Inc. Reports Third Quarter 2025 Financial Results

businesswire.com

2025-11-04 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) today posted its third quarter 2025 financial results on its website at https://investor.mbia.com/investor-relations/financial-information/default.aspx. The financial results will also be furnished to the Securities and Exchange Commission (SEC) on a Current Report on Form 8-K available at sec.gov. As previously announced, the Company will host a webcast and conference call for investors on Wednesday, November 5 at 8:00 a.m. (ET) to discuss.

MBIA Inc. Investor Conference Call to Discuss Third Quarter 2025 Financial Results Scheduled for Wednesday, November 5 at 8:00 A.M. Eastern Time

businesswire.com

2025-10-29 13:21:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) will host a webcast and conference call for investors on Wednesday, November 5 at 8:00 a.m. (ET) to discuss its third quarter 2025 financial results and other issues related to the Company. The dial-in number for the call is 800-445-7795 in the U.S. and 785-424-1699 from outside the U.S. The conference call code is MBIAQ325. A live webcast of the conference call will also be accessible on www.mbia.com. The conference call will consist of bri.

MBIA Inc. (MBI) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-07 15:01:45MBIA Inc. (NYSE:MBI ) Q2 2025 Earnings Conference Call August 7, 2025 8:00 AM ET Company Participants Gregory R. Diamond - MD and Head of Investor & Media Relations Joseph Ralph Schachinger - Executive VP, CFO & Treasurer William Charles Fallon - CEO & Director Conference Call Participants John Adolphus Staley - Staley Capital Advisers, Inc. Paul Saunders - Hutch Capital Management LLC Thomas Patrick McJoynt-Griffith - Keefe, Bruyette, & Woods, Inc., Research Division Operator Welcome to the MBIA Inc. Second Quarter 2025 Financial Results Conference Call.

MBIA Inc. Reports Second Quarter 2025 Financial Results

businesswire.com

2025-08-06 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) today posted its second quarter 2025 financial results on its website at https://investor.mbia.com/investor-relations/financial-information/default.aspx. The financial results will also be furnished to the Securities and Exchange Commission (SEC) on a Current Report on Form 8-K available at sec.gov. As previously announced, the Company will host a webcast and conference call for investors on Thursday, August 7 at 8:00 a.m. (ET) to discuss it.

MBIA Inc. Investor Conference Call to Discuss Second Quarter 2025 Financial Results Scheduled for Thursday, August 7 at 8:00 A.M. Eastern Time

businesswire.com

2025-07-31 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) will host a webcast and conference call for investors on Thursday, August 7 at 8:00 a.m. (ET) to discuss its second quarter 2025 financial results and other issues related to the Company. The dial-in number for the call is 800-343-5172 in the U.S. and 203-518-9856 from outside the U.S. The conference call code is MBIAQ225. A live webcast of the conference call will also be accessible on www.mbia.com. The conference call will consist of brief.

Cable One: Cashcow And Takeover Candidate

seekingalpha.com

2025-05-11 08:42:07Cable One's stock has plummeted over 90% due to competition and the costly Mega Broadband Investments (MBI) acquisition, but financing is secure. Subscriber losses and lower revenue per customer have hurt Cabo, but new lower-priced offerings may stabilize the situation. The MBI acquisition is expensive, but Cabo can finance it through retained earnings and has sufficient credit to manage debt.

MBIA Inc. (MBI) Q1 2025 Earnings Call Transcript

seekingalpha.com

2025-05-09 11:35:55MBIA Inc. (NYSE:MBI ) Q1 2025 Earnings Conference Call May 9, 2025 8:00 AM ET Company Participants Greg Diamond - Managing Director, Investor & Media Relations Bill Fallon - Chief Executive Officer Joe Schachinger - Executive Vice President & Chief Financial Officer Conference Call Participants John Staley - Staley Capital Advisers Operator [Abrupt start] MBIA Inc. First Quarter 2025 Financial Results Conference Call. I would now like to turn the call over to Greg Diamond, Managing Director of Investor and Media Relations at MBIA.

MBIA (MBI) Reports Q1 Loss, Tops Revenue Estimates

zacks.com

2025-05-08 19:35:33MBIA (MBI) came out with a quarterly loss of $0.16 per share versus the Zacks Consensus Estimate of a loss of $0.07. This compares to loss of $0.52 per share a year ago.

MBIA Inc. Reports First Quarter 2025 Financial Results

businesswire.com

2025-05-08 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) today posted its first quarter 2025 financial results on its website at https://investor.mbia.com/investor-relations/financial-information/default.aspx. The financial results will also be furnished to the Securities and Exchange Commission (SEC) on a Current Report on Form 8-K available at sec.gov. As previously announced, the Company will host a webcast and conference call for investors on Friday, May 9 at 8:00 a.m. (ET) to discuss its fina.

MBIA Inc. Investor Conference Call to Discuss First Quarter 2025 Financial Results Scheduled for Friday, May 9 at 8:00 A.M. Eastern Time

businesswire.com

2025-05-06 14:00:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) will host a webcast and conference call for investors on Friday, May 9 at 8:00 a.m. (ET) to discuss its first quarter 2025 financial results and other issues related to the Company. The dial-in number for the call is 800-267-6316 in the U.S. and 203-518-9783 from outside the U.S. The conference call code is MBIAQ125. A live webcast of the conference call will also be accessible on www.mbia.com. The conference call will consist of brief comme.

Down -29.5% in 4 Weeks, Here's Why You Should You Buy the Dip in MBIA (MBI)

zacks.com

2025-03-27 10:35:26MBIA (MBI) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

MBIA Inc. (MBI) Q4 2024 Earnings Call Transcript

seekingalpha.com

2025-02-28 17:01:54MBIA Inc. (NYSE:MBI ) Q4 2024 Earnings Conference Call February 28, 2025 8:00 AM ET Company Participants Greg Diamond - MD, Investor and Media Relations Bill Fallon - CEO Joe Schachinger - EVP and CFO Conference Call Participants Tommy McJoynt - KBW Paul Saunders - Hutch Capital Operator Welcome to the MBIA Inc. Fourth Quarter and Full Year 2024 Financial Results Conference Call. I would now like to turn the call over to Greg Diamond, Managing Director of Investor and Media Relations at MBIA.

MBIA (MBI) Reports Q4 Loss, Tops Revenue Estimates

zacks.com

2025-02-27 19:25:36MBIA (MBI) came out with a quarterly loss of $0.48 per share versus the Zacks Consensus Estimate of a loss of $0.11. This compares to loss of $0.16 per share a year ago.

Kahn Brothers' Strategic Moves: GSK PLC Sees a -3.08% Impact

gurufocus.com

2025-11-12 12:00:00Exploring Kahn Brothers (Trades, Portfolio)' Recent 13F Filing and Investment Strategies Kahn Brothers (Trades, Portfolio) recently submitted their 13F filing

MBIA Inc. (MBI) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-05 11:01:10MBIA Inc. ( MBI ) Q3 2025 Earnings Call November 5, 2025 8:00 AM EST Company Participants Greg Diamond - MD and Head of Investor & Media Relations William Fallon - CEO & Director Joseph Schachinger - Executive VP, CFO & Treasurer Conference Call Participants Carlos Pardo Patrick Stadelhofer John Staley - Staley Capital Advisers, Inc. Presentation Operator Welcome to the MBIA Inc. Third Quarter 2025 Financial Results Conference Call. I would now like to turn the call over to Greg Diamond, Managing Director of Investor and Media Relations at MBIA.

MBIA (MBI) Reports Q3 Loss, Lags Revenue Estimates

zacks.com

2025-11-04 19:56:06MBIA (MBI) came out with a quarterly loss of $0.15 per share versus the Zacks Consensus Estimate of a loss of $0.03. This compares to break-even earnings per share a year ago.

MBIA Inc. Reports Third Quarter 2025 Financial Results

businesswire.com

2025-11-04 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) today posted its third quarter 2025 financial results on its website at https://investor.mbia.com/investor-relations/financial-information/default.aspx. The financial results will also be furnished to the Securities and Exchange Commission (SEC) on a Current Report on Form 8-K available at sec.gov. As previously announced, the Company will host a webcast and conference call for investors on Wednesday, November 5 at 8:00 a.m. (ET) to discuss.

MBIA Inc. Investor Conference Call to Discuss Third Quarter 2025 Financial Results Scheduled for Wednesday, November 5 at 8:00 A.M. Eastern Time

businesswire.com

2025-10-29 13:21:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) will host a webcast and conference call for investors on Wednesday, November 5 at 8:00 a.m. (ET) to discuss its third quarter 2025 financial results and other issues related to the Company. The dial-in number for the call is 800-445-7795 in the U.S. and 785-424-1699 from outside the U.S. The conference call code is MBIAQ325. A live webcast of the conference call will also be accessible on www.mbia.com. The conference call will consist of bri.

MBIA Inc. (MBI) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-07 15:01:45MBIA Inc. (NYSE:MBI ) Q2 2025 Earnings Conference Call August 7, 2025 8:00 AM ET Company Participants Gregory R. Diamond - MD and Head of Investor & Media Relations Joseph Ralph Schachinger - Executive VP, CFO & Treasurer William Charles Fallon - CEO & Director Conference Call Participants John Adolphus Staley - Staley Capital Advisers, Inc. Paul Saunders - Hutch Capital Management LLC Thomas Patrick McJoynt-Griffith - Keefe, Bruyette, & Woods, Inc., Research Division Operator Welcome to the MBIA Inc. Second Quarter 2025 Financial Results Conference Call.

MBIA Inc. Reports Second Quarter 2025 Financial Results

businesswire.com

2025-08-06 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) today posted its second quarter 2025 financial results on its website at https://investor.mbia.com/investor-relations/financial-information/default.aspx. The financial results will also be furnished to the Securities and Exchange Commission (SEC) on a Current Report on Form 8-K available at sec.gov. As previously announced, the Company will host a webcast and conference call for investors on Thursday, August 7 at 8:00 a.m. (ET) to discuss it.

MBIA Inc. Investor Conference Call to Discuss Second Quarter 2025 Financial Results Scheduled for Thursday, August 7 at 8:00 A.M. Eastern Time

businesswire.com

2025-07-31 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) will host a webcast and conference call for investors on Thursday, August 7 at 8:00 a.m. (ET) to discuss its second quarter 2025 financial results and other issues related to the Company. The dial-in number for the call is 800-343-5172 in the U.S. and 203-518-9856 from outside the U.S. The conference call code is MBIAQ225. A live webcast of the conference call will also be accessible on www.mbia.com. The conference call will consist of brief.

Cable One: Cashcow And Takeover Candidate

seekingalpha.com

2025-05-11 08:42:07Cable One's stock has plummeted over 90% due to competition and the costly Mega Broadband Investments (MBI) acquisition, but financing is secure. Subscriber losses and lower revenue per customer have hurt Cabo, but new lower-priced offerings may stabilize the situation. The MBI acquisition is expensive, but Cabo can finance it through retained earnings and has sufficient credit to manage debt.

MBIA Inc. (MBI) Q1 2025 Earnings Call Transcript

seekingalpha.com

2025-05-09 11:35:55MBIA Inc. (NYSE:MBI ) Q1 2025 Earnings Conference Call May 9, 2025 8:00 AM ET Company Participants Greg Diamond - Managing Director, Investor & Media Relations Bill Fallon - Chief Executive Officer Joe Schachinger - Executive Vice President & Chief Financial Officer Conference Call Participants John Staley - Staley Capital Advisers Operator [Abrupt start] MBIA Inc. First Quarter 2025 Financial Results Conference Call. I would now like to turn the call over to Greg Diamond, Managing Director of Investor and Media Relations at MBIA.

MBIA (MBI) Reports Q1 Loss, Tops Revenue Estimates

zacks.com

2025-05-08 19:35:33MBIA (MBI) came out with a quarterly loss of $0.16 per share versus the Zacks Consensus Estimate of a loss of $0.07. This compares to loss of $0.52 per share a year ago.

MBIA Inc. Reports First Quarter 2025 Financial Results

businesswire.com

2025-05-08 16:15:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) today posted its first quarter 2025 financial results on its website at https://investor.mbia.com/investor-relations/financial-information/default.aspx. The financial results will also be furnished to the Securities and Exchange Commission (SEC) on a Current Report on Form 8-K available at sec.gov. As previously announced, the Company will host a webcast and conference call for investors on Friday, May 9 at 8:00 a.m. (ET) to discuss its fina.

MBIA Inc. Investor Conference Call to Discuss First Quarter 2025 Financial Results Scheduled for Friday, May 9 at 8:00 A.M. Eastern Time

businesswire.com

2025-05-06 14:00:00PURCHASE, N.Y.--(BUSINESS WIRE)--MBIA Inc. (NYSE:MBI) will host a webcast and conference call for investors on Friday, May 9 at 8:00 a.m. (ET) to discuss its first quarter 2025 financial results and other issues related to the Company. The dial-in number for the call is 800-267-6316 in the U.S. and 203-518-9783 from outside the U.S. The conference call code is MBIAQ125. A live webcast of the conference call will also be accessible on www.mbia.com. The conference call will consist of brief comme.

Down -29.5% in 4 Weeks, Here's Why You Should You Buy the Dip in MBIA (MBI)

zacks.com

2025-03-27 10:35:26MBIA (MBI) is technically in oversold territory now, so the heavy selling pressure might have exhausted. This along with strong agreement among Wall Street analysts in raising earnings estimates could lead to a trend reversal for the stock.

MBIA Inc. (MBI) Q4 2024 Earnings Call Transcript

seekingalpha.com

2025-02-28 17:01:54MBIA Inc. (NYSE:MBI ) Q4 2024 Earnings Conference Call February 28, 2025 8:00 AM ET Company Participants Greg Diamond - MD, Investor and Media Relations Bill Fallon - CEO Joe Schachinger - EVP and CFO Conference Call Participants Tommy McJoynt - KBW Paul Saunders - Hutch Capital Operator Welcome to the MBIA Inc. Fourth Quarter and Full Year 2024 Financial Results Conference Call. I would now like to turn the call over to Greg Diamond, Managing Director of Investor and Media Relations at MBIA.

MBIA (MBI) Reports Q4 Loss, Tops Revenue Estimates

zacks.com

2025-02-27 19:25:36MBIA (MBI) came out with a quarterly loss of $0.48 per share versus the Zacks Consensus Estimate of a loss of $0.11. This compares to loss of $0.16 per share a year ago.