Landmark Infrastructure Partners LP (LMRKP)

Price:

25.47 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

FLJ Group Limited

VALUE SCORE:

0

2nd position

CoStar Group, Inc.

VALUE SCORE:

8

The best

Wetouch Technology Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

NEWS

Landmark Infrastructure Partners' (LMRK) CEO Tim Brazy on Q3 2021 Results - Earnings Call Transcript

seekingalpha.com

2021-11-05 13:15:02Landmark Infrastructure Partners' (LMRK) CEO Tim Brazy on Q3 2021 Results - Earnings Call Transcript

Landmark Infrastructure: The Higher Offer Is Melody To Our Ears

seekingalpha.com

2021-08-05 07:00:00Landmark Infrastructure: The Higher Offer Is Melody To Our Ears

Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q2 2021 Results - Earnings Call Transcript

seekingalpha.com

2021-08-04 14:14:04Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q2 2021 Results - Earnings Call Transcript

Landmark: A Higher Bid Is Very Probable From Colony

seekingalpha.com

2021-05-19 06:00:00Landmark Infrastructure Partners LP is a stock where we recently have taken a bullish bias.

Strength Seen in Landmark Infrastructure (LMRK): Can Its 7.4% Jump Turn into More Strength?

zacks.com

2021-05-18 10:31:14Landmark Infrastructure (LMRK) witnessed a jump in share price last session on above-average trading volume.

For A Triple-Net Lease REIT, Landmark Isn't The Worst Inflation Hedge

seekingalpha.com

2021-03-06 09:34:03The Fed announcement yesterday has made something very clear: easing is our mandate. Inflation might be under control in consumer prices, where it's already impacted asset prices with retail money pouring in, but if it's not it could kill a portfolio.

Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q4 2020 Results - Earnings Call Transcript

seekingalpha.com

2021-02-24 16:09:10Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q4 2020 Results - Earnings Call Transcript

2 Must-Own Preferreds For Retirees From Monmouth And Landmark Infrastructure

seekingalpha.com

2021-01-22 10:32:47Reliable and attractive retirement income has never been harder to find. MNR.PC offers a safe 6.1% yield.

Landmark: Warming Up To Opportunities Here

seekingalpha.com

2021-01-19 04:48:03Landmark Infrastructure Partners LP. has a high quality asset base. We like the company's exposure to cell towers and billboards, but have had a gripe with the payout in the past.

Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q3 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-11-04 15:38:04Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q3 2020 Results - Earnings Call Transcript

Oasis In The Desert Of Quality Yields: Landmark Preferred Shares Offer Consistent 8% Income From Cell Towers, Billboards And Renewable Power

seekingalpha.com

2020-11-04 14:14:09Landmark Infrastructure Partners' sound business model provides stable cash flows and growth potential, standing as an oasis in the yield desert. LMRKO and LMRKP, the preferred shares of Landmark Infrastructure Partners, offer a generous 8% yield at current preferred stock share prices at below $25 ($25 par).

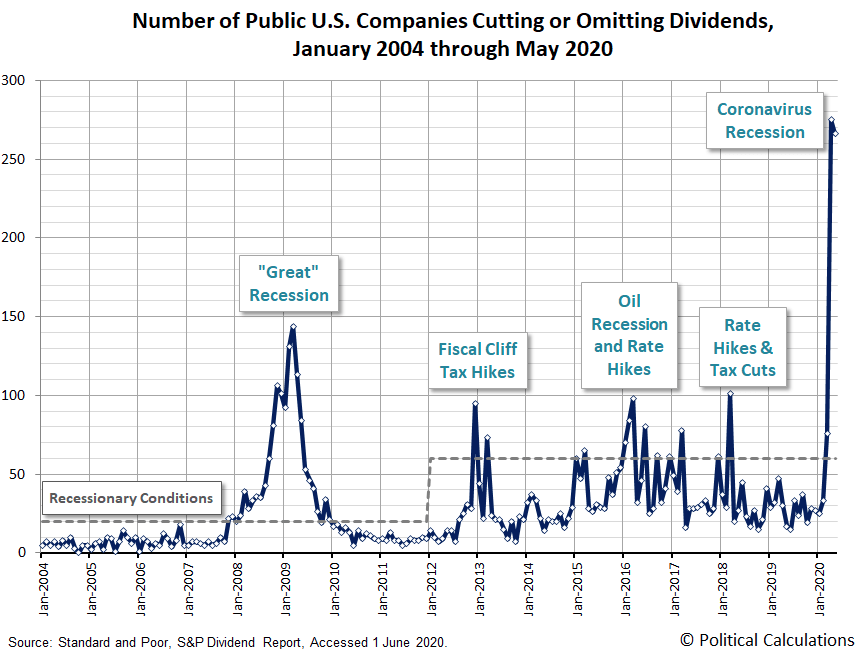

Understanding Landmark Infrastructure's Ex-Dividend Date

benzinga.com

2020-10-30 11:16:47Landmark Infrastructure (NASDAQ: LMRK) declared a dividend payable on November 13, 2020 to its shareholders as of October 23, 2020. It was also announced that shareholders of Landmark Infrastructure's stock as of November 3, 2020 are entitled to the dividend.

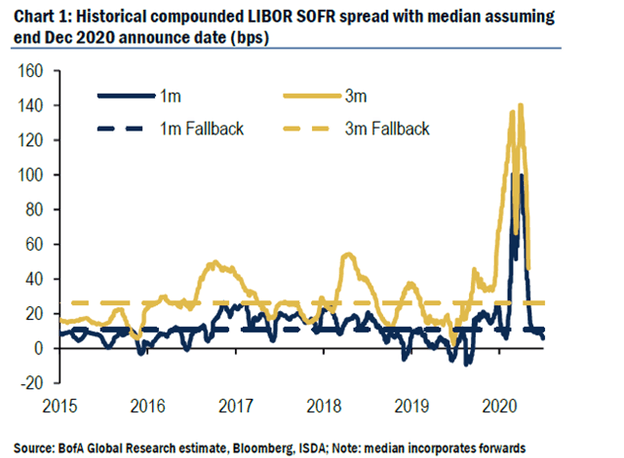

Transition From LIBOR: What You Need To Know

seekingalpha.com

2020-09-08 08:35:00LIBOR's five-decade run is coming to an end. In the US, it will be replaced by SOFR.

Landmark: 8% Yields With 3 Times Coverage

seekingalpha.com

2020-08-28 09:45:00Landmark reported excellent Q2 2020 results. The company is showing a healthy cash flow retention.

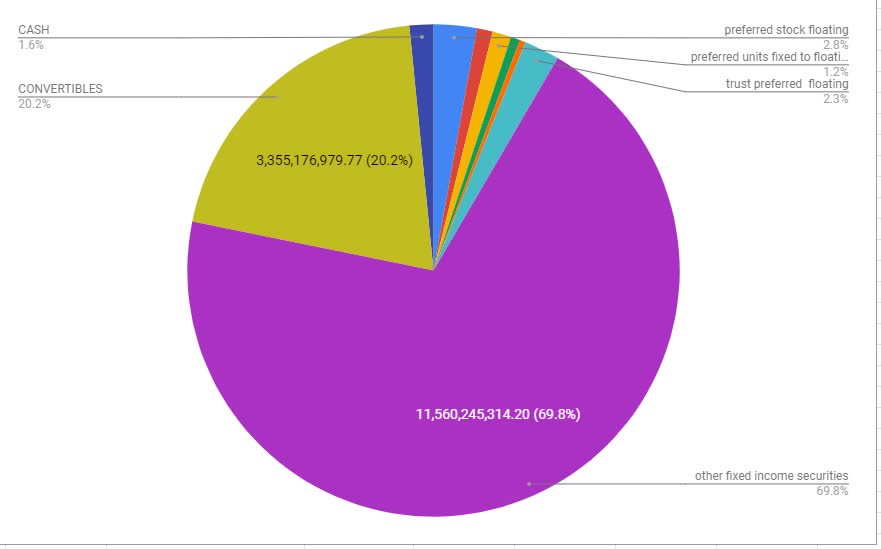

Not So Common Fixed Income Preview

seekingalpha.com

2020-08-26 13:48:50A review of all floating-rate preferred stocks, third-party trust preferred securities, trust preferred stocks, and preferred units.

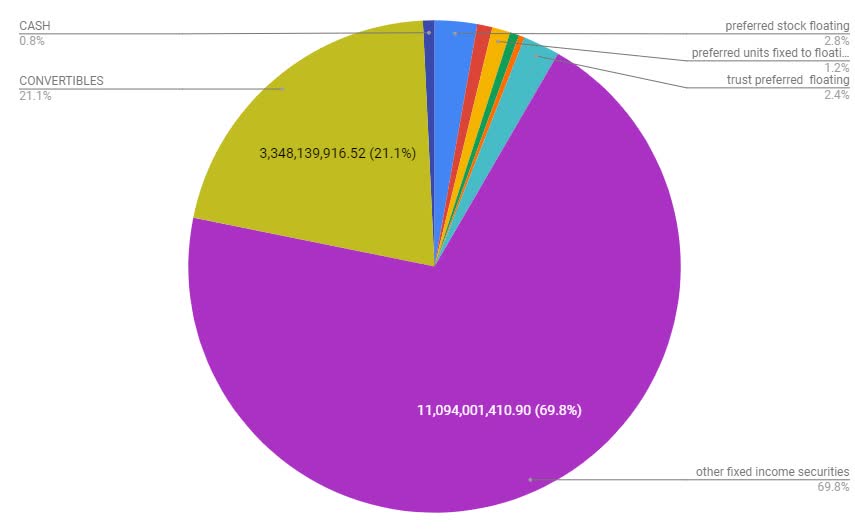

Not So Common Fixed Income Preview

seekingalpha.com

2020-07-29 11:04:53A review of all floating-rate preferred stocks, third-party trust preferred securities, trust preferred stocks, and preferred units.

Landmark Infrastructure Partners' (LMRK) CEO Tim Brazy on Q3 2021 Results - Earnings Call Transcript

seekingalpha.com

2021-11-05 13:15:02Landmark Infrastructure Partners' (LMRK) CEO Tim Brazy on Q3 2021 Results - Earnings Call Transcript

Landmark Infrastructure: The Higher Offer Is Melody To Our Ears

seekingalpha.com

2021-08-05 07:00:00Landmark Infrastructure: The Higher Offer Is Melody To Our Ears

Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q2 2021 Results - Earnings Call Transcript

seekingalpha.com

2021-08-04 14:14:04Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q2 2021 Results - Earnings Call Transcript

Landmark: A Higher Bid Is Very Probable From Colony

seekingalpha.com

2021-05-19 06:00:00Landmark Infrastructure Partners LP is a stock where we recently have taken a bullish bias.

Strength Seen in Landmark Infrastructure (LMRK): Can Its 7.4% Jump Turn into More Strength?

zacks.com

2021-05-18 10:31:14Landmark Infrastructure (LMRK) witnessed a jump in share price last session on above-average trading volume.

For A Triple-Net Lease REIT, Landmark Isn't The Worst Inflation Hedge

seekingalpha.com

2021-03-06 09:34:03The Fed announcement yesterday has made something very clear: easing is our mandate. Inflation might be under control in consumer prices, where it's already impacted asset prices with retail money pouring in, but if it's not it could kill a portfolio.

Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q4 2020 Results - Earnings Call Transcript

seekingalpha.com

2021-02-24 16:09:10Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q4 2020 Results - Earnings Call Transcript

2 Must-Own Preferreds For Retirees From Monmouth And Landmark Infrastructure

seekingalpha.com

2021-01-22 10:32:47Reliable and attractive retirement income has never been harder to find. MNR.PC offers a safe 6.1% yield.

Landmark: Warming Up To Opportunities Here

seekingalpha.com

2021-01-19 04:48:03Landmark Infrastructure Partners LP. has a high quality asset base. We like the company's exposure to cell towers and billboards, but have had a gripe with the payout in the past.

Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q3 2020 Results - Earnings Call Transcript

seekingalpha.com

2020-11-04 15:38:04Landmark Infrastructure Partners LP (LMRK) CEO Tim Brazy on Q3 2020 Results - Earnings Call Transcript

Oasis In The Desert Of Quality Yields: Landmark Preferred Shares Offer Consistent 8% Income From Cell Towers, Billboards And Renewable Power

seekingalpha.com

2020-11-04 14:14:09Landmark Infrastructure Partners' sound business model provides stable cash flows and growth potential, standing as an oasis in the yield desert. LMRKO and LMRKP, the preferred shares of Landmark Infrastructure Partners, offer a generous 8% yield at current preferred stock share prices at below $25 ($25 par).

Understanding Landmark Infrastructure's Ex-Dividend Date

benzinga.com

2020-10-30 11:16:47Landmark Infrastructure (NASDAQ: LMRK) declared a dividend payable on November 13, 2020 to its shareholders as of October 23, 2020. It was also announced that shareholders of Landmark Infrastructure's stock as of November 3, 2020 are entitled to the dividend.

Transition From LIBOR: What You Need To Know

seekingalpha.com

2020-09-08 08:35:00LIBOR's five-decade run is coming to an end. In the US, it will be replaced by SOFR.

Landmark: 8% Yields With 3 Times Coverage

seekingalpha.com

2020-08-28 09:45:00Landmark reported excellent Q2 2020 results. The company is showing a healthy cash flow retention.

Not So Common Fixed Income Preview

seekingalpha.com

2020-08-26 13:48:50A review of all floating-rate preferred stocks, third-party trust preferred securities, trust preferred stocks, and preferred units.

Not So Common Fixed Income Preview

seekingalpha.com

2020-07-29 11:04:53A review of all floating-rate preferred stocks, third-party trust preferred securities, trust preferred stocks, and preferred units.