Lennox International Inc. (LII)

Price:

613.47 USD

( + 13.41 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Carrier Global Corporation

VALUE SCORE:

8

2nd position

Simpson Manufacturing Co., Inc.

VALUE SCORE:

9

The best

Trane Technologies plc

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

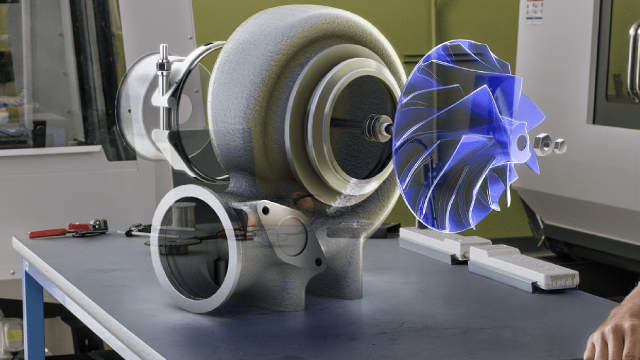

Lennox International Inc., together with its subsidiaries, designs, manufactures, and markets a range of products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally. It operates through three segments: Residential Heating & Cooling, Commercial Heating & Cooling, and Refrigeration. The Residential Heating & Cooling segment provides furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment and accessories, comfort control products, and replacement parts and supplies for residential replacement and new construction markets. The Commercial Heating & Cooling segment offers unitary heating and air conditioning equipment, applied systems, controls, installation and service of commercial heating and cooling equipment, and variable refrigerant flow commercial products for light commercial markets. The Refrigeration segment offers condensing units, unit coolers, fluid coolers, air cooled condensers, air handlers, and refrigeration rack systems for preserving food and other perishables in supermarkets, convenience stores, restaurants, warehouses, and distribution centers, as well as for data centers, machine tooling, and other cooling applications; and compressor racks and industrial process chillers. The company sells its products and services through direct sales, distributors, and company-owned parts and supplies stores. Lennox International Inc. was founded in 1895 and is headquartered in Richardson, Texas.

NEWS

Lennox Signs Agreement to Acquire HVAC Division of NSI Industries

prnewswire.com

2025-08-18 08:00:00Strategic acquisition expands parts and supplies portfolio for commercial and residential HVAC customers. DALLAS , Aug. 18, 2025 /PRNewswire/ -- Lennox (NYSE: LII), a leader in energy-efficient climate control solutions, announced today it has signed a definitive agreement to purchase the HVAC division of NSI Industries from Sentinel Capital Partners for approximately $550 million.

Here's Why Lennox (LII) Is a Great 'Buy the Bottom' Stock Now

zacks.com

2025-08-04 10:56:14Lennox (LII) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. This coupled with an upward trend in earnings estimate revisions could mean a trend reversal for the stock in the near term.

Lennox Posts 14 Percent EPS Jump in Q2

fool.com

2025-07-23 17:12:53Lennox International (LII 6.69%), a major manufacturer of HVAC (heating, ventilation, air conditioning, and refrigeration) systems, reported its results for the second quarter on July 23, 2025. The earnings release showed stronger-than-expected performance: earnings per share (Non-GAAP) reached $7.82, higher than the analyst consensus of $6.86, and GAAP revenue came in at $1.50 billion, ahead of the $1,471.07 million estimate.

Lennox International Inc. (LII) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-23 15:02:13Lennox International Inc. (NYSE:LII ) Q2 2025 Earnings Conference Call July 23, 2025 9:30 AM ET Company Participants Alok Maskara - CEO, President & Director Chelsey Pulcheon - Corporate Participant Michael P. Quenzer - Executive VP & CFO Conference Call Participants Brett Logan Linzey - Mizuho Securities USA LLC, Research Division Charles Stephen Tusa - JPMorgan Chase & Co, Research Division Christopher M.

Lennox Posts 14% EPS Jump in Q2

fool.com

2025-07-23 12:56:15Lennox Posts 14% EPS Jump in Q2

Lennox (LII) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

zacks.com

2025-07-23 10:30:52The headline numbers for Lennox (LII) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Lennox International (LII) Q2 Earnings and Revenues Beat Estimates

zacks.com

2025-07-23 08:56:08Lennox International (LII) came out with quarterly earnings of $7.82 per share, beating the Zacks Consensus Estimate of $6.9 per share. This compares to earnings of $6.83 per share a year ago.

Lennox Reports Second Quarter Results

prnewswire.com

2025-07-23 06:45:00Q2 Highlights (All comparisons are year-over-year, unless otherwise noted) Revenue $1.5 billion, up 3% GAAP Operating Income $354 million – Segment profit up 11% to $354 million GAAP diluted EPS $7.82 – Adjusted diluted EPS up 14% to $7.82 FY 25 guidance increased – Revenue up 3% and revised EPS range of $23.25-$24.25 DALLAS , July 23, 2025 /PRNewswire/ -- Lennox (NYSE: LII), a leader in energy-efficient climate-control solutions, today reported second quarter financial results with $1.5 billion of revenue, $354 million of operating income, and $7.82 GAAP diluted earnings per share. Revenue grew 3% to $1.5 billion.

Countdown to Lennox (LII) Q2 Earnings: A Look at Estimates Beyond Revenue and EPS

zacks.com

2025-07-21 10:15:28Besides Wall Street's top-and-bottom-line estimates for Lennox (LII), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended June 2025.

Can Lennox (LII) Keep the Earnings Surprise Streak Alive?

zacks.com

2025-07-18 13:11:09Lennox (LII) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Lennox International (LII) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

zacks.com

2025-07-16 11:06:53Lennox (LII) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Lennox Schedules Second Quarter Results

prnewswire.com

2025-07-07 09:03:00DALLAS , July 7, 2025 /PRNewswire/ -- Lennox (NYSE: LII), a leader in energy-efficient climate control solutions, will report second quarter 2025 financial results before the market opens on Wednesday, July 23, 2025. An earnings conference call and webcast are scheduled for the same day at 8:30 a.m.

7 Upcoming Dividend Increases Including Two Kings

seekingalpha.com

2025-06-29 23:59:00I highlight companies with strong dividend growth, focusing on those with long streaks and consistent increases as key long-term investments. Dividend Kings like National Fuel Gas (NFG) and Sysco (SYY) extended their 55-year streaks, showcasing reliability and financial strength. Top performers over the past decade include HEI, LII, and SSD, all significantly outperforming the SCHD ETF and warranting deeper analysis.

Lennox Unveils Elite Series EL18KSLV Side Discharge Heat Pump Designed for Compact Homes

prnewswire.com

2025-06-23 09:03:00The Lennox Side Discharge Heat Pump is a compact unit designed for efficient, quiet operation. DALLAS , June 23, 2025 /PRNewswire/ -- Lennox Residential HVAC, industry-leader in home comfort solutions, announced the launch of the Elite Series EL18KSLV Side Discharge Heat Pump, combining efficient performance and space-saving design.

These 3 Stocks Are Buying Back Billions in Shares

marketbeat.com

2025-06-03 09:05:17As market volatility and sector rotations persist in 2025, companies sitting on strong balance sheets are leaning into one of the most shareholder-friendly strategies available: stock buybacks. A wave of fresh repurchase authorizations has hit the tape in recent weeks, signaling confidence from management teams about the future of their businesses and the current undervaluation of their stocks.

Watch 4 Stocks That Recently Declared Dividends Amid Market Volatility

zacks.com

2025-05-28 09:11:05TD, MAR, LII and RL just raised dividends, offering income stability as markets remain volatile amid trade tensions and rate cut uncertainty.

Lennox Signs Agreement to Acquire HVAC Division of NSI Industries

prnewswire.com

2025-08-18 08:00:00Strategic acquisition expands parts and supplies portfolio for commercial and residential HVAC customers. DALLAS , Aug. 18, 2025 /PRNewswire/ -- Lennox (NYSE: LII), a leader in energy-efficient climate control solutions, announced today it has signed a definitive agreement to purchase the HVAC division of NSI Industries from Sentinel Capital Partners for approximately $550 million.

Here's Why Lennox (LII) Is a Great 'Buy the Bottom' Stock Now

zacks.com

2025-08-04 10:56:14Lennox (LII) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. This coupled with an upward trend in earnings estimate revisions could mean a trend reversal for the stock in the near term.

Lennox Posts 14 Percent EPS Jump in Q2

fool.com

2025-07-23 17:12:53Lennox International (LII 6.69%), a major manufacturer of HVAC (heating, ventilation, air conditioning, and refrigeration) systems, reported its results for the second quarter on July 23, 2025. The earnings release showed stronger-than-expected performance: earnings per share (Non-GAAP) reached $7.82, higher than the analyst consensus of $6.86, and GAAP revenue came in at $1.50 billion, ahead of the $1,471.07 million estimate.

Lennox International Inc. (LII) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-07-23 15:02:13Lennox International Inc. (NYSE:LII ) Q2 2025 Earnings Conference Call July 23, 2025 9:30 AM ET Company Participants Alok Maskara - CEO, President & Director Chelsey Pulcheon - Corporate Participant Michael P. Quenzer - Executive VP & CFO Conference Call Participants Brett Logan Linzey - Mizuho Securities USA LLC, Research Division Charles Stephen Tusa - JPMorgan Chase & Co, Research Division Christopher M.

Lennox Posts 14% EPS Jump in Q2

fool.com

2025-07-23 12:56:15Lennox Posts 14% EPS Jump in Q2

Lennox (LII) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

zacks.com

2025-07-23 10:30:52The headline numbers for Lennox (LII) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Lennox International (LII) Q2 Earnings and Revenues Beat Estimates

zacks.com

2025-07-23 08:56:08Lennox International (LII) came out with quarterly earnings of $7.82 per share, beating the Zacks Consensus Estimate of $6.9 per share. This compares to earnings of $6.83 per share a year ago.

Lennox Reports Second Quarter Results

prnewswire.com

2025-07-23 06:45:00Q2 Highlights (All comparisons are year-over-year, unless otherwise noted) Revenue $1.5 billion, up 3% GAAP Operating Income $354 million – Segment profit up 11% to $354 million GAAP diluted EPS $7.82 – Adjusted diluted EPS up 14% to $7.82 FY 25 guidance increased – Revenue up 3% and revised EPS range of $23.25-$24.25 DALLAS , July 23, 2025 /PRNewswire/ -- Lennox (NYSE: LII), a leader in energy-efficient climate-control solutions, today reported second quarter financial results with $1.5 billion of revenue, $354 million of operating income, and $7.82 GAAP diluted earnings per share. Revenue grew 3% to $1.5 billion.

Countdown to Lennox (LII) Q2 Earnings: A Look at Estimates Beyond Revenue and EPS

zacks.com

2025-07-21 10:15:28Besides Wall Street's top-and-bottom-line estimates for Lennox (LII), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended June 2025.

Can Lennox (LII) Keep the Earnings Surprise Streak Alive?

zacks.com

2025-07-18 13:11:09Lennox (LII) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Lennox International (LII) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

zacks.com

2025-07-16 11:06:53Lennox (LII) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Lennox Schedules Second Quarter Results

prnewswire.com

2025-07-07 09:03:00DALLAS , July 7, 2025 /PRNewswire/ -- Lennox (NYSE: LII), a leader in energy-efficient climate control solutions, will report second quarter 2025 financial results before the market opens on Wednesday, July 23, 2025. An earnings conference call and webcast are scheduled for the same day at 8:30 a.m.

7 Upcoming Dividend Increases Including Two Kings

seekingalpha.com

2025-06-29 23:59:00I highlight companies with strong dividend growth, focusing on those with long streaks and consistent increases as key long-term investments. Dividend Kings like National Fuel Gas (NFG) and Sysco (SYY) extended their 55-year streaks, showcasing reliability and financial strength. Top performers over the past decade include HEI, LII, and SSD, all significantly outperforming the SCHD ETF and warranting deeper analysis.

Lennox Unveils Elite Series EL18KSLV Side Discharge Heat Pump Designed for Compact Homes

prnewswire.com

2025-06-23 09:03:00The Lennox Side Discharge Heat Pump is a compact unit designed for efficient, quiet operation. DALLAS , June 23, 2025 /PRNewswire/ -- Lennox Residential HVAC, industry-leader in home comfort solutions, announced the launch of the Elite Series EL18KSLV Side Discharge Heat Pump, combining efficient performance and space-saving design.

These 3 Stocks Are Buying Back Billions in Shares

marketbeat.com

2025-06-03 09:05:17As market volatility and sector rotations persist in 2025, companies sitting on strong balance sheets are leaning into one of the most shareholder-friendly strategies available: stock buybacks. A wave of fresh repurchase authorizations has hit the tape in recent weeks, signaling confidence from management teams about the future of their businesses and the current undervaluation of their stocks.

Watch 4 Stocks That Recently Declared Dividends Amid Market Volatility

zacks.com

2025-05-28 09:11:05TD, MAR, LII and RL just raised dividends, offering income stability as markets remain volatile amid trade tensions and rate cut uncertainty.