Lennar Corporation (LEN)

Price:

110.73 USD

( - -5.67 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Lennar Corporation

VALUE SCORE:

6

2nd position

Taylor Morrison Home Corporation

VALUE SCORE:

9

The best

D.R. Horton, Inc.

VALUE SCORE:

9

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Lennar Corporation, together with its subsidiaries, operates as a homebuilder primarily under the Lennar brand in the United States. It operates through Homebuilding East, Homebuilding Central, Homebuilding Texas, Homebuilding West, Financial Services, Multifamily, and Lennar Other segments. The company's homebuilding operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development, and sale of residential land; and development, construction, and management of multifamily rental properties. It also offers residential mortgage financing, title insurance, and closing services for home buyers and others, as well as originates and sells securitization commercial mortgage loans. In addition, the company is involved in the fund investment activity. It primarily serves first-time, move-up, active adult, and luxury homebuyers. Lennar Corporation was founded in 1954 and is based in Miami, Florida.

NEWS

Lennar (LEN) Stock Falls Amid Market Uptick: What Investors Need to Know

zacks.com

2026-02-25 19:15:20Lennar (LEN) closed at $110.73 in the latest trading session, marking a -4.87% move from the prior day.

Mortgage Rates are Finally Falling. How to Invest in That.

fool.com

2026-02-25 11:50:00Falling mortgage rates should be a boon for homebuilder stocks.

Rep. Gilbert Ray Cisneros, Jr. Sells Off Shares of Lennar Corporation (NYSE:LEN)

defenseworld.net

2026-02-22 02:05:27Representative Gilbert Ray Cisneros, Jr. (D-California) recently sold shares of Lennar Corporation (NYSE: LEN). In a filing disclosed on February 13th, the Representative disclosed that they had sold between $1,001 and $15,000 in Lennar stock on January 9th. The trade occurred in the Representative's "150 MAIN STREET TRUST > BANK OF AMERICA" account. Representative Gilbert Ray

Why Lennar (LEN) Dipped More Than Broader Market Today

zacks.com

2026-02-19 19:15:21The latest trading day saw Lennar (LEN) settling at $116.12, representing a -4.24% change from its previous close.

Lennar Stake Lifts Opendoor Stock Before Earnings

benzinga.com

2026-02-18 11:20:26The Form 13F shows Lennar holding about 18.8 million shares plus several series of tradable warrants, highlighting a large bet on the stock. Here's what investors need to know.

Lennar (LEN) Exceeds Market Returns: Some Facts to Consider

zacks.com

2026-02-13 19:15:22In the latest trading session, Lennar (LEN) closed at $122.28, marking a +1.2% move from the previous day.

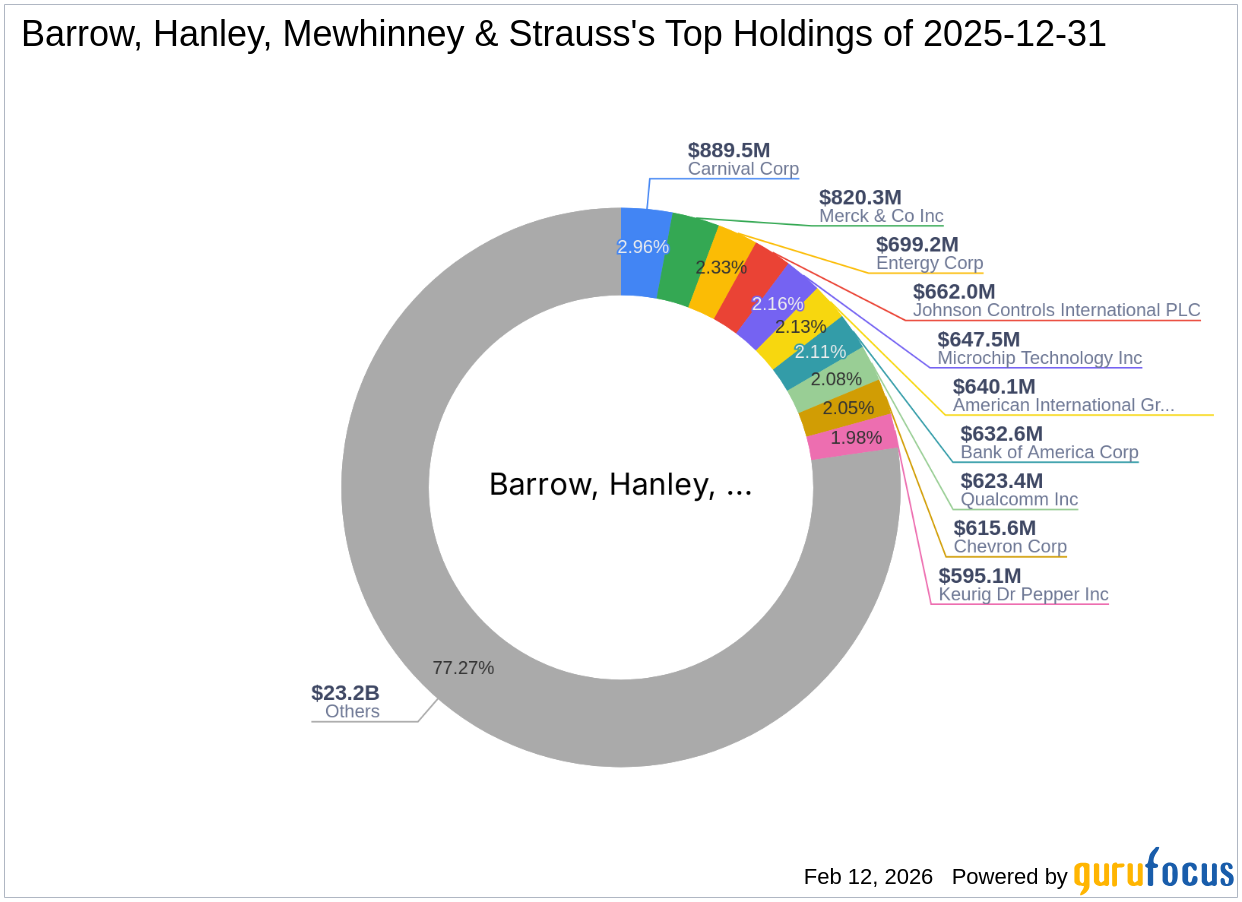

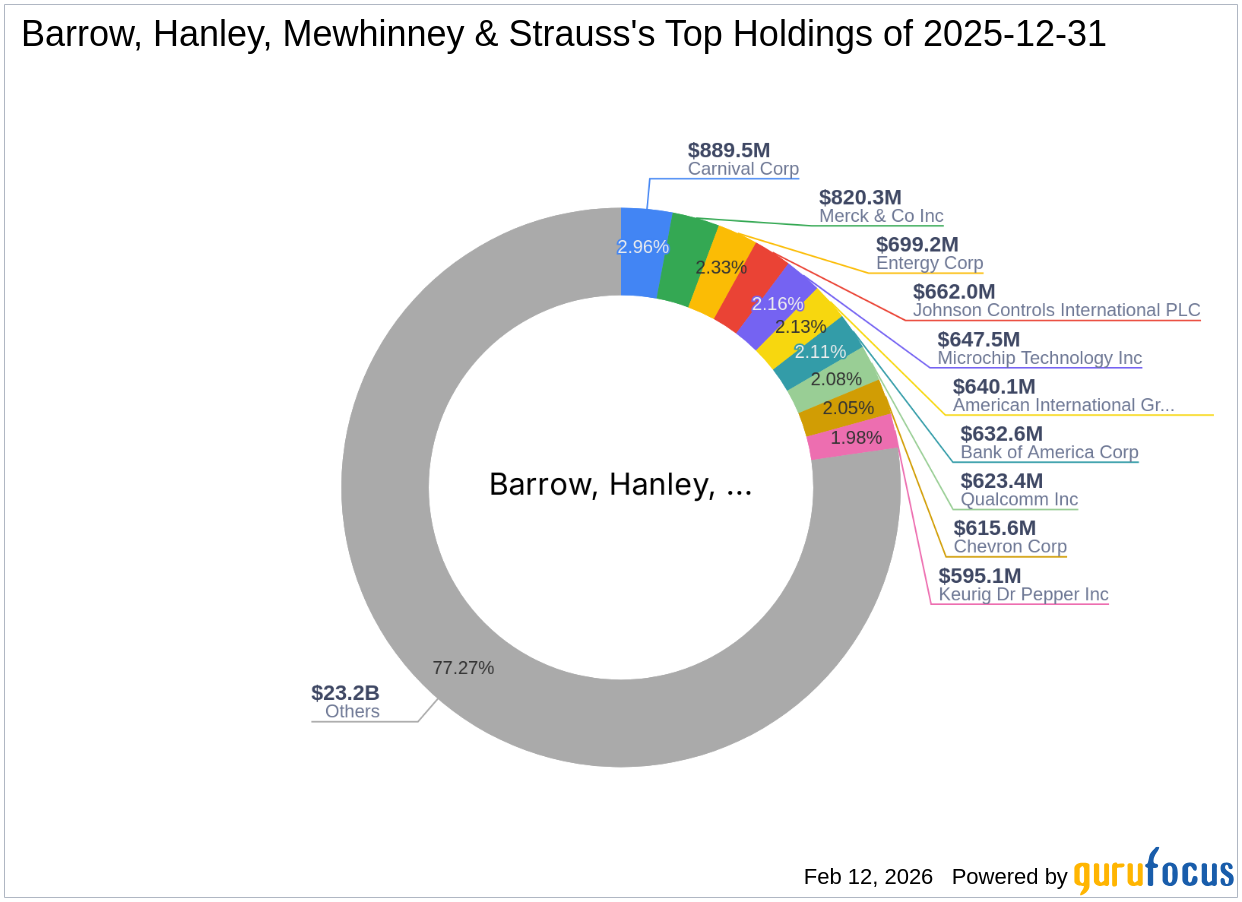

Barrow, Hanley, Mewhinney & Strauss Makes Significant Move with GE HealthCare Technologies Inc

gurufocus.com

2026-02-12 11:03:00Insight into the Fourth Quarter 2025 13F Filing Barrow, Hanley, Mewhinney and Strauss (Trades, Portfolio) recently submitted their 13F filing for the fourth quar

Why "Golden Handcuffs" are a Gift to Homebuilders in 2026

zacks.com

2026-02-12 00:30:23As high mortgage rates keep existing homes off the market, a perfect storm of restricted supply and federal incentives is positioning homebuilders for an unlikely breakout year in 2026.

Home Builder Stocks Are Breaking Out. Why It's the Best Start to the Year in a Decade.

barrons.com

2026-02-11 13:22:00Builder stocks are getting a boost from the expectation of a busier spring homebuying season.

Is This the Smartest Value Stock to Buy Right Now?

fool.com

2026-02-10 15:57:00The fact that few others like it right now only adds to its potential upside.

First Look: Amazon's $200B Capex, Coinbase's SB Ad, Kroger CEO

gurufocus.com

2026-02-09 07:38:00Stock News Japan rally on election landslide: Japanese stocks hit record highs after Prime Minister Sanae Takaichi's coalition secured a two-thirds lower-house

Lennar (LEN) Stock Falls Amid Market Uptick: What Investors Need to Know

zacks.com

2026-02-06 19:17:06The latest trading day saw Lennar (LEN) settling at $114.02, representing a -1.17% change from its previous close.

Lennar Wants to Build "Trump Homes." Is It Time to Consider an Investment?

fool.com

2026-02-05 10:30:00Lennar and other homebuilders are about to propose a home construction plan to the White House.

These Homebuilder Stocks Get a Boost Following Report of Plan to Build 'Trump Homes'

investopedia.com

2026-02-04 13:46:00Several homebuilder stocks got a boost following a report the Trump administration is considering a program to build more new homes.

First Look: Lilly jumps; Novo warns; Walmart tops $1T

gurufocus.com

2026-02-04 07:38:00Stock News Lilly beats and lifts outlook: Eli Lilly (LLY) posted Q4 revenue of $19.29B (+43%) and adjusted EPS of $7.54, and guided 2026 revenue to $80â$83B a

These Homebuilder Stocks Climb Following Report of Plan to Build 'Trump Homes'

investopedia.com

2026-02-03 18:41:31Several homebuilder stocks got a boost Tuesday, following a report the Trump administration is considering a program to build more new homes.

Lennar (LEN) Stock Falls Amid Market Uptick: What Investors Need to Know

zacks.com

2026-02-25 19:15:20Lennar (LEN) closed at $110.73 in the latest trading session, marking a -4.87% move from the prior day.

Mortgage Rates are Finally Falling. How to Invest in That.

fool.com

2026-02-25 11:50:00Falling mortgage rates should be a boon for homebuilder stocks.

Rep. Gilbert Ray Cisneros, Jr. Sells Off Shares of Lennar Corporation (NYSE:LEN)

defenseworld.net

2026-02-22 02:05:27Representative Gilbert Ray Cisneros, Jr. (D-California) recently sold shares of Lennar Corporation (NYSE: LEN). In a filing disclosed on February 13th, the Representative disclosed that they had sold between $1,001 and $15,000 in Lennar stock on January 9th. The trade occurred in the Representative's "150 MAIN STREET TRUST > BANK OF AMERICA" account. Representative Gilbert Ray

Why Lennar (LEN) Dipped More Than Broader Market Today

zacks.com

2026-02-19 19:15:21The latest trading day saw Lennar (LEN) settling at $116.12, representing a -4.24% change from its previous close.

Lennar Stake Lifts Opendoor Stock Before Earnings

benzinga.com

2026-02-18 11:20:26The Form 13F shows Lennar holding about 18.8 million shares plus several series of tradable warrants, highlighting a large bet on the stock. Here's what investors need to know.

Lennar (LEN) Exceeds Market Returns: Some Facts to Consider

zacks.com

2026-02-13 19:15:22In the latest trading session, Lennar (LEN) closed at $122.28, marking a +1.2% move from the previous day.

Barrow, Hanley, Mewhinney & Strauss Makes Significant Move with GE HealthCare Technologies Inc

gurufocus.com

2026-02-12 11:03:00Insight into the Fourth Quarter 2025 13F Filing Barrow, Hanley, Mewhinney and Strauss (Trades, Portfolio) recently submitted their 13F filing for the fourth quar

Why "Golden Handcuffs" are a Gift to Homebuilders in 2026

zacks.com

2026-02-12 00:30:23As high mortgage rates keep existing homes off the market, a perfect storm of restricted supply and federal incentives is positioning homebuilders for an unlikely breakout year in 2026.

Home Builder Stocks Are Breaking Out. Why It's the Best Start to the Year in a Decade.

barrons.com

2026-02-11 13:22:00Builder stocks are getting a boost from the expectation of a busier spring homebuying season.

Is This the Smartest Value Stock to Buy Right Now?

fool.com

2026-02-10 15:57:00The fact that few others like it right now only adds to its potential upside.

First Look: Amazon's $200B Capex, Coinbase's SB Ad, Kroger CEO

gurufocus.com

2026-02-09 07:38:00Stock News Japan rally on election landslide: Japanese stocks hit record highs after Prime Minister Sanae Takaichi's coalition secured a two-thirds lower-house

Lennar (LEN) Stock Falls Amid Market Uptick: What Investors Need to Know

zacks.com

2026-02-06 19:17:06The latest trading day saw Lennar (LEN) settling at $114.02, representing a -1.17% change from its previous close.

Lennar Wants to Build "Trump Homes." Is It Time to Consider an Investment?

fool.com

2026-02-05 10:30:00Lennar and other homebuilders are about to propose a home construction plan to the White House.

These Homebuilder Stocks Get a Boost Following Report of Plan to Build 'Trump Homes'

investopedia.com

2026-02-04 13:46:00Several homebuilder stocks got a boost following a report the Trump administration is considering a program to build more new homes.

First Look: Lilly jumps; Novo warns; Walmart tops $1T

gurufocus.com

2026-02-04 07:38:00Stock News Lilly beats and lifts outlook: Eli Lilly (LLY) posted Q4 revenue of $19.29B (+43%) and adjusted EPS of $7.54, and guided 2026 revenue to $80â$83B a

These Homebuilder Stocks Climb Following Report of Plan to Build 'Trump Homes'

investopedia.com

2026-02-03 18:41:31Several homebuilder stocks got a boost Tuesday, following a report the Trump administration is considering a program to build more new homes.