Ribbit LEAP, Ltd. (LEAP)

Price:

10.02 USD

( - 0 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Lucid Group, Inc.

VALUE SCORE:

0

2nd position

Jackson Acquisition Company II

VALUE SCORE:

8

The best

Jackson Acquisition Company II

VALUE SCORE:

8

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Ribbit LEAP, Ltd. does not have significant operations. The company focuses on effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. It intends to focus on businesses in the financial services and technology sectors worldwide. The company was incorporated in 2020 and is based in Palo Alto, California.

NEWS

Liquid's Edge AI Platform, LEAP, Expands Support to Laptops With Best-in-Class Performance on AMD Ryzen™ and Ryzen AI™ Processors

businesswire.com

2025-08-18 09:00:00CAMBRIDGE, Mass.--(BUSINESS WIRE)--Liquid AI, the MIT-born leader in efficient foundation models, today announced native support for AMD's latest Ryzen™ and Ryzen AI™ processors within the Liquid Edge AI Platform (LEAP), unlocking new performance gains for developers building high-quality, on-device AI solutions. With this update, developers gain immediate access to Liquid's low-latency, memory-optimized models, now natively accelerated on AMD's latest “Zen 5” with AMD Radeon™ integrated graphi.

Bureau Veritas Accelerates its LEAP | 28 Strategy Execution and Evolves its Executive Committee

businesswire.com

2025-06-18 12:00:00PARIS--(BUSINESS WIRE)--Bureau Veritas, a global leader in Testing, Inspection, and Certification services (TIC) is accelerating the execution of its LEAP | 28 strategy to reach its vision of being the preferred partner for its customers' excellence and sustainability. Taking LEAP | 28 to the next level, Bureau Veritas is evolving the structure of its executive committee to drive greater organizational alignment, strengthening its geographical platform with scalable Product Line structures, and.

Bureau Veritas accelerates its LEAP | 28 strategy execution and evolves its Executive Committee

globenewswire.com

2025-06-18 11:45:00PRESS RELEASE Paris – June 18, 2025 Bureau Veritas accelerates its LEAP | 28 strategy execution and evolves its Executive Committee Bureau Veritas , a global leader in T esting, I nspection, and C ertification services (TIC) is accelerating t he execution of its LEAP | 28 strategy to reach its vision of being the preferred partner for its customers' excellence and sustainability . Taking LEAP | 28 to the next level , Bureau Veritas is evolving the structure of its executive committee to drive greater organizational alignment , strengthen ing its geographical platform with scalable Product Line structure s , and optimiz ing its operations to enhance agility and effectiveness.

AerCap and Air France Industries KLM Engineering & Maintenance Enter into Exclusive Negotiations to Form a LEAP Joint Venture

prnewswire.com

2025-06-17 07:30:00LE BOURGET, France , June 17, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) and Air France Industries KLM Engineering & Maintenance ("AFI KLM E&M") have announced today that they have entered into exclusive negotiations to form a LEAP engine leasing joint venture to support AFI KLM E&M LEAP Premier MRO customers worldwide.

Oman's Low-Cost Carrier SalamAir Selects StandardAero for CFM International LEAP-1A Engine Maintenance, Repair & Overhaul Support

businesswire.com

2025-06-16 18:51:00SCOTTSDALE, Ariz.--(BUSINESS WIRE)--StandardAero, a leading independent pure-play provider of aerospace engine aftermarket services, is proud to announce its selection by SalamAir, Oman's low-cost carrier, to provide maintenance, repair & overhaul (MRO) support for the CFM International LEAP-1A turbofan engines powering its fleet of Airbus A320neo family narrowbody aircraft. StandardAero provides support for the next-generation CFM International LEAP-1A and LEAP-1B engine family from its 81.

StandardAero Adds Lease Engines To Its CFM International LEAP-1A And LEAP-1B Service Offering, Supporting the Airbus A320neo And Boeing 737 MAX Customer Base

businesswire.com

2025-05-19 15:48:00SCOTTSDALE, Ariz.--(BUSINESS WIRE)--StandardAero, a leading independent pure-play provider of aerospace engine aftermarket services, including engine maintenance, repair and overhaul (MRO) and engine component repair, has recently expanded its CFM International LEAP-1A and LEAP-1B service offering to include lease engines. StandardAero has partnered with some of the world's leading engine leasing companies to support the needs of Airbus A320neo (LEAP-1A) and Boeing 737 MAX (LEAP-1B) customers w.

GE Aerospace Opens a CFM LEAP Maintenance Facility in Poland

zacks.com

2025-03-25 13:26:06GE opens XEOS facility to provide overhaul and repair services for CFM International LEAP engines that are used in narrowbody aircraft.

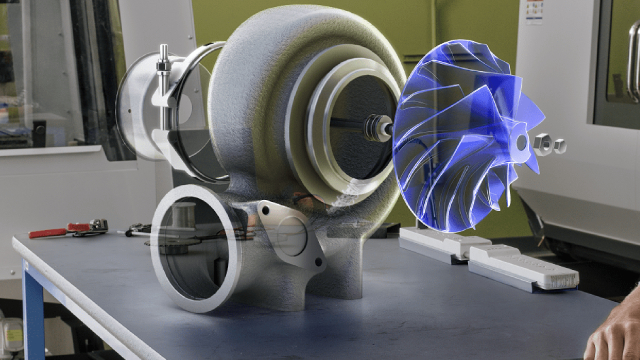

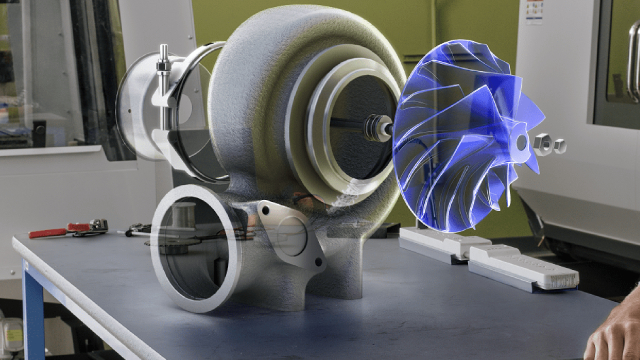

XEOS inaugurates CFM LEAP maintenance in Poland

prnewswire.com

2025-03-24 07:30:00WROCŁAW, Poland , March 24, 2025 /PRNewswire/ -- GE Aerospace (NYSE: GE) today announced the inauguration of XEOS, a state-of-the-art engine maintenance, repair and overhaul (MRO) facility in Środa Śląska near Wrocław. A joint venture between GE Aerospace and Lufthansa Technik, the facility is focused on the overhaul and repair of CFM International* LEAP engines, which power today's most popular narrowbody aircraft.

Willis Lease Finance Corporation Exercises Options for 30 CFM LEAP Engines

globenewswire.com

2025-02-20 14:30:00COCONUT CREEK, Fla., Feb. 20, 2025 (GLOBE NEWSWIRE) -- Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC” or the “Company”), a leading lessor of commercial aircraft engines and provider of global aviation service operations, has announced that it has exercised existing purchase rights for 30 new LEAP engines from CFM International, the 50-50 joint company between GE Aerospace and Safran Aircraft Engines. The purchase, pursuant to an option in a 2019 order, will include LEAP-1A engines for Airbus A320neo family aircraft, as well as LEAP-1B engines for Boeing 737 MAX aircraft, with delivery dates to be determined. With the addition of these engines to the WLFC portfolio, the Company will be able to offer even more flexible support to operators of these popular engine and aircraft types.

StandardAero Signs 15-Year CFM LEAP Support Agreement with Major Middle East Airline; Engine Inductions Already Underway

businesswire.com

2025-02-06 16:15:00SCOTTSDALE, Ariz.--(BUSINESS WIRE)--StandardAero, a leading independent provider of engine maintenance, repair and overhaul (MRO) services, has signed a definitive 15-year agreement with a major Middle East airline to provide aftermarket services for the CFM International LEAP turbofan engine. Under the new agreement, StandardAero's LEAP MRO facility in San Antonio, TX, will provide engine and engine component repair and overhaul, including LEAP performance restoration shop visits (PRSV) and co.

BUREAU VERITAS: Strong Q3 2024 organic revenue growth; Refocused portfolio with ongoing acquisitions acceleration, in line with the LEAP | 28 strategy; 2024 revenue outlook upgraded

globenewswire.com

2024-10-23 11:45:00PRESS RELEASE Neuilly-sur-Seine, France – October 23, 2024 Strong Q3 2024 organic revenue growth; Refocused portfolio with ongoing acquisitions acceleration, in line with the LEAP.

GE Aerospace working to keep up with LEAP engine demand, says CEO

reuters.com

2024-10-22 11:47:01GE Aerospace CEO Larry Culp said the company is working to ramp up production to keep up with demand for LEAP engines, which power Airbus and Boeing narrowbody aircraft.

GE Aerospace Q3: Strength In Order Book Continues

seekingalpha.com

2024-10-22 10:03:44I reiterate a “Buy” rating for GE Aerospace with a fair value of $230 per share, driven by strong order growth and LEAP engine market share gains. GE Aerospace's commercial engine deliveries increased by 25% sequentially, with a 23% growth in the LEAP program, indicating robust demand and future revenue growth. Investments in MRO facilities and LEAP service facilities are expected to accelerate growth, with a projected 9% revenue increase from FY25 onwards.

Saint Peter’s Leads as First NJ Health System with Upfront

headlinesoftoday.com

2024-03-20 00:40:06NEW BRUNSWICK, N.J. and LOS ANGELES, March 19, 2024 (GLOBE NEWSWIRE) — Saint Peter’s Healthcare System has launched New Jersey’s first tuition-free education benefit available for healthcare employees through a new partnership with InStride, a tech-enabled services company that delivers workforce education solutions. The Learning, Education and Advancement Program (LEAP), available to Saint Peter’s full- … The post Saint Peter’s Leads as First NJ Health System with Upfront appeared first on Head...

Ribbit LEAP, Ltd. Will Redeem Public Shares

businesswire.com

2022-08-02 23:20:00PALO ALTO, Calif.--(BUSINESS WIRE)--Ribbit LEAP, Ltd. (the “Company”) (NYSE: LEAP.U, LEAP, LEAP.WS), a special purpose acquisition company, today announced that it will redeem all of its outstanding Class A ordinary shares, par value $0.0001 (the “Public Shares”), effective as of the close of business on August 15, 2022, as the Company will not consummate an initial business combination within the time period required by its Amended and Restated Memorandum and Articles of Association (the “Articles”). The Company has shared a Letter to Investors with details on this decision that can be found at www.ribbitleap.com/corporate-information/letter-to-our-partners. The Company concluded it would be unable to meet it expectations for quality and long-term return potential by completing an initial business combination by September 10, 2022 (twenty four months from the closing of the Company’s initial public offering). As such, in accordance with the Company’s Articles, the Company will: cease all operations as of August 15, 2022, except those required to wind up the Company’s business; as promptly as reasonably possible, redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Company’s trust account (the “Trust Account”), including interest earned on the funds held in the Trust Account and not previously released to the Company to pay the Company’s income taxes, if any (less $100,000 of interest to pay dissolution expenses), divided by the number of the then-outstanding Public Shares, which redemption will completely extinguish public shareholders’ rights as shareholders of the Company (including the right to receive further liquidation distributions, if any); and as promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining shareholders and the Company’s board of directors, liquidate and dissolve, subject to the Company’s obligations under Cayman Islands law to provide for claims of creditors and the requirements of other applicable law. The per-share redemption price for the public shares will be approximately $10.02 (the “Redemption Amount”). The balance of the Trust Account as of July 30, 2022 was approximately $403,645,315.57, which includes approximately $1,145,315.57 in interest and dividend income (excess of cash over $402,500,000, the funds deposited into the Trust Account). In accordance with the terms of the related trust agreement, the Company expects to retain $100,000 of the interest and dividend income from the Trust Account to pay dissolution expenses. As of the close of business on August 15, 2022, the Public Shares will be deemed cancelled and will represent only the right to receive the Redemption Amount. The Redemption Amount will be payable to the holders of the Public Shares upon presentation of their respective stock or unit certificates or other delivery of their shares or units to the Company’s transfer agent, Continental Stock Transfer & Trust Company. Beneficial owners of public shares held in “street name,” however, will not need to take any action in order to receive the Redemption Amount. There will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless. The Company’s sponsor has waived its redemption rights with respect to the outstanding Class A ordinary shares, held by the sponsor, and the Class B ordinary shares and Class L ordinary shares. After August 15, 2022, the Company shall cease all operations except for those required to wind up the Company’s business. The Company expects that New York Stock Exchange will file a Form 25 with the U.S. Securities and Exchange Commission (the “Commission”) to delist its securities. The Company thereafter expects to file a Form 15 with the Commission to terminate the registration of its securities under the Securities Exchange Act of 1934, as amended. Forward-Looking Statements This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking statements are based on current information and expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the “Risk Factors” in the Company’s registration statement on Form S-1 (Registration No. 333-248415), as amended, initially filed with the Commission on August 25, 2020, relating to its initial public offering, annual, quarterly reports and subsequent reports filed with the Commission, as amended from time to time. Copies of such filings are available on the Commission’s website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Lattice Semiconductor Wins Two Medals at 2020 LEAP Awards

businesswire.com

2020-10-14 00:00:00Lattice Semiconductor Corporation (NASDAQ: LSCC), the low power programmable leader, announced that both the Lattice Propel™ design environment and th

No data to display

Liquid's Edge AI Platform, LEAP, Expands Support to Laptops With Best-in-Class Performance on AMD Ryzen™ and Ryzen AI™ Processors

businesswire.com

2025-08-18 09:00:00CAMBRIDGE, Mass.--(BUSINESS WIRE)--Liquid AI, the MIT-born leader in efficient foundation models, today announced native support for AMD's latest Ryzen™ and Ryzen AI™ processors within the Liquid Edge AI Platform (LEAP), unlocking new performance gains for developers building high-quality, on-device AI solutions. With this update, developers gain immediate access to Liquid's low-latency, memory-optimized models, now natively accelerated on AMD's latest “Zen 5” with AMD Radeon™ integrated graphi.

Bureau Veritas Accelerates its LEAP | 28 Strategy Execution and Evolves its Executive Committee

businesswire.com

2025-06-18 12:00:00PARIS--(BUSINESS WIRE)--Bureau Veritas, a global leader in Testing, Inspection, and Certification services (TIC) is accelerating the execution of its LEAP | 28 strategy to reach its vision of being the preferred partner for its customers' excellence and sustainability. Taking LEAP | 28 to the next level, Bureau Veritas is evolving the structure of its executive committee to drive greater organizational alignment, strengthening its geographical platform with scalable Product Line structures, and.

Bureau Veritas accelerates its LEAP | 28 strategy execution and evolves its Executive Committee

globenewswire.com

2025-06-18 11:45:00PRESS RELEASE Paris – June 18, 2025 Bureau Veritas accelerates its LEAP | 28 strategy execution and evolves its Executive Committee Bureau Veritas , a global leader in T esting, I nspection, and C ertification services (TIC) is accelerating t he execution of its LEAP | 28 strategy to reach its vision of being the preferred partner for its customers' excellence and sustainability . Taking LEAP | 28 to the next level , Bureau Veritas is evolving the structure of its executive committee to drive greater organizational alignment , strengthen ing its geographical platform with scalable Product Line structure s , and optimiz ing its operations to enhance agility and effectiveness.

AerCap and Air France Industries KLM Engineering & Maintenance Enter into Exclusive Negotiations to Form a LEAP Joint Venture

prnewswire.com

2025-06-17 07:30:00LE BOURGET, France , June 17, 2025 /PRNewswire/ -- AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) and Air France Industries KLM Engineering & Maintenance ("AFI KLM E&M") have announced today that they have entered into exclusive negotiations to form a LEAP engine leasing joint venture to support AFI KLM E&M LEAP Premier MRO customers worldwide.

Oman's Low-Cost Carrier SalamAir Selects StandardAero for CFM International LEAP-1A Engine Maintenance, Repair & Overhaul Support

businesswire.com

2025-06-16 18:51:00SCOTTSDALE, Ariz.--(BUSINESS WIRE)--StandardAero, a leading independent pure-play provider of aerospace engine aftermarket services, is proud to announce its selection by SalamAir, Oman's low-cost carrier, to provide maintenance, repair & overhaul (MRO) support for the CFM International LEAP-1A turbofan engines powering its fleet of Airbus A320neo family narrowbody aircraft. StandardAero provides support for the next-generation CFM International LEAP-1A and LEAP-1B engine family from its 81.

StandardAero Adds Lease Engines To Its CFM International LEAP-1A And LEAP-1B Service Offering, Supporting the Airbus A320neo And Boeing 737 MAX Customer Base

businesswire.com

2025-05-19 15:48:00SCOTTSDALE, Ariz.--(BUSINESS WIRE)--StandardAero, a leading independent pure-play provider of aerospace engine aftermarket services, including engine maintenance, repair and overhaul (MRO) and engine component repair, has recently expanded its CFM International LEAP-1A and LEAP-1B service offering to include lease engines. StandardAero has partnered with some of the world's leading engine leasing companies to support the needs of Airbus A320neo (LEAP-1A) and Boeing 737 MAX (LEAP-1B) customers w.

GE Aerospace Opens a CFM LEAP Maintenance Facility in Poland

zacks.com

2025-03-25 13:26:06GE opens XEOS facility to provide overhaul and repair services for CFM International LEAP engines that are used in narrowbody aircraft.

XEOS inaugurates CFM LEAP maintenance in Poland

prnewswire.com

2025-03-24 07:30:00WROCŁAW, Poland , March 24, 2025 /PRNewswire/ -- GE Aerospace (NYSE: GE) today announced the inauguration of XEOS, a state-of-the-art engine maintenance, repair and overhaul (MRO) facility in Środa Śląska near Wrocław. A joint venture between GE Aerospace and Lufthansa Technik, the facility is focused on the overhaul and repair of CFM International* LEAP engines, which power today's most popular narrowbody aircraft.

Willis Lease Finance Corporation Exercises Options for 30 CFM LEAP Engines

globenewswire.com

2025-02-20 14:30:00COCONUT CREEK, Fla., Feb. 20, 2025 (GLOBE NEWSWIRE) -- Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC” or the “Company”), a leading lessor of commercial aircraft engines and provider of global aviation service operations, has announced that it has exercised existing purchase rights for 30 new LEAP engines from CFM International, the 50-50 joint company between GE Aerospace and Safran Aircraft Engines. The purchase, pursuant to an option in a 2019 order, will include LEAP-1A engines for Airbus A320neo family aircraft, as well as LEAP-1B engines for Boeing 737 MAX aircraft, with delivery dates to be determined. With the addition of these engines to the WLFC portfolio, the Company will be able to offer even more flexible support to operators of these popular engine and aircraft types.

StandardAero Signs 15-Year CFM LEAP Support Agreement with Major Middle East Airline; Engine Inductions Already Underway

businesswire.com

2025-02-06 16:15:00SCOTTSDALE, Ariz.--(BUSINESS WIRE)--StandardAero, a leading independent provider of engine maintenance, repair and overhaul (MRO) services, has signed a definitive 15-year agreement with a major Middle East airline to provide aftermarket services for the CFM International LEAP turbofan engine. Under the new agreement, StandardAero's LEAP MRO facility in San Antonio, TX, will provide engine and engine component repair and overhaul, including LEAP performance restoration shop visits (PRSV) and co.

BUREAU VERITAS: Strong Q3 2024 organic revenue growth; Refocused portfolio with ongoing acquisitions acceleration, in line with the LEAP | 28 strategy; 2024 revenue outlook upgraded

globenewswire.com

2024-10-23 11:45:00PRESS RELEASE Neuilly-sur-Seine, France – October 23, 2024 Strong Q3 2024 organic revenue growth; Refocused portfolio with ongoing acquisitions acceleration, in line with the LEAP.

GE Aerospace working to keep up with LEAP engine demand, says CEO

reuters.com

2024-10-22 11:47:01GE Aerospace CEO Larry Culp said the company is working to ramp up production to keep up with demand for LEAP engines, which power Airbus and Boeing narrowbody aircraft.

GE Aerospace Q3: Strength In Order Book Continues

seekingalpha.com

2024-10-22 10:03:44I reiterate a “Buy” rating for GE Aerospace with a fair value of $230 per share, driven by strong order growth and LEAP engine market share gains. GE Aerospace's commercial engine deliveries increased by 25% sequentially, with a 23% growth in the LEAP program, indicating robust demand and future revenue growth. Investments in MRO facilities and LEAP service facilities are expected to accelerate growth, with a projected 9% revenue increase from FY25 onwards.

Saint Peter’s Leads as First NJ Health System with Upfront

headlinesoftoday.com

2024-03-20 00:40:06NEW BRUNSWICK, N.J. and LOS ANGELES, March 19, 2024 (GLOBE NEWSWIRE) — Saint Peter’s Healthcare System has launched New Jersey’s first tuition-free education benefit available for healthcare employees through a new partnership with InStride, a tech-enabled services company that delivers workforce education solutions. The Learning, Education and Advancement Program (LEAP), available to Saint Peter’s full- … The post Saint Peter’s Leads as First NJ Health System with Upfront appeared first on Head...

Ribbit LEAP, Ltd. Will Redeem Public Shares

businesswire.com

2022-08-02 23:20:00PALO ALTO, Calif.--(BUSINESS WIRE)--Ribbit LEAP, Ltd. (the “Company”) (NYSE: LEAP.U, LEAP, LEAP.WS), a special purpose acquisition company, today announced that it will redeem all of its outstanding Class A ordinary shares, par value $0.0001 (the “Public Shares”), effective as of the close of business on August 15, 2022, as the Company will not consummate an initial business combination within the time period required by its Amended and Restated Memorandum and Articles of Association (the “Articles”). The Company has shared a Letter to Investors with details on this decision that can be found at www.ribbitleap.com/corporate-information/letter-to-our-partners. The Company concluded it would be unable to meet it expectations for quality and long-term return potential by completing an initial business combination by September 10, 2022 (twenty four months from the closing of the Company’s initial public offering). As such, in accordance with the Company’s Articles, the Company will: cease all operations as of August 15, 2022, except those required to wind up the Company’s business; as promptly as reasonably possible, redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Company’s trust account (the “Trust Account”), including interest earned on the funds held in the Trust Account and not previously released to the Company to pay the Company’s income taxes, if any (less $100,000 of interest to pay dissolution expenses), divided by the number of the then-outstanding Public Shares, which redemption will completely extinguish public shareholders’ rights as shareholders of the Company (including the right to receive further liquidation distributions, if any); and as promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining shareholders and the Company’s board of directors, liquidate and dissolve, subject to the Company’s obligations under Cayman Islands law to provide for claims of creditors and the requirements of other applicable law. The per-share redemption price for the public shares will be approximately $10.02 (the “Redemption Amount”). The balance of the Trust Account as of July 30, 2022 was approximately $403,645,315.57, which includes approximately $1,145,315.57 in interest and dividend income (excess of cash over $402,500,000, the funds deposited into the Trust Account). In accordance with the terms of the related trust agreement, the Company expects to retain $100,000 of the interest and dividend income from the Trust Account to pay dissolution expenses. As of the close of business on August 15, 2022, the Public Shares will be deemed cancelled and will represent only the right to receive the Redemption Amount. The Redemption Amount will be payable to the holders of the Public Shares upon presentation of their respective stock or unit certificates or other delivery of their shares or units to the Company’s transfer agent, Continental Stock Transfer & Trust Company. Beneficial owners of public shares held in “street name,” however, will not need to take any action in order to receive the Redemption Amount. There will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless. The Company’s sponsor has waived its redemption rights with respect to the outstanding Class A ordinary shares, held by the sponsor, and the Class B ordinary shares and Class L ordinary shares. After August 15, 2022, the Company shall cease all operations except for those required to wind up the Company’s business. The Company expects that New York Stock Exchange will file a Form 25 with the U.S. Securities and Exchange Commission (the “Commission”) to delist its securities. The Company thereafter expects to file a Form 15 with the Commission to terminate the registration of its securities under the Securities Exchange Act of 1934, as amended. Forward-Looking Statements This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking statements are based on current information and expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the “Risk Factors” in the Company’s registration statement on Form S-1 (Registration No. 333-248415), as amended, initially filed with the Commission on August 25, 2020, relating to its initial public offering, annual, quarterly reports and subsequent reports filed with the Commission, as amended from time to time. Copies of such filings are available on the Commission’s website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Lattice Semiconductor Wins Two Medals at 2020 LEAP Awards

businesswire.com

2020-10-14 00:00:00Lattice Semiconductor Corporation (NASDAQ: LSCC), the low power programmable leader, announced that both the Lattice Propel™ design environment and th