iShares ESG MSCI EM Leaders ETF (LDEM)

Price:

58.77 USD

( - -0.45 USD)

Your position:

0 USD

ACTION PANEL

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Strategy Shares Nasdaq 7 Handl Index ETF

VALUE SCORE:

9

2nd position

Angel Oak Ultrashort Income ETF

VALUE SCORE:

12

The best

Invesco Variable Rate Investment Grade ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

The fund generally will invest at least 90% of its assets in the component securities of the underlying index and in investments that have economic characteristics that are substantially identical to the component securities of the underlying index. The underlying index is a free float-adjusted market capitalization-weighted index designed to reflect the equity performance of emerging market companies with favorable environmental, social and governance ("ESG") characteristics. It is non-diversified.

NEWS

Emerging Markets Growth Remains Solid Amid Intensifying Inflationary Pressures

seekingalpha.com

2024-03-14 13:15:00Emerging markets continued to expand at a solid pace midway into the first quarter of 2024, supported by broad-based expansion across both manufacturing and service sectors.

IShares ESG fund suffered 91% drop in assets under management this week

reuters.com

2021-12-30 10:53:00The iShares ESG MSCI EM Leaders ETF suffered heavy outflows this week, according to public data, leading to a tenfold drop in the assets managed by the exchange-traded fund focused on sustainable emerging-market companies.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

Socially Responsible, ESG ETFs Are Turning Heads

etftrends.com

2020-12-21 17:26:42Investors are taking a shine to exchange traded funds that track socially responsible investments, like those based on environmental, social, and governance principles. According to FactSet data, investors have funneled a record $27.4 billion in to ESG-related ETFs so far in 2020, doubling the size of the asset category, the Wall Street Journal reports.

Growing Optimism On A COVID-19 Vaccine Boosts Investor Confidence In August

seekingalpha.com

2020-09-11 03:13:50Asian markets rose in August to seal the best regional performance in EMs. Stocks in China, India and Indonesia posted notable gains.

Smaller Stocks Open Broader Windows To Emerging Markets

seekingalpha.com

2020-09-09 19:53:17Allocating to smaller companies can help broaden an EM allocation by providing a different mix of exposures to opportunities across countries and sectors.

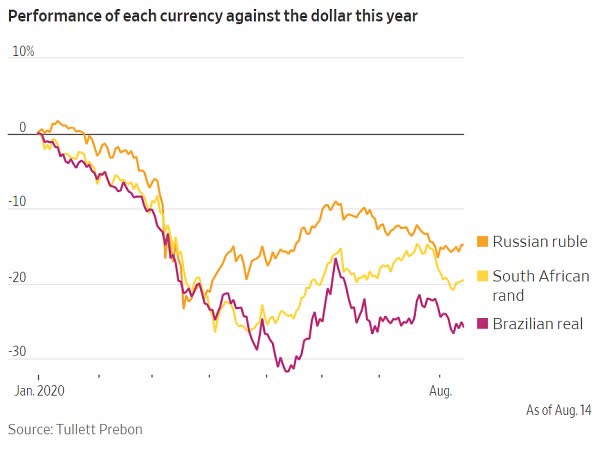

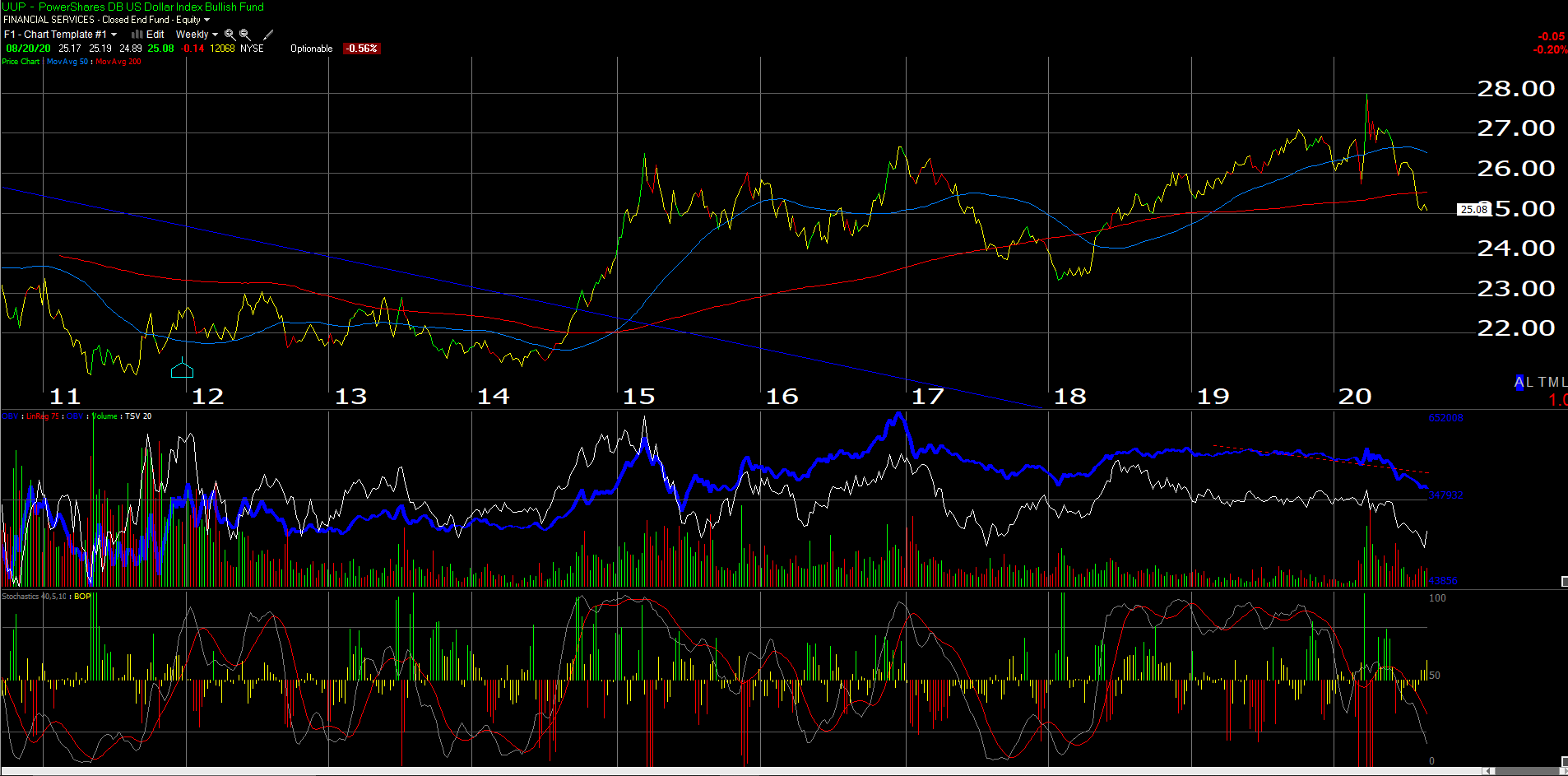

Will A Weak Dollar Bail Out Emerging Markets? Nope

seekingalpha.com

2020-08-22 08:35:57Back in the simpler days of 2019, there was this (now completely forgotten) impending crisis in which emerging market countries' dollar-denominated debt was going to blow up their - and by extension the rest of the world's - economies.

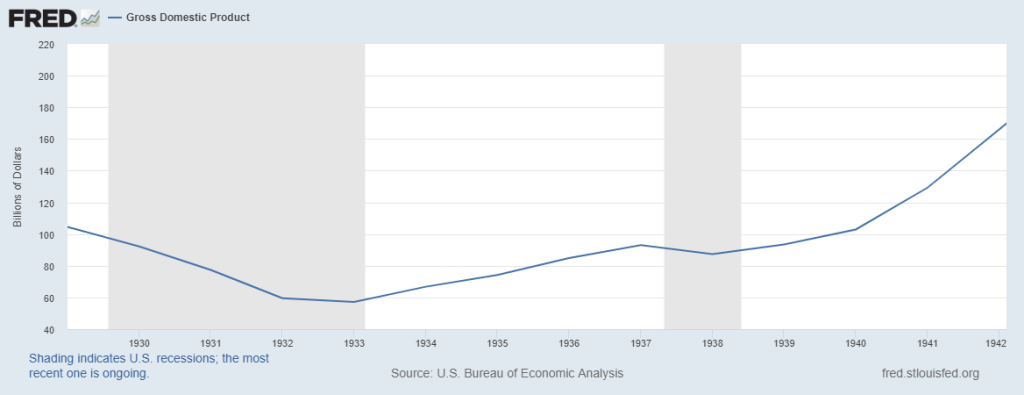

When Does A Recession Become A Depression?

seekingalpha.com

2020-08-21 08:03:19Defining a depression as opposed to a recession is open to wide interpretation. Recessions are a natural part of the credit cycle.

On Emerging Markets, The Dollar And Oakmark Int'l

seekingalpha.com

2020-08-21 05:59:53The emerging markets had a solid July 2020, up roughly 7% depending on the proxy you use. VWO and OAKIX represent uncorrelated holdings for the growthier positions in client accounts.

Euro Strength Driving Dollar Weakness, Inflationary Breakout Stories: Hirst

seekingalpha.com

2020-08-19 23:40:56The size and speed of the dollar’s fall are driven more by euro strength flowing out from the ECB’s move toward debt mutualization than by dollar weakness.

Are Emerging Markets Poised For The Long Run?

seekingalpha.com

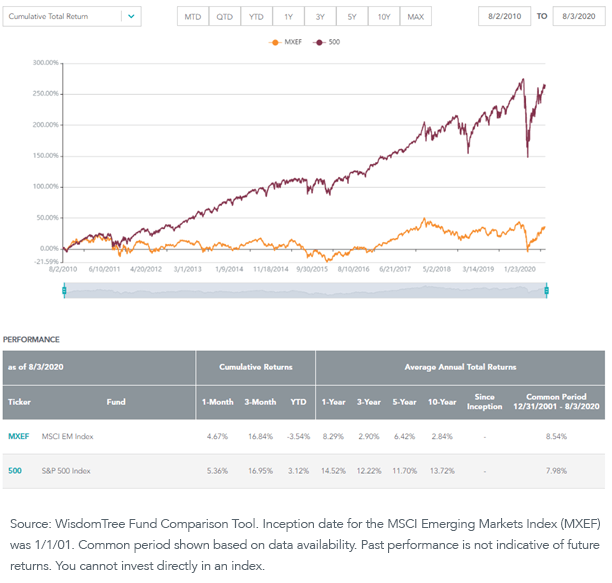

2020-08-18 06:06:42It's been a remarkable decade for the S&P 500 Index. Less so for global benchmarks.

Sentiment Speaks: A Huge Opportunity For Investors In 2021

seekingalpha.com

2020-08-17 08:00:00Emerging markets provided us a great warning for the decline experienced earlier in 2020. Emerging markets are now setting up for a multi-year rally.

Our Hypothesis For A Bull Market In Emerging Markets Equities

seekingalpha.com

2020-08-15 11:25:18Why we think EM equity asset class will be among the most attractive investment opportunities over the next decade.

U.S. Dollar Weakness Should Reinforce The Blossoming Rally In Cyclical Stocks

seekingalpha.com

2020-08-14 04:23:25We believe compelling opportunities exist for investors in EM stocks at a time when many emerging economies - especially Asia excluding Japan - are recovering from the virus-related sudden stop in activity.

3 Big Challenges For Emerging Markets Amid COVID-19

seekingalpha.com

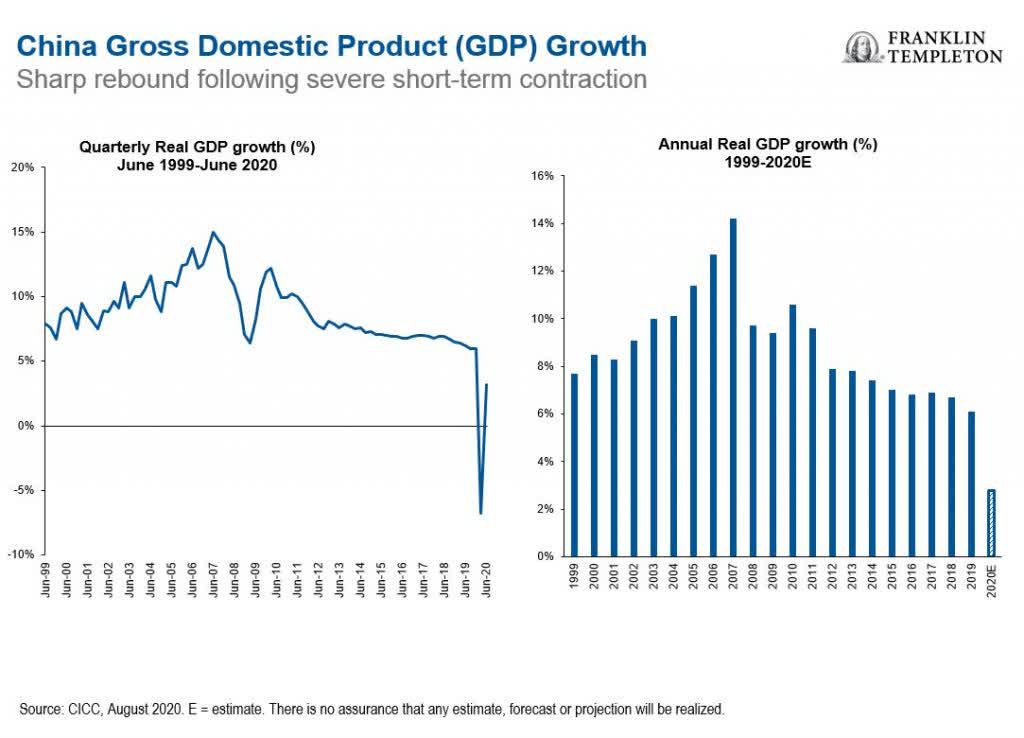

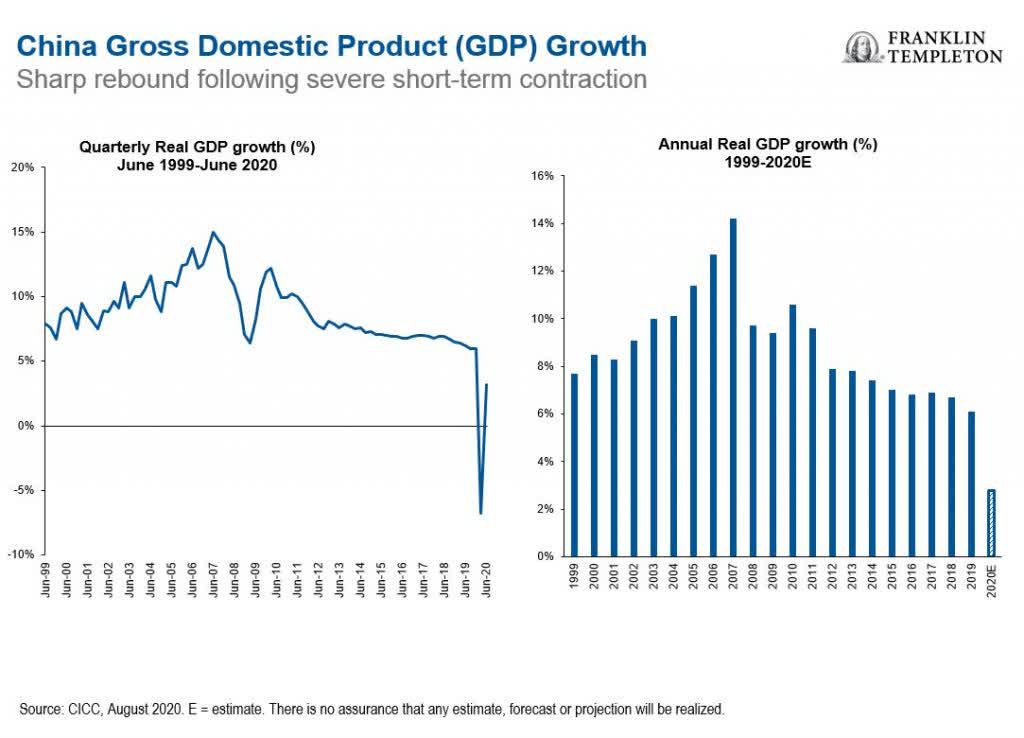

2020-08-13 13:29:50Today, China's economic recovery continues ticking along, and we are even seeing some indicators showing growth relative to last year.

The Two-Sided Recovery: A Conversation About The Markets And Economy

seekingalpha.com

2020-07-31 03:00:40From a sector and industry perspective, we're starting to see hints of cyclicality returning to the marketplace after taking the last several weeks off (read: summer doldrums).

No data to display

Emerging Markets Growth Remains Solid Amid Intensifying Inflationary Pressures

seekingalpha.com

2024-03-14 13:15:00Emerging markets continued to expand at a solid pace midway into the first quarter of 2024, supported by broad-based expansion across both manufacturing and service sectors.

IShares ESG fund suffered 91% drop in assets under management this week

reuters.com

2021-12-30 10:53:00The iShares ESG MSCI EM Leaders ETF suffered heavy outflows this week, according to public data, leading to a tenfold drop in the assets managed by the exchange-traded fund focused on sustainable emerging-market companies.

Investing In Emerging Markets As Global Rates Rise

seekingalpha.com

2021-02-22 18:39:51Past experience shows us that emerging markets have historically reacted positively to higher global rates, especially if the latter reflects an improving global growth outlook. Most emerging markets will start normalizing rates well before the U.S. and developed markets.

Socially Responsible, ESG ETFs Are Turning Heads

etftrends.com

2020-12-21 17:26:42Investors are taking a shine to exchange traded funds that track socially responsible investments, like those based on environmental, social, and governance principles. According to FactSet data, investors have funneled a record $27.4 billion in to ESG-related ETFs so far in 2020, doubling the size of the asset category, the Wall Street Journal reports.

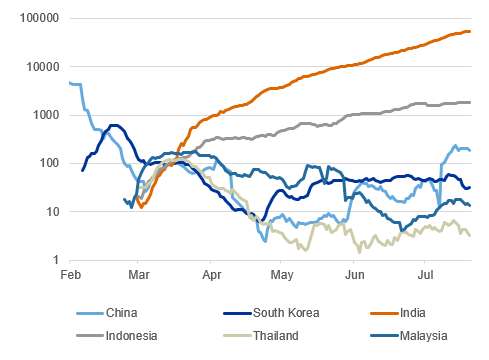

Growing Optimism On A COVID-19 Vaccine Boosts Investor Confidence In August

seekingalpha.com

2020-09-11 03:13:50Asian markets rose in August to seal the best regional performance in EMs. Stocks in China, India and Indonesia posted notable gains.

Smaller Stocks Open Broader Windows To Emerging Markets

seekingalpha.com

2020-09-09 19:53:17Allocating to smaller companies can help broaden an EM allocation by providing a different mix of exposures to opportunities across countries and sectors.

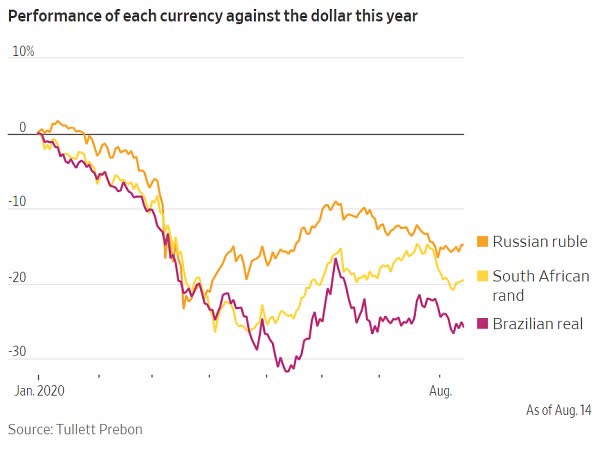

Will A Weak Dollar Bail Out Emerging Markets? Nope

seekingalpha.com

2020-08-22 08:35:57Back in the simpler days of 2019, there was this (now completely forgotten) impending crisis in which emerging market countries' dollar-denominated debt was going to blow up their - and by extension the rest of the world's - economies.

When Does A Recession Become A Depression?

seekingalpha.com

2020-08-21 08:03:19Defining a depression as opposed to a recession is open to wide interpretation. Recessions are a natural part of the credit cycle.

On Emerging Markets, The Dollar And Oakmark Int'l

seekingalpha.com

2020-08-21 05:59:53The emerging markets had a solid July 2020, up roughly 7% depending on the proxy you use. VWO and OAKIX represent uncorrelated holdings for the growthier positions in client accounts.

Euro Strength Driving Dollar Weakness, Inflationary Breakout Stories: Hirst

seekingalpha.com

2020-08-19 23:40:56The size and speed of the dollar’s fall are driven more by euro strength flowing out from the ECB’s move toward debt mutualization than by dollar weakness.

Are Emerging Markets Poised For The Long Run?

seekingalpha.com

2020-08-18 06:06:42It's been a remarkable decade for the S&P 500 Index. Less so for global benchmarks.

Sentiment Speaks: A Huge Opportunity For Investors In 2021

seekingalpha.com

2020-08-17 08:00:00Emerging markets provided us a great warning for the decline experienced earlier in 2020. Emerging markets are now setting up for a multi-year rally.

Our Hypothesis For A Bull Market In Emerging Markets Equities

seekingalpha.com

2020-08-15 11:25:18Why we think EM equity asset class will be among the most attractive investment opportunities over the next decade.

U.S. Dollar Weakness Should Reinforce The Blossoming Rally In Cyclical Stocks

seekingalpha.com

2020-08-14 04:23:25We believe compelling opportunities exist for investors in EM stocks at a time when many emerging economies - especially Asia excluding Japan - are recovering from the virus-related sudden stop in activity.

3 Big Challenges For Emerging Markets Amid COVID-19

seekingalpha.com

2020-08-13 13:29:50Today, China's economic recovery continues ticking along, and we are even seeing some indicators showing growth relative to last year.

The Two-Sided Recovery: A Conversation About The Markets And Economy

seekingalpha.com

2020-07-31 03:00:40From a sector and industry perspective, we're starting to see hints of cyclicality returning to the marketplace after taking the last several weeks off (read: summer doldrums).