Khosla Ventures Acquisition Co. (KVSA)

Price:

10.74 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Churchill Capital Corp X

VALUE SCORE:

7

2nd position

M3-Brigade Acquisition V Corp. Units

VALUE SCORE:

11

The best

Horizon Kinetics SPAC Active ETF

VALUE SCORE:

12

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

No data to display

DESCRIPTION

Khosla Ventures Acquisition Co. does not have significant operations. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company was incorporated in 2021 and is based in Menlo Park, California.

NEWS

Khosla Ventures Acquisition Co. Announces Redemption of Public Shares and Subsequent Dissolution

prnewswire.com

2023-12-04 17:38:00MENLO PARK, Calif. , Dec. 4, 2023 /PRNewswire/ -- Khosla Ventures Acquisition Co. (the "Company") (Nasdaq: KVSA) today announced that it will redeem all of its outstanding shares of Class A common stock that were issued in its initial public offering and not previously redeemed (the "public shares"), effective as of the close of business on December 11, 2023, as the Company will not consummate an initial business combination on or prior to December 8, 2023.

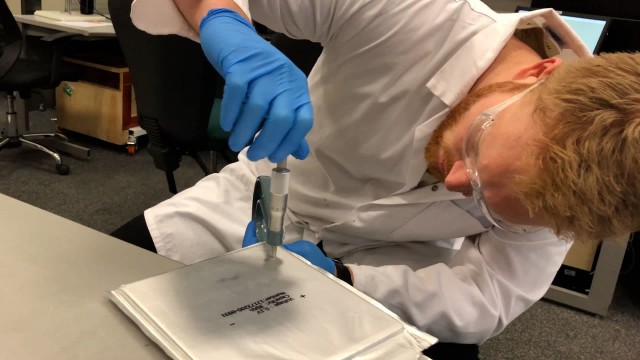

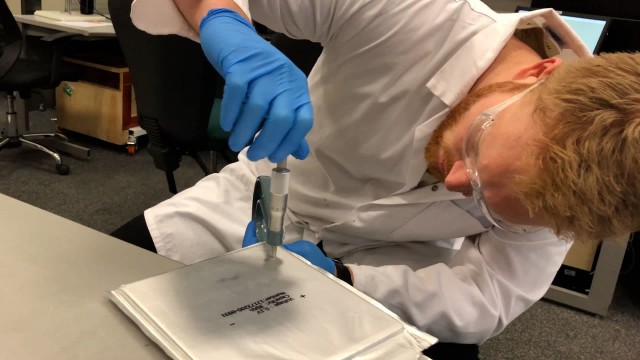

Here's why sodium-ion batteries are shaping up to be a big technology breakthrough

cnbc.com

2023-05-10 08:30:01Although still in its infancy, the global market for sodium-ion batteries is expected to be worth over $11 billion by 2033.

Khosla Ventures/Valo Health De-SPAC: Heed The Sponsor's Advice And Stay Away

seekingalpha.com

2021-06-10 09:00:00Khosla Ventures/Valo Health De-SPAC: Heed The Sponsor's Advice And Stay Away

Valo Health To Combine With Vinod Khosla-Backed SPAC In $2.8B Deal

benzinga.com

2021-06-09 14:16:42Boston-based Valo Health LLC has agreed to go public through a reverse merger with a blank-check firm backed by venture capitalist Vinod Khosla, in a deal valuing the combined company at about $2.8 billion. Founded in 2019, Valo Health is a biotech company that uses data analysis and artificial intelligence to help drug discovery and development.

The latest SPAC deal to know about: Valo Health to combine with Khosla Ventures Acquisition

invezz.com

2021-06-09 11:49:21Khosla Ventures Acquisition Co. (NASDAQ: KVSA), a special purpose acquisition vehicle (SPAC), and Valo Health LLC, a technology startup company, have entered into a definitive merger agreement to combine and take Valo Health public. Valo is a Boston-headquartered technology company that aims to accelerate the drug discovery and development process using its Opal Computational Platform […] The post The latest SPAC deal to know about: Valo Health to combine with Khosla Ventures Acquisition appeared first on Invezz.

No data to display

Khosla Ventures Acquisition Co. Announces Redemption of Public Shares and Subsequent Dissolution

prnewswire.com

2023-12-04 17:38:00MENLO PARK, Calif. , Dec. 4, 2023 /PRNewswire/ -- Khosla Ventures Acquisition Co. (the "Company") (Nasdaq: KVSA) today announced that it will redeem all of its outstanding shares of Class A common stock that were issued in its initial public offering and not previously redeemed (the "public shares"), effective as of the close of business on December 11, 2023, as the Company will not consummate an initial business combination on or prior to December 8, 2023.

Here's why sodium-ion batteries are shaping up to be a big technology breakthrough

cnbc.com

2023-05-10 08:30:01Although still in its infancy, the global market for sodium-ion batteries is expected to be worth over $11 billion by 2033.

Khosla Ventures/Valo Health De-SPAC: Heed The Sponsor's Advice And Stay Away

seekingalpha.com

2021-06-10 09:00:00Khosla Ventures/Valo Health De-SPAC: Heed The Sponsor's Advice And Stay Away

Valo Health To Combine With Vinod Khosla-Backed SPAC In $2.8B Deal

benzinga.com

2021-06-09 14:16:42Boston-based Valo Health LLC has agreed to go public through a reverse merger with a blank-check firm backed by venture capitalist Vinod Khosla, in a deal valuing the combined company at about $2.8 billion. Founded in 2019, Valo Health is a biotech company that uses data analysis and artificial intelligence to help drug discovery and development.

The latest SPAC deal to know about: Valo Health to combine with Khosla Ventures Acquisition

invezz.com

2021-06-09 11:49:21Khosla Ventures Acquisition Co. (NASDAQ: KVSA), a special purpose acquisition vehicle (SPAC), and Valo Health LLC, a technology startup company, have entered into a definitive merger agreement to combine and take Valo Health public. Valo is a Boston-headquartered technology company that aims to accelerate the drug discovery and development process using its Opal Computational Platform […] The post The latest SPAC deal to know about: Valo Health to combine with Khosla Ventures Acquisition appeared first on Invezz.