Keurig Dr Pepper Inc. (KDP)

Price:

29.50 USD

( + 0.03 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Celsius Holdings, Inc.

VALUE SCORE:

8

2nd position

Coca-Cola Europacific Partners PLC

VALUE SCORE:

8

The best

Chagee Holdings Limited American Depositary Shares

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Keurig Dr Pepper Inc. operates as a beverage company in the United States and internationally. It operates through Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages segments. The Coffee Systems segment manufactures and distributes various finished goods related to its coffee systems, K-Cup pods, and brewers, as well as specialty coffee. This segment sells its brewers through third-party distributors and retail partners, as well as through its website at keurig.com. The Packaged Beverages segment engages in the manufacture and distribution of packaged beverages of its brands; contract manufacturing of various private label and emerging brand beverages; and distribution of packaged beverages for its partner brands. The Beverage Concentrates segment manufactures and sells beverage concentrates primarily under the Dr Pepper, Canada Dry, A&W, 7UP, Sunkist, Squirt, Big Red, RC Cola, Vernors, Snapple, Mott's, Bai, Hawaiian Punch, Clamato, Yoo-Hoo, Core, ReaLemon, evian, Vita Coco, and Mr and Mrs T mixers brands. This segment also manufactures beverage concentrates into syrup. The Latin America Beverages segment manufactures and distributes carbonated mineral water, flavored carbonated soft drinks, bottled water, and vegetable juice products under the Peñafiel, Clamato, Squirt, Dr Pepper, Crush, and Aguafiel brands. The company serves retailers, bottlers and distributors, restaurants, hotel chains, office coffee distributors, and end-use consumers. Keurig Dr Pepper Inc. was founded in 1981 and is headquartered in Burlington, Massachusetts.

NEWS

Keurig Dr Pepper Declares Quarterly Dividend

prnewswire.com

2025-12-09 16:15:00BURLINGTON, Mass. and FRISCO, Texas , Dec. 9, 2025 /PRNewswire/ -- Keurig Dr Pepper (NASDAQ: KDP) announced today that its Board of Directors has declared a regular quarterly cash dividend of $0.23 per share, payable in U.S. dollars, on the Company's common stock.

Dr Pepper Marks 18 Years of Impact with the Announcement of the 2025 Dr Pepper Tuition Giveaway Winners

prnewswire.com

2025-12-08 10:13:00Three College Students Each Awarded $100,000 in Tuition Funds FRISCO, Texas , Dec. 8, 2025 /PRNewswire/ -- Dr Pepper®, part of the Keurig Dr Pepper (NASDAQ: KDP) portfolio of brands, has announced the winners of the 18th annual Dr Pepper Tuition Giveaway, awarding three students each $100,000 in tuition funds during the three College Football Conference Championship games (SEC, Big Ten, ACC) on Saturday, December 6th. Six finalists participated in the Dr Pepper Tuition Giveaway where they competed against a peer to see who could throw the most footballs into an oversized Dr Pepper can in 30 seconds.

Keurig Dr Pepper, Inc $KDP Shares Sold by California Public Employees Retirement System

defenseworld.net

2025-12-08 04:44:59California Public Employees Retirement System lessened its position in Keurig Dr Pepper, Inc (NASDAQ: KDP) by 14.0% during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 4,476,530 shares of the company's stock after selling 728,454 shares during the period. California Public Employees Retirement System

Groupe la Francaise Acquires New Stake in Keurig Dr Pepper, Inc $KDP

defenseworld.net

2025-12-04 04:43:12Groupe la Francaise bought a new stake in shares of Keurig Dr Pepper, Inc (NASDAQ: KDP) in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 122,833 shares of the company's stock, valued at approximately $4,043,000. Other institutional investors also recently added

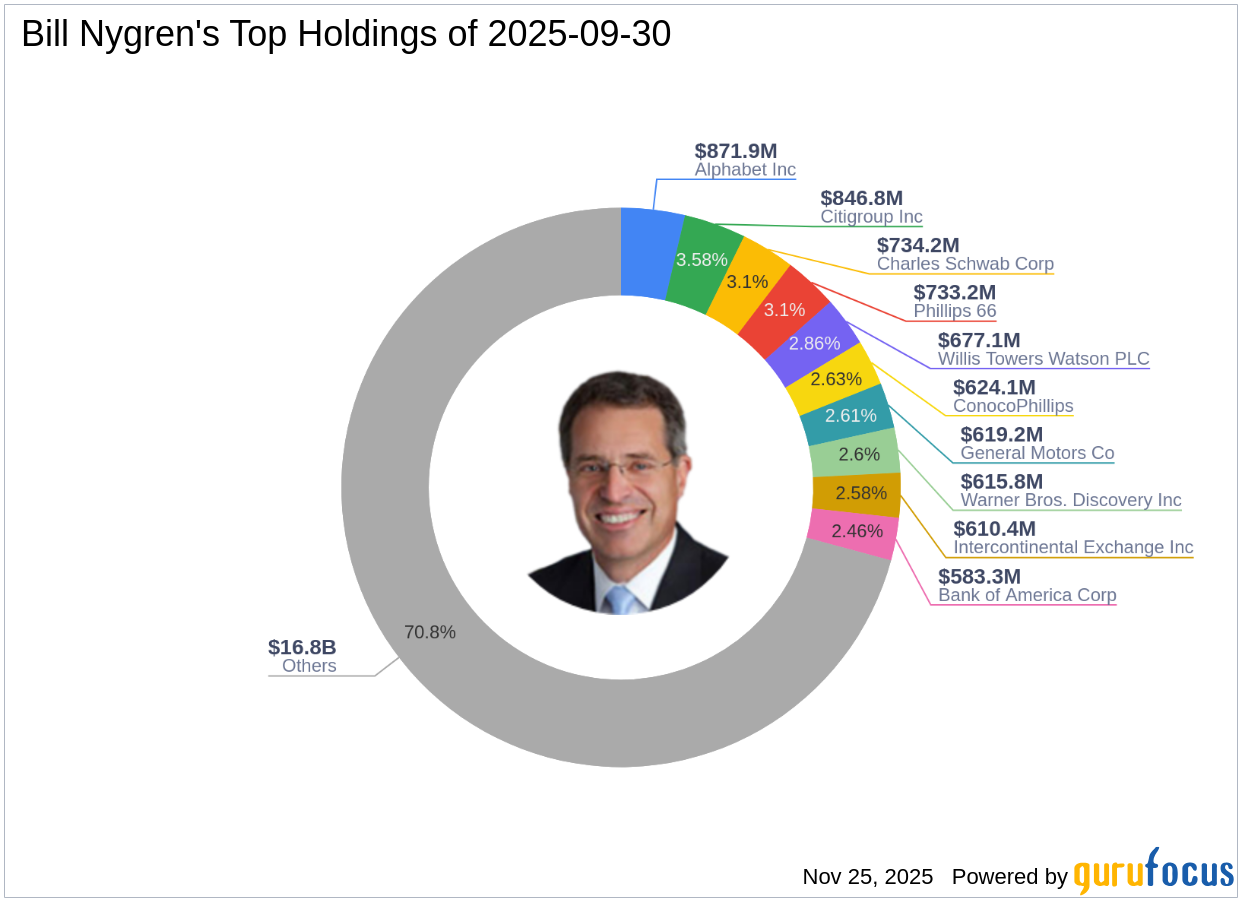

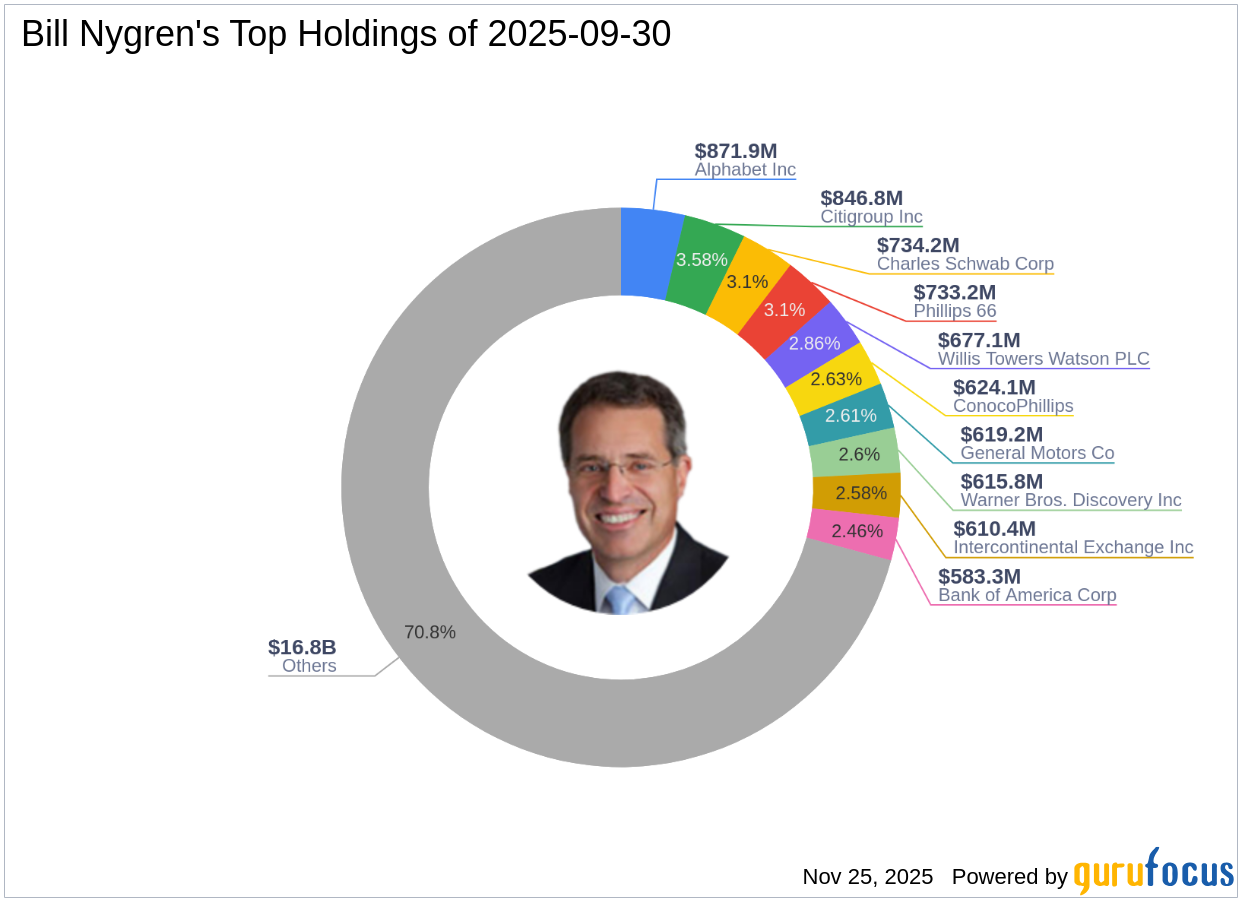

3 Interesting Buys Bill Nygren Made Last Quarter

247wallst.com

2025-12-02 11:25:40Bill Nygren's legendary Oakmark fund made some remarkable moves in the third quarter, to say the least.

Treat Yourself to a Crazy Good Coffee - The Original Donut Shop® and Pop-Tarts® Announce New Flavor Innovation Ahead of 2025 Pop-Tarts Bowl

prnewswire.com

2025-12-01 10:00:00A new dream team combines all the flavor and fun you expect from The Original Donut Shop® with the crave-worthy taste of Pop-Tarts® Brown Sugar Cinnamon. BURLINGTON, Mass.

Advisors Asset Management Inc. Boosts Stock Position in Keurig Dr Pepper, Inc $KDP

defenseworld.net

2025-12-01 03:16:56Advisors Asset Management Inc. raised its stake in shares of Keurig Dr Pepper, Inc (NASDAQ: KDP) by 6.3% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 38,851 shares of the company's stock after buying an additional 2,314 shares during the

Keurig Dr Pepper, Inc (NASDAQ:KDP) Given Consensus Recommendation of “Hold” by Brokerages

defenseworld.net

2025-12-01 01:46:45Keurig Dr Pepper, Inc (NASDAQ: KDP - Get Free Report) has earned a consensus rating of "Hold" from the nineteen analysts that are presently covering the firm, Marketbeat reports. Two analysts have rated the stock with a sell recommendation, seven have assigned a hold recommendation and ten have given a buy recommendation to the company. The

5 Soft Drink Stocks to Hold Their Ground As Cost Pressures Mount

zacks.com

2025-11-25 13:16:12About the Industry

Bill Nygren's Strategic Moves: Centene Corp Exits with a -2.14% Impact

gurufocus.com

2025-11-25 09:01:00Exploring Bill Nygren (Trades, Portfolio)'s Recent Investment Adjustments Bill Nygren (Trades, Portfolio) recently submitted the N-PORT filing for the third qu

Keurig Dr Pepper Appoints Anthony DiSilvestro as Chief Financial Officer

prnewswire.com

2025-11-25 07:30:00BURLINGTON, Mass. and FRISCO, Texas , Nov. 25, 2025 /PRNewswire/ -- Keurig Dr Pepper (NASDAQ: KDP) today announced the appointment of Anthony DiSilvestro to the position of Chief Financial Officer, effective immediately.

Keurig® Transforms the At-Home Coffee Experience with the Debut of Keurig Coffee Collective - Its First Ever Branded Coffee Line

prnewswire.com

2025-11-24 09:00:00Powered by innovation, Keurig's newest product is expertly crafted in-house and available now in five bold roasts BURLINGTON, Mass. , Nov. 24, 2025 /PRNewswire/ -- Keurig®, the brand that transformed single-serve coffee, today expands its portfolio to the premium coffee category with the launch of Keurig Coffee Collective.

4 Ideal November Buys In Barron's 100 Sustainable Dividend Dogs Of 47 'Safer'

seekingalpha.com

2025-11-13 10:38:16Barron's 2025 list of 100 most sustainable companies highlights top ESG performers, with 82 paying dividends and 47 deemed "safer" by free cash flow metrics. Yield-based "dogcatcher" analysis identifies 10 high-yield ESG stocks, including RHI, IPG, GIS, HRL, CPB, RF, LKQ, AVNT, KDP, and GPK, with notable upside potential. Analyst forecasts project average net gains of 37.1% for the top ten ESG "dogs" by November 2026, with several stocks already at or near "fair price" levels.

Can KDP Sustain Its Growth Amid Cost Pressures & Coffee Headwinds?

zacks.com

2025-11-12 13:15:39KDP's strong beverage momentum offsets coffee softness and rising costs as innovation and scale drive long-term growth confidence.

Invesco Diversified Dividend Fund Q3 2025 Portfolio Positioning

seekingalpha.com

2025-11-12 03:58:00Dupont (DD) is a leading specialty chemical company in the process of spinning off its electronics business, which in our view should unlock shareholder value. KKR (KKR) is a leading private equity investment firm with a large portion of earnings coming from recurring revenue sources. Alcon (ALC) revenues fell short of consensus estimates for two consecutive quarters, and management lowered its full year revenue outlook.

Oakmark Concentrated Strategy: 6 Stocks That Raised Guidance And Drove Innovation

seekingalpha.com

2025-11-07 02:15:00Warner Bros Discovery reported merger with Paramount-Skydance could generate meaningful cost synergies and create a scaled competitor with a deep and unmatched content library. Innovations in the Google Search experience are driving both engagement and revenue benefits for Alphabet. IQVIA's R&D solutions business showed signs of gaining share, with its win rate improving significantly.

Keurig Dr Pepper Declares Quarterly Dividend

prnewswire.com

2025-12-09 16:15:00BURLINGTON, Mass. and FRISCO, Texas , Dec. 9, 2025 /PRNewswire/ -- Keurig Dr Pepper (NASDAQ: KDP) announced today that its Board of Directors has declared a regular quarterly cash dividend of $0.23 per share, payable in U.S. dollars, on the Company's common stock.

Dr Pepper Marks 18 Years of Impact with the Announcement of the 2025 Dr Pepper Tuition Giveaway Winners

prnewswire.com

2025-12-08 10:13:00Three College Students Each Awarded $100,000 in Tuition Funds FRISCO, Texas , Dec. 8, 2025 /PRNewswire/ -- Dr Pepper®, part of the Keurig Dr Pepper (NASDAQ: KDP) portfolio of brands, has announced the winners of the 18th annual Dr Pepper Tuition Giveaway, awarding three students each $100,000 in tuition funds during the three College Football Conference Championship games (SEC, Big Ten, ACC) on Saturday, December 6th. Six finalists participated in the Dr Pepper Tuition Giveaway where they competed against a peer to see who could throw the most footballs into an oversized Dr Pepper can in 30 seconds.

Keurig Dr Pepper, Inc $KDP Shares Sold by California Public Employees Retirement System

defenseworld.net

2025-12-08 04:44:59California Public Employees Retirement System lessened its position in Keurig Dr Pepper, Inc (NASDAQ: KDP) by 14.0% during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 4,476,530 shares of the company's stock after selling 728,454 shares during the period. California Public Employees Retirement System

Groupe la Francaise Acquires New Stake in Keurig Dr Pepper, Inc $KDP

defenseworld.net

2025-12-04 04:43:12Groupe la Francaise bought a new stake in shares of Keurig Dr Pepper, Inc (NASDAQ: KDP) in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 122,833 shares of the company's stock, valued at approximately $4,043,000. Other institutional investors also recently added

3 Interesting Buys Bill Nygren Made Last Quarter

247wallst.com

2025-12-02 11:25:40Bill Nygren's legendary Oakmark fund made some remarkable moves in the third quarter, to say the least.

Treat Yourself to a Crazy Good Coffee - The Original Donut Shop® and Pop-Tarts® Announce New Flavor Innovation Ahead of 2025 Pop-Tarts Bowl

prnewswire.com

2025-12-01 10:00:00A new dream team combines all the flavor and fun you expect from The Original Donut Shop® with the crave-worthy taste of Pop-Tarts® Brown Sugar Cinnamon. BURLINGTON, Mass.

Advisors Asset Management Inc. Boosts Stock Position in Keurig Dr Pepper, Inc $KDP

defenseworld.net

2025-12-01 03:16:56Advisors Asset Management Inc. raised its stake in shares of Keurig Dr Pepper, Inc (NASDAQ: KDP) by 6.3% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 38,851 shares of the company's stock after buying an additional 2,314 shares during the

Keurig Dr Pepper, Inc (NASDAQ:KDP) Given Consensus Recommendation of “Hold” by Brokerages

defenseworld.net

2025-12-01 01:46:45Keurig Dr Pepper, Inc (NASDAQ: KDP - Get Free Report) has earned a consensus rating of "Hold" from the nineteen analysts that are presently covering the firm, Marketbeat reports. Two analysts have rated the stock with a sell recommendation, seven have assigned a hold recommendation and ten have given a buy recommendation to the company. The

5 Soft Drink Stocks to Hold Their Ground As Cost Pressures Mount

zacks.com

2025-11-25 13:16:12About the Industry

Bill Nygren's Strategic Moves: Centene Corp Exits with a -2.14% Impact

gurufocus.com

2025-11-25 09:01:00Exploring Bill Nygren (Trades, Portfolio)'s Recent Investment Adjustments Bill Nygren (Trades, Portfolio) recently submitted the N-PORT filing for the third qu

Keurig Dr Pepper Appoints Anthony DiSilvestro as Chief Financial Officer

prnewswire.com

2025-11-25 07:30:00BURLINGTON, Mass. and FRISCO, Texas , Nov. 25, 2025 /PRNewswire/ -- Keurig Dr Pepper (NASDAQ: KDP) today announced the appointment of Anthony DiSilvestro to the position of Chief Financial Officer, effective immediately.

Keurig® Transforms the At-Home Coffee Experience with the Debut of Keurig Coffee Collective - Its First Ever Branded Coffee Line

prnewswire.com

2025-11-24 09:00:00Powered by innovation, Keurig's newest product is expertly crafted in-house and available now in five bold roasts BURLINGTON, Mass. , Nov. 24, 2025 /PRNewswire/ -- Keurig®, the brand that transformed single-serve coffee, today expands its portfolio to the premium coffee category with the launch of Keurig Coffee Collective.

4 Ideal November Buys In Barron's 100 Sustainable Dividend Dogs Of 47 'Safer'

seekingalpha.com

2025-11-13 10:38:16Barron's 2025 list of 100 most sustainable companies highlights top ESG performers, with 82 paying dividends and 47 deemed "safer" by free cash flow metrics. Yield-based "dogcatcher" analysis identifies 10 high-yield ESG stocks, including RHI, IPG, GIS, HRL, CPB, RF, LKQ, AVNT, KDP, and GPK, with notable upside potential. Analyst forecasts project average net gains of 37.1% for the top ten ESG "dogs" by November 2026, with several stocks already at or near "fair price" levels.

Can KDP Sustain Its Growth Amid Cost Pressures & Coffee Headwinds?

zacks.com

2025-11-12 13:15:39KDP's strong beverage momentum offsets coffee softness and rising costs as innovation and scale drive long-term growth confidence.

Invesco Diversified Dividend Fund Q3 2025 Portfolio Positioning

seekingalpha.com

2025-11-12 03:58:00Dupont (DD) is a leading specialty chemical company in the process of spinning off its electronics business, which in our view should unlock shareholder value. KKR (KKR) is a leading private equity investment firm with a large portion of earnings coming from recurring revenue sources. Alcon (ALC) revenues fell short of consensus estimates for two consecutive quarters, and management lowered its full year revenue outlook.

Oakmark Concentrated Strategy: 6 Stocks That Raised Guidance And Drove Innovation

seekingalpha.com

2025-11-07 02:15:00Warner Bros Discovery reported merger with Paramount-Skydance could generate meaningful cost synergies and create a scaled competitor with a deep and unmatched content library. Innovations in the Google Search experience are driving both engagement and revenue benefits for Alphabet. IQVIA's R&D solutions business showed signs of gaining share, with its win rate improving significantly.