OPENLANE, Inc. (KAR)

Price:

27.32 USD

( - -0.38 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Penske Automotive Group, Inc.

VALUE SCORE:

9

2nd position

Cars.com Inc.

VALUE SCORE:

10

The best

Asbury Automotive Group, Inc.

VALUE SCORE:

10

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

OPENLANE, Inc., together with its subsidiaries, operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom. The company operates through two segments, Marketplace and Finance. The Marketplace segment offers digital marketplace services for buying and selling used vehicles; and value-added ancillary services, including inbound and outbound transportation logistics, reconditioning, vehicle inspection and certification, titling, administrative, and collateral recovery services. Its digital marketplaces include OPENLANE platform, a mobile app enabled solutions that allows dealers to sell and source inventory. This segment sells its products and services through commercial fleet operators, financial institutions, rental car companies, new and used vehicle dealers, and vehicle manufacturers. The Finance segment offers floorplan financing, a short-term inventory-secured financing to independent vehicle dealers. It serves commercial customers, and franchise and independent dealer customers. The company was formerly known as KAR Auction Services, Inc. and changed its name to OPENLANE, Inc. in May 2023. OPENLANE, Inc. was incorporated in 2006 and is headquartered in Carmel, Indiana.

NEWS

OPENLANE Names Bill Wright Vice President of Investor Relations

prnewswire.com

2025-10-06 08:00:00Strengthens Leadership Bench With More Than 30 Years ofInvestor Relations and Financial Markets Experience CARMEL, Ind. , Oct. 6, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, announces the appointment of Bill Wright as Vice President of Investor Relations.

OPENLANE to Repurchase 53% of Series A Convertible Preferred Stock

prnewswire.com

2025-09-09 17:22:00CARMEL, Ind., Sept. 9, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, has reached definitive agreements to repurchase 53% of the Company's Series A Convertible Preferred Stock originally issued in June 2020.

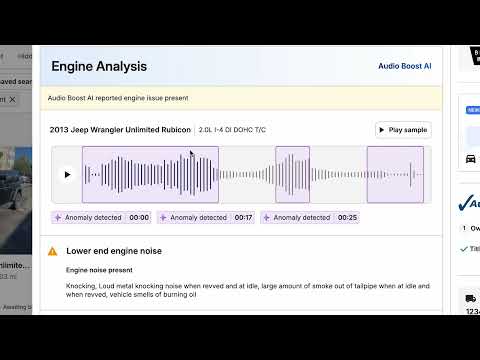

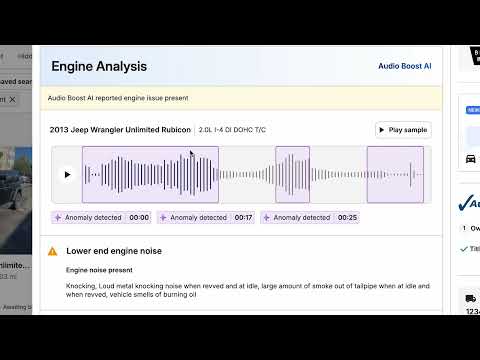

OPENLANE Launches Audio Boost AI for Faster, Easier Vehicle Evaluations

prnewswire.com

2025-09-03 08:30:00AI-Powered Tool Pinpoints Engine Sound Anomalies to Boost Dealer Confidence CARMEL, Ind. , Sept. 3, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, today announced the launch of Audio Boost AI, a groundbreaking new feature on OPENLANE's US marketplace designed to give dealers deeper confidence and speed when evaluating vehicles.

OPENLANE (KAR) Is Up 2.78% in One Week: What You Should Know

zacks.com

2025-08-29 13:01:32Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Openlane: Buy On Improving Industry Fundamentals And Debt Payoff (Upgrade)

seekingalpha.com

2025-08-14 12:50:02I am upgrading OPENLANE to Buy after strong Q2 2025 results, debt elimination, and a robust share repurchase program. KAR is delivering profitable growth, expanding its dealer network, and prioritizing digital marketplace capabilities and financing integration. The company boasts strong free cash flow, low stock-based compensation, and a $250 million buyback authorization through 2026.

Are You Looking for a Top Momentum Pick? Why OPENLANE (KAR) is a Great Choice

zacks.com

2025-08-13 13:01:15Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Openlane (KAR) Q2 Revenue Jumps 9%

fool.com

2025-08-06 21:35:23Openlane (KAR 15.70%), a leading digital marketplace operator for wholesale used vehicles, reported its second quarter 2025 earnings on August 6, 2025. The most notable news from the release was a significant beat on both the top and bottom line: GAAP revenue reached $482 million, handily outpacing the consensus estimate of $454.5 million.

OPENLANE, Inc. (KAR) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-06 14:04:39OPENLANE, Inc. (NYSE:KAR ) Q2 2025 Earnings Conference Call August 6, 2025 8:30 AM ET Company Participants Bradley Herring - Executive VP & CFO Itunu Orelaru - Head of Investor Relations Peter J. Kelly - CEO & Director Conference Call Participants Bret David Jordan - Jefferies LLC, Research Division Craig R.

OPENLANE (KAR) Tops Q2 Earnings and Revenue Estimates

zacks.com

2025-08-06 09:55:14OPENLANE (KAR) came out with quarterly earnings of $0.33 per share, beating the Zacks Consensus Estimate of $0.24 per share. This compares to earnings of $0.19 per share a year ago.

OPENLANE, Inc. Reports Second Quarter 2025 Financial Results

prnewswire.com

2025-08-06 07:45:00Marketplace dealer volume growth of 21% YoY Gross Merchandise Value (GMV) of approximately $7.5 billion, representing 10% YoY growth Revenue of $482 million, representing 9% YoY growth, driven by 24% growth in auction fee revenue Income from continuing operations of $33 million, representing 212% YoY growth Adjusted EBITDA of $87 million, representing 21% YoY growth Cash flow from operating activities of $72 million, representing 91% YoY growth Adjusted Free Cash Flow of $87 million, representing 34% YoY growth Raised full year guidance for Adjusted EBITDA and Operating Adjusted EPS CARMEL, Ind. , Aug. 6, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), today reported its second quarter financial results for the period ended June 30, 2025.

OPENLANE (KAR) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

zacks.com

2025-07-30 11:09:00OPENLANE (KAR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

5 Names With Relative Price Strength to Ride the Rally Now

zacks.com

2025-07-24 09:26:09WDC, FLS, KAR, AU and JBL show strong relative price strength as trade deals and economic data fuel the S&P 500 rally.

OPENLANE (KAR) is a Great Momentum Stock: Should You Buy?

zacks.com

2025-07-23 13:01:18Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

OPENLANE to Announce Second Quarter 2025 Earnings

prnewswire.com

2025-07-16 16:15:00CARMEL, Ind. , July 16, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, will release its second quarter 2025 financial results before the market opens on Wednesday, Aug. 6, 2025.

OPENLANE (KAR) Upgraded to Buy: Here's Why

zacks.com

2025-07-09 13:00:55OPENLANE (KAR) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

OPENLANE, Inc. (KAR) Q1 2025 Earnings Call Transcript

seekingalpha.com

2025-05-08 06:00:17OPENLANE, Inc. (NYSE:KAR ) Q1 2025 Earnings Conference Call May 7, 2025 5:00 PM ET Company Participants Jared Harnish - IR Peter Kelly - CEO Ryan Miller - VP of Finance, Marketplace Business Conference Call Participants Craig Kennison - Baird Rajat Gupta - JPMorgan Jeff Lick - Stephens Bret Jordan - Jefferies Operator Good day, and welcome to the OPENLANE's First Quarter 2025 Earnings Call. All participants will be in a listen-only mode.

OPENLANE Names Bill Wright Vice President of Investor Relations

prnewswire.com

2025-10-06 08:00:00Strengthens Leadership Bench With More Than 30 Years ofInvestor Relations and Financial Markets Experience CARMEL, Ind. , Oct. 6, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, announces the appointment of Bill Wright as Vice President of Investor Relations.

OPENLANE to Repurchase 53% of Series A Convertible Preferred Stock

prnewswire.com

2025-09-09 17:22:00CARMEL, Ind., Sept. 9, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, has reached definitive agreements to repurchase 53% of the Company's Series A Convertible Preferred Stock originally issued in June 2020.

OPENLANE Launches Audio Boost AI for Faster, Easier Vehicle Evaluations

prnewswire.com

2025-09-03 08:30:00AI-Powered Tool Pinpoints Engine Sound Anomalies to Boost Dealer Confidence CARMEL, Ind. , Sept. 3, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, today announced the launch of Audio Boost AI, a groundbreaking new feature on OPENLANE's US marketplace designed to give dealers deeper confidence and speed when evaluating vehicles.

OPENLANE (KAR) Is Up 2.78% in One Week: What You Should Know

zacks.com

2025-08-29 13:01:32Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Openlane: Buy On Improving Industry Fundamentals And Debt Payoff (Upgrade)

seekingalpha.com

2025-08-14 12:50:02I am upgrading OPENLANE to Buy after strong Q2 2025 results, debt elimination, and a robust share repurchase program. KAR is delivering profitable growth, expanding its dealer network, and prioritizing digital marketplace capabilities and financing integration. The company boasts strong free cash flow, low stock-based compensation, and a $250 million buyback authorization through 2026.

Are You Looking for a Top Momentum Pick? Why OPENLANE (KAR) is a Great Choice

zacks.com

2025-08-13 13:01:15Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Openlane (KAR) Q2 Revenue Jumps 9%

fool.com

2025-08-06 21:35:23Openlane (KAR 15.70%), a leading digital marketplace operator for wholesale used vehicles, reported its second quarter 2025 earnings on August 6, 2025. The most notable news from the release was a significant beat on both the top and bottom line: GAAP revenue reached $482 million, handily outpacing the consensus estimate of $454.5 million.

OPENLANE, Inc. (KAR) Q2 2025 Earnings Call Transcript

seekingalpha.com

2025-08-06 14:04:39OPENLANE, Inc. (NYSE:KAR ) Q2 2025 Earnings Conference Call August 6, 2025 8:30 AM ET Company Participants Bradley Herring - Executive VP & CFO Itunu Orelaru - Head of Investor Relations Peter J. Kelly - CEO & Director Conference Call Participants Bret David Jordan - Jefferies LLC, Research Division Craig R.

OPENLANE (KAR) Tops Q2 Earnings and Revenue Estimates

zacks.com

2025-08-06 09:55:14OPENLANE (KAR) came out with quarterly earnings of $0.33 per share, beating the Zacks Consensus Estimate of $0.24 per share. This compares to earnings of $0.19 per share a year ago.

OPENLANE, Inc. Reports Second Quarter 2025 Financial Results

prnewswire.com

2025-08-06 07:45:00Marketplace dealer volume growth of 21% YoY Gross Merchandise Value (GMV) of approximately $7.5 billion, representing 10% YoY growth Revenue of $482 million, representing 9% YoY growth, driven by 24% growth in auction fee revenue Income from continuing operations of $33 million, representing 212% YoY growth Adjusted EBITDA of $87 million, representing 21% YoY growth Cash flow from operating activities of $72 million, representing 91% YoY growth Adjusted Free Cash Flow of $87 million, representing 34% YoY growth Raised full year guidance for Adjusted EBITDA and Operating Adjusted EPS CARMEL, Ind. , Aug. 6, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), today reported its second quarter financial results for the period ended June 30, 2025.

OPENLANE (KAR) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

zacks.com

2025-07-30 11:09:00OPENLANE (KAR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

5 Names With Relative Price Strength to Ride the Rally Now

zacks.com

2025-07-24 09:26:09WDC, FLS, KAR, AU and JBL show strong relative price strength as trade deals and economic data fuel the S&P 500 rally.

OPENLANE (KAR) is a Great Momentum Stock: Should You Buy?

zacks.com

2025-07-23 13:01:18Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

OPENLANE to Announce Second Quarter 2025 Earnings

prnewswire.com

2025-07-16 16:15:00CARMEL, Ind. , July 16, 2025 /PRNewswire/ -- OPENLANE, Inc. (NYSE: KAR), a leading operator of digital marketplaces for wholesale used vehicles, will release its second quarter 2025 financial results before the market opens on Wednesday, Aug. 6, 2025.

OPENLANE (KAR) Upgraded to Buy: Here's Why

zacks.com

2025-07-09 13:00:55OPENLANE (KAR) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

OPENLANE, Inc. (KAR) Q1 2025 Earnings Call Transcript

seekingalpha.com

2025-05-08 06:00:17OPENLANE, Inc. (NYSE:KAR ) Q1 2025 Earnings Conference Call May 7, 2025 5:00 PM ET Company Participants Jared Harnish - IR Peter Kelly - CEO Ryan Miller - VP of Finance, Marketplace Business Conference Call Participants Craig Kennison - Baird Rajat Gupta - JPMorgan Jeff Lick - Stephens Bret Jordan - Jefferies Operator Good day, and welcome to the OPENLANE's First Quarter 2025 Earnings Call. All participants will be in a listen-only mode.