Jackson Financial Inc. (JXN)

Price:

116.84 USD

( + 3.92 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Jackson Financial Inc.

VALUE SCORE:

4

2nd position

Prudential Financial, Inc. 5.95

VALUE SCORE:

11

The best

Unum Group

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

Jackson Financial Inc., through its subsidiaries, primarily provides a suite of annuities to retail investors in the United States. The company operates through three segments: Retail Annuities, Institutional Products, and Closed Life and Annuity Blocks. The Retail Annuities segment offers various retirement income and savings products, including variable, fixed index, fixed, and immediate payout annuities, as well as registered index-linked annuities and lifetime income solutions. The Institutional Products segment provides traditional guaranteed investment contracts; funding agreements comprising agreements issued in conjunction with its participation in the U.S. federal home loan bank program; and medium-term funding agreement-backed notes. The Closed Life and Annuity Blocks segment offers various protection products, such as whole life, universal life, variable universal life, and term life insurance products, as well as fixed, fixed index, and payout annuities. This segment also provides a block of group payout annuities. The company also offers investment management services. It sells its products through a distribution network that includes independent broker-dealers, banks and other financial institutions, wirehouses and regional broker-dealers, and independent registered investment advisors, third-party platforms, and insurance agents. Jackson Financial Inc. was formerly known as Brooke (Holdco1) Inc. and changed its name to Jackson Financial Inc. in July 2020. The company was incorporated in 2006 and is headquartered in Lansing, Michigan.

NEWS

Counterpoint Mutual Funds LLC Has $347,000 Position in Jackson Financial Inc. $JXN

defenseworld.net

2026-02-26 04:44:41Counterpoint Mutual Funds LLC lowered its holdings in Jackson Financial Inc. (NYSE: JXN) by 58.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 3,429 shares of the company's stock after selling 4,778 shares during the quarter. Counterpoint

Jackson Financial Inc. (JXN) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-02-19 13:15:11Jackson Financial Inc. (JXN) Q4 2025 Earnings Call Transcript

Jackson Announces Excellent Fourth Quarter and Full Year 2025 Results

businesswire.com

2026-02-18 16:15:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc. (NYSE: JXN) (Jackson®) today announced its financial results for the fourth quarter and full year ended December 31, 2025. Fourth Quarter 2025 Key Highlights Record retail annuity sales1 of $5.9 billion in the fourth quarter of 2025, up 27% from the fourth quarter of 2024, reflecting continued strong demand across our product suite Variable annuity sales1 of $2.8 billion were up 1% from the fourth quarter of 2024, reflecting higher sales o.

Jackson Announces Increase to First Quarter 2026 Common Stock Dividend

businesswire.com

2026-02-18 16:14:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc.1 (Jackson®) announced its Board of Directors has declared a cash dividend of $0.90 per share of common stock (NYSE: JXN) for the first quarter of 2026, reflecting a 12.5% increase over the fourth quarter 2025 dividend level. This is the fifth annual increase to the dividend since becoming an independent company. The dividend on the common stock will be payable on March 26, 2026, to shareholders of record at the close of business on March 1.

Brokerages Set Jackson Financial Inc. (NYSE:JXN) PT at $113.00

defenseworld.net

2026-02-16 01:58:52Jackson Financial Inc. (NYSE: JXN - Get Free Report) has been given a consensus rating of "Hold" by the seven analysts that are covering the firm, MarketBeat.com reports. Five research analysts have rated the stock with a hold recommendation, one has issued a buy recommendation and one has assigned a strong buy recommendation to the company.

Four Tree Island Advisory LLC Purchases 7,394 Shares of Jackson Financial Inc. $JXN

defenseworld.net

2026-02-15 05:00:53Four Tree Island Advisory LLC lifted its position in Jackson Financial Inc. (NYSE: JXN) by 3.4% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 223,947 shares of the company's stock after purchasing an additional 7,394 shares during the quarter. Jackson

Jackson Financial: Still Cheap After A Triple-Digit Run, Preferreds Closer To Rate Reset

seekingalpha.com

2026-02-13 05:17:25Jackson Financial remains undervalued despite big gains; trades below book value. Recent earnings strength leaned on volatile net investment income and lower expenses. Series A preferred pays ~7.6% now; the reset feature reduces long-term rate risk.

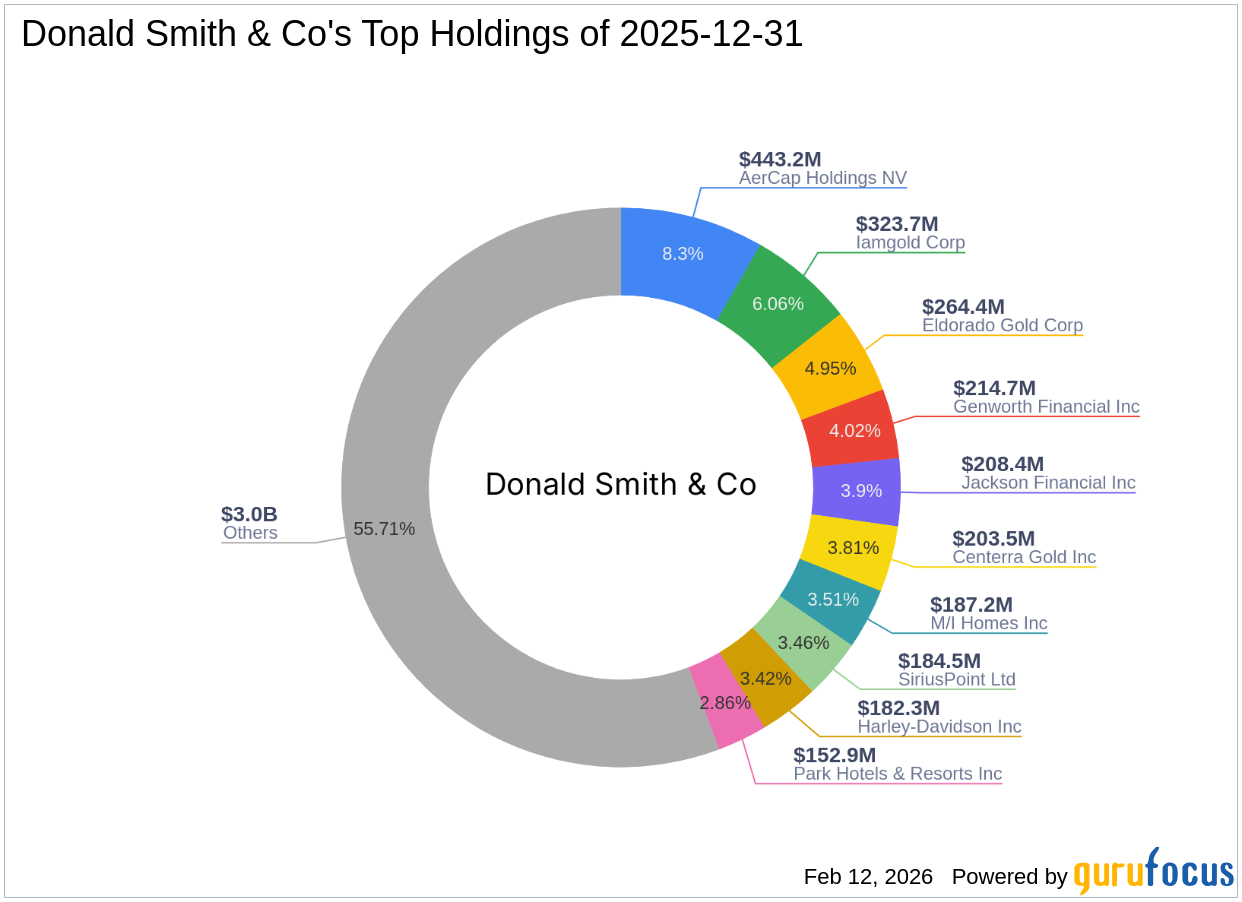

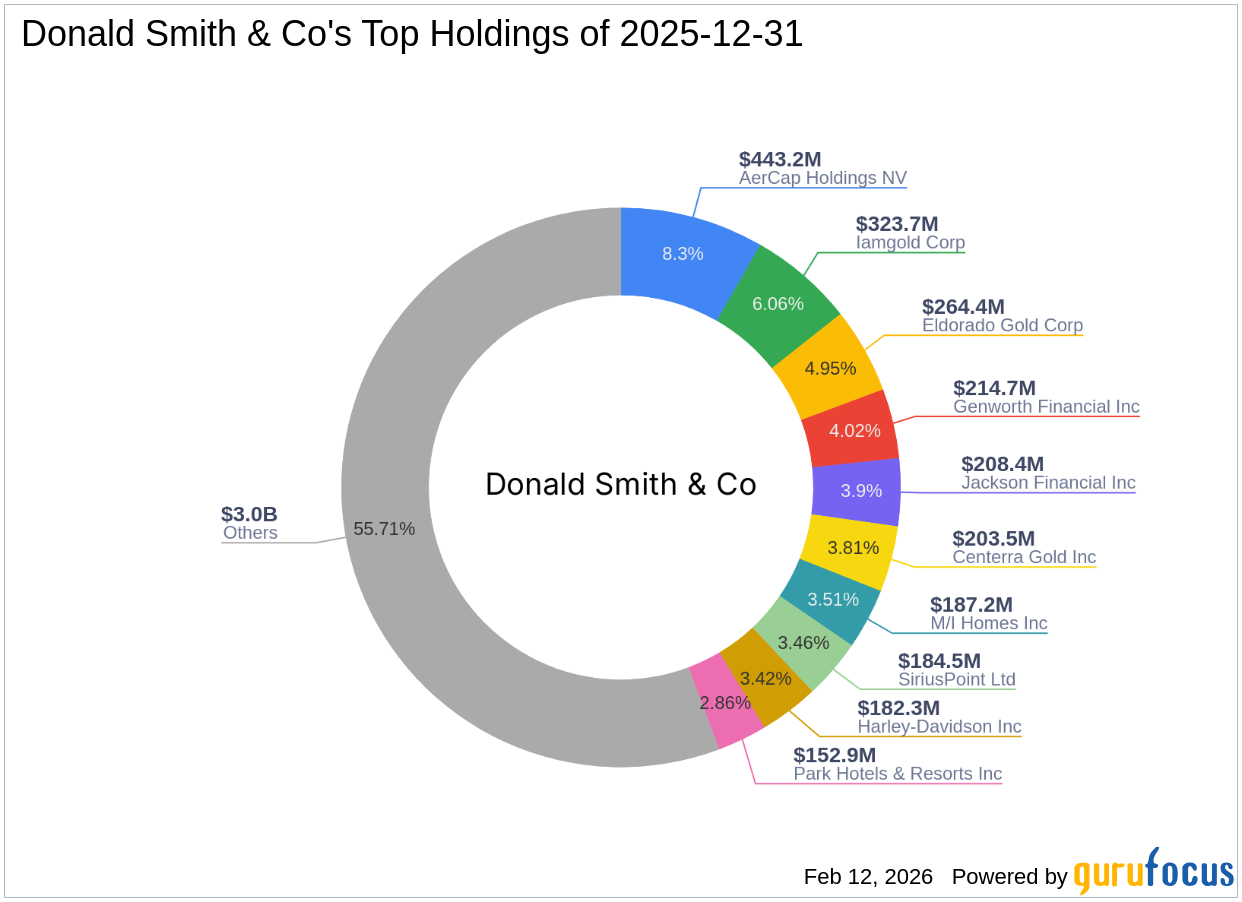

Donald Smith & Co's Strategic Moves: Equinox Gold Corp Sees a -2.9% Impact

gurufocus.com

2026-02-12 11:03:00Analyzing the Fourth Quarter 2025 13F Filing Donald Smith and Co (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing

Jackson Financial Inc. $JXN Shares Sold by Caisse Des Depots ET Consignations

defenseworld.net

2026-02-12 05:18:51Caisse Des Depots ET Consignations trimmed its holdings in Jackson Financial Inc. (NYSE: JXN) by 58.5% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 17,780 shares of the company's stock after selling 25,063 shares during the quarter. Caisse Des Depots ET

Jackson Financial Inc. and TPG Inc. Announce Launch of Long-Term Strategic Partnership

businesswire.com

2026-02-11 16:15:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc.1 (NYSE: JXN) (Jackson®) announced today the closing of the previously announced long-term strategic partnership with TPG Inc. (NASDAQ: TPG). The partnership includes a $500 million common equity investment from TPG to help accelerate Jackson's growth in its spread-based business and provide flexibility for future innovative insurance solutions. Jackson and TPG established a non-exclusive investment management arrangement with a 10-year ini.

TPG and Jackson Financial Inc. Announce Launch of Long-Term Strategic Partnership

businesswire.com

2026-02-11 16:15:00SAN FRANCISCO & FORT WORTH, Texas--(BUSINESS WIRE)--TPG Inc. (NASDAQ: TPG), a leading global alternative asset management firm, today announced the closing of the previously announced long-term strategic investment management partnership with Jackson Financial Inc. (NYSE: JXN) (Jackson®), a leading U.S. retirement services firm. Under the agreement, which was first announced by TPG and Jackson on January 6, 2026, TPG will manage a minimum commitment of $12 billion of AUM for Jackson, with econo.

Allianz Asset Management GmbH Has $39.63 Million Stake in Jackson Financial Inc. $JXN

defenseworld.net

2026-02-06 04:22:49Allianz Asset Management GmbH lowered its stake in shares of Jackson Financial Inc. (NYSE: JXN) by 33.3% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 391,469 shares of the company's stock after selling 195,603 shares during the quarter.

Federated Hermes Inc. Raises Holdings in Jackson Financial Inc. $JXN

defenseworld.net

2026-01-29 04:26:45Federated Hermes Inc. boosted its position in Jackson Financial Inc. (NYSE: JXN) by 6.4% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 854,435 shares of the company's stock after acquiring an additional 51,494 shares during the quarter. Federated Hermes Inc. owned 1.23%

Jackson Financial Inc. (NYSE:JXN) Receives $113.00 Average PT from Analysts

defenseworld.net

2026-01-22 01:15:05Jackson Financial Inc. (NYSE: JXN - Get Free Report) has been given an average recommendation of "Hold" by the seven brokerages that are currently covering the stock, MarketBeat reports. Five research analysts have rated the stock with a hold recommendation, one has given a buy recommendation and one has given a strong buy recommendation to the

Jackson to Report Fourth Quarter and Full-Year 2025 Financial Results and Provide 2026 Outlook on February 18

businesswire.com

2026-01-20 16:15:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc.1 (NYSE: JXN) (Jackson®) today announced that it will release fourth quarter and full year 2025 financial results after market close on Wednesday, February 18, 2026. Jackson's press release and supplemental financial materials will be available at investors.jackson.com. Jackson will host a conference call and webcast at 10 a.m. ET on Thursday, February 19, 2026, to review the results and discuss the Company's 2026 outlook. The live webcast.

TPG: Jackson Financial Deal A Positive But Valuation Now Less Compelling (Ratings Downgrade)

seekingalpha.com

2026-01-13 21:09:04TPG Inc. (TPG) is downgraded to Buy from Strong Buy after a 42% total return since May 2025, due in part to reduced relative valuation appeal. The strategic partnership with Jackson Financial adds a minimum of $12B AUM, preserves TPG's capital light business model, and will significantly strengthen TPG's insurance asset management business. TPG shares continue to trade at an attractive valuation relative to the broader market.

Counterpoint Mutual Funds LLC Has $347,000 Position in Jackson Financial Inc. $JXN

defenseworld.net

2026-02-26 04:44:41Counterpoint Mutual Funds LLC lowered its holdings in Jackson Financial Inc. (NYSE: JXN) by 58.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 3,429 shares of the company's stock after selling 4,778 shares during the quarter. Counterpoint

Jackson Financial Inc. (JXN) Q4 2025 Earnings Call Transcript

seekingalpha.com

2026-02-19 13:15:11Jackson Financial Inc. (JXN) Q4 2025 Earnings Call Transcript

Jackson Announces Excellent Fourth Quarter and Full Year 2025 Results

businesswire.com

2026-02-18 16:15:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc. (NYSE: JXN) (Jackson®) today announced its financial results for the fourth quarter and full year ended December 31, 2025. Fourth Quarter 2025 Key Highlights Record retail annuity sales1 of $5.9 billion in the fourth quarter of 2025, up 27% from the fourth quarter of 2024, reflecting continued strong demand across our product suite Variable annuity sales1 of $2.8 billion were up 1% from the fourth quarter of 2024, reflecting higher sales o.

Jackson Announces Increase to First Quarter 2026 Common Stock Dividend

businesswire.com

2026-02-18 16:14:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc.1 (Jackson®) announced its Board of Directors has declared a cash dividend of $0.90 per share of common stock (NYSE: JXN) for the first quarter of 2026, reflecting a 12.5% increase over the fourth quarter 2025 dividend level. This is the fifth annual increase to the dividend since becoming an independent company. The dividend on the common stock will be payable on March 26, 2026, to shareholders of record at the close of business on March 1.

Brokerages Set Jackson Financial Inc. (NYSE:JXN) PT at $113.00

defenseworld.net

2026-02-16 01:58:52Jackson Financial Inc. (NYSE: JXN - Get Free Report) has been given a consensus rating of "Hold" by the seven analysts that are covering the firm, MarketBeat.com reports. Five research analysts have rated the stock with a hold recommendation, one has issued a buy recommendation and one has assigned a strong buy recommendation to the company.

Four Tree Island Advisory LLC Purchases 7,394 Shares of Jackson Financial Inc. $JXN

defenseworld.net

2026-02-15 05:00:53Four Tree Island Advisory LLC lifted its position in Jackson Financial Inc. (NYSE: JXN) by 3.4% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 223,947 shares of the company's stock after purchasing an additional 7,394 shares during the quarter. Jackson

Jackson Financial: Still Cheap After A Triple-Digit Run, Preferreds Closer To Rate Reset

seekingalpha.com

2026-02-13 05:17:25Jackson Financial remains undervalued despite big gains; trades below book value. Recent earnings strength leaned on volatile net investment income and lower expenses. Series A preferred pays ~7.6% now; the reset feature reduces long-term rate risk.

Donald Smith & Co's Strategic Moves: Equinox Gold Corp Sees a -2.9% Impact

gurufocus.com

2026-02-12 11:03:00Analyzing the Fourth Quarter 2025 13F Filing Donald Smith and Co (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing

Jackson Financial Inc. $JXN Shares Sold by Caisse Des Depots ET Consignations

defenseworld.net

2026-02-12 05:18:51Caisse Des Depots ET Consignations trimmed its holdings in Jackson Financial Inc. (NYSE: JXN) by 58.5% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 17,780 shares of the company's stock after selling 25,063 shares during the quarter. Caisse Des Depots ET

Jackson Financial Inc. and TPG Inc. Announce Launch of Long-Term Strategic Partnership

businesswire.com

2026-02-11 16:15:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc.1 (NYSE: JXN) (Jackson®) announced today the closing of the previously announced long-term strategic partnership with TPG Inc. (NASDAQ: TPG). The partnership includes a $500 million common equity investment from TPG to help accelerate Jackson's growth in its spread-based business and provide flexibility for future innovative insurance solutions. Jackson and TPG established a non-exclusive investment management arrangement with a 10-year ini.

TPG and Jackson Financial Inc. Announce Launch of Long-Term Strategic Partnership

businesswire.com

2026-02-11 16:15:00SAN FRANCISCO & FORT WORTH, Texas--(BUSINESS WIRE)--TPG Inc. (NASDAQ: TPG), a leading global alternative asset management firm, today announced the closing of the previously announced long-term strategic investment management partnership with Jackson Financial Inc. (NYSE: JXN) (Jackson®), a leading U.S. retirement services firm. Under the agreement, which was first announced by TPG and Jackson on January 6, 2026, TPG will manage a minimum commitment of $12 billion of AUM for Jackson, with econo.

Allianz Asset Management GmbH Has $39.63 Million Stake in Jackson Financial Inc. $JXN

defenseworld.net

2026-02-06 04:22:49Allianz Asset Management GmbH lowered its stake in shares of Jackson Financial Inc. (NYSE: JXN) by 33.3% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 391,469 shares of the company's stock after selling 195,603 shares during the quarter.

Federated Hermes Inc. Raises Holdings in Jackson Financial Inc. $JXN

defenseworld.net

2026-01-29 04:26:45Federated Hermes Inc. boosted its position in Jackson Financial Inc. (NYSE: JXN) by 6.4% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 854,435 shares of the company's stock after acquiring an additional 51,494 shares during the quarter. Federated Hermes Inc. owned 1.23%

Jackson Financial Inc. (NYSE:JXN) Receives $113.00 Average PT from Analysts

defenseworld.net

2026-01-22 01:15:05Jackson Financial Inc. (NYSE: JXN - Get Free Report) has been given an average recommendation of "Hold" by the seven brokerages that are currently covering the stock, MarketBeat reports. Five research analysts have rated the stock with a hold recommendation, one has given a buy recommendation and one has given a strong buy recommendation to the

Jackson to Report Fourth Quarter and Full-Year 2025 Financial Results and Provide 2026 Outlook on February 18

businesswire.com

2026-01-20 16:15:00LANSING, Mich.--(BUSINESS WIRE)--Jackson Financial Inc.1 (NYSE: JXN) (Jackson®) today announced that it will release fourth quarter and full year 2025 financial results after market close on Wednesday, February 18, 2026. Jackson's press release and supplemental financial materials will be available at investors.jackson.com. Jackson will host a conference call and webcast at 10 a.m. ET on Thursday, February 19, 2026, to review the results and discuss the Company's 2026 outlook. The live webcast.

TPG: Jackson Financial Deal A Positive But Valuation Now Less Compelling (Ratings Downgrade)

seekingalpha.com

2026-01-13 21:09:04TPG Inc. (TPG) is downgraded to Buy from Strong Buy after a 42% total return since May 2025, due in part to reduced relative valuation appeal. The strategic partnership with Jackson Financial adds a minimum of $12B AUM, preserves TPG's capital light business model, and will significantly strengthen TPG's insurance asset management business. TPG shares continue to trade at an attractive valuation relative to the broader market.