James River Group Holdings, Ltd. (JRVR)

Price:

6.84 USD

( + 0.10 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

AMERISAFE, Inc.

VALUE SCORE:

5

2nd position

AIFU Inc.

VALUE SCORE:

9

The best

NMI Holdings, Inc.

VALUE SCORE:

11

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

James River Group Holdings, Ltd., through its subsidiaries, provides specialty insurance and reinsurance services in the United States. It operates through Excess and Surplus Lines, Specialty Admitted Insurance, and Casualty Reinsurance segments. The Excess and Surplus Lines segment underwrites liability and property insurance on an excess and surplus commercial lines basis in all states and the District of Columbia. This segment distributes its insurance policies primarily through wholesale insurance brokers. The Specialty Admitted Insurance segment provides workers' compensation coverage for building trades, healthcare employees, goods and services, light manufacturing, specialty transportation, and agriculture, as well as fronting and program business. The Casualty Reinsurance segment offers proportional and working layer casualty reinsurance to third parties and other insurance companies. James River Group Holdings, Ltd. was founded in 2002 and is headquartered in Pembroke, Bermuda.

NEWS

JRVR, BCAL and More Are Now Strong Buy Stocks (Dec. 11)

zacks.com

2025-12-11 07:15:57PDLB, JRVR, BCAL, UHS and WAY have been added to the Zacks Rank #1 (Strong Buy) List on December 11th, 2025.

Head-To-Head Contrast: James River Group (NASDAQ:JRVR) vs. Amacore Group (OTCMKTS:ACGI)

defenseworld.net

2025-12-02 02:54:45Amacore Group (OTCMKTS:ACGI - Get Free Report) and James River Group (NASDAQ: JRVR - Get Free Report) are both finance companies, but which is the better stock? We will contrast the two businesses based on the strength of their dividends, valuation, risk, earnings, profitability, institutional ownership and analyst recommendations. Institutional and Insider Ownership 95.2% of James

What Makes James River Group (JRVR) a Strong Momentum Stock: Buy Now?

zacks.com

2025-11-26 13:01:22Does James River Group (JRVR) have what it takes to be a top stock pick for momentum investors? Let's find out.

New Strong Buy Stocks for Nov. 26: JRVR, CMC, and More

zacks.com

2025-11-26 05:36:14WTBA, JRVR, CMC, PAAS and AEM have been added to the Zacks Rank #1 (Strong Buy) List on Nov. 26, 2025.

Best Value Stocks to Buy for Nov. 26

zacks.com

2025-11-26 05:16:05CMC, AA and JRVR made it to the Zacks Rank #1 (Strong Buy) value stocks list on Nov. 26, 2025.

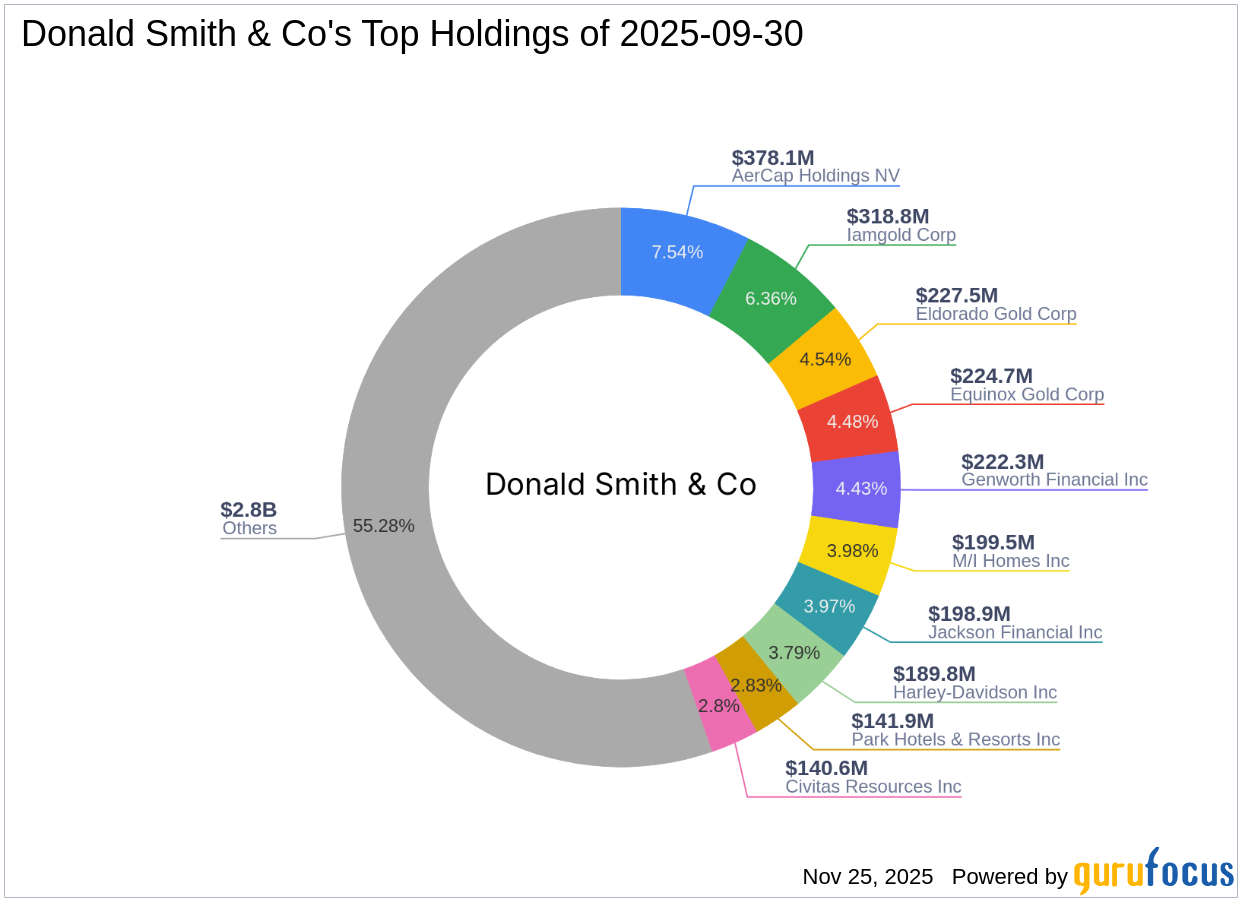

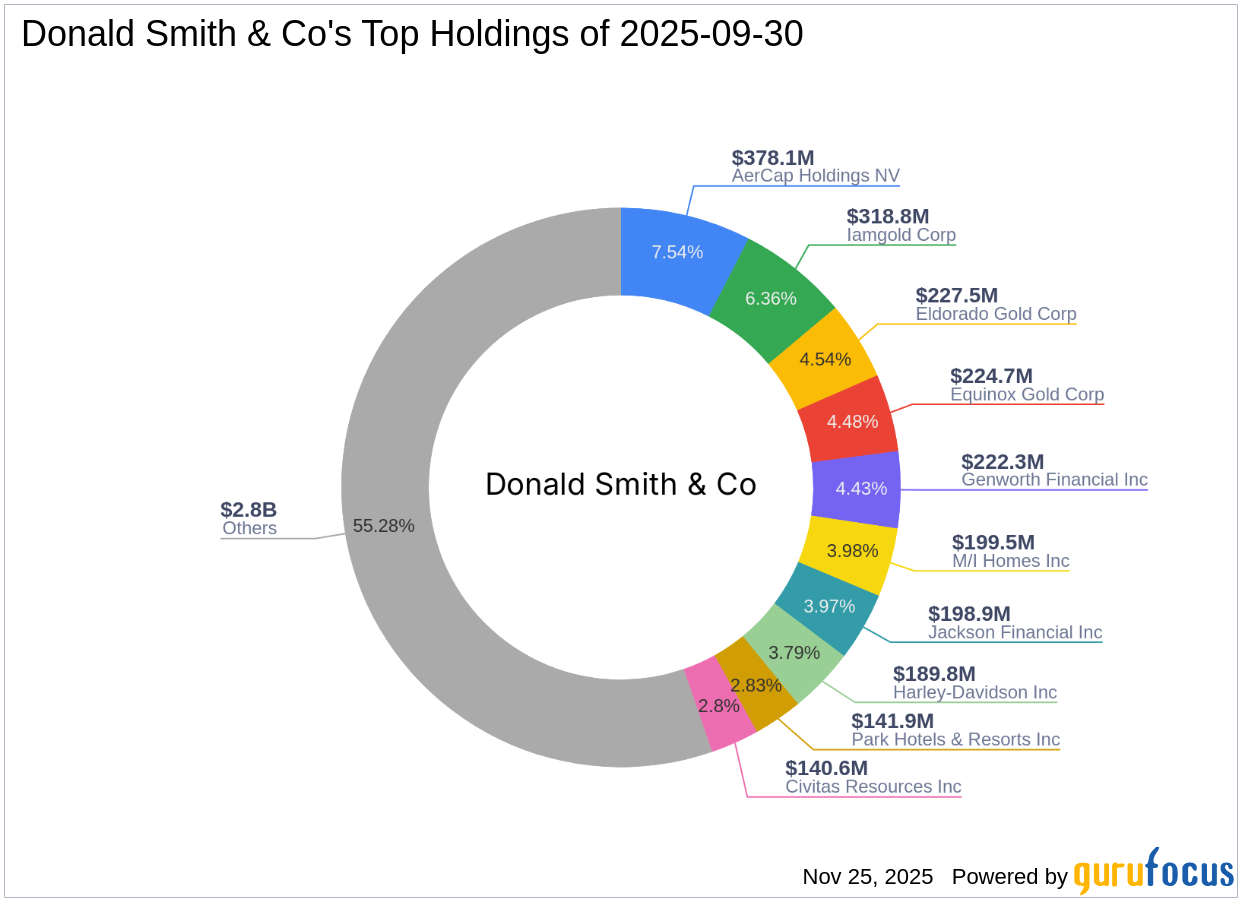

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Analysts Set James River Group Holdings, Ltd. (NASDAQ:JRVR) Price Target at $6.06

defenseworld.net

2025-11-25 01:04:52James River Group Holdings, Ltd. (NASDAQ: JRVR - Get Free Report) has been given a consensus rating of "Hold" by the seven analysts that are currently covering the firm, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell rating, three have issued a hold rating, two have given a buy rating and

Reviewing James River Group (NASDAQ:JRVR) & Allianz (OTCMKTS:ALIZY)

defenseworld.net

2025-11-19 03:10:57James River Group (NASDAQ: JRVR - Get Free Report) and Allianz (OTCMKTS:ALIZY - Get Free Report) are both finance companies, but which is the better business? We will contrast the two businesses based on the strength of their institutional ownership, dividends, analyst recommendations, profitability, earnings, valuation and risk. Profitability This table compares James River Group and

Does James River Group (JRVR) Have the Potential to Rally 26.75% as Wall Street Analysts Expect?

zacks.com

2025-11-17 10:56:14The mean of analysts' price targets for James River Group (JRVR) points to a 26.8% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

James River Group Holdings, Ltd. (JRVR) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-04 15:36:29James River Group Holdings, Ltd. ( JRVR ) Q3 2025 Earnings Call November 4, 2025 9:00 AM EST Company Participants Bob Zimardo - Senior VP for Investments & Investor Relations Frank D'Orazio - CEO & Director Sarah Doran - Chief Financial Officer Conference Call Participants Mark Hughes - Truist Securities, Inc., Research Division Brian Meredith - UBS Investment Bank, Research Division Presentation Operator Good morning.

James River Recruits Georgia Collier and Matt Sinosky, Completing E&S Leadership Reorganization

globenewswire.com

2025-10-06 08:30:00PEMBROKE, Bermuda, Oct. 06, 2025 (GLOBE NEWSWIRE) -- James River Group Holdings, Ltd. ("James River" or the "Company") (NASDAQ: JRVR) today announced the appointments of Georgia Collier and Matt Sinosky to its Excess and Surplus (“E&S”) leadership team, each reporting to Todd Sutherland, President of E&S. These two appointments support James River's continued momentum to capture market opportunities and drive its next phase of profitable growth.

Best Value Stock to Buy for October 1st

zacks.com

2025-10-01 10:06:07JRVR, PAGS and STNE made it to the Zacks Rank #1 (Strong Buy) value stocks list on October 1, 2025.

New Strong Buy Stocks for September 23rd

zacks.com

2025-09-23 06:16:07BHB, VEON, FCF, MUFG and JRVR have been added to the Zacks Rank #1 (Strong Buy) List on September 23, 2025.

Best Value Stocks to Buy for September 23rd

zacks.com

2025-09-23 05:41:13VEON, KT and JRVR made it to the Zacks Rank #1 (Strong Buy) value stocks list on September 23, 2025.

Best Momentum Stocks to Buy for September 10th

zacks.com

2025-09-10 11:01:08JRVR, SFD and CRDO made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on September 10, 2025.

New Strong Buy Stocks for September 10th

zacks.com

2025-09-10 07:01:06JRVR, SITE, EVR, TRMK and CZFS have been added to the Zacks Rank #1 (Strong Buy) List on September 10, 2025.

JRVR, BCAL and More Are Now Strong Buy Stocks (Dec. 11)

zacks.com

2025-12-11 07:15:57PDLB, JRVR, BCAL, UHS and WAY have been added to the Zacks Rank #1 (Strong Buy) List on December 11th, 2025.

Head-To-Head Contrast: James River Group (NASDAQ:JRVR) vs. Amacore Group (OTCMKTS:ACGI)

defenseworld.net

2025-12-02 02:54:45Amacore Group (OTCMKTS:ACGI - Get Free Report) and James River Group (NASDAQ: JRVR - Get Free Report) are both finance companies, but which is the better stock? We will contrast the two businesses based on the strength of their dividends, valuation, risk, earnings, profitability, institutional ownership and analyst recommendations. Institutional and Insider Ownership 95.2% of James

What Makes James River Group (JRVR) a Strong Momentum Stock: Buy Now?

zacks.com

2025-11-26 13:01:22Does James River Group (JRVR) have what it takes to be a top stock pick for momentum investors? Let's find out.

New Strong Buy Stocks for Nov. 26: JRVR, CMC, and More

zacks.com

2025-11-26 05:36:14WTBA, JRVR, CMC, PAAS and AEM have been added to the Zacks Rank #1 (Strong Buy) List on Nov. 26, 2025.

Best Value Stocks to Buy for Nov. 26

zacks.com

2025-11-26 05:16:05CMC, AA and JRVR made it to the Zacks Rank #1 (Strong Buy) value stocks list on Nov. 26, 2025.

Donald Smith & Co's Strategic Moves: Honda Motor Co Ltd Takes Center Stage

gurufocus.com

2025-11-25 11:02:00Exploring the Latest 13F Filing and Investment Strategies Donald Smith and Co (Trades, Portfolio) recently submitted its 13F filing for the third quarter of 2025

Analysts Set James River Group Holdings, Ltd. (NASDAQ:JRVR) Price Target at $6.06

defenseworld.net

2025-11-25 01:04:52James River Group Holdings, Ltd. (NASDAQ: JRVR - Get Free Report) has been given a consensus rating of "Hold" by the seven analysts that are currently covering the firm, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell rating, three have issued a hold rating, two have given a buy rating and

Reviewing James River Group (NASDAQ:JRVR) & Allianz (OTCMKTS:ALIZY)

defenseworld.net

2025-11-19 03:10:57James River Group (NASDAQ: JRVR - Get Free Report) and Allianz (OTCMKTS:ALIZY - Get Free Report) are both finance companies, but which is the better business? We will contrast the two businesses based on the strength of their institutional ownership, dividends, analyst recommendations, profitability, earnings, valuation and risk. Profitability This table compares James River Group and

Does James River Group (JRVR) Have the Potential to Rally 26.75% as Wall Street Analysts Expect?

zacks.com

2025-11-17 10:56:14The mean of analysts' price targets for James River Group (JRVR) points to a 26.8% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

James River Group Holdings, Ltd. (JRVR) Q3 2025 Earnings Call Transcript

seekingalpha.com

2025-11-04 15:36:29James River Group Holdings, Ltd. ( JRVR ) Q3 2025 Earnings Call November 4, 2025 9:00 AM EST Company Participants Bob Zimardo - Senior VP for Investments & Investor Relations Frank D'Orazio - CEO & Director Sarah Doran - Chief Financial Officer Conference Call Participants Mark Hughes - Truist Securities, Inc., Research Division Brian Meredith - UBS Investment Bank, Research Division Presentation Operator Good morning.

James River Recruits Georgia Collier and Matt Sinosky, Completing E&S Leadership Reorganization

globenewswire.com

2025-10-06 08:30:00PEMBROKE, Bermuda, Oct. 06, 2025 (GLOBE NEWSWIRE) -- James River Group Holdings, Ltd. ("James River" or the "Company") (NASDAQ: JRVR) today announced the appointments of Georgia Collier and Matt Sinosky to its Excess and Surplus (“E&S”) leadership team, each reporting to Todd Sutherland, President of E&S. These two appointments support James River's continued momentum to capture market opportunities and drive its next phase of profitable growth.

Best Value Stock to Buy for October 1st

zacks.com

2025-10-01 10:06:07JRVR, PAGS and STNE made it to the Zacks Rank #1 (Strong Buy) value stocks list on October 1, 2025.

New Strong Buy Stocks for September 23rd

zacks.com

2025-09-23 06:16:07BHB, VEON, FCF, MUFG and JRVR have been added to the Zacks Rank #1 (Strong Buy) List on September 23, 2025.

Best Value Stocks to Buy for September 23rd

zacks.com

2025-09-23 05:41:13VEON, KT and JRVR made it to the Zacks Rank #1 (Strong Buy) value stocks list on September 23, 2025.

Best Momentum Stocks to Buy for September 10th

zacks.com

2025-09-10 11:01:08JRVR, SFD and CRDO made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on September 10, 2025.

New Strong Buy Stocks for September 10th

zacks.com

2025-09-10 07:01:06JRVR, SITE, EVR, TRMK and CZFS have been added to the Zacks Rank #1 (Strong Buy) List on September 10, 2025.