Nuveen Multi-Market Income Fund (JMM)

Price:

6.37 USD

( + 0.07 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

Eaton Vance Tax-Managed Global Diversified Equity Income Fund

VALUE SCORE:

9

2nd position

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

The best

The Gabelli Dividend & Income Trust

VALUE SCORE:

13

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Nuveen Multi-Market Income Fund is a closed-ended fixed income mutual fund launched by Nuveen Investments, Inc. The fund is co-managed by Nuveen Fund Advisors LLC and Nuveen Asset Management, LLC. It invests in the fixed income markets of the United States. The fund seeks to invest in securities of companies operating across diversified sectors. It primarily invests in investment grade debt securities such as U.S. agency and privately issued mortgage-backed securities, corporate debt securities, and asset-backed securities. The fund was formerly known as American Income Fund, Inc. Nuveen Multi-Market Income Fund was formed on December 30, 1988 and is domiciled in the United States.

NEWS

Nuveen Closed-End Funds Declare Distributions and Updates to Distribution Policies

businesswire.com

2023-12-01 16:15:00NEW YORK--(BUSINESS WIRE)--Nuveen Closed-End Funds today announced that the Board of Trustees of the Funds has approved the regular monthly and quarterly distributions. In addition, the Board of Trustees has approved updated distribution polices described below under “Monthly & Quarterly Distributions” for The Nuveen Preferred & Income Opportunities Fund (NYSE: JPC), Nuveen Preferred and Income Term Fund (NYSE: JPI), Nuveen Variable Rate Preferred & Income Fund (NYSE: NPFD), Nuveen.

The Quality Closed-End Fund Report, January 2021

seekingalpha.com

2021-02-02 04:34:49Only funds with coverage >100% are considered. Top lists of discount, yield, DxY and DxYxZ are given. The top DxY funds are NHF, ARDC and KIO.

Building Resilient CEF Portfolios

seekingalpha.com

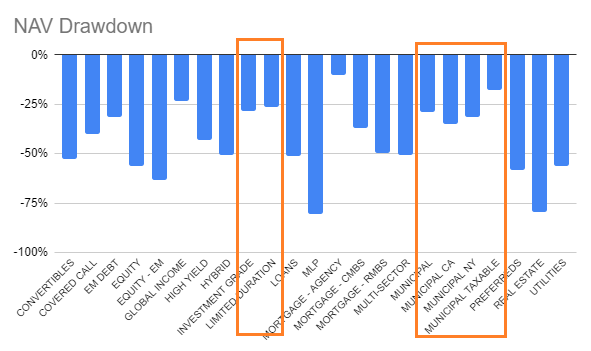

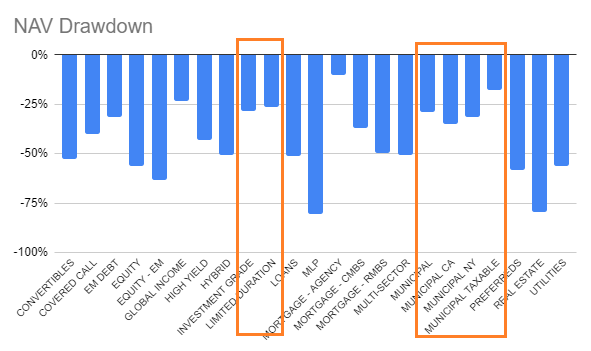

2020-07-31 10:08:06We discuss strategies for income investors that can be used to build more resilient CEF portfolios. These strategies include allocating to higher-quality sectors, choosing CEFs with more robust leverage instruments, allocating to term CEFs and others.

Performance

seekingalpha.com

2020-07-15 09:35:16There are appreciation plays, mostly dominated by hi-tech, or cash flow plays, mostly dominated by closed-end funds that pay dividends monthly.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Participa

em.com

2020-06-06 15:40:00O Brasil perdeu peso importante nas carteiras de investidores estrangeiros em meio ao aumento do risco pol

De l’or obligataire

allnews.ch

2020-06-03 05:00:00Aujourd’hui la déflation, demain l’inflation: les craintes des marchés appellent une réponse tactique de couverture. Le point avec Eric Vanraes.

Bolsonaro atribui imagem ruim

em.com

2020-05-25 18:00:00O presidente da Rep

Postura frente

em.com

2020-05-25 15:05:00

Nuveen Closed-End Funds Announce Postponement of Annual Meeting of Shareholders Originally Scheduled for April 8, 2020 and Change to a Virtual Meeting

finance.yahoo.com

2020-04-02 20:30:00The following Nuveen closed-end funds (each, a "Fund" and collectively, the "Funds") announced today that each Fund’s 2020 Annual Meeting of Shareholders (the "Meeting") has been postponed and that the meeting will be held as a virtual meeting:

View: Robust, liquid & deep financial markets will lead to $5t goal

economictimes.indiatimes.com

2020-03-16 11:57:00The proposal to increase FPI limits in corporate bonds from the current 9% of outstanding to 15% also underscores the importance being assigned to capital markets.

Nuveen Closed-End Funds Declare Distributions and Updates to Distribution Policies

businesswire.com

2023-12-01 16:15:00NEW YORK--(BUSINESS WIRE)--Nuveen Closed-End Funds today announced that the Board of Trustees of the Funds has approved the regular monthly and quarterly distributions. In addition, the Board of Trustees has approved updated distribution polices described below under “Monthly & Quarterly Distributions” for The Nuveen Preferred & Income Opportunities Fund (NYSE: JPC), Nuveen Preferred and Income Term Fund (NYSE: JPI), Nuveen Variable Rate Preferred & Income Fund (NYSE: NPFD), Nuveen.

The Quality Closed-End Fund Report, January 2021

seekingalpha.com

2021-02-02 04:34:49Only funds with coverage >100% are considered. Top lists of discount, yield, DxY and DxYxZ are given. The top DxY funds are NHF, ARDC and KIO.

Building Resilient CEF Portfolios

seekingalpha.com

2020-07-31 10:08:06We discuss strategies for income investors that can be used to build more resilient CEF portfolios. These strategies include allocating to higher-quality sectors, choosing CEFs with more robust leverage instruments, allocating to term CEFs and others.

Performance

seekingalpha.com

2020-07-15 09:35:16There are appreciation plays, mostly dominated by hi-tech, or cash flow plays, mostly dominated by closed-end funds that pay dividends monthly.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

Participa

em.com

2020-06-06 15:40:00O Brasil perdeu peso importante nas carteiras de investidores estrangeiros em meio ao aumento do risco pol

De l’or obligataire

allnews.ch

2020-06-03 05:00:00Aujourd’hui la déflation, demain l’inflation: les craintes des marchés appellent une réponse tactique de couverture. Le point avec Eric Vanraes.

Bolsonaro atribui imagem ruim

em.com

2020-05-25 18:00:00O presidente da Rep

Postura frente

em.com

2020-05-25 15:05:00

Nuveen Closed-End Funds Announce Postponement of Annual Meeting of Shareholders Originally Scheduled for April 8, 2020 and Change to a Virtual Meeting

finance.yahoo.com

2020-04-02 20:30:00The following Nuveen closed-end funds (each, a "Fund" and collectively, the "Funds") announced today that each Fund’s 2020 Annual Meeting of Shareholders (the "Meeting") has been postponed and that the meeting will be held as a virtual meeting:

View: Robust, liquid & deep financial markets will lead to $5t goal

economictimes.indiatimes.com

2020-03-16 11:57:00The proposal to increase FPI limits in corporate bonds from the current 9% of outstanding to 15% also underscores the importance being assigned to capital markets.