Janus Henderson Group plc (JHG)

Price:

45.48 USD

( - -0.44 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

Similar STI Score

State Street Corporation

VALUE SCORE:

10

2nd position

FS Credit Opportunities Corp.

VALUE SCORE:

13

The best

ClearBridge Energy Midstream Opportunity Fund Inc

VALUE SCORE:

15

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

No data to display

DESCRIPTION

Janus Henderson Group plc is an asset management holding entity. Through its subsidiaries, the firm provides services to institutional, retail clients, and high net worth clients. It manages separate client-focused equity and fixed income portfolios. The firm also manages equity, fixed income, and balanced mutual funds for its clients. It invests in public equity and fixed income markets, as well as invests in real estate and private equity. Janus Henderson Group plc was founded in 1934 and is based in London, United Kingdom with additional offices in Jersey, United Kingdom and Sydney, Australia.

NEWS

JHG or KKR: Which Is the Better Value Stock Right Now?

zacks.com

2025-12-11 12:41:15Investors interested in stocks from the Financial - Investment Management sector have probably already heard of Janus Henderson Group plc (JHG) and KKR & Co. Inc. (KKR). But which of these two companies is the best option for those looking for undervalued stocks?

Ariel Investments LLC Sells 111,676 Shares of Janus Henderson Group plc $JHG

defenseworld.net

2025-12-10 03:29:00Ariel Investments LLC reduced its position in Janus Henderson Group plc (NYSE: JHG) by 5.2% during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 2,036,989 shares of the company's stock after selling 111,676 shares during the period. Ariel Investments LLC owned 1.31% of Janus

Janus Henderson Research Fund Q3 2025 Portfolio Review

seekingalpha.com

2025-12-10 01:00:00An underweight position in device and services company Apple (AAPL) detracted from relative performance, as the stock outperformed during the period. An overweight position in enterprise software company Intuit (INTU) also detracted from relative results. Contributors to relative performance included AppLovin (APP), the developer and owner of a mobile marketing platform that matches developers with advertisers looking to be featured on apps and digital games.

The Starlab Space Station Team Just Keeps Growing

fool.com

2025-12-06 06:06:00It's almost time to replace the ISS. Which space stocks should you be watching?

Is Janus Henderson Group (JHG) a Great Value Stock Right Now?

zacks.com

2025-12-01 10:41:04Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Janus Henderson Global Sustainable Equity Fund Q3 2025 Portfolio Review

seekingalpha.com

2025-11-28 09:08:00At the stock level, the largest positive contributors included cables company Prysmian, electrical components manufacturer TE Connectivity, and TSMC. The biggest detractors included audio-streaming service Spotify, insurance company Intact Financial, and building products company Saint-Gobain. We initiated new positions in Hubbell, Intercontinental Exchange, Tetra Tech, Fair Isaac and Disco.

Janus Henderson Group plc $JHG Shares Acquired by Creative Planning

defenseworld.net

2025-11-26 04:12:58Creative Planning raised its stake in Janus Henderson Group plc (NYSE: JHG) by 11.4% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 53,133 shares of the company's stock after acquiring an additional 5,432 shares during the quarter. Creative Planning's

Janus Henderson's Denny Fish on AI: We'll continue to see models ‘leapfrogging each other'

youtube.com

2025-11-25 13:23:44Denny Fish, tech research head and portfolio manager at Janus Henderson, joins 'Money Movers' to discuss the AI race, chip stocks, and more.

Starlab, Developer of Commercial Space Stations, Secures Strategic Investment from Janus Henderson

businesswire.com

2025-11-20 16:05:00LONDON & DENVER--(BUSINESS WIRE)---- $VOYG #MissionReady--Janus Henderson Group (NYSE: JHG; “Janus Henderson”), a leading global asset manager, and Voyager Technologies, Inc. (NYSE: VOYG) jointly announced today that Janus Henderson, on behalf of accounts managed by its advisory affiliates, will make a strategic investment in Starlab Space, which develops next generation commercial space stations. Founded in 2021 and headquartered in Houston, Starlab is a global joint venture led by Voyager Technologies alongside part.

JHG vs. CG: Which Stock Is the Better Value Option?

zacks.com

2025-11-19 12:41:21Investors with an interest in Financial - Investment Management stocks have likely encountered both Janus Henderson Group plc (JHG) and Carlyle Group (CG). But which of these two companies is the best option for those looking for undervalued stocks?

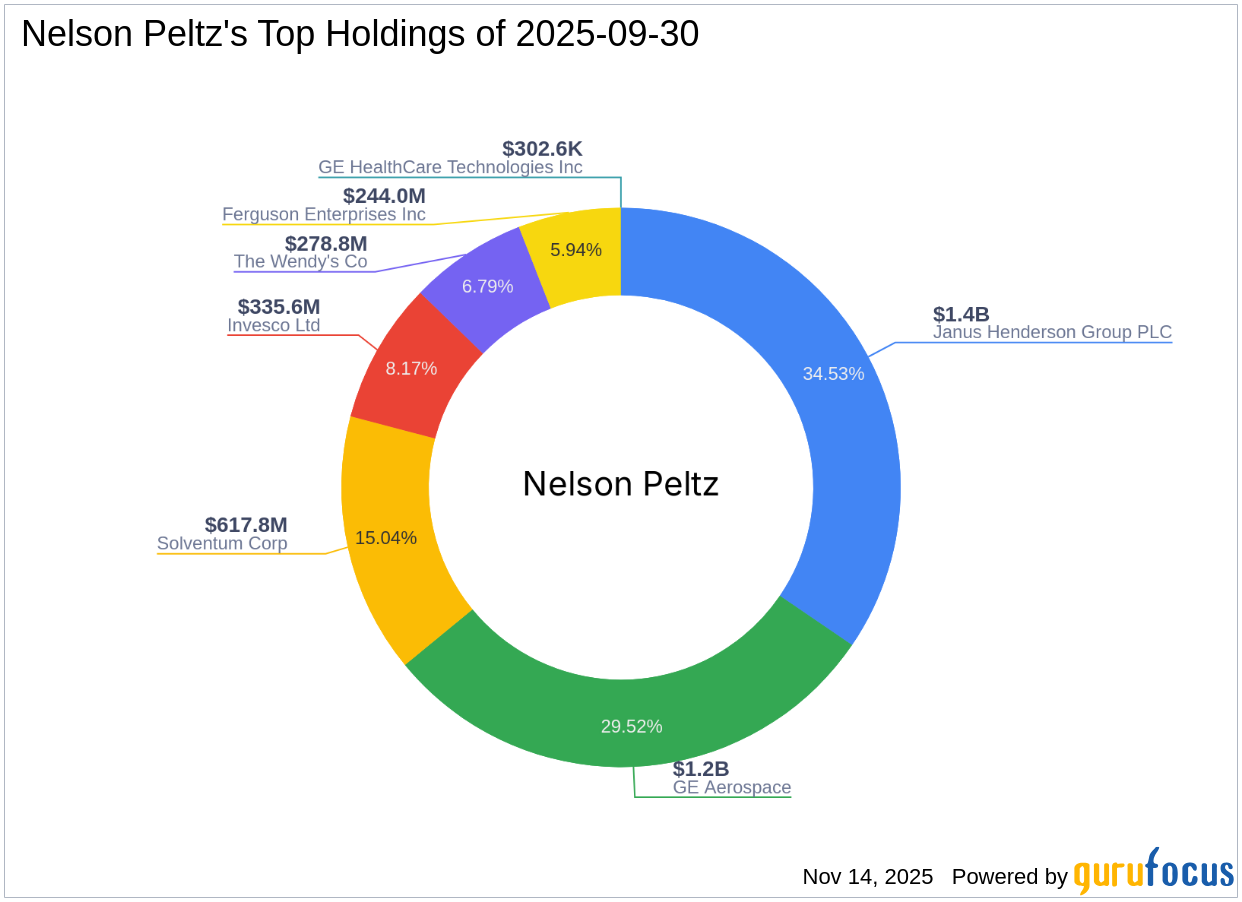

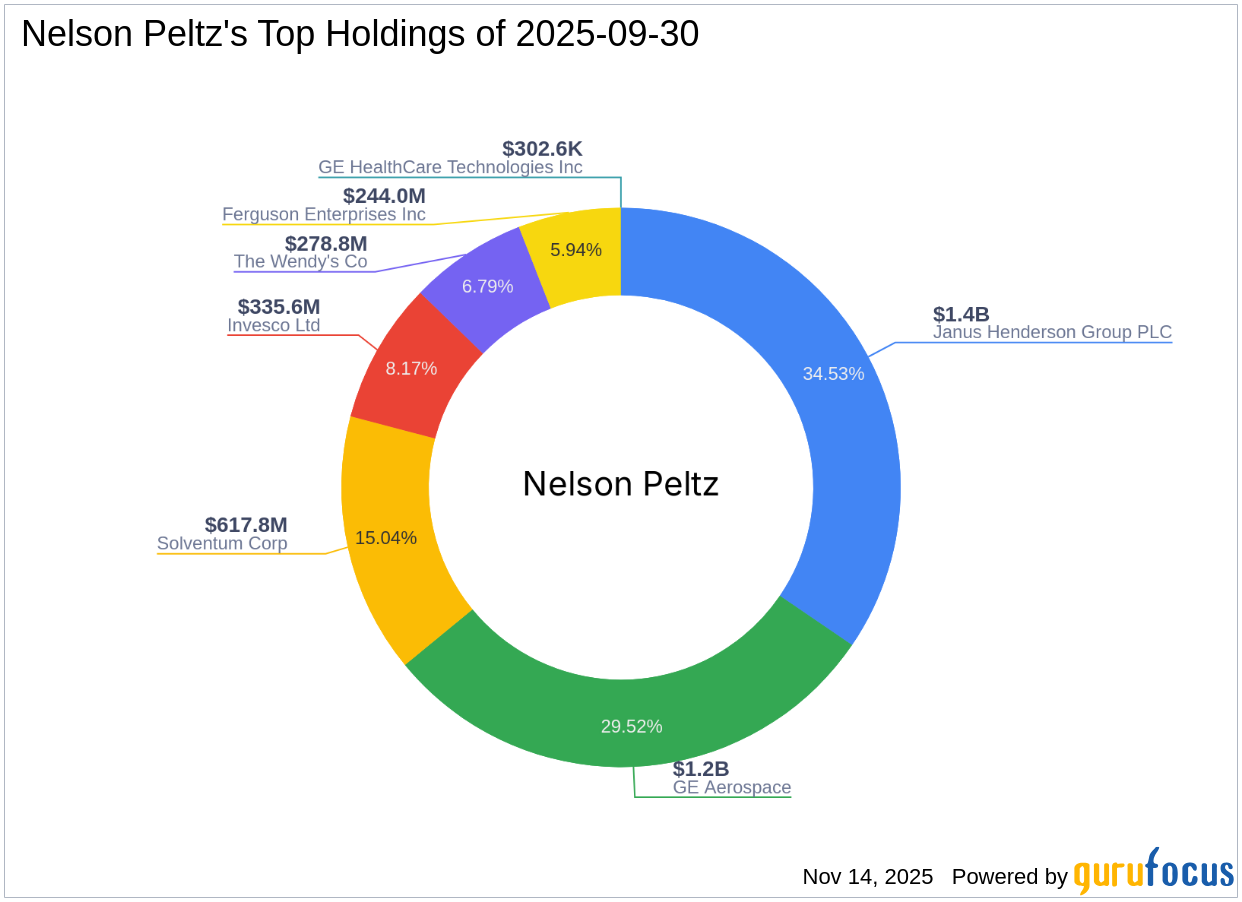

Nelson Peltz's Strategic Moves: U-Haul Holding Co Exit Impacts Portfolio by -0.56%

gurufocus.com

2025-11-14 17:11:00Exploring Nelson Peltz (Trades, Portfolio)'s Recent 13F Filing and Investment Strategy Nelson Peltz (Trades, Portfolio) recently submitted the 13F filing for t

Should Value Investors Buy Janus Henderson Group (JHG) Stock?

zacks.com

2025-11-14 10:40:49Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Aviva PLC Buys Shares of 13,543 Janus Henderson Group plc $JHG

defenseworld.net

2025-11-14 04:01:00Aviva PLC purchased a new stake in Janus Henderson Group plc (NYSE: JHG) during the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 13,543 shares of the company's stock, valued at approximately $526,000. Several other institutional investors and hedge funds have

Janus Henderson: Trian Finally Makes A Move (Rating Upgrade)

seekingalpha.com

2025-11-12 16:31:00Janus Henderson received a non-binding takeover bid, orchestrated by the company's largest shareholder, just days before releasing 3Q 2025 results. Long-term holder Trian Fund Management has partnered with General Catalyst Group Management to deliver a cash bid of $46 per share. Janus Henderson's Board is likely to reject the bid, however I believe that Trian and General Catalyst have capacity to pay a higher implied earnings multiple.

Janus Henderson Announces Appointment of Financial Advisor and Legal Counsel to the Special Committee of the Board of Directors

businesswire.com

2025-11-10 16:05:00LONDON--(BUSINESS WIRE)--Janus Henderson Group plc (NYSE: JHG) (“Janus Henderson” or the “Company”) today announced that the independent special committee (the "Special Committee") of the Company's board of directors (the "Board") has retained Goldman Sachs & Co. LLC as its financial advisor and Wachtell, Lipton, Rosen & Katz as its legal counsel. The Special Committee was formed to evaluate the previously announced non-binding proposal letter from Trian Fund Management, L.P. and its af.

Janus Henderson Global Technology And Innovation Fund Q3 2025 Portfolio Update

seekingalpha.com

2025-11-07 08:15:00For much of the past three years, tech sector performance was largely defined by the emergence of AI as investors scrambled to gain exposure to this generational theme. Out-of-benchmark hyperscaler Amazon weighed on relative performance despite e-commerce, advertising, and profitability holding up well. Relative detractor Constellation Software faced a combination of developments, including its founder and CEO resigning due to health concerns.

JHG or KKR: Which Is the Better Value Stock Right Now?

zacks.com

2025-12-11 12:41:15Investors interested in stocks from the Financial - Investment Management sector have probably already heard of Janus Henderson Group plc (JHG) and KKR & Co. Inc. (KKR). But which of these two companies is the best option for those looking for undervalued stocks?

Ariel Investments LLC Sells 111,676 Shares of Janus Henderson Group plc $JHG

defenseworld.net

2025-12-10 03:29:00Ariel Investments LLC reduced its position in Janus Henderson Group plc (NYSE: JHG) by 5.2% during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 2,036,989 shares of the company's stock after selling 111,676 shares during the period. Ariel Investments LLC owned 1.31% of Janus

Janus Henderson Research Fund Q3 2025 Portfolio Review

seekingalpha.com

2025-12-10 01:00:00An underweight position in device and services company Apple (AAPL) detracted from relative performance, as the stock outperformed during the period. An overweight position in enterprise software company Intuit (INTU) also detracted from relative results. Contributors to relative performance included AppLovin (APP), the developer and owner of a mobile marketing platform that matches developers with advertisers looking to be featured on apps and digital games.

The Starlab Space Station Team Just Keeps Growing

fool.com

2025-12-06 06:06:00It's almost time to replace the ISS. Which space stocks should you be watching?

Is Janus Henderson Group (JHG) a Great Value Stock Right Now?

zacks.com

2025-12-01 10:41:04Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Janus Henderson Global Sustainable Equity Fund Q3 2025 Portfolio Review

seekingalpha.com

2025-11-28 09:08:00At the stock level, the largest positive contributors included cables company Prysmian, electrical components manufacturer TE Connectivity, and TSMC. The biggest detractors included audio-streaming service Spotify, insurance company Intact Financial, and building products company Saint-Gobain. We initiated new positions in Hubbell, Intercontinental Exchange, Tetra Tech, Fair Isaac and Disco.

Janus Henderson Group plc $JHG Shares Acquired by Creative Planning

defenseworld.net

2025-11-26 04:12:58Creative Planning raised its stake in Janus Henderson Group plc (NYSE: JHG) by 11.4% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 53,133 shares of the company's stock after acquiring an additional 5,432 shares during the quarter. Creative Planning's

Janus Henderson's Denny Fish on AI: We'll continue to see models ‘leapfrogging each other'

youtube.com

2025-11-25 13:23:44Denny Fish, tech research head and portfolio manager at Janus Henderson, joins 'Money Movers' to discuss the AI race, chip stocks, and more.

Starlab, Developer of Commercial Space Stations, Secures Strategic Investment from Janus Henderson

businesswire.com

2025-11-20 16:05:00LONDON & DENVER--(BUSINESS WIRE)---- $VOYG #MissionReady--Janus Henderson Group (NYSE: JHG; “Janus Henderson”), a leading global asset manager, and Voyager Technologies, Inc. (NYSE: VOYG) jointly announced today that Janus Henderson, on behalf of accounts managed by its advisory affiliates, will make a strategic investment in Starlab Space, which develops next generation commercial space stations. Founded in 2021 and headquartered in Houston, Starlab is a global joint venture led by Voyager Technologies alongside part.

JHG vs. CG: Which Stock Is the Better Value Option?

zacks.com

2025-11-19 12:41:21Investors with an interest in Financial - Investment Management stocks have likely encountered both Janus Henderson Group plc (JHG) and Carlyle Group (CG). But which of these two companies is the best option for those looking for undervalued stocks?

Nelson Peltz's Strategic Moves: U-Haul Holding Co Exit Impacts Portfolio by -0.56%

gurufocus.com

2025-11-14 17:11:00Exploring Nelson Peltz (Trades, Portfolio)'s Recent 13F Filing and Investment Strategy Nelson Peltz (Trades, Portfolio) recently submitted the 13F filing for t

Should Value Investors Buy Janus Henderson Group (JHG) Stock?

zacks.com

2025-11-14 10:40:49Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Aviva PLC Buys Shares of 13,543 Janus Henderson Group plc $JHG

defenseworld.net

2025-11-14 04:01:00Aviva PLC purchased a new stake in Janus Henderson Group plc (NYSE: JHG) during the undefined quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 13,543 shares of the company's stock, valued at approximately $526,000. Several other institutional investors and hedge funds have

Janus Henderson: Trian Finally Makes A Move (Rating Upgrade)

seekingalpha.com

2025-11-12 16:31:00Janus Henderson received a non-binding takeover bid, orchestrated by the company's largest shareholder, just days before releasing 3Q 2025 results. Long-term holder Trian Fund Management has partnered with General Catalyst Group Management to deliver a cash bid of $46 per share. Janus Henderson's Board is likely to reject the bid, however I believe that Trian and General Catalyst have capacity to pay a higher implied earnings multiple.

Janus Henderson Announces Appointment of Financial Advisor and Legal Counsel to the Special Committee of the Board of Directors

businesswire.com

2025-11-10 16:05:00LONDON--(BUSINESS WIRE)--Janus Henderson Group plc (NYSE: JHG) (“Janus Henderson” or the “Company”) today announced that the independent special committee (the "Special Committee") of the Company's board of directors (the "Board") has retained Goldman Sachs & Co. LLC as its financial advisor and Wachtell, Lipton, Rosen & Katz as its legal counsel. The Special Committee was formed to evaluate the previously announced non-binding proposal letter from Trian Fund Management, L.P. and its af.

Janus Henderson Global Technology And Innovation Fund Q3 2025 Portfolio Update

seekingalpha.com

2025-11-07 08:15:00For much of the past three years, tech sector performance was largely defined by the emergence of AI as investors scrambled to gain exposure to this generational theme. Out-of-benchmark hyperscaler Amazon weighed on relative performance despite e-commerce, advertising, and profitability holding up well. Relative detractor Constellation Software faced a combination of developments, including its founder and CEO resigning due to health concerns.