Nuveen Corporate Income November 2021 Target Term Fund (JHB)

Price:

9.40 USD

( + 0.01 USD)

Your position:

0 USD

ACTION PANEL

ABOUT

Check the

KEY TAKEAWAYS

ASK OUR AI ABOUT THE COMPANY (REGISTER FOR EARLY ACCESS)

(REGISTER FOR EARLY ACCESS) CHOOSE A PROMPT ABOVE TO ASK OUR AI ABOUT THE SPECIFIC INFORMATION

SIMILAR COMPANIES STI SCORE

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS

FUNDAMENTALS PER SHARE

TECHNICAL

DIVIDEND

SIMILAR COMPANIES

DESCRIPTION

Nuveen High Income November 2021 Target Term Fund is a diversified, closed-end management investment company. The Fund's investment objectives are to provide a high level of current income and to return $9.85 per share to holders of common shares on or about November 1, 2021 (the termination date). The Fund invests in a portfolio of primarily below investment grade corporate debt securities. The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the managers to be of comparable quality. Nuveen Fund Advisors, LLC is the Fund’s advisor.

NEWS

Nuveen Corporate Income November 2021 Target Term Fund Announces Termination and Liquidation

businesswire.com

2021-11-02 11:24:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB) completed its termination and liquidation following the close of business on November 1, 2021. The termination and liquidation was performed in accordance with the Fund’s investment objectives and organizational documents, consistent with the fund’s previously announced liquidation plans. The Nuveen Corporate Income November 2021 Target Term Fund (formerly known as Nuveen High Income November 2021 Target Term Fund) launched on August 23, 2016 as a short duration strategy that invested primarily in high yield corporate debt, with two investment objectives, to provide high current income and return the original net asset value (NAV) of $9.85 per common share upon termination on or about November 1, 2021. The investment objective relating to Original NAV was not a guarantee. In June 2020, the fund’s Board of Trustees approved the change in the fund’s name and its investment policy associated with its name. Specifically, the fund’s policy to invest primarily in securities rated below investment grade was eliminated and the fund’s mandate was expanded to cover all corporate debt securities. As previously announced, due to recent market conditions, JHB did not return the Original NAV at its termination. The fund is returning to shareholders an extended NAV of $9.4061 per common share as its liquidating distribution. Over its five year term, the fund paid 60 monthly distributions and one long-term capital gain distribution totaling $2.3789 per share, which equates to an average distribution rate of 4.65% on NAV and 4.58% on market. The annualized total return on NAV for shareholders who invested at the initial public offering was 3.83% and the market price total return was 3.59% Shareholders may recognize gain or loss for U.S. tax purposes as a result of the liquidation. Nuveen does not provide tax advice; investors should consult a professional tax advisor regarding their specific tax situation. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds or contact: Financial Professionals: 800-752-8700 Investors: 800-257-8787 Media: media-inquiries@nuveen.com About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of 30 September 2021 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1895946PR-E1121X

Nuveen Corporate Income November 2021 Target Term Fund Announces Liquidation Details

businesswire.com

2021-09-20 16:30:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB) today announced new details concerning its liquidation. Consistent with its investment objectives and organizational documents, the fund plans to terminate its existence and liquidate on or about 1 November 2021. As the fund approaches liquidation, its common shares will continue trading on the New York Stock Exchange through 26 October 2021 and will be suspended from trading before the open of trading on 27 October 2021. The fund will not declare its regular monthly distribution in October 2021 and expects that all accumulated earnings will be included in the final liquidating distribution. The fund anticipates making its final liquidating distribution on or about 1 November 2021. As previously announced, the fund entered its wind up period in anticipation of its termination date. Leading up to the final distribution date, as the fund’s portfolio securities continue to mature and are sold, the fund may further deviate from its investment objectives and policies, and its portfolio will continue to transition into high quality, short-term securities or cash and cash equivalents. Also as previously announced, due to recent market conditions, JHB does not anticipate returning the Original NAV at its termination. The investment objective relating to Original NAV is not a guarantee and is dependent on a number of factors including the extent of market recovery and the cumulative level of income retained in relation to cumulative portfolio gains net of losses. Shareholders may recognize a gain or loss for U.S. tax purposes as a result of the liquidation. Nuveen does not provide tax advice; investors should consult a professional tax advisor regarding their specific tax situation. Nuveen is a leading sponsor of closed-end funds (CEFs) with $65 billion of assets under management across 62 CEFs as of 30 June 2021. The funds offer exposure to a broad range of asset classes and are designed for income-focused investors seeking regular distributions. Nuveen has more than 30 years of experience managing CEFs. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of 30 June 2021 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. FORWARD-LOOKING STATEMENTS Certain statements made or referenced in this release may be forward-looking statements. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements due to numerous factors. These include, but are not limited to: market developments, including the timing of distributions and other events identified in this press release; legal and regulatory developments; and other additional risks and uncertainties. Nuveen and the closed-end funds managed by Nuveen and its affiliates undertake no responsibility to update publicly or revise any forward-looking statement. EPS-1837136PR-E0921X

Nuveen Corporate Income November 2021 Target Term Fund Announces Liquidation Details

businesswire.com

2021-09-20 16:30:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB) today announced new details concerning its liquidation. Consistent with its investment objectives and organizational documents, the fund plans to terminate its existence and liquidate on or about 1 November 2021. As the fund approaches liquidation, its common shares will continue trading on the New York Stock Exchange through 26 October 2021 and will be suspended from trading before the open of tra

CEF Weekly Market Review: A Value Conundrum

seekingalpha.com

2021-06-21 09:16:38We review CEF market valuation and performance over the past week and highlight recent events. We highlight news and market action across a number of CEFs such as JHB, EIC, and the Blackstone loan trio.

CEF Weekly Market Review: The Everything Rally

seekingalpha.com

2021-06-13 08:43:57We review CEF market valuation and performance over the first week of June and highlight recent events. The CEF market pushed higher at the start of June with a favorable backdrop of stable Treasury yields and rising equity prices.

Nuveen Corporate Income November 2021 Target Term Fund Announces Wind-Up Period

businesswire.com

2021-06-04 13:51:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income 2021 Target Term Fund (NYSE: JHB) has entered the wind-up period in anticipation of its termination date. The fund is a “target term” fund that will cease its investment operations and liquidate its portfolio on November 1, 2021 and distribute the net proceeds to shareholders, unless the term is extended for a period of up to six months by a vote of the fund’s Board of Trustees. The fund has the investment objective to provide a high level of current income and to return the fund’s original $9.85 net asset value to shareholders at termination. Recent market conditions have materially increased the risk associated with achieving the Fund's objective to return Original NAV. This objective is not a guarantee and is dependent on a number of factors including the extent of market recovery and the cumulative level of income retained in relation to cumulative portfolio gains net of losses. Under normal circumstances, the fund invests at least 80% of its managed assets in corporate debt securities. During the wind-up period the fund may deviate from its investment objectives and policies, and may invest up to a 100% of its managed assets in high quality, short-term securities. High quality, short-term securities for this fund include securities rated investment grade (BBB-/Baa3 or higher or unrated but judged by the fund’s subadviser to be of comparable quality) with a final or remaining maturity of 397 days or less. Consequently, for the remainder of its term, the fund will invest at least 80% of its managed assets in (i) corporate debt securities; and (ii) short-term investment grade securities that have a final or remaining maturity of 397 days or less, so long as the maturity of any security in the fund does not occur later than May 1, 2022. These expanded investment parameters currently will provide the fund additional flexibility to reinvest the proceeds of matured or called portfolio securities in higher quality, short-term securities. As the fund gets closer to its termination date, the fund will begin to affirmatively transition its remaining below investment grade portfolio holdings to such high quality, short-term securities to enhance its ability to efficiently liquidate its portfolio at termination. The fund has also completed the process of redeeming and retiring its leverage in anticipation of its termination date. As described in the fund’s prospectus, the general shortening of the time-to-maturity of the fund’s portfolio securities as the fund approaches its termination date, the elimination of leverage, and the repositioning of the fund’s portfolio into higher-quality securities as part of the wind-up process, will tend to reduce interest rate risk and credit risk, and improve portfolio liquidity, but will also tend to reduce amounts of income available to pay as dividends to common shareholders. Nuveen is a leading sponsor of closed-end funds (CEFs) with $63 billion of assets under management across 64 CEFs as of 31 March 2021. The funds offer exposure to a broad range of asset classes and are designed for income-focused investors seeking regular distributions. Nuveen has over 30 years of experience managing CEFs. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of 31 March 2021 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. FORWARD-LOOKING STATEMENTS Certain statements made herein are forward-looking statements. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements due to numerous factors. These include, but are not limited to: market developments; legal and regulatory developments; and other additional risks and uncertainties. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Nuveen and the closed-end funds managed by Nuveen Fund Advisers and Nuveen affiliates undertake no responsibility to update publicly or revise any forward-looking statements. EPS-1673020PR-E0621X

Certain Nuveen Closed-End Funds Announce the Board’s Approval of Amended and Restated By-Laws of the Funds

businesswire.com

2020-10-05 18:08:00NEW YORK--(BUSINESS WIRE)--Nuveen: Nuveen AMT-Free Municipal Credit Income Fund (NYSE: NVG), Nuveen AMT-Free Municipal Value Fund (NYSE: NUW), Nuveen AMT-Free Quality Municipal Income Fund (NYSE: NEA), Nuveen Arizona Quality Municipal Income Fund (NYSE: NAZ), Nuveen California AMT-Free Quality Municipal Income Fund (NYSE: NKX), Nuveen California Municipal Value Fund 2 (NYSE: NCB), Nuveen California Quality Municipal Income Fund (NYSE: NAC), Nuveen California Select Tax-Free Income Portfolio (NYSE: NXC), Nuveen Core Equity Alpha Fund (NYSE: JCE), Nuveen Corporate Income 2023 Target Term Fund (NYSE: JHAA), Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB), Nuveen Credit Opportunities 2022 Target Term Fund (NYSE: JCO), Nuveen Credit Strategies Income Fund (NYSE: JQC), Nuveen Diversified Dividend and Income Fund (NYSE: JDD), Nuveen Dow 30SM Dynamic Overwrite Fund (NYSE: DIAX), Nuveen Dynamic Municipal Opportunities Fund (NYSE: NDMO), Nuveen Emerging Markets Debt 2022 Target Term Fund (NYSE: JEMD), Nuveen Enhanced Municipal Value Fund (NYSE: NEV), Nuveen Floating Rate Income Fund (NYSE: JFR), Nuveen Floating Rate Income Opportunity Fund (NYSE: JRO), Nuveen Georgia Quality Municipal Income Fund (NYSE: NKG), Nuveen Global High Income Fund (NYSE: JGH), Nuveen High Income 2020 Target Term Fund (NYSE: JHY), Nuveen Intermediate Duration Municipal Term Fund (NYSE: NID), Nuveen Intermediate Duration Quality Municipal Term Fund (NYSE: NIQ), Nuveen Maryland Quality Municipal Income Fund (NYSE: NMY), Nuveen Massachusetts Quality Municipal Income Fund (NYSE: NMT), Nuveen Michigan Quality Municipal Income Fund (NYSE: NUM), Nuveen Minnesota Quality Municipal Income Fund (NYSE: NMS), Nuveen Missouri Quality Municipal Income Fund (NYSE: NOM), Nuveen Mortgage and Income Fund (NYSE: JLS), Nuveen Multi-Market Income Fund (NYSE: JMM), Nuveen Municipal 2021 Target Term Fund (NYSE: NHA), Nuveen Municipal Credit Income Fund (NYSE: NZF), Nuveen Municipal Credit Opportunities Fund (NYSE: NMCO), Nuveen Municipal High Income Opportunity Fund (NYSE: NMZ), Nuveen Nasdaq 100 Dynamic Overwrite Fund (NASDAQ: QQQX), Nuveen New Jersey Municipal Value Fund (NYSE: NJV), Nuveen New Jersey Quality Municipal Income Fund (NYSE: NXJ), Nuveen New York AMT-Free Quality Municipal Income Fund (NYSE: NRK), Nuveen New York Municipal Value Fund 2 (NYSE: NYV), Nuveen New York Quality Municipal Income Fund (NYSE: NAN), Nuveen New York Select Tax-Free Income Portfolio (NYSE: NXN), Nuveen Ohio Quality Municipal Income Fund (NYSE: NUO), Nuveen Pennsylvania Municipal Value Fund (NYSE: NPN), Nuveen Pennsylvania Quality Municipal Income Fund (NYSE: NQP), Nuveen Preferred & Income Opportunities Fund (NYSE: JPC), Nuveen Preferred & Income Securities Fund (NYSE: JPS), Nuveen Preferred and Income 2022 Term Fund (NYSE: JPT), Nuveen Preferred and Income Term Fund (NYSE: JPI), Nuveen Quality Municipal Income Fund (NYSE: NAD), Nuveen Real Asset Income and Growth Fund (NYSE: JRI), Nuveen Real Estate Income Fund (NYSE: JRS), Nuveen S&P 500 Buy-Write Income Fund (NYSE: BXMX), Nuveen S&P 500 Dynamic Overwrite Fund (NYSE: SPXX), Nuveen Select Maturities Municipal Fund (NYSE: NIM), Nuveen Select Tax-Free Income Portfolio (NYSE: NXP), Nuveen Select Tax-Free Income Portfolio 2 (NYSE: NXQ), Nuveen Select Tax-Free Income Portfolio 3 (NYSE: NXR), Nuveen Senior Income Fund (NYSE: NSL), Nuveen Short Duration Credit Opportunities Fund (NYSE: JSD), Nuveen Taxable Municipal Income Fund (NYSE: NBB), Nuveen Tax-Advantaged Dividend Growth Fund (NYSE: JTD), Nuveen Tax-Advantaged Total Return Strategy Fund (NYSE: JTA), Nuveen Virginia Quality Municipal Income Fund (NYSE: NPV) (each a Fund and together, the Funds) After a rigorous and deliberative review, and consistent with the interests of the Funds’ long-term shareholders, the Board of Trustees of each Fund has adopted Amended and Restated By-Laws (By-Laws) for the Funds. Among other changes, the By-Laws include new deadlines for advance notice of shareholder proposals or nominations to be brought before a meeting of shareholders. As a result, the advance notice deadlines for certain Funds’ 2021 annual meetings of shareholders will differ from the deadlines previously set forth in such Funds’ proxy statements for the 2020 annual meetings of shareholders. For such Funds, notice of any proposal, other than a proposal submitted pursuant to Rule 14a-8 under the Exchange Act, in connection with such Fund’s 2021 annual meeting of shareholders must be received by the Fund at the Fund’s principal executive offices not earlier than, nor later than, the corresponding dates set forth in the table included in this press release. The deadline for the receipt of advance notice of nominations and proposals made outside of Rule 14a-8 is also the date after which shareholder nominations and proposals made outside of Rule 14a-8 would not be considered “timely” within the meaning of Rule 14a-4(c) under the Exchange Act. If a proposal is not “timely” within the meaning of Rule 14a-4(c), then the persons named as proxies in the proxies solicited by the Board of Trustees for the 2021 annual meeting of shareholders may exercise discretionary voting power with respect to any such proposal. With respect to any Fund not listed in the table below, the deadlines for advance notice of shareholder proposals or nominations to be brought before such Fund’s 2021 annual meeting of shareholders will be set forth in the proxy statement for the Fund’s 2020 annual meeting of shareholders. The By-Laws require compliance with certain amended procedural and informational requirements in connection with any such advance notice of shareholder proposals or nominations, including certain information about the proponent and the proposal, or in the case of a nomination, the nominee. Any shareholder considering making a nomination or other proposal should carefully review and comply with those provisions of the By-Laws. The By-Laws also include provisions (Control Share By-Law) pursuant to which, in summary, a shareholder who obtains beneficial ownership of common shares of a Fund in a “Control Share Acquisition” may exercise voting rights with respect to such shares only to the extent the authorization of such voting rights is approved by other shareholders of the Fund. The Control Share By-Law is primarily intended to protect the interests of the Fund and its long-term shareholders by limiting the risk that the Fund will become subject to undue influence by opportunistic traders pursuing short-term agendas adverse to the best interests of the Fund and its long term shareholders. The Control Share By-Law does not eliminate voting rights for common shares acquired in Control Share Acquisitions, but rather, entrusts the Fund's other "non-interested" shareholders with determining whether to approve the authorization of the voting rights of the person acquiring such shares. Subject to various conditions and exceptions, the Control Share By-Law defines a “Control Share Acquisition” to include an acquisition of common shares that, but for the Control Share By-Law, would give the beneficial owner, upon the acquisition of such shares, the ability to exercise voting power in the election of Trustees of the Fund in any of the following ranges: (i) one-tenth or more, but less than one-fifth of all voting power; (ii) one-fifth or more, but less than one-third of all voting power; (iii) one-third or more, but less than a majority of all voting power; or (iv) a majority or more of all voting power. The Control Share By-Law excludes certain acquisitions of common shares from the definition of Control Share Acquisition, including acquisitions of common shares that occurred prior to October 5, 2020, though such shares are included in assessing whether any subsequent share acquisition exceeds one of the enumerated thresholds. Subject to certain conditions and procedural requirements set forth in the Control Share By-Law, including the delivery of a “Control Share Acquisition Statement” to the Fund's Secretary setting forth certain required information, a shareholder who obtains or proposes to obtain beneficial ownership of common shares in a Control Share Acquisition generally may demand a special meeting of shareholders for the purpose of considering whether the voting rights of such acquiring person with respect such shares shall be authorized. The foregoing discussion is only a summary of certain aspects of the By-Laws, and is qualified in its entirety by reference to the By-Laws. Investors should refer to the By-Laws for more information. A copy of the By-Laws can be found in the Current Report on Form 8-K filed today by the Funds with the Securities and Exchange Commission and available at www.sec.gov and may be obtained by writing to the Secretary of the Fund at 333 West Wacker Drive, Chicago, Illinois 60606. Advance Notice Deadlines Fund 14a-8 Deadline Non-14a-8 Deadline Earliest Date Latest Date Nuveen AMT-Free Municipal Credit Income Fund (NVG) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen AMT-Free Municipal Value Fund (NUW) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen AMT-Free Quality Municipal Income Fund (NEA) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen California Select Tax-Free Income Portfolio (NXC) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Core Equity Alpha Fund (JCE) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Corporate Income 2023 Target Term Fund (JHAA) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Corporate Income November 2021 Target Term Fund (JHB) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Credit Opportunities 2022 Target Term Fund (JCO) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Credit Strategies Income Fund (JQC) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Diversified Dividend and Income Fund (JDD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Enhanced Municipal Value Fund (NEV) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Floating Rate Income Fund (JFR) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Floating Rate Income Opportunity Fund (JRO) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Georgia Quality Municipal Income Fund (NKG) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Global High Income Fund (JGH) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen High Income 2020 Target Term Fund (JHY) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Intermediate Duration Municipal Term Fund (NID) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Intermediate Duration Quality Municipal Term Fund (NIQ) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Maryland Quality Municipal Income Fund (NMY) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Minnesota Quality Municipal Income Fund (NMS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Missouri Quality Municipal Income Fund (NOM) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Mortgage and Income Fund (JLS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Multi-Market Income Fund (JMM) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Municipal 2021 Target Term Fund (NHA) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Municipal Credit Income Fund (NZF) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Municipal High Income Opportunity Fund (NMZ) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen New York AMT-Free Quality Municipal Income Fund (NRK) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen New York Municipal Value Fund 2 (NYV) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen New York Quality Municipal Income Fund (NAN) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen New York Select Tax-Free Income Portfolio (NXN) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Preferred & Income Opportunities Fund (JPC) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Preferred & Income Securities Fund (JPS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Preferred and Income 2022 Term Fund (JPT) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Preferred and Income Term Fund (JPI) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Quality Municipal Income Fund (NAD) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Real Asset Income and Growth Fund (JRI) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Real Estate Income Fund (JRS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen S&P 500 Buy-Write Income Fund (BXMX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Select Maturities Municipal Fund (NIM) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Select Tax-Free Income Portfolio (NXP) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Select Tax-Free Income Portfolio 2 (NXQ) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Select Tax-Free Income Portfolio 3 (NXR) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Senior Income Fund (NSL) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Short Duration Credit Opportunities Fund (JSD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Taxable Municipal Income Fund (NBB) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Tax-Advantaged Dividend Growth Fund (JTD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Tax-Advantaged Total Return Strategy Fund (JTA) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Virginia Quality Municipal Income Fund (NPV) November 6, 2020 December 5, 2020 December 20, 2020 This press release is not intended to, and does not, constitute an offer to purchase or sell shares of any Fund; nor is this press release intended to solicit a proxy from any shareholder of any Fund. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds or contact: About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1 trillion in assets under management as of 30 June 2020 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1354521PR-E1020X

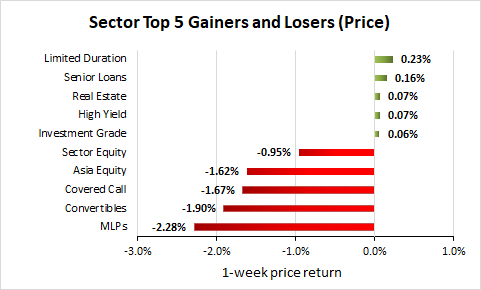

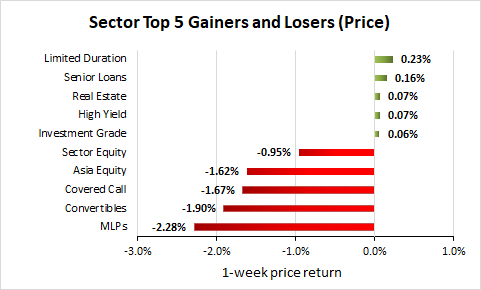

Weekly Closed-End Fund Roundup: September 6, 2020

seekingalpha.com

2020-09-13 04:32:185 out of 23 CEF sectors positive on price and 7 out of 23 sectors positive on NAV last week. Risk-off as MLPs and convertibles lag.

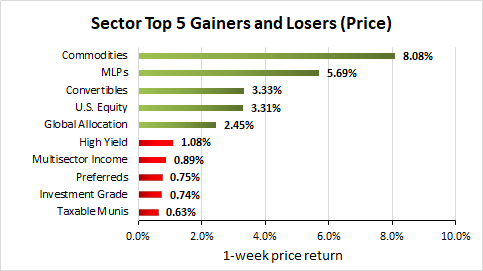

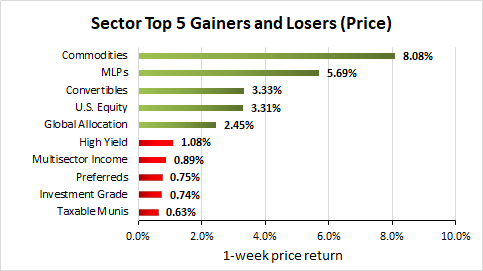

Weekly Closed-End Fund Roundup: August 9, 2020

seekingalpha.com

2020-08-18 04:16:0523 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Commodities continue to rally, energy also puts in a strong performance.

Nuveen Announces Update to Closed-End Fund Portfolio Management Teams

businesswire.com

2020-08-17 08:00:00NEW YORK--(BUSINESS WIRE)--Portfolio manager responsibilities for twelve closed-end funds have been updated. Michael Ainge, Anders Persson, Bernard Wong and Jenny Rhee are being removed as portfolio managers from several funds. Jake Fitzpatrick, Chris Williams and Kevin Lorenz are being added as portfolio managers to several funds. Portfolio manager changes by fund are detailed in the table below. There will be no impact on the investment approach, investment strategies or any of the fund’s investment objectives or policies. Ticker Fund Current Portfolio Management Team Portfolio Management Team as of 8/17/2020 Portfolio Management Team as of 10/1/2020 JGH Nuveen Global High Income Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson Jake Fitzpatrick No Change JHY Nuveen High Income 2020 Target Term Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson No Change JHB Nuveen High Income November 2021 Target Term Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson Jake Fitzpatrick Chris Williams Kevin Lorenz Jake Fitzpatrick Chris Williams JHAA Nuveen High Income 2023 Target Term Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson Jake Fitzpatrick Chris Williams Kevin Lorenz Jake Fitzpatrick Chris Williams JQC Nuveen Credit Strategies Income Fund Bernard Wong Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JFR Nuveen Floating Rate Income Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JRO Nuveen Floating Rate Income Opportunity Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz NSL Nuveen Senior Income Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JSD Nuveen Short Duration Credit Opportunities Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JCO Nuveen Credit Opportunities 2022 Target Term Fund Jenny Rhee Scott Caraher Scott Caraher Jenny Rhee Kevin Lorenz Jake Fitzpatrick Scott Caraher Kevin Lorenz Jake Fitzpatrick JDD Nuveen Diversified Dividend and Income Fund James Stephenson Thomas Ray Susi Budiman Scott Caraher Jenny Rhee Anthony Manno Kenneth Statz Kevin Bedell Nathan Gear James Valone Kevin Murphy No Change James Stephenson Thomas Ray Susi Budiman Scott Caraher Anthony Manno Kenneth Statz Kevin Bedell Nathan Gear James Valone Kevin Murphy JTA Nuveen Tax-Advantaged Total Return Strategy Fund James Stephenson Thomas Ray Susi Budiman Scott Caraher Jenny Rhee No Change James Stephenson Thomas Ray Susi Budiman Scott Caraher The following provides information about each new portfolio manager’s business experience. Jake Fitzpatrick is an associate portfolio manager for Nuveen’s global fixed income team and a member of the leveraged finance sector team. He began working in the investment industry in 2006 and joined the firm in 2015. Previously, he worked as a co-manager of structured product portfolios at Allianz Investment Management. In that role, he was responsible for the investment strategy and allocation of insurance product premiums within the core capital markets. He began his career at U.S. Bancorp Asset Management, where he was a corporate and municipal bond trader for the firm’s mutual funds and wealth management group. Jake graduated with a B.S. in Finance from the University of Minnesota’s Carlson School of Management and holds the CFA designation. Chris Williams is a trader and co-portfolio manager for Nuveen’s global fixed income team and member of the leveraged finance sector team. He is responsible for managing the organization’s leveraged finance trading, along with trading both high yield bonds and loans in the primary and secondary markets. In addition, he serves as the co-portfolio manager for the CLO strategies. Prior to joining the firm in 2011, he traded leveraged loans and high yield bonds at Gulf Stream Asset Management. Christopher graduated with a B.S. in Business Administration with an emphasis in Finance from Winthrop University. Kevin Lorenz is a portfolio manager for Nuveen’s global fixed income team and heads the leveraged finance sector team, which selects high yield and leveraged loan securities for all portfolios. He is also the lead portfolio manager for the High Yield strategies and a member of the Investment Committee, which establishes investment policy for all global fixed income products. Kevin has served in a variety of roles since joining the firm in 1987. Most recently, he served as a director with the private placements team, investing in both high-grade and high yield securities. He began his career at the firm as a generalist focusing on the private placement market. Kevin has been quoted in The New York Times, Barron’s, The Wall Street Journal, Reuters and other financial press as well as appearances on CNBC for his seasoned views on the high yield asset class. Kevin graduated with a B.S. in Accounting from Rider University and an M.B.A. in Finance from Indiana University. He holds the CFA designation and is a member of the New York Society of Security Analysts. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1 trillion in assets under management as of 30 June 2020 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1302617PR-E0820X

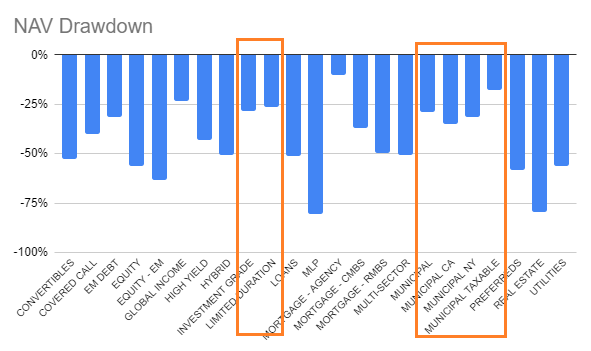

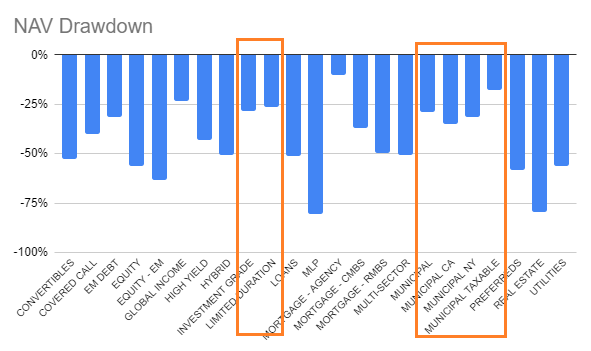

Building Resilient CEF Portfolios

seekingalpha.com

2020-07-31 10:08:06We discuss strategies for income investors that can be used to build more resilient CEF portfolios. These strategies include allocating to higher-quality sectors, choosing CEFs with more robust leverage instruments, allocating to term CEFs and others.

Retirement Strategy: Low-Priced Dividend Investments That Pay Monthly - JHB, JFR, PHT

seekingalpha.com

2020-07-17 09:00:00It is human nature to seek out low-priced investment products. It appears that the cost to even enter the dividend game is somewhat pricey.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

The Chemist's Quality Closed-End Fund Report: June 2020

seekingalpha.com

2020-06-29 00:42:23Only funds with coverage >100% are considered. Top lists of discount, yield, DxY and DxYxZ are given. ARDC, PHT and HNW are the top-ranked DxYxZ funds.

Two Nuveen Target Term Closed-end Funds Approve Investment Policy and Name Changes

businesswire.com

2020-06-25 16:30:00NEW YORK--(BUSINESS WIRE)--The Fund Board of the Nuveen High Income 2023 Target Term Fund (NYSE: JHAA) and Nuveen High Income November 2021 Target Term Fund (NYSE: JHB) has approved changes to each Fund’s name to “Nuveen Corporate Income 2023 Target Term Fund” and “Nuveen Corporate Income November 2021 Target Term Fund”, respectively. Each Fund will also change its investment policy associated with its name. Currently, each Fund seeks to achieve its investment objectives by investing, under normal circumstances, at least 80% of its Managed Assets in securities that, at the time of investment, are rated below investment grade (BB+/Ba1 or lower) or are unrated but deemed equivalent by the subadviser. Pursuant to the revised policy, each Fund’s requirement to invest 80% of its Managed Assets in securities that are rated below investment grade is eliminated. Each Fund will continue to invest at least 80% of its Managed Assets in corporate debt securities. The table below summarizes the changes to the each Fund described above. The changes are expected to go into effect on August 24, 2020: Current Name New Name Current Policy New Policy Nuveen High Income 2023 Target Term Fund Nuveen Corporate Income 2023 Target Term Fund Under normal circumstances, the Fund will invest at least 80% of its Managed Assets in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the Fund’s subadviser to be of comparable quality. Existing policy eliminated. Nuveen High Income November 2021 Target Term Fund Nuveen Corporate Income November 2021 Target Term Fund Under normal circumstances, the Fund will invest at least 80% of its Managed Assets in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the Fund’s subadviser to be of comparable quality. Existing policy eliminated. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1 trillion in assets under management as of 31 March 2020 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1223622PR-E0620X

CEF Weekly Commentary: May 3, 2020

seekingalpha.com

2020-05-15 11:00:00Markets on the week were little changed, but did end on a down note and some friction boiling up again on the trade front. We discuss the closed-end fund news o

No data to display

Nuveen Corporate Income November 2021 Target Term Fund Announces Termination and Liquidation

businesswire.com

2021-11-02 11:24:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB) completed its termination and liquidation following the close of business on November 1, 2021. The termination and liquidation was performed in accordance with the Fund’s investment objectives and organizational documents, consistent with the fund’s previously announced liquidation plans. The Nuveen Corporate Income November 2021 Target Term Fund (formerly known as Nuveen High Income November 2021 Target Term Fund) launched on August 23, 2016 as a short duration strategy that invested primarily in high yield corporate debt, with two investment objectives, to provide high current income and return the original net asset value (NAV) of $9.85 per common share upon termination on or about November 1, 2021. The investment objective relating to Original NAV was not a guarantee. In June 2020, the fund’s Board of Trustees approved the change in the fund’s name and its investment policy associated with its name. Specifically, the fund’s policy to invest primarily in securities rated below investment grade was eliminated and the fund’s mandate was expanded to cover all corporate debt securities. As previously announced, due to recent market conditions, JHB did not return the Original NAV at its termination. The fund is returning to shareholders an extended NAV of $9.4061 per common share as its liquidating distribution. Over its five year term, the fund paid 60 monthly distributions and one long-term capital gain distribution totaling $2.3789 per share, which equates to an average distribution rate of 4.65% on NAV and 4.58% on market. The annualized total return on NAV for shareholders who invested at the initial public offering was 3.83% and the market price total return was 3.59% Shareholders may recognize gain or loss for U.S. tax purposes as a result of the liquidation. Nuveen does not provide tax advice; investors should consult a professional tax advisor regarding their specific tax situation. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds or contact: Financial Professionals: 800-752-8700 Investors: 800-257-8787 Media: media-inquiries@nuveen.com About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of 30 September 2021 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1895946PR-E1121X

Nuveen Corporate Income November 2021 Target Term Fund Announces Liquidation Details

businesswire.com

2021-09-20 16:30:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB) today announced new details concerning its liquidation. Consistent with its investment objectives and organizational documents, the fund plans to terminate its existence and liquidate on or about 1 November 2021. As the fund approaches liquidation, its common shares will continue trading on the New York Stock Exchange through 26 October 2021 and will be suspended from trading before the open of trading on 27 October 2021. The fund will not declare its regular monthly distribution in October 2021 and expects that all accumulated earnings will be included in the final liquidating distribution. The fund anticipates making its final liquidating distribution on or about 1 November 2021. As previously announced, the fund entered its wind up period in anticipation of its termination date. Leading up to the final distribution date, as the fund’s portfolio securities continue to mature and are sold, the fund may further deviate from its investment objectives and policies, and its portfolio will continue to transition into high quality, short-term securities or cash and cash equivalents. Also as previously announced, due to recent market conditions, JHB does not anticipate returning the Original NAV at its termination. The investment objective relating to Original NAV is not a guarantee and is dependent on a number of factors including the extent of market recovery and the cumulative level of income retained in relation to cumulative portfolio gains net of losses. Shareholders may recognize a gain or loss for U.S. tax purposes as a result of the liquidation. Nuveen does not provide tax advice; investors should consult a professional tax advisor regarding their specific tax situation. Nuveen is a leading sponsor of closed-end funds (CEFs) with $65 billion of assets under management across 62 CEFs as of 30 June 2021. The funds offer exposure to a broad range of asset classes and are designed for income-focused investors seeking regular distributions. Nuveen has more than 30 years of experience managing CEFs. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of 30 June 2021 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. FORWARD-LOOKING STATEMENTS Certain statements made or referenced in this release may be forward-looking statements. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements due to numerous factors. These include, but are not limited to: market developments, including the timing of distributions and other events identified in this press release; legal and regulatory developments; and other additional risks and uncertainties. Nuveen and the closed-end funds managed by Nuveen and its affiliates undertake no responsibility to update publicly or revise any forward-looking statement. EPS-1837136PR-E0921X

Nuveen Corporate Income November 2021 Target Term Fund Announces Liquidation Details

businesswire.com

2021-09-20 16:30:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB) today announced new details concerning its liquidation. Consistent with its investment objectives and organizational documents, the fund plans to terminate its existence and liquidate on or about 1 November 2021. As the fund approaches liquidation, its common shares will continue trading on the New York Stock Exchange through 26 October 2021 and will be suspended from trading before the open of tra

CEF Weekly Market Review: A Value Conundrum

seekingalpha.com

2021-06-21 09:16:38We review CEF market valuation and performance over the past week and highlight recent events. We highlight news and market action across a number of CEFs such as JHB, EIC, and the Blackstone loan trio.

CEF Weekly Market Review: The Everything Rally

seekingalpha.com

2021-06-13 08:43:57We review CEF market valuation and performance over the first week of June and highlight recent events. The CEF market pushed higher at the start of June with a favorable backdrop of stable Treasury yields and rising equity prices.

Nuveen Corporate Income November 2021 Target Term Fund Announces Wind-Up Period

businesswire.com

2021-06-04 13:51:00NEW YORK--(BUSINESS WIRE)--The Nuveen Corporate Income 2021 Target Term Fund (NYSE: JHB) has entered the wind-up period in anticipation of its termination date. The fund is a “target term” fund that will cease its investment operations and liquidate its portfolio on November 1, 2021 and distribute the net proceeds to shareholders, unless the term is extended for a period of up to six months by a vote of the fund’s Board of Trustees. The fund has the investment objective to provide a high level of current income and to return the fund’s original $9.85 net asset value to shareholders at termination. Recent market conditions have materially increased the risk associated with achieving the Fund's objective to return Original NAV. This objective is not a guarantee and is dependent on a number of factors including the extent of market recovery and the cumulative level of income retained in relation to cumulative portfolio gains net of losses. Under normal circumstances, the fund invests at least 80% of its managed assets in corporate debt securities. During the wind-up period the fund may deviate from its investment objectives and policies, and may invest up to a 100% of its managed assets in high quality, short-term securities. High quality, short-term securities for this fund include securities rated investment grade (BBB-/Baa3 or higher or unrated but judged by the fund’s subadviser to be of comparable quality) with a final or remaining maturity of 397 days or less. Consequently, for the remainder of its term, the fund will invest at least 80% of its managed assets in (i) corporate debt securities; and (ii) short-term investment grade securities that have a final or remaining maturity of 397 days or less, so long as the maturity of any security in the fund does not occur later than May 1, 2022. These expanded investment parameters currently will provide the fund additional flexibility to reinvest the proceeds of matured or called portfolio securities in higher quality, short-term securities. As the fund gets closer to its termination date, the fund will begin to affirmatively transition its remaining below investment grade portfolio holdings to such high quality, short-term securities to enhance its ability to efficiently liquidate its portfolio at termination. The fund has also completed the process of redeeming and retiring its leverage in anticipation of its termination date. As described in the fund’s prospectus, the general shortening of the time-to-maturity of the fund’s portfolio securities as the fund approaches its termination date, the elimination of leverage, and the repositioning of the fund’s portfolio into higher-quality securities as part of the wind-up process, will tend to reduce interest rate risk and credit risk, and improve portfolio liquidity, but will also tend to reduce amounts of income available to pay as dividends to common shareholders. Nuveen is a leading sponsor of closed-end funds (CEFs) with $63 billion of assets under management across 64 CEFs as of 31 March 2021. The funds offer exposure to a broad range of asset classes and are designed for income-focused investors seeking regular distributions. Nuveen has over 30 years of experience managing CEFs. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1.2 trillion in assets under management as of 31 March 2021 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. FORWARD-LOOKING STATEMENTS Certain statements made herein are forward-looking statements. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements due to numerous factors. These include, but are not limited to: market developments; legal and regulatory developments; and other additional risks and uncertainties. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Nuveen and the closed-end funds managed by Nuveen Fund Advisers and Nuveen affiliates undertake no responsibility to update publicly or revise any forward-looking statements. EPS-1673020PR-E0621X

Certain Nuveen Closed-End Funds Announce the Board’s Approval of Amended and Restated By-Laws of the Funds

businesswire.com

2020-10-05 18:08:00NEW YORK--(BUSINESS WIRE)--Nuveen: Nuveen AMT-Free Municipal Credit Income Fund (NYSE: NVG), Nuveen AMT-Free Municipal Value Fund (NYSE: NUW), Nuveen AMT-Free Quality Municipal Income Fund (NYSE: NEA), Nuveen Arizona Quality Municipal Income Fund (NYSE: NAZ), Nuveen California AMT-Free Quality Municipal Income Fund (NYSE: NKX), Nuveen California Municipal Value Fund 2 (NYSE: NCB), Nuveen California Quality Municipal Income Fund (NYSE: NAC), Nuveen California Select Tax-Free Income Portfolio (NYSE: NXC), Nuveen Core Equity Alpha Fund (NYSE: JCE), Nuveen Corporate Income 2023 Target Term Fund (NYSE: JHAA), Nuveen Corporate Income November 2021 Target Term Fund (NYSE: JHB), Nuveen Credit Opportunities 2022 Target Term Fund (NYSE: JCO), Nuveen Credit Strategies Income Fund (NYSE: JQC), Nuveen Diversified Dividend and Income Fund (NYSE: JDD), Nuveen Dow 30SM Dynamic Overwrite Fund (NYSE: DIAX), Nuveen Dynamic Municipal Opportunities Fund (NYSE: NDMO), Nuveen Emerging Markets Debt 2022 Target Term Fund (NYSE: JEMD), Nuveen Enhanced Municipal Value Fund (NYSE: NEV), Nuveen Floating Rate Income Fund (NYSE: JFR), Nuveen Floating Rate Income Opportunity Fund (NYSE: JRO), Nuveen Georgia Quality Municipal Income Fund (NYSE: NKG), Nuveen Global High Income Fund (NYSE: JGH), Nuveen High Income 2020 Target Term Fund (NYSE: JHY), Nuveen Intermediate Duration Municipal Term Fund (NYSE: NID), Nuveen Intermediate Duration Quality Municipal Term Fund (NYSE: NIQ), Nuveen Maryland Quality Municipal Income Fund (NYSE: NMY), Nuveen Massachusetts Quality Municipal Income Fund (NYSE: NMT), Nuveen Michigan Quality Municipal Income Fund (NYSE: NUM), Nuveen Minnesota Quality Municipal Income Fund (NYSE: NMS), Nuveen Missouri Quality Municipal Income Fund (NYSE: NOM), Nuveen Mortgage and Income Fund (NYSE: JLS), Nuveen Multi-Market Income Fund (NYSE: JMM), Nuveen Municipal 2021 Target Term Fund (NYSE: NHA), Nuveen Municipal Credit Income Fund (NYSE: NZF), Nuveen Municipal Credit Opportunities Fund (NYSE: NMCO), Nuveen Municipal High Income Opportunity Fund (NYSE: NMZ), Nuveen Nasdaq 100 Dynamic Overwrite Fund (NASDAQ: QQQX), Nuveen New Jersey Municipal Value Fund (NYSE: NJV), Nuveen New Jersey Quality Municipal Income Fund (NYSE: NXJ), Nuveen New York AMT-Free Quality Municipal Income Fund (NYSE: NRK), Nuveen New York Municipal Value Fund 2 (NYSE: NYV), Nuveen New York Quality Municipal Income Fund (NYSE: NAN), Nuveen New York Select Tax-Free Income Portfolio (NYSE: NXN), Nuveen Ohio Quality Municipal Income Fund (NYSE: NUO), Nuveen Pennsylvania Municipal Value Fund (NYSE: NPN), Nuveen Pennsylvania Quality Municipal Income Fund (NYSE: NQP), Nuveen Preferred & Income Opportunities Fund (NYSE: JPC), Nuveen Preferred & Income Securities Fund (NYSE: JPS), Nuveen Preferred and Income 2022 Term Fund (NYSE: JPT), Nuveen Preferred and Income Term Fund (NYSE: JPI), Nuveen Quality Municipal Income Fund (NYSE: NAD), Nuveen Real Asset Income and Growth Fund (NYSE: JRI), Nuveen Real Estate Income Fund (NYSE: JRS), Nuveen S&P 500 Buy-Write Income Fund (NYSE: BXMX), Nuveen S&P 500 Dynamic Overwrite Fund (NYSE: SPXX), Nuveen Select Maturities Municipal Fund (NYSE: NIM), Nuveen Select Tax-Free Income Portfolio (NYSE: NXP), Nuveen Select Tax-Free Income Portfolio 2 (NYSE: NXQ), Nuveen Select Tax-Free Income Portfolio 3 (NYSE: NXR), Nuveen Senior Income Fund (NYSE: NSL), Nuveen Short Duration Credit Opportunities Fund (NYSE: JSD), Nuveen Taxable Municipal Income Fund (NYSE: NBB), Nuveen Tax-Advantaged Dividend Growth Fund (NYSE: JTD), Nuveen Tax-Advantaged Total Return Strategy Fund (NYSE: JTA), Nuveen Virginia Quality Municipal Income Fund (NYSE: NPV) (each a Fund and together, the Funds) After a rigorous and deliberative review, and consistent with the interests of the Funds’ long-term shareholders, the Board of Trustees of each Fund has adopted Amended and Restated By-Laws (By-Laws) for the Funds. Among other changes, the By-Laws include new deadlines for advance notice of shareholder proposals or nominations to be brought before a meeting of shareholders. As a result, the advance notice deadlines for certain Funds’ 2021 annual meetings of shareholders will differ from the deadlines previously set forth in such Funds’ proxy statements for the 2020 annual meetings of shareholders. For such Funds, notice of any proposal, other than a proposal submitted pursuant to Rule 14a-8 under the Exchange Act, in connection with such Fund’s 2021 annual meeting of shareholders must be received by the Fund at the Fund’s principal executive offices not earlier than, nor later than, the corresponding dates set forth in the table included in this press release. The deadline for the receipt of advance notice of nominations and proposals made outside of Rule 14a-8 is also the date after which shareholder nominations and proposals made outside of Rule 14a-8 would not be considered “timely” within the meaning of Rule 14a-4(c) under the Exchange Act. If a proposal is not “timely” within the meaning of Rule 14a-4(c), then the persons named as proxies in the proxies solicited by the Board of Trustees for the 2021 annual meeting of shareholders may exercise discretionary voting power with respect to any such proposal. With respect to any Fund not listed in the table below, the deadlines for advance notice of shareholder proposals or nominations to be brought before such Fund’s 2021 annual meeting of shareholders will be set forth in the proxy statement for the Fund’s 2020 annual meeting of shareholders. The By-Laws require compliance with certain amended procedural and informational requirements in connection with any such advance notice of shareholder proposals or nominations, including certain information about the proponent and the proposal, or in the case of a nomination, the nominee. Any shareholder considering making a nomination or other proposal should carefully review and comply with those provisions of the By-Laws. The By-Laws also include provisions (Control Share By-Law) pursuant to which, in summary, a shareholder who obtains beneficial ownership of common shares of a Fund in a “Control Share Acquisition” may exercise voting rights with respect to such shares only to the extent the authorization of such voting rights is approved by other shareholders of the Fund. The Control Share By-Law is primarily intended to protect the interests of the Fund and its long-term shareholders by limiting the risk that the Fund will become subject to undue influence by opportunistic traders pursuing short-term agendas adverse to the best interests of the Fund and its long term shareholders. The Control Share By-Law does not eliminate voting rights for common shares acquired in Control Share Acquisitions, but rather, entrusts the Fund's other "non-interested" shareholders with determining whether to approve the authorization of the voting rights of the person acquiring such shares. Subject to various conditions and exceptions, the Control Share By-Law defines a “Control Share Acquisition” to include an acquisition of common shares that, but for the Control Share By-Law, would give the beneficial owner, upon the acquisition of such shares, the ability to exercise voting power in the election of Trustees of the Fund in any of the following ranges: (i) one-tenth or more, but less than one-fifth of all voting power; (ii) one-fifth or more, but less than one-third of all voting power; (iii) one-third or more, but less than a majority of all voting power; or (iv) a majority or more of all voting power. The Control Share By-Law excludes certain acquisitions of common shares from the definition of Control Share Acquisition, including acquisitions of common shares that occurred prior to October 5, 2020, though such shares are included in assessing whether any subsequent share acquisition exceeds one of the enumerated thresholds. Subject to certain conditions and procedural requirements set forth in the Control Share By-Law, including the delivery of a “Control Share Acquisition Statement” to the Fund's Secretary setting forth certain required information, a shareholder who obtains or proposes to obtain beneficial ownership of common shares in a Control Share Acquisition generally may demand a special meeting of shareholders for the purpose of considering whether the voting rights of such acquiring person with respect such shares shall be authorized. The foregoing discussion is only a summary of certain aspects of the By-Laws, and is qualified in its entirety by reference to the By-Laws. Investors should refer to the By-Laws for more information. A copy of the By-Laws can be found in the Current Report on Form 8-K filed today by the Funds with the Securities and Exchange Commission and available at www.sec.gov and may be obtained by writing to the Secretary of the Fund at 333 West Wacker Drive, Chicago, Illinois 60606. Advance Notice Deadlines Fund 14a-8 Deadline Non-14a-8 Deadline Earliest Date Latest Date Nuveen AMT-Free Municipal Credit Income Fund (NVG) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen AMT-Free Municipal Value Fund (NUW) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen AMT-Free Quality Municipal Income Fund (NEA) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen California Select Tax-Free Income Portfolio (NXC) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Core Equity Alpha Fund (JCE) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Corporate Income 2023 Target Term Fund (JHAA) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Corporate Income November 2021 Target Term Fund (JHB) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Credit Opportunities 2022 Target Term Fund (JCO) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Credit Strategies Income Fund (JQC) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Diversified Dividend and Income Fund (JDD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Enhanced Municipal Value Fund (NEV) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Floating Rate Income Fund (JFR) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Floating Rate Income Opportunity Fund (JRO) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Georgia Quality Municipal Income Fund (NKG) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Global High Income Fund (JGH) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen High Income 2020 Target Term Fund (JHY) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Intermediate Duration Municipal Term Fund (NID) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Intermediate Duration Quality Municipal Term Fund (NIQ) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Maryland Quality Municipal Income Fund (NMY) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Minnesota Quality Municipal Income Fund (NMS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Missouri Quality Municipal Income Fund (NOM) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Mortgage and Income Fund (JLS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Multi-Market Income Fund (JMM) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Municipal 2021 Target Term Fund (NHA) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Municipal Credit Income Fund (NZF) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Municipal High Income Opportunity Fund (NMZ) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen New York AMT-Free Quality Municipal Income Fund (NRK) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen New York Municipal Value Fund 2 (NYV) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen New York Quality Municipal Income Fund (NAN) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen New York Select Tax-Free Income Portfolio (NXN) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Preferred & Income Opportunities Fund (JPC) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Preferred & Income Securities Fund (JPS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Preferred and Income 2022 Term Fund (JPT) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Preferred and Income Term Fund (JPI) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Quality Municipal Income Fund (NAD) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Real Asset Income and Growth Fund (JRI) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Real Estate Income Fund (JRS) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen S&P 500 Buy-Write Income Fund (BXMX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Select Maturities Municipal Fund (NIM) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Select Tax-Free Income Portfolio (NXP) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Select Tax-Free Income Portfolio 2 (NXQ) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Select Tax-Free Income Portfolio 3 (NXR) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Senior Income Fund (NSL) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Short Duration Credit Opportunities Fund (JSD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Taxable Municipal Income Fund (NBB) March 2, 2021 April 1, 2021 April 16, 2021 Nuveen Tax-Advantaged Dividend Growth Fund (JTD) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Tax-Advantaged Total Return Strategy Fund (JTA) November 6, 2020 December 5, 2020 December 20, 2020 Nuveen Virginia Quality Municipal Income Fund (NPV) November 6, 2020 December 5, 2020 December 20, 2020 This press release is not intended to, and does not, constitute an offer to purchase or sell shares of any Fund; nor is this press release intended to solicit a proxy from any shareholder of any Fund. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds or contact: About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1 trillion in assets under management as of 30 June 2020 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1354521PR-E1020X

Weekly Closed-End Fund Roundup: September 6, 2020

seekingalpha.com

2020-09-13 04:32:185 out of 23 CEF sectors positive on price and 7 out of 23 sectors positive on NAV last week. Risk-off as MLPs and convertibles lag.

Weekly Closed-End Fund Roundup: August 9, 2020

seekingalpha.com

2020-08-18 04:16:0523 out of 23 CEF sectors positive on price and 23 out of 23 sectors positive on NAV last week. Commodities continue to rally, energy also puts in a strong performance.

Nuveen Announces Update to Closed-End Fund Portfolio Management Teams

businesswire.com

2020-08-17 08:00:00NEW YORK--(BUSINESS WIRE)--Portfolio manager responsibilities for twelve closed-end funds have been updated. Michael Ainge, Anders Persson, Bernard Wong and Jenny Rhee are being removed as portfolio managers from several funds. Jake Fitzpatrick, Chris Williams and Kevin Lorenz are being added as portfolio managers to several funds. Portfolio manager changes by fund are detailed in the table below. There will be no impact on the investment approach, investment strategies or any of the fund’s investment objectives or policies. Ticker Fund Current Portfolio Management Team Portfolio Management Team as of 8/17/2020 Portfolio Management Team as of 10/1/2020 JGH Nuveen Global High Income Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson Jake Fitzpatrick No Change JHY Nuveen High Income 2020 Target Term Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson No Change JHB Nuveen High Income November 2021 Target Term Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson Jake Fitzpatrick Chris Williams Kevin Lorenz Jake Fitzpatrick Chris Williams JHAA Nuveen High Income 2023 Target Term Fund Kevin Lorenz Anders Persson Michael Ainge Kevin Lorenz Anders Persson Jake Fitzpatrick Chris Williams Kevin Lorenz Jake Fitzpatrick Chris Williams JQC Nuveen Credit Strategies Income Fund Bernard Wong Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JFR Nuveen Floating Rate Income Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JRO Nuveen Floating Rate Income Opportunity Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz NSL Nuveen Senior Income Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JSD Nuveen Short Duration Credit Opportunities Fund Scott Caraher Jenny Rhee Scott Caraher Jenny Rhee Kevin Lorenz Scott Caraher Kevin Lorenz JCO Nuveen Credit Opportunities 2022 Target Term Fund Jenny Rhee Scott Caraher Scott Caraher Jenny Rhee Kevin Lorenz Jake Fitzpatrick Scott Caraher Kevin Lorenz Jake Fitzpatrick JDD Nuveen Diversified Dividend and Income Fund James Stephenson Thomas Ray Susi Budiman Scott Caraher Jenny Rhee Anthony Manno Kenneth Statz Kevin Bedell Nathan Gear James Valone Kevin Murphy No Change James Stephenson Thomas Ray Susi Budiman Scott Caraher Anthony Manno Kenneth Statz Kevin Bedell Nathan Gear James Valone Kevin Murphy JTA Nuveen Tax-Advantaged Total Return Strategy Fund James Stephenson Thomas Ray Susi Budiman Scott Caraher Jenny Rhee No Change James Stephenson Thomas Ray Susi Budiman Scott Caraher The following provides information about each new portfolio manager’s business experience. Jake Fitzpatrick is an associate portfolio manager for Nuveen’s global fixed income team and a member of the leveraged finance sector team. He began working in the investment industry in 2006 and joined the firm in 2015. Previously, he worked as a co-manager of structured product portfolios at Allianz Investment Management. In that role, he was responsible for the investment strategy and allocation of insurance product premiums within the core capital markets. He began his career at U.S. Bancorp Asset Management, where he was a corporate and municipal bond trader for the firm’s mutual funds and wealth management group. Jake graduated with a B.S. in Finance from the University of Minnesota’s Carlson School of Management and holds the CFA designation. Chris Williams is a trader and co-portfolio manager for Nuveen’s global fixed income team and member of the leveraged finance sector team. He is responsible for managing the organization’s leveraged finance trading, along with trading both high yield bonds and loans in the primary and secondary markets. In addition, he serves as the co-portfolio manager for the CLO strategies. Prior to joining the firm in 2011, he traded leveraged loans and high yield bonds at Gulf Stream Asset Management. Christopher graduated with a B.S. in Business Administration with an emphasis in Finance from Winthrop University. Kevin Lorenz is a portfolio manager for Nuveen’s global fixed income team and heads the leveraged finance sector team, which selects high yield and leveraged loan securities for all portfolios. He is also the lead portfolio manager for the High Yield strategies and a member of the Investment Committee, which establishes investment policy for all global fixed income products. Kevin has served in a variety of roles since joining the firm in 1987. Most recently, he served as a director with the private placements team, investing in both high-grade and high yield securities. He began his career at the firm as a generalist focusing on the private placement market. Kevin has been quoted in The New York Times, Barron’s, The Wall Street Journal, Reuters and other financial press as well as appearances on CNBC for his seasoned views on the high yield asset class. Kevin graduated with a B.S. in Accounting from Rider University and an M.B.A. in Finance from Indiana University. He holds the CFA designation and is a member of the New York Society of Security Analysts. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1 trillion in assets under management as of 30 June 2020 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1302617PR-E0820X

Building Resilient CEF Portfolios

seekingalpha.com

2020-07-31 10:08:06We discuss strategies for income investors that can be used to build more resilient CEF portfolios. These strategies include allocating to higher-quality sectors, choosing CEFs with more robust leverage instruments, allocating to term CEFs and others.

Retirement Strategy: Low-Priced Dividend Investments That Pay Monthly - JHB, JFR, PHT

seekingalpha.com

2020-07-17 09:00:00It is human nature to seek out low-priced investment products. It appears that the cost to even enter the dividend game is somewhat pricey.

The Reopening Killed The V-Shaped Recovery

seekingalpha.com

2020-06-29 07:43:33This is a weekly series focused on analyzing the previous week’s economic data releases. The objective is to concentrate on leading indicators of economic activ

The Chemist's Quality Closed-End Fund Report: June 2020

seekingalpha.com

2020-06-29 00:42:23Only funds with coverage >100% are considered. Top lists of discount, yield, DxY and DxYxZ are given. ARDC, PHT and HNW are the top-ranked DxYxZ funds.

Two Nuveen Target Term Closed-end Funds Approve Investment Policy and Name Changes

businesswire.com

2020-06-25 16:30:00NEW YORK--(BUSINESS WIRE)--The Fund Board of the Nuveen High Income 2023 Target Term Fund (NYSE: JHAA) and Nuveen High Income November 2021 Target Term Fund (NYSE: JHB) has approved changes to each Fund’s name to “Nuveen Corporate Income 2023 Target Term Fund” and “Nuveen Corporate Income November 2021 Target Term Fund”, respectively. Each Fund will also change its investment policy associated with its name. Currently, each Fund seeks to achieve its investment objectives by investing, under normal circumstances, at least 80% of its Managed Assets in securities that, at the time of investment, are rated below investment grade (BB+/Ba1 or lower) or are unrated but deemed equivalent by the subadviser. Pursuant to the revised policy, each Fund’s requirement to invest 80% of its Managed Assets in securities that are rated below investment grade is eliminated. Each Fund will continue to invest at least 80% of its Managed Assets in corporate debt securities. The table below summarizes the changes to the each Fund described above. The changes are expected to go into effect on August 24, 2020: Current Name New Name Current Policy New Policy Nuveen High Income 2023 Target Term Fund Nuveen Corporate Income 2023 Target Term Fund Under normal circumstances, the Fund will invest at least 80% of its Managed Assets in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the Fund’s subadviser to be of comparable quality. Existing policy eliminated. Nuveen High Income November 2021 Target Term Fund Nuveen Corporate Income November 2021 Target Term Fund Under normal circumstances, the Fund will invest at least 80% of its Managed Assets in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the Fund’s subadviser to be of comparable quality. Existing policy eliminated. For more information, please visit Nuveen’s CEF homepage www.nuveen.com/closed-end-funds. About Nuveen Nuveen, the investment manager of TIAA, offers a comprehensive range of outcome-focused investment solutions designed to secure the long-term financial goals of institutional and individual investors. Nuveen has $1 trillion in assets under management as of 31 March 2020 and operations in 27 countries. Its investment specialists offer deep expertise across a comprehensive range of traditional and alternative investments through a wide array of vehicles and customized strategies. For more information, please visit www.nuveen.com. Nuveen Securities, LLC, member FINRA and SIPC. The information contained on the Nuveen website is not a part of this press release. EPS-1223622PR-E0620X

CEF Weekly Commentary: May 3, 2020

seekingalpha.com

2020-05-15 11:00:00Markets on the week were little changed, but did end on a down note and some friction boiling up again on the trade front. We discuss the closed-end fund news o